Winona County Transfer on Death Deed by Married Sole Owner Form

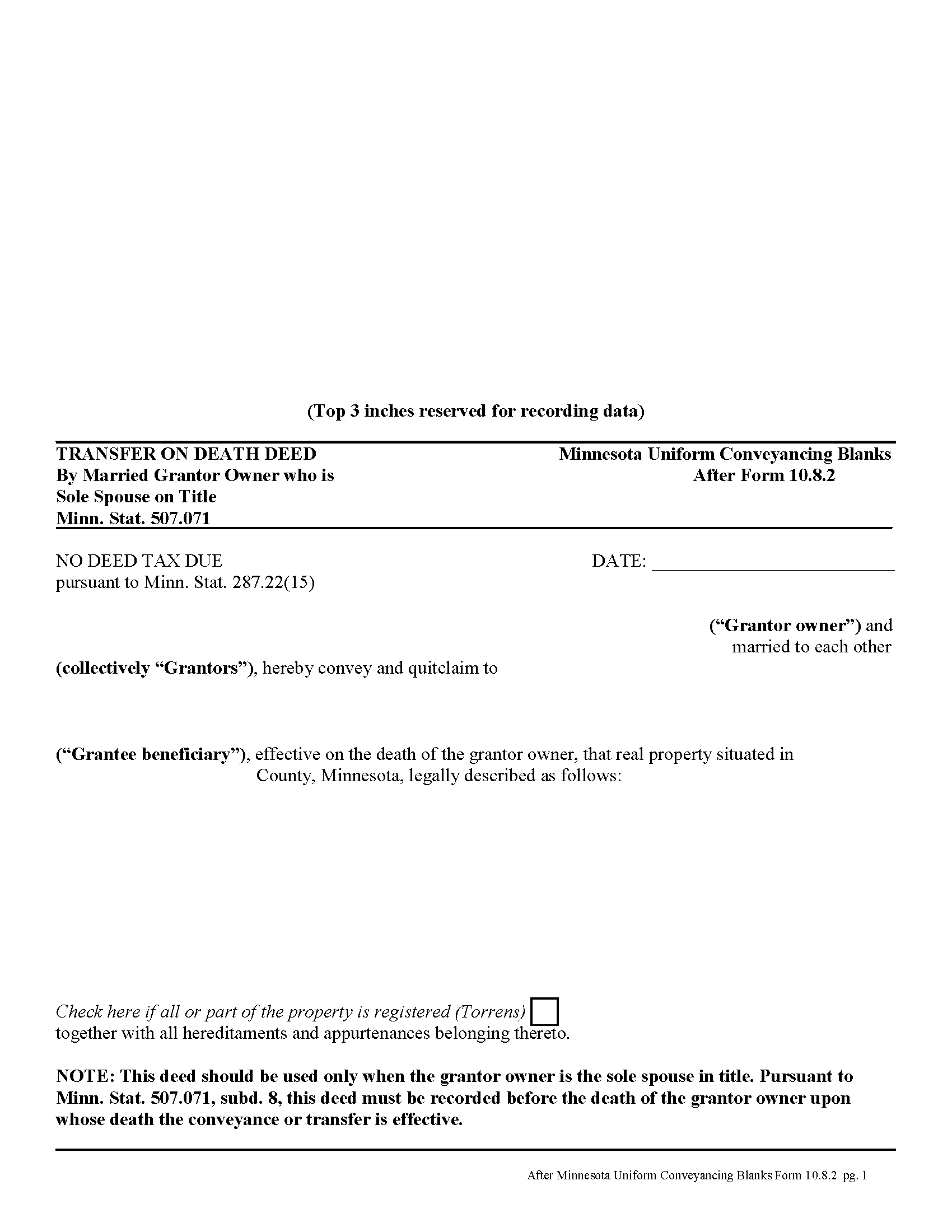

Winona County Transfer on Death Deed by Married Sole Owner

Fill in the blank form formatted to comply with all recording and content requirements.

