Lincoln County Beneficiary Deed Form

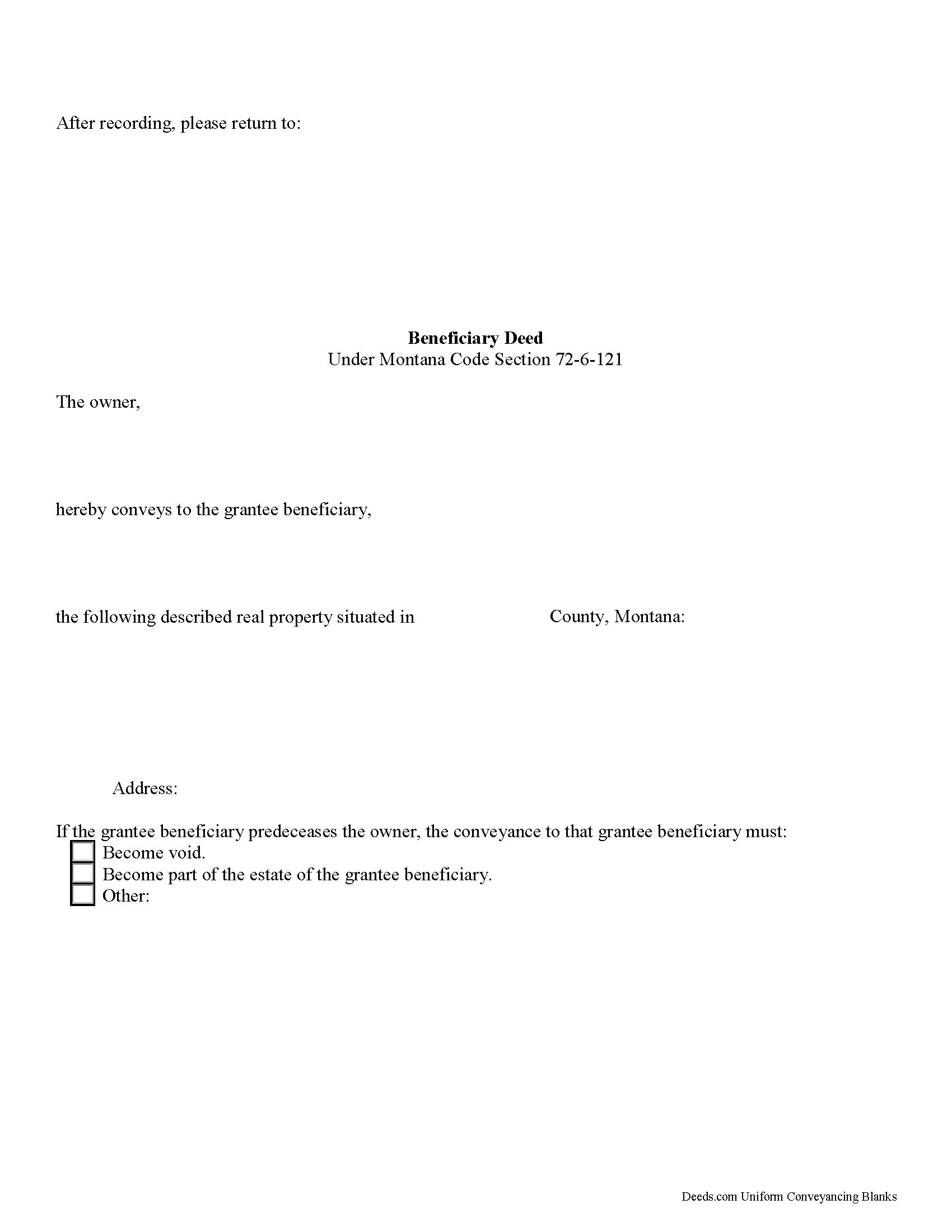

Lincoln County Beneficiary Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

