Glacier County Deed of Trust and Promissory Note Form

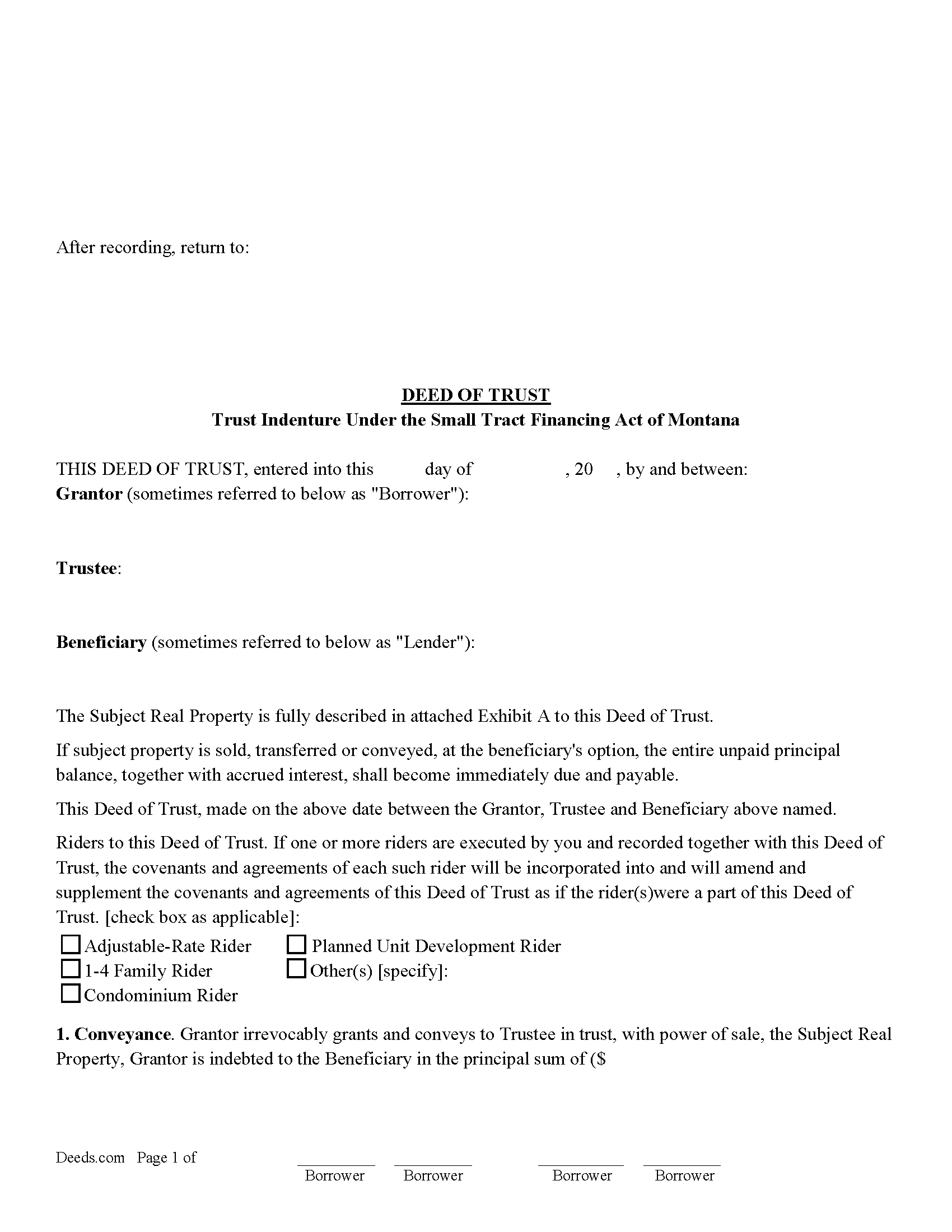

Glacier County Deed of Trust Form

Fill in the blank form formatted to comply with all recording and content requirements.

