Worth County Deed of Trust and Promissory Note Form

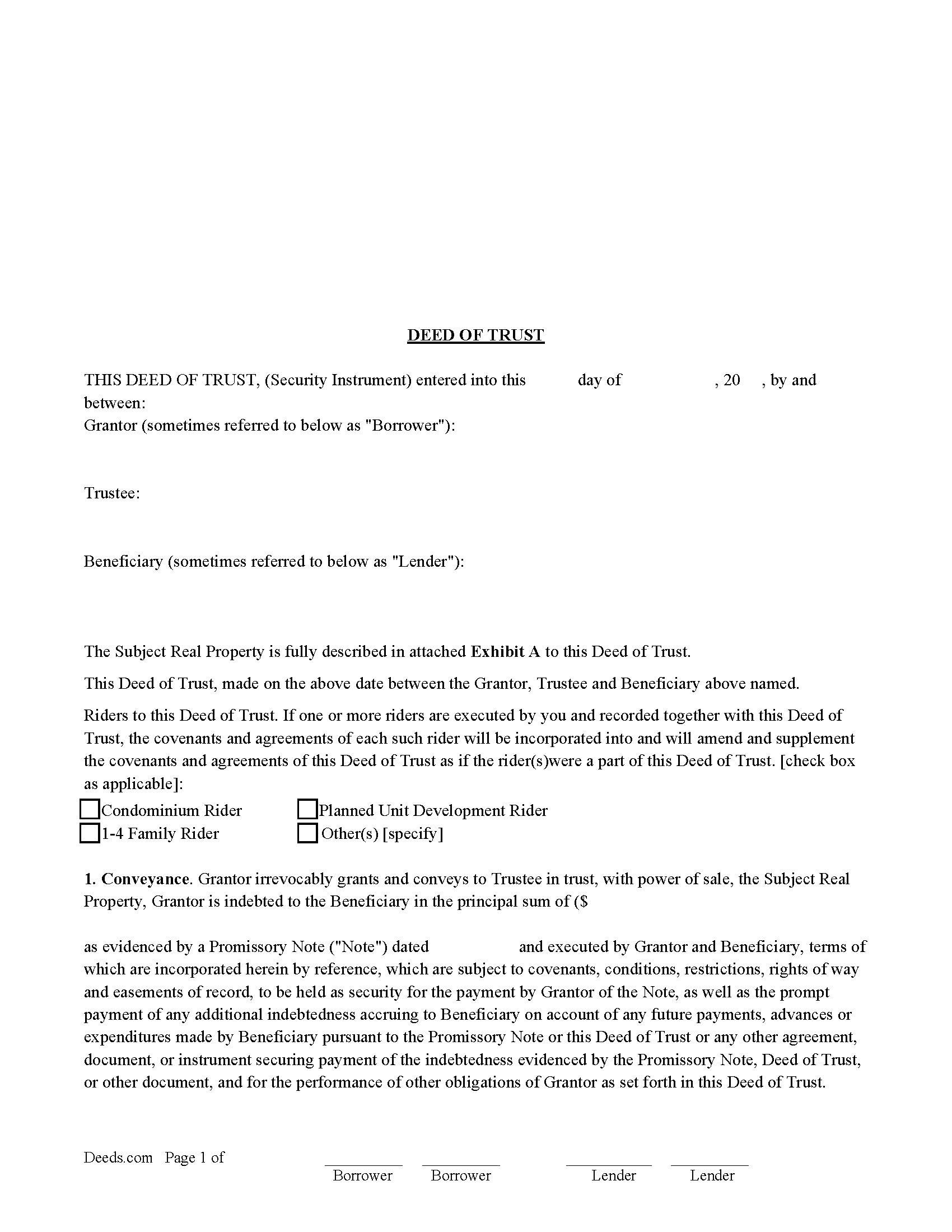

Worth County Deed of Trust Form

Fill in the blank Deed of Trust and Promissory Note form formatted to comply with all Missouri recording and content requirements.