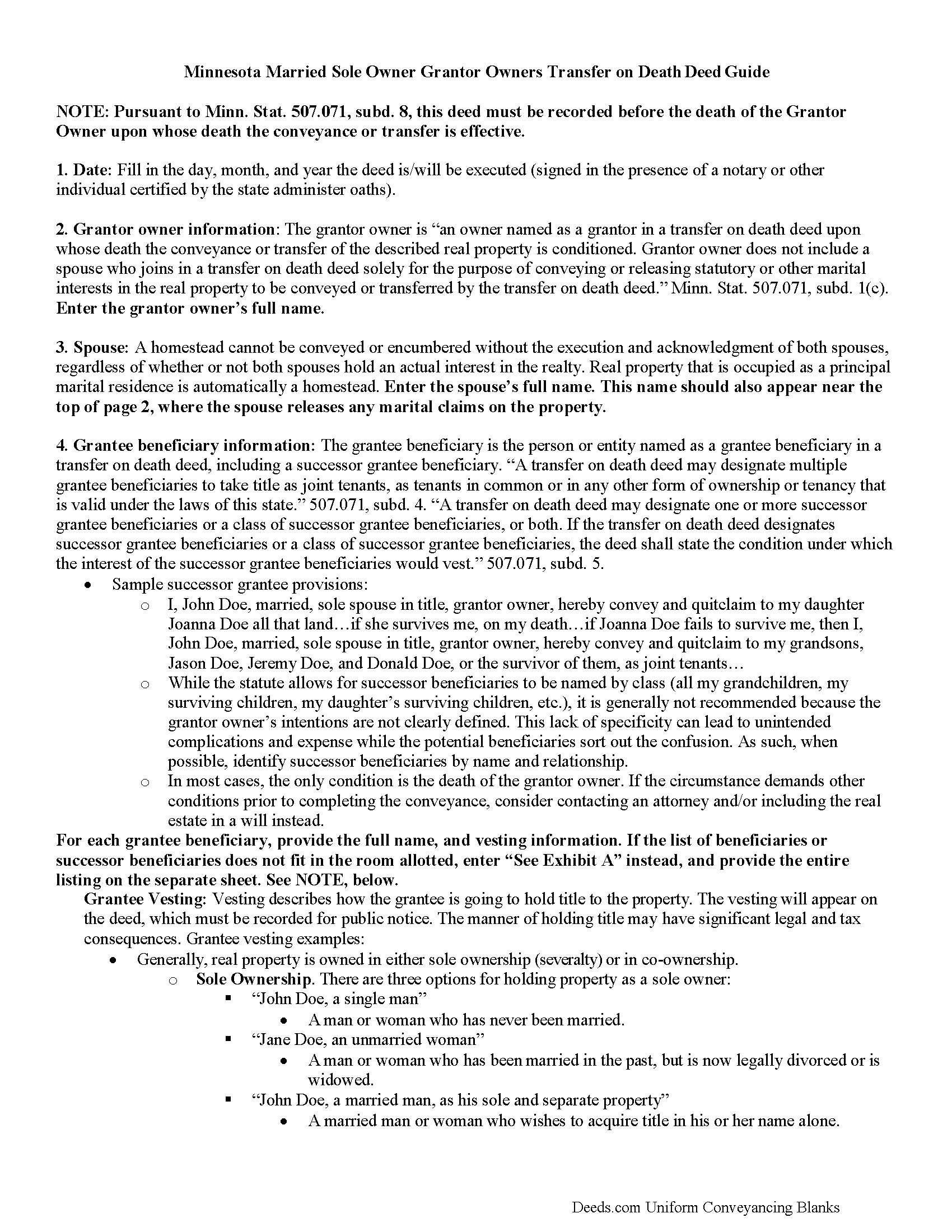

Winona County Transfer on Death Deed by Married Sole Owner Guide

Line by line guide explaining every blank on the form.

