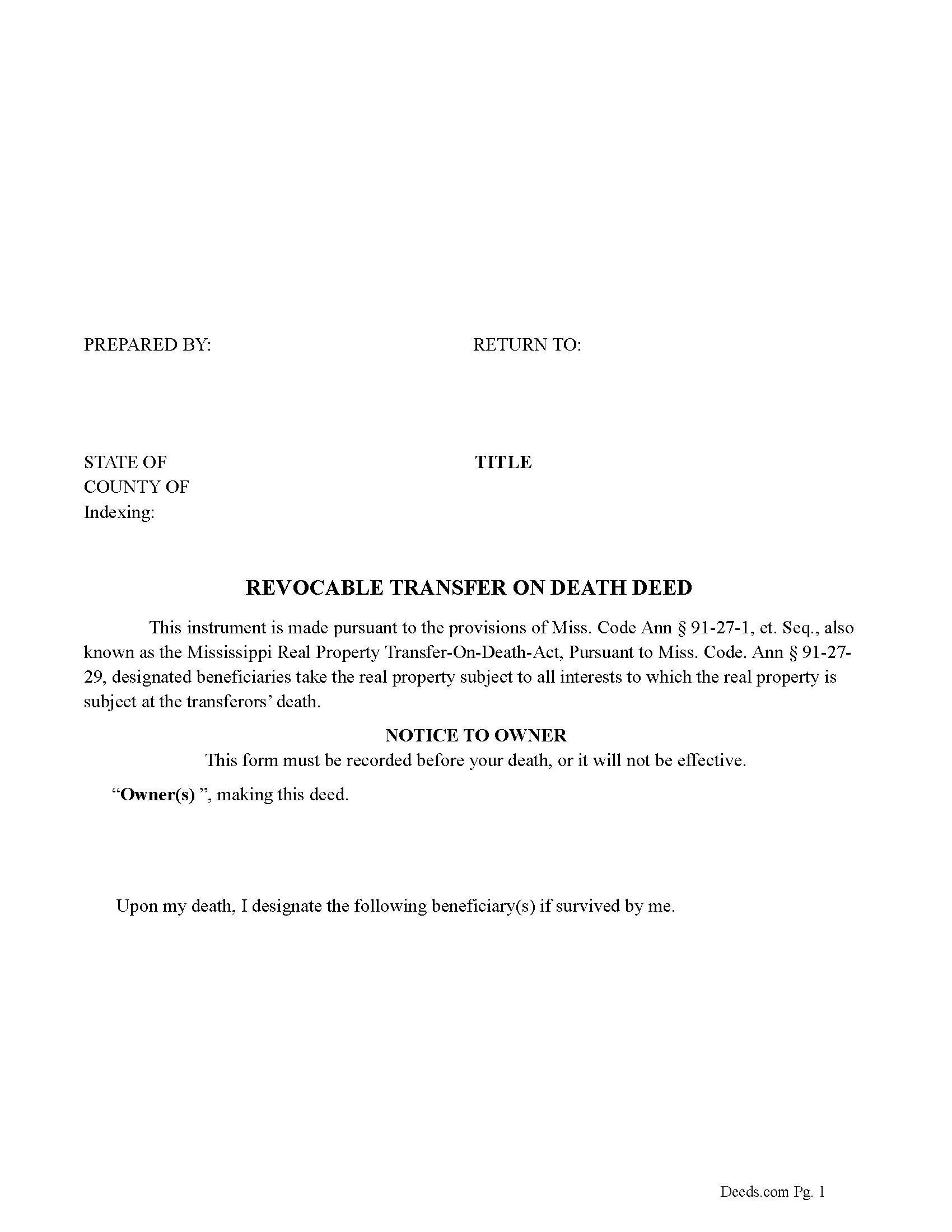

Forrest County Revocable Transfer on Death Deed Form

Forrest County Revocable Transfer on Death Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

