Lee County Deed of Trust and Promissory Note Form (Mississippi)

All Lee County specific forms and documents listed below are included in your immediate download package:

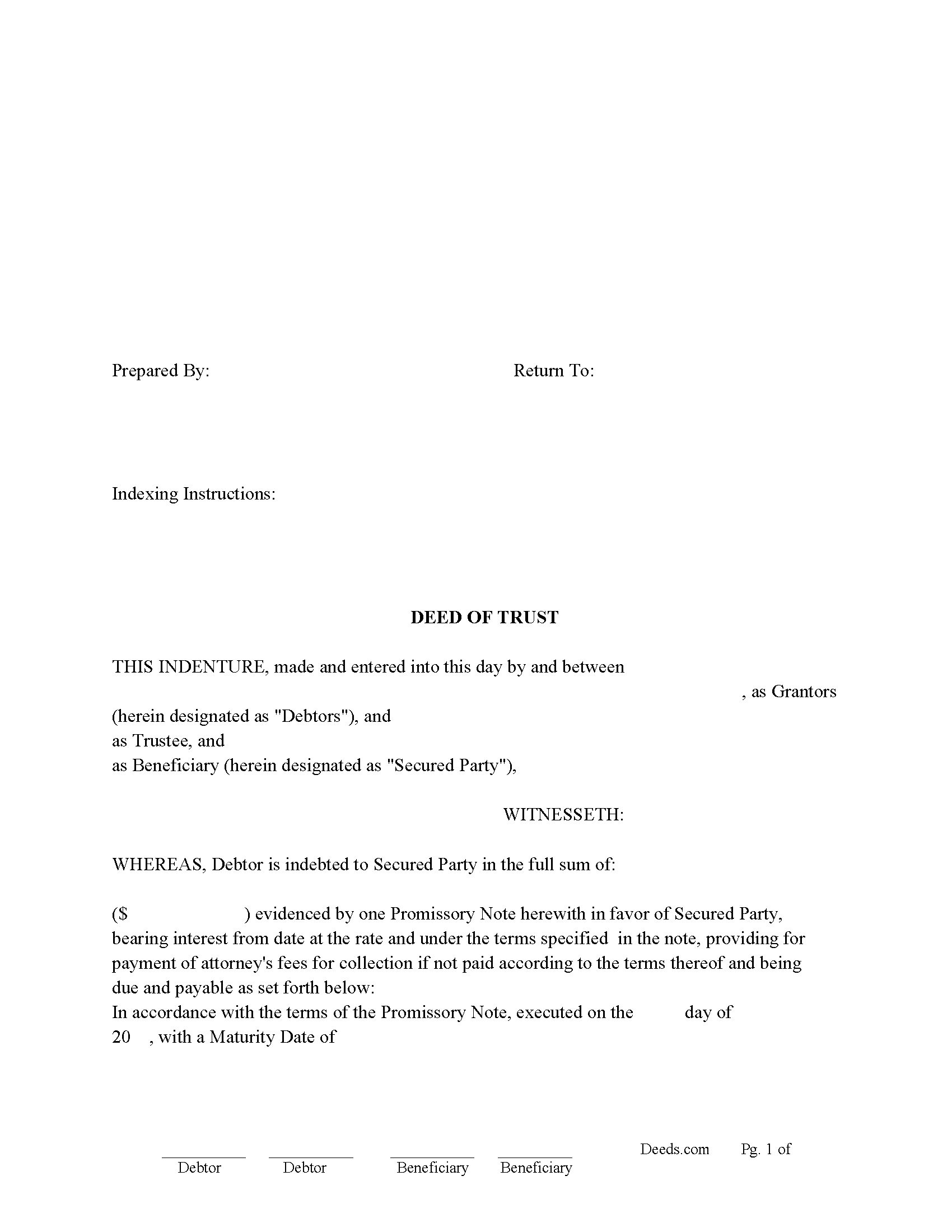

Deed of Trust Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Lee County compliant document last validated/updated 6/24/2025

