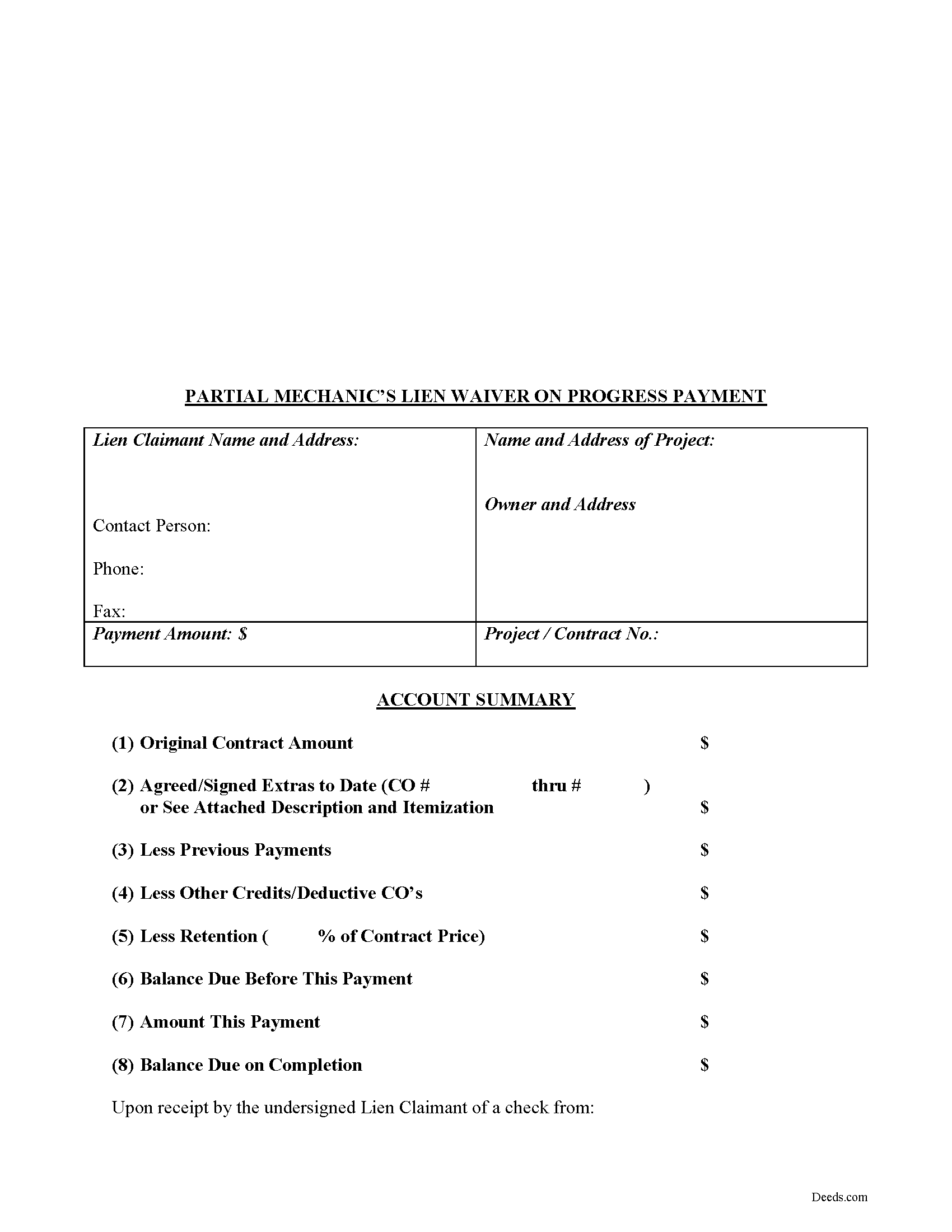

Newton County Partial Mechanic's Lien Waiver on Progress Payment Form

Newton County Partial Mechanic's Lien Waiver on Progress Payment Form

Fill in the blank Partial Mechanic's Lien Waiver on Progress Payment form formatted to comply with all Missouri recording and content requirements.

