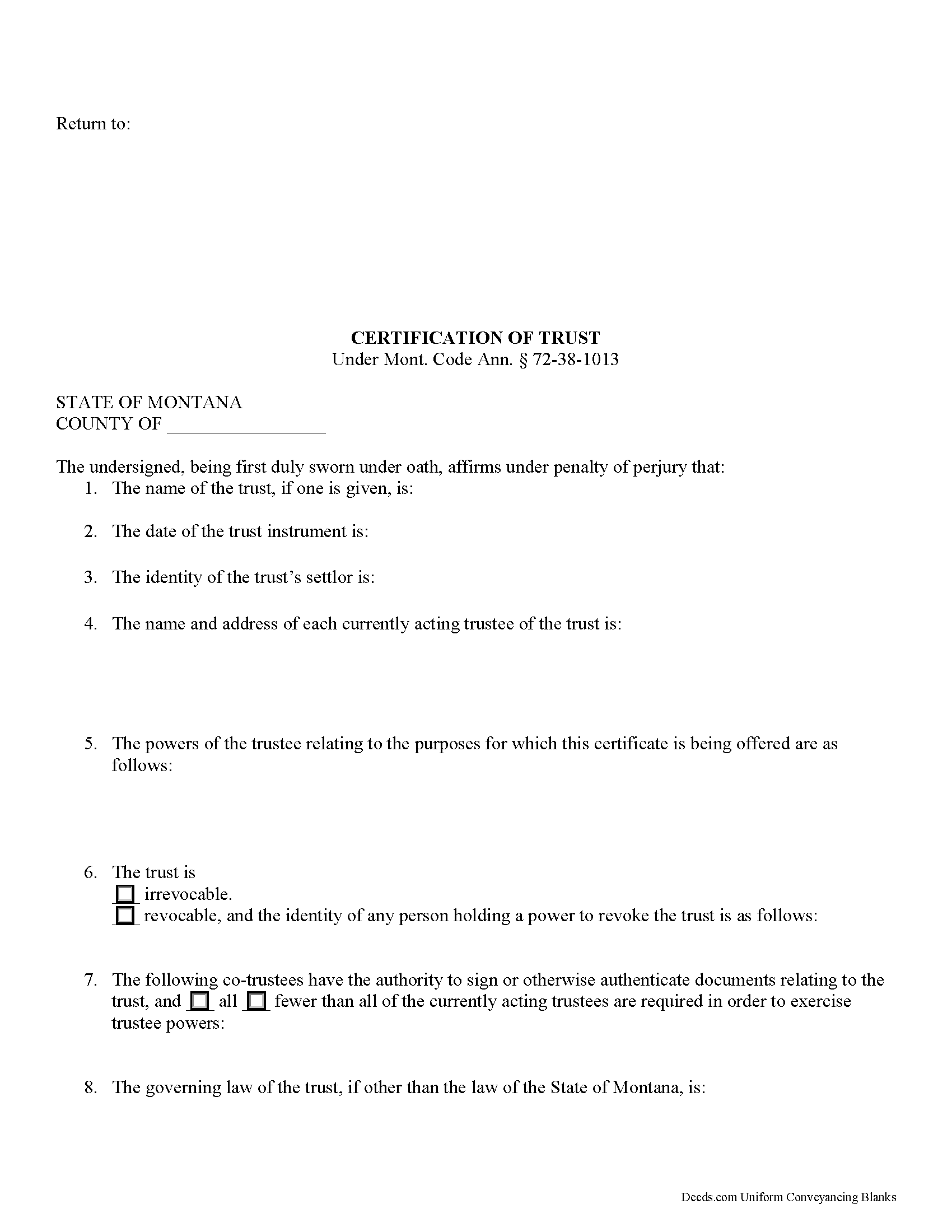

Lincoln County Certificate of Trust Form

Lincoln County Certificate of Trust Form

Fill in the blank form formatted to comply with all recording and content requirements.

