Panola County Revocable Transfer on Death Deed Form

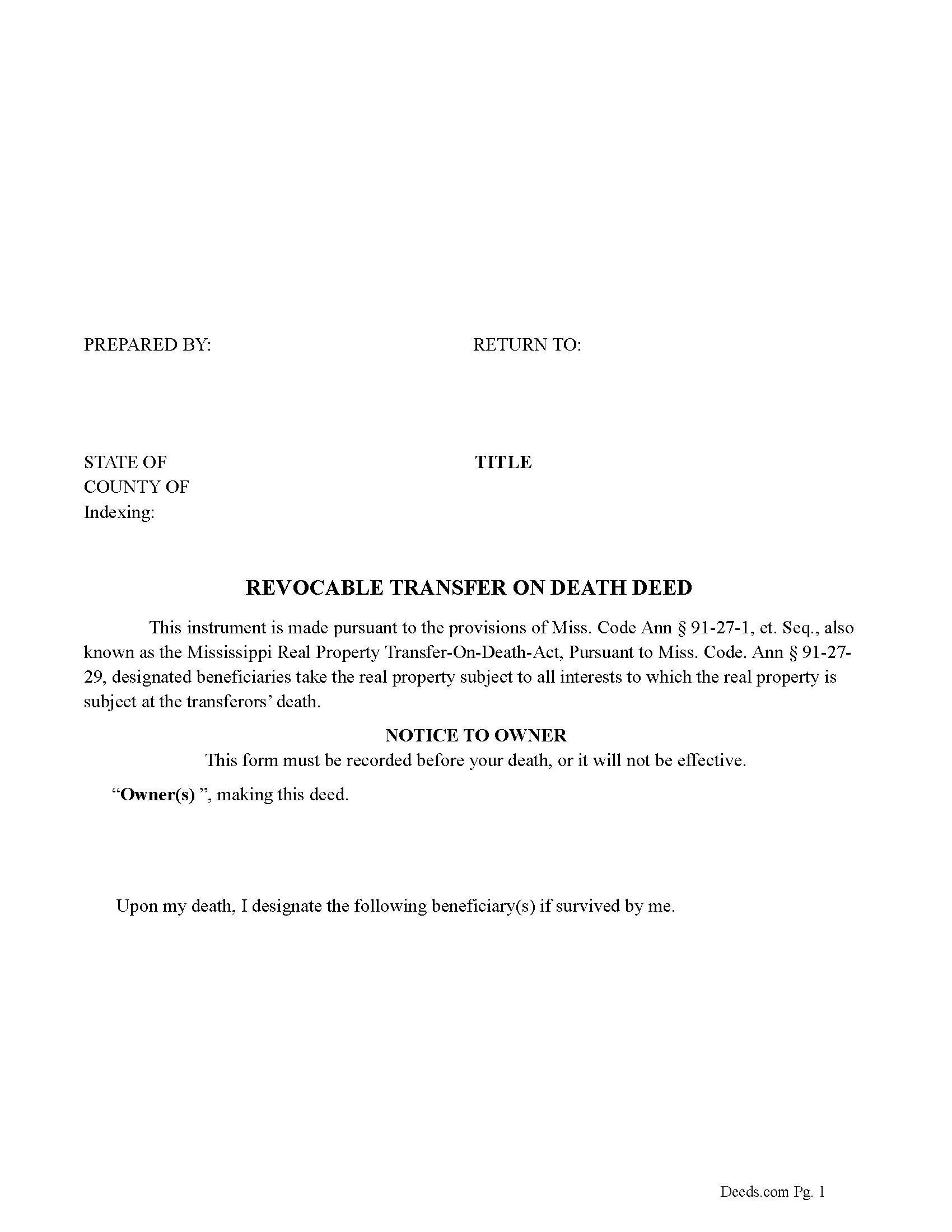

Panola County Revocable Transfer on Death Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

