Lincoln County Grant Deed Form (Mississippi)

All Lincoln County specific forms and documents listed below are included in your immediate download package:

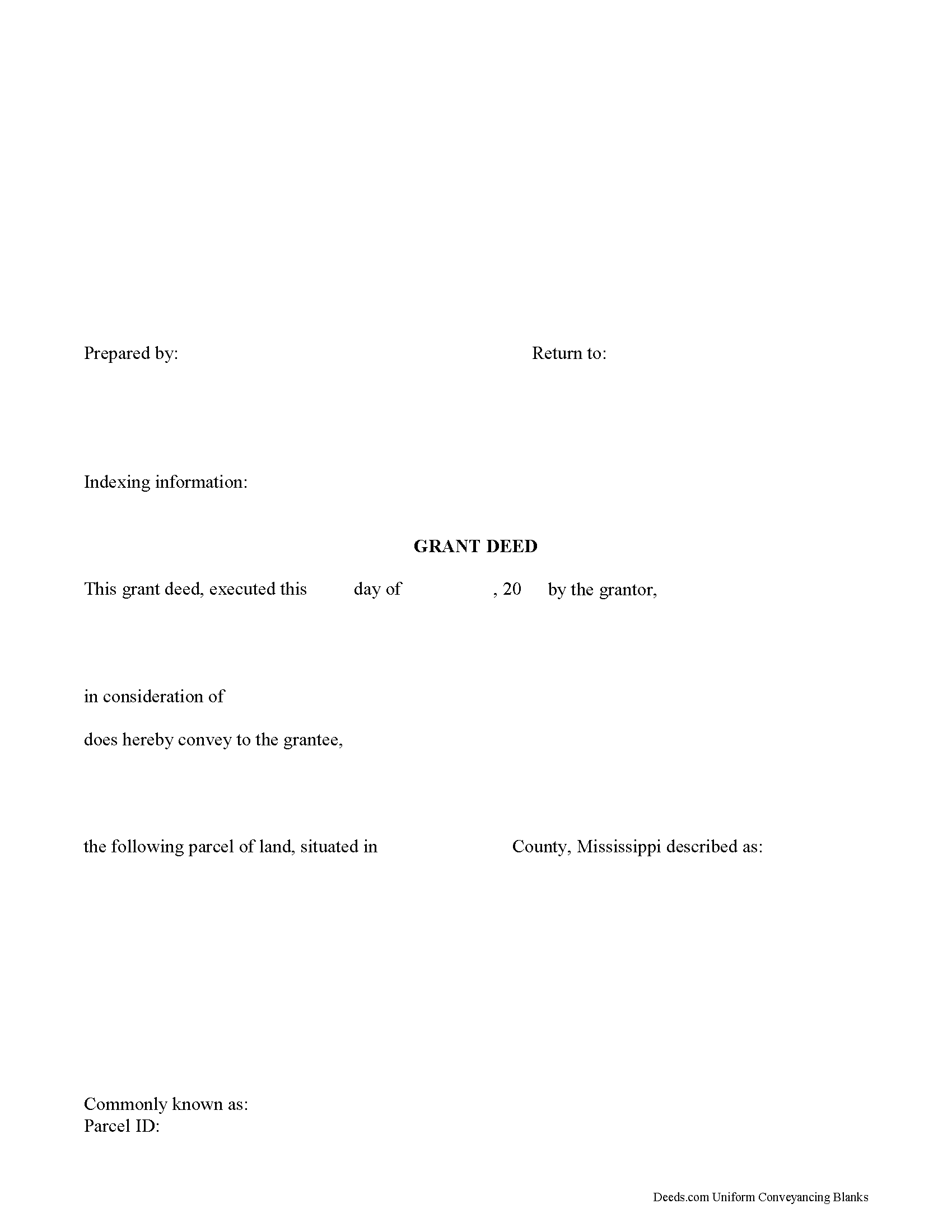

Grant Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Lincoln County compliant document last validated/updated 1/17/2025