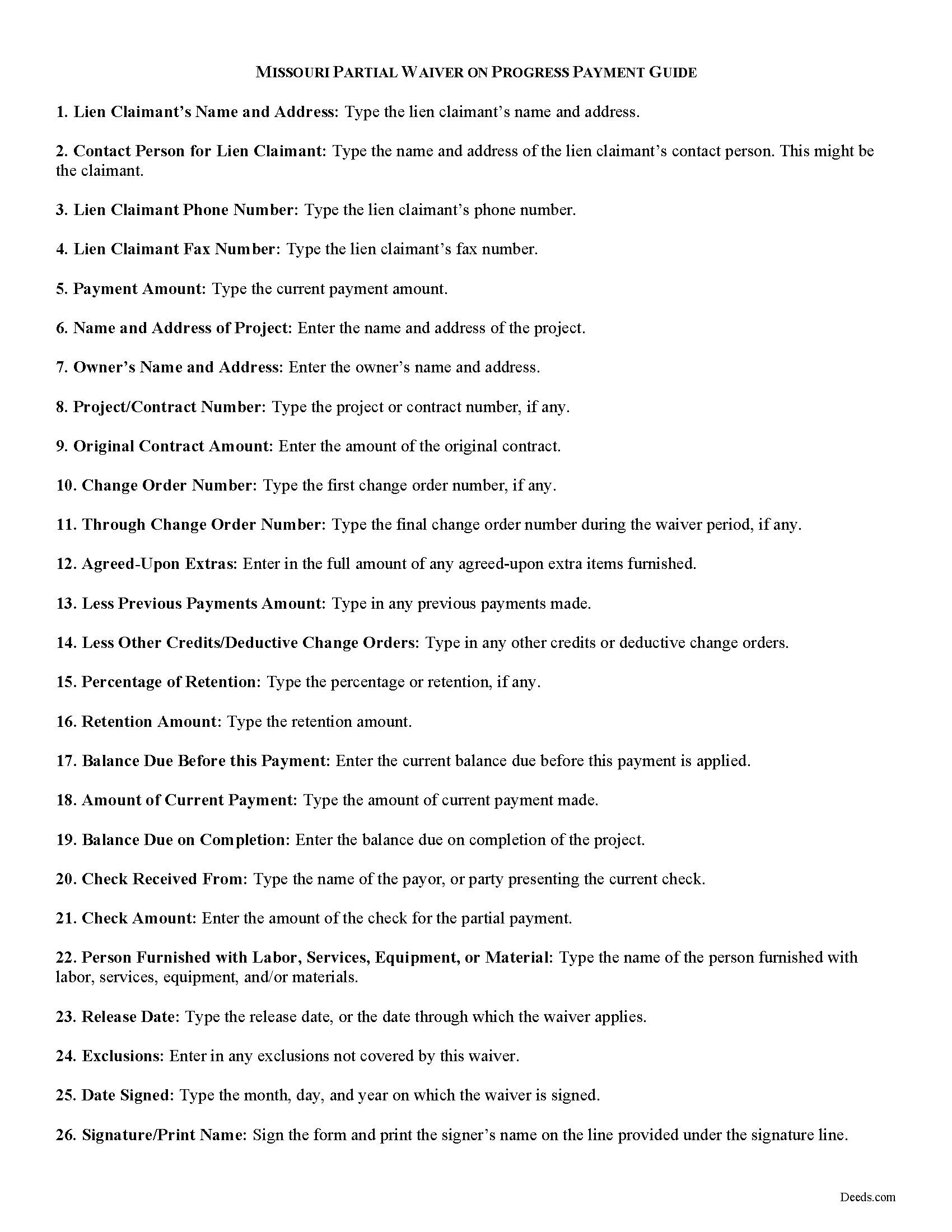

Newton County Partial Lien Waiver Guide

Line by line guide explaining every blank on the form.

