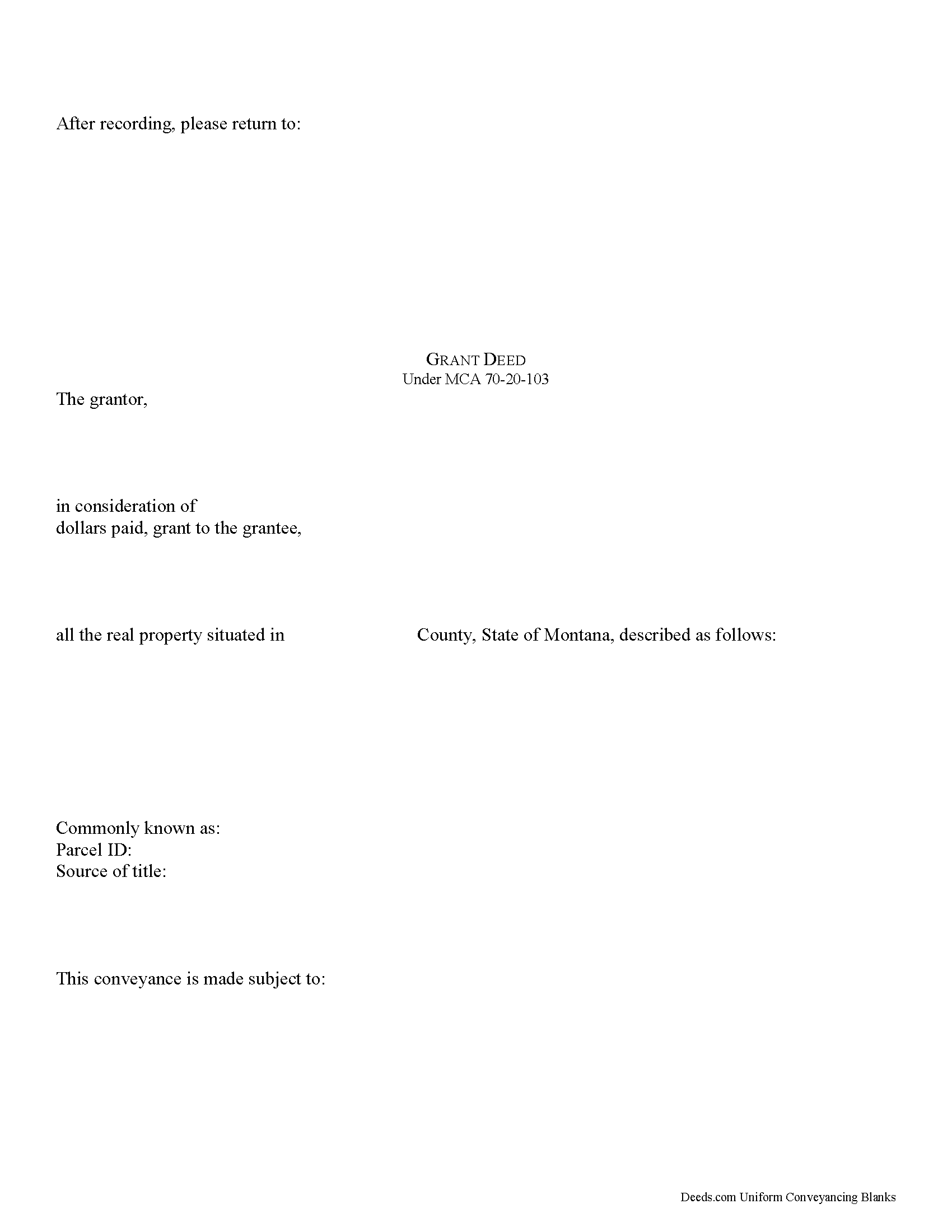

Musselshell County Grant Deed Form

Musselshell County Grant Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