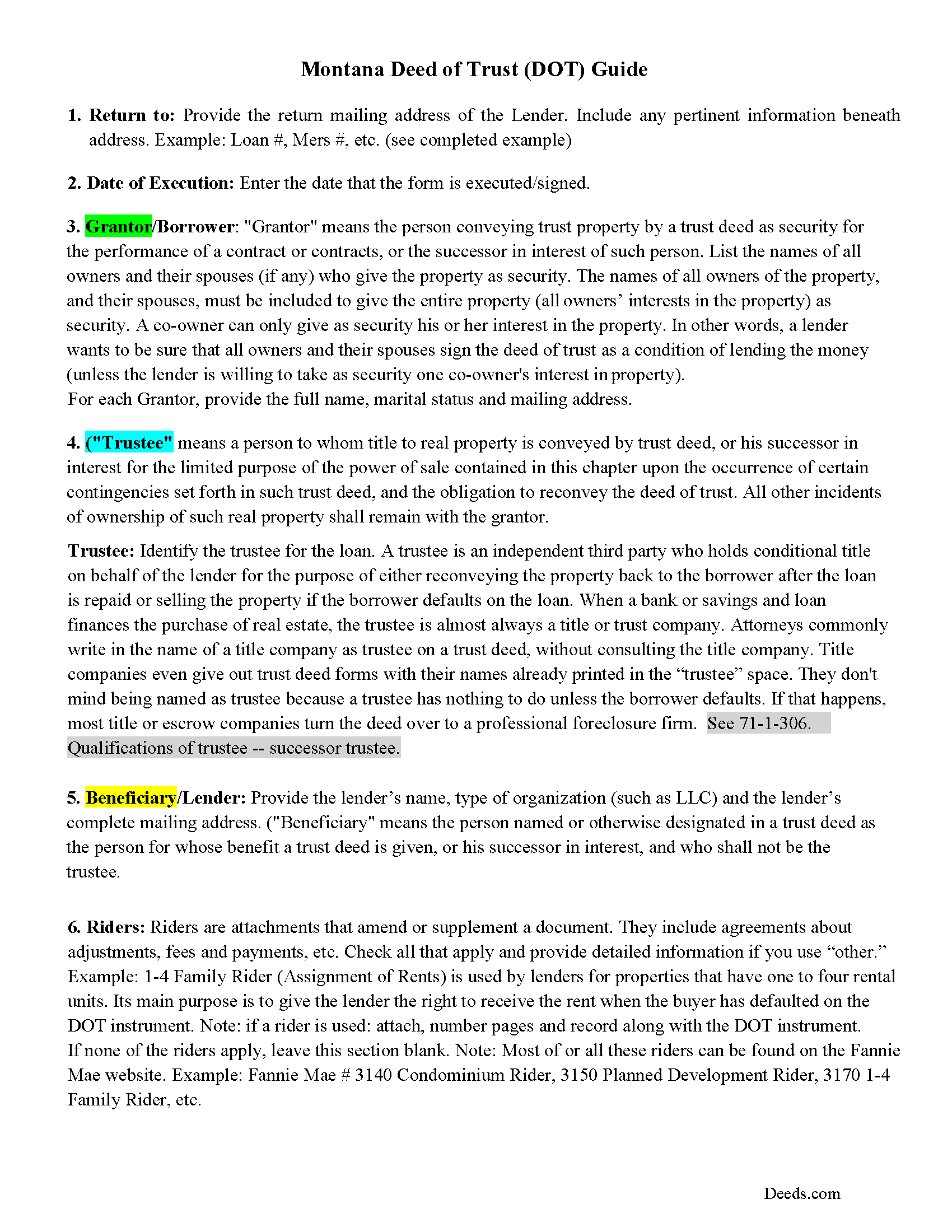

Glacier County Deed of Trust Guidelines

Line by line guide explaining every blank on the form.

