Wright County Trustee Deed Individual Form (Minnesota)

All Wright County specific forms and documents listed below are included in your immediate download package:

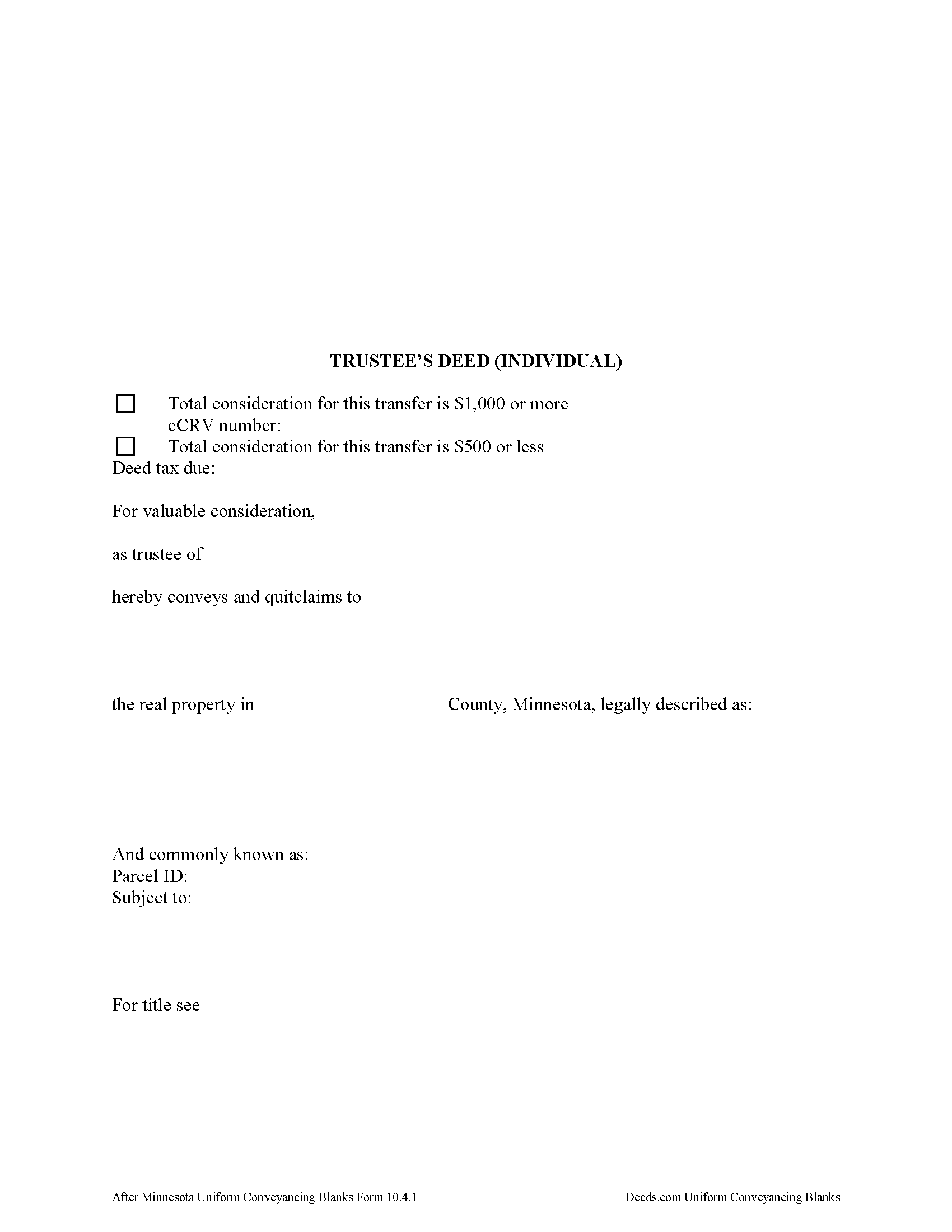

Trustee Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Wright County compliant document last validated/updated 3/24/2025

Trustee Deed Guide

Line by line guide explaining every blank on the form.

