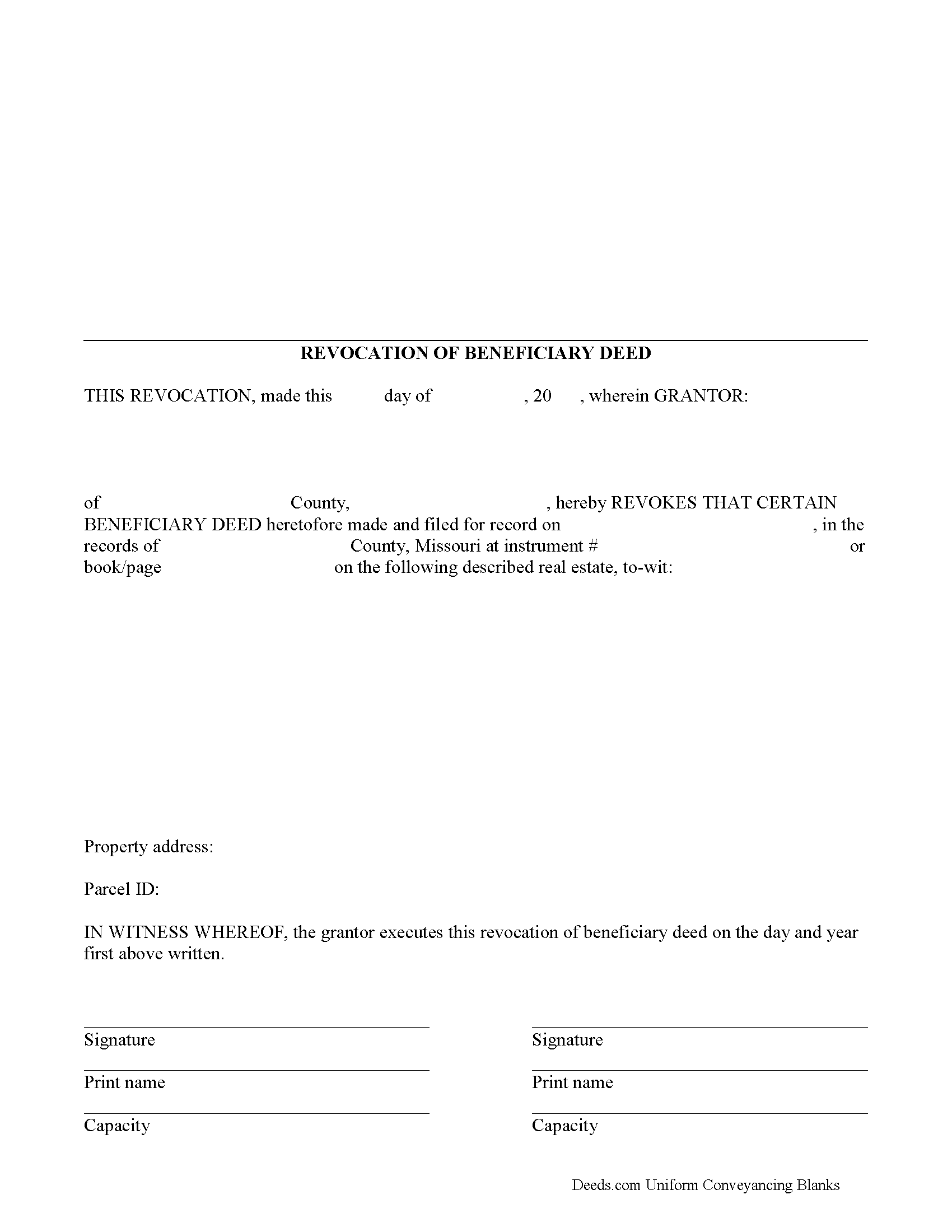

Miller County Revocation of Beneficiary Deed Form

Miller County Revocation of Beneficiary Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