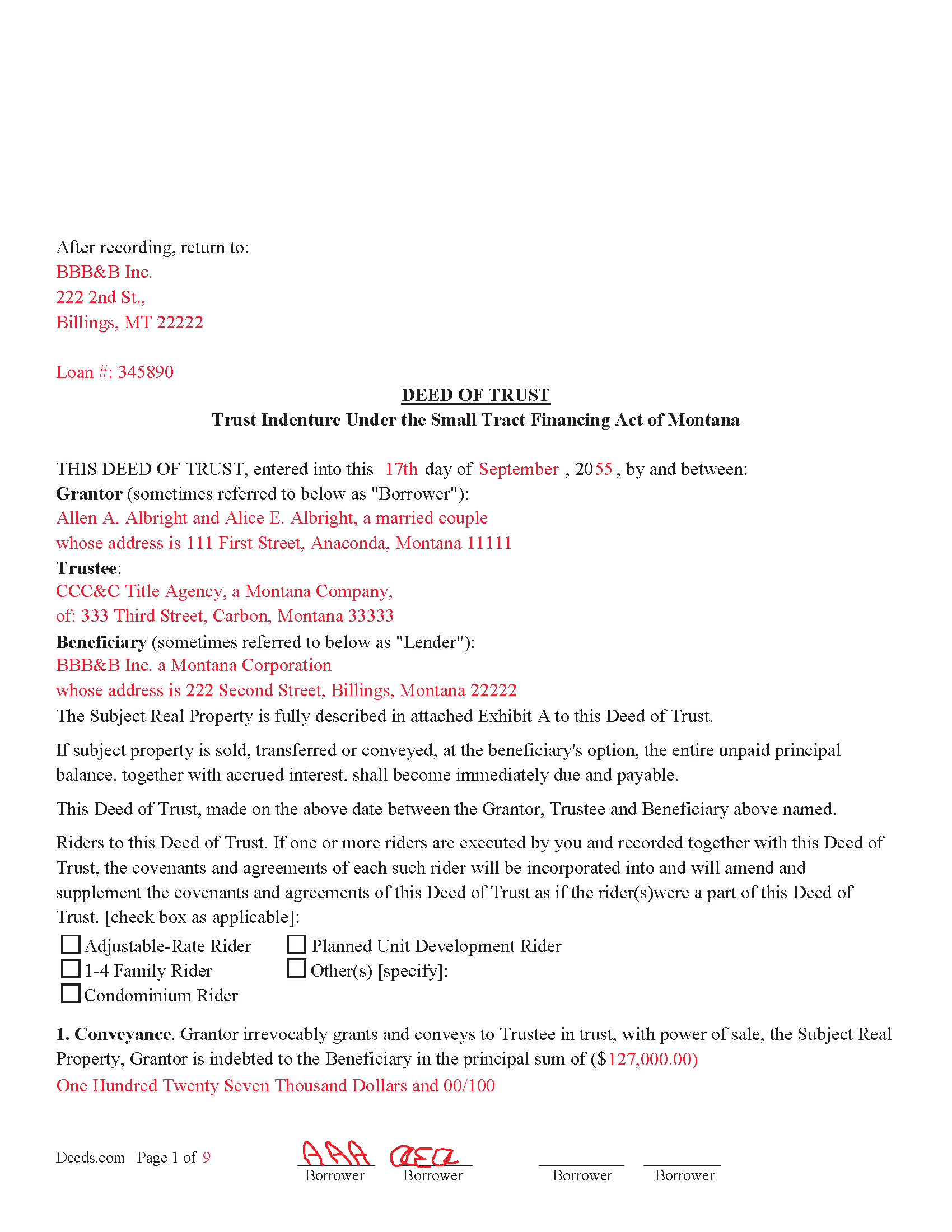

Glacier County Completed Example of the Deed of Trust Document

Example of a properly completed form for reference.