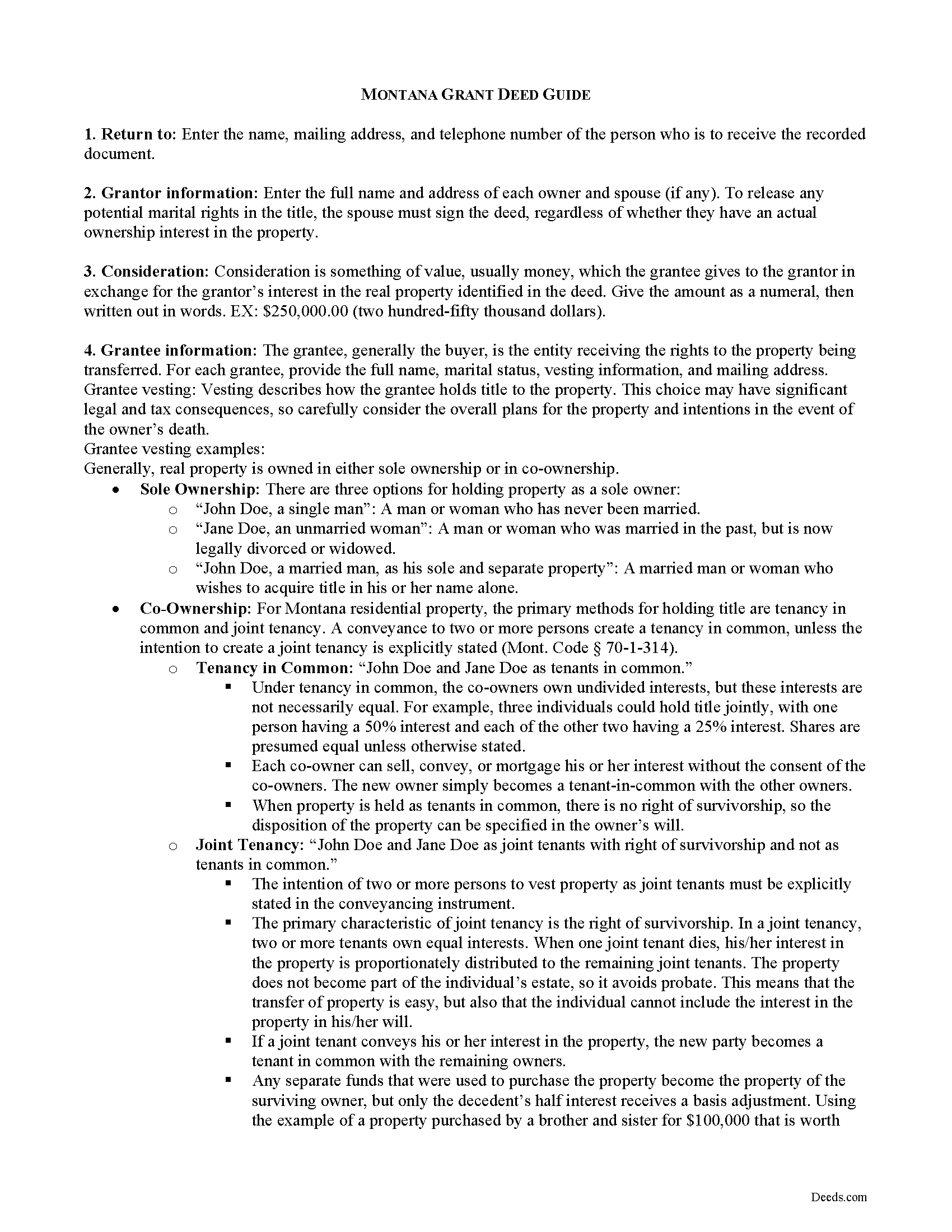

Musselshell County Grant Deed Guide

Line by line guide explaining every blank on the form.