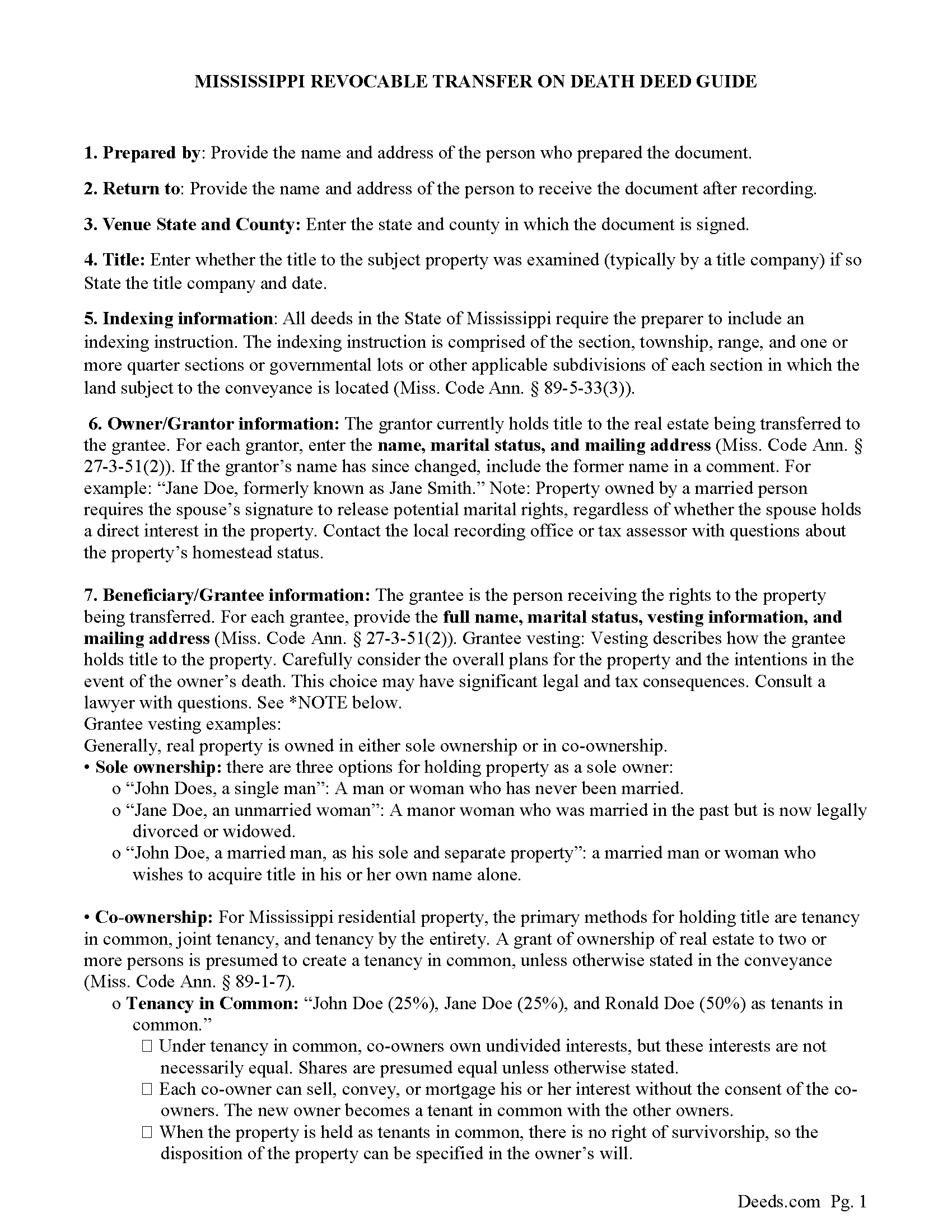

Forrest County Revocable Transfer on Death Deed Guide

Line by line guide explaining every blank on the form.