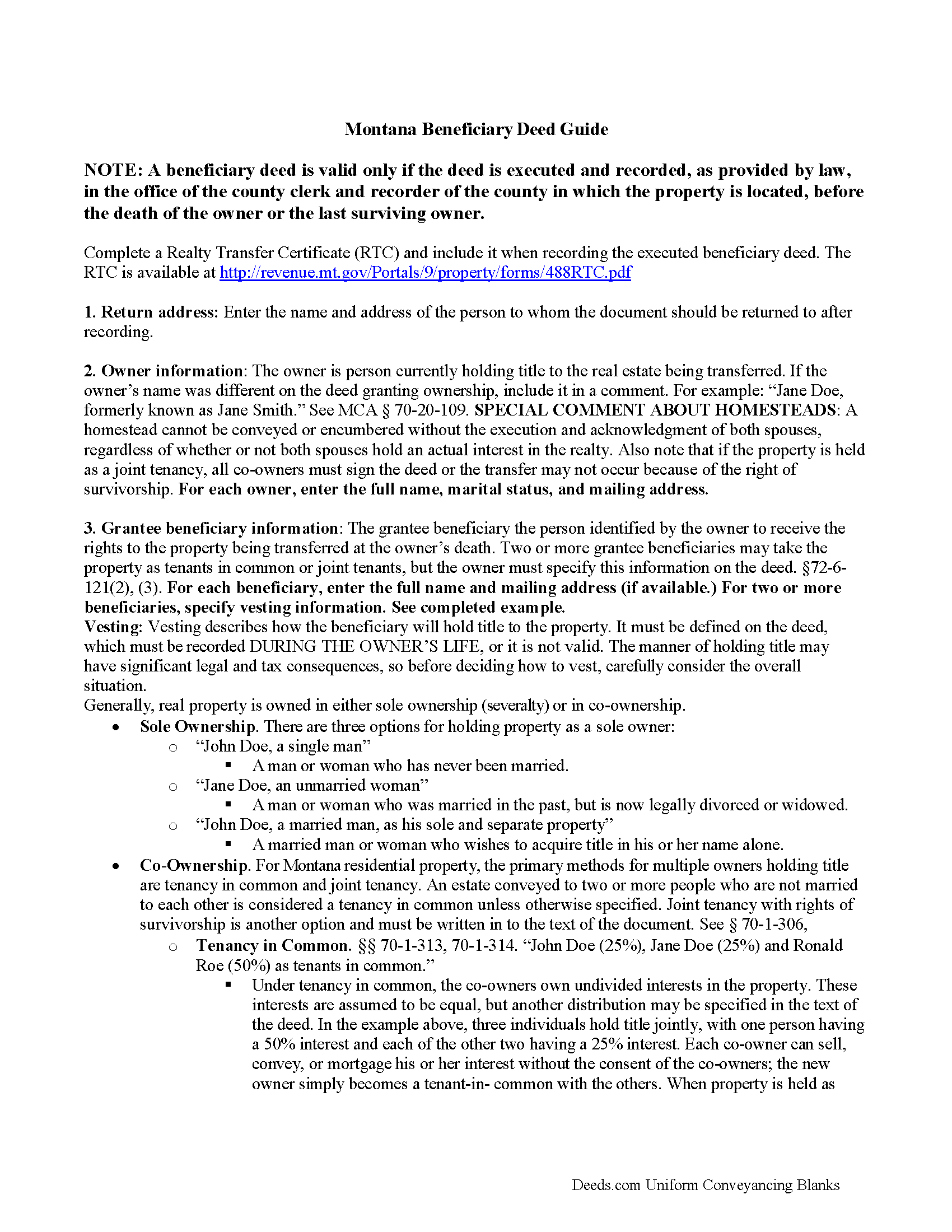

Lincoln County Beneficiary Deed Guide

Line by line guide explaining every blank on the form.