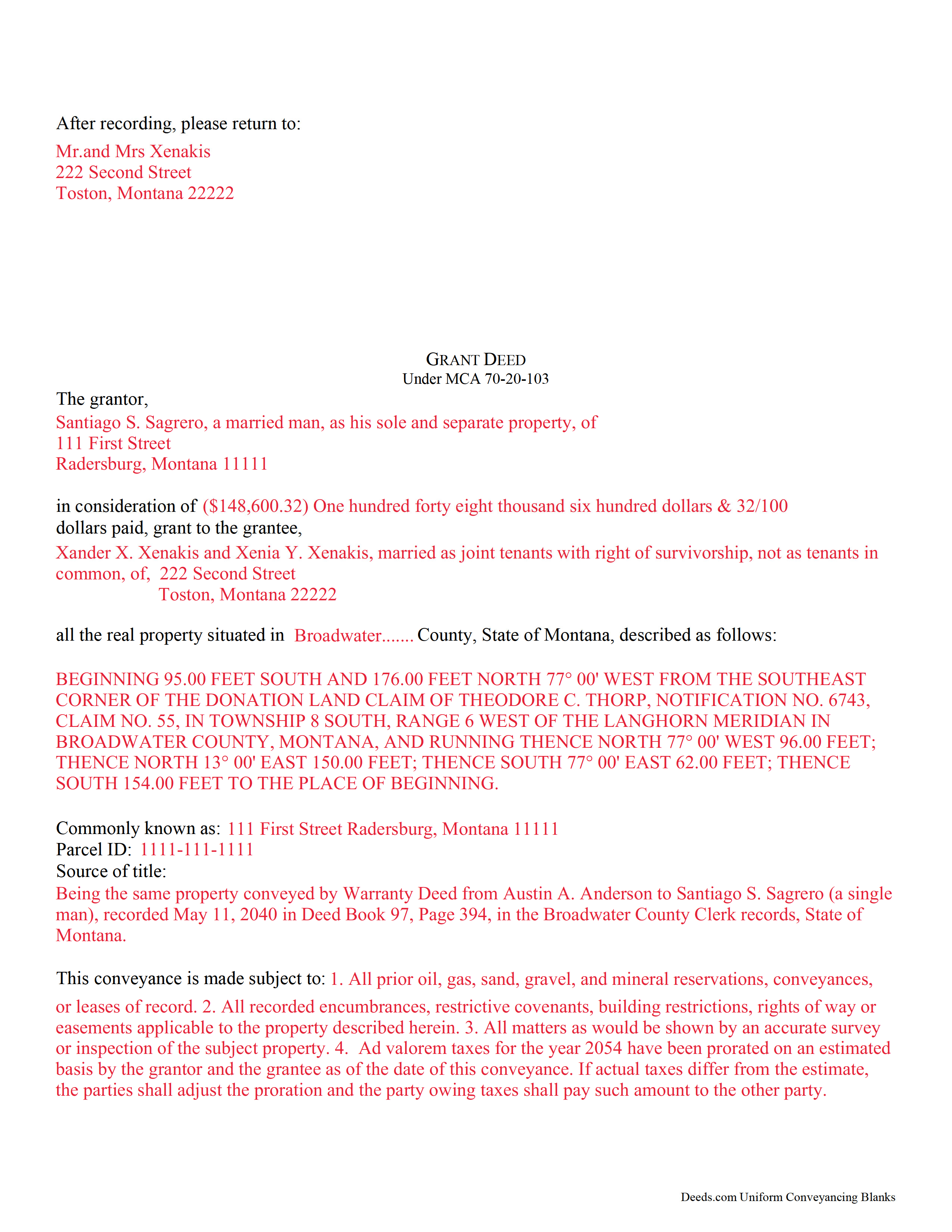

Musselshell County Completed Example of the Grant Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Montana and Musselshell County documents included at no extra charge:

Where to Record Your Documents

Musselshell County Clerk / Recorder

Round Up, Montana 59072

Hours: 8:00 to 5:00 M-F

Phone: (406) 323-1104

Recording Tips for Musselshell County:

- White-out or correction fluid may cause rejection

- Ask if they accept credit cards - many offices are cash/check only

- Request a receipt showing your recording numbers

- Consider using eRecording to avoid trips to the office

Cities and Jurisdictions in Musselshell County

Properties in any of these areas use Musselshell County forms:

- Melstone

- Musselshell

- Roundup

Hours, fees, requirements, and more for Musselshell County

How do I get my forms?

Forms are available for immediate download after payment. The Musselshell County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Musselshell County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Musselshell County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Musselshell County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Musselshell County?

Recording fees in Musselshell County vary. Contact the recorder's office at (406) 323-1104 for current fees.

Questions answered? Let's get started!