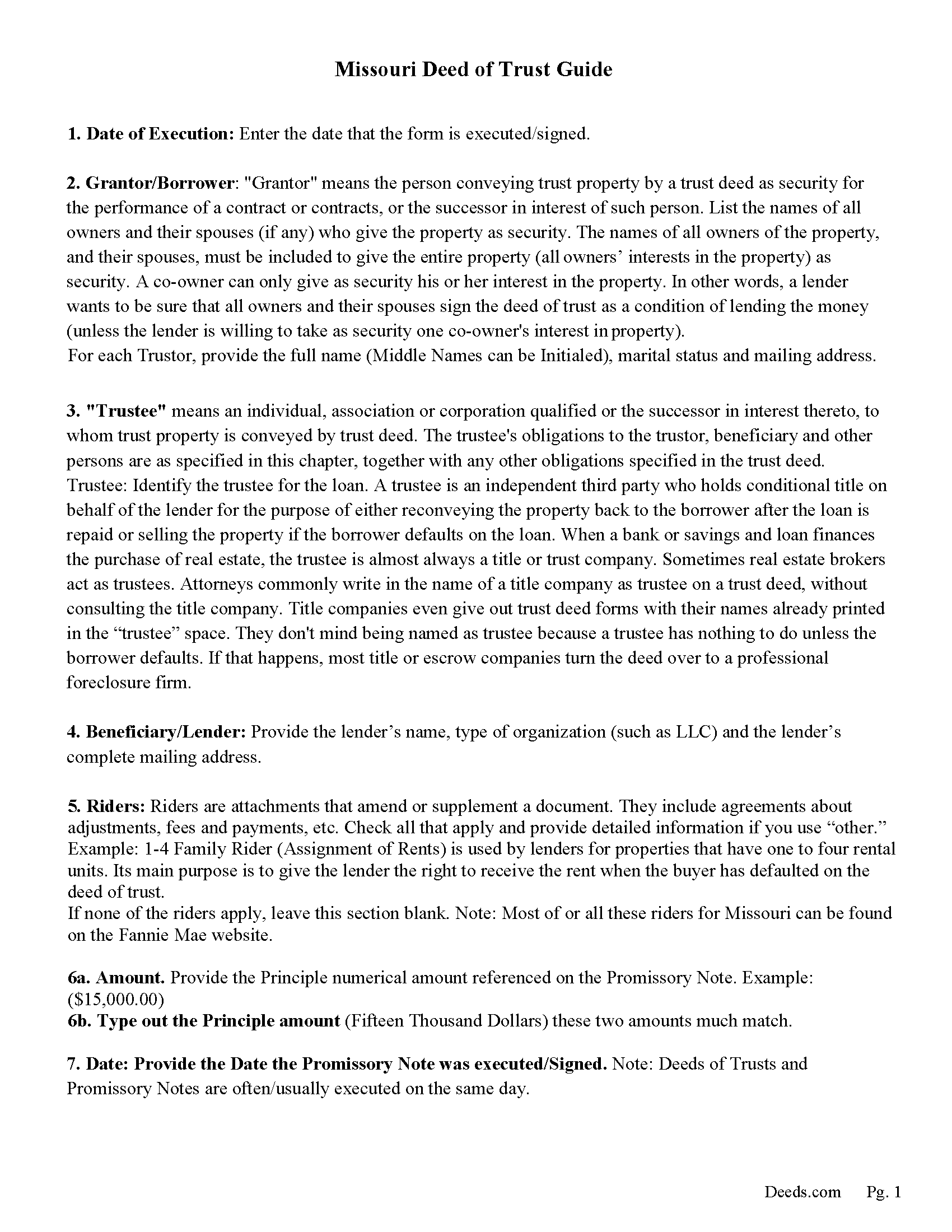

Worth County Deed of Trust Guidelines

Line by line guide explaining every blank on the form.

