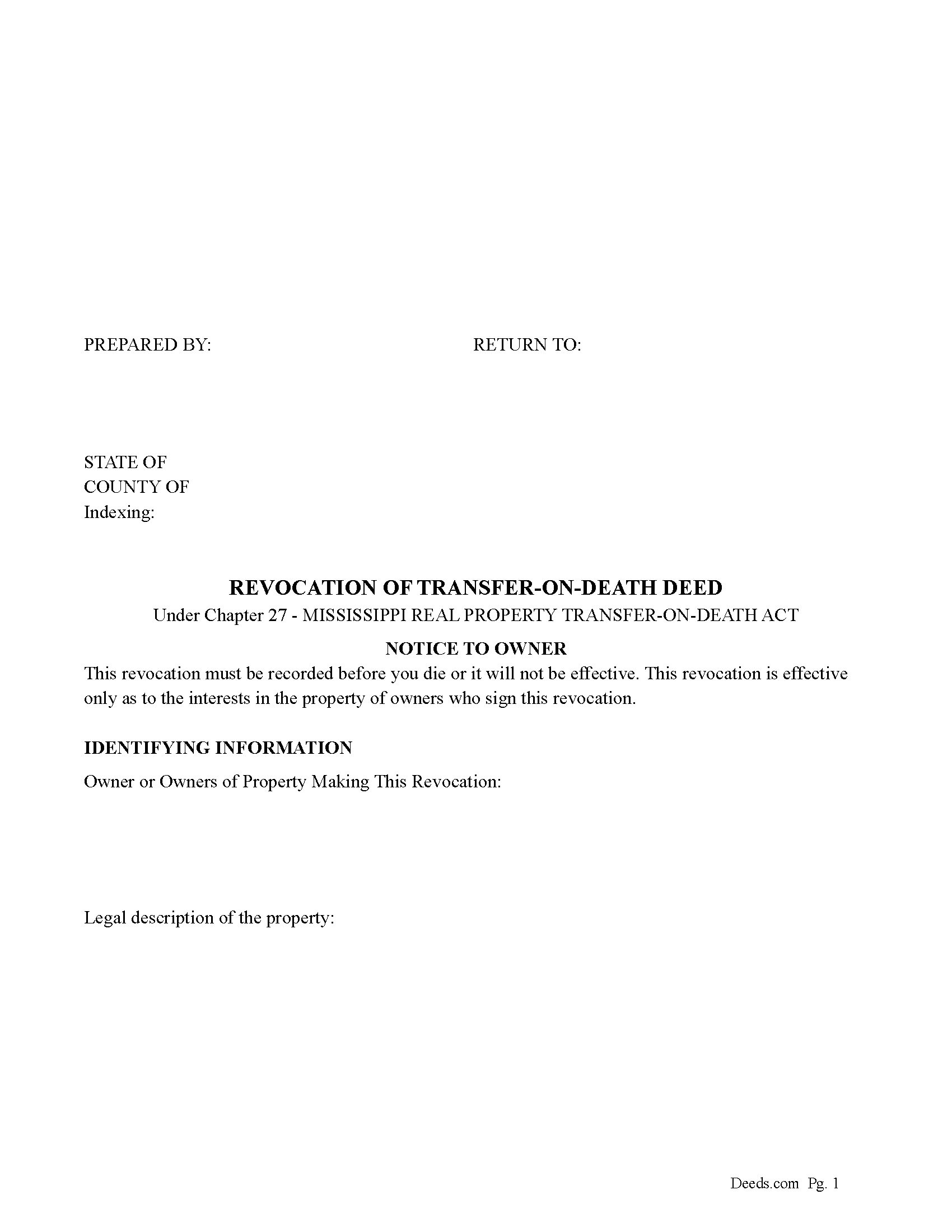

Forrest County Revocation of Transfer on Death Deed Form

Forrest County Revocation of Transfer on Death Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

