Miller County Quitclaim Deed Form

Miller County Quitclaim Deed Form

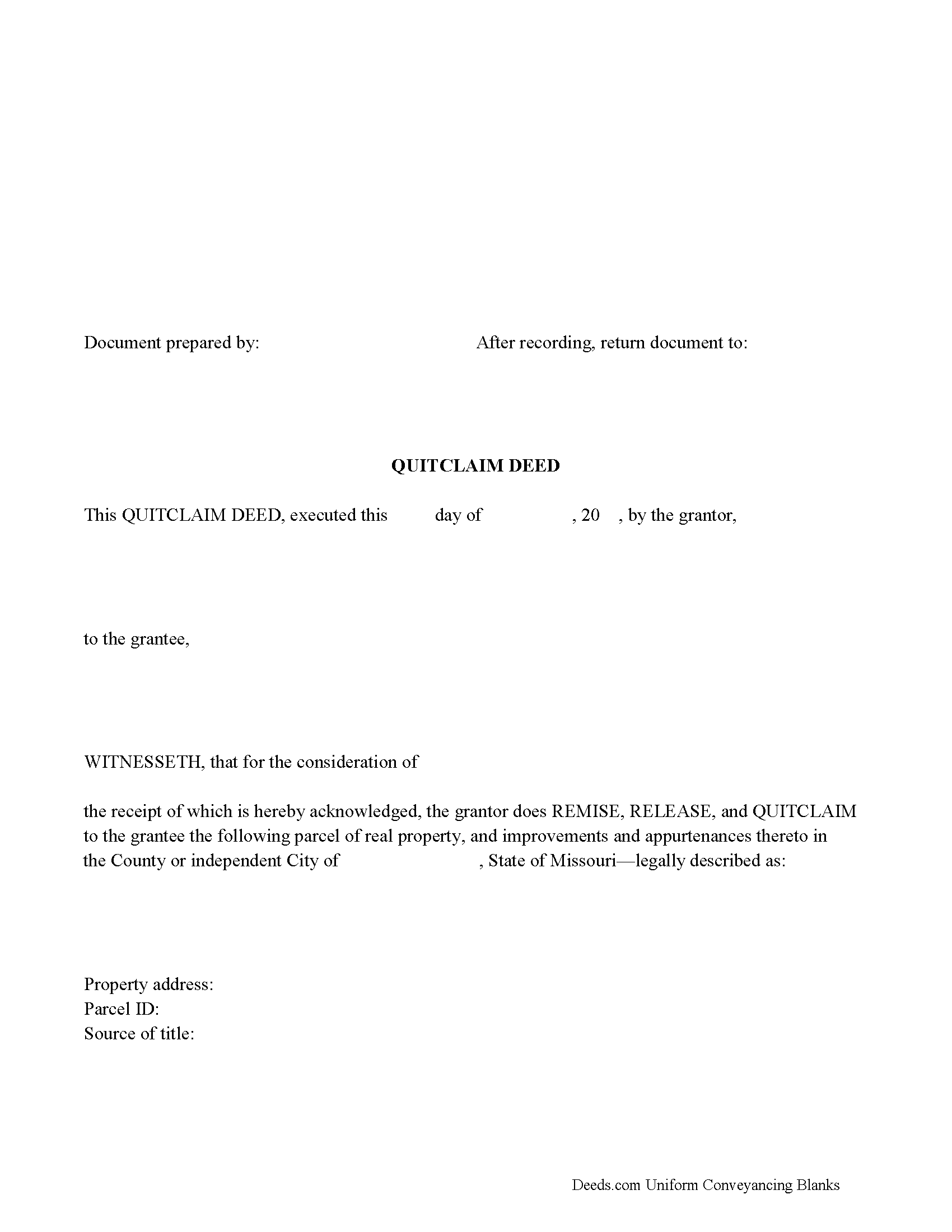

Fill in the blank Quitclaim Deed form formatted to comply with all Missouri recording and content requirements.