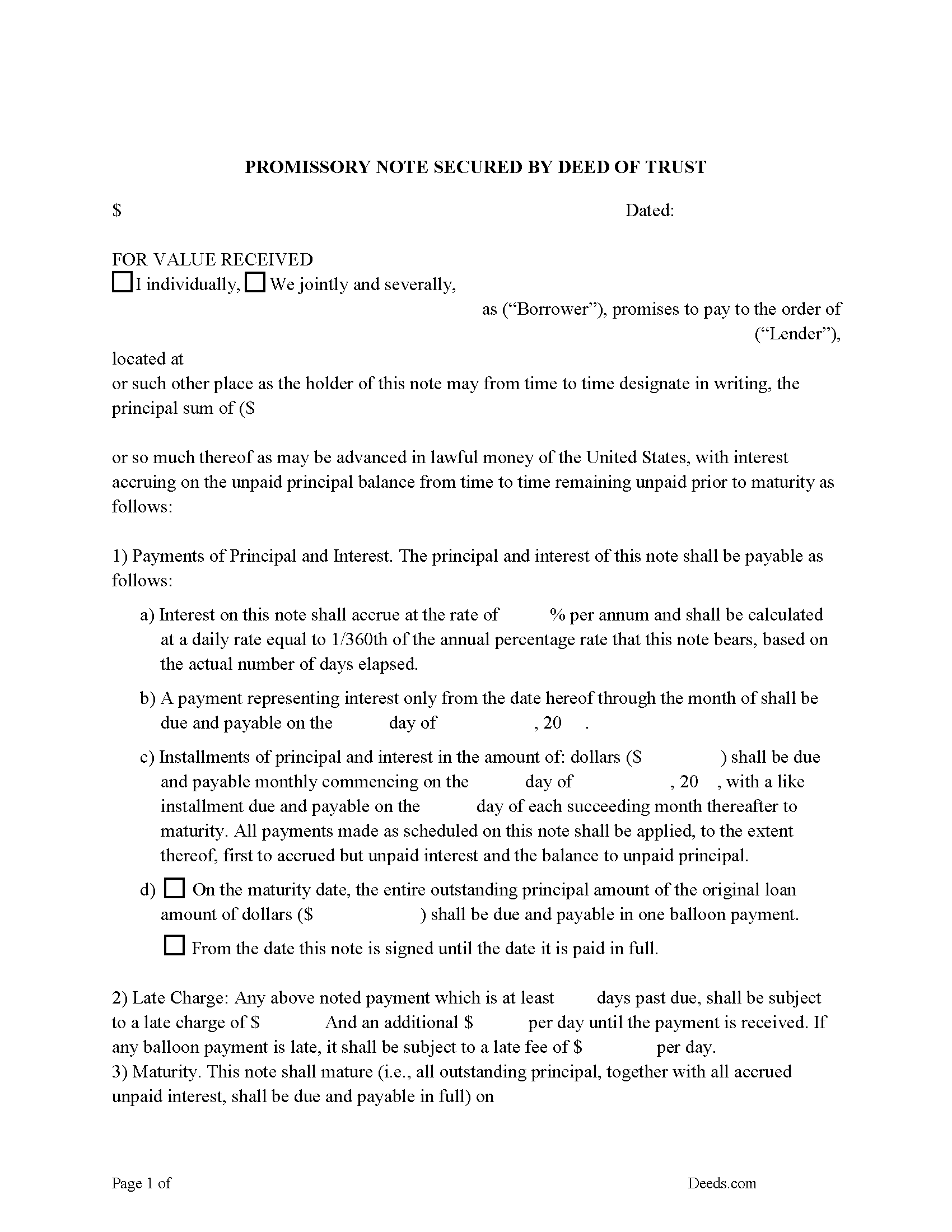

Glacier County Promissory Note Form

Note that is secured by the Deed of Trust document.