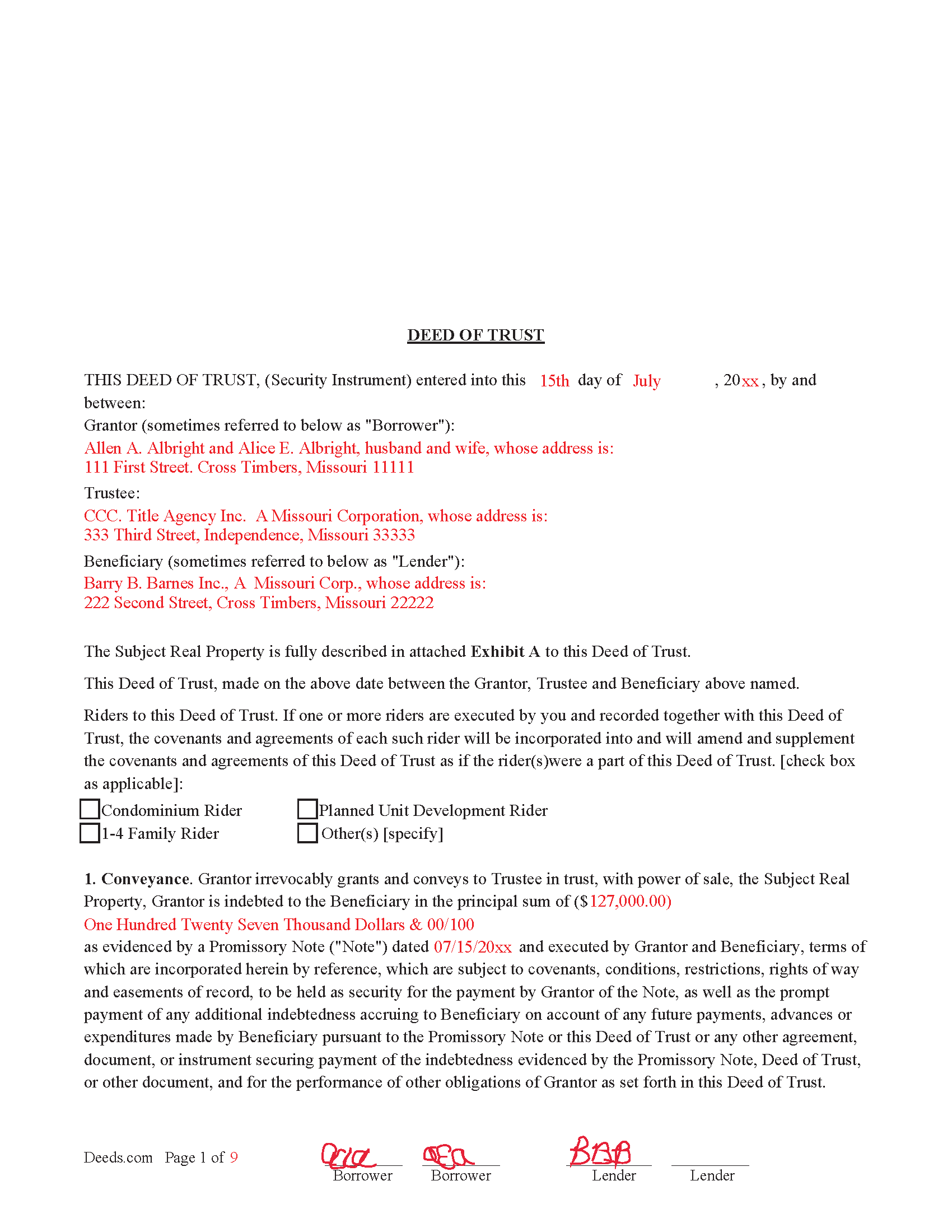

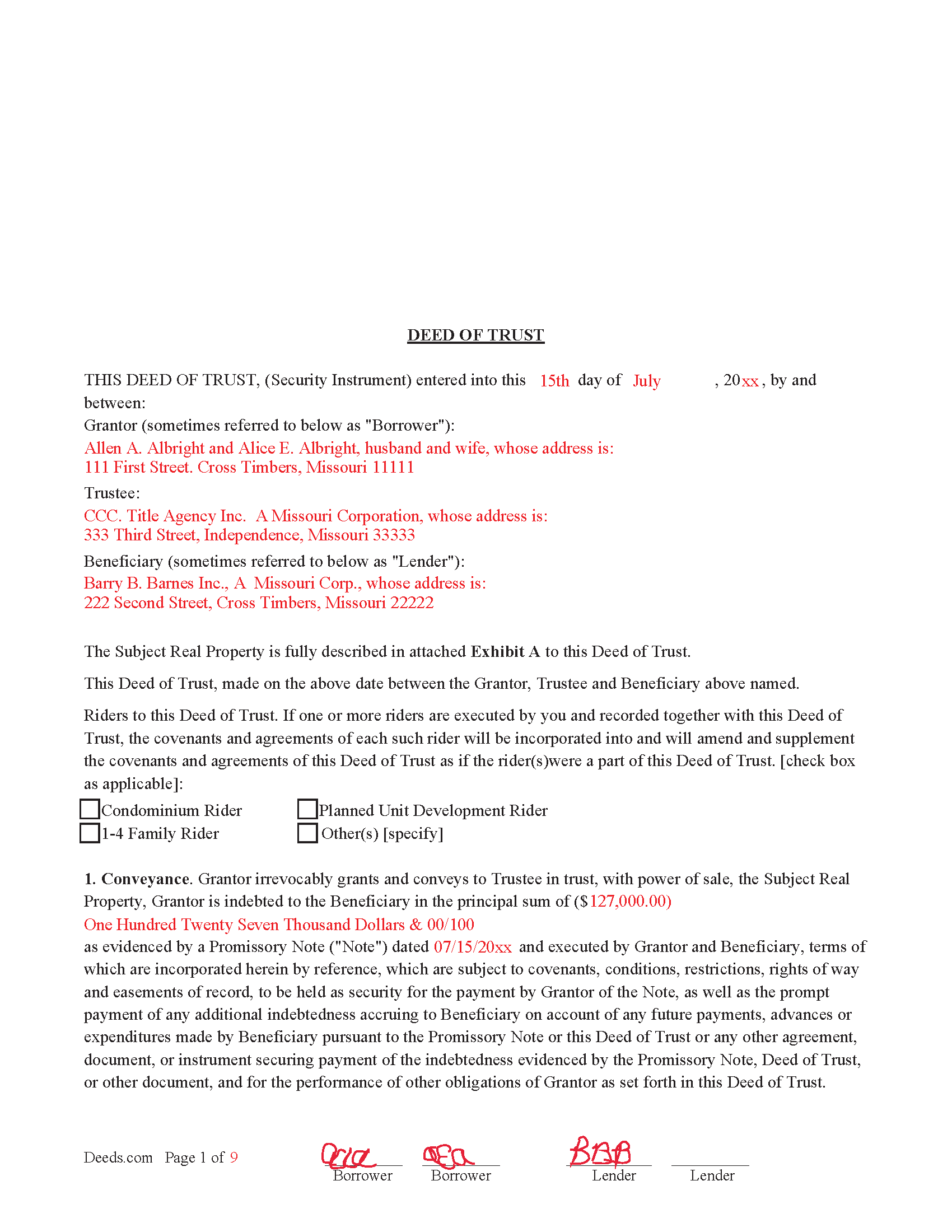

Worth County Completed Example of the Deed of Trust

Example of a properly completed form for reference.