Real property can be transferred with an instrument in writing, which can be a grant, bill of sale, or a conveyance. A grant deed can be used in Montana to transfer title to real property. The Montana Code Annotated provides a general form for conveyances that can be used for a grant deed in this state (70-20-103). A grant deed includes covenants that the grantor has not conveyed the same property to any person other than the grantor and that the estate is free from any encumbrances done, made, or suffered by the grantor. A transfer of real property in Montana will pass all the easements attached to the property and will create in favor thereof an easement to use other real property of the person whose estate is transferred in the same manner and to the same extent as such property was obviously and permanently used by the person whose estate is transferred for the benefit thereof at the time the transfer was agreed upon or completed (70-20-308).

In order to have a grant deed recorded in Montana, it must be in writing, signed by the grantor or the grantor's lawful agent authorized in writing, and acknowledged or proved. The execution of the deed must be acknowledged as defined in 1-5-602 of the Montana Code Annotated or proved by a subscribing witness, which also must be notarized (70-21-203). Grant deeds can be acknowledged in other states in accordance with MAC 1-5-606, and they will be valid for recordation in Montana. A Realty Transfer Certificate must accompany all applicable grant deeds when they are presented for recording (15-7-305).

All real estate deeds, including grant deeds, should be recorded in the county where the property is located in order to provide constructive notice of the contents thereof to subsequent purchasers and mortgagees (70-21-302). If the property is located in more than one county and the deed has been recorded in either of such counties, a certified copy of the deed can be recorded in the other county where the rest of the property is located (70-21-201). If a grant deed is not recorded, it will be valid only between the parties to it and those who have notice thereof (70-21-102). Additionally, the deed will be void against any subsequent purchaser or encumbrancer of the same real property or part thereof in good faith and for a valuable consideration whose conveyance is first duly recorded (70-21-304). A deed will take effect so as to vest the interest intended to be transferred only upon the grantor's delivery of it (70-1-508).

(Montana GD Package includes form, guidelines, and completed example)

Important: Your property must be located in Musselshell County to use these forms. Documents should be recorded at the office below.

This Grant Deed meets all recording requirements specific to Musselshell County.

Our Promise

The documents you receive here will meet, or exceed, the Musselshell County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Musselshell County Grant Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Adan S.

February 9th, 2020

Five star

Thank you!

John H.

August 1st, 2019

Great service

Thank you!

Christina H.

December 29th, 2022

I appreciate having forms available and not having to go to a business supply or attorney. This is great. However, there are two individual quit claim deed forms and I don't know which one is appropriate.

Thank you for your feedback. We really appreciate it. Have a great day!

Shantu S.

December 1st, 2022

Easy to follow directions and complete the Deed.

Thank you!

Steven H.

July 12th, 2019

Great Product!!! Used the more commonly known websites before, but never again. It was easy, great examples to follow so that I was sure and confident that I completed the document correctly. Thank You!

Thank you for your feedback. We really appreciate it. Have a great day!

heather i.

December 5th, 2022

I don't pay very close attention to what I'm doing all the time which leads to mistakes. Deeds.com was helpful in correcting my error and getting me on my way.

Thank you!

Dana R.

February 20th, 2021

This site is Awesome! So easy to use and they really work fast. I will use this for all my Maricopa County Recorder items or deeds, etc. Love this site.

Thank you for your feedback. We really appreciate it. Have a great day!

Donald S.

July 7th, 2020

Good

Thank you!

DIANA S.

August 19th, 2019

Five star rating. I requested a copy of the deed to my house and it arrived very quickly and for a fraction of the cost that it would have cost me on other sites. Great company. Will do business again. Five stars.

Thank you!

Danelle S.

November 22nd, 2019

So easy and fast that even I could do it, and I'm technologically challenged! Thank you Deeds.com for taking care of the technical stuff so I can live and play. Definitely speedy delivery!

Thank you!

JUDITH G.

April 22nd, 2022

So far, so good! I appreciate a no-hassle website.

Thank you!

chungming a.

March 30th, 2019

easy to use website.

Thank you!

James M.

July 22nd, 2023

Great selection of documents. Easy to use, with guidance material.

Thank you for taking the time to leave your feedback James. We appreciate you.

SHARON R.

September 12th, 2019

Excellent Service! Please note that form Realty Transfer Tax Statement of Value does not print completely. Part of the pages are cut off. Otherwise, excellent service.

Thank you for your feedback. We really appreciate it. Have a great day!

DUINA F.

June 17th, 2025

Fast and Easy

Thank you for your feedback. We really appreciate it. Have a great day!