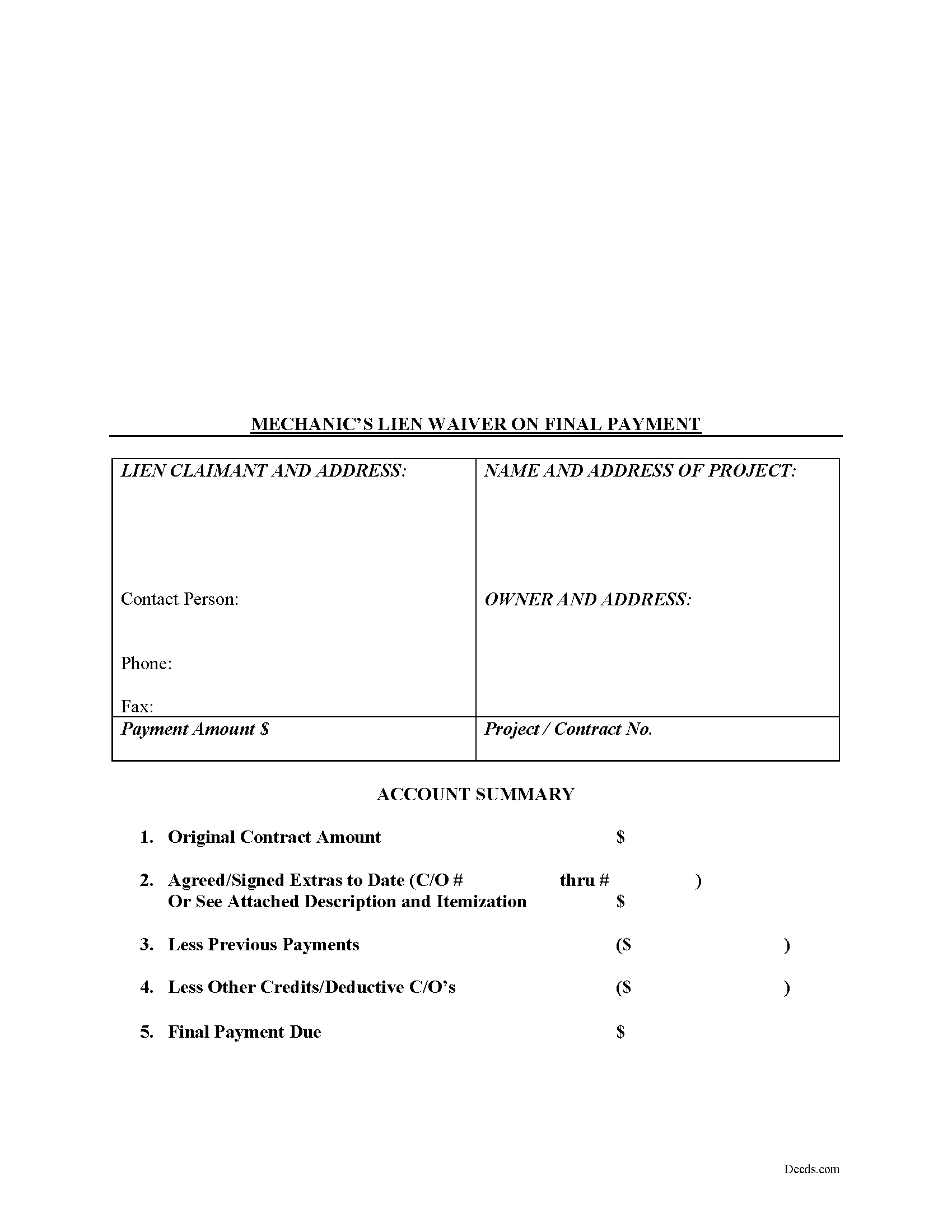

Harrison County Mechanic's Lien Waiver on Final Payment Form

Harrison County Mechanic's Lien Waiver on Final Payment Form

Fill in the blank Mechanic's Lien Waiver on Final Payment form formatted to comply with all Missouri recording and content requirements.