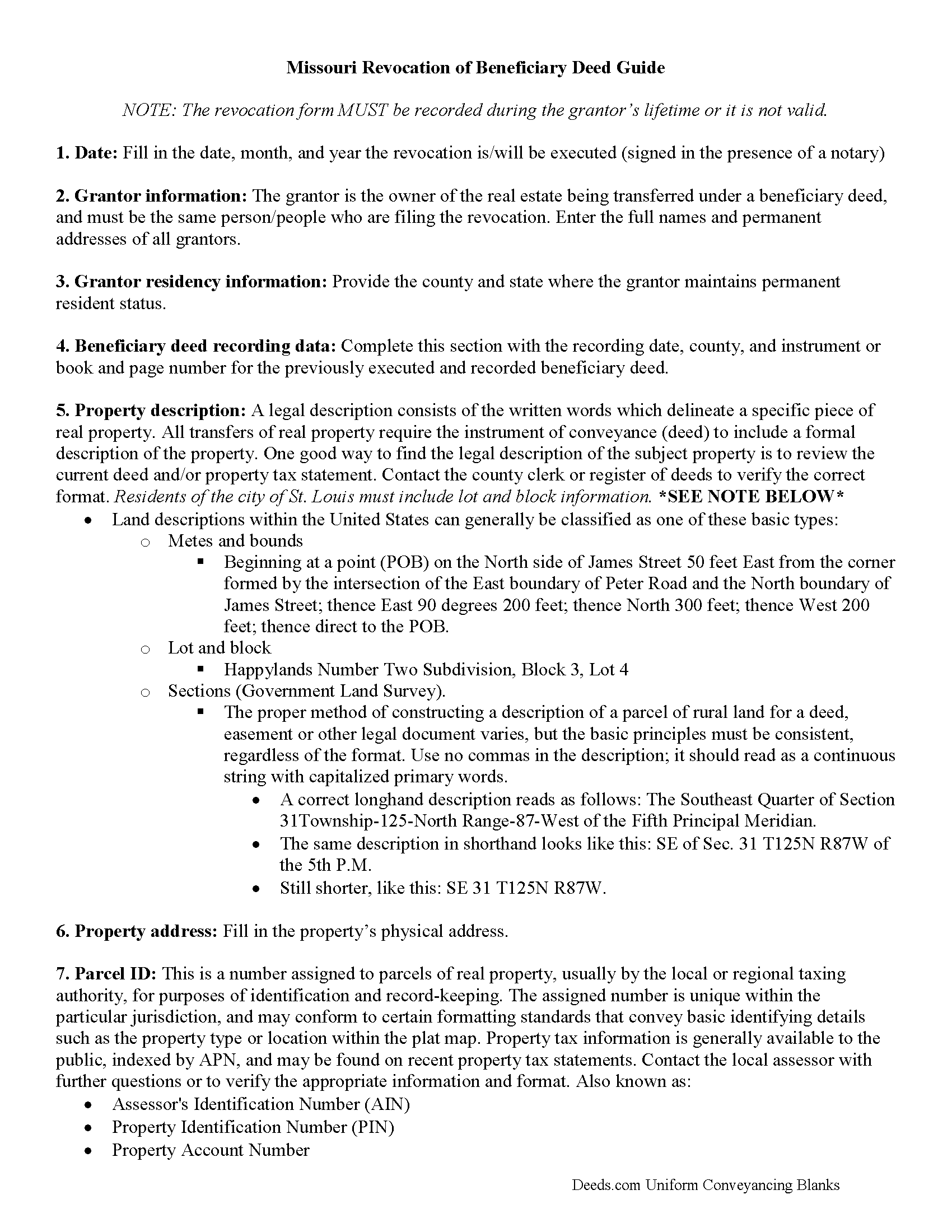

Miller County Revocation of Beneficiary Deed Guide

Line by line guide explaining every blank on the form.

