Leflore County Revocable Transfer on Death Deed Form (Mississippi)

All Leflore County specific forms and documents listed below are included in your immediate download package:

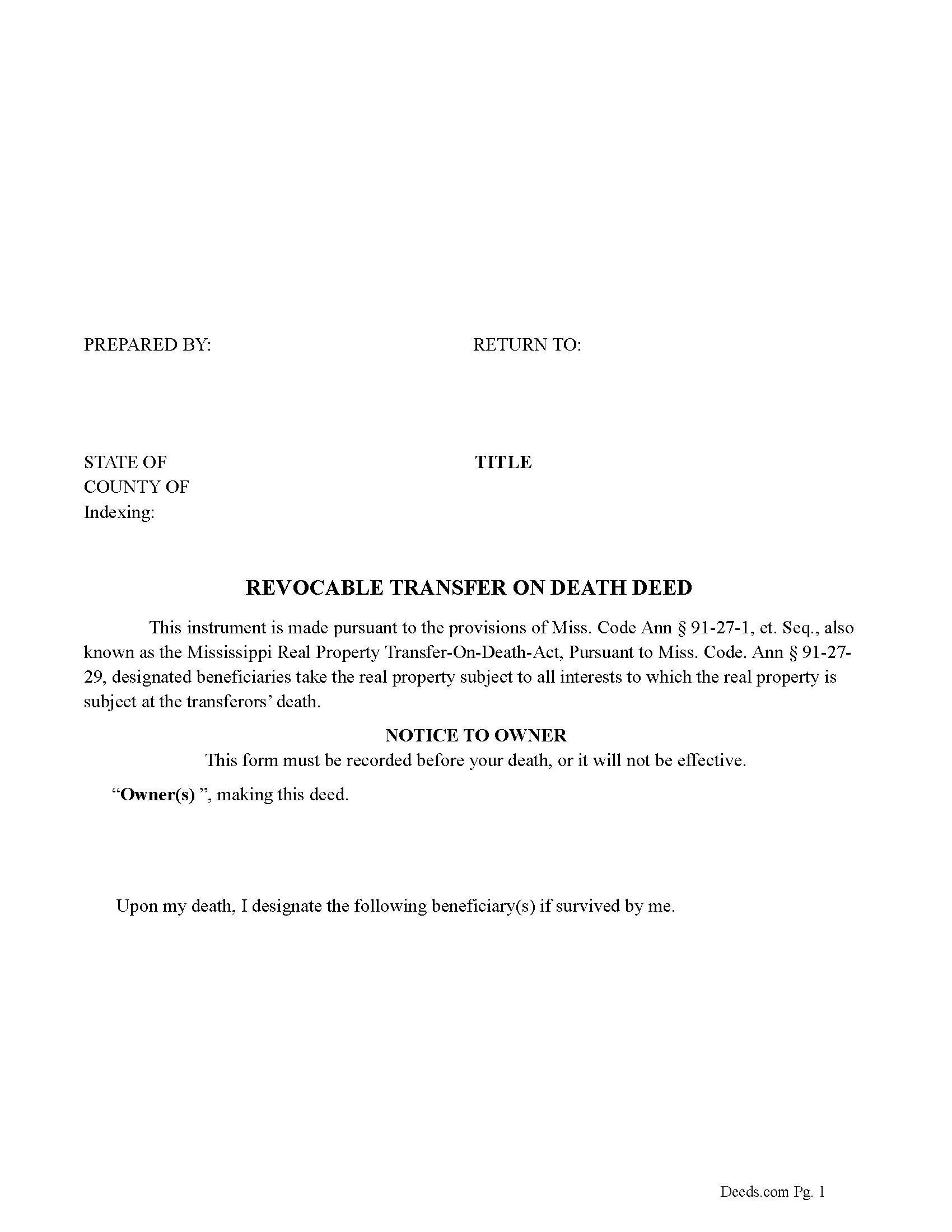

Revocable Transfer on Death Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Leflore County compliant document last validated/updated 6/16/2025

