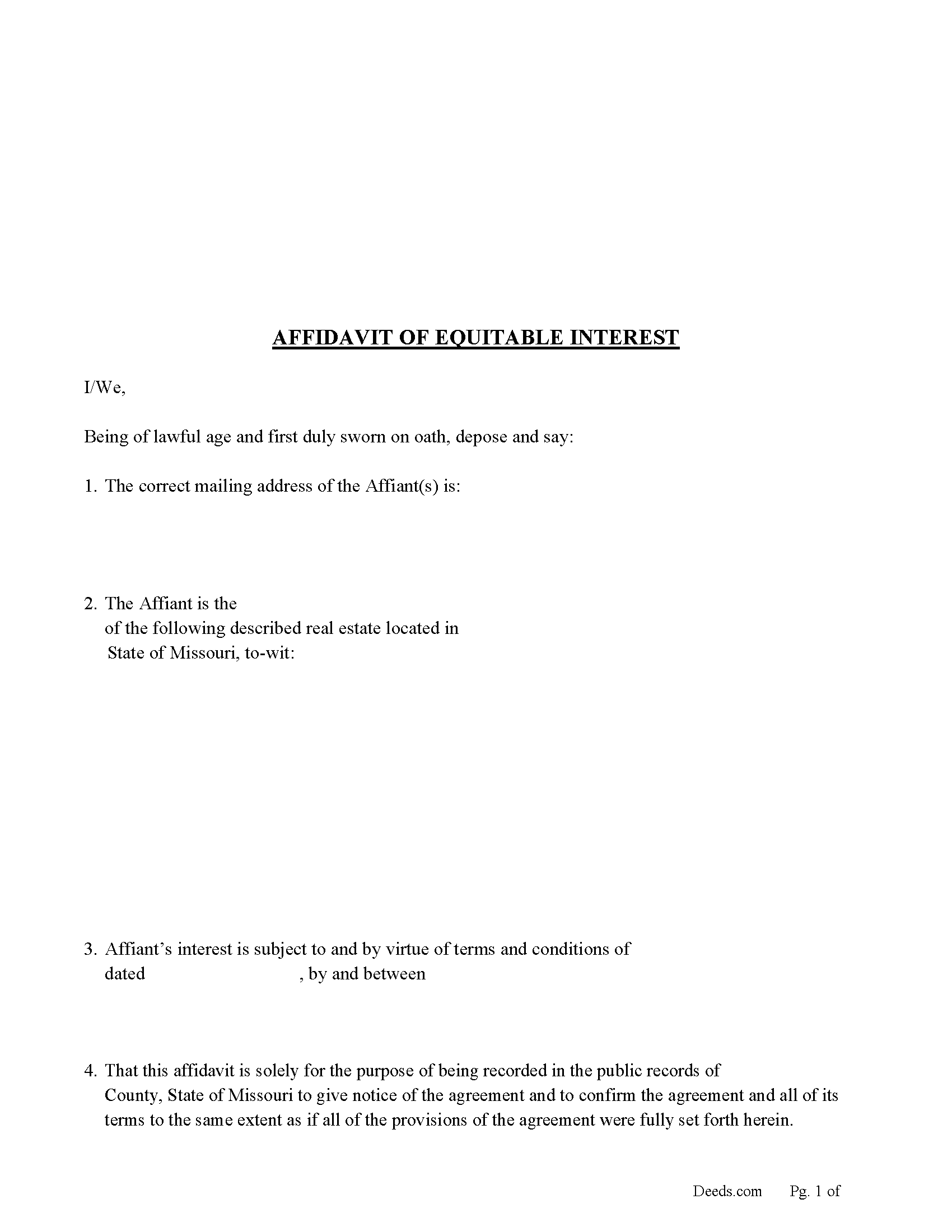

Lawrence County Affidavit of Equitable Interest Form

Lawrence County Affidavit of Equitable Interest Form

Fill in the blank Affidavit of Equitable Interest form formatted to comply with all Missouri recording and content requirements.