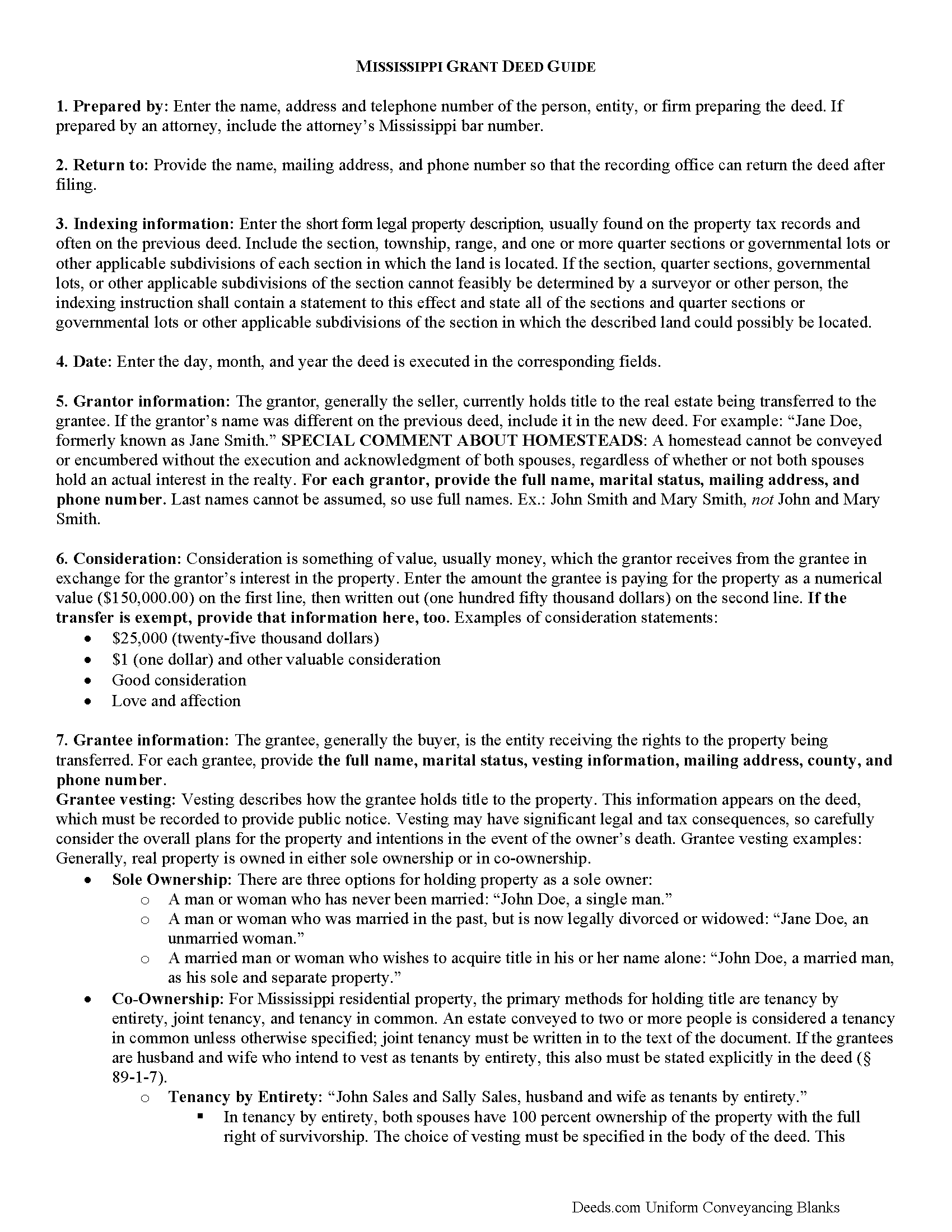

Grant Deed Guide

Line by line guide explaining every blank on the form.