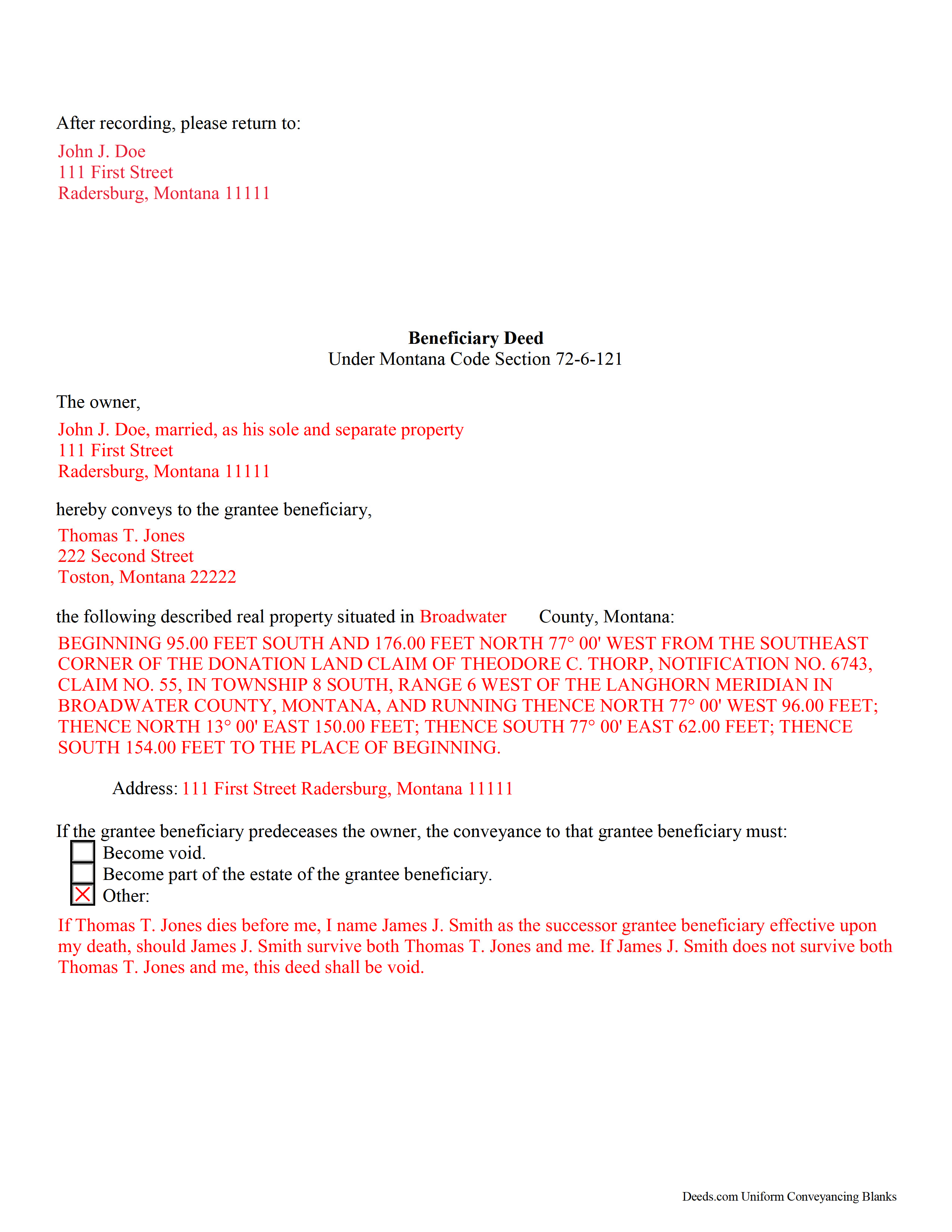

Lincoln County Completed Example of the Beneficiary Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Montana and Lincoln County documents included at no extra charge:

Where to Record Your Documents

Lincoln County Clerk / Recorder

Libby, Montana 59923

Hours: 8:00am-5:00pm M-F

Phone: (406) 283-2301

Recording Tips for Lincoln County:

- Bring your driver's license or state-issued photo ID

- Verify all names are spelled correctly before recording

- White-out or correction fluid may cause rejection

- Recorded documents become public record - avoid including SSNs

- Make copies of your documents before recording - keep originals safe

Cities and Jurisdictions in Lincoln County

Properties in any of these areas use Lincoln County forms:

- Eureka

- Fortine

- Libby

- Rexford

- Stryker

- Trego

- Troy

Hours, fees, requirements, and more for Lincoln County

How do I get my forms?

Forms are available for immediate download after payment. The Lincoln County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Lincoln County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Lincoln County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Lincoln County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Lincoln County?

Recording fees in Lincoln County vary. Contact the recorder's office at (406) 283-2301 for current fees.

Questions answered? Let's get started!

A beneficiary deed must be lawfully executed and recorded during the owner's life or it has no effect.

The Montana Legislature enacted the state's beneficiary deed law, found at Montana Code Annotated Section 72-6-121. All following parenthetical references identify the part of that section which contains additional information.

Beneficiary deeds are nontestamentary documents (11) that convey a potential future interest in real property, but they only become effective when the owner dies. Until that point, the owner retains absolute title to, control over, and use of the property, including the freedom to change or revoke the beneficiary designation, or to sell the property to someone else (6). If an owner executes and records more than one beneficiary deed concerning the same real property, the document recorded closest to the owner's death is the effective beneficiary deed (8).

Note that if the real estate is held as joint tenancy with the right of survivorship, all co-owners should sign the deed or the future transfer might be voided. Review the statute carefully and contact an attorney with questions before executing a beneficiary deed for jointly-held property (4).

