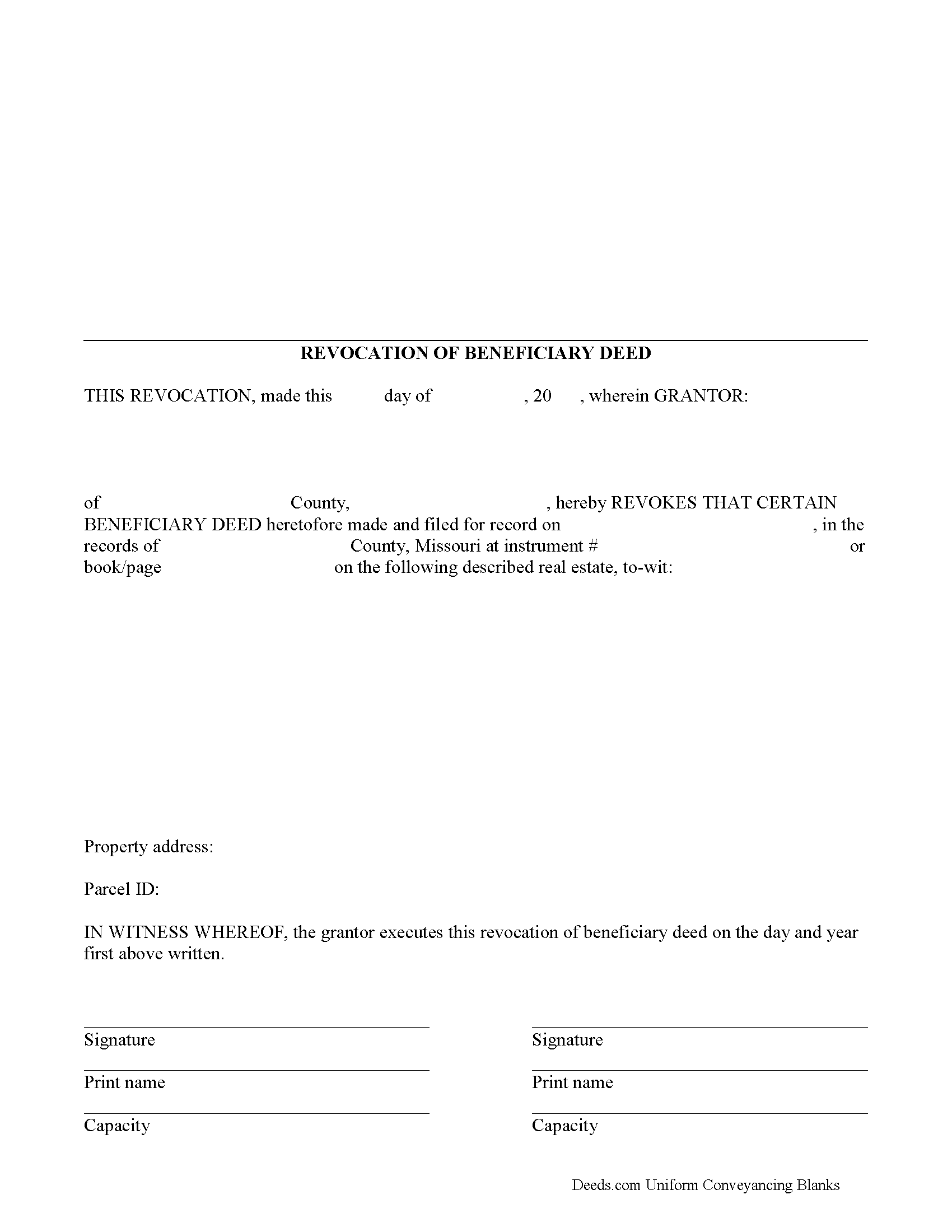

Scotland County Revocation of Beneficiary Deed Form

Scotland County Revocation of Beneficiary Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