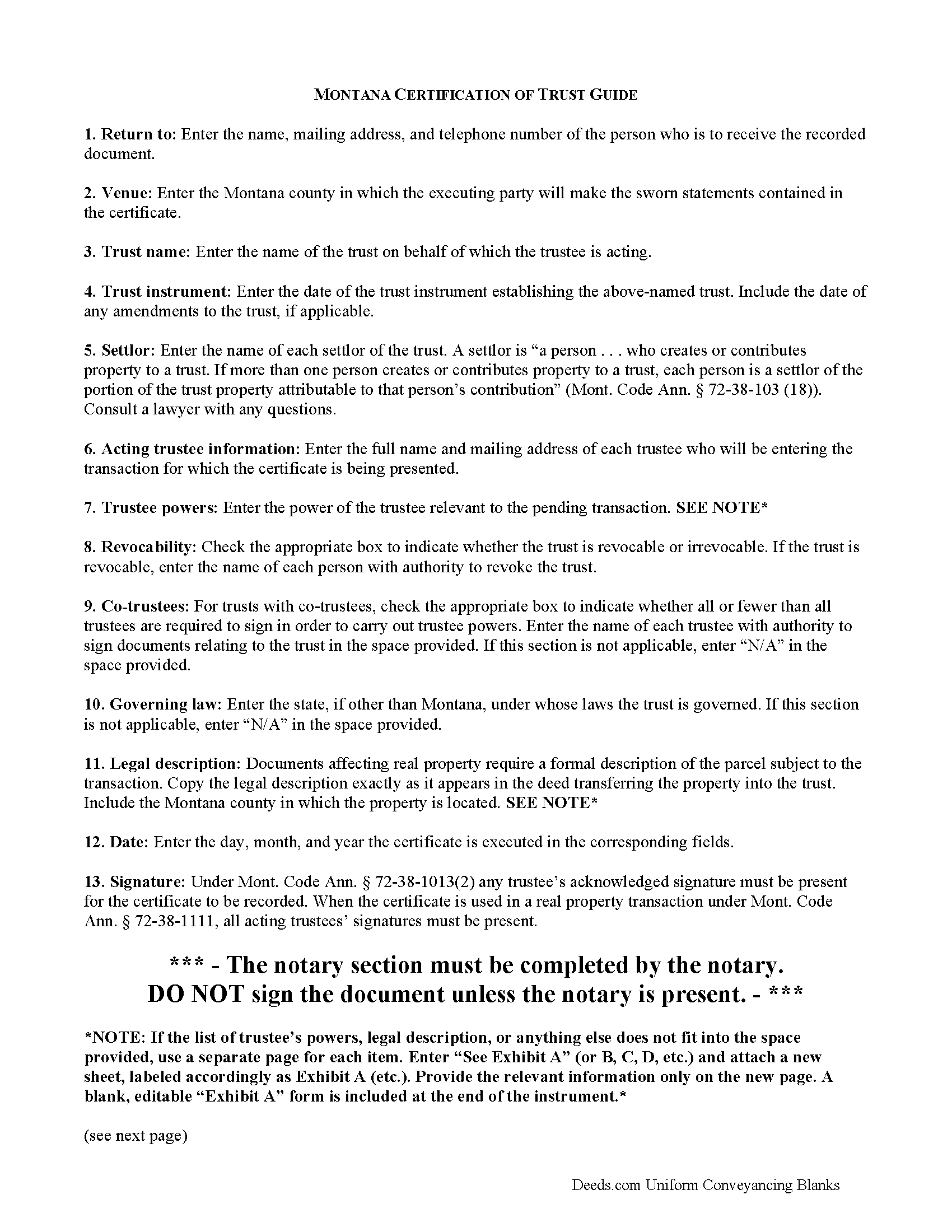

Lincoln County Certificate of Trust Guide

Line by line guide explaining every blank on the form.

