Liberty County Beneficiary Deed Revocation Form

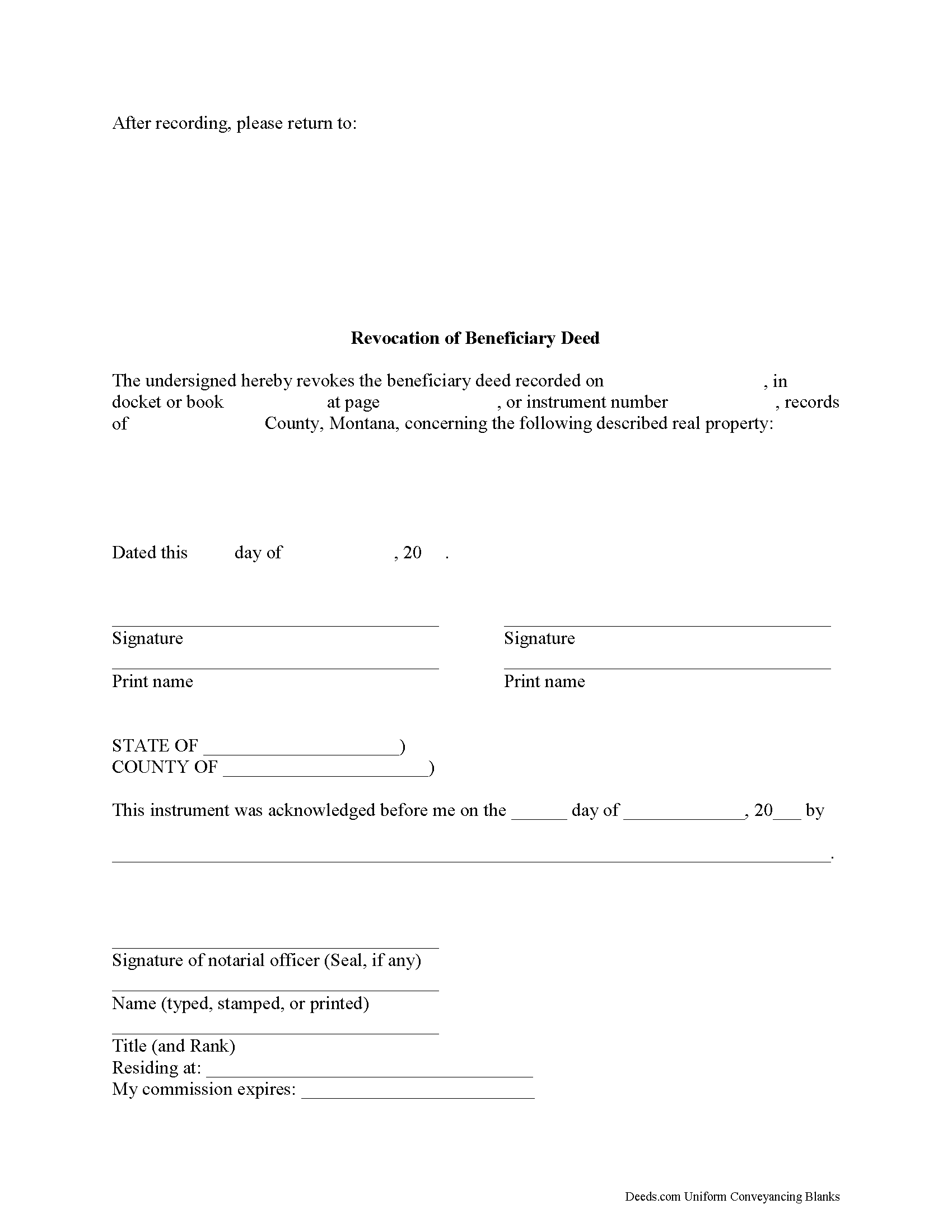

Liberty County Revocation of Beneficiary Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