Included Wright County compliant document last validated/updated 3/12/2025

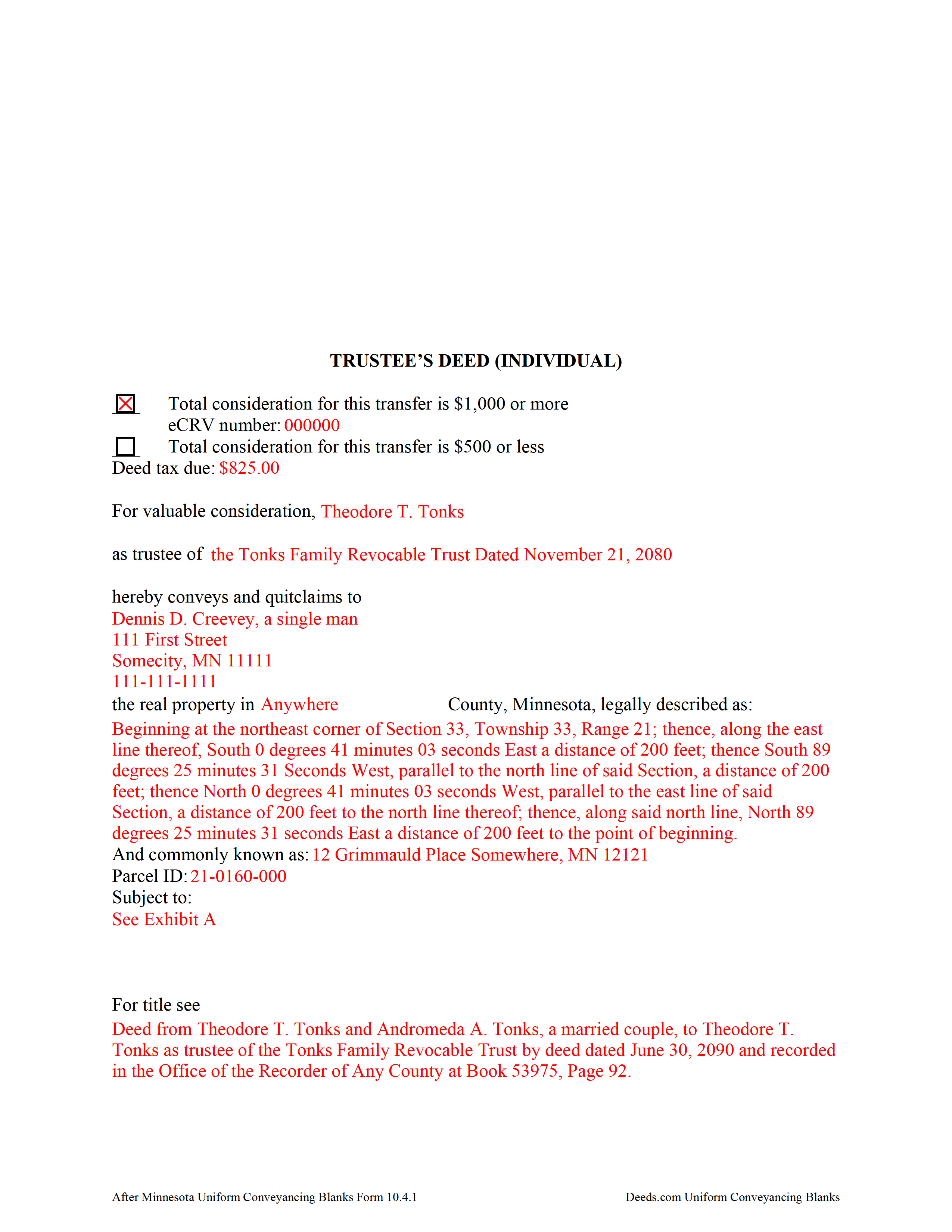

Completed Example of the Trustee Deed Document

Example of a properly completed form for reference.

Included Wright County compliant document last validated/updated 6/5/2025

The following Minnesota and Wright County supplemental forms are included as a courtesy with your order:

When using these Trustee Deed Individual forms, the subject real estate must be physically located in Wright County. The executed documents should then be recorded in the following office:

County Recorder & Registrar

10 Second St NW, Rm 210, Buffalo, Minnesota 55313

Hours: 8:00am to 4:30pm M-F

Phone: (763) 682-7357

Local jurisdictions located in Wright County include:

- Albertville

- Annandale

- Buffalo

- Clearwater

- Cokato

- Delano

- Hanover

- Howard Lake

- Maple Lake

- Maple Plain

- Monticello

- Montrose

- Rockford

- Saint Michael

- Silver Creek

- South Haven

- Waverly

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Wright County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Wright County using our eRecording service.

Are these forms guaranteed to be recordable in Wright County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Wright County including margin requirements, content requirements, font and font size requirements.

Can the Trustee Deed Individual forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Wright County that you need to transfer you would only need to order our forms once for all of your properties in Wright County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Minnesota or Wright County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Wright County Trustee Deed Individual forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

What's in a Minnesota Trustee's Deed?

Minnesota allows for two main types of trustees deeds: one between individuals, and one for use by business entities. The primary differences between the two forms are that the deed intended for businesses contains details about the corporate entity and the laws under which it was formed, and a corporate notary acknowledgement, while the form for individuals does not require that information. This article focuses on the trustee's deed for individuals.

A trustee's deed conveys title to real property held in a non-testamentary trust. The deed is named for the executing trustee, unlike other deed forms, which are named for the warranties of title they contain. Trustees are authorized to sell property under Minn. Stat. 501C.0816.

In a trust arrangement, the trustee holds legal title to property conveyed to the trust by the settlor, for the benefit of the trust's beneficiaries. A beneficiary is someone with a present or future interest in the trust (Minn. Stat. 501C. 0103). The settlor establishes the provisions of the trust, including the designation of a trustee and a trust beneficiary, in the trust instrument, which typically is not recorded.

