Miller County Partial Mechanic's Lien Waiver on Progress Payment Form

Miller County Partial Mechanic's Lien Waiver on Progress Payment Form

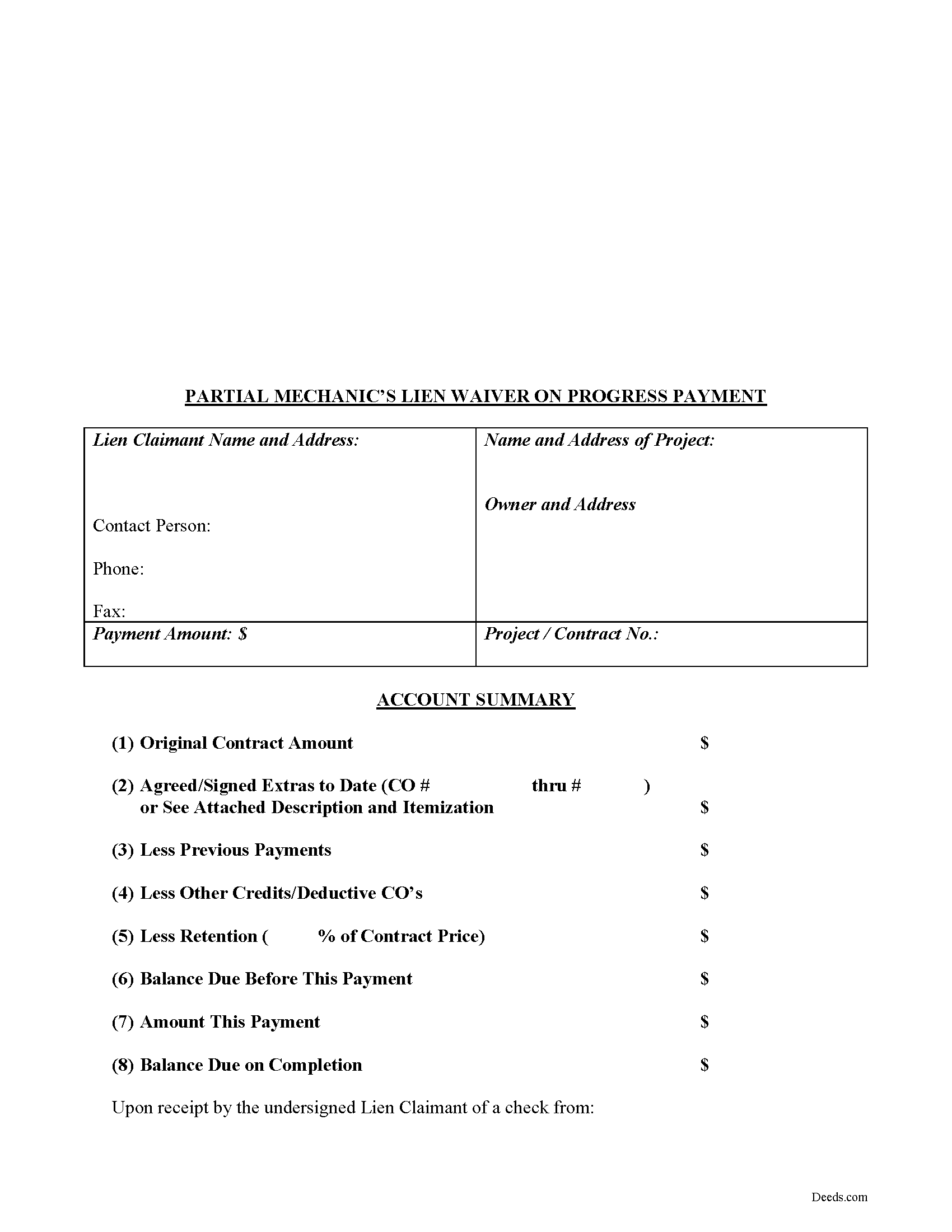

Fill in the blank Partial Mechanic's Lien Waiver on Progress Payment form formatted to comply with all Missouri recording and content requirements.

