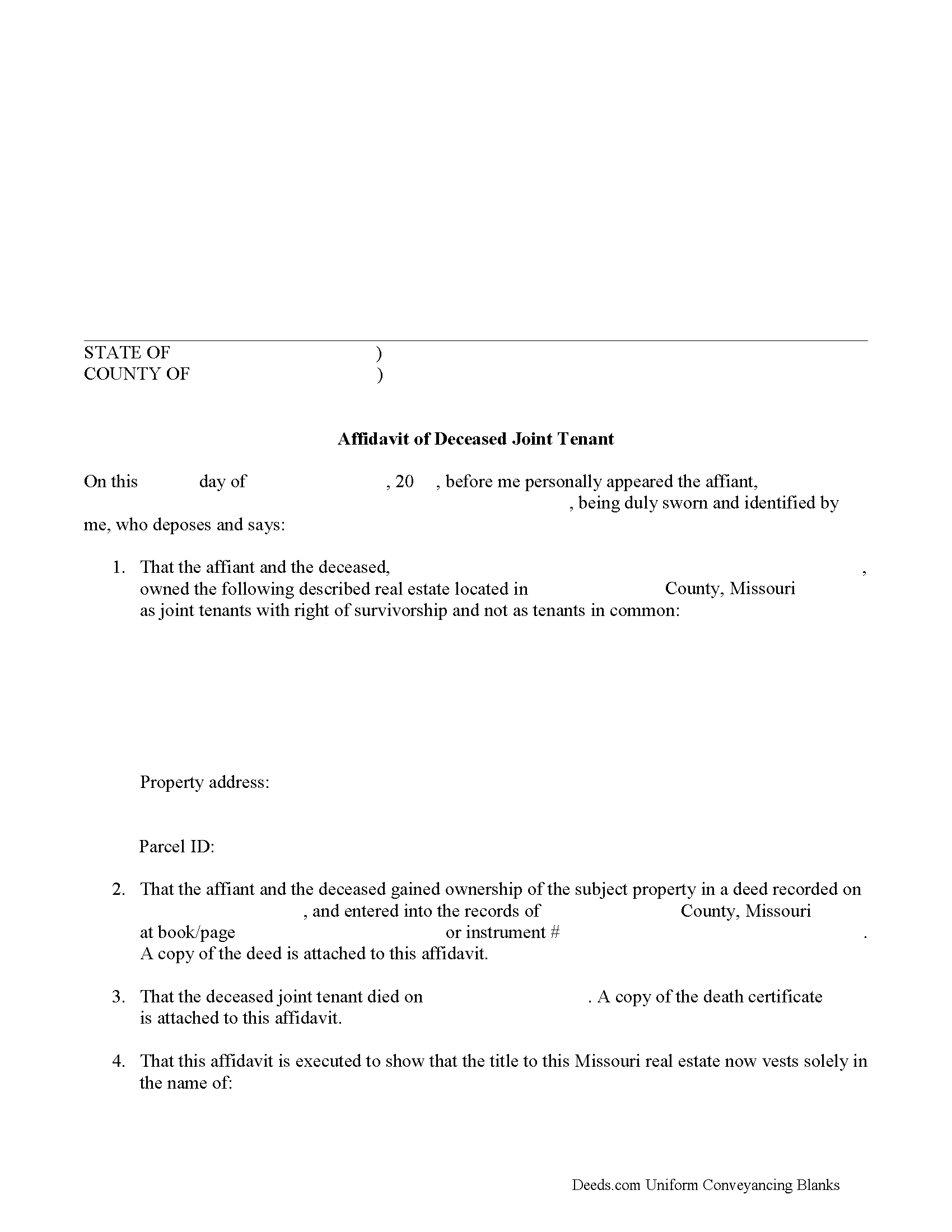

Wayne County Affidavit of Deceased Joint Tenant Form

Wayne County Affidavit of Deceased Joint Tenant Form

Fill in the blank form formatted to comply with all recording and content requirements.