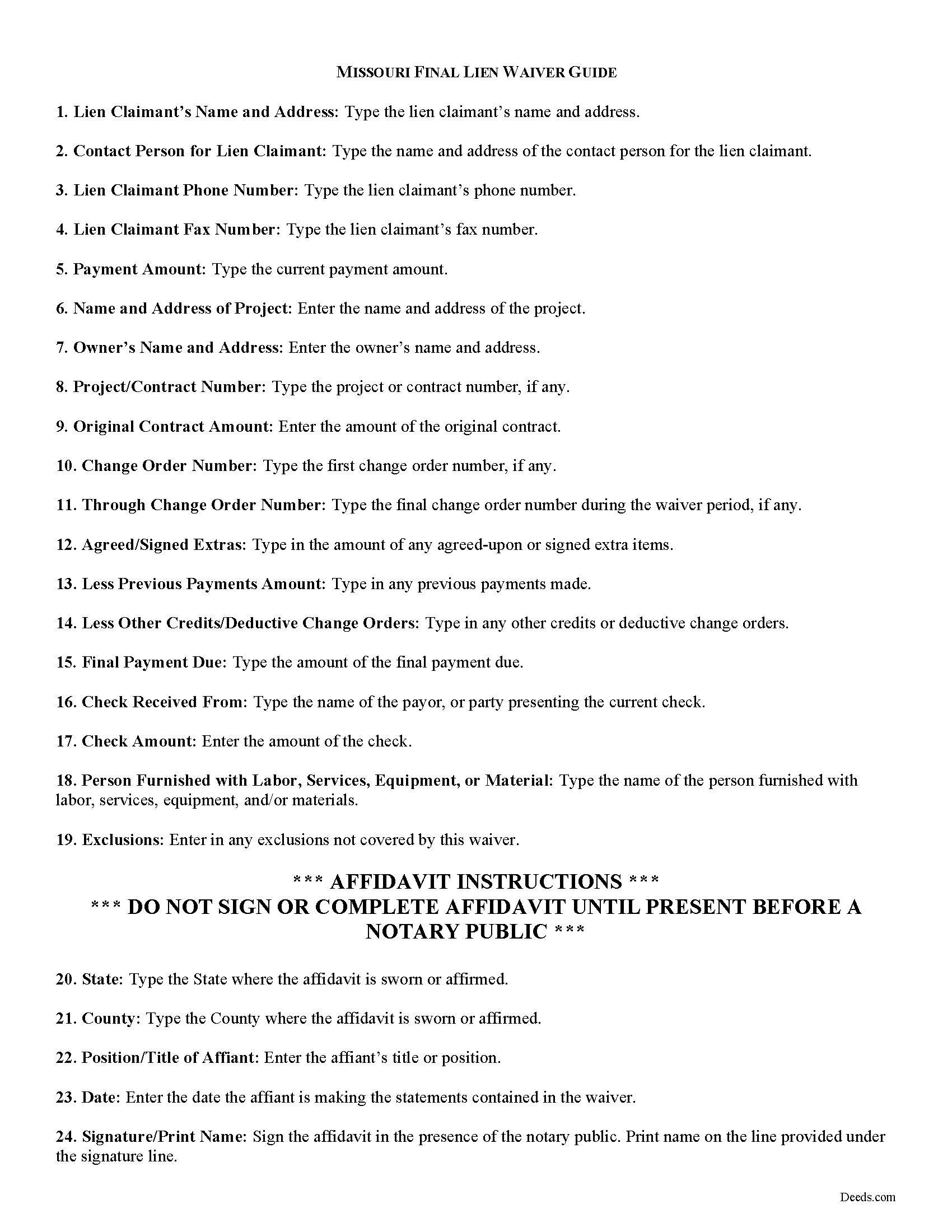

Harrison County Final Lien Waiver Guide

Line by line guide explaining every blank on the form.