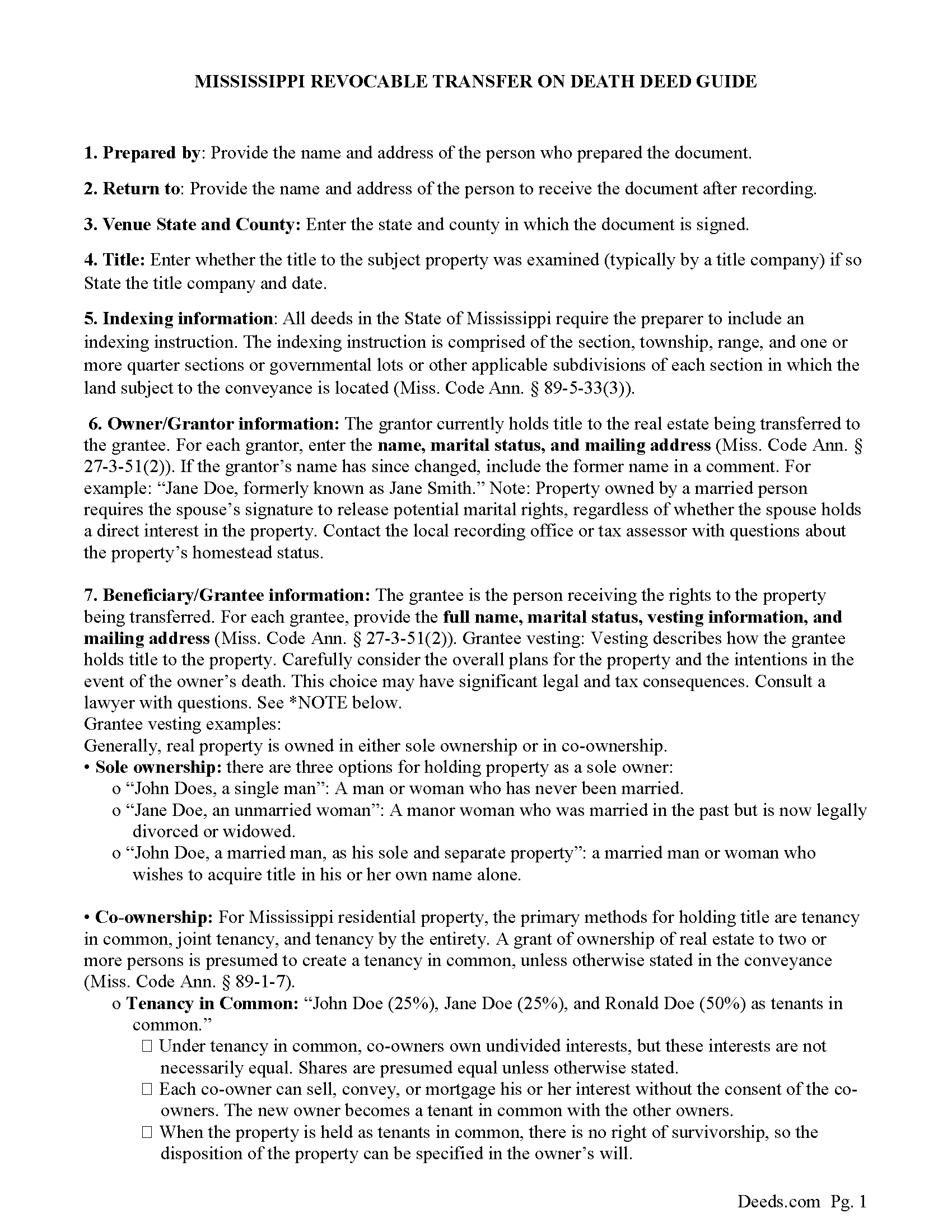

Panola County Revocable Transfer on Death Deed Guide

Line by line guide explaining every blank on the form.