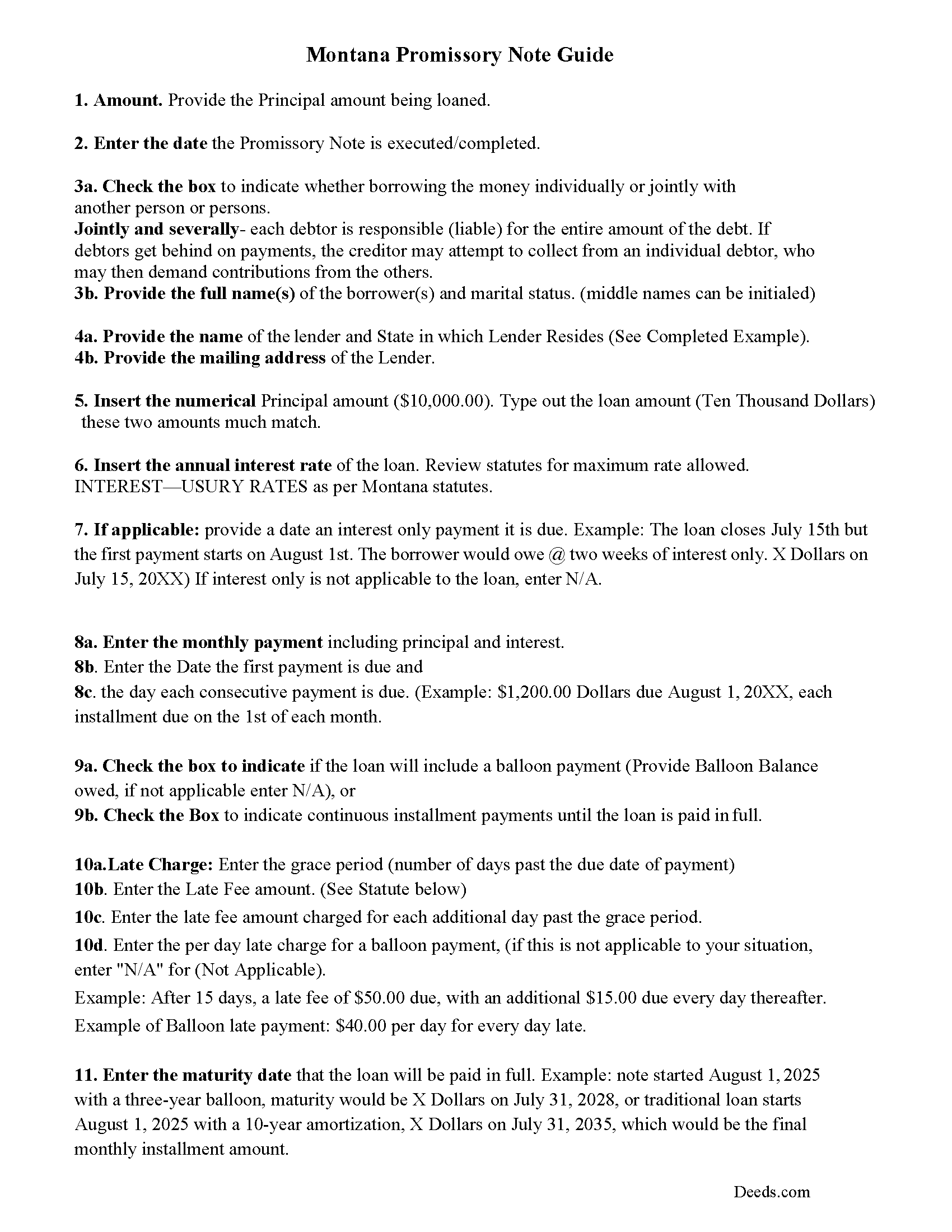

Glacier County Promissory Note Guidelines

Line by line guide explaining every blank on the form.