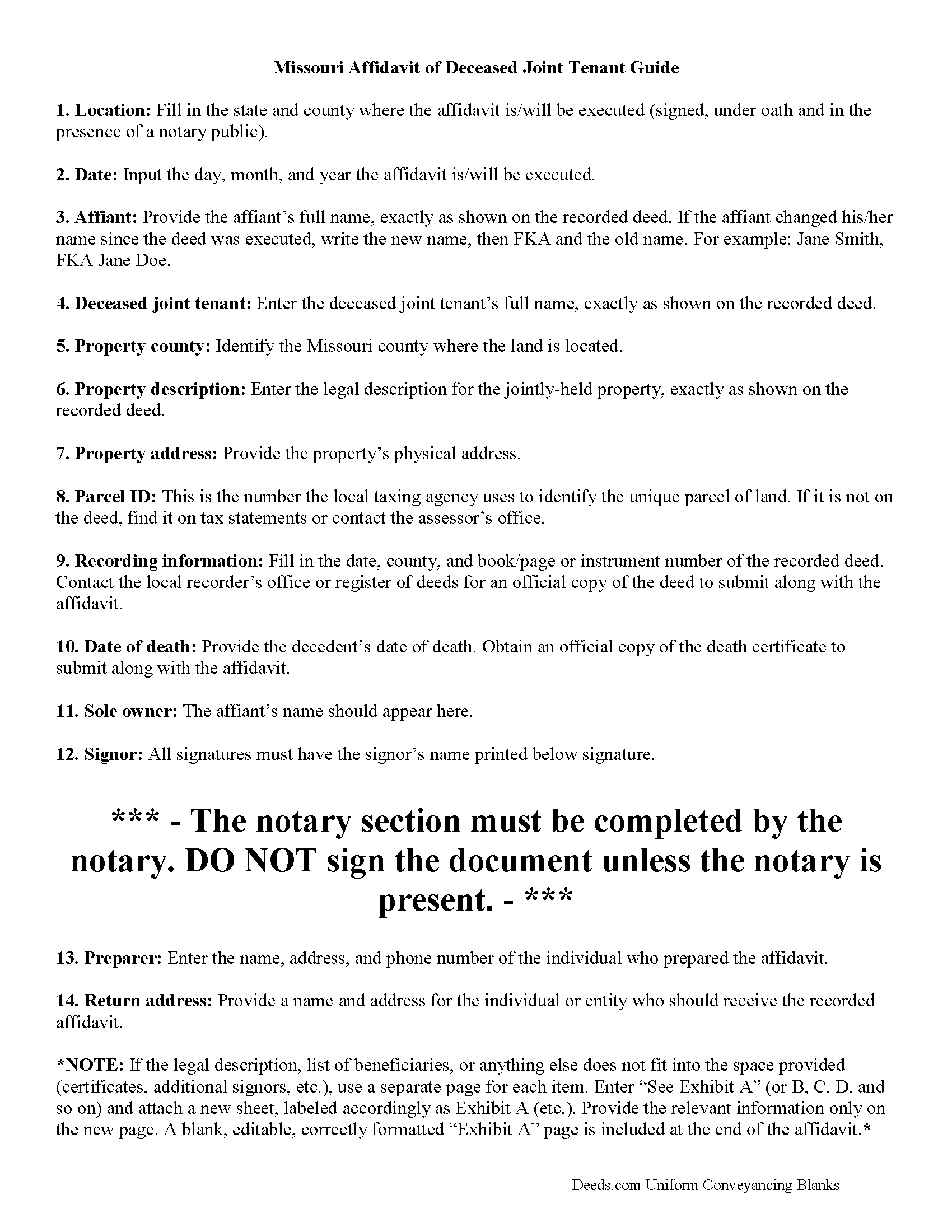

Wayne County Affidavit of Deceased Joint Tenant Guide

Line by line guide explaining every blank on the form.

