Worth County Beneficiary Deed Form

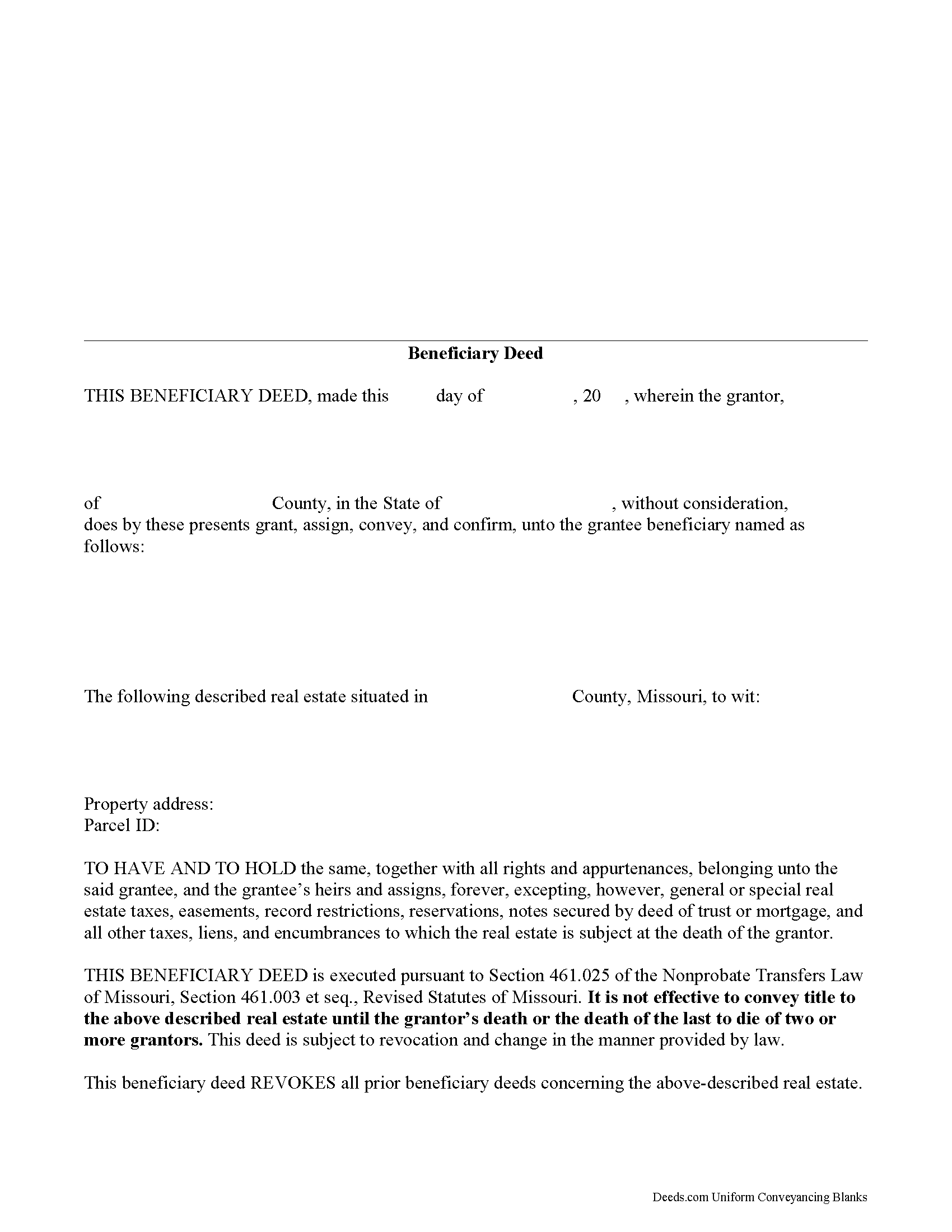

Worth County Beneficiary Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