Worth County Completed Example of the Deed of Trust Document

Example of a properly completed Missouri Deed of Trust and Promissory Note document for reference.

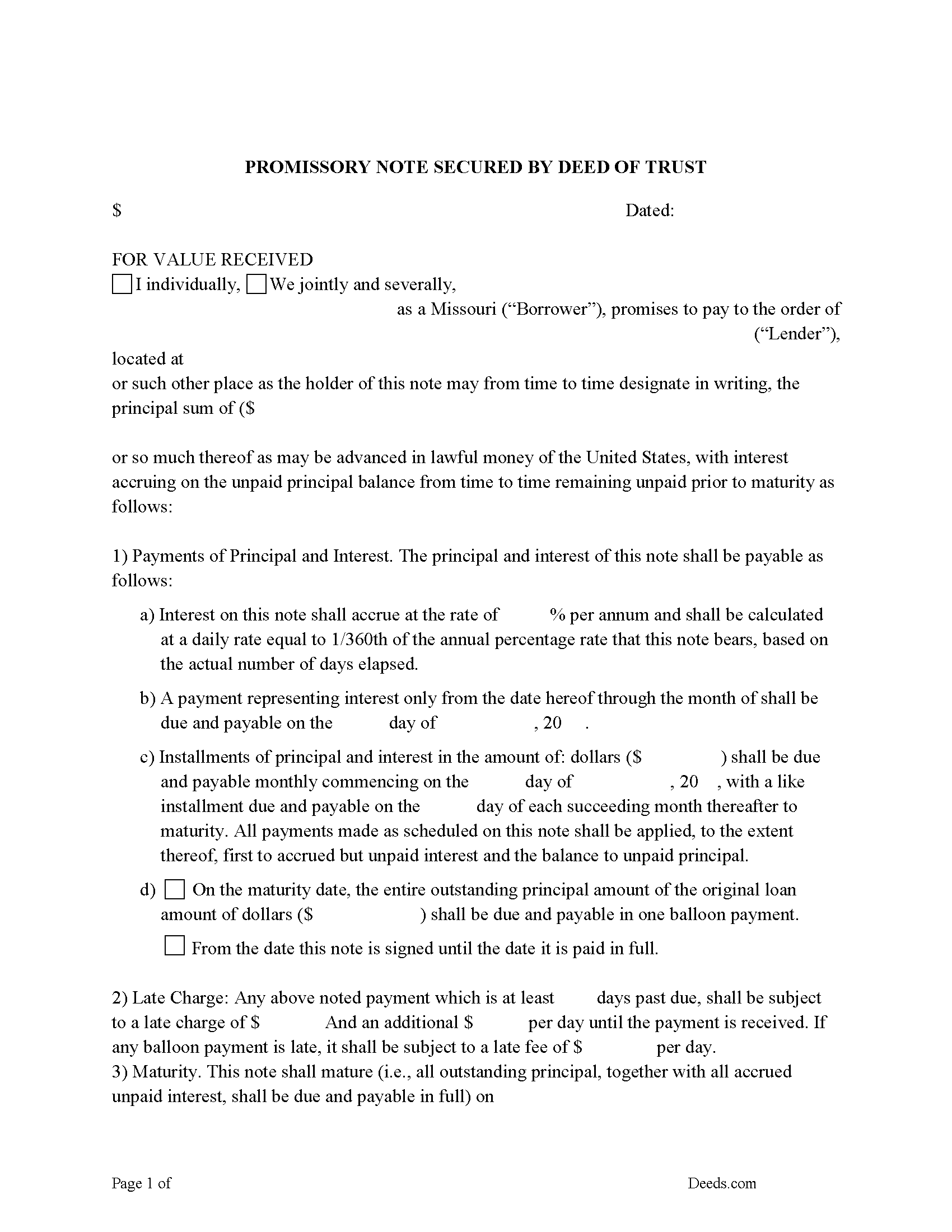

Worth County Promissory Note Form

Note that is secured by the Deed of Trust.