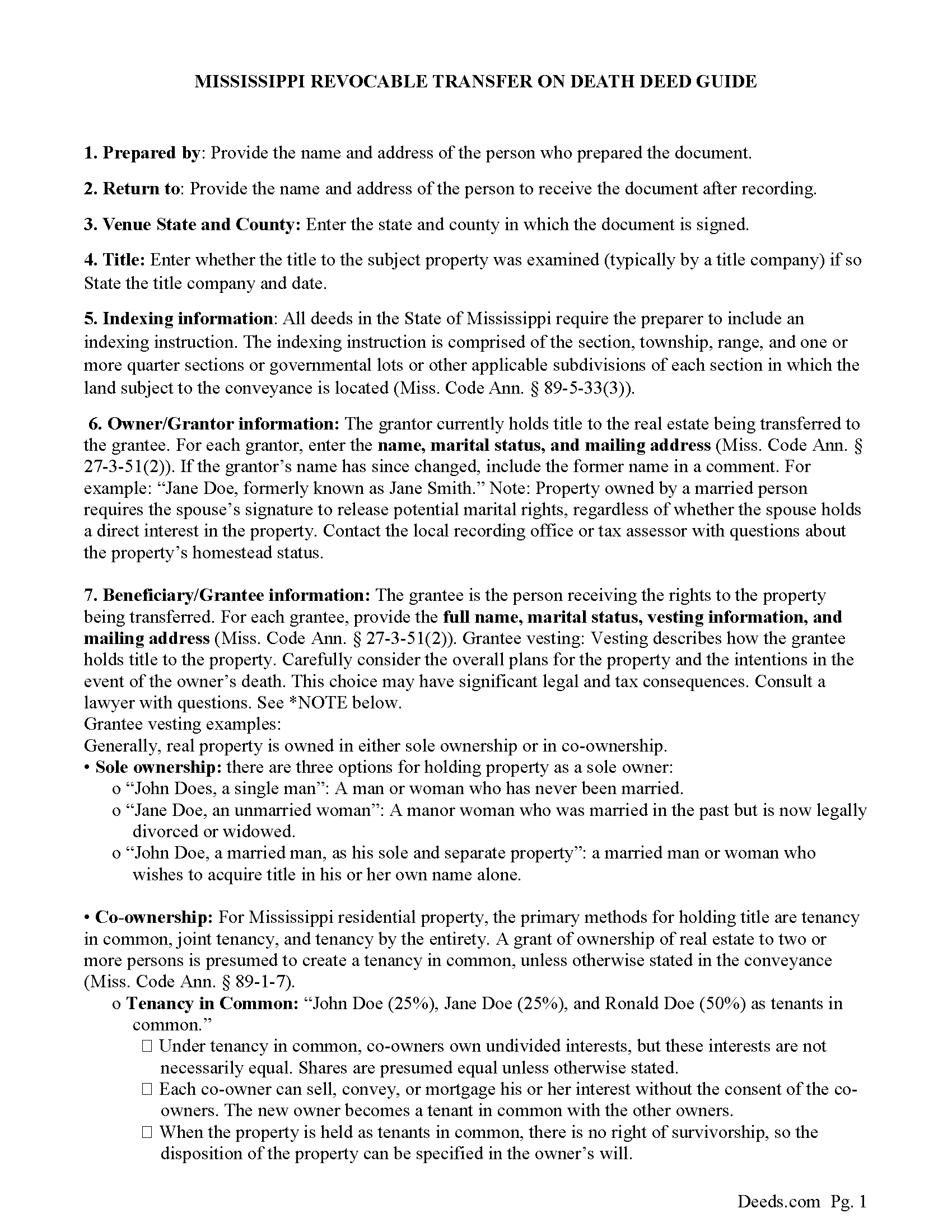

Revocable Transfer on Death Deed Guide

Line by line guide explaining every blank on the form.