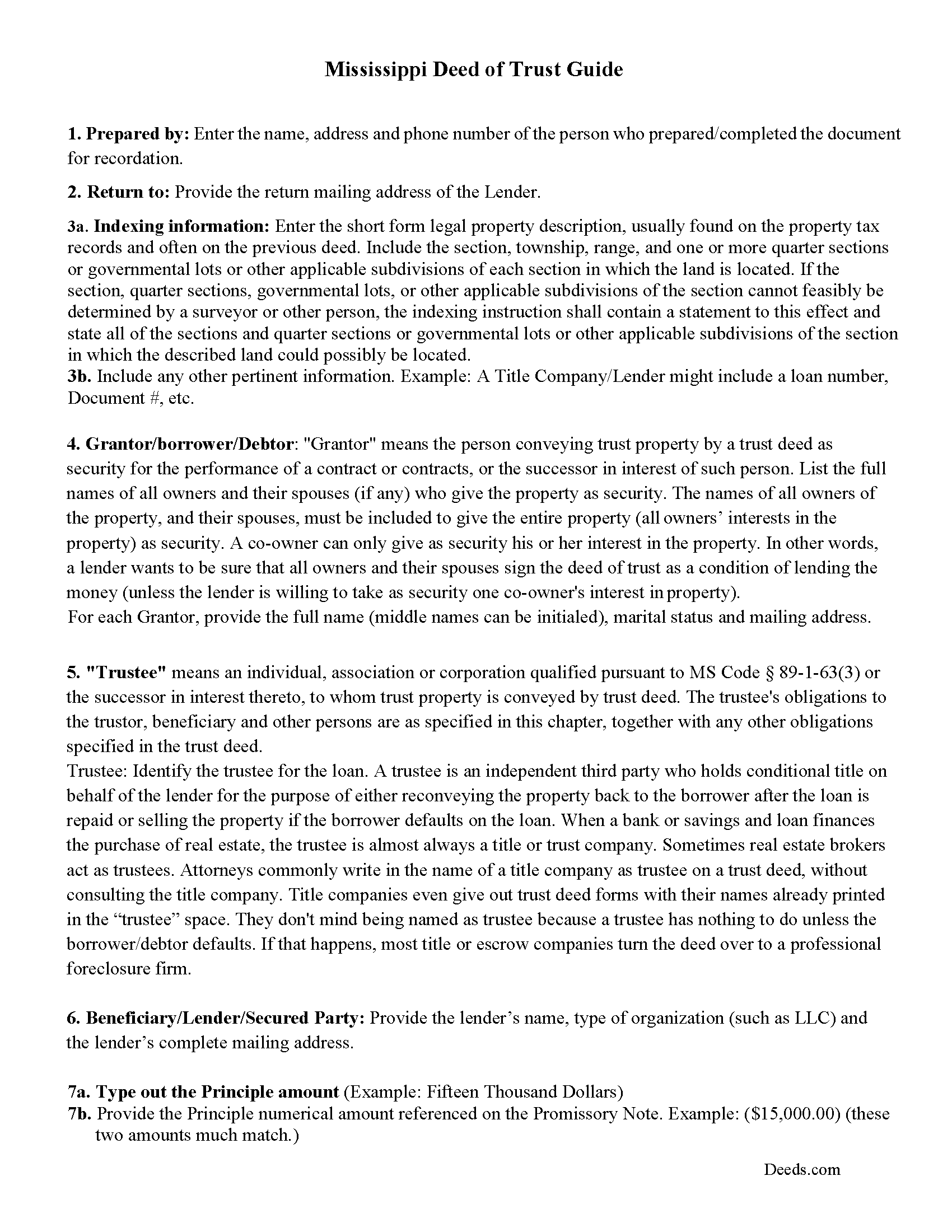

Deed of Trust Guidelines

Line by line guide explaining every blank on the form.