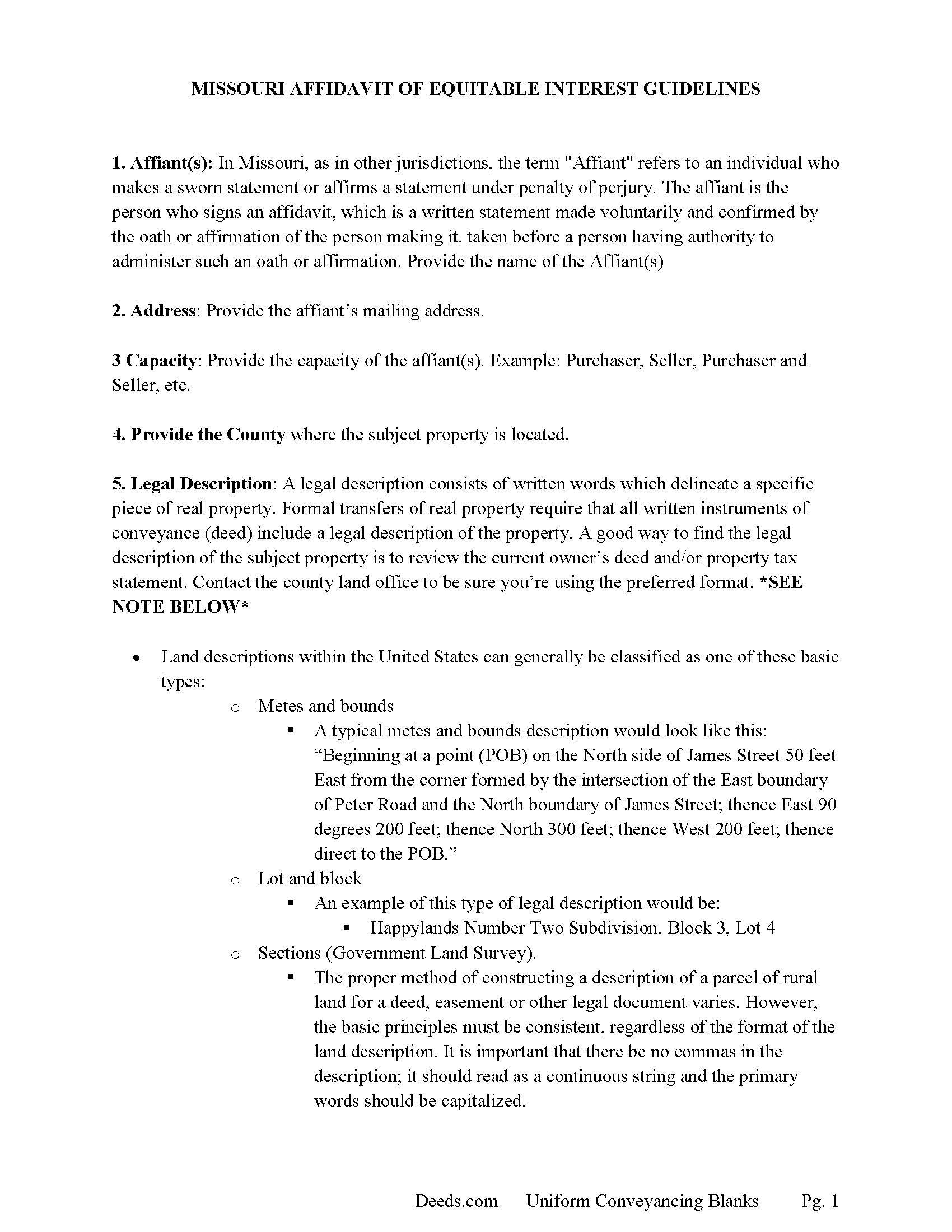

Lawrence County Affidavit of Equitable Interest Guide

Line by line guide explaining every blank on the Affidavit of Equitable Interest form.