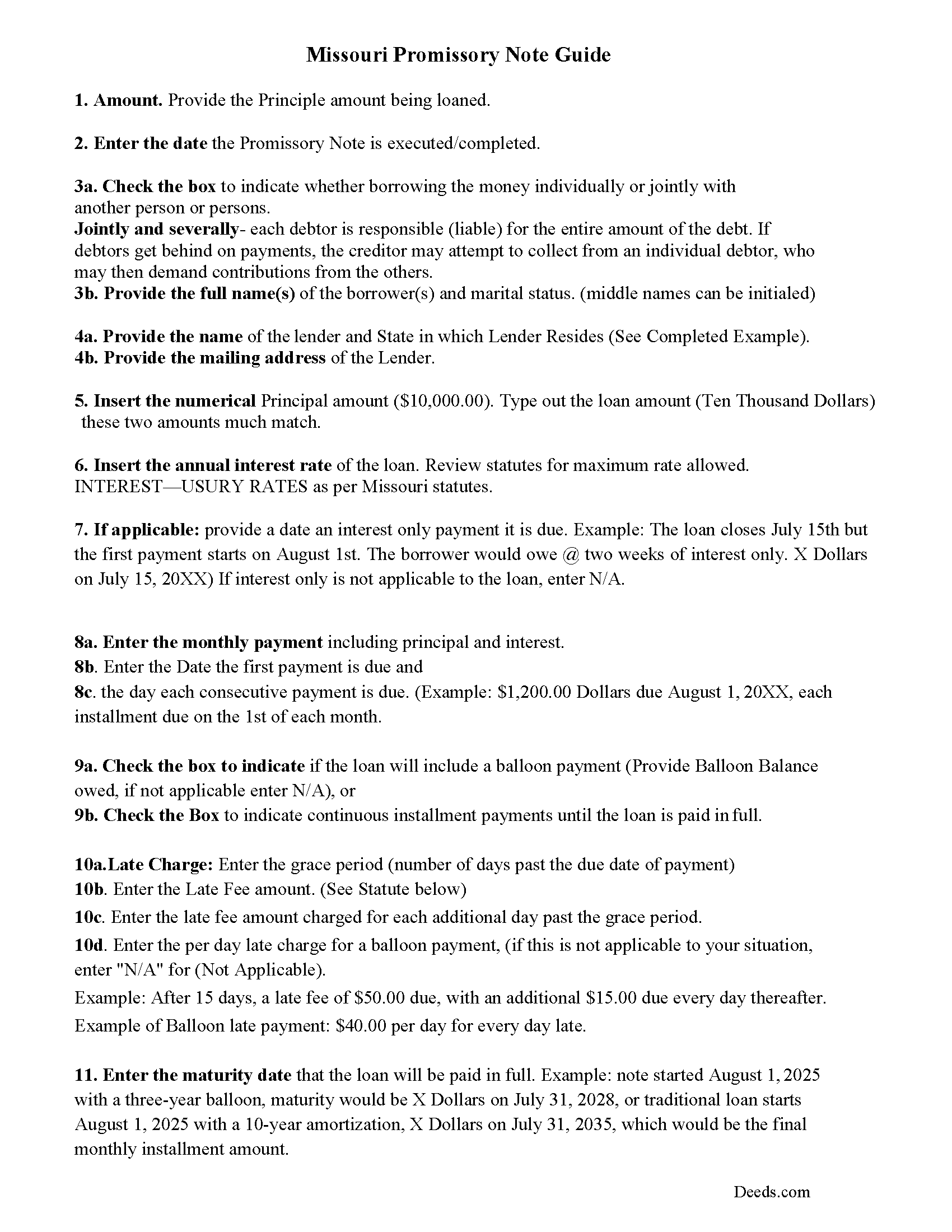

Worth County Promissory Note Guidelines

Line by line guide explaining every blank on the form.