Included Lee County compliant document last validated/updated 6/3/2025

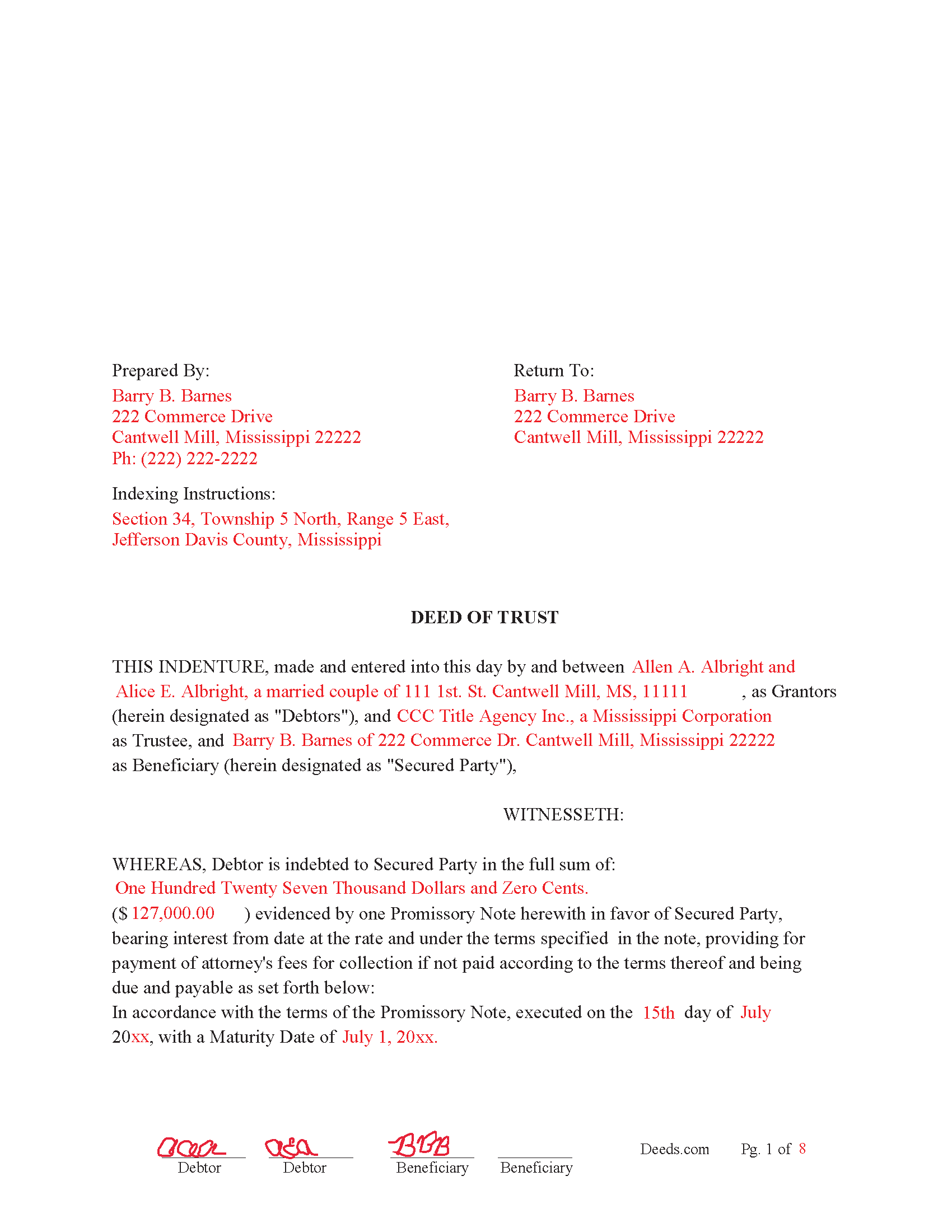

Completed Example of the Deed of Trust

Example of a properly completed form for reference.