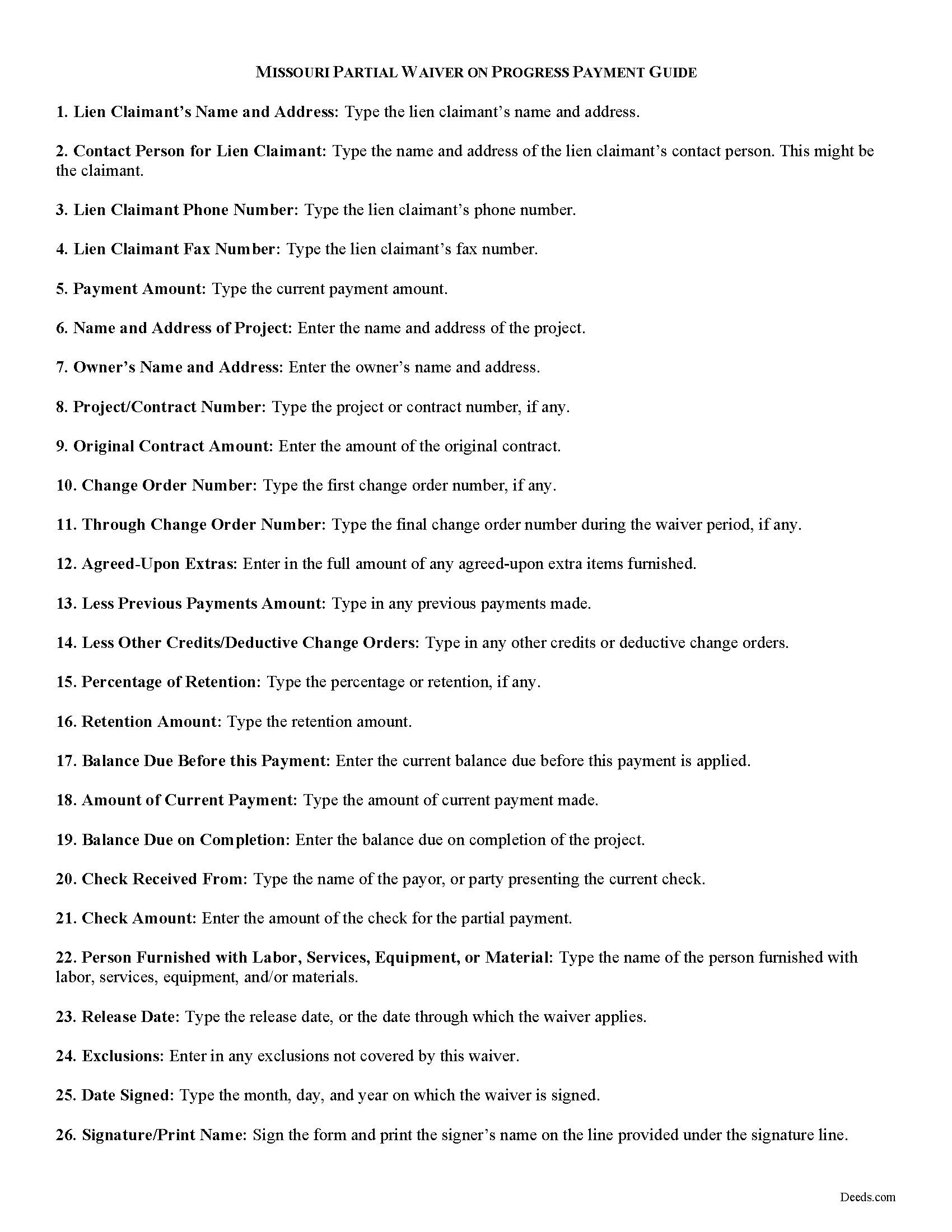

Miller County Partial Lien Waiver Guide

Line by line guide explaining every blank on the form.

