Hubbard County Transfer on Death Deed by Married Sole Owner Form (Minnesota)

All Hubbard County specific forms and documents listed below are included in your immediate download package:

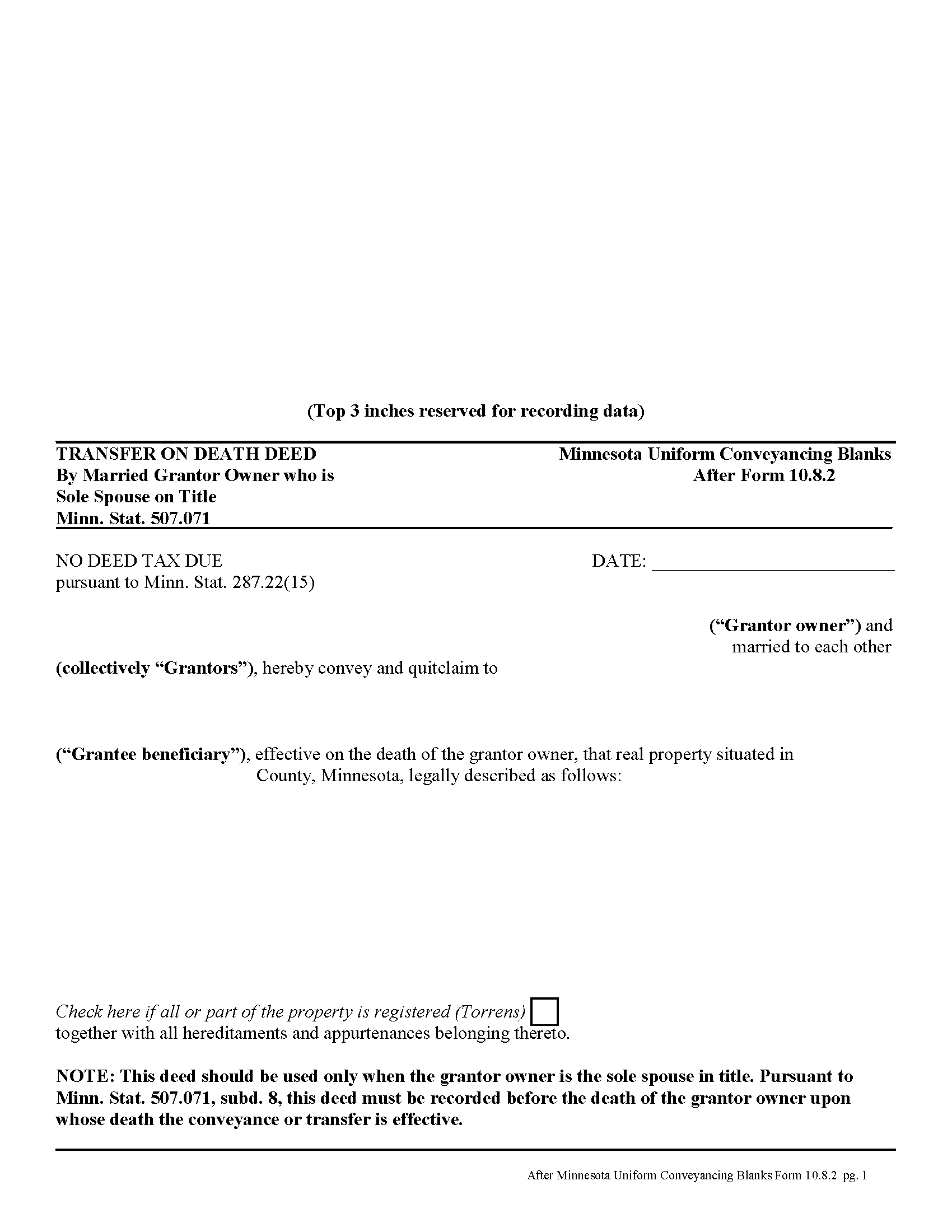

Transfer on Death Deed by Married Sole Owner

Fill in the blank form formatted to comply with all recording and content requirements.