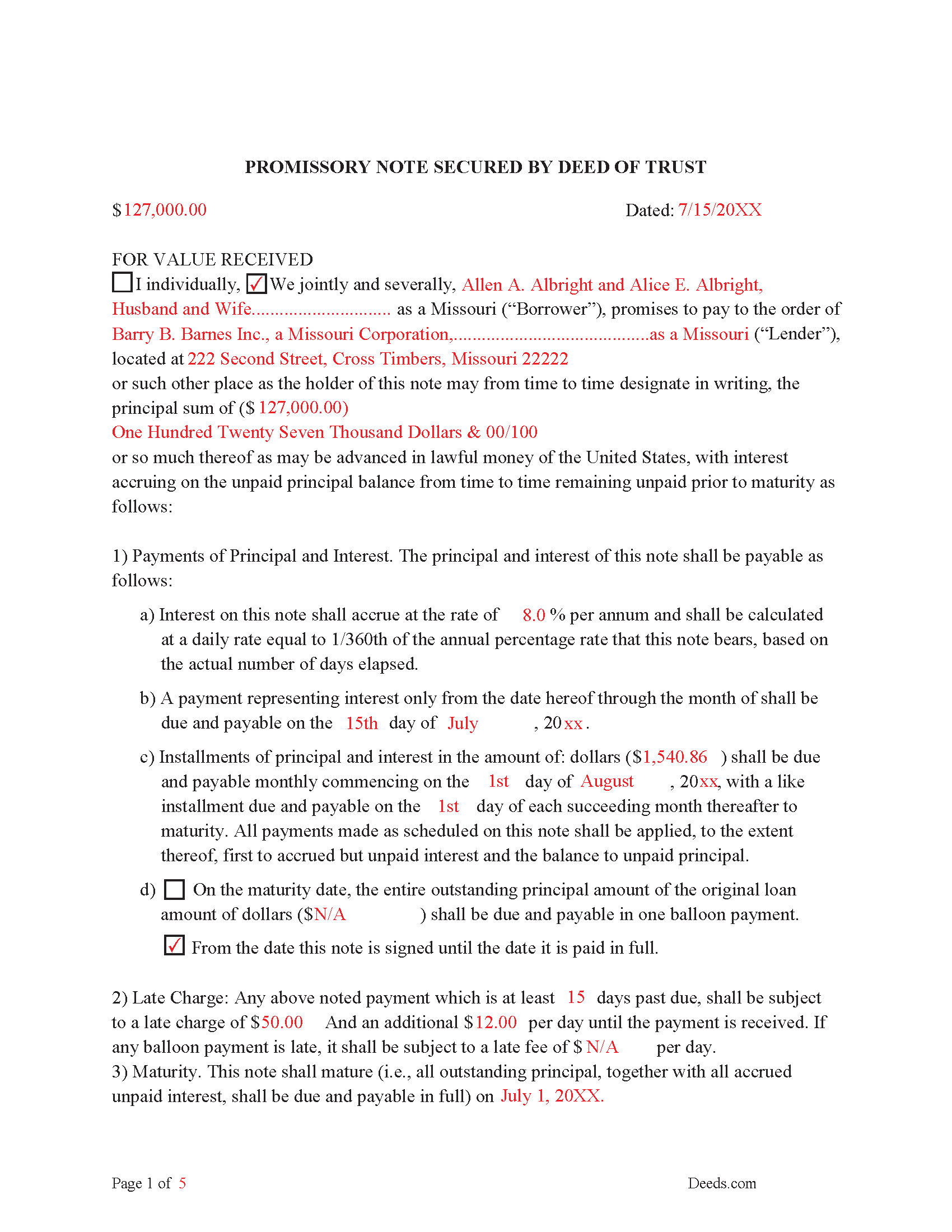

Worth County Completed Example of the Promissory Note Document

Example of a properly completed form for reference.

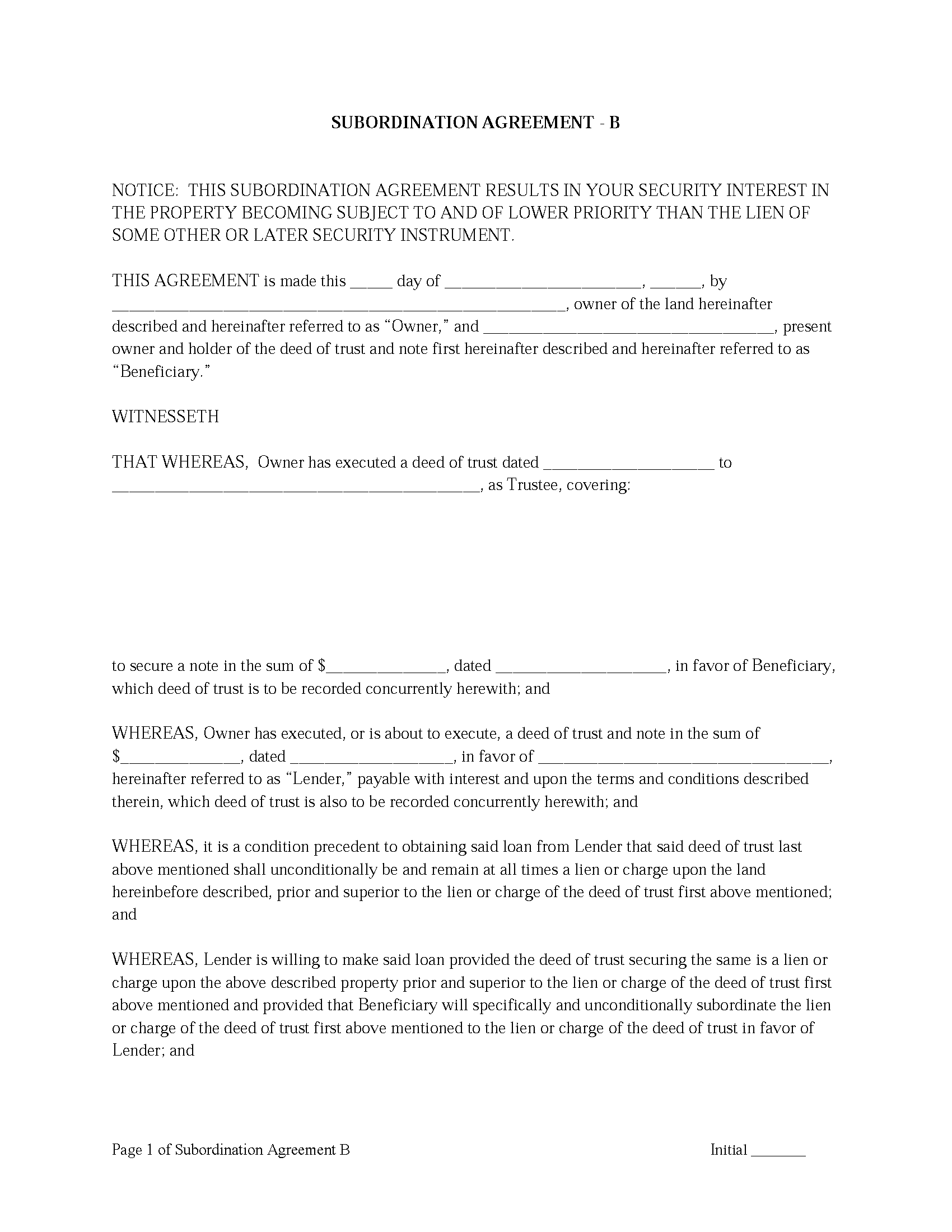

Worth County Subordination Agreements

Used to place priority on claim of debt. Included are 4 separate agreements for unique situations. If needed, add to Deed of Trust as an addendum or rider.