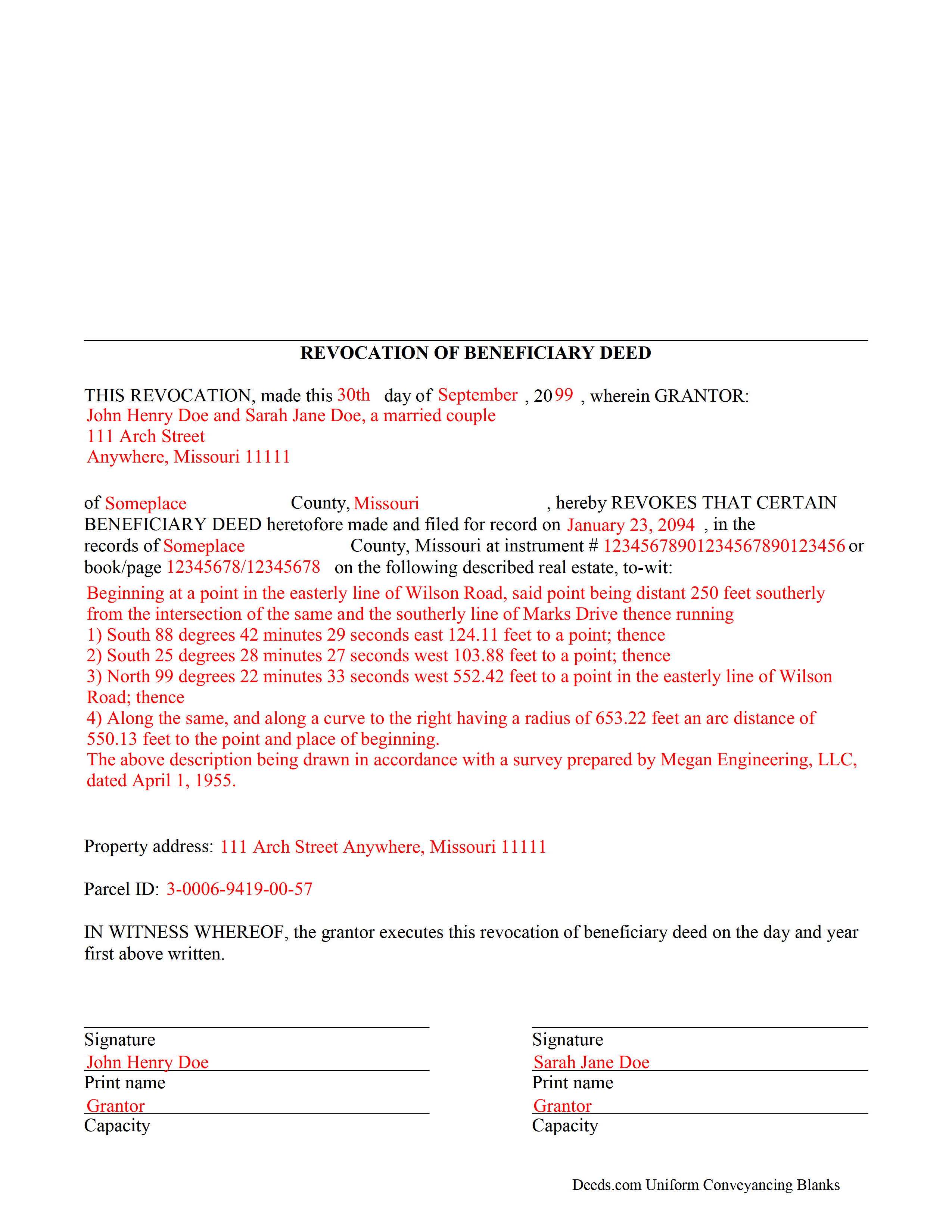

Miller County Completed Example of the Revocation of Beneficiary Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Missouri and Miller County documents included at no extra charge:

Where to Record Your Documents

Miller County Recorder of Deeds

Tuscumbia, Missouri 65082

Hours: 8:00 to 4:30 Monday through Friday

Phone: (573) 369-1935

Recording Tips for Miller County:

- Ask if they accept credit cards - many offices are cash/check only

- Check that your notary's commission hasn't expired

- White-out or correction fluid may cause rejection

- Avoid the last business day of the month when possible

- Recorded documents become public record - avoid including SSNs

Cities and Jurisdictions in Miller County

Properties in any of these areas use Miller County forms:

- Brumley

- Eldon

- Iberia

- Kaiser

- Olean

- Saint Elizabeth

- Tuscumbia

- Ulman

Hours, fees, requirements, and more for Miller County

How do I get my forms?

Forms are available for immediate download after payment. The Miller County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Miller County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Miller County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Miller County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Miller County?

Recording fees in Miller County vary. Contact the recorder's office at (573) 369-1935 for current fees.

Questions answered? Let's get started!