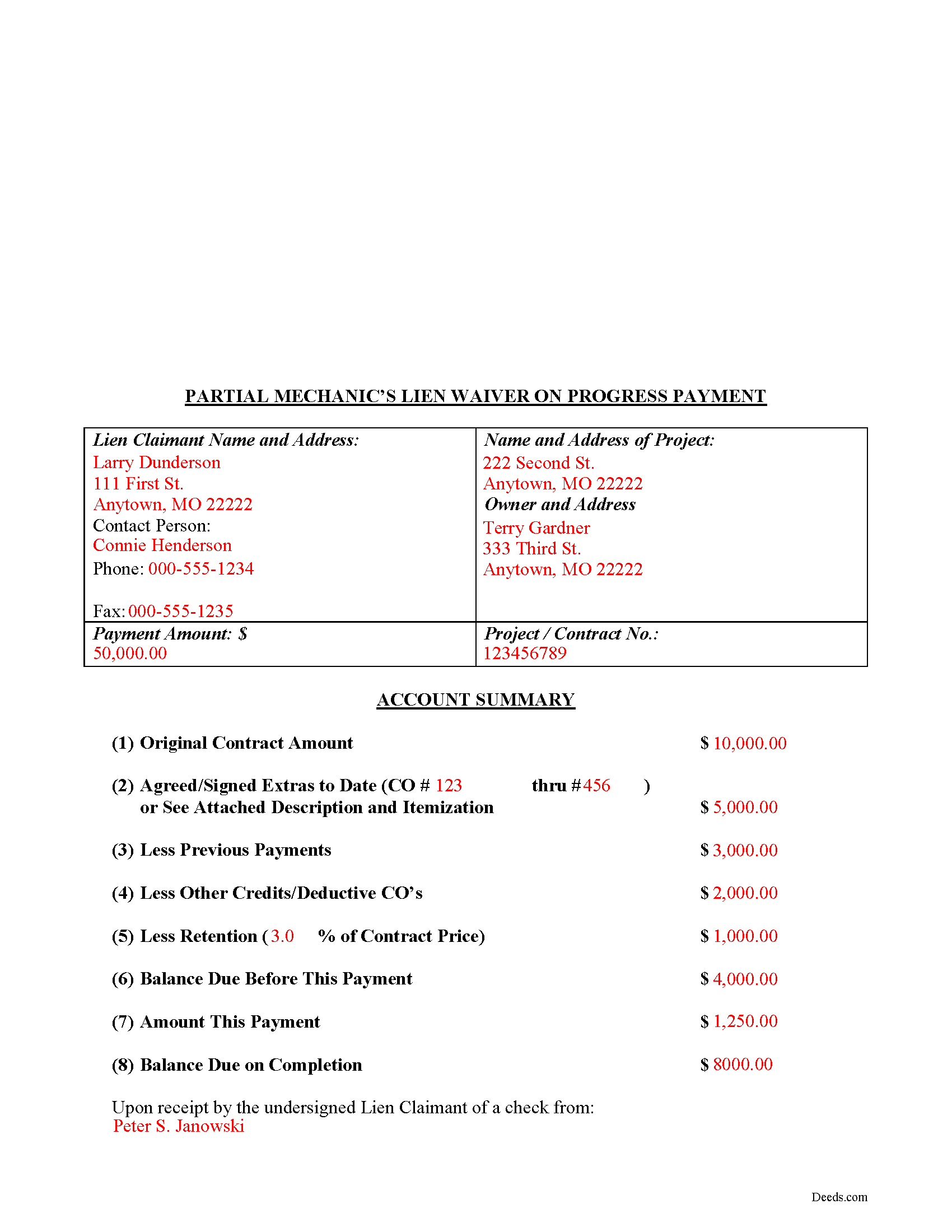

Newton County Completed Example of the Partial Lien Waiver Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Missouri and Newton County documents included at no extra charge:

Where to Record Your Documents

Newton County Recorder

Neosho, Missouri 64850

Hours: 8:00 to 5:00 M-F

Phone: (417) 451-8224

Recording Tips for Newton County:

- Ask if they accept credit cards - many offices are cash/check only

- Request a receipt showing your recording numbers

- Recording fees may differ from what's posted online - verify current rates

Cities and Jurisdictions in Newton County

Properties in any of these areas use Newton County forms:

- Diamond

- Fairview

- Granby

- Neosho

- Newtonia

- Racine

- Saginaw

- Seneca

- Stark City

- Stella

Hours, fees, requirements, and more for Newton County

How do I get my forms?