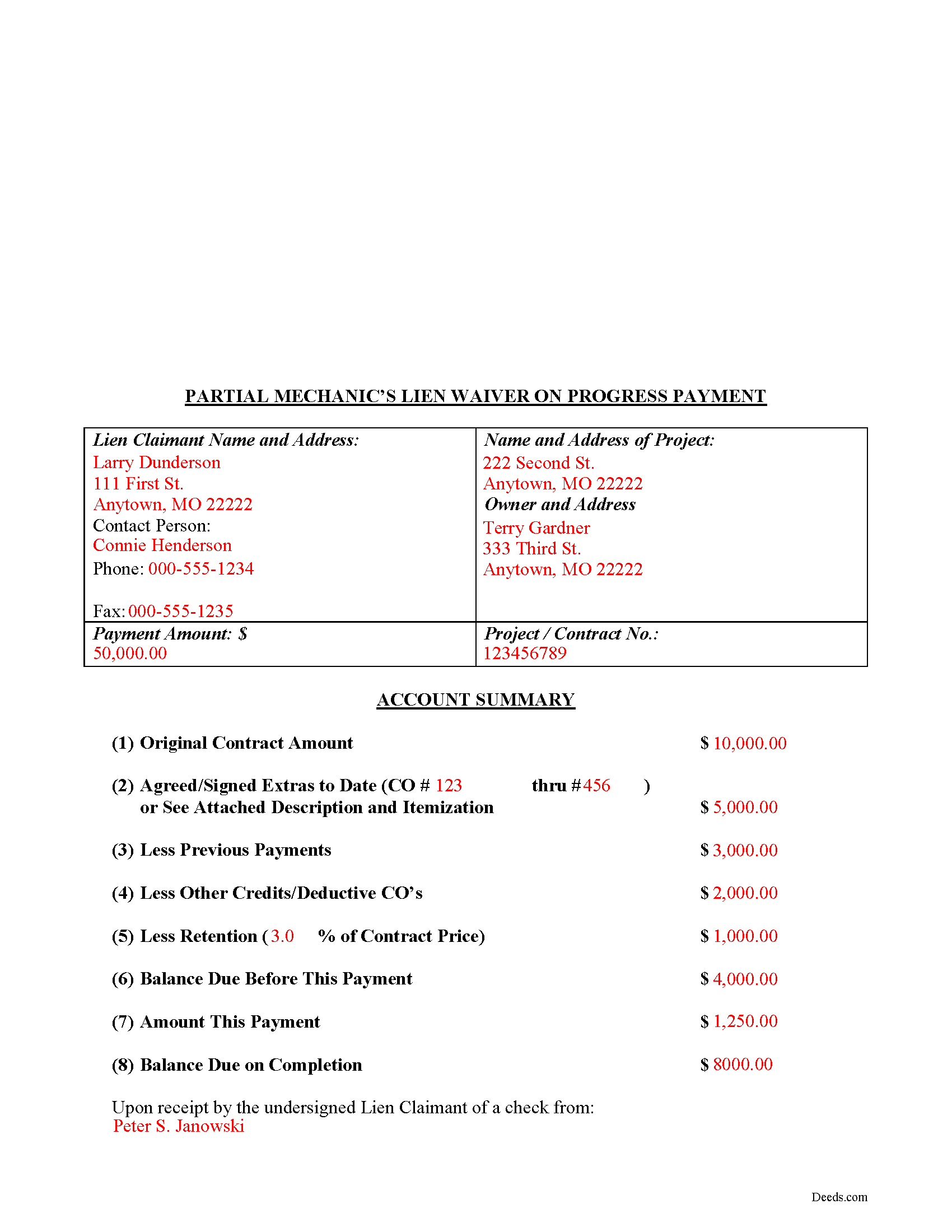

Miller County Completed Example of the Partial Lien Waiver Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Missouri and Miller County documents included at no extra charge:

Where to Record Your Documents

Miller County Recorder of Deeds

Tuscumbia, Missouri 65082

Hours: 8:00 to 4:30 Monday through Friday

Phone: (573) 369-1935

Recording Tips for Miller County:

- Double-check legal descriptions match your existing deed

- Both spouses typically need to sign if property is jointly owned

- Check margin requirements - usually 1-2 inches at top

Cities and Jurisdictions in Miller County

Properties in any of these areas use Miller County forms:

- Brumley

- Eldon

- Iberia

- Kaiser

- Olean

- Saint Elizabeth

- Tuscumbia

- Ulman

Hours, fees, requirements, and more for Miller County

How do I get my forms?

Forms are available for immediate download after payment. The Miller County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Miller County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Miller County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Miller County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Miller County?

Recording fees in Miller County vary. Contact the recorder's office at (573) 369-1935 for current fees.

Questions answered? Let's get started!

Lien waivers are used to facilitate payment between contractors, subcontractors, customers, and property owners. A waiver is a known relinquishment of a right. In this case, the person granting the waiver is relinquishing the right to seek a mechanic's lien for all or part of the amount due.

