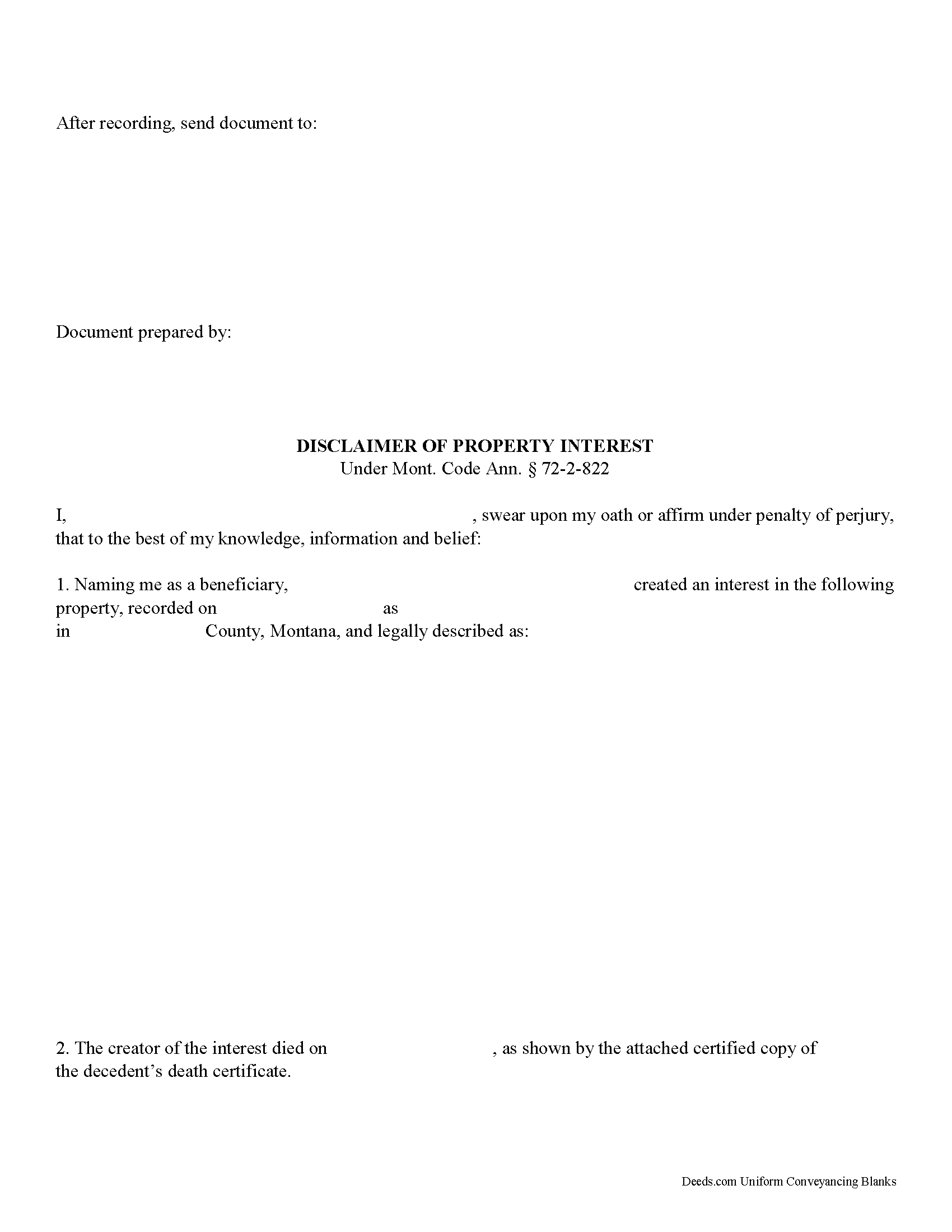

Carter County Disclaimer of Interest Form

Carter County Disclaimer of Interest Form

Fill in the blank form formatted to comply with all recording and content requirements.

