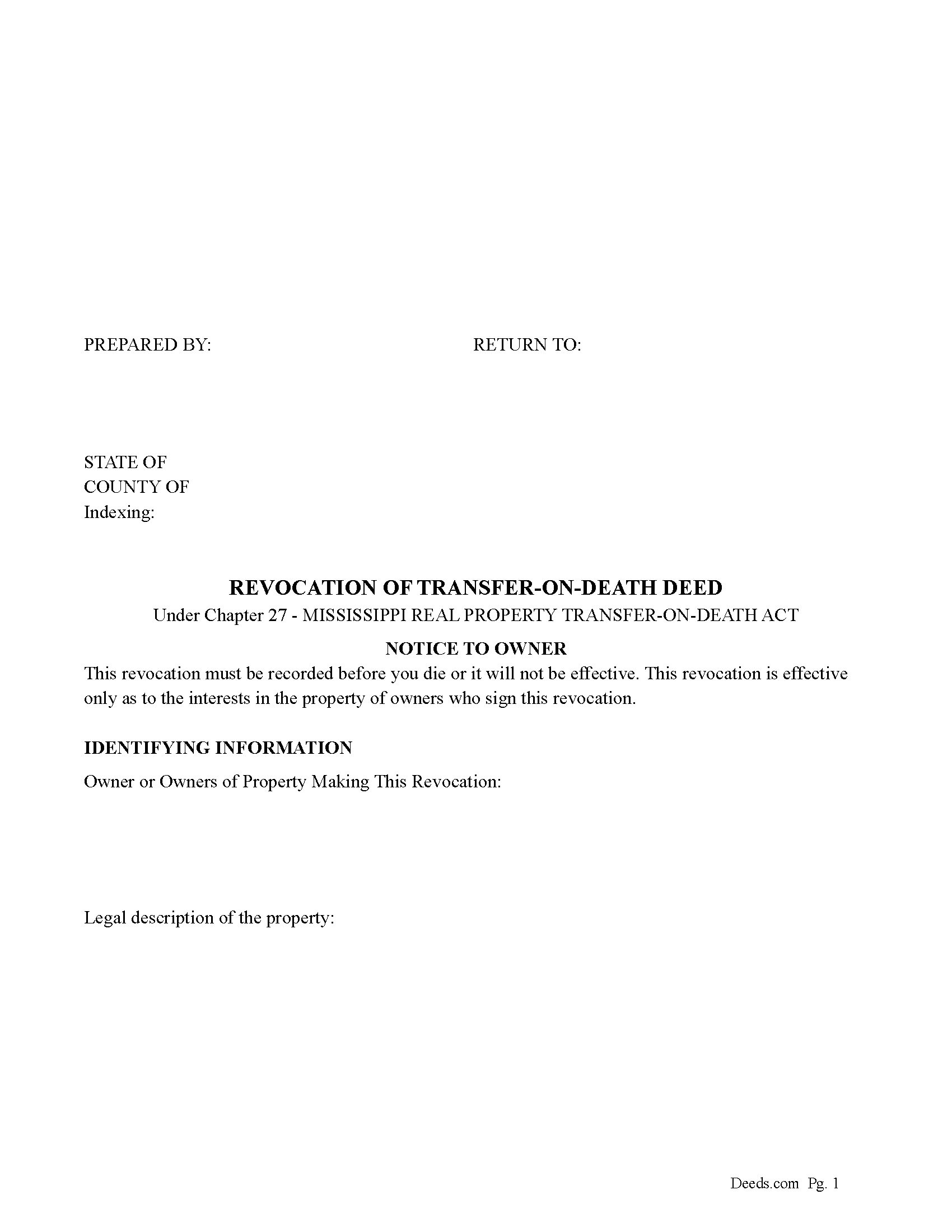

Prentiss County Revocation of Transfer on Death Deed Form

Prentiss County Revocation of Transfer on Death Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