In general, there are two types of waivers: partial and final. A partial waiver is used when a progress or partial payment is made and money is still due and owing. The waiver applies only to the partial payment amount and is conditioned upon the actual receipt of that money (the check clears the bank). A final waiver releases all rights immediately. Be cautious about using the correct form of waiver, as partial waivers provide more protection to the lien claimant, while final waivers offer more protection for the customer or property owner.

The waiver must include details identifying the parties, the location of the project, relevant details from the original agreement such as work requested, costs and changes, important dates, payments, and any exclusions, conditions, or agreements. It also lists the dates covered by the partial waiver. The person waiving the lien gives a sworn statement in front of a notary, signs the form, and then records it in the property records for the county where the property is located.

This article is provided for information purposes only and should not be relied upon as a substitute for the advice from a legal professional. Please speak with an attorney with questions about using a lien waiver or any other issue related to liens in Missouri.

Important: Your property must be located in Miller County to use these forms. Documents should be recorded at the office below.

This Partial Mechanic's Lien Waiver on Progress Payment meets all recording requirements specific to Miller County.

Our Promise

The documents you receive here will meet, or exceed, the Miller County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Miller County Partial Mechanic's Lien Waiver on Progress Payment form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4580 Reviews )

Keith K.

October 21st, 2022

More expensive that I would have thought.

Thank you for your feedback. We really appreciate it. Have a great day!

Julia C.

May 18th, 2025

Deeds.com was such a blessing in order for me to get something done that my lawyers could not get done. Transferring a mineral right from my deceased parents to me and my husband. The mineral company person I worked with went above and beyond helping me fill the paperwork out perfectly so that it had “right of survivorship” (and other things phrased properly) so that either my husband or I won’t have the issue I have had. Had it not been for deeds.com I don’t think I would have been able to complete this process. I hope anyone that ever needs something such as this learns about I deeds.com.

Thank you, Julia, for your kind and thoughtful review. We're truly honored to have played a role in helping you and your husband secure your mineral rights — especially after such a frustrating experience elsewhere. It’s great to hear that our team and resources were able to guide you through the process with clarity and care. Your words mean a lot to us, and we hope others in similar situations find the support they need through Deeds.com, just like you did. Wishing you continued peace of mind and security with your property.

Viola G.

July 7th, 2022

Some of the forms I ordered didn't have enough space for all of the information, but were useful as a guide for creating what I needed. Now I'll be trying the e-recording to see how that goes.

Thank you!

Ron D.

January 14th, 2019

No choice since the county does not seem to provide info you supplied.

Thank Ron, have a great day!

Gail W.

July 2nd, 2019

Easy to use!!

Thank you!

Jane H.

February 5th, 2019

So far, so good!

Thank you Jane. Have a great day!

Crystal P.

April 16th, 2024

This service is amazing! We have tried several other online recording services which all disappointed. Deeds.com got all three of our documents recorded same day as invoice payment. Thank you for the quick turn around! We will be using this service often.

We are sincerely grateful for your feedback and are committed to providing the highest quality service. Thank you for your trust in us.

Melanie W.

October 23rd, 2022

I used deeds.com to complete a gift deed for transferring a house to our son. Finding the correct form and completing it correctly was extremely easy due to wonderful explanations and examples provided with the purchase of the form. The registrar filing the deed told me she was impressed with the work we did. An attorney would have charged $150 so the $28.00 was well worth the money.

Thank you for your feedback. We really appreciate it. Have a great day!

Heather T.

January 21st, 2022

Thank you for making this so easy

Thank you!

Anne G.

April 6th, 2020

I used deeds.com's services for the first time while the Stay at Home Order is in effect and found it to be very user friendly and seamless. I am very impressed.

Thank you Anne, glad we could help.

Nicole T.

February 9th, 2021

Absolutely Amazing Service! I learned about Deeds.com, created my Account, uploaded my documents into my Recording Package, paid my Invoice and received my Three Recorded Deeds all in less than two hours! Awesome!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jacqueline C.

August 15th, 2019

Was relieved to see your site actually delivered what I paid for.

Thank you!

Andrew D.

August 12th, 2019

I was very pleased with the entire package we received. It will certainly make my job easier.

Thank you for your feedback. We really appreciate it. Have a great day!

Timothy G.

May 16th, 2023

Very happy with the cost and with the speed in which the deed was recorded.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Michael M.

February 20th, 2020

Thanks worked out great as the form was perfect and no problems filing it with the county.

Thank you for your feedback. We really appreciate it. Have a great day!