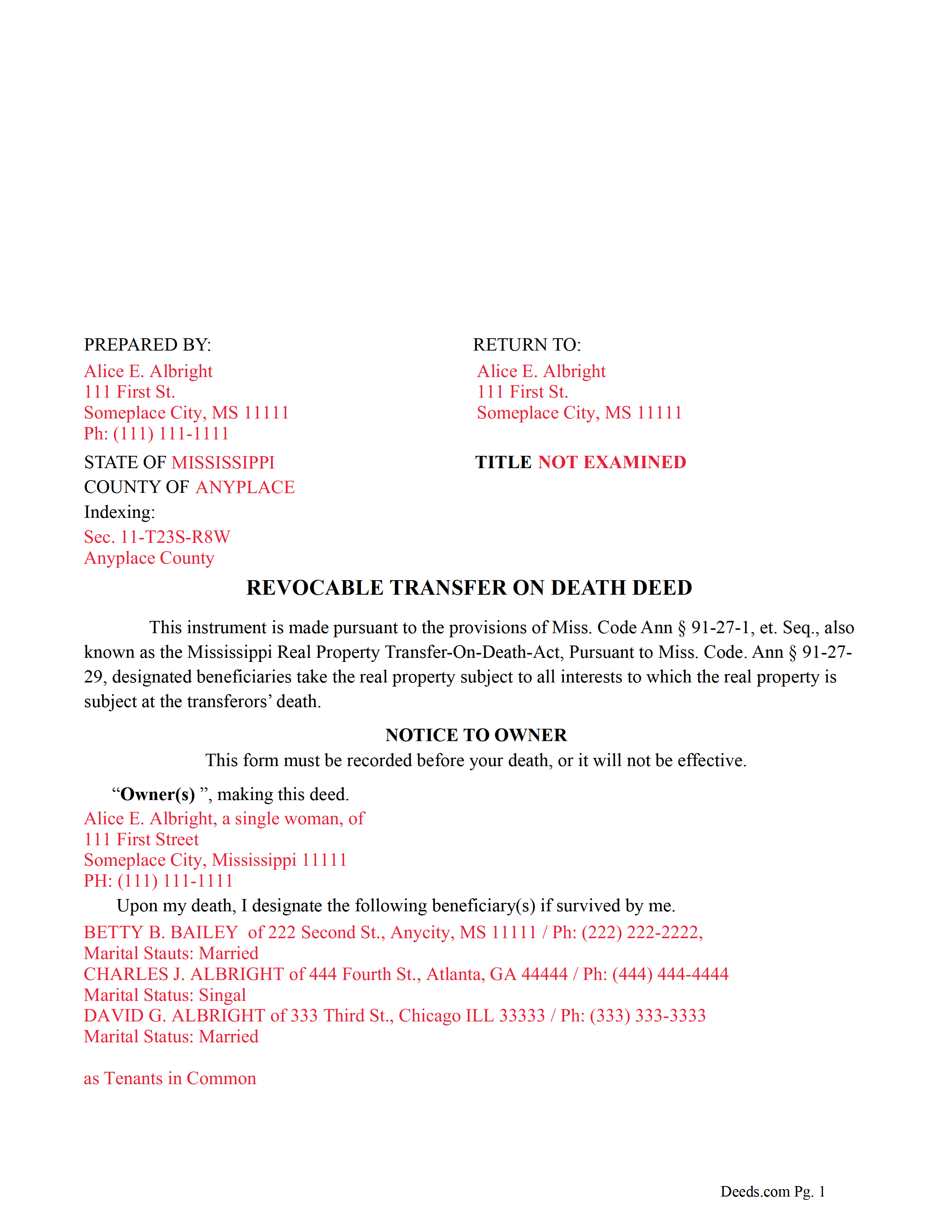

Forrest County Completed Example of the Revocable Transfer on Death Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Mississippi and Forrest County documents included at no extra charge:

Where to Record Your Documents

Forrest County Chancery Clerk

Hattiesburg, Mississippi 39401

Hours: 8:30 to 5:00 M-F

Phone: (601) 545-6014

Recording Tips for Forrest County:

- Ensure all signatures are in blue or black ink

- Ask if they accept credit cards - many offices are cash/check only

- Ask about their eRecording option for future transactions

- Recording early in the week helps ensure same-week processing

- Multi-page documents may require additional fees per page

Cities and Jurisdictions in Forrest County

Properties in any of these areas use Forrest County forms:

- Brooklyn

- Hattiesburg

- Petal

Hours, fees, requirements, and more for Forrest County

How do I get my forms?

Forms are available for immediate download after payment. The Forrest County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Forrest County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Forrest County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Forrest County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Forrest County?

Recording fees in Forrest County vary. Contact the recorder's office at (601) 545-6014 for current fees.

Questions answered? Let's get started!

On July 1, 2020, the "Mississippi Real Property Transfer on Death Act" became effective, allowing the owner/transferor the right to transfer his/her/their property rights upon the death of the transferor(s). {"Transferor" means an individual who makes a transfer-on-death deed.} The instrument used is a "Transfer on Death Deed" (TODD). The transferor(s) names a designated beneficiary(s)/transferee(s) who will receive the property upon the transferor's death. ["Beneficiary" means a person who receives real property under a transfer-on-death deed.] To be effective the TODD must be recorded before the transferor's death ({in the official records of the chancery clerk of the county where the real property is located)}. A TODD is unique in that it does NOT have to be delivered or accepted by the beneficiary(s). {Section 91-27-3 (g)} [Section 91-27-3(b)] ({Section 91-27-17(3)})

A TODD allows the transferor to keep possession of the subject property throughout his/her/their lifetime and is frequently used to bypass the probate process, thus saving time and money. A TODD may be revoked, by the transferor if the revocation is recorded before the death of the transferor.