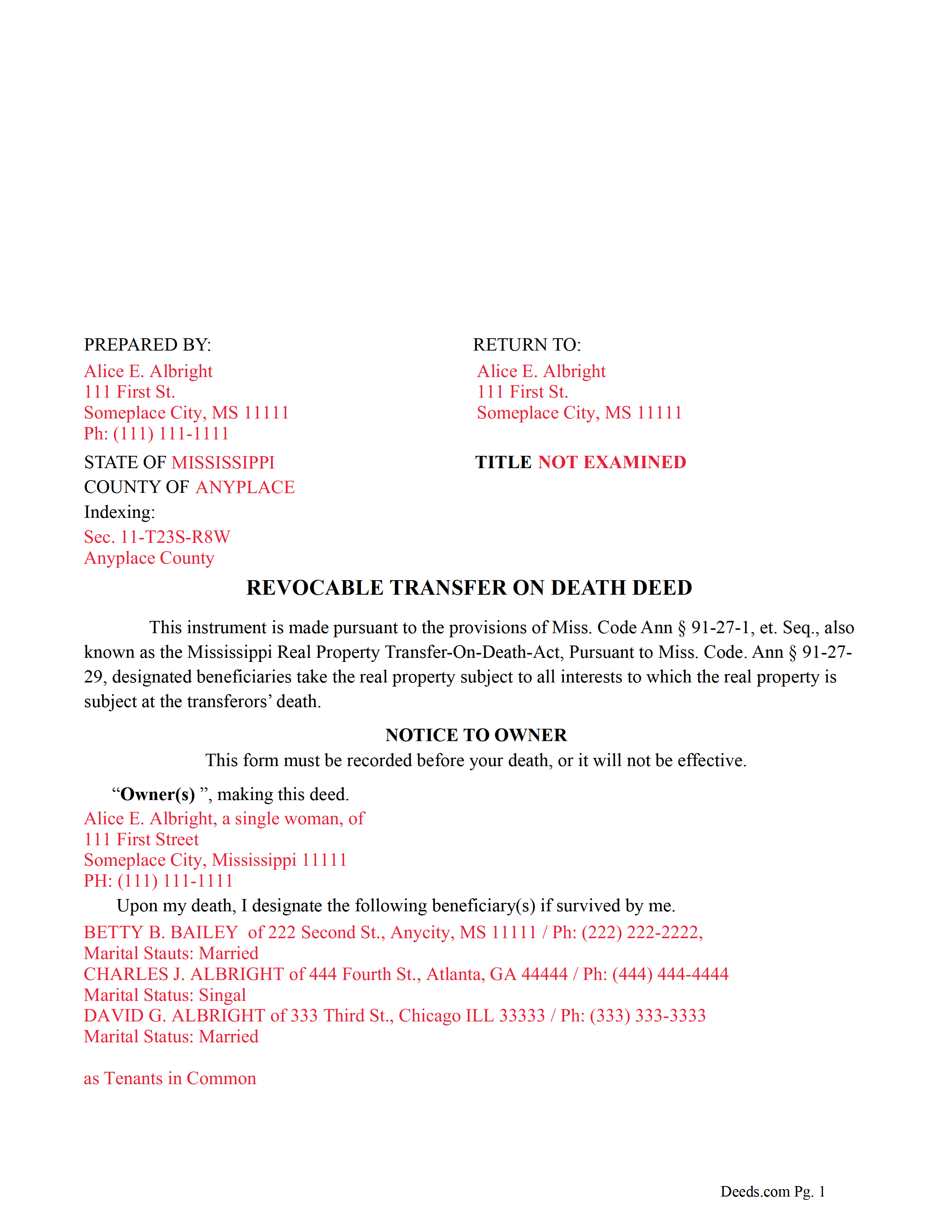

Panola County Completed Example of the Revocable Transfer on Death Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Mississippi and Panola County documents included at no extra charge:

Where to Record Your Documents

Chancery Court - First Judicial District

Sardis, Mississippi 38666

Hours: Call for hours

Phone: (662) 487-2070

Chancery Court - Second Judicial District

Batesville, Mississippi 38606

Hours: Call for hours

Phone: (662) 563-6205

Recording Tips for Panola County:

- Ensure all signatures are in blue or black ink

- Verify all names are spelled correctly before recording

- Request a receipt showing your recording numbers

Cities and Jurisdictions in Panola County

Properties in any of these areas use Panola County forms:

- Batesville

- Como

- Courtland

- Crenshaw

- Pope

- Sarah

- Sardis

Hours, fees, requirements, and more for Panola County

How do I get my forms?

Forms are available for immediate download after payment. The Panola County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Panola County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Panola County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Panola County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Panola County?

Recording fees in Panola County vary. Contact the recorder's office at (662) 487-2070 for current fees.

Questions answered? Let's get started!

On July 1, 2020, the "Mississippi Real Property Transfer on Death Act" became effective, allowing the owner/transferor the right to transfer his/her/their property rights upon the death of the transferor(s). {"Transferor" means an individual who makes a transfer-on-death deed.} The instrument used is a "Transfer on Death Deed" (TODD). The transferor(s) names a designated beneficiary(s)/transferee(s) who will receive the property upon the transferor's death. ["Beneficiary" means a person who receives real property under a transfer-on-death deed.] To be effective the TODD must be recorded before the transferor's death ({in the official records of the chancery clerk of the county where the real property is located)}. A TODD is unique in that it does NOT have to be delivered or accepted by the beneficiary(s). {Section 91-27-3 (g)} [Section 91-27-3(b)] ({Section 91-27-17(3)})

A TODD allows the transferor to keep possession of the subject property throughout his/her/their lifetime and is frequently used to bypass the probate process, thus saving time and money. A TODD may be revoked, by the transferor if the revocation is recorded before the death of the transferor.