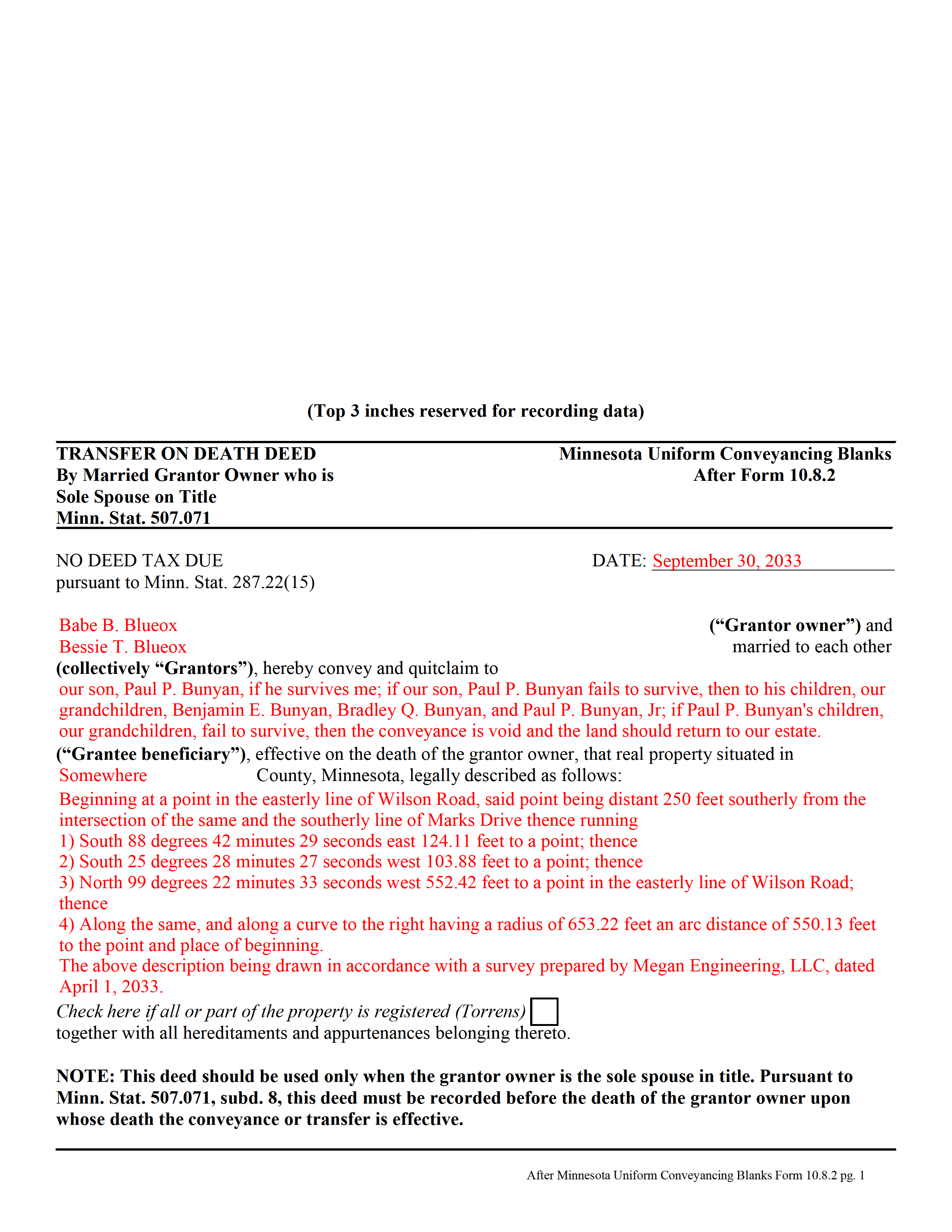

Winona County Completed Example of the Transfer on Death Deed by Married Sole Owner Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Minnesota and Winona County documents included at no extra charge:

Where to Record Your Documents

Winona County Recorder

Winona, Minnesota 55987

Hours: 8:00am to 4:30pm Monday through Friday

Phone: (507) 457-6340

Recording Tips for Winona County:

- Ensure all signatures are in blue or black ink

- Ask if they accept credit cards - many offices are cash/check only

- Leave recording info boxes blank - the office fills these

- Bring extra funds - fees can vary by document type and page count

- Multi-page documents may require additional fees per page

Cities and Jurisdictions in Winona County

Properties in any of these areas use Winona County forms:

- Altura

- Dakota

- Homer

- Lewiston

- Minnesota City

- Rollingstone

- Saint Charles

- Stockton

- Utica

- Winona

Hours, fees, requirements, and more for Winona County

How do I get my forms?