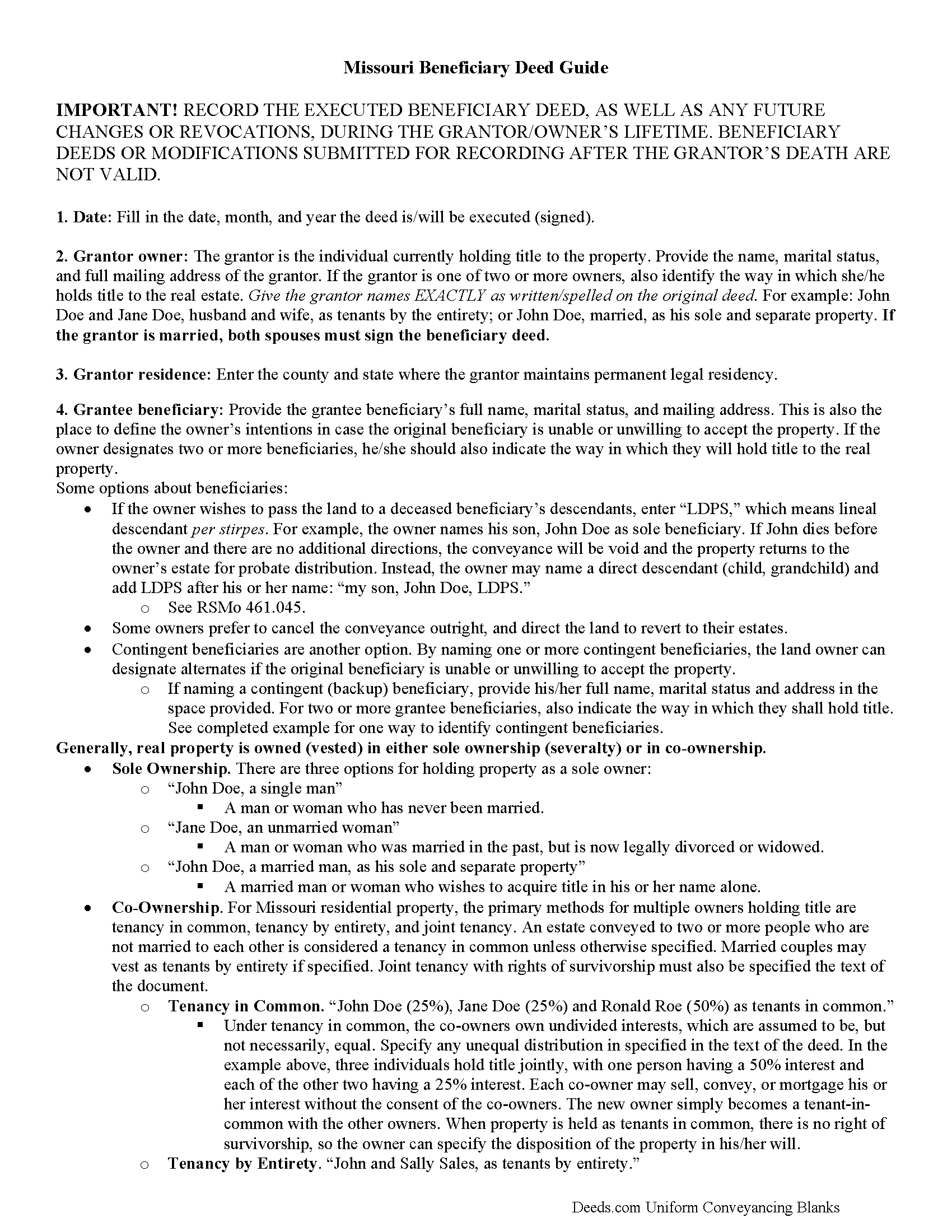

Worth County Beneficiary Deed Guide

Line by line guide explaining every blank on the form.