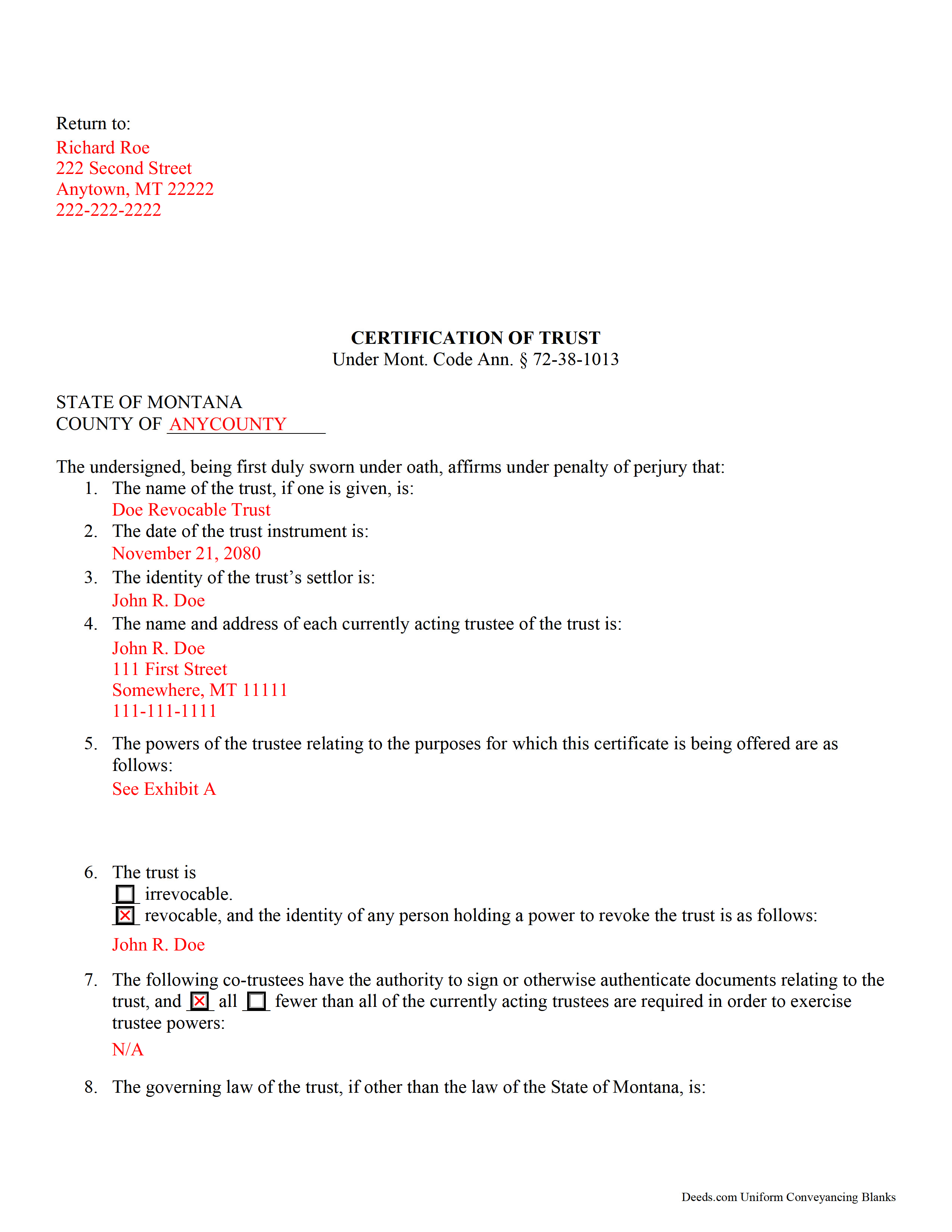

Lincoln County Completed Example of the Certificate of Trust Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Montana and Lincoln County documents included at no extra charge:

Where to Record Your Documents

Lincoln County Clerk / Recorder

Libby, Montana 59923

Hours: 8:00am-5:00pm M-F

Phone: (406) 283-2301

Recording Tips for Lincoln County:

- White-out or correction fluid may cause rejection

- Documents must be on 8.5 x 11 inch white paper

- Both spouses typically need to sign if property is jointly owned

- Bring extra funds - fees can vary by document type and page count

Cities and Jurisdictions in Lincoln County

Properties in any of these areas use Lincoln County forms:

- Eureka

- Fortine

- Libby

- Rexford

- Stryker

- Trego

- Troy

Hours, fees, requirements, and more for Lincoln County

How do I get my forms?

Forms are available for immediate download after payment. The Lincoln County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Lincoln County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Lincoln County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Lincoln County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Lincoln County?

Recording fees in Lincoln County vary. Contact the recorder's office at (406) 283-2301 for current fees.

Questions answered? Let's get started!

The certification of trust in Montana is an affidavit containing sworn statements made by the trustee or trustees of a trust.

In a trust arrangement, a settlor entrusts property to a trustee for the benefit of a beneficiary. The trustee is the administrator of the trust's assets.

Instead of furnishing the trust instrument (an unrecorded document containing the trust's provisions, including the designation of the trust's beneficiary) the certificate is an abstract supplying only the relevant information required of the trustee in order to prove his authority to enter into a transaction on the trust's behalf.

Codified under the Montana Uniform Trust Code at 72-38-1013, the certification of trust contains basic information, such as the trust's name, date, settlor, and each trustee's name and address. The certificate verifies that the trust exists and that the trustee is authorized to act by providing a description of the trustee's powers relating to the pending action.

For example, a trustee may furnish a certificate when conveying real property held in a living trust. When used in real property transactions, a recorded certificate fulfills the requirements under Mont. Code Ann. 72-38-1111 for a valid transfer of real property by a trustee. When used for transactions involving real property, the certificate should also include the legal description of the parcel subject to the transaction.