Included Hubbard County compliant document last validated/updated 6/3/2025

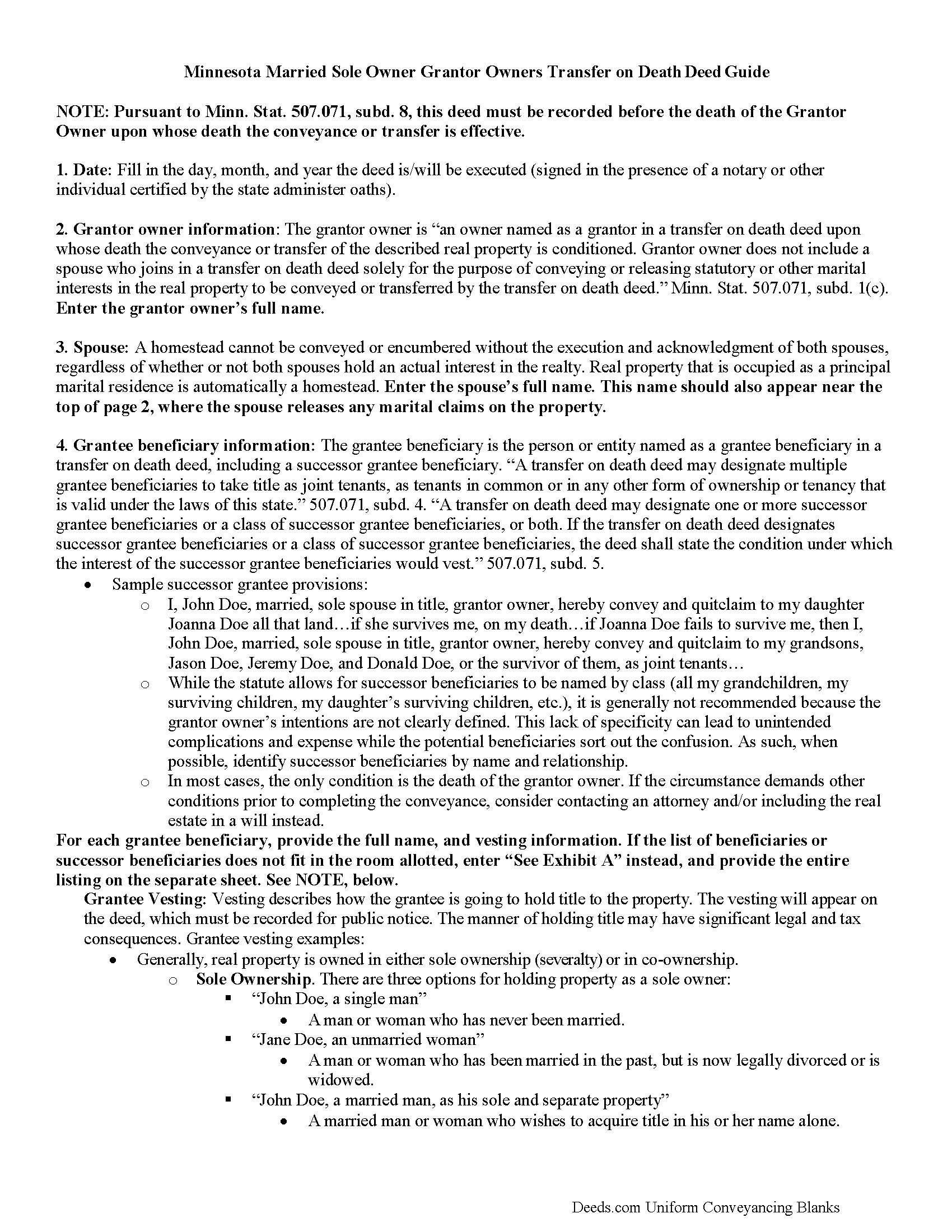

Transfer on Death Deed by Married Sole Owner Guide

Line by line guide explaining every blank on the form.