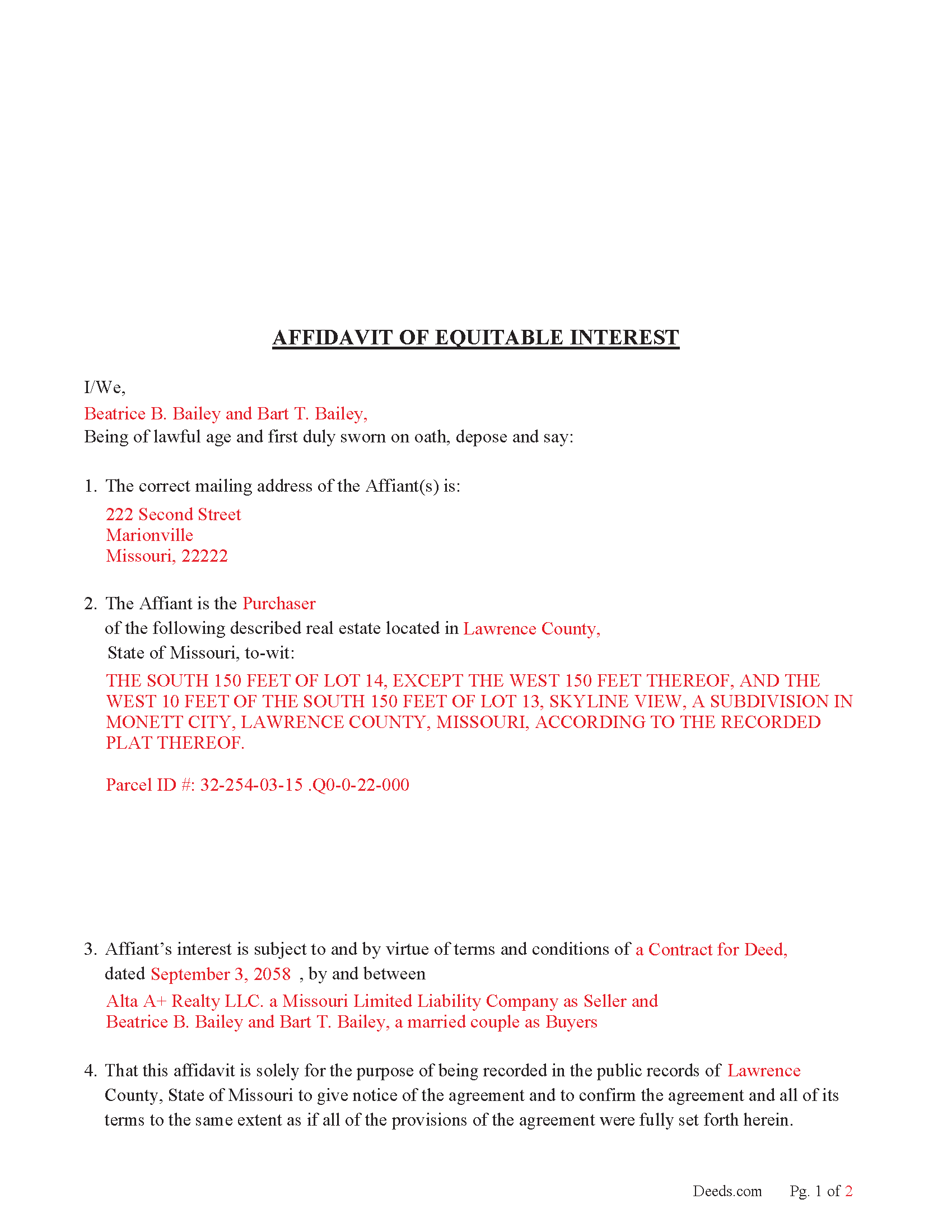

Lawrence County Completed Example of the Affidavit of Equitable Interest Document

Example of a properly completed Missouri Affidavit of Equitable Interest document for reference. Executed by Purchaser/Buyer.