Included Lee County compliant document last validated/updated 6/27/2025

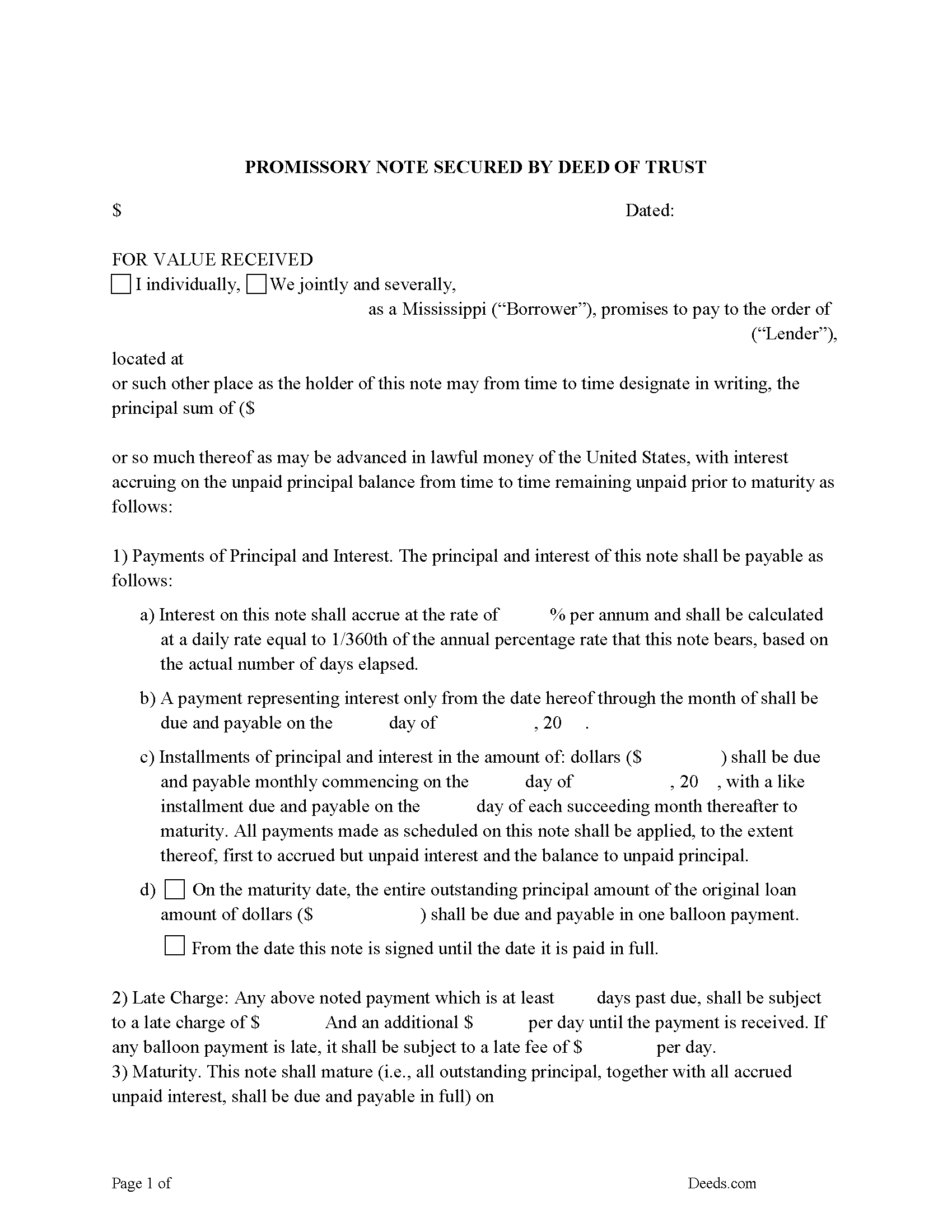

Promissory Note Form

Note that is secured by the Deed of Trust.

Included Lee County compliant document last validated/updated 6/23/2025

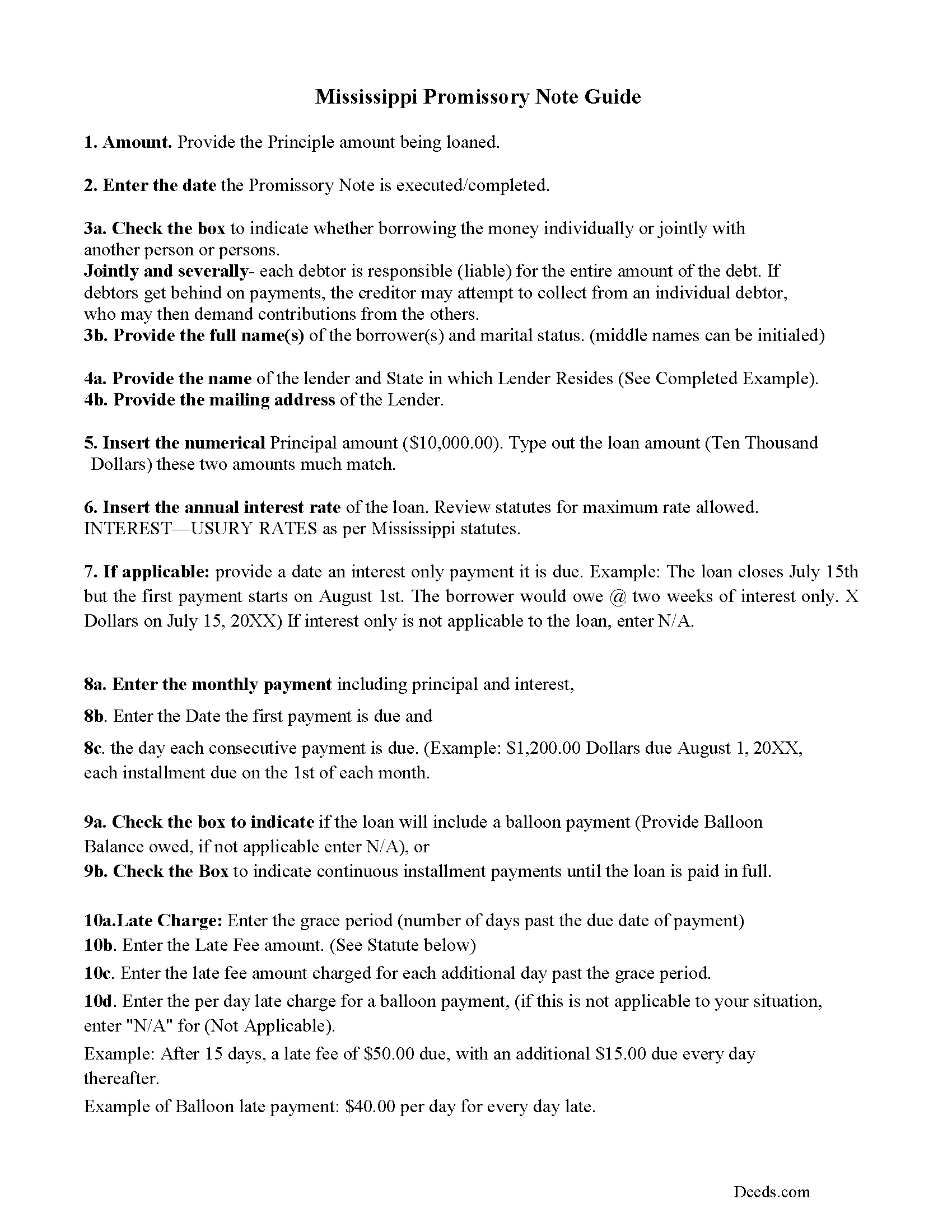

Promissory Note Guidelines

Line by line guide explaining every blank on the form.