The certificate must also designate whether or not the trust is revocable, and who, if any, has authority to revoke the trust. For trusts with multiple trustees, the document also specifies which trustees have signing authority, and how many are required in order to execute the trustee's powers. The certificate also cites the governing law under which the trust was formed.

Mont. Code Ann. 72-38-1013 provides that the certificate can be signed by any trustee, and signatures must be acknowledged if the document is recorded. When used in real property transfers under 72-38-1111, each acting trustee must sign before the document is recorded, and the certificate should meet all requirements of form and content for recording documents in Montana under 7-4-2636.

Recipients of the certificate can request, in addition, excerpts and/or later amendments from the trust instrument which name the trustee and confer the relevant powers upon the trustee. Requesting the entire trust document exposes the person making the request to certain liabilities ( 72-38-1013(8)).

Finally, the certificate contains a statement confirming that the trust has not been modified in any way that would cause the statements made within to be inaccurate, and the recipient "may assume without inquiry the existence of the facts contained" within ( 72-38-1013(6)).

Consult a lawyer with any questions and for professional guidance regarding certifications of trust in Montana, as each situation is unique.

(Montana COT Package includes form, guidelines, and completed example)

Important: Your property must be located in Lincoln County to use these forms. Documents should be recorded at the office below.

This Certificate of Trust meets all recording requirements specific to Lincoln County.

Our Promise

The documents you receive here will meet, or exceed, the Lincoln County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Lincoln County Certificate of Trust form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4578 Reviews )

Charles C.

July 8th, 2021

Easy to use. Good price. I like that it came with instructions and an example.

Thank you for your feedback. We really appreciate it. Have a great day!

Thomas T.

August 8th, 2022

Amazing site, been using it since 2018 for forms and never an issue.

Thank you for your feedback. We really appreciate it. Have a great day!

Elizabeth N.

April 3rd, 2019

I love how easy it is to understand and complete.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Eleody L.

January 7th, 2019

I mistakenly ordered the wrong package and within 3 minutes of asking for a replacement, I was given one by the company. I am extremely impressed with the prompt response and the forms! I will use this site again if I needed other deed forms!!!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Tiffany P.

May 7th, 2019

Very quick and gave me exactly what I needed! I would have had to go down to the courts and take off work to get this info otherwise.

Thank you for your feedback. We really appreciate it. Have a great day!

Brandi P.

December 9th, 2020

The service itself is great, but the deed sample I ordered wasn't as accurate as I'd hoped. I needed to correct and resubmit. Not a huge deal, but a bit of an inconvenience.

Thank you for your feedback. We really appreciate it. Have a great day!

Anne-Marie B.

December 30th, 2020

This was the first time I have ever e-recorded a document. The process was smooth and simple. I loved being informed at each step along the way. I am glad I chose deeds.com and plan to use them in the future for all my electronic recording of legal documents.

Thank you!

Chris M.

April 19th, 2022

simple, Clean, and easy, to retrieve the forms i needed, while on this site. and the Fee for the Fill-in forms is Remarkably inexpensive, to say the least!

Thank you!

Kitty H.

February 19th, 2019

I have had it reviewed by a mortgage broker and a title manager and both said it was done correctly! Your product and the instructions are what made this possible. It took me several hours as I continued to review your information. I just finished printing and ready to file. Yeah! Thanks! Highly recommend the product!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Marjorie D.

November 1st, 2021

The process was easy and efficient. I will definitely be using this service!

Thank you for your feedback. We really appreciate it. Have a great day!

Jay T.

August 6th, 2020

I filled out the deed, had it notarized, and recorded. No problems. I put this off for so long. Once I had the form it was recorded in one day.

Thank you for your feedback. We really appreciate it. Have a great day!

Deborah H.

July 13th, 2020

Wonderful service, very fast and great customer service will be using you guys from now on. Thanks a bunch

Thank you for your feedback. We really appreciate it. Have a great day!

Devra R.

May 30th, 2022

A refreshingly easy service to use. They offer auxiliary forms as a courtesy. Theres no "gotcha" capitalism. You pay the reasonable fee and the needed forms are accessible instantly to download. I've used it twice so far and it worked perfectly!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Patricia E.

June 8th, 2020

Easy to understand and download!

Thank you!

Niranjan C.

August 24th, 2021

Whole process was very easy and quick. Forms were easy to fill, examples were quite appropriate. Recommended.

Thank you!