Included Lincoln County compliant document last validated/updated 6/4/2025

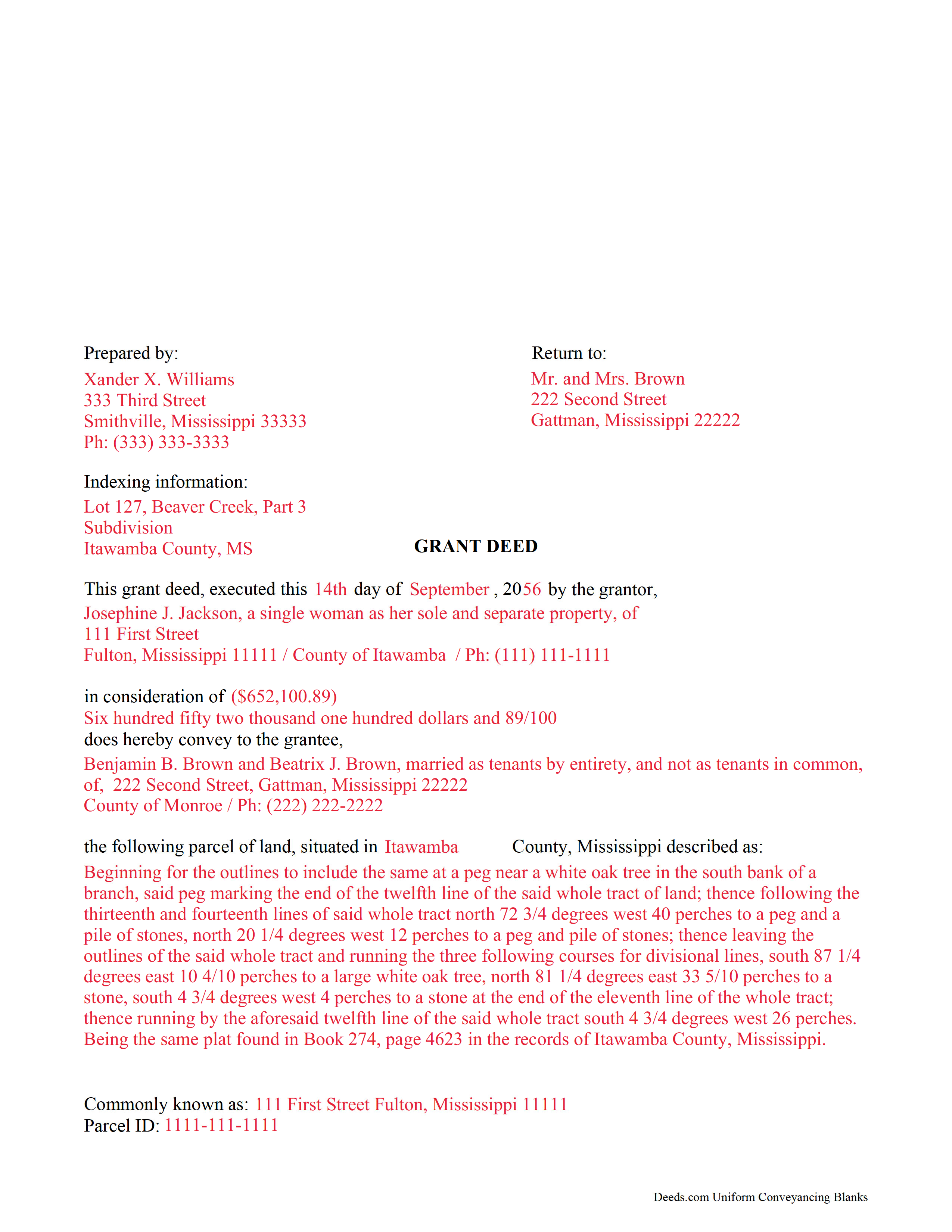

Completed Example of the Grant Deed Document

Example of a properly completed form for reference.

Included Lincoln County compliant document last validated/updated 5/7/2025

The following Mississippi and Lincoln County supplemental forms are included as a courtesy with your order:

When using these Grant Deed forms, the subject real estate must be physically located in Lincoln County. The executed documents should then be recorded in the following office:

Lincoln County Chancery Clerk

300 South First St / PO Box 555, Brookhaven, Mississippi 39601 / 39602

Hours: 8:30 to 5:00 M-F

Phone: (601) 835-3452

Local jurisdictions located in Lincoln County include:

- Bogue Chitto

- Brookhaven

- Ruth

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Lincoln County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Lincoln County using our eRecording service.

Are these forms guaranteed to be recordable in Lincoln County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Lincoln County including margin requirements, content requirements, font and font size requirements.

Can the Grant Deed forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Lincoln County that you need to transfer you would only need to order our forms once for all of your properties in Lincoln County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Mississippi or Lincoln County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Lincoln County Grant Deed forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

A grant deed can be used to convey real property in Mississippi. In a conveyance of real estate in this state, the use of the words "grant, bargain, and sell" will operate as an express covenant to the grantee, his heirs, and assigns, that the grantee was seized of an indefeasible estate, free from encumbrances made or suffered by the grantor, except the rents and services that may be reserved, and also for quiet enjoyment against the grantor, his heirs, and assigns, unless limited by specific words contained in the deed ( 89-1-41).