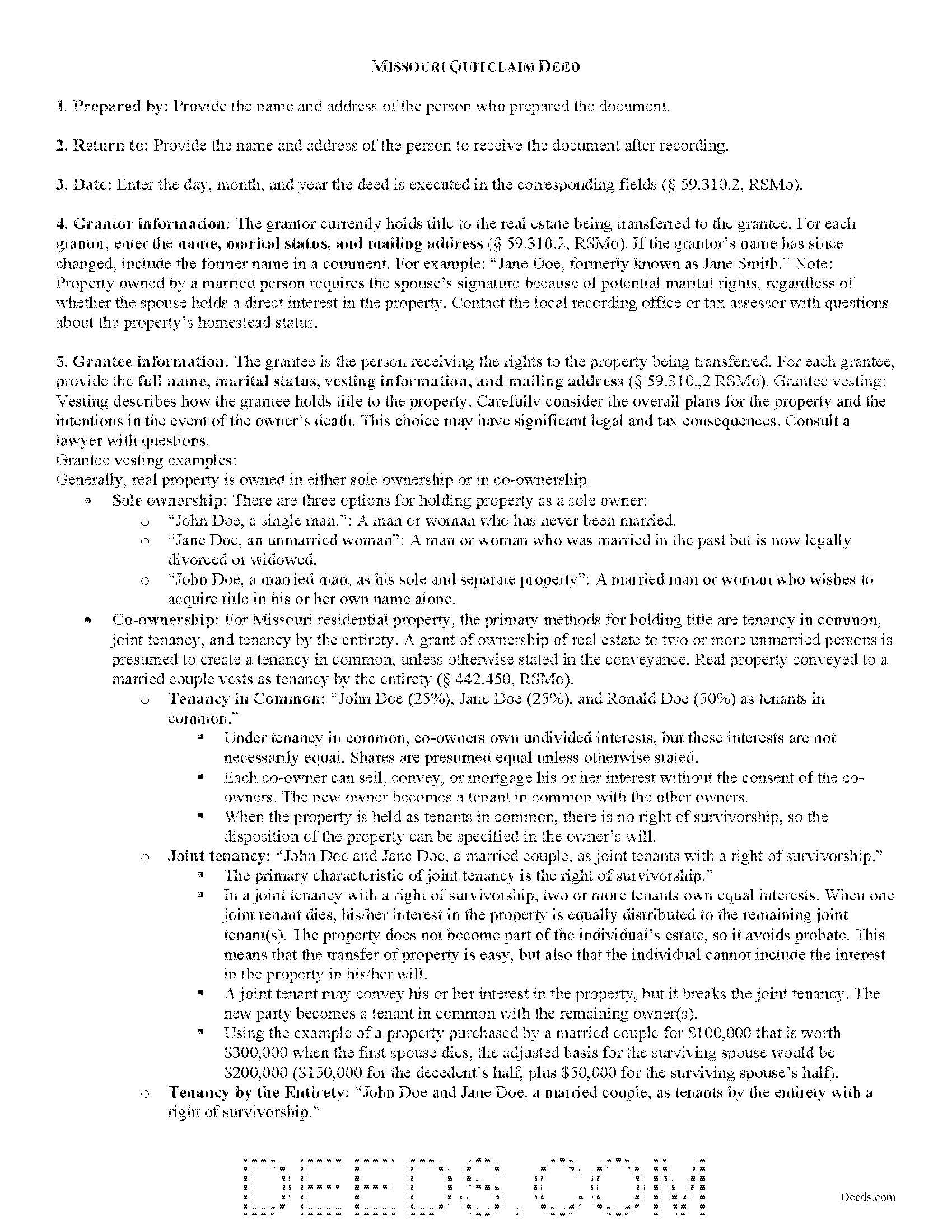

Miller County Quitclaim Deed Guide

Line by line guide explaining every blank on the Quitclaim Deed form.