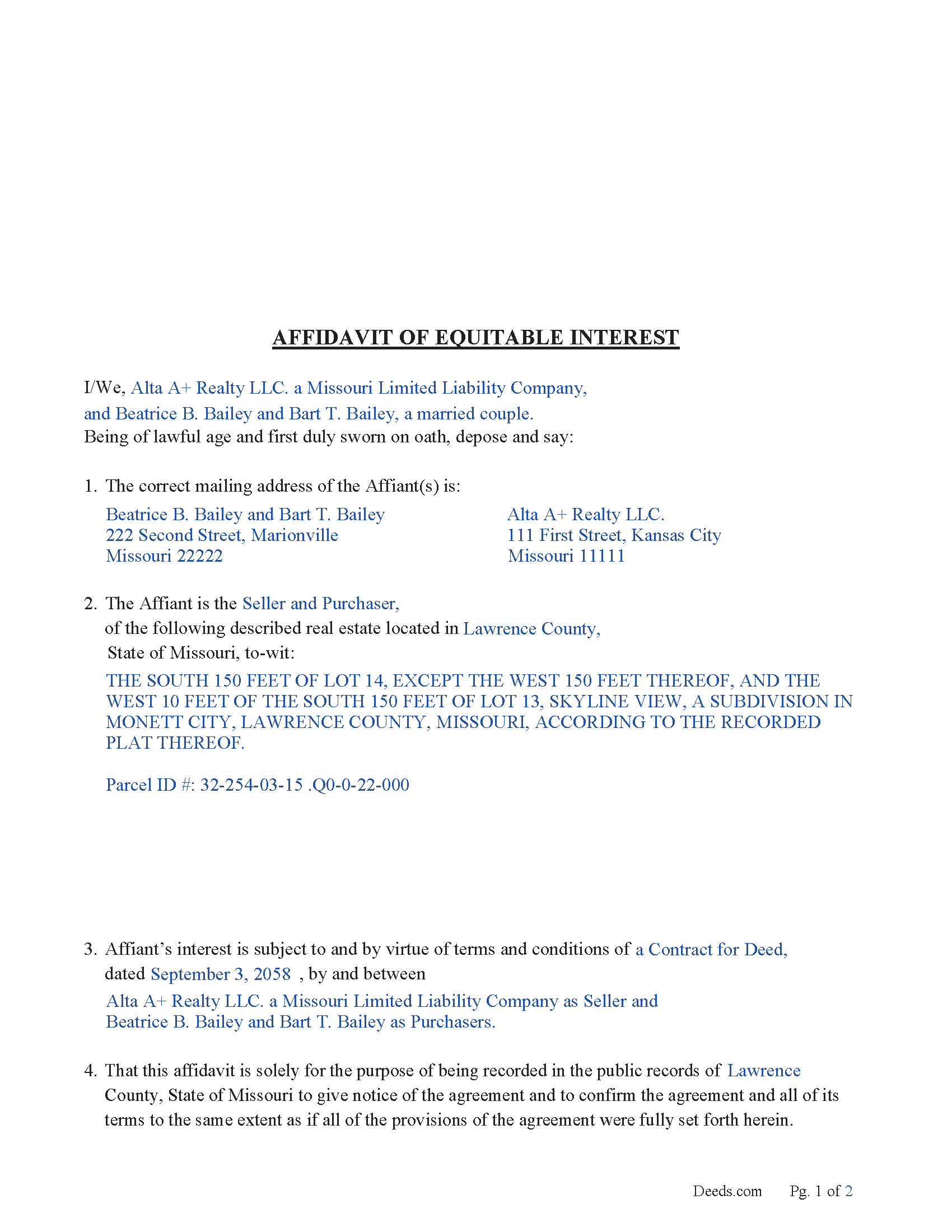

Lawrence County Completed Example of the Affidavit of Equitable Interest Document

Example of a properly completed Missouri Affidavit of Equitable Interest document for reference. Executed by Seller and Purchaser/Buyer

All 4 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Missouri and Lawrence County documents included at no extra charge:

Where to Record Your Documents

Lawrence County Recorder of Deeds

Mt. Vernon, Missouri 65712

Hours: 9:00 to 5:00 M-F / Recording cut-off is at 3:00

Phone: (417) 466-2670

Recording Tips for Lawrence County:

- Ask if they accept credit cards - many offices are cash/check only

- Make copies of your documents before recording - keep originals safe

- Bring extra funds - fees can vary by document type and page count

- Avoid the last business day of the month when possible

- Ask about their eRecording option for future transactions

Cities and Jurisdictions in Lawrence County

Properties in any of these areas use Lawrence County forms:

- Aurora

- Freistatt

- Halltown

- La Russell

- Marionville

- Miller

- Mount Vernon

- Pierce City

- Stotts City

- Verona

- Wentworth

Hours, fees, requirements, and more for Lawrence County

How do I get my forms?

Forms are available for immediate download after payment. The Lawrence County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Lawrence County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Lawrence County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Lawrence County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Lawrence County?

Recording fees in Lawrence County vary. Contact the recorder's office at (417) 466-2670 for current fees.