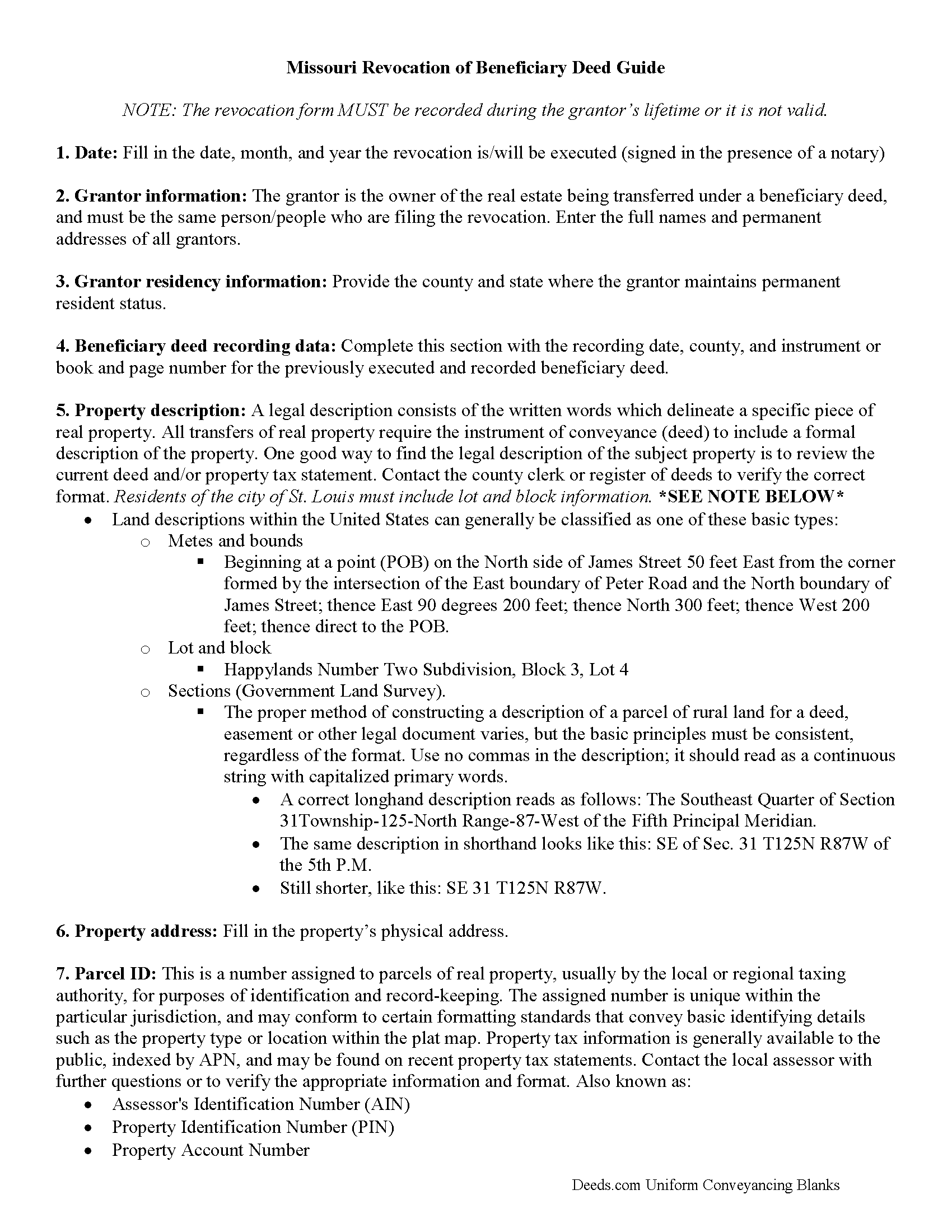

Scotland County Revocation of Beneficiary Deed Guide

Line by line guide explaining every blank on the form.