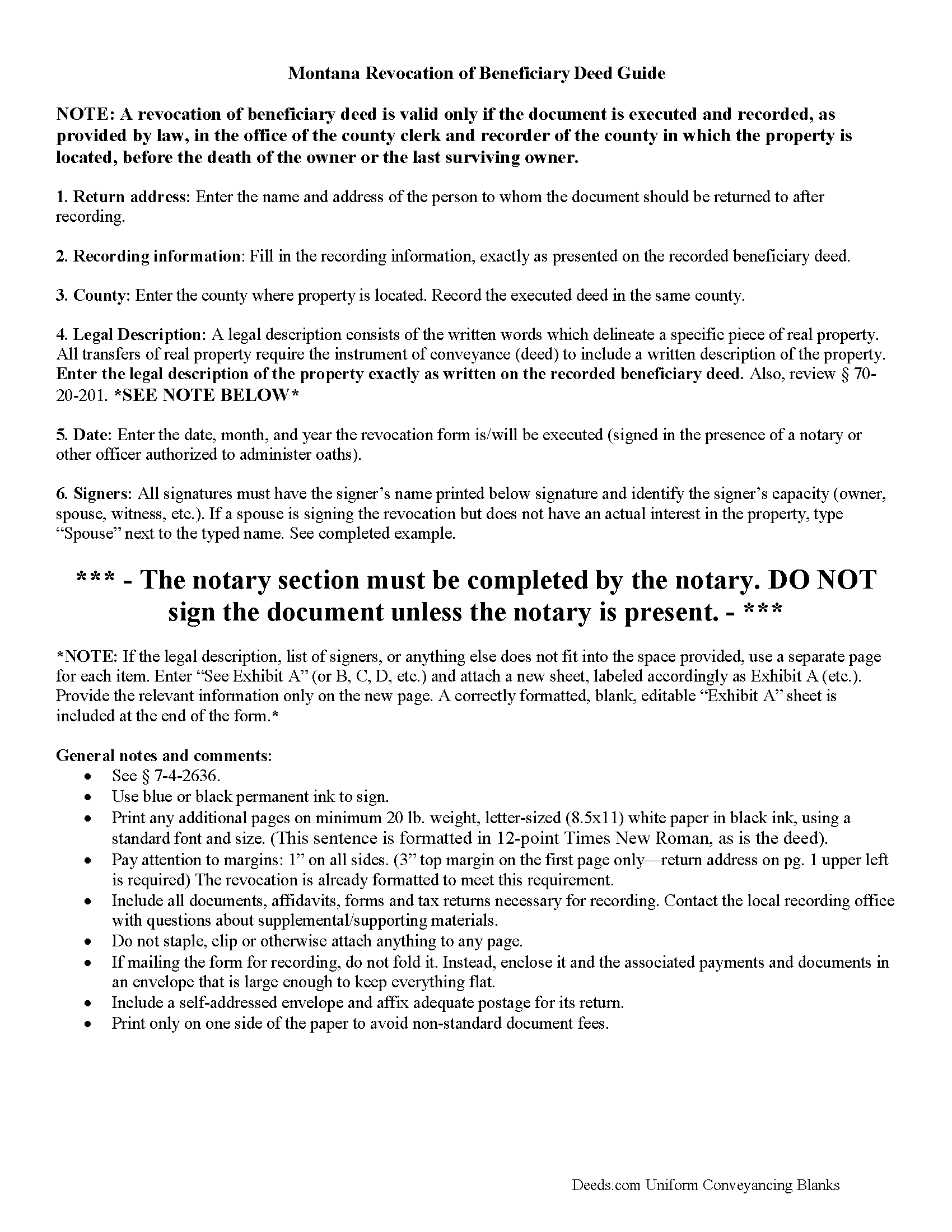

Liberty County Beneficiary Deed Revocation Guide

Line by line guide explaining every blank on the form.