Included Hubbard County compliant document last validated/updated 5/19/2025

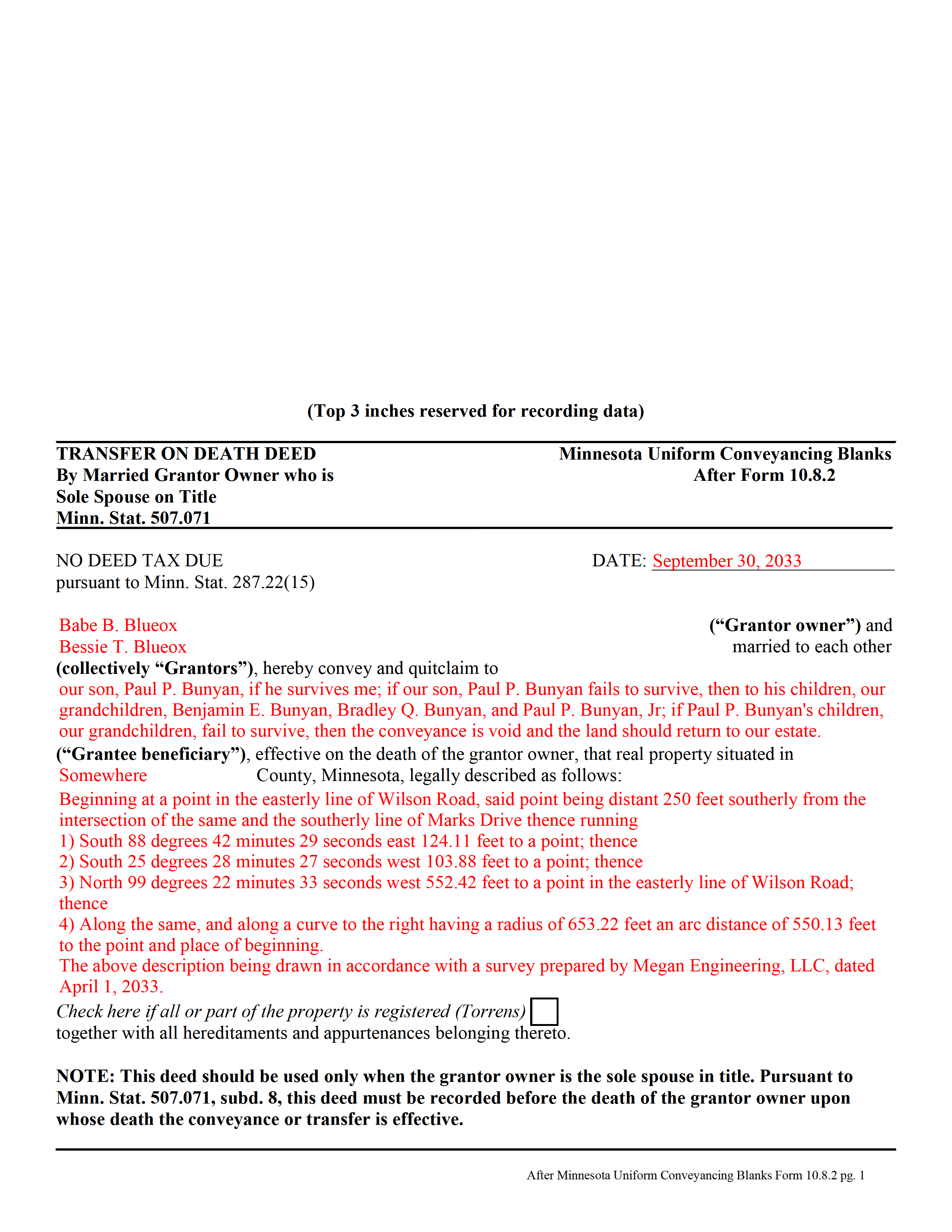

Completed Example of the Transfer on Death Deed by Married Sole Owner Document

Example of a properly completed form for reference.

Included Hubbard County compliant document last validated/updated 6/6/2025

The following Minnesota and Hubbard County supplemental forms are included as a courtesy with your order:

When using these Transfer on Death Deed by Married Sole Owner forms, the subject real estate must be physically located in Hubbard County. The executed documents should then be recorded in the following office:

Hubbard County Recorder

301 Court Ave, Park Rapids, Minnesota 56470

Hours: 8:30 to 4:30 M-F

Phone: (218) 732-3552

Local jurisdictions located in Hubbard County include:

- Akeley

- Benedict

- Lake George

- Laporte

- Nevis

- Park Rapids

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Hubbard County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Hubbard County using our eRecording service.

Are these forms guaranteed to be recordable in Hubbard County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Hubbard County including margin requirements, content requirements, font and font size requirements.

Can the Transfer on Death Deed by Married Sole Owner forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Hubbard County that you need to transfer you would only need to order our forms once for all of your properties in Hubbard County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Minnesota or Hubbard County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Hubbard County Transfer on Death Deed by Married Sole Owner forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

In Minnesota, transfer on death deeds are governed by Minn. Stat. 507.071.