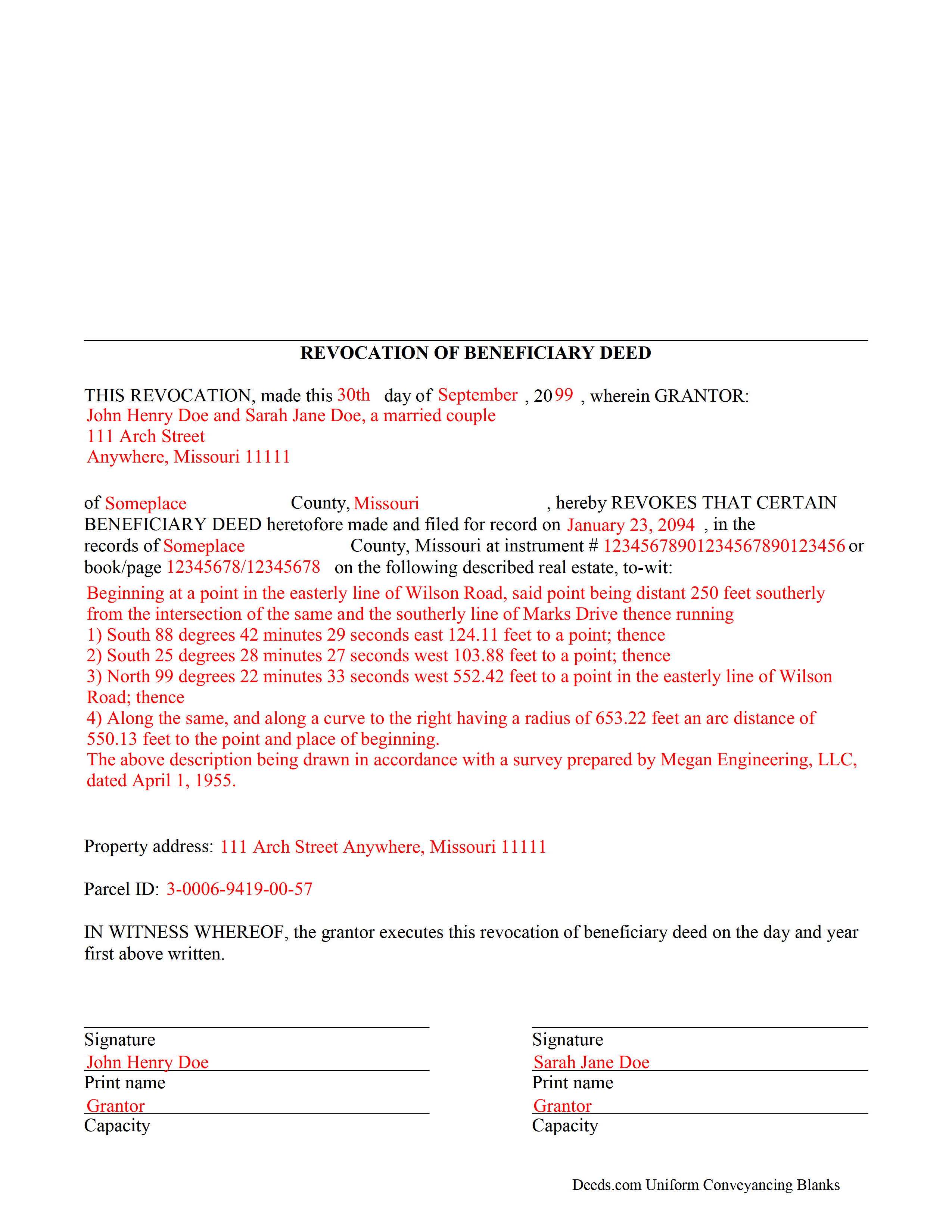

Scotland County Completed Example of the Revocation of Beneficiary Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Missouri and Scotland County documents included at no extra charge:

Where to Record Your Documents

Scotland County Recorder of Deeds

Memphis, Missouri 63555

Hours: Call for hours

Phone: (660) 465-2284

Recording Tips for Scotland County:

- Double-check legal descriptions match your existing deed

- Bring extra funds - fees can vary by document type and page count

- Request a receipt showing your recording numbers

- Leave recording info boxes blank - the office fills these

- Multi-page documents may require additional fees per page

Cities and Jurisdictions in Scotland County

Properties in any of these areas use Scotland County forms:

- Arbela

- Gorin

- Granger

- Memphis

- Rutledge

Hours, fees, requirements, and more for Scotland County

How do I get my forms?

Forms are available for immediate download after payment. The Scotland County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Scotland County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Scotland County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Scotland County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Scotland County?