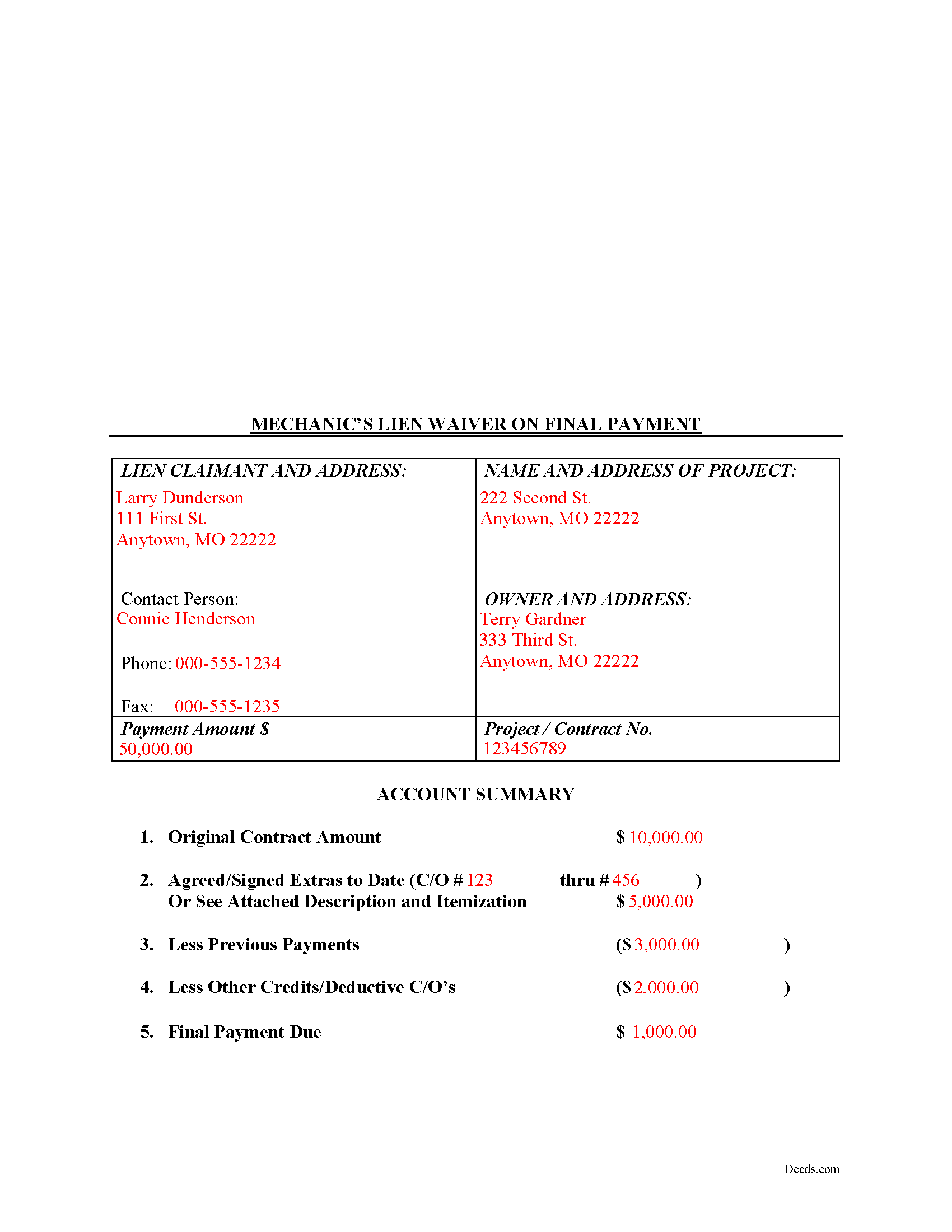

Harrison County Completed Example of the Final Lien Waiver Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Missouri and Harrison County documents included at no extra charge:

Where to Record Your Documents

Harrison County Recorder of Deeds

Bethany, Missouri 64424

Hours: 8:00 to 4:00 Monday through Friday

Phone: (660) 425-6425

Recording Tips for Harrison County:

- Ensure all signatures are in blue or black ink

- Verify all names are spelled correctly before recording

- Bring extra funds - fees can vary by document type and page count

- Avoid the last business day of the month when possible

- Leave recording info boxes blank - the office fills these

Cities and Jurisdictions in Harrison County

Properties in any of these areas use Harrison County forms:

- Bethany

- Blythedale

- Cainsville

- Eagleville

- Gilman City

- Hatfield

- Martinsville

- New Hampton

- Ridgeway

Hours, fees, requirements, and more for Harrison County

How do I get my forms?

Forms are available for immediate download after payment. The Harrison County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Harrison County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Harrison County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Harrison County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Harrison County?

Recording fees in Harrison County vary. Contact the recorder's office at (660) 425-6425 for current fees.

Questions answered? Let's get started!

Lien waivers are used to facilitate payment between contractors, subcontractors, customers, and property owners. A waiver is a known relinquishment of a right. In this case, the person granting the waiver is relinquishing the right to seek a mechanic's lien for all or part of the amount due.