Included Lee County compliant document last validated/updated 6/16/2025

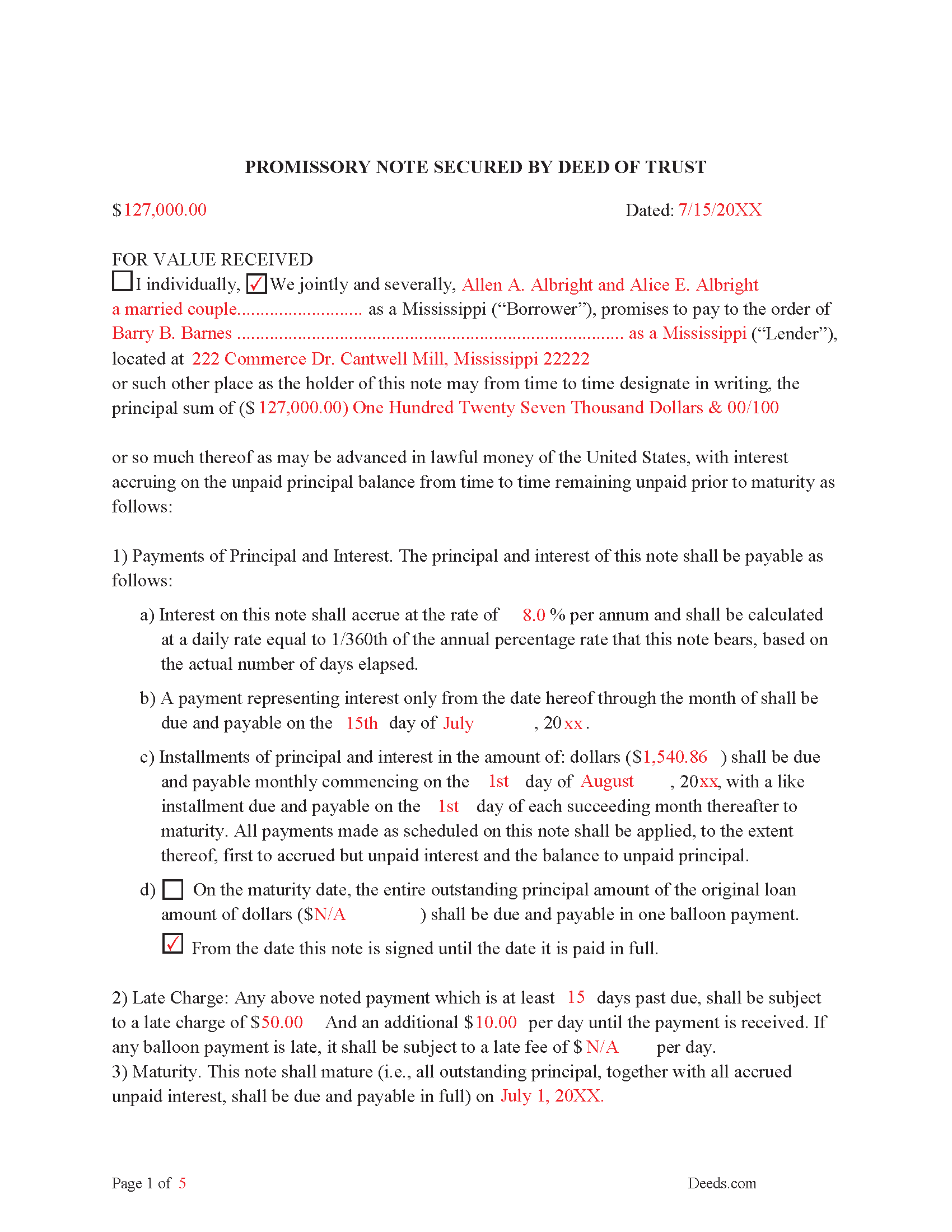

Completed Example of the Promissory Note Document

Example of a properly completed form for reference.