One of the many useful aspects of the Nonprobate Transfers Law of Missouri (RSMo Sections 461.003 to 461.081) is the option to revoke a previously recorded beneficiary deed. Revocation is specifically addressed in RSMo 431.033. The option to revoke is possible for several reasons: the grantor is not required to notify the beneficiary of the potential future interest; there is no consideration given in exchange for property rights; and the transfer of ownership is not completed until the grantor or grantors have all died. As a result, the named beneficiary has no actual interest in the real estate.

A grantor on a beneficiary deed may change or revoke beneficiary designations at will, and with no obligation to the individuals named as beneficiaries on the deed. To accomplish this, the original grantor (or grantors) may record a signed, notarized notice of revocation with the same office that accepted the original beneficiary deed. While effective, real estate that is not re-conveyed under a new beneficiary deed reverts back to the grantor's estate at his/her death, and is then distributed via the probate process. Alternately, the grantor may execute a new beneficiary deed, designating someone else as the beneficiary. Recording the new deed removes the prior beneficiary's name and replaces it, identifying the current beneficiary's information.

Note that any change in beneficiary designation must be executed and submitted for recordation during the grantor's lifetime.

(Missouri Revocation of BD Package includes form, guidelines, and completed example)

Important: Your property must be located in Miller County to use these forms. Documents should be recorded at the office below.

This Revocation of Beneficiary Deed meets all recording requirements specific to Miller County.

Our Promise

The documents you receive here will meet, or exceed, the Miller County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Miller County Revocation of Beneficiary Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4580 Reviews )

Steve W.

September 9th, 2020

Perfect

Thank you!

Thomas W.

July 14th, 2020

Very quick and responsive. Faster than finding out by mail if you've done something incorrectly. Very satisfied with offerings and service.

Thank you for your feedback. We really appreciate it. Have a great day!

Barbara J.

February 27th, 2020

I haven't actually used any forms yet, but I am very pleased with the simplicity of the website. I love the nmber and variety of forms offered. Thank you for such a great website,

Thank you!

Debra M.

May 29th, 2020

Since the recorder's office is closed, due to Covid, this worked well to submit my Quit Claim Deed. I was a bit confused with the direction and download. But, I think I got her done! We'll see if I get recorded and confirmation is received. I may be back

Thank you for your feedback. We really appreciate it. Have a great day!

Aldona P.

April 9th, 2020

Awesome Job! thank you

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

George R.

September 29th, 2021

Your website worked but I am waiting for answers for two questions.

Thank you for your feedback. We really appreciate it. Have a great day!

Irwin C.

August 25th, 2023

For starters, enrolling was as easy as could be. Then, it only took minutes before my entry was formatted and filed. Finally, when I asked a question, I got an answer within a few minutes. Couldn't be happier with service

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kevin & Kim S.

August 20th, 2020

So very easy to use and we're so glad we could do everything from our home office.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Thomas B.

May 29th, 2020

My deeds were filed with Pinellas County Florida with a simple process and with no problems. 5 star for sure.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

William G.

January 11th, 2021

I am very pleased with Deeds.com. They responded back very quickly, checked my forms, gave an example for a correction, and submitted the forms over the weekend. What more could you ask?

Thank you!

Nicole D.

January 12th, 2021

Very pleased with Deed.com. Quick response with instructions. Great service and will use again.

Thank you for your feedback. We really appreciate it. Have a great day!

Lynnellen S.

May 9th, 2019

My rating is not a 5. Although it had good instructions, it would NOT print the whole document no matter how many times I inputted the names. I ended up writing it in to complete. I also recommend putting it on one page. I had to pay an additional fees per page and if I had to notarize it, why did I have to find 2 witnesses as well. I deserve a discount for the time I spent repeatedly putting the same data. I was trying to save money since Im on social security only. It didnt. Get it to work correctly

Thank you for your feedback Lynnellen. Sorry to hear of your struggle with our document. We've gone ahead and refunded your payment. Hope you have a wonderful day.

Helen H.

August 31st, 2022

I had a notary to read over my quitclaim deed and she said it looked good. So I am pleased.

Thank you!

Roy T.

April 3rd, 2020

Thank you for an easy to use system. I was able to find all the information I needed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Marjorie K.

August 13th, 2021

This was super easy to use, especially if you remember to look for a downloaded PDF file, not a Word file. Found the files right away after the light bulb went on! Thank you!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!