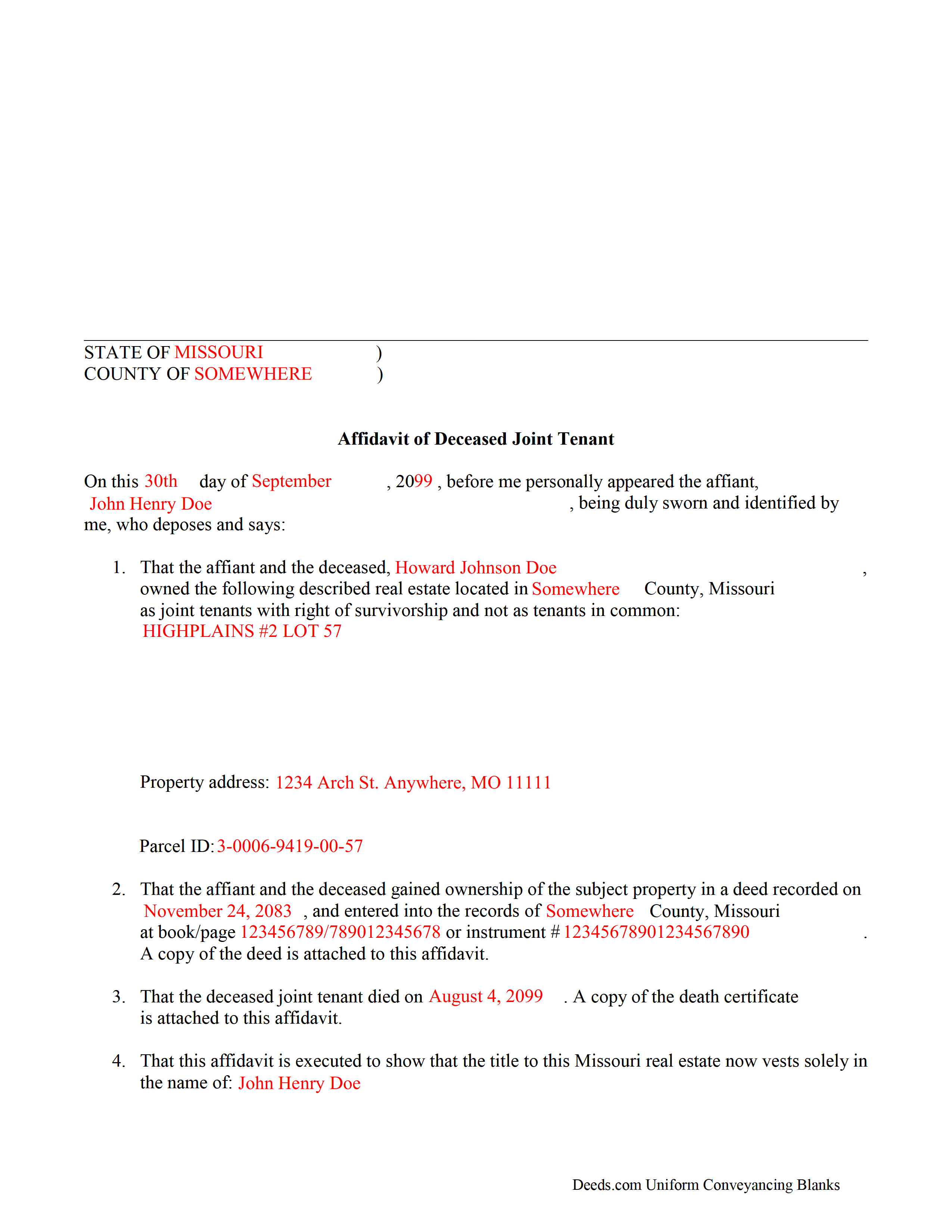

Wayne County Completed Example of the Affidavit of Deceased Joint Tenant Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Missouri and Wayne County documents included at no extra charge:

Where to Record Your Documents

Wayne County Recorder of Deeds

Greenville, Missouri 63944

Hours: 8:30 -12:00 & 1:00 to 4:30 Monday through Friday

Phone: (573) 224-5600 Ext 257

Recording Tips for Wayne County:

- Bring your driver's license or state-issued photo ID

- Verify all names are spelled correctly before recording

- Both spouses typically need to sign if property is jointly owned

- Recording fees may differ from what's posted online - verify current rates

- Request a receipt showing your recording numbers

Cities and Jurisdictions in Wayne County

Properties in any of these areas use Wayne County forms:

- Cascade

- Clubb

- Greenville

- Lodi

- Lowndes

- Mc Gee

- Mill Spring

- Patterson

- Piedmont

- Shook

- Silva

- Wappapello

- Williamsville

Hours, fees, requirements, and more for Wayne County

How do I get my forms?

Forms are available for immediate download after payment. The Wayne County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Wayne County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Wayne County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Wayne County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Wayne County?

Recording fees in Wayne County vary. Contact the recorder's office at (573) 224-5600 Ext 257 for current fees.

Questions answered? Let's get started!

The process of removing a deceased joint tenant from a Missouri deed is fairly simple.

When two or more property owners hold title as joint tenants with right of survivorship, and one co-owner dies, the surviving owners share the decedent's interest in the land by function of law, and outside of the probate process.