Section 91-27-27 - Effect of transfer-on-death deed at transferor's death

On the death of the transferor, the following rules apply to an interest in real property that is the subject of a transfer-on-death deed and owned by the transferor at death except as otherwise provided: in the transfer-on-death deed; in this chapter; in Title 91, Chapter 29, Mississippi Code of 1972, relating to revocation by divorce; in Section 91-1-25 relating to the prohibition on inheriting from a person whom one has killed; in Title 91, Chapter 3, Mississippi Code of 1972, the Mississippi Uniform Simultaneous Death Act; and in Section 91-5-25 relating to the spousal right to renounce a will:

(1) If a transferor is a joint owner with right of survivorship who is survived by one or more other joint owners, the real property that is the subject of the transfer-on-death deed belongs to the surviving joint owner or owners. If a transferor is a joint owner with right of survivorship who is the last-surviving joint owner, the transfer-on-death deed is effective.

(2) The last-surviving joint owner may revoke the transfer-on-death deed subject to Section 91-27-19.

(3) A transfer-on-death deed transfers real property without covenant or warranty of title even if the deed contains a contrary provision.

(4) The interest in the property is transferred to a designated beneficiary in accordance with the deed, but the interest of a designated beneficiary is contingent on the designated beneficiary surviving the transferor. The interest of a designated beneficiary that fails to survive the transferor lapses.

(5) Concurrent interests are transferred to the beneficiaries in equal and undivided shares with no right of survivorship, but if the transferor has identified two (2) or more designated beneficiaries to receive concurrent interests in the property, the share of one which lapses or fails for any reason is transferred to the other, or to the others in proportion to the interest of each in the remaining part of the property held concurrently.

(Mississippi RTODD Package includes form, guidelines, and completed example) For use in Mississippi only.

Important: Your property must be located in Panola County to use these forms. Documents should be recorded at the office below.

This Revocable Transfer on Death Deed meets all recording requirements specific to Panola County.

Our Promise

The documents you receive here will meet, or exceed, the Panola County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Panola County Revocable Transfer on Death Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4581 Reviews )

Dominick D.

October 21st, 2020

Deed.com was easy to work with, not just a website, they have real people that speak to you. They were extremely helpful with a VERY difficult Northeast county. They made the process smooth and effortless.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

jim g.

June 4th, 2020

so far so good. was hoping to have the recorded document already. i need the recorded document by friday, june 5th for my city approval. anyway you can please get it to me tomorrow. thanks, jim

Thank you!

Any S.

January 11th, 2019

I was looking for realty transfer or deed in the name of ***** **** and could never find the list of realty transfers.

Thank you for the feedback Any. We do not offer searches by name, only by property.

Jim J.

February 8th, 2019

The forms were easy to use and the fields are tabbed so that you can enter your information and then move quickly to the next entry. The Guide for the documents was very helpful.

Thanks Jim, we appreciate your feedback.

Alan S.

April 28th, 2020

Great job! Fast and easy. Terrific communications.

Thank you!

Deana A.

April 30th, 2020

Great forms and info, easy step-by-step guidance.

Thank you!

Gregory N.

September 10th, 2020

Good information guiding through filling out the product. Would like form to be more flexible in terms of spacing, but otherwise excellent.

Thank you for your feedback. We really appreciate it. Have a great day!

Richard G.

August 28th, 2022

I was not able to add more linea to the deed and add up to four people and their addresses. The document should be able to be expanded.

Thank you for your feedback. We really appreciate it. Have a great day!

Connie C.

February 18th, 2021

I thought the process was fairly easy. The price was reasonable. I had a slight problem, some of the words were missing from one page of the documents when I printed it. However, after I saved it to my computer, I was able to print the page in full.

Thank you for your feedback. We really appreciate it. Have a great day!

Erik J.

January 8th, 2021

First time using Deeds.com and feel that your platform is clear and easy to use. I was also pleased with the messaging center and follow-up and also surprised at how quickly our particular deed was recorded and available to view. Having said that, when I first investigated Deeds.com the fee was $15 and as of 1/1/21 it has increased to $19 which I feel is pretty steep for the handling of 1 simple document especially when the turnaround was basically the same day. Your fee was nearly the equivalent of the cost of the Clerk's recording fee. Perhaps you should offer a fee schedule for those of us who are not volume recorders. Just a thought.

Thank you!

Joni S.

February 6th, 2024

Excellent service, no hassle, easy to use, affordable, best service -- hands down. I thought it would be difficult for me to record a deed in Florida while residing in California but you made it so easy. I will tell everyone about your service. Thank you.

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Ardith S.

February 14th, 2021

Very informative and user friendly. Was able to get all information and forms needed without any problems.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Paula V.

April 15th, 2025

Fast, easy, helpful instructions. I’ll use them again!

Thank you for your feedback. We really appreciate it. Have a great day!

wendell s.

September 25th, 2020

The forms were everything promised. The guide was very helpful and made the process painless.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Thomas G.

March 16th, 2020

A few parts are confusing'.Like sending Tax statements to WHO ?/ The rest is simple I hope.Have not tried to record yet

Thank you!