Included Leflore County compliant document last validated/updated 6/10/2025

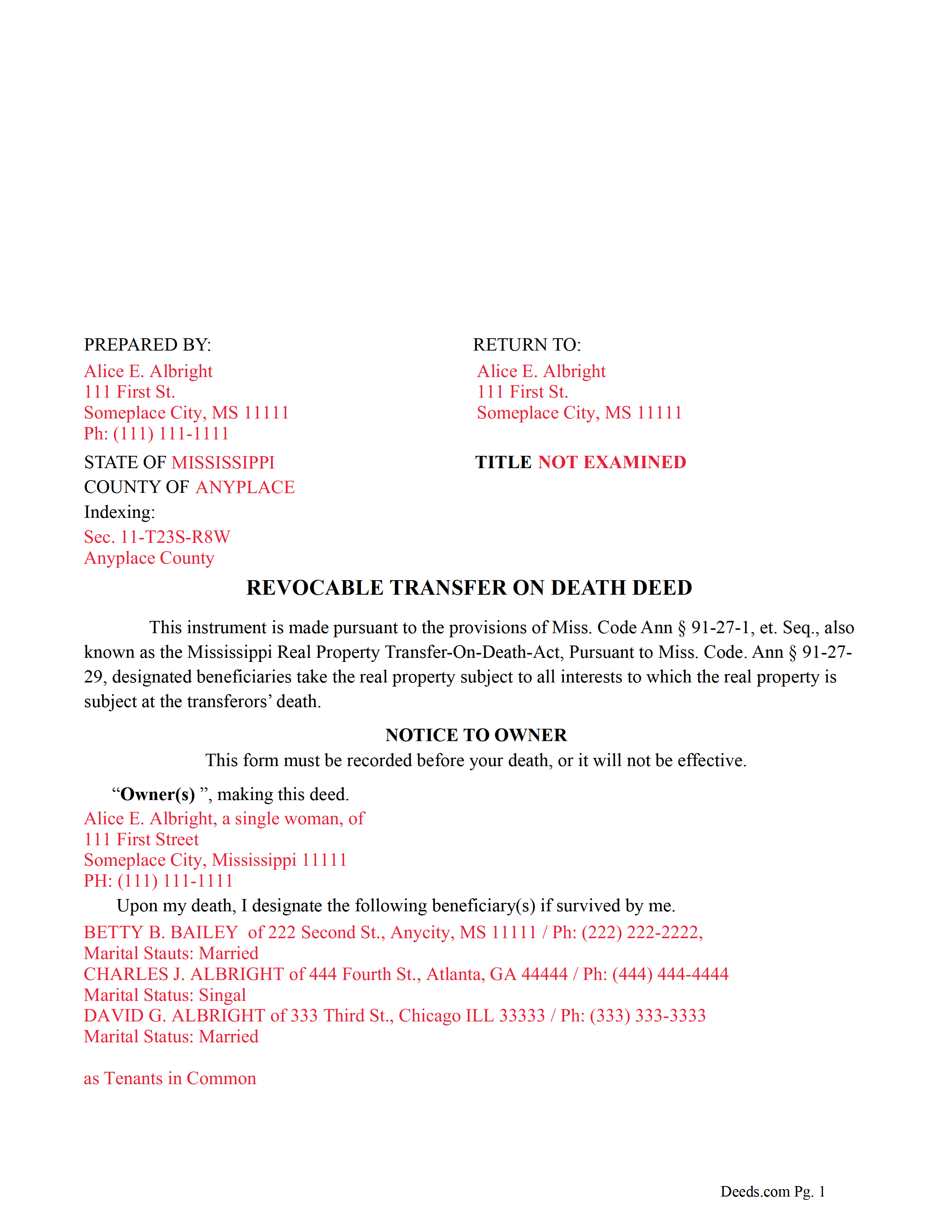

Completed Example of the Revocable Transfer on Death Deed Document

Example of a properly completed form for reference.

Included Leflore County compliant document last validated/updated 3/28/2025

The following Mississippi and Leflore County supplemental forms are included as a courtesy with your order:

When using these Revocable Transfer on Death Deed forms, the subject real estate must be physically located in Leflore County. The executed documents should then be recorded in the following office:

LeFlore County Chancery Clerk

306 West Market St / PO Box 250, Greenwood, Mississippi 38935

Hours: 8:30 to 4:30 M-F

Phone: (662) 453-6203

Local jurisdictions located in Leflore County include:

- Greenwood

- Itta Bena

- Minter City

- Money

- Morgan City

- Schlater

- Swiftown

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Leflore County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Leflore County using our eRecording service.

Are these forms guaranteed to be recordable in Leflore County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Leflore County including margin requirements, content requirements, font and font size requirements.

Can the Revocable Transfer on Death Deed forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Leflore County that you need to transfer you would only need to order our forms once for all of your properties in Leflore County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Mississippi or Leflore County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Leflore County Revocable Transfer on Death Deed forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

On July 1, 2020, the "Mississippi Real Property Transfer on Death Act" became effective, allowing the owner/transferor the right to transfer his/her/their property rights upon the death of the transferor(s). {"Transferor" means an individual who makes a transfer-on-death deed.} The instrument used is a "Transfer on Death Deed" (TODD). The transferor(s) names a designated beneficiary(s)/transferee(s) who will receive the property upon the transferor's death. ["Beneficiary" means a person who receives real property under a transfer-on-death deed.] To be effective the TODD must be recorded before the transferor's death ({in the official records of the chancery clerk of the county where the real property is located)}. A TODD is unique in that it does NOT have to be delivered or accepted by the beneficiary(s). {Section 91-27-3 (g)} [Section 91-27-3(b)] ({Section 91-27-17(3)})

A TODD allows the transferor to keep possession of the subject property throughout his/her/their lifetime and is frequently used to bypass the probate process, thus saving time and money. A TODD may be revoked, by the transferor if the revocation is recorded before the death of the transferor.