A grant deed in Mississippi is required to be declared in writing, signed by the grantor, and delivered ( 89-1-3). Grant deeds should be acknowledged or proved in order to entitle them to be recorded, and such acknowledgment or proof should be certified by an officer authorized to take acknowledgments. Any of the officers listed in section 89-3-3 of the Mississippi Revised Code are authorized to acknowledge or prove deeds. If the party executing a grant deed or other conveyance does not reside in Mississippi, the deed can be acknowledged or proved by any of the officers listed in 89-3-9, and the instrument will be as good and effectual as if the certificate of acknowledgment or proof had been made by an authorized officer in Mississippi ( 89-3-9). Grant deeds lacking a proper acknowledgment or proof may be refused for record by the clerk. However, if an instrument is not acknowledged or proved according to law but is otherwise admitted to record, then all persons are considered to be on constructive notice of the instrument ( 89-3-1).

The recording of a grant deed in Mississippi is essential in order to provide notice to third parties. Except as may be provided by Mississippi laws, a grant deed or other conveyance is invalid as against a purchaser for valuable consideration without notice, or any creditor, unless the deed has been recorded with the clerk of the chancery court in the county where the real property is located. After the deed has been filed with the clerk, the priority of the filing time will determine the priority of all conveyances of the same land as between the several holders of such conveyances ( 89-5-1). If a grant deed is not filed for record with the clerk, the failure to do so will prevent any claim of priority by the holder of such instrument over any similar recorded instrument affecting the same property, to the end that with reference to all instruments which may be filed for record, the priority thereof is governed by the priority of the filing time of the several instruments, in the absence of actual notice. A grant deed will take effect, as to all creditors and subsequent purchasers for a valuable consideration without notice only from the time it is delivered to the clerk to be recorded ( 89-5-5). An unrecorded grant deed will be valid and binding only between the parties and their heirs, and as to all subsequent purchasers with notice or without valuable consideration ( 89-5-3).

(Mississippi GD Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Lincoln County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Lincoln County Grant Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4562 Reviews )

MARY LACEY M.

June 30th, 2025

Great service! Recording was smooth and swiftly performed. Deeds.com is an excellent service.rn

We are delighted to have been of service. Thank you for the positive review!

Robert F.

June 30th, 2025

Breeze.... It feels silly to hire an attorney to do this for just one beneficiary. Thanks.

Thank you for your feedback. We really appreciate it. Have a great day!

Pauline C.

June 29th, 2025

Everything that was stated to be included in my order was complete. Very satisfied

Thank you for your positive words! We’re thrilled to hear about your experience.

Michael T.

January 23rd, 2021

This site was recommended to me. The deed worked just fine for recording a property transfer (Warranty Deed). What I like is that there is a 1 time fee, not a subscription. I would highly recommend. It saved us $2000 in closing costs and fees.

Thank you!

O. Peter P.

June 21st, 2019

I find your forms hard to use, inasmuch as the forms cannot be converted to a Word Document. Editing and deleting of extra lines is not possible, making for a deed with large blank spaces.

Document that results is not usable for me.

Sorry to hear that we did not meet your expectations. We have canceled your order and payment. We do hope you find something more suitable to your needs elsewhere. Have a wonderful day.

Angela B.

September 19th, 2020

Great forms! Quick, easy, and to the point. The completed document, when printed out, looks really professional.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Any S.

January 11th, 2019

I was looking for realty transfer or deed in the name of ***** **** and could never find the list of realty transfers.

Thank you for the feedback Any. We do not offer searches by name, only by property.

Desiree T.

September 4th, 2020

In a world where "immediate satisfaction" takes too long, Deeds provided exceptionally satisfying service. Answered all of my questions quickly, and had my document recorded within one day. Thank you so much!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kim M.

January 5th, 2019

Purchased the Warranty Deed package for $19.95 which included all the forms I needed including instructions and a sample form. Seamless transaction filing with our local county clerk's office - she even commented it was one of the best prepared packages she has seen. Thanks for saving me a ton of money!

Thank you Kim, we appreciate your feedback.

David W.

May 4th, 2024

Great examples on how to fill out the quitclaim deed, but no info on how to fill out the cover sheet.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

CECIL E C.

June 27th, 2019

You made it easy to attain the documents I needed. The cost was very reasonable...thanks

Thank you for your feedback Cecil, we really appreciate it.

Jana H.

March 23rd, 2020

This company has made my life so much easier. I'm not driving 25 miles twice a week to record a document. I'm almost giddy! Thank you for making my job so much faster!

Jana Hamilton

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Gwen R.

January 23rd, 2019

Happy with the forms no complaints at all.

Thank you Gwen!

Michael P.

June 17th, 2020

excellent and timely service.

Thank you!

LANDON C.

March 5th, 2021

Process was simple, with a reasonable fee and within the suggested timetable for recordation. I highly recommend Deeds.com

Thank you!