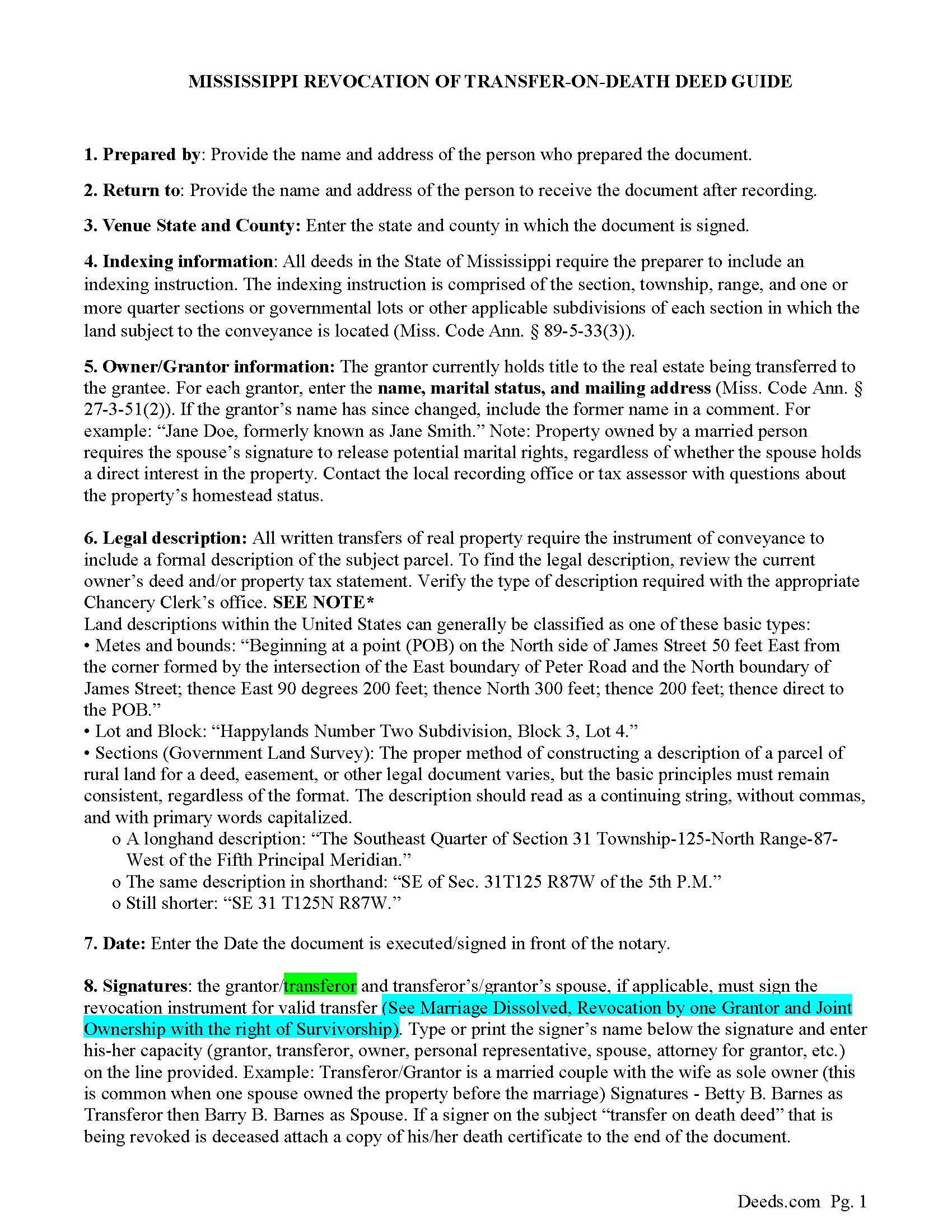

Forrest County Guidelines for Revocation of Transfer on Death Deed

Line by line guide explaining every blank on the form.