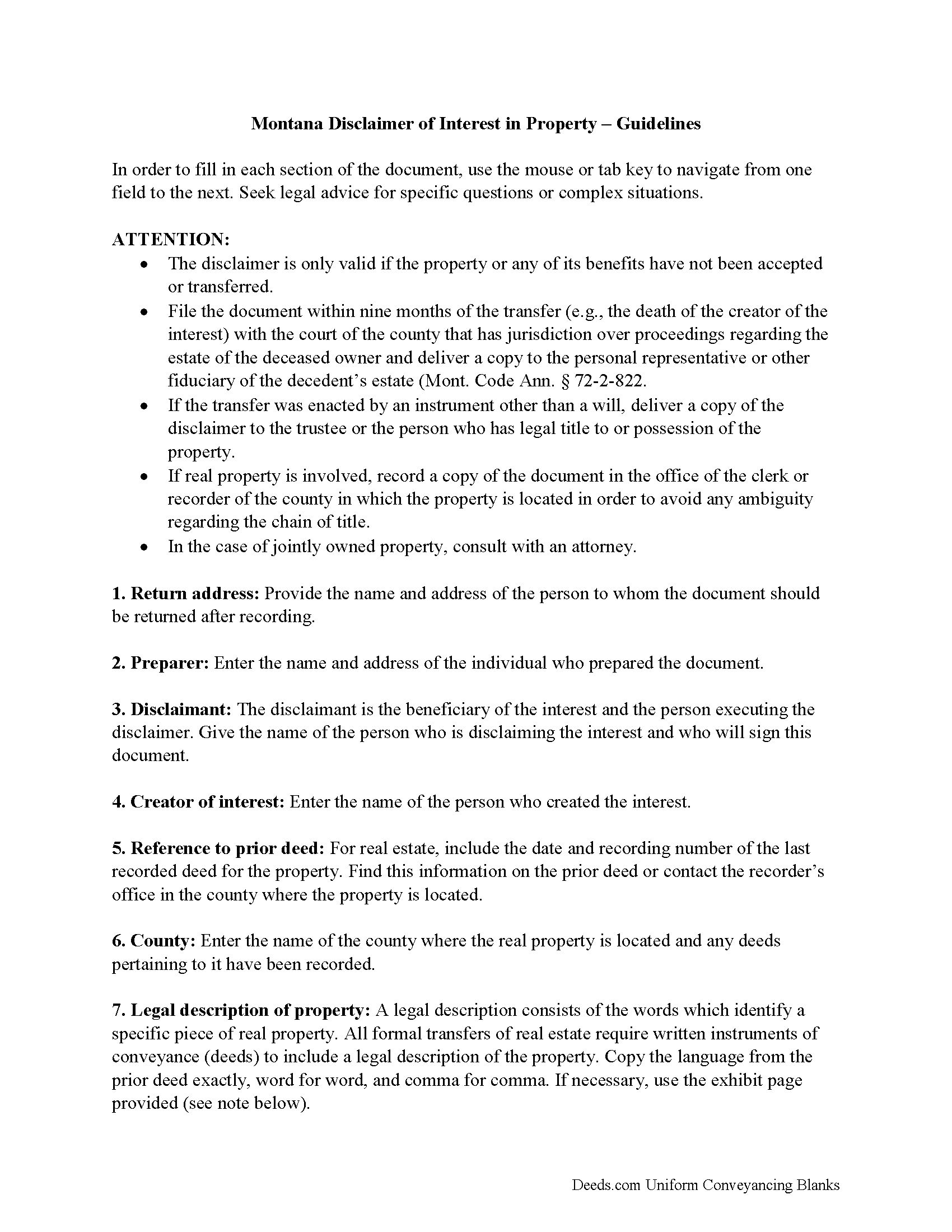

Carter County Disclaimer of Interest Guide

Line by line guide explaining every blank on the form.