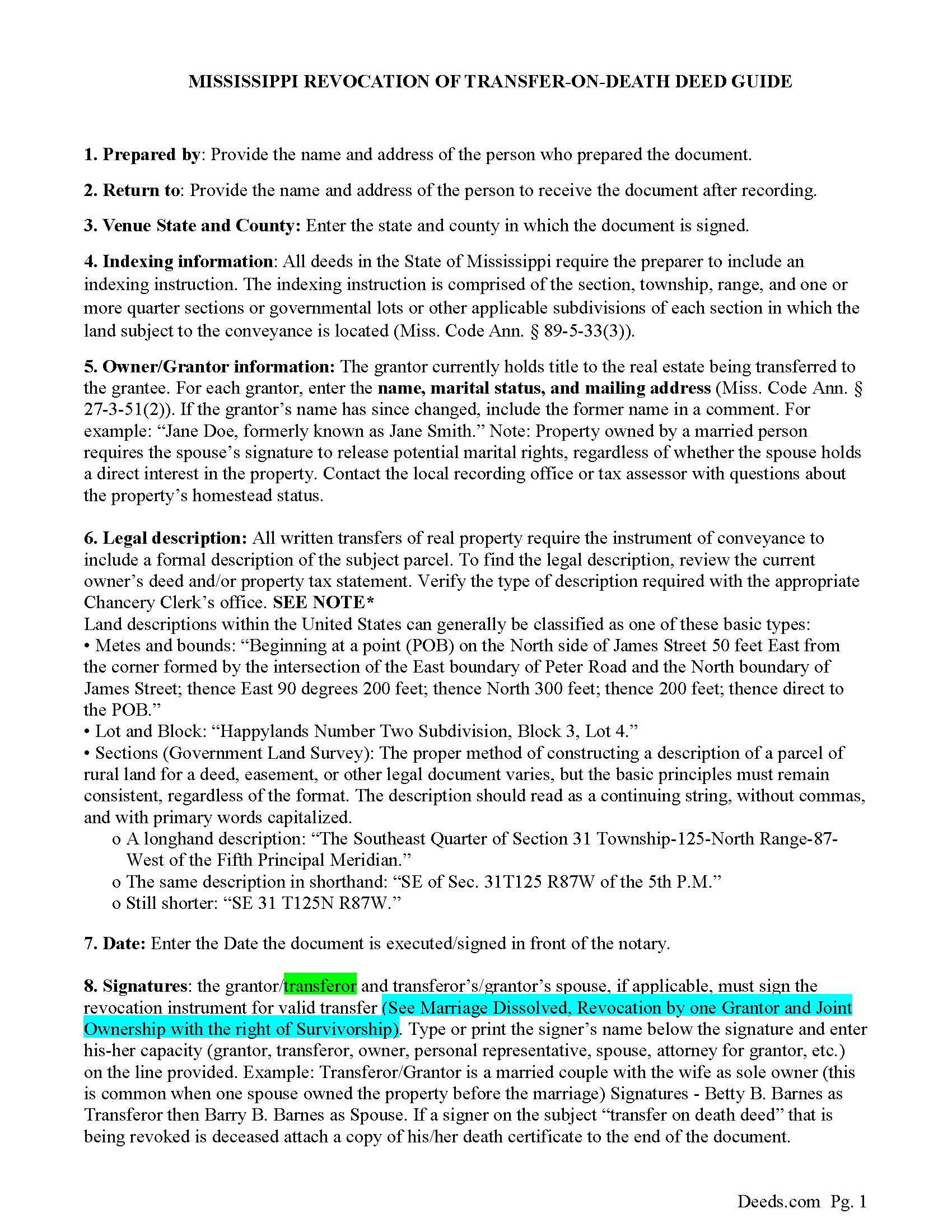

Prentiss County Guidelines for Revocation of Transfer on Death Deed

Line by line guide explaining every blank on the form.