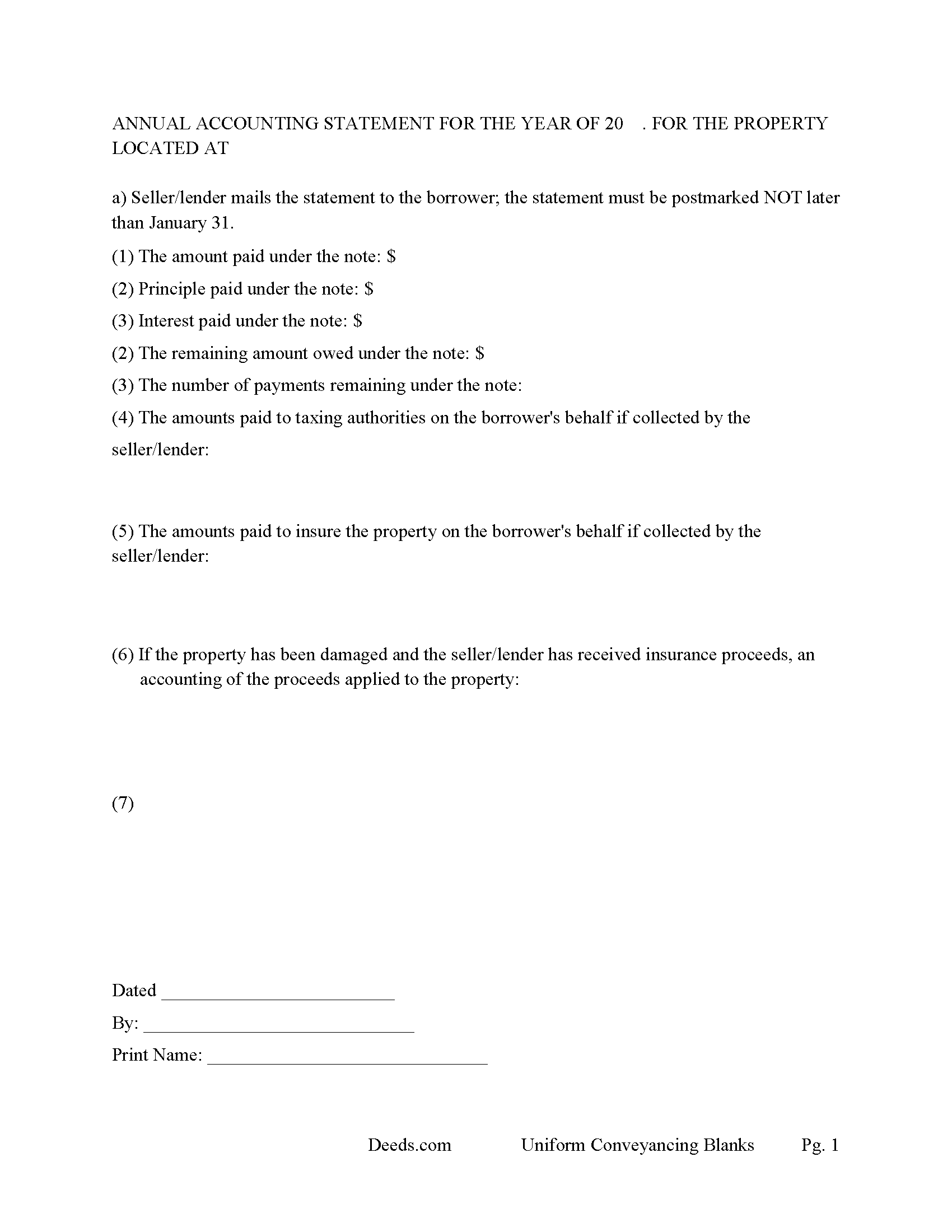

Worth County Annual Accounting Statement Form

Fill in the blank Deed of Trust and Promissory Note form formatted to comply with all Missouri recording and content requirements.

All 9 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Missouri and Worth County documents included at no extra charge:

Where to Record Your Documents

Worth County Recorder of Deeds

Grant City, Missouri 64456

Hours: 8:30 to 12:00 & 1:00 to 4:30 M-F

Phone: (660) 564-2484

Recording Tips for Worth County:

- White-out or correction fluid may cause rejection

- Double-check legal descriptions match your existing deed

- Leave recording info boxes blank - the office fills these

- Consider using eRecording to avoid trips to the office

Cities and Jurisdictions in Worth County

Properties in any of these areas use Worth County forms:

- Allendale

- Denver

- Grant City

- Sheridan

- Worth

Hours, fees, requirements, and more for Worth County

How do I get my forms?

Forms are available for immediate download after payment. The Worth County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Worth County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Worth County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Worth County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Worth County?

Recording fees in Worth County vary. Contact the recorder's office at (660) 564-2484 for current fees.

Questions answered? Let's get started!