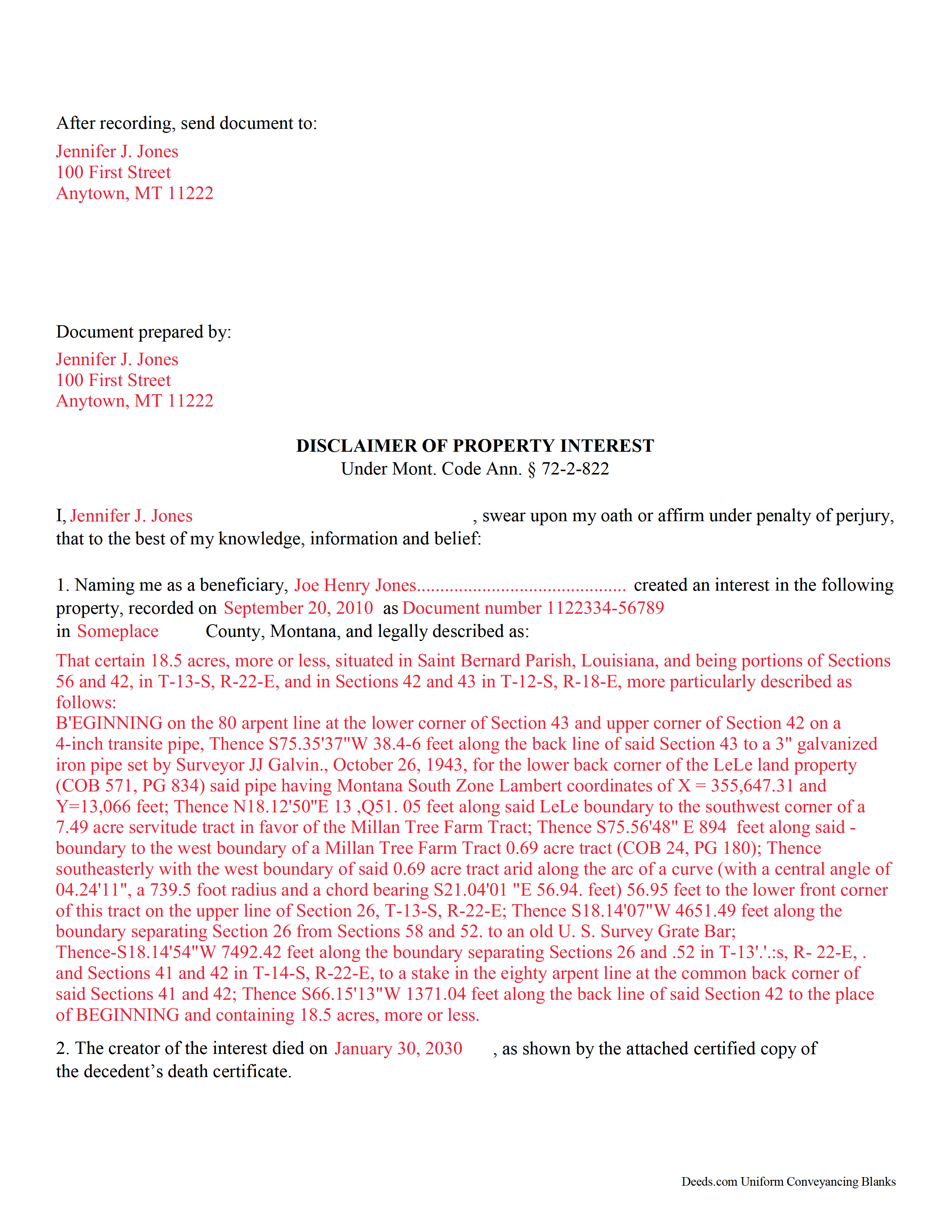

Carter County Completed Example of the Disclaimer of Interest Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Montana and Carter County documents included at no extra charge:

Where to Record Your Documents

Carter County Clerk / Recorder

Ekalaka, Montana 59324

Hours: 8:00 to 12:00 & 1:00 to 5:00 Mon-Fri

Phone: (406) 775-8749

Recording Tips for Carter County:

- Ensure all signatures are in blue or black ink

- Ask if they accept credit cards - many offices are cash/check only

- Avoid the last business day of the month when possible

- Bring extra funds - fees can vary by document type and page count

Cities and Jurisdictions in Carter County

Properties in any of these areas use Carter County forms:

- Alzada

- Boyes

- Capitol

- Ekalaka

- Hammond

Hours, fees, requirements, and more for Carter County

How do I get my forms?

Forms are available for immediate download after payment. The Carter County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Carter County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Carter County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Carter County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Carter County?

Recording fees in Carter County vary. Contact the recorder's office at (406) 775-8749 for current fees.

Questions answered? Let's get started!

Montana Disclaimer of Property Interest

Under the Montana Code, the beneficiary of an interest in property may disclaim the gift, either in part or in full (Mont. Code Ann. 72-2-822). Note that the option to disclaim is only available to beneficiaries who have not acted in any way to indicate acceptance or ownership of the interest (72-2-822).

TITLE 72. ESTATES, TRUSTS, AND FIDUCIARY RELATIONSHIPS

CHAPTER 2. UPC -- INTESTACY, WILLS, AND DONATIVE TRANSFERS

Part 8. General Provisions Concerning Probate and Nonprobate Transfers

Disclaimer Of Interest In Property

72-2-822.Disclaimer of interest in property. (1) In this section:

(a)"Future interest" means an interest that takes effect in possession or enjoyment, if at all, later than the time of its creation.

(b)"Time of distribution" means the time when a disclaimed interest would have taken effect in possession or enjoyment.

(2)Except for a disclaimer governed by 72-2-823 or 72-2-824, the following rules apply to a disclaimer of an interest in property:

(a)The disclaimer takes effect as of the time the instrument creating the interest becomes irrevocable, or, if the interest arose under the law of intestate succession, as of the time of the intestate's death.