Section 91-27-27 - Effect of transfer-on-death deed at transferor's death

On the death of the transferor, the following rules apply to an interest in real property that is the subject of a transfer-on-death deed and owned by the transferor at death except as otherwise provided: in the transfer-on-death deed; in this chapter; in Title 91, Chapter 29, Mississippi Code of 1972, relating to revocation by divorce; in Section 91-1-25 relating to the prohibition on inheriting from a person whom one has killed; in Title 91, Chapter 3, Mississippi Code of 1972, the Mississippi Uniform Simultaneous Death Act; and in Section 91-5-25 relating to the spousal right to renounce a will:

(1) If a transferor is a joint owner with right of survivorship who is survived by one or more other joint owners, the real property that is the subject of the transfer-on-death deed belongs to the surviving joint owner or owners. If a transferor is a joint owner with right of survivorship who is the last-surviving joint owner, the transfer-on-death deed is effective.

(2) The last-surviving joint owner may revoke the transfer-on-death deed subject to Section 91-27-19.

(3) A transfer-on-death deed transfers real property without covenant or warranty of title even if the deed contains a contrary provision.

(4) The interest in the property is transferred to a designated beneficiary in accordance with the deed, but the interest of a designated beneficiary is contingent on the designated beneficiary surviving the transferor. The interest of a designated beneficiary that fails to survive the transferor lapses.

(5) Concurrent interests are transferred to the beneficiaries in equal and undivided shares with no right of survivorship, but if the transferor has identified two (2) or more designated beneficiaries to receive concurrent interests in the property, the share of one which lapses or fails for any reason is transferred to the other, or to the others in proportion to the interest of each in the remaining part of the property held concurrently.

(Mississippi RTODD Package includes form, guidelines, and completed example) For use in Mississippi only.

Our Promise

The documents you receive here will meet, or exceed, the Leflore County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Leflore County Revocable Transfer on Death Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4562 Reviews )

MARY LACEY M.

June 30th, 2025

Great service! Recording was smooth and swiftly performed. Deeds.com is an excellent service.rn

We are delighted to have been of service. Thank you for the positive review!

Robert F.

June 30th, 2025

Breeze.... It feels silly to hire an attorney to do this for just one beneficiary. Thanks.

Thank you for your feedback. We really appreciate it. Have a great day!

Pauline C.

June 29th, 2025

Everything that was stated to be included in my order was complete. Very satisfied

Thank you for your positive words! We’re thrilled to hear about your experience.

Debbra .S C.

June 1st, 2023

Very easy and nice website to use.

Thank you for your feedback. We really appreciate it. Have a great day!

Dina B.

February 6th, 2021

The web cite is very easy to navigate through making a document process simple to obtain.

Thank you!

Daniel F.

June 26th, 2020

It was convenient to be able to download the deed template, instructions, and a completed sample deed all from deeds.com. I was able to complete my deed with little effort. My only complaint is that the editable fields in the pdf document are of fixed size, leaving some large spaces within a sentence, for example: Executed on this 1st day of July ,2020. This makes the printed document look a little peculiar.

Thank you for your feedback. We really appreciate it. Have a great day!

Barbara S.

June 12th, 2021

Thanks for this service. I believe it will be all I need. Will know for sure within a week

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Raymond P.

August 7th, 2019

User Friendly- so easy to fill in online!!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Julia M.

March 9th, 2019

Your PDF form Personal Representative's Deed was exceedingly helpful.

Thank you Julia. Have a fantastic day!

Jorge F.

October 15th, 2021

It would be helpful for documents to be in word format as well and for PDF version not to be locked.

Thank you for your feedback. We really appreciate it. Have a great day!

Joan S.

May 21st, 2020

Thanks for providing this service. We had searched for weeks for the correct documents. It might help clients to find you soon if the banks and mortgage companies can refer clients to you. They require the forms but offer no direct source to obtain them. You are 5 star in every way.

Thank you!

Ann-Margaret G.

August 8th, 2022

Found what I was looking for quickly, no issues. Able to pay & download my forms. Haven't filed them yet so I can't review that process.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Narcedalia G.

December 4th, 2023

Easy to use quick responses with accurate information and great customer service. No need to say more!

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Paul F.

December 26th, 2018

Excellent - no reservations. I used them on a Sunday and had my info on Monday. Not only did they execute the order flawlessly, the fixed my screw up* immediately. *I hit refresh before the "secured" page transmitted, so I created (2) two orders of the same item.

Thanks for the review Paul, glad you were happy with the service and staff. Our staff is pretty good at catching the few duplicate orders that get through.

Stanley S.

September 23rd, 2022

Extremely convenient and easy to execute the document. Instructions and example are very helpful. I have bookmarked the site and will surely use again. 5 stars!!

Thank you!