A Deed of Trust is a (security instrument securing the payment or satisfaction of any debt or other obligation.) (MRS 443.005) This is often considered a preferred method of financing real property because foreclosures are done non-judicially with no right of redemption, through a trustee sale, saving time (typically 60-90 days if uncontested) and expense. This Deed of Trust contains a "Power of Sale" clause, in the case of default the borrower(s) have pre-authorized the sale of the property. Without a "Power of Sale" a judicial foreclosure will likely have to be performed. (See 443.290 Mortgages and security agreements with power of sale)

The "Promissory Note" defines the terms of the loan, Principle owed, interest rate charged, default rate (interest charged if Note is in Default), late payment fees, etc.

These forms are flexible, use for residential, rental units, vacant land, small office and commercial. A "Special Provisions" section allows the lender to further customize the package to his/her needs. Can be used when existing liens are in place.

Fully formatted for recording. (See MRS 443.035. Recording of instrument required)

A Deed of Trust and Promissory Note that includes stringent default terms can be beneficial the lender/debt holder.

(Missouri DOT Package includes forms, guidelines, and completed examples)

Important: Your property must be located in Worth County to use these forms. Documents should be recorded at the office below.

This Deed of Trust and Promissory Note meets all recording requirements specific to Worth County.

Our Promise

The documents you receive here will meet, or exceed, the Worth County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Worth County Deed of Trust and Promissory Note form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Terri E.

October 6th, 2023

Quick Accurate experience will recommend this service to my friends

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Dee S.

July 18th, 2019

This was easy and much cheaper than getting a lawyer. Thanks! - From alabama

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

ROBERT L.

April 1st, 2019

I got a blank, a sample and detailed instructions, I'm happy. If the recorder's office had a form as they like to see, with your name as they like to see, and the property name as they like to see, no one would ever pay a lawyer for this but a little time to look up the exact names and this package you're all set. I recommend this because, while it isn't difficult, making a mistake could be very bad so getting the details right for a particular county is well worth the cost.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Debra H.

April 11th, 2019

I find this site easy to use and every form I may need. Now to figure out how to fill in on line. :)

Thank you for your feedback Debra. Be sure to download the forms and fill them out on your computer, they should not be filled out "online". Have a great day.

Carolyn D.

March 18th, 2022

The sight provided exactly what I needed and was easy to use. I was able to download the type of Deed I used and was completely satisfied with the website.

Thank you for your feedback. We really appreciate it. Have a great day!

Natasha M.

January 9th, 2024

Your forms, guides, sample deeds and submission process were accessible, easy to understand and simple. I also was pleasantly surprised by the efficiency, professionalism and ease of staff communicating with me after I uploaded the document to ensure the county accepted it. I will continue to use this website to record deeds. Thank you!

Thank you for your feedback. We really appreciate it. Have a great day!

Melvin M.

June 6th, 2019

loads of forms and instructions....for a good buy...it would help to know where to send the forms after completing them...

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jami B.

November 6th, 2019

I was blown away by all the information I received for just $19.00!! I am still reading through it. Great job of explaining everything.

Thank you!

CORA T.

January 17th, 2022

very convenient and quick access

Thank you!

roger m.

April 2nd, 2019

super clean interface i thank you very much

Thank you!

Tammy S.

October 6th, 2022

Easy to download, great guidelines, and samples of each form needed.

Thank you!

Cruz C.

December 8th, 2020

L-o-v-e your site. Great over-all usable docs. thanks

Thank you for your feedback. We really appreciate it. Have a great day!

cora c.

December 30th, 2021

ALTHOUGH IT TOOK A LITTLE LONGER THAN EXPECTED TO RECEIVE AN INVOICE TO ALLOW ME TO PAY THE REQUIRED FEES AND HAVE MY DOCUMENT SUBMITTED FOR RECORDING, I REALLY APPRECIATED THE SERVICE AND PROMPT RESPONSES TO MY MESSAGES, SEEKING ASSISTANCE. THANK YOU SO MUCH!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Title H.

July 27th, 2023

THIS SERVICE IS DIFFICULT TO USE AND TROUBLESOME, IN MY PROFESSIOBAL OPINION; a true NUGHTMARE! As a Title / Petroleum Land Professional (Landman), I use a wide variert of online title research tools and services. Mist are EXTREMELY COMPREHENSIVE, and relatively easy to perform one’s research. I am beginning to beliece that there is no search intrrfaxe here; just a long list of instructions full of circular references that simply tuns the researcher around and around to the same pages repeatedly. This service takes users NOWHERE. Good luck to those seeking to waste their time reading a vast set of redundant words and NO INTERFACE FOR CREATING OR EXECUTING AN AXTUAL SEARCH.

Thank you for sharing your feedback with us. We're genuinely sorry to hear about the difficulties you faced while using our service. As a Title / Petroleum Land Professional, your experience is invaluable to us, and we regret that our website did not meet your expectations.

We are committed to making the necessary changes to enhance our platform and provide a better experience for all users, including professionals like yourself.

Angela M.

November 14th, 2024

Great communication and always on timely manner unless issue appears with the document. I like their customer service, very helpful and assisting when necessary.

We are sincerely grateful for your feedback and are committed to providing the highest quality service. Thank you for your trust in us.