Section 91-27-27 - Effect of transfer-on-death deed at transferor's death

On the death of the transferor, the following rules apply to an interest in real property that is the subject of a transfer-on-death deed and owned by the transferor at death except as otherwise provided: in the transfer-on-death deed; in this chapter; in Title 91, Chapter 29, Mississippi Code of 1972, relating to revocation by divorce; in Section 91-1-25 relating to the prohibition on inheriting from a person whom one has killed; in Title 91, Chapter 3, Mississippi Code of 1972, the Mississippi Uniform Simultaneous Death Act; and in Section 91-5-25 relating to the spousal right to renounce a will:

(1) If a transferor is a joint owner with right of survivorship who is survived by one or more other joint owners, the real property that is the subject of the transfer-on-death deed belongs to the surviving joint owner or owners. If a transferor is a joint owner with right of survivorship who is the last-surviving joint owner, the transfer-on-death deed is effective.

(2) The last-surviving joint owner may revoke the transfer-on-death deed subject to Section 91-27-19.

(3) A transfer-on-death deed transfers real property without covenant or warranty of title even if the deed contains a contrary provision.

(4) The interest in the property is transferred to a designated beneficiary in accordance with the deed, but the interest of a designated beneficiary is contingent on the designated beneficiary surviving the transferor. The interest of a designated beneficiary that fails to survive the transferor lapses.

(5) Concurrent interests are transferred to the beneficiaries in equal and undivided shares with no right of survivorship, but if the transferor has identified two (2) or more designated beneficiaries to receive concurrent interests in the property, the share of one which lapses or fails for any reason is transferred to the other, or to the others in proportion to the interest of each in the remaining part of the property held concurrently.

(Mississippi RTODD Package includes form, guidelines, and completed example) For use in Mississippi only.

Important: Your property must be located in Forrest County to use these forms. Documents should be recorded at the office below.

This Revocable Transfer on Death Deed meets all recording requirements specific to Forrest County.

Our Promise

The documents you receive here will meet, or exceed, the Forrest County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Forrest County Revocable Transfer on Death Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4580 Reviews )

Nancy J.

June 17th, 2020

This is a great service recommended by CSC. I only had one document to e-file. I would recommend to anyone.

Thank you for your feedback. We really appreciate it. Have a great day!

Jennifer D.

March 9th, 2022

I was skeptical; but, so thankful I went with them. They were beyond helpful through the entire process and very patient with me. I could not have done my quit deed form without them. Thank you for all of your help.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

spencer d.

February 9th, 2023

Great and quick service!

Thank you!

FRANK O.

March 1st, 2019

Easy to download and use the forms, however two forms needed for my county recording were not included.

Thank you for your feedback Frank. We'll look into finding and including the additional supplemental documents. Sometimes supplemental documents have to be generated by the county's system, specific to the transaction.

Larry H.

March 29th, 2019

Wow! So easy and such a cost savings. Thanks

Thanks Larry, we appreciate your feedback.

Gertrude H.

October 1st, 2019

I used this form and guide a couple years ago and found it helpful and easy to fill out. Had good results at the Recorder's Office. Would recommend Deeds.com.

Thank you for your feedback. We really appreciate it. Have a great day!

Muriel S.

October 5th, 2023

The three people we dealt with were courteous and helpful.

Thank you!

Tracey H.

November 10th, 2020

The transaction was easy and the download was immediately, What a great service to provide for a reasonable price. I highly recommend this service.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Rosanne E.

October 8th, 2020

Excellent response and all went well with downloading documents. Thank you for offering this important service.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Michelle M.

April 24th, 2023

This was an excellent source. The fee was much lower than the first site I checked. The sample form was very helpful.

Thank you!

Judith F.

June 29th, 2022

Was easy to use the eRecording service.

Thank you!

Rodney K.

April 12th, 2022

I need more time to review the vast number of documents received for such a good price. Hoping your info allows me to meet with and talk intelligently with a lawyer.

Thank you!

annie m.

February 13th, 2023

recently joined Deeds.com. still exploring the site. has been very helpful in providing local information for recording, such as fees and requirements. i am working to correct mistakes made within a deed. it is amazing how these municipalities operate outside the scope of Article 1, Section 8, Clause 17; to claim land is "in" the "State of ____. when the land is actually not ceded to the United States of America as for use for needful buildings. beware of the fraud perpetrated by Attorneys in the recording of your Deeds. Registration as "RESIDENTIAL" puts your private-use land on the TAX rolls with the use of that one word. i recommend this site as it appears there is information for each state and each county office. will update my review once i place an order.

Thank you!

Michelle G.

May 28th, 2021

This was a great service! I was having trouble recording something and found this was the best, and quickest, way to get it completed. Excellent service! Will definitely use them again!

Thank you for your feedback. We really appreciate it. Have a great day!

constance t.

December 30th, 2019

Excellent service!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!