Included Lee County compliant document last validated/updated 4/15/2025

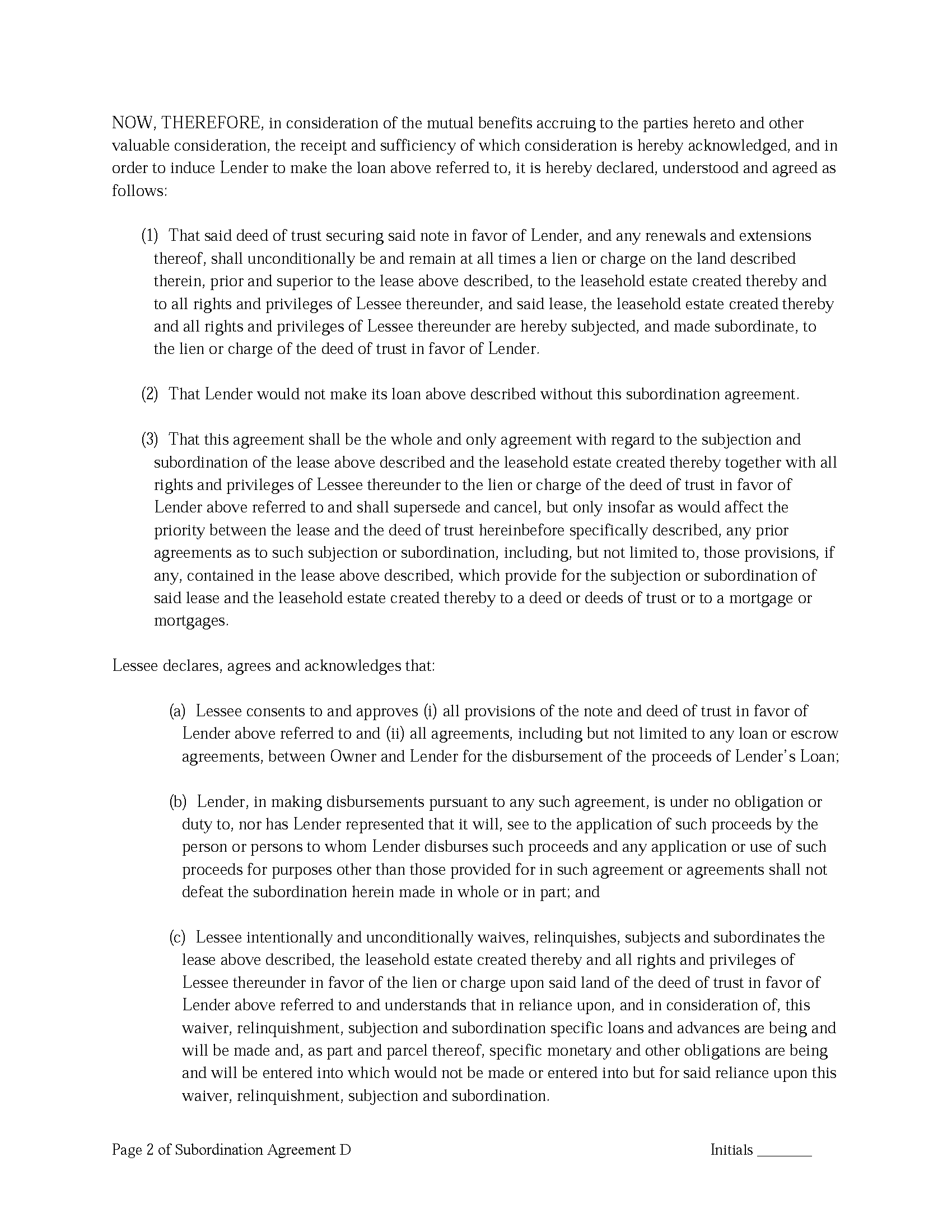

Subordination Clauses

Used to place priority on claim of debt. Included are 4 clauses for unique situations. If needed, add to Deed of Trust as an addendum or rider.