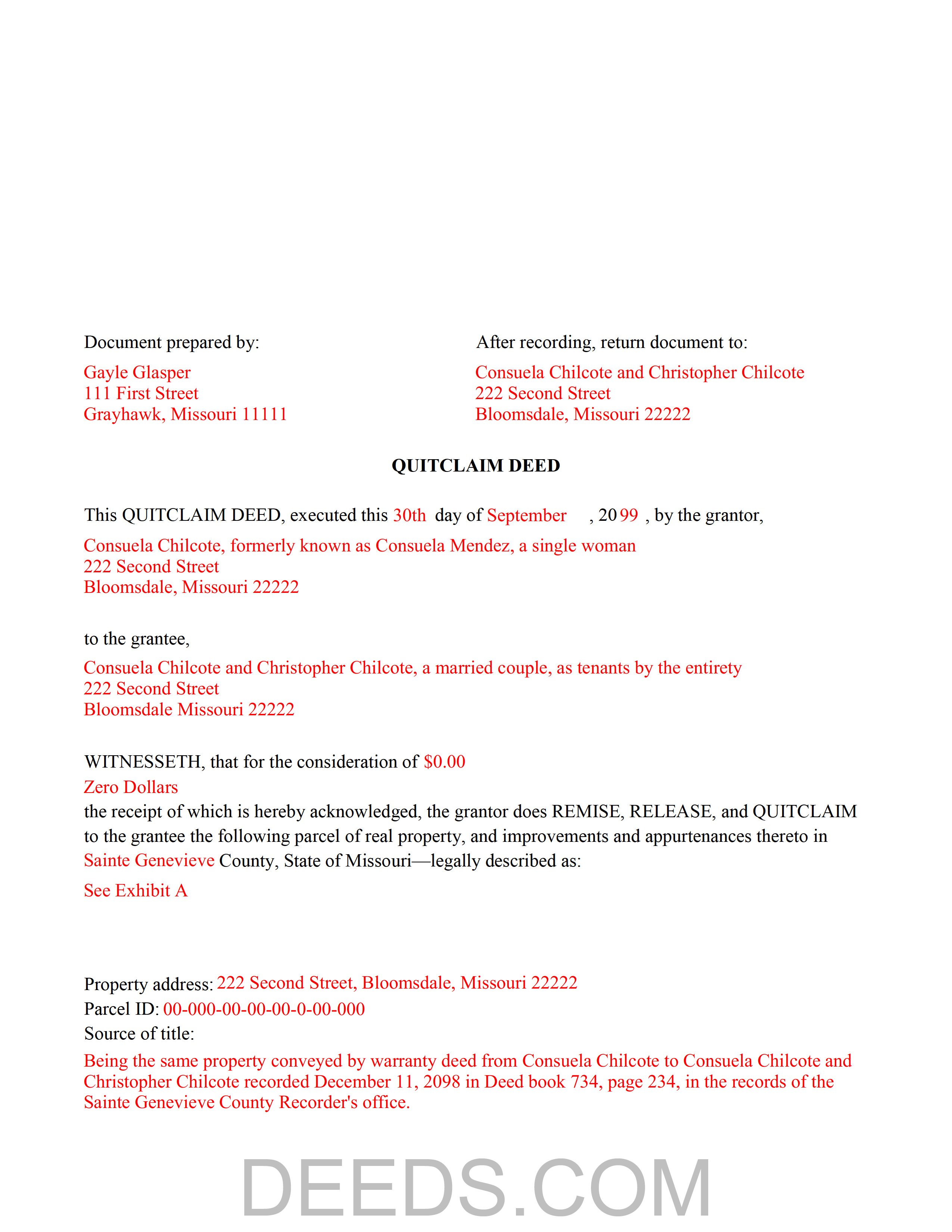

Miller County Completed Example of the Quitclaim Deed Document

Example of a properly completed Missouri Quitclaim Deed document for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Missouri and Miller County documents included at no extra charge:

Where to Record Your Documents

Miller County Recorder of Deeds

Tuscumbia, Missouri 65082

Hours: 8:00 to 4:30 Monday through Friday

Phone: (573) 369-1935

Recording Tips for Miller County:

- Make copies of your documents before recording - keep originals safe

- Check margin requirements - usually 1-2 inches at top

- Request a receipt showing your recording numbers

- Both spouses typically need to sign if property is jointly owned

- Bring extra funds - fees can vary by document type and page count

Cities and Jurisdictions in Miller County

Properties in any of these areas use Miller County forms:

- Brumley

- Eldon

- Iberia

- Kaiser

- Olean

- Saint Elizabeth

- Tuscumbia

- Ulman

Hours, fees, requirements, and more for Miller County

How do I get my forms?

Forms are available for immediate download after payment. The Miller County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Miller County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Miller County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Miller County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Miller County?

Recording fees in Miller County vary. Contact the recorder's office at (573) 369-1935 for current fees.

Questions answered? Let's get started!

Real property transfers are governed by Chapter 442 of the Missouri Revised Statutes. Quitclaim deeds, however, are not specifically defined in the statutes.

(Missouri QD Package includes form, guidelines, and completed example)

Quitclaim deeds are used to transfer the rights, title, and interest in real estate from the grantor (seller) to the grantee (buyer) without any warranty of title. When using a quitclaim deed, there may be potential unknown claims or restrictions on the title, and the buyer accepts the risk, effectively taking the title as-is.