Grantee beneficiaries are the declared recipients of the real estate, but they have no rights to or interest in it until the owner's death. They gain title according to the owner's instructions as stated on the recorded deed. By accepting the transfer, beneficiaries become bound to fulfill any obligations, including mortgages or financial agreements associated with the land during the owner's life (1). These obligations may also include a claim against the property by the state for Medicaid benefit reimbursement (7). The signature, consent, or agreement of, or notice to, a grantee beneficiary of a beneficiary deed is not required for any purpose during the lifetime of the owner (10).

Two or more grantee beneficiaries may hold title as tenants in common, joint tenants, or any other form of ownership allowed by Montana laws (2). Owners may also specify one or more successor beneficiaries in case the primary ones are unable or unwilling to accept the transfer after the owner's death (3).

Beneficiary deeds are convenient, flexible tools to include in an overall estate plan, but they may not be appropriate for everyone. Contact an attorney with specific questions or for complex situations.

(Montana BD Package includes form, guidelines, and completed example)

Important: Your property must be located in Lincoln County to use these forms. Documents should be recorded at the office below.

This Beneficiary Deed meets all recording requirements specific to Lincoln County.

Our Promise

The documents you receive here will meet, or exceed, the Lincoln County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Lincoln County Beneficiary Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4578 Reviews )

Thomas D.

July 10th, 2019

The site is fine with one exception. About half the pdf files I downloaded were corrupted. I could not open them or view their contents. Fortunately, the link continued to work, so after I discovered this, I downloaded the corrupted files again, and they now seem fine. I do not know if my computer or the website caused this odd problem.

Thank you for your feedback. We really appreciate it. Have a great day!

Peggy J.

July 26th, 2021

I have been researching for months to figure out how to remove deceased owner of property with right of survivorship in Florida. The County Clerk was not helpful. They refer you to get legal advice which is expensive. So hopefully by completing these forms I can actually complete the task. And would be helpful to be reassured that this is all I need to complete overdue task. I was hesitant to pay, but I believe this is legit. If so- a great Thank you.

Thank you for your feedback. We really appreciate it. Have a great day!

Matilde A.

October 25th, 2021

Very easy to navigate... will be back to use!

Thank you for your feedback. We really appreciate it. Have a great day!

Betty Z.

June 21st, 2023

Thank you so much for giving us a service so important to many. I will pass on this pertinent process to all who need it. again, thank you. bz

Thanks so much Betty. We appreciate you. Have a spectacular day!

Cecelia S.

July 31st, 2021

I was looking for a copy of my deed and was able to complete the request and get copy fast.

Thank you!

Heidi S.

August 5th, 2021

I had prompt service thank you

Thank you!

Willie P.

June 15th, 2022

got the forms needed plus all the information needed to fill them out.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Michael W.

October 21st, 2022

Easy to use and fast

Thank you!

Tullea S.

October 15th, 2024

Although I didn't get what I needed, the customer service is outstanding. I got a text asking if I needed any help. He canceled my subscription right away and was very helpful. He responded quickly each time.

We are delighted to have been of service. Thank you for the positive review!

Joyce D.

January 27th, 2019

Good after I figured out the form process. Hopefully I won't be charged for two as I redid the request thinking I might have made a mistake in the first request.

Thank you for your feedback Joyce. We have reviewed your account and there have been no duplicate orders submitted. Have a great day!

Ted D.

August 17th, 2020

Very good/user friendly

Thank you!

Joy N.

February 22nd, 2024

As a real estate professional, I've had the opportunity to use various legal form providers over the years, but none have matched the quality and user-friendliness of Deeds.com's real estate legal forms. The forms themselves are comprehensive, up-to-date, and in line with current real estate laws and regulations, which is paramount in our field. The clarity and thoroughness of the documentation ensured that I could complete with confidence, knowing that every detail was covered. I wholeheartedly recommend their services and look forward to continuing our partnership.

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Patrick K.

September 1st, 2020

Fast and easy to use. Great update communications

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Barbara S.

February 28th, 2019

I had an issue due to the fact that I had many beneficiaries. I was and still am not sure how to handle this. We do have Adobe Pro and can modify the form, if needed. But I would like to talk to your organization for more information.

While we are unable to assist you specifically with completing the document we can note that this is addressed in the guide. Information that does not fit in the available space should be included in an exhibit page.

Laura H.

January 12th, 2023

Process was easy. The instructions for TOD and a sample completed form was very helpful. E-recording of deed saved a trip to the county building and well worth the very reasonable charge.

Thank you for your feedback. We really appreciate it. Have a great day!