In Minnesota, the trustee's deed is a modified quitclaim deed, containing the granting language "convey and quitclaim." A quitclaim deed merely grants "all right, title, and interest of the grantor in the premises described" to the grantee, and contains no warranty of title (Minn. Stat. 707.07).

The deed names the trustee and the trust on behalf of which the trustee is authorized to act. As with all other forms of conveyance, the deed requires the name, vesting information, and address of the grantee. In addition, the deed recites the full legal description of the premises conveyed, and indicates whether the deed is to be recorded in the abstract or Torrens system (the Office of the Recorder for the county in which the property is situated handles recording for both systems).

In a nutshell, the Torrens system is a system of recording whereby the state guarantees the title through a more rigorous certification process; conveyances submitted in the abstract system meeting basic recording requirements will be recorded, but the title is not guaranteed.

Finally, all conveyances in Minnesota need to contain the drafter's information, and an address to which property tax statements can be sent.

Minnesota statutes require an Electronic Certificate of Real Value (eCRV) to accompany deeds with a consideration of $1,000 or more (Min. Stat. 272.115). The certificate is submitted online through the Department of Revenue. For transfers requiring an eCRV, the electronic certificate number must be reflected on the first page of the documents. Considerations of $500 or less qualify for the minimum deed tax. Because the eCRV contains more specific information for a majority of documents, the consideration statement reflected on the face of the deed is typically generic.

Pursuant to Minn. Stat. 103I.235, sellers of real property must submit a well disclosure certificate, along with the $50 well disclosure certificate fee, before agreeing to a transfer. Subd. 1(c) of that statute explains that the certificate is unnecessary "if the seller does not know of any wells on the property" and includes a statement to that effect on the deed. A deed may also state that the status of wells on the property has not changed since the previously filed certificate. Finally, recite the electronic well disclosure certificate number if relevant to the property.

All acting trustees must sign the deed in the presence of a notary public or other authorized officer before submitting the deed for recording at the county level. A certificate of trust and/or affidavit of trustee may be required alongside the trustee's deed.

Each situation is unique, so contact an attorney with any questions about trustee's deeds, trusts, and directions relating specifically to your situation.

(Minnesota Trustee Deed Individual Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Wright County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Wright County Trustee Deed Individual form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4562 Reviews )

MARY LACEY M.

June 30th, 2025

Great service! Recording was smooth and swiftly performed. Deeds.com is an excellent service.rn

We are delighted to have been of service. Thank you for the positive review!

Robert F.

June 30th, 2025

Breeze.... It feels silly to hire an attorney to do this for just one beneficiary. Thanks.

Thank you for your feedback. We really appreciate it. Have a great day!

Pauline C.

June 29th, 2025

Everything that was stated to be included in my order was complete. Very satisfied

Thank you for your positive words! We’re thrilled to hear about your experience.

Ruth R.

January 31st, 2020

Very pleased with the service, solved an immediate problem for me and at good price.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Paul M.

July 1st, 2021

Great site! Got what I needed and I'm not the brightest bulb in the box when it comes to this interwebz stuff.

Thank you!

Kimberly W.

May 11th, 2022

Thank you for making this process so convenient.

Thank you for your feedback. We really appreciate it. Have a great day!

Joni S.

February 6th, 2024

Excellent service, no hassle, easy to use, affordable, best service -- hands down. I thought it would be difficult for me to record a deed in Florida while residing in California but you made it so easy. I will tell everyone about your service.rnThank you.

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Natalie F.

April 13th, 2020

So convenient and easy to use! Will definitely recommend to anyone.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Terrell W.

January 27th, 2021

Was a little hard to find the form but once I did everything worked well

Thank you for your feedback. We really appreciate it. Have a great day!

Michael L.

September 5th, 2020

Pretty good stuff, not exactly clear on the deed transfer costs and all

Thank you for your feedback. We really appreciate it. Have a great day!

Vita L.

January 28th, 2021

A coworker recommended this service to me and I was hesitant to try it. Turned out to be a life saver, they filed my document in 24 hours. No standing in line and no confusing government websites to navigate.

Thank you!

Leah P.

March 16th, 2021

Thank you for your complete listing of deeds and forms. The Deed form I needed worked perfectly!

Thank you!

Karelia W.

February 14th, 2024

Was a bit skeptical because I'd never heard of it, but just got something submitted and confirmed recorded in less than 24 hrs. UI could use some work but other than that, straightforward and works!

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Crystal P.

April 16th, 2024

This service is amazing! We have tried several other online recording services which all disappointed. Deeds.com got all three of our documents recorded same day as invoice payment. Thank you for the quick turn around! We will be using this service often.

We are sincerely grateful for your feedback and are committed to providing the highest quality service. Thank you for your trust in us.

Curley B.

January 6th, 2023

So far, I'm pleased. I am a first-time user, as most of my clients are in California. I look forward to working with you more in the future.

Thank you for your feedback. We really appreciate it. Have a great day!