Recording fees in Scotland County vary. Contact the recorder's office at (660) 465-2284 for current fees.

Questions answered? Let's get started!

One of the many useful aspects of the Nonprobate Transfers Law of Missouri (RSMo Sections 461.003 to 461.081) is the option to revoke a previously recorded beneficiary deed. Revocation is specifically addressed in RSMo 431.033. The option to revoke is possible for several reasons: the grantor is not required to notify the beneficiary of the potential future interest; there is no consideration given in exchange for property rights; and the transfer of ownership is not completed until the grantor or grantors have all died. As a result, the named beneficiary has no actual interest in the real estate.

A grantor on a beneficiary deed may change or revoke beneficiary designations at will, and with no obligation to the individuals named as beneficiaries on the deed. To accomplish this, the original grantor (or grantors) may record a signed, notarized notice of revocation with the same office that accepted the original beneficiary deed. While effective, real estate that is not re-conveyed under a new beneficiary deed reverts back to the grantor's estate at his/her death, and is then distributed via the probate process. Alternately, the grantor may execute a new beneficiary deed, designating someone else as the beneficiary. Recording the new deed removes the prior beneficiary's name and replaces it, identifying the current beneficiary's information.

Note that any change in beneficiary designation must be executed and submitted for recordation during the grantor's lifetime.

(Missouri Revocation of BD Package includes form, guidelines, and completed example)

Important: Your property must be located in Scotland County to use these forms. Documents should be recorded at the office below.

This Revocation of Beneficiary Deed meets all recording requirements specific to Scotland County.

Our Promise

The documents you receive here will meet, or exceed, the Scotland County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Scotland County Revocation of Beneficiary Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4577 Reviews )

Richard A.

February 17th, 2023

Deeds.com was easy to use and provided everything needed to do a quitclaim deed!

Thank you!

Tony W.

May 27th, 2022

I have not completed the forms yet but they appear to be exactly what I need for the purpose they are intended. Thanks

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Clarence O.

July 17th, 2020

Very easy process to record a Quit Claim Deed. Would definitely recommend!

Thank you!

Debra K.

January 16th, 2019

Very happy with forms downloaded. Well worth the price. Could not find them anywhere else on the web. Also had easy to understand instructions and a demo form as a guide

Thank you Debra, we appreciate your feedback. Have a wonderful day!

Armando R.

December 13th, 2022

Great service and support!

Thank you!

Christine L.

May 13th, 2025

User friendly!

Thank you!

Kevin M.

December 3rd, 2021

My first time using Deeds.com and I am impressed how much you offer and how easy it is to use this site. Had the real-estate forms I needed plus a bonus of how to fill them out. Best value on the internet for real-estate forms and information.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Nancy B.

August 23rd, 2020

Deeds.com is a godsend! Being able to download the pertinent state and county specific forms reassured me of having the correct t forms in which to proceed. The cost was most reasonable. Thanks for this service.

Thank you!

Karen B.

August 1st, 2025

Great forms! No issues at all at the recorder office. Will be back for sure if needed.

Wonderful to hear Karen. Thanks for taking the time to share your experience. Have a great day!

Cecelia C.

December 16th, 2021

Service was fantastic. So helpful and they promptly get back with you. No reason to drive if you are out of state and need to get a deed filed. Safe way to file if you don't want to go to public office or can't physically get there.

Thank you for your feedback. We really appreciate it. Have a great day!

Steven T.

August 1st, 2022

I needed the deed forms for setting up our living trust. It appears this will do the trick! Steve

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Pierre M.

October 13th, 2020

The form was very easy to fill out. The instructions were clear. Overall, a very user friendly product that made my job easier. Thanks you.

Thank you!

Donna D.

March 20th, 2020

Easy to use. Good information. Would use again.

Thank you!

Tim T.

November 6th, 2023

Straightforward and handy. Spacing of the spaces I filled out was not pretty, but it all worked.

We are motivated by your feedback to continue delivering excellence. Thank you!

Angela J M.

September 29th, 2023

Quick turnaround (about 24hrs) easy process.

Thank you for your feedback. We really appreciate it. Have a great day!