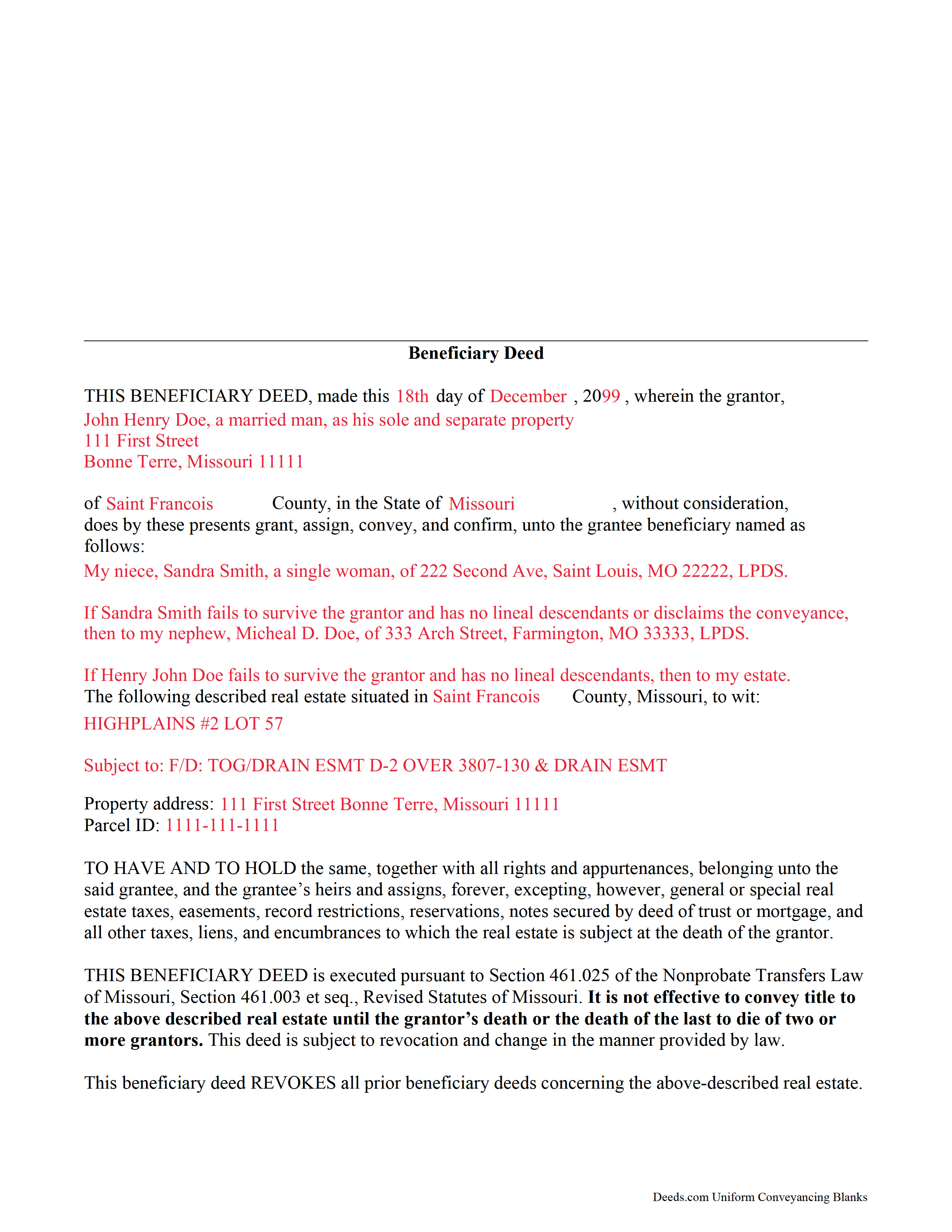

Worth County Completed Example of the Beneficiary Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Missouri and Worth County documents included at no extra charge:

Where to Record Your Documents

Worth County Recorder of Deeds

Grant City, Missouri 64456

Hours: 8:30 to 12:00 & 1:00 to 4:30 M-F

Phone: (660) 564-2484

Recording Tips for Worth County:

- Ensure all signatures are in blue or black ink

- Both spouses typically need to sign if property is jointly owned

- Check margin requirements - usually 1-2 inches at top

- Recording fees may differ from what's posted online - verify current rates

Cities and Jurisdictions in Worth County

Properties in any of these areas use Worth County forms:

- Allendale

- Denver

- Grant City

- Sheridan

- Worth

Hours, fees, requirements, and more for Worth County

How do I get my forms?