Forms are available for immediate download after payment. The Winona County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Winona County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Winona County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Winona County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Winona County?

Recording fees in Winona County vary. Contact the recorder's office at (507) 457-6340 for current fees.

Questions answered? Let's get started!

In Minnesota, transfer on death deeds are governed by Minn. Stat. 507.071.

While the statute provides a basic form, as well as overall content requirements, the state authorized the development of uniform conveyance documents for some specific situations. One such situation occurs when a married property owner holds sole title to the real estate he or she wishes to convey with a transfer on death deed. A correctly-completed basic statutory form is valid in most cases, but because the owner's husband or wife may be able to claim spousal interest in the property, these deeds require the spouse to sign a statement releasing any marital rights. Without this release, the non-probate transfer on death may not occur, and the property could revert to the deceased owner's estate for probate distribution instead. To prevent such unintended outcomes, there is a special deed for this circumstance.

This transfer on death deed form is for use ONLY by married grantor owners who are the sole spouse on the property's title.

As with other transfer on death deeds, this form must be executed and RECORDED during the grantor owner's lifetime.

(Minnesota TOD Deed by Married Sole Owner Package includes form, guidelines, and completed example)

Important: Your property must be located in Winona County to use these forms. Documents should be recorded at the office below.

This Transfer on Death Deed by Married Sole Owner meets all recording requirements specific to Winona County.

Our Promise

The documents you receive here will meet, or exceed, the Winona County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Winona County Transfer on Death Deed by Married Sole Owner form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4614 Reviews )

Rick R.

February 5th, 2021

So far excellent service - I made a boo boo on the deed - no problem they made the change before they sent it off to be recorded. I will never drive to the Recorder's office again.

Thank you!

Santos V.

March 18th, 2023

Great and easy to understand.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Logan S.

April 27th, 2020

Wonderful experience. Was preapred to wait days, recording was finished in less than an hour.

Thank you!

Frank R.

January 20th, 2020

Our notary. Marie was prompt, courteous and professional. Would definitely use again and reccomend

Thank you for your feedback. We really appreciate it. Have a great day!

R Rodney H.

January 29th, 2019

Excellent service--I got just the information I needed quickly and reasonably priced. I am glad to know of this service for future needs, as an individual, in this sector. Cheers, RRH

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

raquel f.

July 28th, 2021

Wow!!! that was super easy to record a mechanic lien! I will definitely use your service again but I hope I won't have to.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Maricela N.

May 5th, 2021

very easy and quick to get all the forms needed! Thank you!

Thank you for your feedback. We really appreciate it. Have a great day!

Brian R.

May 12th, 2020

Your website is very informative, and easy to use.The purchase and download process was clear and went well. I would add that your Virginia Quitclaim Deed Guide is very comprehensive and informative. This combined with the example form you provide is most helpful. Thank You. Brian R

Thank you for your feedback. We really appreciate it. Have a great day!

Lori G.

May 21st, 2020

thank you for all your help and patience. I would highly recommend Deeds.com to everyone. Sincerely, Lori G.

Thank you!

Alan K.

May 14th, 2019

The instructions and example for filling out the form were very clear and detailed making the whole process fairly easy. An attorney I talked to wanted $200 to fill out this simple form. I haven't tried to file it yet but I will let you know if there are any issues. Really a great deal. $20 vs $200.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Sven S.

April 10th, 2019

great experience so far! Im using Deeds.com for e-recording. Easy to use website, document upload is a snap, you are walked through and reminded if theres something missing.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Dr. Rev. Cheryl T.

July 20th, 2021

five stars thanks so m,uch so easy to use and save. Good Job... Peace & many Blessings Sincerely, dr. Rev. Cheryl israel tibbrine

Thank you for your feedback. We really appreciate it. Have a great day!

Emily P.

March 25th, 2020

Used the quitclaim form and the erecording service. Very smooth transaction, everything worked as it should.

Thank you for your feedback. We really appreciate it. Have a great day!

Wanda L.

July 30th, 2020

Really nice and helped with more information.

Thank you for your feedback. We really appreciate it. Have a great day!

Richard O.

June 2nd, 2020

Thank you for providing this service. It was quick and easy.

Thank you for your feedback. We really appreciate it. Have a great day!