These deeds are frequently used in instances such as a divorce, with one spouse signing all of his or her rights in a piece of real property over to the other spouse; when there is uncertainty about the history of the property's title; or when a current owner or buyer wishes another party with interest in the property to disclaim that interest.

A lawful quitclaim deed includes the names and addresses of each grantor and grantee, and a complete legal description of the property (59.310, RSMo). Include the preparer's name, address, and signature as well. Besides these requirements, the form must meet all state and local standards for recorded documents.

All recorded documents or documents affecting a change in property ownership must contain information on how the property will be vested. For Missouri residential property, the primary methods for holding title are tenancy in common, joint tenancy, and tenancy by the entirety. A grant of ownership of real estate to two or more unmarried persons is presumed to create a tenancy in common, unless otherwise stated in the conveyance. Real property conveyed to a married couple vests as tenancy by the entirety (442.450, RSMo).

Include all relevant documents, affidavits, forms, and fees along with the deed for recording. Jackson County, St. Louis County, the City of St. Louis, and St. Charles County each have their own Real Property Certificate of Value. File this form with the deed at the time of recording.

In Missouri, the grantor must sign the deed in the presence of a notary public before presenting it to the county recorder. In the City of St. Louis, both the grantor and grantee must sign the deed.

Recording the deed preserves a clear chain of ownership history and provides public notice. An unrecorded quitclaim deed in writing will be valid between the parties to it and those that have actual notice of it (442.400). Submit all deeds to the local county clerk's office of the county in which the property conveyed is located.

This article is provided for informational purposes only and is not a substitute for legal advice. Contact a lawyer with questions about quitclaim deeds or any other issues related to the transfer of real property in Missouri.

(Missouri QD Package includes form, guidelines, and completed example)

Important: Your property must be located in Miller County to use these forms. Documents should be recorded at the office below.

This Quitclaim Deed meets all recording requirements specific to Miller County.

Our Promise

The documents you receive here will meet, or exceed, the Miller County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Miller County Quitclaim Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Linda W.

January 16th, 2019

Got the forms, very straight forward. No problems completing them.

Thanks Linda!

Jason B.

August 8th, 2021

Deeds.com did a great job in explaining exactly what I'd need to file a deed transfer (quitclaim deed). I didn't have to order the forms piecemeal, but was able to order the whole package at once for a reasonable price. Once downloaded, their fill-in-the-blank PDF was easy to use with detailed instructions for each line item. I'd definitely use them again.

Thank you for your feedback. We really appreciate it. Have a great day!

LISA B.

December 5th, 2019

GOT WHAT I NEEDED FORMS WORKED FINE.

Thank you!

Leonard S.

March 2nd, 2023

OK service

Thank you!

Caroline E.

June 28th, 2024

Very easy!

Thank you for your feedback. We really appreciate it. Have a great day!

Robert P.

November 3rd, 2020

Overall, your website was straightforward and easy to navigate. I was able to accomplish what I needed to do very quickly. If needed again, I would certainly use and recommend others to use deeds.com.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Woody P.

August 28th, 2021

I was informed that a quit Claim Deed that I had submitted, did not meet county requirements. I ordered the correct form and was surprised that the form included instructions and a sample "completed" form for me to follow. I found it al very helpful. Thank you !!!

Thank you!

Gene N.

November 11th, 2021

My mind is blown! For some reason, our veteran title companies wouldn't record our deed but luckily, the assessor's page recommended Deeds and other sites to e-record. It was so simple and so convenient!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kelly M.

August 27th, 2021

Deeds.com made it so easy and convenient to get my homestead document recorded. Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

John M.

August 18th, 2022

I ordered my gift deed forms one evening, filled them out the next day, and registered them with the register of deeds the next morning. Boom. Done! Easy peasy, no lawyer expense!

Thank you!

Ma Luisa R.

July 2nd, 2020

Great service and fast

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Christina A G.

December 19th, 2020

It was easy to locate, purchase, and download the documents I needed on the Deeds.com website.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jimmy W.

February 15th, 2022

The forms where easy to get to and I hope that they will be as easy to fill out.

Thank you!

Thanh P.

July 18th, 2024

Awesome services. Quick and efficient.

Thank you for your kind words Thanh, we appreciate you.

Ray L.

February 8th, 2019

Thank you, I am very satisfied with the process and will provide a final review after the documents are completed and accepted by the state.

Thank you for your feedback. We really appreciate it. Have a great day!