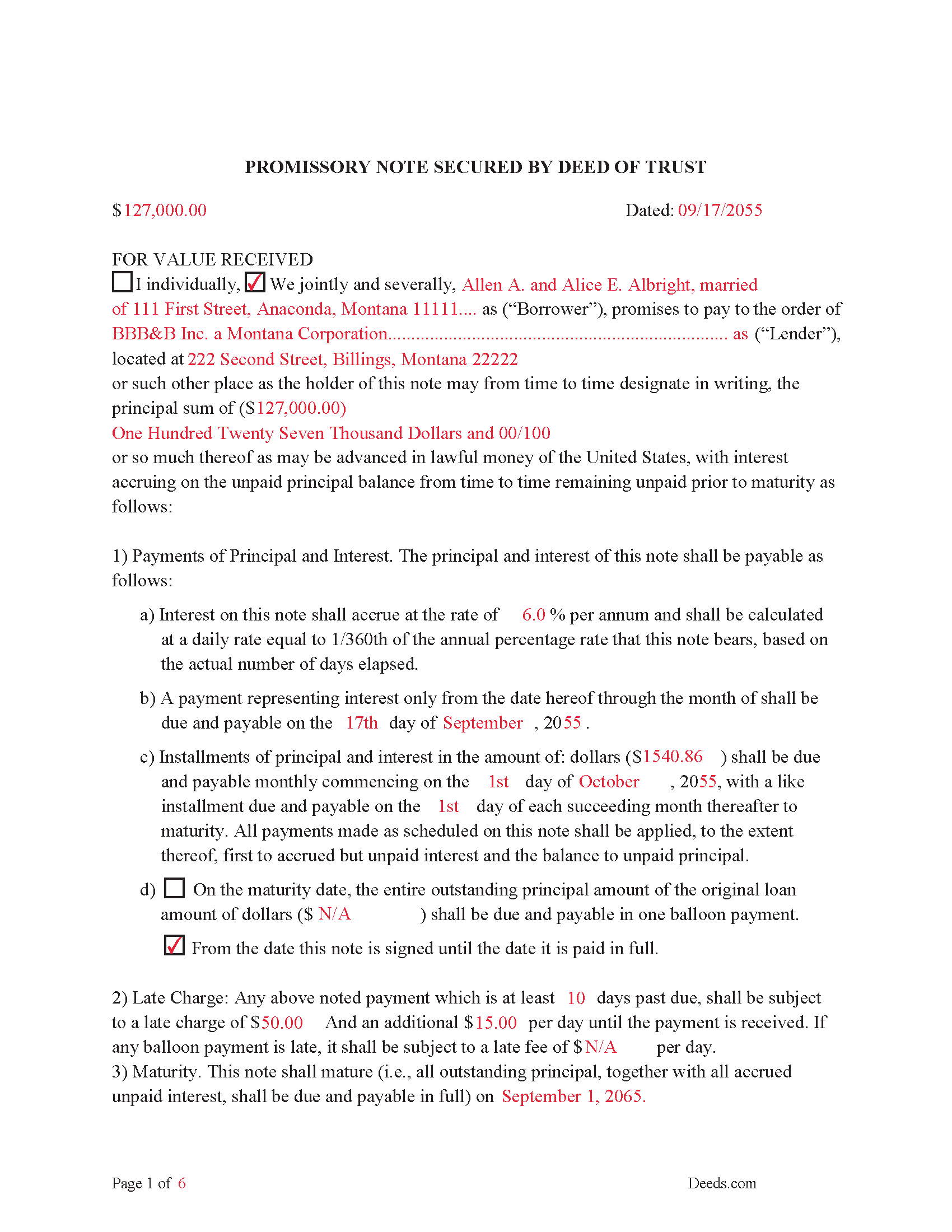

Glacier County Completed Example of the Promissory Note Document

Example of a properly completed form for reference.