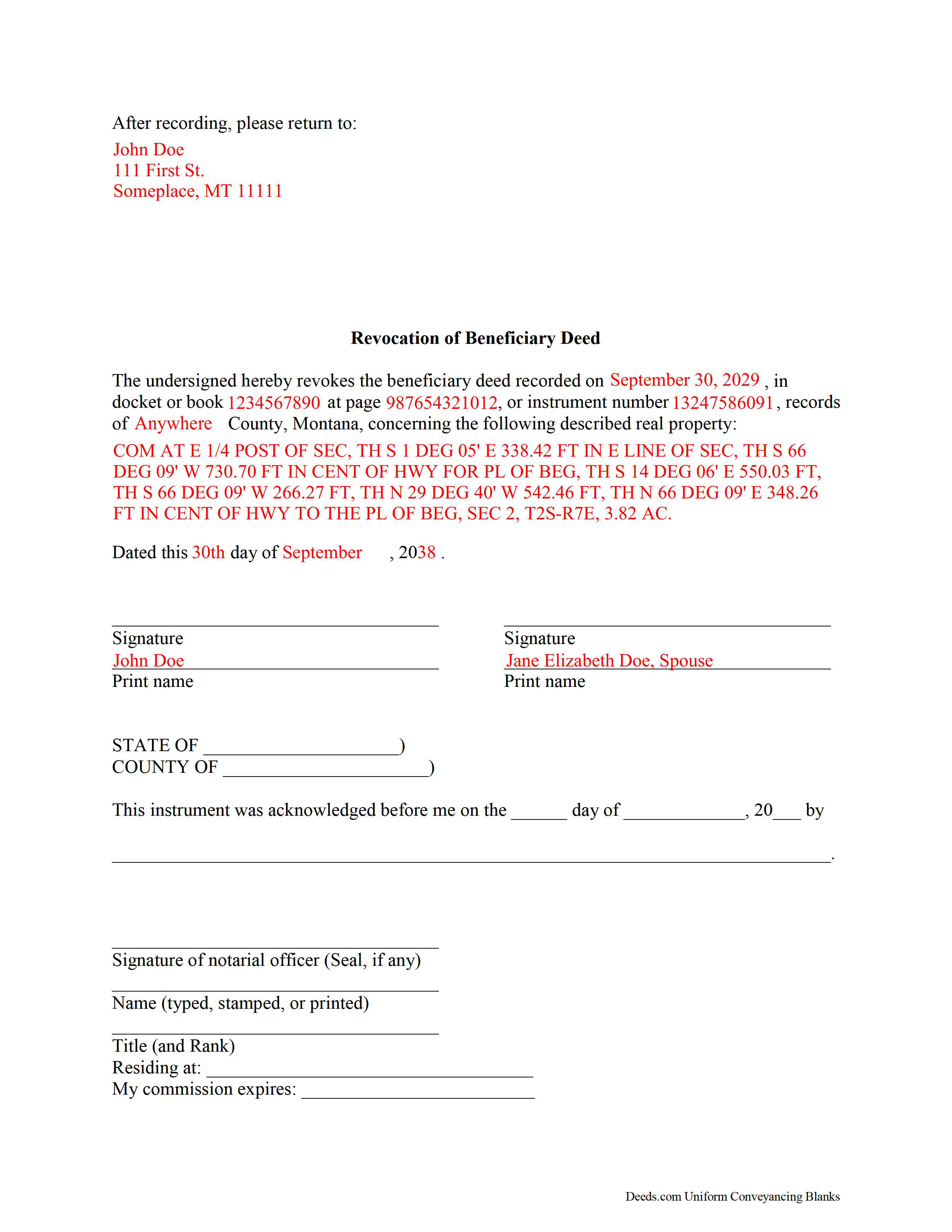

Liberty County Completed Example of the Revocation of Beneficiary Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Montana and Liberty County documents included at no extra charge:

Where to Record Your Documents

Liberty County Clerk / Recorder

Chester, Montana 59522

Hours: 8:00 to 5:00 M-F

Phone: (406) 759-5365

Recording Tips for Liberty County:

- Double-check legal descriptions match your existing deed

- White-out or correction fluid may cause rejection

- Check margin requirements - usually 1-2 inches at top

- Make copies of your documents before recording - keep originals safe

Cities and Jurisdictions in Liberty County

Properties in any of these areas use Liberty County forms:

- Chester

- Joplin

- Lothair

- Whitlash

Hours, fees, requirements, and more for Liberty County

How do I get my forms?

Forms are available for immediate download after payment. The Liberty County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Liberty County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Liberty County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Liberty County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Liberty County?

Recording fees in Liberty County vary. Contact the recorder's office at (406) 759-5365 for current fees.

Questions answered? Let's get started!

Revoking a Montana Beneficiary Deed

A revocation of a recorded beneficiary deed must be lawfully executed and recorded during the owner's life or it has no effect.