Forms are available for immediate download after payment. The Worth County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Worth County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Worth County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Worth County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Worth County?

Recording fees in Worth County vary. Contact the recorder's office at (660) 564-2484 for current fees.

Questions answered? Let's get started!

Enacted in 1989, the Missouri Nonprobate Transfers Law (Sections 461.003 et seq, Revised Statutes of Missouri (2012)) allows those who own real property in Missouri the option of conveying real property after death, but without the need for probate distribution.

One distinctive feature of this useful estate planning tool is its flexibility. The grantor retains absolute ownership of and control over the Missouri real estate, with the freedom to sell, rent, mortgage, or otherwise use the land at will with no penalty for waste or obligation to inform the named beneficiary. He or she may also change details about beneficiaries or even revoke the beneficiary deed outright by executing and recording a new document containing the updated information. For the beneficiary deed and any related changes or revocations to be valid, however, the deed must be recorded during the grantor's lifetime.

This flexibility is possible because the transfer of ownership is incomplete. There is no statutory obligation to notify grantees of their beneficiary status, so there is typically no consideration (something of value, usually money) paid for the potential future interest in the real estate. The transfer of ownership rights is completed when the grantor dies and the beneficiary records the appropriate documentation.

Overall, Missouri beneficiary deeds are a simple and effective estate planning tool for individuals who want to pass on real property rights outside of the probate process. Even so, it is essential to review how executing a beneficiary deed might impact taxes, as well as eligibility for local, state, and federal benefits and asset-based programs.

(Missouri BD Package includes form, guidelines, and completed example)

Important: Your property must be located in Worth County to use these forms. Documents should be recorded at the office below.

This Beneficiary Deed meets all recording requirements specific to Worth County.

Our Promise

The documents you receive here will meet, or exceed, the Worth County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Worth County Beneficiary Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Shantu S.

December 1st, 2022

Easy to follow directions and complete the Deed.

Thank you!

Lisa D.

May 2nd, 2023

Great service, would be nice if it provided an address to send this to once completed!

Thank you for your feedback. We really appreciate it. Have a great day!

Jing H.

March 8th, 2019

Excellent work. I have recommended some friends to your website and will continue. Thanks.

Thank you Jing. Have a fantastic day!

Luis C.

May 10th, 2019

Excellent forms but the instructions are not to clear.

Thank you for your feedback. We really appreciate it. Have a great day!

Jami B.

November 6th, 2019

I was blown away by all the information I received for just $19.00!! I am still reading through it. Great job of explaining everything.

Thank you!

David C.

July 21st, 2021

I was very impressed. Your program makes it very user friendly which is a must for most of the public . I have recommended this site to various clients for estate planning documents with simple estates.

Thank you!

Larry A.

December 17th, 2021

Provided exactly the form I was looking for at a reasonable price. Easy to do as well.

Thank you!

Veronica T.

September 14th, 2021

Great Service! Thank you

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jennifer M.

April 3rd, 2024

Consistent and quick. This site saves me so much time away from my desk. It's a great resource for my small business!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Daniel S.

November 7th, 2022

Easy to access documents.

Thank you for your feedback. We really appreciate it. Have a great day!

Lesa F.

May 14th, 2021

Excellent service for recovering a couple of deeds that had been misplaced. They were fast and efficient at a fair price. I would definitely use them again.

Thank you!

Joe W.

January 22nd, 2020

Effortless transaction and very thorough paperwork and explanations.

Thank you!

Christopher B.

October 3rd, 2020

The service was simple and easy enough but the UI isn't the easiest on the eyes and the process is a tad strange.

Thank you for your feedback. We really appreciate it. Have a great day!

Stephen W.

May 16th, 2020

It provided the forms I could not find elsewhere. Thank you.

Thank you!

Richard G.

August 28th, 2022

I was not able to add more linea to the deed and add up to four people and their addresses. The document should be able to be expanded.

Thank you for your feedback. We really appreciate it. Have a great day!