While the statute provides a basic form, as well as overall content requirements, the state authorized the development of uniform conveyance documents for some specific situations. One such situation occurs when a married property owner holds sole title to the real estate he or she wishes to convey with a transfer on death deed. A correctly-completed basic statutory form is valid in most cases, but because the owner's husband or wife may be able to claim spousal interest in the property, these deeds require the spouse to sign a statement releasing any marital rights. Without this release, the non-probate transfer on death may not occur, and the property could revert to the deceased owner's estate for probate distribution instead. To prevent such unintended outcomes, there is a special deed for this circumstance.

This transfer on death deed form is for use ONLY by married grantor owners who are the sole spouse on the property's title.

As with other transfer on death deeds, this form must be executed and RECORDED during the grantor owner's lifetime.

(Minnesota TOD Deed by Married Sole Owner Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Hubbard County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Hubbard County Transfer on Death Deed by Married Sole Owner form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4563 Reviews )

JAMES D.

July 10th, 2025

Slick as can be and so convenient.rnrnWorked like a charm

Thank you for your feedback. We really appreciate it. Have a great day!

MARY LACEY M.

June 30th, 2025

Great service! Recording was smooth and swiftly performed. Deeds.com is an excellent service.rn

We are delighted to have been of service. Thank you for the positive review!

Robert F.

June 30th, 2025

Breeze.... It feels silly to hire an attorney to do this for just one beneficiary. Thanks.

Thank you for your feedback. We really appreciate it. Have a great day!

Susan B.

July 23rd, 2021

This package of documents from Deeds.com has been extremely helpful, particularly for one who has never needed this kind of service before and is unfamiliar with legal documents in general. It is well worth the price; I would recommend this company to anyone needing help with legal documents and information.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Terralynn J.

July 18th, 2019

I was very pleased to find ONLINE, Deed Revision Document(s) and their explanation. I ordered these document Forms, downloaded them and Printed them. Now, I will be able to fill them out in the privacy of my home. Instructions were also included, how to file this new Deed, after I complete it and have it Notarized. This has saved me time and emotional stress following the death of my husband.

THANK YOU.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kecia L.

February 9th, 2021

Great place to find much needed documents.

A huge thanks!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Julie R.

December 16th, 2020

Seamless and prompt service.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jose R.

January 16th, 2020

User friendly. Smooth transaction. I saved a lot of time

Thank you for taking the time to leave your feedback Jose, we really appreciate it. Have a fantastic day!

DELORES D.

July 20th, 2022

SO EASY. love that there is an example to follow and instructions.

Thank you!

Charles W.

December 26th, 2022

in one of the reviews, the person said they wished that there was more room allowed for use in the grantor section. the reply was that they were sorry but there was only enough room for what was there considering margins, etc. that is not true. on the forms i downloaded there was plenty of extra room at the top of the page (about 2 inches) that was not being used.

Thank you!

Robert C.

May 31st, 2023

Not easy to navigate as a first time user. I printed the first page but lost the link to the second page.

Thank you for taking the time to provide us with your valuable feedback. I'm sorry to hear that you've encountered difficulties with our website's navigation, particularly as a first-time user.

Furthermore, your comments about the website's navigation have been taken into account. We continually strive to improve our website and make it as intuitive and user-friendly as possible. Your feedback is crucial for us in achieving this goal.

Thank you again for your feedback. If you have any other suggestions or need further assistance, please don't hesitate to contact us.

Candy A.

June 27th, 2020

Super simple to download all necessary forms. BIG thank you for this service.

Thank you!

EARL R.

June 4th, 2023

easy to use once i found out i could fill it out right on the deeds website instead of downloading it to word duh.

Thank you for your feedback Earl. We'll work on ways to make it more clear that the forms are fill in the blank right in the PDF. Have an amazing day!

Dorothy R.

August 27th, 2019

Actually, it was user friendly once I figured out where to go to get the forms.

Thank you.

Thank you for your feedback. We really appreciate it. Have a great day!

Pauline C.

June 29th, 2025

Everything that was stated to be included in my order was complete. Very satisfied

Thank you for your positive words! We’re thrilled to hear about your experience.