Included Lee County compliant document last validated/updated 6/2/2025

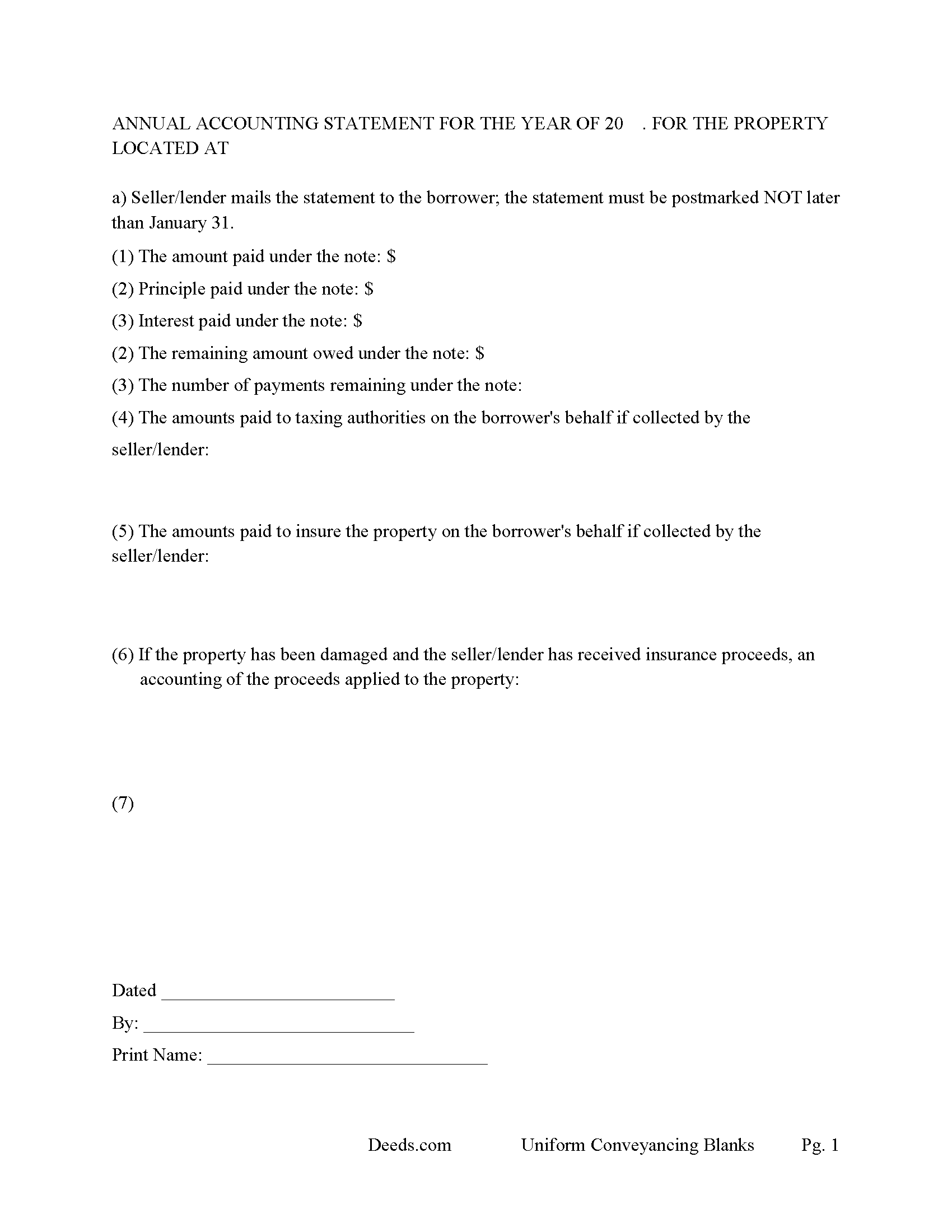

Annual Accounting Statement

Mail to borrower for fiscal year reporting.

Included Lee County compliant document last validated/updated 5/2/2025

The following Mississippi and Lee County supplemental forms are included as a courtesy with your order:

When using these Deed of Trust and Promissory Note forms, the subject real estate must be physically located in Lee County. The executed documents should then be recorded in the following office:

Lee County Chancery Clerk

200 West Jefferson St / PO Box 7127, Tupelo, Mississippi 38802

Hours: 8:00am to 5:00pm.M-F

Phone: (662) 432-2100

Local jurisdictions located in Lee County include:

- Baldwyn

- Belden

- Guntown

- Mooreville

- Plantersville

- Saltillo

- Shannon

- Tupelo

- Verona

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Lee County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Lee County using our eRecording service.

Are these forms guaranteed to be recordable in Lee County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Lee County including margin requirements, content requirements, font and font size requirements.

Can the Deed of Trust and Promissory Note forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Lee County that you need to transfer you would only need to order our forms once for all of your properties in Lee County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Mississippi or Lee County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Lee County Deed of Trust and Promissory Note forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

In Mississippi, a Deed of Trust (DOT) is the most commonly used instrument to secure a loan. If the DOT has a "Power of Sale" clause, foreclosure can be done non-judicially, saving time and expense, because the trustee doesn't require the court's involvement. This process is called a Trustee Sale. Explained in Mississippi 89-1-55 - "How lands sold under mortgages and Deeds in Trust"

There are three parties in this Deed of Trust:

1- The Grantor (Borrower)

2- Beneficiary (Lender) and a

3- Trustee (Neutral Third Party)

Basic Concept. The Grantor (Borrower) conveys property title to a Trustee (Neutral Party). A Trustee or beneficiary/Lender can take action against any person for damages.

(The beneficiary or holder of any deed of trust, including his agents, employees, successors, assigns, attorneys-in-fact or other legal representatives, may appoint a trustee or substitute a trustee, with or without the permission of the mortgagor or mortgagors. The trustee or substitute trustee so appointed may be a natural person, partnership, corporation, limited liability company, professional association or any other legal entity.) (MS Code 89-1-63)(3))

Debtors/Borrowers shall be in default under the provisions of this Deed of Trust if Debtor

(a) shall fail to comply with any of Debtor's covenants or obligations contained herein,

(b) shall fail to pay any of the Indebtedness secured hereby, or any installment thereof or interest thereon, as such Indebtedness, installment or interest shall be due by contractual agreement or by acceleration,

(c) shall become bankrupt or insolvent or be placed in receivership,

(d) shall, if a corporation, a partnership or an unincorporated association, be dissolved voluntarily or involuntarily, or

(e) if Secured Party in good faith deems itself insecure and its prospect of repayment seriously

impaired.