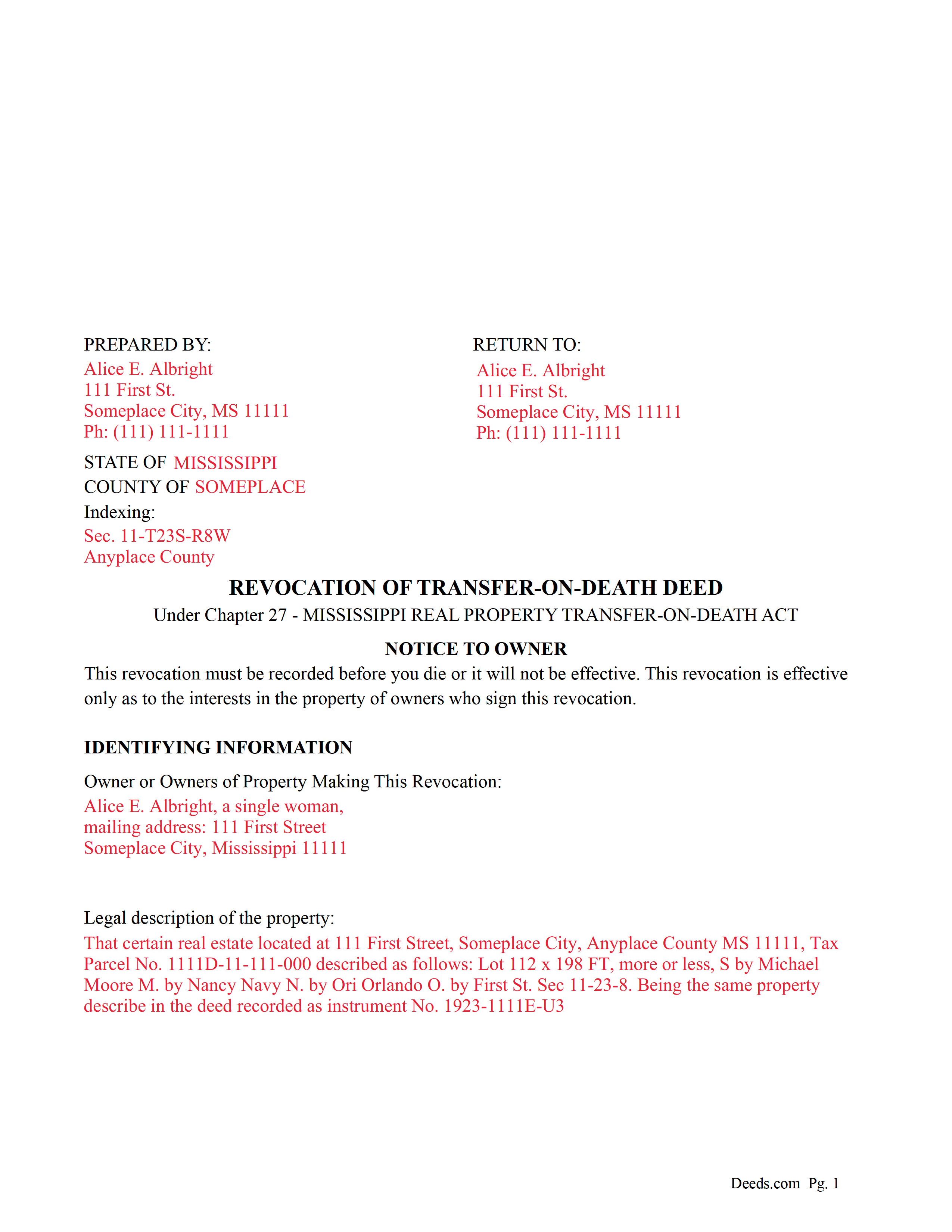

Prentiss County Completed Example of a Revocation of Transfer on Death Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Mississippi and Prentiss County documents included at no extra charge:

Where to Record Your Documents

Prentiss County Chancery Clerk

Booneville, Mississippi 38829

Hours: 8:00 to 5:00 M-F

Phone: (662) 728-8151

Recording Tips for Prentiss County:

- Documents must be on 8.5 x 11 inch white paper

- Recorded documents become public record - avoid including SSNs

- Leave recording info boxes blank - the office fills these

Cities and Jurisdictions in Prentiss County

Properties in any of these areas use Prentiss County forms:

- Booneville

- Marietta

- New Site

- Wheeler

Hours, fees, requirements, and more for Prentiss County

How do I get my forms?

Forms are available for immediate download after payment. The Prentiss County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Prentiss County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Prentiss County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Prentiss County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Prentiss County?

Recording fees in Prentiss County vary. Contact the recorder's office at (662) 728-8151 for current fees.

Questions answered? Let's get started!

Use this form to revoke or partially revoke a previously recorded Revocable Transfer on Death Deed.