Forms are available for immediate download after payment. The Newton County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Newton County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Newton County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Newton County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Newton County?

Recording fees in Newton County vary. Contact the recorder's office at (417) 451-8224 for current fees.

Questions answered? Let's get started!

Lien waivers are used to facilitate payment between contractors, subcontractors, customers, and property owners. A waiver is a known relinquishment of a right. In this case, the person granting the waiver is relinquishing the right to seek a mechanic's lien for all or part of the amount due.

In general, there are two types of waivers: partial and final. A partial waiver is used when a progress or partial payment is made and money is still due and owing. The waiver applies only to the partial payment amount and is conditioned upon the actual receipt of that money (the check clears the bank). A final waiver releases all rights immediately. Be cautious about using the correct form of waiver, as partial waivers provide more protection to the lien claimant, while final waivers offer more protection for the customer or property owner.

The waiver must include details identifying the parties, the location of the project, relevant details from the original agreement such as work requested, costs and changes, important dates, payments, and any exclusions, conditions, or agreements. It also lists the dates covered by the partial waiver. The person waiving the lien gives a sworn statement in front of a notary, signs the form, and then records it in the property records for the county where the property is located.

This article is provided for information purposes only and should not be relied upon as a substitute for the advice from a legal professional. Please speak with an attorney with questions about using a lien waiver or any other issue related to liens in Missouri.

Important: Your property must be located in Newton County to use these forms. Documents should be recorded at the office below.

This Partial Mechanic's Lien Waiver on Progress Payment meets all recording requirements specific to Newton County.

Our Promise

The documents you receive here will meet, or exceed, the Newton County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Newton County Partial Mechanic's Lien Waiver on Progress Payment form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

George L. W.

August 30th, 2022

Where have you been all my life?

Thank you!

LINDA S.

November 11th, 2020

This was SO much easier than having to go down to the county recorder's office. I would definitely use this company again!

Thank you for your feedback. We really appreciate it. Have a great day!

PAUL B.

August 18th, 2023

Very fast and efficient reply

Thank you!

Clarice O.

June 15th, 2020

It was very easy plus exactly what I neded.

Thank you!

John v.

November 13th, 2019

I don't have any experience with real estate legal forms and these were fairly easy to understand. The guide helped a bunch and the information provided on the site filled in any gaps. Overall I would definitely use again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Amanda P.

April 14th, 2021

Quick kind and useful feedback provided related to issues.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jeanne A.

October 22nd, 2019

great forms, nice that they are fillable pdfs, easy to use, no issues. thanks.

Thank you for your feedback. We really appreciate it. Have a great day!

Rox Ann S.

April 15th, 2023

Very impressed with how fast the service was. Got what I needed within 20 to 30 minutes.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Mary B.

December 1st, 2021

Great job, Deeds.com! I'm a retired lawyer, and I'm liking what I see. Well done.

Thank you!

Vicki G.

November 24th, 2020

Thank you for this service, saved me from driving down town. It was quick and very easy to navigate. Have a great Thanksgiving break.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

William V.

July 18th, 2021

I finally got it. Thanks, William Vickery

Thank you!

Robyn R.

May 14th, 2020

Deeds.com was so simple and easy to use! My local recorders office is closed due to COVID-19 and their recording said to use Deeds.com. I thought it was going to either be very complicated or very expensive and it was neither!!! The site walked me through step by step and the price of their service was very fair and affordable. They were very timely and efficient and my documents were recorded almost immediately! Thank you Deeds.com!!!

Thank you Robyn, glad we could help.

William B.

October 22nd, 2023

The forms, and other information, are all excellent. I would be giving a 5-star review if it were not for the fact that downloading a "bundle" about quitclaim deeds required I download every single file independently (15 files). I would far prefer a zip file, or one click to download the whole pile of independent files.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

Roberta J B.

February 17th, 2021

User friendly

Thank you!

Jeremiah W.

August 2nd, 2020

Very helpful information and great forms.

Thank you for your feedback. We really appreciate it. Have a great day!