Even though the transfer of ownership rights is, in theory, automatic, it makes sense to formalize the change in title. One way to accomplish this is by completing and recording an affidavit of deceased joint tenant document, accompanied by official copies of the recorded deed showing the joint tenancy and the deceased owner's death certificate. His/her name will still appear on the deed, but the records will show that the property rights were transferred to the surviving owner.

To remove the decedent's name altogether, execute a new deed showing both joint tenants as grantors and only the survivor as a grantee. For example: "John Doe (deceased) and Richard Roe, as joint tenants with right of survivorship, convey to Richard Roe as sole owner." Present the new deed along with the affidavit of surviving joint tenant or submit it for recording on its own at a later date.

By following this procedure, the survivor helps to maintain a clear chain of title (ownership history), which will simplify future transactions relating to the property.

(Missouri Affidavit of DJT Package includes form, guidelines, and completed example)

Important: Your property must be located in Wayne County to use these forms. Documents should be recorded at the office below.

This Affidavit of Deceased Joint Tenant meets all recording requirements specific to Wayne County.

Our Promise

The documents you receive here will meet, or exceed, the Wayne County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Wayne County Affidavit of Deceased Joint Tenant form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4583 Reviews )

Ellen O K.

April 25th, 2019

Good experience. Easy peasy. :)

Thank you Ellen, have a wonderful day!

Marites T.

April 6th, 2023

Extremely helpful team of professionals who are patient when you need to get things filed correctly. Very small price for the comfort of knowing your DOCUMENTS are FILED with you local Recorder's Office. Some of the filings, if they are correctly formatted are already uploaded and official within a few hours. Here's the ALTERNATIVE you may encounter. For Example: King County Recorder's Office moved which means most filings are backed up 7-10 days if you DROP your filing in a BOX with your CHECK or MAIL IT. Neither is a great option, since they have no WALK IN HOURS.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Mark B.

March 8th, 2021

I had to download forms one by one: would be more convenient to have a single download for all.

Thank you for your feedback. We really appreciate it. Have a great day!

Robert I.

May 9th, 2023

This site was easy to use with full instructions on how to fill out and file forms very good

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

John T.

January 11th, 2022

I bought a quitclaim deed package, and it was very easy to use. Prints nicely. Two thumbs up!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Laurel D.

October 7th, 2020

This is a great service. I can't believe how fast my document was recorded!

Thank you for your feedback. We really appreciate it. Have a great day!

Fred B.

May 19th, 2020

Great site and very easy to use. I will be using this for all of my search and form requirements.

Thank you for your feedback. We really appreciate it. Have a great day!

Charles C.

October 1st, 2020

Easy to use, fast!

Thank you!

Janice T.

September 14th, 2020

The downloads were a great help in understanding of both what a Warranty Deed was and how to follow the steps as well as filling out the forms.

Thank you for your feedback. We really appreciate it. Have a great day!

james b.

May 29th, 2020

worked great

Thank you!

Michael C.

January 16th, 2019

I would appreciate being able to increase the size of the blocks such as the Grantor block and the legal description block where information is enter on the form and to adjust the font. Otherwise great product,

Thank you for your feedback Michael. We do wish we could make that an option. Unfortunately, adhering to formatting requirements (specifically margin requirements) leaves a finite amount of space available on the page.

Ronald C.

January 31st, 2019

My goal was to find the Covenant, Conditions, and Restrictions for my HOA. From what I can read, these documents should be attached to our Deed (single family, patio home in New Hanover County). I am not sure if I have a copy of my Deed. I would need to check my Safe Deposit Box. Unfortunately, I was not successful at finding these documents from your Website. If you can help me find them, I would appreciate that.

It is most common to obtain a copy of CC&Rs directly from the HOA. Alternatively, they are also usually a matter of public record recorded with the local recorder and you can obtain a copy there.

Maurice C.

September 14th, 2023

This is a great service! Very much needed.

Thank you!

Keith L.

March 15th, 2019

Great to have a downloadable form, rather than a cloud solution that gives no guarantee of privacy. Appreciated the sample.......but all of that still left me with open issues about how to tweak the form to serve my particular needs......for example: how to ensure that survivor rights were properly characterized; how far back I should go with the "Source" section + how I should layer my own additions to the chain of ownership, etc. Nonetheless, an overall happy experience. Thank you for your help

Thank you for your feedback. We really appreciate it. Have a great day!

kevin d.

April 19th, 2022

the quitclaim form worked well with the Nevada Recorders office. Tried other vendors, theirs were rejected.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!