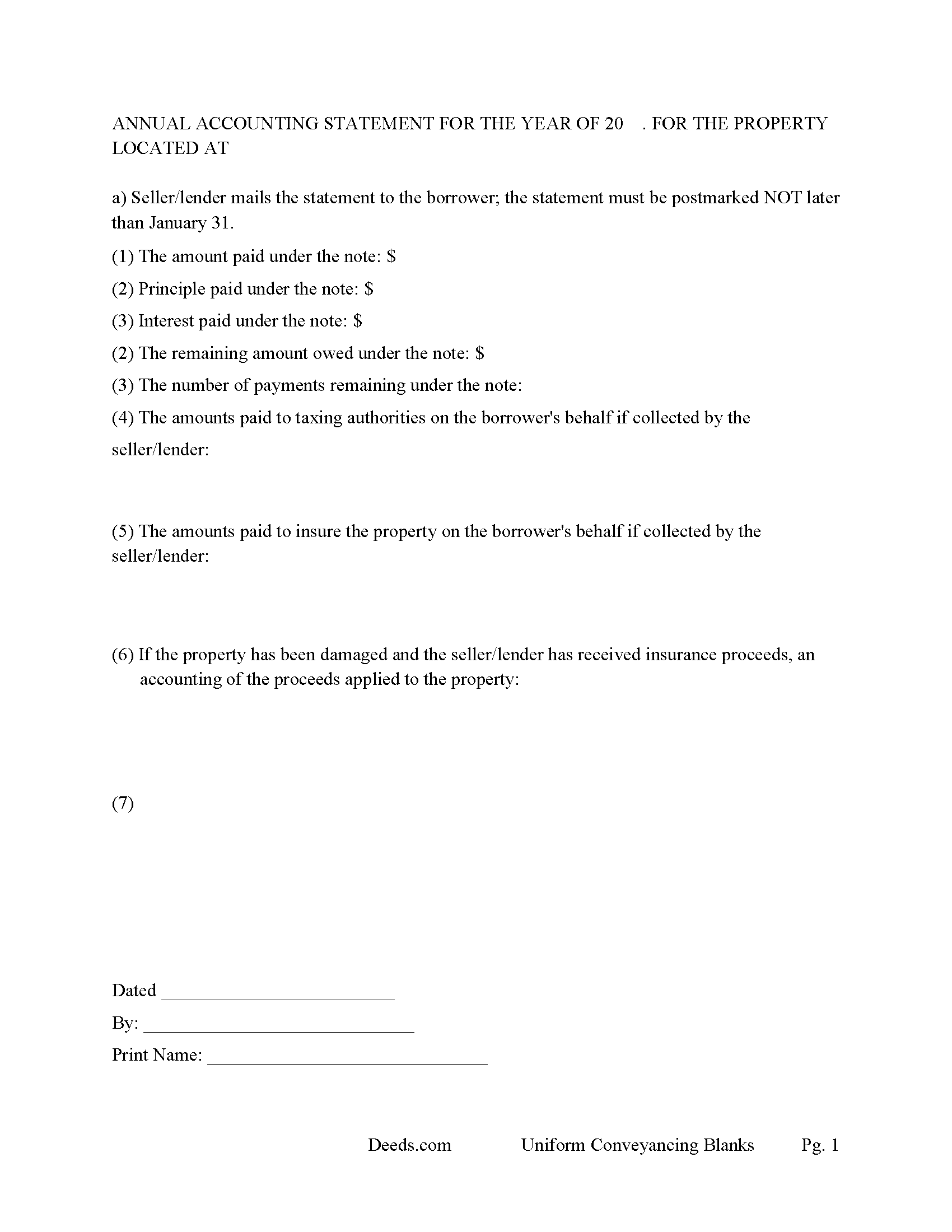

Glacier County Annual Accounting Statement Form

Fill in the blank Deed of Trust and Promissory Note form formatted to comply with all Montana recording and content requirements.

All 7 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Montana and Glacier County documents included at no extra charge:

Where to Record Your Documents

Glacier County Clerk / Recorder

Cut Bank, Montana 59427

Hours: 8:30 to 4:00 M-F

Phone: (406) 873-3610

Recording Tips for Glacier County:

- Ensure all signatures are in blue or black ink

- Documents must be on 8.5 x 11 inch white paper

- Avoid the last business day of the month when possible

- Bring extra funds - fees can vary by document type and page count

Cities and Jurisdictions in Glacier County

Properties in any of these areas use Glacier County forms:

- Babb

- Browning

- Cut Bank

- East Glacier Park

Hours, fees, requirements, and more for Glacier County

How do I get my forms?

Forms are available for immediate download after payment. The Glacier County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Glacier County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Glacier County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Glacier County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Glacier County?

Recording fees in Glacier County vary. Contact the recorder's office at (406) 873-3610 for current fees.

Questions answered? Let's get started!

A Deed of Trust with Trust Indenture Under the Small Tract Financing Act of Montana is the preferred form of financing in Montana for properties not exceeding 40 acres and under $500,000.00 in financing.

71-1-302 Policy- Because the financing of homes and business expansion is essential to the development of the state of Montana and because financing of homes and business expansion, usually involving areas of real estate of not more than 40 acres, has been restricted by the laws relating to mortgages of real property and because more financing of homes and business expansion is available if the parties can use security instruments and procedures not subject to all the provisions of the mortgage laws, it is the public policy of the state of Montana to permit the use of trust indentures for estates in real property of not more than 40 acres as provided in this part.

This form includes the Power of Sale clause, which allows for a non-judicial foreclosure, saving time and expense, in general:

Non-judicial foreclosure takes (130-180 days) compared to @1 year -- judicial foreclosure

In a non-judicial foreclosure Borrower has no right of redemption vs. an additional year beyond a judicial foreclosure.

Typically, no frivolous lawsuits filed to slow down a non-judicial foreclosure vs. common in a judicial foreclosure.

Typically, no deficiency judgement upon completion of sale in a non-judicial foreclosure vs. deficiency judgment used in judicial foreclosure.

71-1-304 Trust indentures authorized -- power of sale for breach in trustee

(1) A transfer in trust of an interest in real property of an area not exceeding 40 acres may be made to secure the performance of an obligation of a grantor or any other person named in the indenture to a beneficiary. However, a trust indenture may not be substituted for a mortgage that was in existence on March 5, 1963.

(2) When a transfer in trust of an interest in real property is made to secure the performance of the obligation referred to in subsection (1), a power of sale is conferred upon the trustee to be exercised after a breach of the obligation for which the transfer is security.

(3) A trust indenture executed in conformity with this part may be foreclosed by advertisement and sale in the manner provided in this part or, at the option of the beneficiary, by judicial procedure as provided by law for the foreclosure of mortgages on real property. The power of sale may be exercised by the trustee without express provision in the trust indenture.