Questions answered? Let's get started!

Key Purposes of the Affidavit in Missouri:

1. Public Notice of Buyer’s Interest

Records the buyer’s equitable interest in the property with the county Recorder of Deeds.

Alerts anyone doing a title search (e.g., other buyers, lenders, title companies) that a prior claim exists.

2. Protects Against Seller Misconduct

Prevents the seller from:

Reselling the property to someone else.

Taking out loans against the property without disclosure.

Makes it harder for the seller to act in bad faith or “back out” after contract execution.

3. Supports Legal Standing in Court

Establishes evidence that a buyer has taken action to protect their interest.

Useful in disputes involving breach of contract, specific performance, or fraud.

4. Used in Creative Financing / Wholesaling

Common tool used by real estate investors or wholesalers to "cloud title" and ensure their deal doesn’t get bypassed.

Especially useful in Contracts for Deed, lease-options, and assignment deals.

5. Low-Commitment Alternative to Full Contract Recording

Instead of recording the full sales contract (which may contain sensitive info), the affidavit briefly states that a contract exists and protects the buyer's interest.

Legal Effect in Missouri:

Does not transfer legal title

Does not create a lien—it simply notifies the public of your interest

Gives priority rights if filed before others (like mechanics’ liens, new purchase agreements, etc.)

Important: Your property must be located in Lawrence County to use these forms. Documents should be recorded at the office below.

This Affidavit of Equitable Interest meets all recording requirements specific to Lawrence County.

Our Promise

The documents you receive here will meet, or exceed, the Lawrence County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Lawrence County Affidavit of Equitable Interest form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4585 Reviews )

Laurie B.

June 23rd, 2021

You have made this process so simple - I can see it would have been complicated and frustrating without Deeds.com. Thank you!

Thank you!

Christi W.

December 9th, 2020

Very simple and made recording a breeze. Worth the fee!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Monica M.

September 15th, 2020

I was very impressed with the quick responses I received from my questions. Usually when forced to communicate via email, responses aren't received right away. Thank you for being on top of things.

Thank you!

SHALINI W.

August 24th, 2020

Exceptionally easy to use. Very user friendly. Would highly recommend.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

SANTTINA W.

August 13th, 2022

IT WAS SO VERY HELPFUL AND EASY TO DO WILL RETUN TO THE SITE AGAIN.

Thank you for your feedback. We really appreciate it. Have a great day!

Ron M.

December 2nd, 2020

The download of forms, etc. was easy and the guides that were provided were good, but more information would have been nice as to where to find tax map #, parcel #, and district mentioned in Exemptions from Property Transfer Fees (and Declaration of Consideration or Value. In general, I was quite pleased with your product.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Dianne W.

July 14th, 2020

Thank you for responding so quickly to my question. I was able to locate the form and get everything downloaded. Once I saw the icon, it was easy peasy!!

Thank you!

Lawrence R.

February 4th, 2020

Forms do not allow enough space for fields and cutoff. Need to expand the fields to allow for more writing. I ended up re-typing to be able to include full property description. Would be nice if available in Word format rather than only PDF format.

Thank you for your feedback. We really appreciate it. Have a great day!

William Q.

September 30th, 2020

The website and information is fine. The proof in the pudding, of course, is whether the forms I used now will provide the results I want if the changes are challenged at some future date.

Thank you for your feedback. We really appreciate it. Have a great day!

William C.

August 28th, 2019

Great service and fast also

Thank you!

Tommie G.

March 11th, 2021

I saved 225.00 with this purchase.Make sure you have an updated property description from your county tax collectors' office.In Bay county,Florida the tax office will email you an updated property description.I attached the email to the the deed.I had to change the date and they accepted a white out and ink correction on your form.

Thank you for your feedback. We really appreciate it. Have a great day!

ed c.

May 24th, 2022

real easy and fast

Thank you!

Sara P.

February 1st, 2019

Wonderful response time, and patient with me. Thank you.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Louise S.

May 15th, 2022

The form was easy to download and complete however you should be able to convert to a word document.

Thank you for your feedback. We really appreciate it. Have a great day!

John C N.

June 17th, 2023

Just the website I needed. Very detailed and efficient.

Thank you for taking the time to provide your feedback John, we really appreciate it. Have an amazing day!