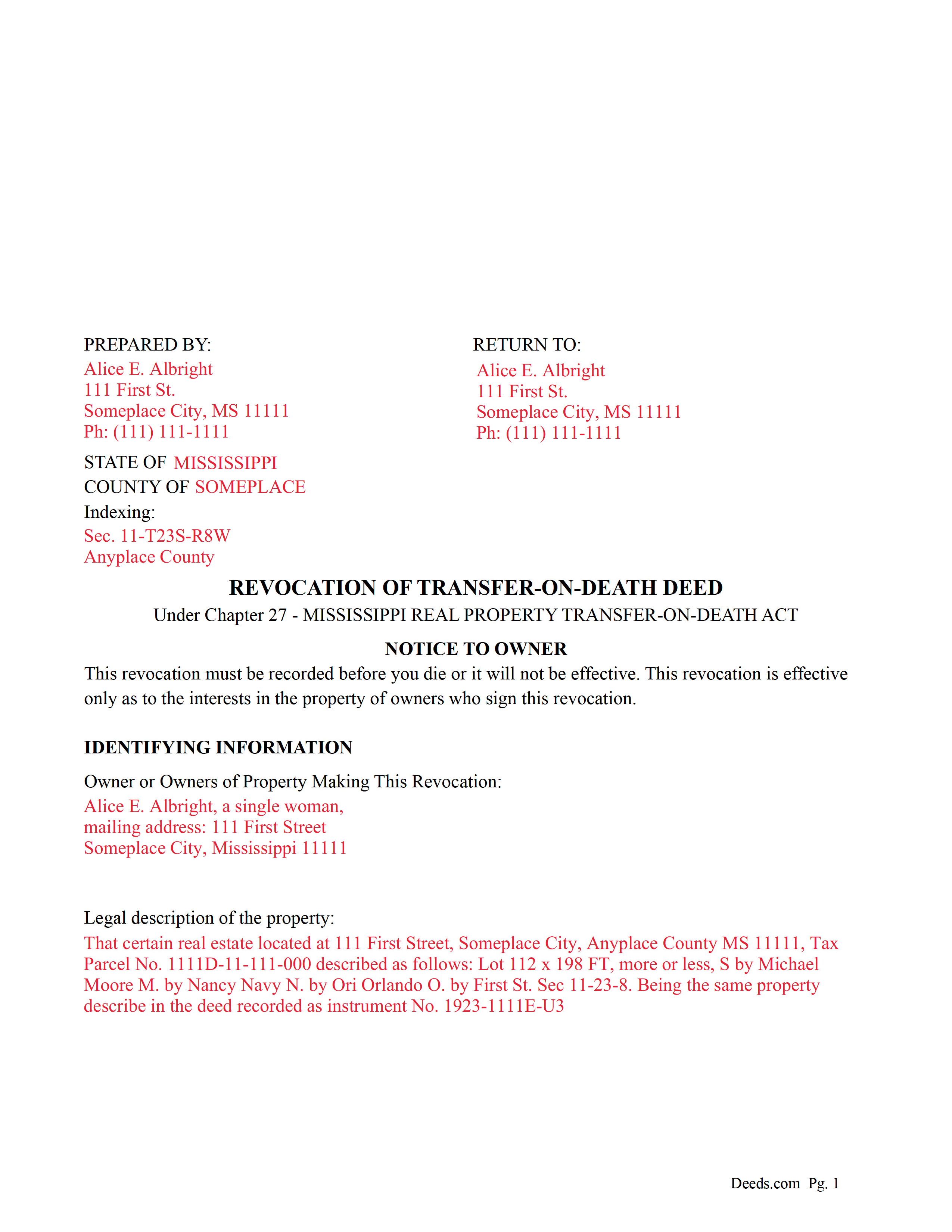

Forrest County Completed Example of a Revocation of Transfer on Death Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Mississippi and Forrest County documents included at no extra charge:

Where to Record Your Documents

Forrest County Chancery Clerk

Hattiesburg, Mississippi 39401

Hours: 8:30 to 5:00 M-F

Phone: (601) 545-6014

Recording Tips for Forrest County:

- White-out or correction fluid may cause rejection

- Recording fees may differ from what's posted online - verify current rates

- Recorded documents become public record - avoid including SSNs

- Request a receipt showing your recording numbers

Cities and Jurisdictions in Forrest County

Properties in any of these areas use Forrest County forms:

- Brooklyn

- Hattiesburg

- Petal

Hours, fees, requirements, and more for Forrest County

How do I get my forms?

Forms are available for immediate download after payment. The Forrest County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Forrest County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Forrest County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Forrest County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Forrest County?

Recording fees in Forrest County vary. Contact the recorder's office at (601) 545-6014 for current fees.

Questions answered? Let's get started!

Use this form to revoke or partially revoke a previously recorded Revocable Transfer on Death Deed.