This form can be used by a party financing residential property, rental property, condominiums or small office buildings. Note: if the property being financed is rental, see (Assignment of Leases and Rents Form) it acts to induce the lender to finance.

Promissory Note secured by Deed of Trust

A Deed of Trust and Promissory Note are usually executed/signed at the same time. The Promissory Note contains the finance terms.

Details:

1. Dollar amount of Principle Owed

2. Installment payments or Balloon payment (common with owner financing, borrower can establish history of payments and equity, which banks attractive when financing)

3, Late Charges, $ owed after so many days, with $ owed for each additional day.

4. Default Rate: If Borrowers go into default an increased interest rate is charged, until note is out of default.

5. Overdue Loan Fee: In addition to any other remedies available to Lender if this Note is not paid in full at the Maturity Date, Borrowers shall pay to Lender an Overdue Loan Fee, which fee shall be due at the time this Note is otherwise paid in full. The "Overdue Loan Fee" shall be determined based upon the outstanding principal balance of this Note as of the Maturity Date and shall be:

(a) one percent (1.0%) Of such principal balance if the Note is paid in full on or after thirty (30) days after the Maturity Date but less than sixty (60) days after the Maturity Date, or

(b) two percent (2.0%) of such principal balance if the Note is paid in full on or after sixty (60) days after the Maturity Date.

The obligations of Borrower to Lender under this Note and the Additional Obligations herein remain in full force and effect until Lender has received payment in full of all obligations.

This Note and the Loan Documents are made in and shall be governed by the State of Mississippi. Upon Lender's request, the venue of any legal action in connection with this Note or the Loan Documents shall be in _________County, Mississippi.

Attorney's Fees and Costs: Borrower shall pay all costs incurred by Lender in collecting sums due under this Note after a default, including reasonable attorneys' fees, whether or not suit is brought.

This Deed of Trust and Promissory Note, has stringent default terms and is suitable to owner selling/financing or investor financing.

(Mississippi DOT Package includes forms, guidelines, and completed examples) For use in Mississippi only.

Our Promise

The documents you receive here will meet, or exceed, the Lee County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Lee County Deed of Trust and Promissory Note form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4562 Reviews )

MARY LACEY M.

June 30th, 2025

Great service! Recording was smooth and swiftly performed. Deeds.com is an excellent service.rn

We are delighted to have been of service. Thank you for the positive review!

Robert F.

June 30th, 2025

Breeze.... It feels silly to hire an attorney to do this for just one beneficiary. Thanks.

Thank you for your feedback. We really appreciate it. Have a great day!

Pauline C.

June 29th, 2025

Everything that was stated to be included in my order was complete. Very satisfied

Thank you for your positive words! We’re thrilled to hear about your experience.

Judi W.

May 24th, 2022

Great website! Well organized, easy to navigate and put to practical use. Would use again.

Thank you!

Ming Z.

September 28th, 2022

Definitely 5 Stars !

Thank you!

Kwaku A.

May 27th, 2021

Excellent service ! Came through in the clutch! Easy to use and understand ! Exceptional service ! 10/10

Thank you!

Carl R.

August 26th, 2020

Wonderful forms even for an simpleton like me. Thank goodness there are people that actually know what they are doing.

Thanks for the kind words Carl.

Kay M.

August 27th, 2020

Worked great. Not being real tech savey was no problem.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Lacee G.

November 25th, 2019

Great real estate deed forms.

Thank you!

Jeff H.

November 7th, 2020

Fast, inexpensive, great customer service. I will definitely use them a gain.

Thank you!

Katie G.

February 3rd, 2019

I haven't used the forms yet but it appears, with your tutelage, that they should not be too difficult to fill out and file.

Your site was easy to navigate.

Thank You

Thank you for the kinds words Katie. have a fantastic day!

Michael L.

December 28th, 2018

I accidentally ordered the wrong deed package. Was looking for a quit claim deed and got a trustee deed. I immediately emailed the company, nothing back from them. I would like to exchange my purchase.

Thank you for your feedback. We replied to your message on December 20th at 2:05 pm, the reply was as follows: As a one time courtesy we have canceled your order/payment for the Trustee Deed document.

Miranda C.

August 16th, 2023

very expensive

Thank you for your continued trust and repeated purchases with us over the past year. We deeply value our loyal customers and understand the importance of providing value for your investment. Our pricing reflects the meticulous care, research, and expertise we put into each of our legal forms. However, we always strive to improve and genuinely value your feedback.

Catherine S.

December 19th, 2019

Description of document could have been better

Thank you!

Merry K.

January 5th, 2024

I am a WA State Attorney and just made my first purchase. The experience was flawless, and I appreciate the sample and the guide, too. The price was extremely reasonable. This was a huge time-saver for me - thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!