Section 91-27-21 - Revocation by instrument authorized; revocation by act not permitted

(a) Subject to subsections (d) and (e), an instrument is effective to revoke a recorded transfer-on-death deed, or any part of it, if the instrument:

(1) Is one (1) of the following:

(A) A subsequent transfer-on-death deed that revokes the preceding transfer-on-death deed or part of the deed expressly or by inconsistency; or

(B) Except as provided by subsection (b), an instrument of revocation that expressly revokes the transfer-on-death deed or part of the deed;

(2) Is acknowledged by the transferor after the acknowledgment of the deed being revoked; and

(3) Is recorded before the transferor's death in the official records of the chancery clerk of the county where the deed being revoked is recorded.

(b) A will does not revoke or supersede a transfer-on-death deed.

(c) If a marriage between the transferor and a designated beneficiary is dissolved after a transfer-on-death deed is recorded, a final judgment of the court dissolving the marriage operates to revoke the transfer-on-death deed as to that designated beneficiary.

(d) If a transfer-on-death deed is made by more than one (1) transferor, revocation by a transferor does not affect the deed as to the interest of another transferor who does not make that revocation.

(e) A transfer-on-death deed made by joint owners with right of survivorship is revoked only if it is revoked by all of the living joint owners.

(f) This section does not limit the effect of an inter vivos transfer of the real property.

(Mississippi Revocation of TODD Package includes form, guidelines, and completed example) For use in Mississippi only.

Important: Your property must be located in Prentiss County to use these forms. Documents should be recorded at the office below.

This Revocation of Transfer on Death Deed meets all recording requirements specific to Prentiss County.

Our Promise

The documents you receive here will meet, or exceed, the Prentiss County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Prentiss County Revocation of Transfer on Death Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4580 Reviews )

Donald T.

February 6th, 2020

very user friendly. includes an example you can reference, and explanation of terms, which helps greatly in understanding.

Thank you!

Kim M.

January 5th, 2019

Purchased the Warranty Deed package for $19.95 which included all the forms I needed including instructions and a sample form. Seamless transaction filing with our local county clerk's office - she even commented it was one of the best prepared packages she has seen. Thanks for saving me a ton of money!

Thank you Kim, we appreciate your feedback.

Joni S.

February 6th, 2024

Excellent service, no hassle, easy to use, affordable, best service -- hands down. I thought it would be difficult for me to record a deed in Florida while residing in California but you made it so easy. I will tell everyone about your service. Thank you.

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Frank K.

July 27th, 2023

One thing I suggest is use the nomenclature Borrower / Lender / instead of Mortgatator / Mortgatee… Had to google which is which ? !

Thank you for your feedback. We really appreciate it. Have a great day!

Elizabeth B.

November 22nd, 2020

Very efficient

Thank you!

Jesse S.

January 2nd, 2020

I am excited for your service. I'm counting on this working-and calling to see if I can e-file with the County of dealing with, and if so, your service will have saved me more years of stress, worrying about how to correct a deed that was titled incorrectly.

Thank you!

David H.

May 25th, 2021

So So

Thank you!

John L.

April 22nd, 2023

WOW, This site saved me from going to a lawyer. Not only do they give you great directions, they also include a sample that is extremely helpful.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Chris K.

April 18th, 2023

Wasn't able to get the deed from you. Had to wade through the county offices myself.

Sorry we were not able to help you find what you needed.

Ann M.

February 11th, 2022

I was extremely pleased with how easy this process was, and how quickly my document was recorded. I will definitely use this again!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Richard L.

April 22nd, 2020

very useful

Thank you!

Cynthia E.

October 12th, 2024

Disappointed that you were not able to provide me with the information requested. They did issue a refund but I don’t think it’s come through yet.

We are grateful for your engagement and feedback, which help us to serve you better. Thank you for being an integral part of our community.

Elizabeth F.

February 14th, 2022

This was great other than exemption codes did not populate and I couldn't refer to it.

Thank you for your feedback. We really appreciate it. Have a great day!

Diyang W.

January 12th, 2025

Very Good Product. Provided a lot of good info to assist people to DIY various Deed

We are grateful for your engagement and feedback, which help us to serve you better. Thank you for being an integral part of our community.

Claude F.

February 8th, 2021

quick and easy to use, thank you

Thank you!