(b)The disclaimed interest passes according to any provision in the instrument creating the interest providing for the disposition of the interest, should it be disclaimed, or of disclaimed interests in general.

(c)If the instrument does not contain a provision described in subsection (2)(b), the following rules apply:

(i)If the disclaimant is not an individual, the disclaimed interest passes as if the disclaimant did not exist.

(ii)If the disclaimant is an individual, except as otherwise provided in subsections (2)(c)(iii) and (2)(c)(iv), the disclaimed interest passes as if the disclaimant had died immediately before the time of distribution.

(iii)If by law or under the instrument, the descendants of the disclaimant would share in the disclaimed interest by any method of representation had the disclaimant died before the time of distribution, the disclaimed interest passes only to the descendants of the disclaimant who survive the time of distribution.

(iv)If the disclaimed interest would pass to the disclaimant's estate had the disclaimant died before the time of distribution, the disclaimed interest instead passes by representation to the descendants of the disclaimant who survive the time of distribution. If no descendant of the disclaimant survives the time of distribution, the disclaimed interest passes to those persons, including the state but excluding the disclaimant, and in such shares as would succeed to the transferor's intestate estate under the intestate succession law of the transferor's domicile had the transferor died at the time of distribution. However, if the transferor's surviving spouse is living but is remarried at the time of distribution, the transferor is deemed to have died unmarried at the time of distribution.

(d)Upon the disclaimer of a preceding interest, a future interest held by a person other than the disclaimant takes effect as if the disclaimant had died or ceased to exist immediately before the time of distribution, but a future interest held by the disclaimant is not accelerated in possession or enjoyment.

A disclaimer is irrevocable and binding for the disclaiming/renouncing party and his or her creditors, so be sure to consult an attorney when in doubt about the drawbacks and benefits. If the interest arises out of jointly-owned property, seek legal advice as well.

(Montana DOI Package includes form, guidelines, and completed example)

Important: Your property must be located in Carter County to use these forms. Documents should be recorded at the office below.

This Disclaimer of Interest meets all recording requirements specific to Carter County.

Our Promise

The documents you receive here will meet, or exceed, the Carter County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Carter County Disclaimer of Interest form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Cecil S.

January 3rd, 2023

EXCELLENT SERVICE DONE WELL AND QUICKLY

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jerry W.

March 16th, 2020

Great program and easy to follow instructions.

Thank you for your feedback. We really appreciate it. Have a great day!

Cary C.

February 8th, 2021

I am very grateful for this service! But I was quite surprised to see the fees went up over 50%! The last 5 or 6 recordings I have done we each only $25.00. Thank you, Sally Center

Thank you for your feedback. We really appreciate it. Have a great day!

Daniel D.

April 22nd, 2019

quick and easy

Thank you Daniel.

Marion B.

September 2nd, 2023

As far as I know all is in order as far as my transfer on death instrument for Illinois. Thank you so much!

Thank you for your feedback. We really appreciate it. Have a great day!

Susan V.

January 13th, 2021

With a little assist from the customer service department-- who was extremely nice and professional- I was able to get my documents printed. I was pleased with the process and hope that the forms will work out for me. Thank you deeds.com for saving me $250 in lawyers fees.

Thank you for your feedback. We really appreciate it. Have a great day!

Karen V.

June 18th, 2021

It was a easy process to get the forms I needed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Rod G.

August 7th, 2020

You guys have it DOWN!! You made it easy to navigate your site and services. You explained things effectively. You are helpful and fast. NO WAY would even entertain using a different deed/ document recording service. I'll be back! Thank you. Rod

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Sunny S.

November 23rd, 2020

Easy to use and quick turnaround. I would use again.

Thank you!

Chrisona S.

October 27th, 2022

Received the forms as promised. Very satisfied.

Thank you!

Adriane L.

November 20th, 2024

great experience. Great communication and very fast turn around ty Adriane

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

Sandrs T.

August 27th, 2020

It would be good to be able to print several documents at 1 time by highlighting them in the list without having to do one document at a time.

Thank you for your feedback. We really appreciate it. Have a great day!

Peggy H.

December 9th, 2022

Very good!

Thank you!

Lowell P.

May 26th, 2020

Exceptionally helpful instruments that are compliant with State law and anticipate various contingencies. Very pleased.

Thank you for your feedback. We really appreciate it. Have a great day!

Jeanette S.

September 3rd, 2020

Your site was easy to figure out after a few mistakes on my part. Messages were returned quickly. Very convenient for our recording of documents. I will recommend using this method for recording in future. Thank you for working fast in our recording.

Thank you for your feedback. We really appreciate it. Have a great day!