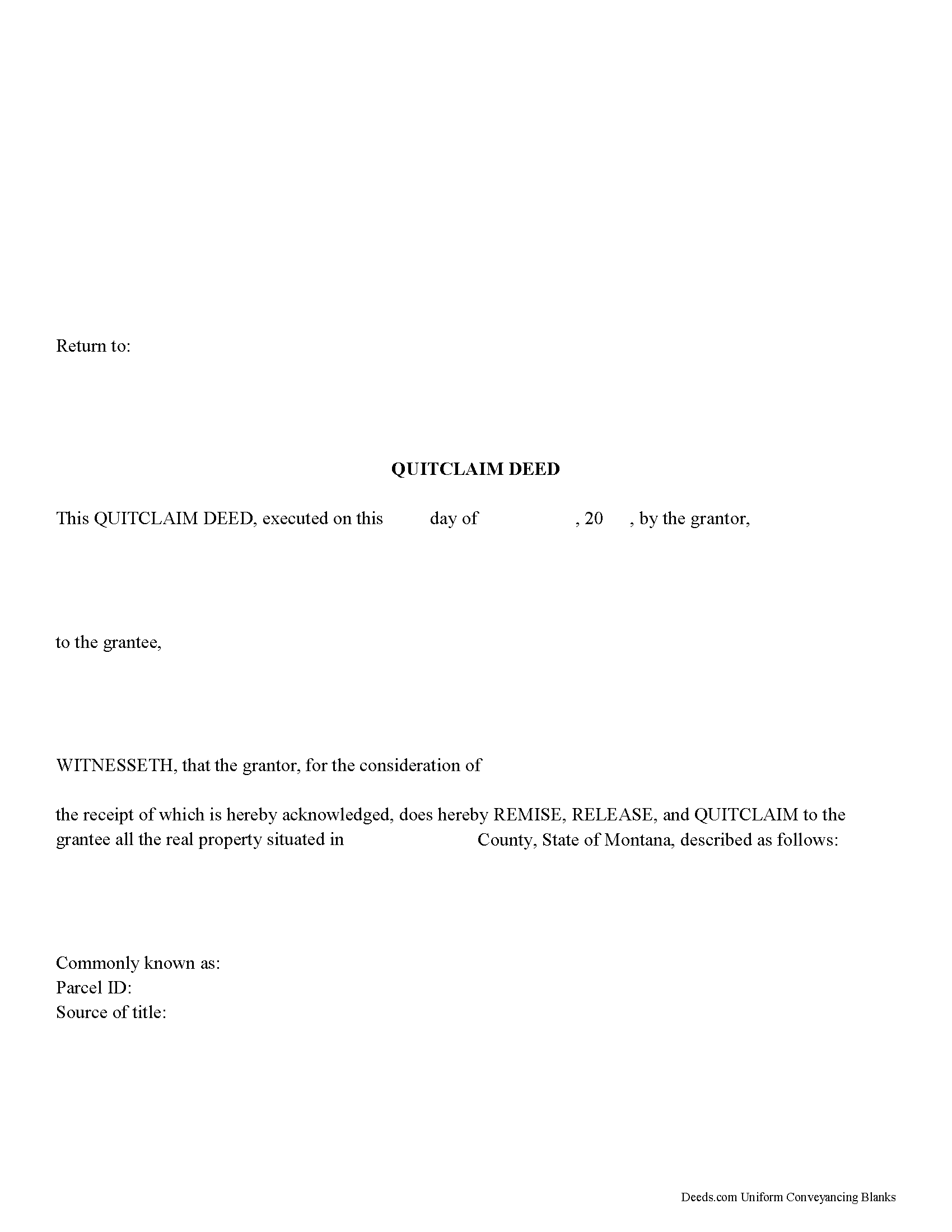

Carter County Quitclaim Deed Form

Carter County Quitclaim Deed Form

Fill in the blank Quitclaim Deed form formatted to comply with all Montana recording and content requirements.