In general, there are two types of waivers: partial and final. A partial waiver is used when a progress or partial payment is made and money is still due and owing. The waiver applies only to the partial payment amount and is conditioned upon the actual receipt of that money. A final waiver releases all rights immediately. Be cautious about using the correct form of waiver, as partial waivers provide more protection to the lien claimant, while final waivers offer more protection for the customer or property owner.

The waiver must include details identifying the parties, the location of the project, relevant details from the original agreement such as work requested, costs and changes, important dates, payments, and any exclusions or agreements. The person waiving the lien gives a sworn statement in front of a notary, signs the form, and then records it in the property records for the county where the property is located.

Best practices dictate that claimants should only use the final waiver after the customer makes the final payment, meaning nothing is left due and owing after this payment. When issuing a final waiver, verify that the funds actually go through (meaning the check has cleared).

This article is provided for information purposes only and should not be relied upon as a substitute for the advice from a legal professional. Please speak with an attorney with questions about using a lien waiver or any other issues related to liens in Missouri.

Important: Your property must be located in Harrison County to use these forms. Documents should be recorded at the office below.

This Mechanic's Lien Waiver on Final Payment meets all recording requirements specific to Harrison County.

Our Promise

The documents you receive here will meet, or exceed, the Harrison County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Harrison County Mechanic's Lien Waiver on Final Payment form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4578 Reviews )

THOMAS P.

September 11th, 2020

This site is excellent and makes everything so much easier. 5 star platform.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Stephen B.

August 21st, 2024

This was the first time to use the Deeds.com website for preparing my deed document. This was painless and easy to follow the instructions and sample package for filling in the blank boxes document. The city clerk was impressed to review my document and easily filed my deed record without questions. I would recommend anyone to prepare a legal form that is available from the Deeds.com website.

Your appreciative words mean the world to us. Thank you.

Stephanie S.

July 24th, 2019

I received my information almost immediately. I read a few more things on the website and then refreshed and it was there! SO much easier than having to go to the office myself - thanks!!

Thank you!

Bryan C.

August 2nd, 2019

Fast and just as promised

Thank you for your feedback. We really appreciate it. Have a great day!

Paul R. A.

September 10th, 2019

Great and prompt service. Thank you for your assistance. Paul R. Ashe, Esq.

Thank you!

Chuck M.

May 30th, 2019

Easy to use service. However, the product that I purchased did not meet my needs. No fault of the company.

Thank you for your feedback Chuck. We certainly don't want you to purchase something you can not use. We have canceled your order and payment. Have a wonderful day.

Jeffrey M.

December 1st, 2021

Great service. It had all the forms I needed.

Thank you!

Robert F.

July 11th, 2023

This service is excellent. I submitted a Quickclaim Deed so my home would be in the name of a Living Trust I had just created. This was my first attempted at any of this and the staff person, KVH, who reviewed my Deed was extremely helpful and quick to respond to any questions I had and to make sure the Deed had the correct information before submittal to the county for recording. I started the process one afternoon and by the next day, the Deed was submitted to, and recorded in, my county. I will use them again whenever needed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Vallerie M.

March 12th, 2024

Amazing! Great prompt service and follow up. I couldn’t be happier

We are grateful for your engagement and feedback, which help us to serve you better. Thank you for being an integral part of our community.

deborah k.

April 7th, 2022

was very easy to fill out the directions were very helpful

Thank you!

willie jr t.

November 23rd, 2020

Awesome! Thanks so so much!

Thank you!

Jo Anne C.

February 1st, 2021

Excellent documentation. Thank you.

Thank you for your feedback. We really appreciate it. Have a great day!

MARY LACEY M.

July 1st, 2024

The service provided by the staff at Deeds.com is consistently excellent with prompt replies and smooth recording transactions. I am grateful to have their service available as driving to downtown Phoenix to record documents is always a daunting prospect. Their assistance in recording our firm's documents has been 100% accurate and a pleasure.

Thank you for your positive words! We’re thrilled to hear about your experience.

Debbie K.

June 18th, 2020

I am very happy with Deeds.com. I found the site easy to use and all the directions I needed were available. I'm so happy I didn't have to go to a title company to get this done. The site is easy to navigate and the documents are easy to download.

Thank you for your feedback. We really appreciate it. Have a great day!

Laurie B.

May 30th, 2022

easy to use, good experience

Thank you!