In 2007, the Montana Legislature enacted the state's beneficiary deed law, found at Montana Code Annotated Section 72-6-121. All following parenthetical references identify the part of that section which contains additional information.

Beneficiary deeds are nontestamentary documents that convey a potential future interest in real property, but they only become effective when the owner dies (11). Until that point, the owner retains absolute title to, control over, and use of the property, including the freedom to modify or revoke the beneficiary designation, or to sell the property to someone else. This flexibility is what makes beneficiary deeds so useful; it allows the owners to respond quickly if circumstances change. Note that if the real property is owned as joint tenants with right of survivorship and if the revocation is not executed by all the owners, the revocation is not effective unless executed by the last surviving owner (6).

If an owner executes and records more than one beneficiary deed concerning the same real property, the document recorded closest to the owner's death is the effective beneficiary deed (8). Even though the recording date directs the transfer, it makes sense to execute and record a revocation because it adds an endpoint to the original deed and helps to preserve a clear chain of title (ownership history). This is important because any perceived irregularities can add unnecessary complexity to future sales of the property.

Revoking a beneficiary deed is a simple process, but it may not be appropriate in all cases. Contact an attorney with specific questions or for complex situations.

(Montana BD Revocation Package includes form, guidelines, and completed example)

Important: Your property must be located in Liberty County to use these forms. Documents should be recorded at the office below.

This Beneficiary Deed Revocation meets all recording requirements specific to Liberty County.

Our Promise

The documents you receive here will meet, or exceed, the Liberty County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Liberty County Beneficiary Deed Revocation form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4574 Reviews )

Rosa Irene G.

December 4th, 2020

nd your site/forms. The cost is also great. Thank you so much for making this affordable to everyone.

Thank you for your feedback. We really appreciate it. Have a great day!

jennifer e.

September 1st, 2020

EXCELLENT, PROMPT SERVICE. I will definitely use again .HIGHLY RECOMMEND.

Thank you for your feedback. We really appreciate it. Have a great day!

Michelle M.

July 3rd, 2020

The website was easy to navigate and great communication on every step of the process.

Thank you for your feedback. We really appreciate it. Have a great day!

Iva R.

August 20th, 2020

Great service. Fast, got everything done (form, recording) done in a couple of hours, lightning speed in the real estate world. Thanks!

Thank you for your feedback. We really appreciate it. Have a great day!

Carol W.

March 14th, 2021

The only reason for the low review was I could not find the form that I needed.

Sorry to hear that we did not have what you needed. We hope you found it somewhere. Have a wonderful day.

Guy G.

March 22nd, 2023

Deeds.com was easy to use and their easement deed was exactly what I was looking for. I knew I didn't need to spend hundreds of dollars talking to an attorney.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Donna G.

April 26th, 2023

Very happy with this service, comprehensive detailed instructions as well as correct forms for my location

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Marcus W.

July 14th, 2022

I was very pleased and satisfied with the ease of use, expeditious turnaround and costs involved to eRecord my documentation to the Probate Court. I live in another city and state and your service allowed me to get what I needed done. in a matter of a few hours from the time I submitted my package for filing, within an hour. I received noted and stamped confirmation from the county clerks office the document was now on file with them. I highly recommend Deeds.com and will be utilizing your online services for any future legal documentation.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Richard W.

May 25th, 2023

Very happy I tried your service/product. The quit deed forms were excepted by the register of deeds with no issue. Thank You

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kathy P.

November 25th, 2019

I like that the quit claim form was fill in the blank on my computer instead of online, made it so much easier than having to do everything at once, at the mercy of the internet connection. Will refer others here.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Sherri S.

March 30th, 2021

Easy to access forms, and reasonably priced. I'll definitely use again in the future.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Brad T.

November 9th, 2019

I didn't spend a lot of time there but seems to be a good site with a valuable service.

Thank you!

Vernon A L.

March 23rd, 2022

They are forms....no magic there. I still have to round up the details.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Susan J.

June 6th, 2023

I was pleased that I could send the documents this way rather than having to mail it or take time out of my day to go down to the records office.

Thank you for taking the time to leave your feedback Susan, we really appreciate you. Have an amazing day.

NORA F.

May 19th, 2020

The guide was so helpful, really made filing out the form easy. Thanks!

Thank you for your feedback. We really appreciate it. Have a great day!