(4) If a trust indenture states that the real property involved does not exceed 40 acres, the statement is binding upon all parties and conclusive as to compliance with the provisions of this part relative to the power to make a transfer, trust, and power of sale.

If the parameters of the trust indenture are not met (example: the subject property is 50 acres or $600.000.00) then it converts to a mortgage and treated as mortgage in foreclosure.

71-1-305 Trust indenture considered to be mortgage on real property A trust indenture is deemed to be a mortgage on real property and is subject to all laws relating to mortgages on real property except to the extent that such laws are inconsistent with the provisions of this part, in which event the provisions of this part shall control. For the purpose of applying the mortgage laws, the grantor in a trust indenture is deemed the mortgagor and the beneficiary is deemed the mortgagee.

71-1-321 Deeds of trust and trust deeds not invalidated The Small Tract Financing Act of Montana does not invalidate or preclude the use in this state of instruments, sometimes denominated deeds of trust, trust deeds, or trust indentures, which are not executed in conformity with this part, but in which a conveyance for security purposes is made to a trustee or trustees for the benefit of one or more lenders. Such instruments are considered to be mortgages and are subject to all laws relating to mortgages on real property. Every such instrument, recorded as prescribed by law, from the time it is filed for record is constructive notice of its contents to subsequent purchasers and encumbrancers.

(Montana DOT Package includes forms, guidelines, and completed examples) For use in Montana only.

Important: Your property must be located in Glacier County to use these forms. Documents should be recorded at the office below.

This Deed of Trust and Promissory Note meets all recording requirements specific to Glacier County.

Our Promise

The documents you receive here will meet, or exceed, the Glacier County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Glacier County Deed of Trust and Promissory Note form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4578 Reviews )

Heather M.

January 9th, 2019

Great service, convenient, fast and easy to use. Thumbs Up!!!!w

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Ronald P.

August 18th, 2020

Very easy to use... awaiting info

Thank you for your feedback. We really appreciate it. Have a great day!

Nicholas B.

October 24th, 2020

A lot of information to read over but downloading process was great and ill definitely use the service again. Showed me my country and city that my forms would be valid in and the information is step by step with examples and that is great

Thank you for your feedback. We really appreciate it. Have a great day!

Wendy B.

December 20th, 2019

Really appreciate you he quick response and solution to my problem!! Thank you!!

Thank you for your feedback. We really appreciate it. Have a great day!

Kathryn G.

December 21st, 2023

This was extremely helpful!

We are motivated by your feedback to continue delivering excellence. Thank you!

Regina S.

January 13th, 2022

5 STARS!!! YOU WERE AWESOME!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

John W.

February 10th, 2021

Wow, I wish that I would have found Deeds.com before! Great service!

Thank you!

Diane P.

July 22nd, 2022

Form was very easy to use and was processed/ recorded with no issue. Thank you it saved me from having to contact an attorney.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Sharon B.

April 3rd, 2024

Downloaded pdf form was difficult to use,/modify and has too much space between sections.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

Erik J.

January 8th, 2021

First time using Deeds.com and feel that your platform is clear and easy to use. I was also pleased with the messaging center and follow-up and also surprised at how quickly our particular deed was recorded and available to view. Having said that, when I first investigated Deeds.com the fee was $15 and as of 1/1/21 it has increased to $19 which I feel is pretty steep for the handling of 1 simple document especially when the turnaround was basically the same day. Your fee was nearly the equivalent of the cost of the Clerk's recording fee. Perhaps you should offer a fee schedule for those of us who are not volume recorders. Just a thought.

Thank you!

John C.

December 1st, 2020

Great site and information. Very useful.

Thanks John, we appreciate your kind words.

Julie L.

April 3rd, 2019

Great documents! with complete instructions and the CTC as well. I work with a lot of recordings and transfers, this is a great comprehensive set..

Thank you!

Ernest K.

July 27th, 2020

Im an out of state realtor, but couldnt believe how quick and easy the process was. Recieved my deed within 15 min of submission. I will be referring clients to this service.

Thank you!

Susan N.

August 28th, 2022

Easy to use.

Thank you!

JUDITH G.

April 22nd, 2022

So far, so good! I appreciate a no-hassle website.

Thank you!