Section 91-27-21 - Revocation by instrument authorized; revocation by act not permitted

(a) Subject to subsections (d) and (e), an instrument is effective to revoke a recorded transfer-on-death deed, or any part of it, if the instrument:

(1) Is one (1) of the following:

(A) A subsequent transfer-on-death deed that revokes the preceding transfer-on-death deed or part of the deed expressly or by inconsistency; or

(B) Except as provided by subsection (b), an instrument of revocation that expressly revokes the transfer-on-death deed or part of the deed;

(2) Is acknowledged by the transferor after the acknowledgment of the deed being revoked; and

(3) Is recorded before the transferor's death in the official records of the chancery clerk of the county where the deed being revoked is recorded.

(b) A will does not revoke or supersede a transfer-on-death deed.

(c) If a marriage between the transferor and a designated beneficiary is dissolved after a transfer-on-death deed is recorded, a final judgment of the court dissolving the marriage operates to revoke the transfer-on-death deed as to that designated beneficiary.

(d) If a transfer-on-death deed is made by more than one (1) transferor, revocation by a transferor does not affect the deed as to the interest of another transferor who does not make that revocation.

(e) A transfer-on-death deed made by joint owners with right of survivorship is revoked only if it is revoked by all of the living joint owners.

(f) This section does not limit the effect of an inter vivos transfer of the real property.

(Mississippi Revocation of TODD Package includes form, guidelines, and completed example) For use in Mississippi only.

Important: Your property must be located in Forrest County to use these forms. Documents should be recorded at the office below.

This Revocation of Transfer on Death Deed meets all recording requirements specific to Forrest County.

Our Promise

The documents you receive here will meet, or exceed, the Forrest County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Forrest County Revocation of Transfer on Death Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4580 Reviews )

William O.

June 13th, 2025

form worked great but was over priced for such a simple form , should be around $10 and most people could easily create this themselves.

Hi William, thank you for your review. We’re glad the form worked well for you. We understand it may seem simple on the surface, but Transfer on Death Deeds—especially in New York—require precise language and adherence to both state and county-level rules. Our forms are attorney-prepared, regularly reviewed for legal compliance, and include helpful instructions to reduce the risk of costly filing errors. We appreciate your feedback and hope the document serves its purpose smoothly.

Christine M.

September 8th, 2021

Forms were top notch, easy to complete, printed beautifully, recorded with no revisions. Highly recommend for anyone preparing their own deeds.

Thank you for the kind words Christine. Have an amazing day!

Norma J H.

April 27th, 2022

Your forms have been very helpful. I thank you very much for making them easy to use.

Thank you for your feedback. We really appreciate it. Have a great day!

Sven S.

April 10th, 2019

great experience so far! Im using Deeds.com for e-recording. Easy to use website, document upload is a snap, you are walked through and reminded if theres something missing.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

edward s.

October 1st, 2020

This is the go to place for quick work. They are awesome.

Thank you!

William S.

June 4th, 2021

Contents were well done. Could not remove and replace the "Deeds/" footer, rendering the form unusable for filing with a court and county deed records. This should be corrected.

Thank you for your feedback. We really appreciate it. Have a great day!

Gary S.

January 9th, 2022

Easy to use. Very helpful

Thank you!

Laurentina F.

December 10th, 2020

Great and efficient.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Frank S.

March 28th, 2025

ALL THE DEED DOCUMENTS ARE ALL EXCELLENT AND ADDITIONAL DOCUMENTS REGARDING COMPLETING THE DOCUMENTS!!! EXCELLENT!!

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Hanna M.

June 10th, 2019

Very helpful information! Thank you for your service!

Thank you!

Ingrid K.

December 18th, 2020

Prompt efficient service.

Thank you!

Elizabeth W.

February 9th, 2023

would have been smart to give each pdf a name instead of unintelligible numbers...

Thank you for your feedback. We really appreciate it. Have a great day!

Juan M.

February 11th, 2021

Very happy

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

ronald d.

February 19th, 2021

I found that the website was laid out well and referenced documents were professionally created.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Gene N.

November 11th, 2021

My mind is blown! For some reason, our veteran title companies wouldn't record our deed but luckily, the assessor's page recommended Deeds and other sites to e-record. It was so simple and so convenient!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!