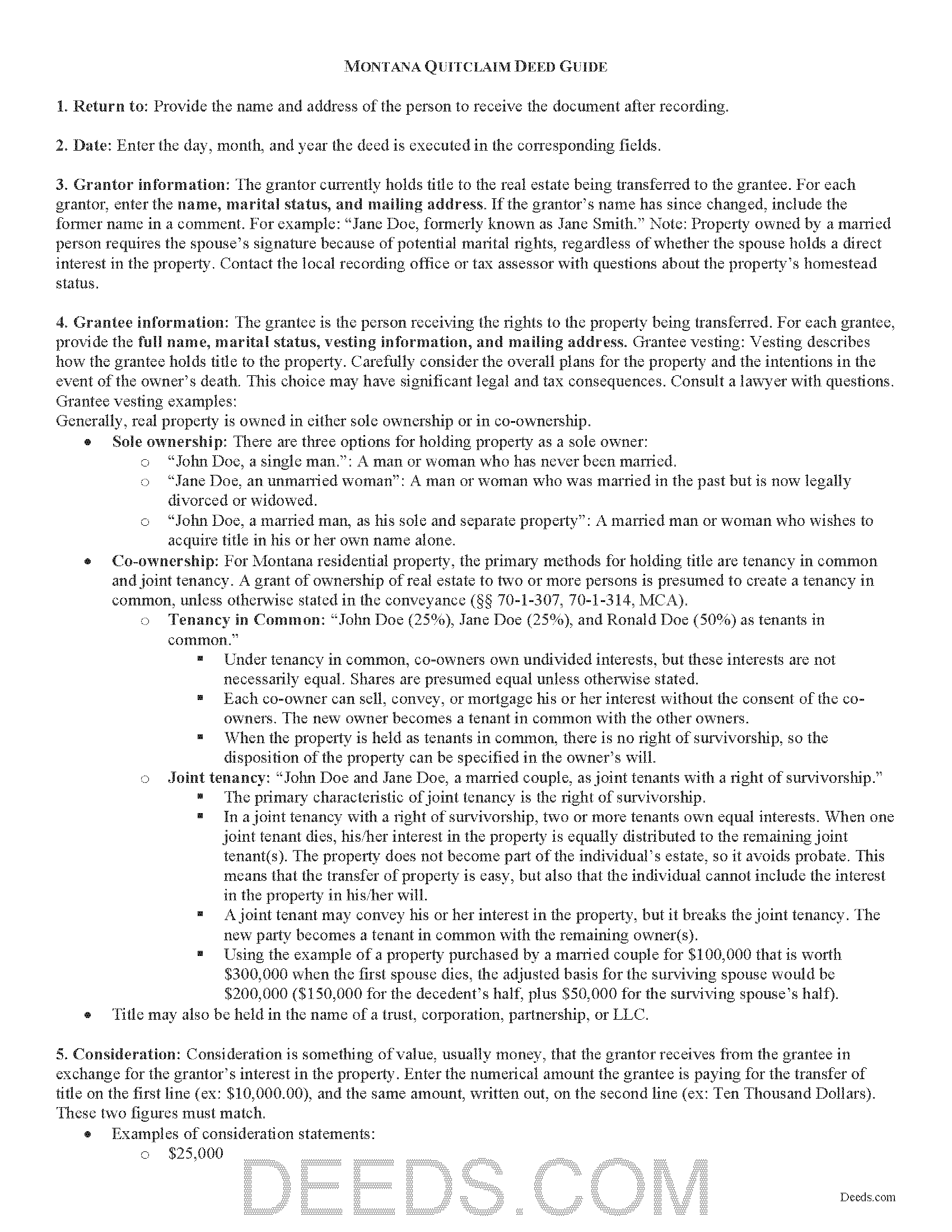

Carter County Quitclaim Deed Guide

Line by line guide explaining every blank on the Quitclaim Deed form.

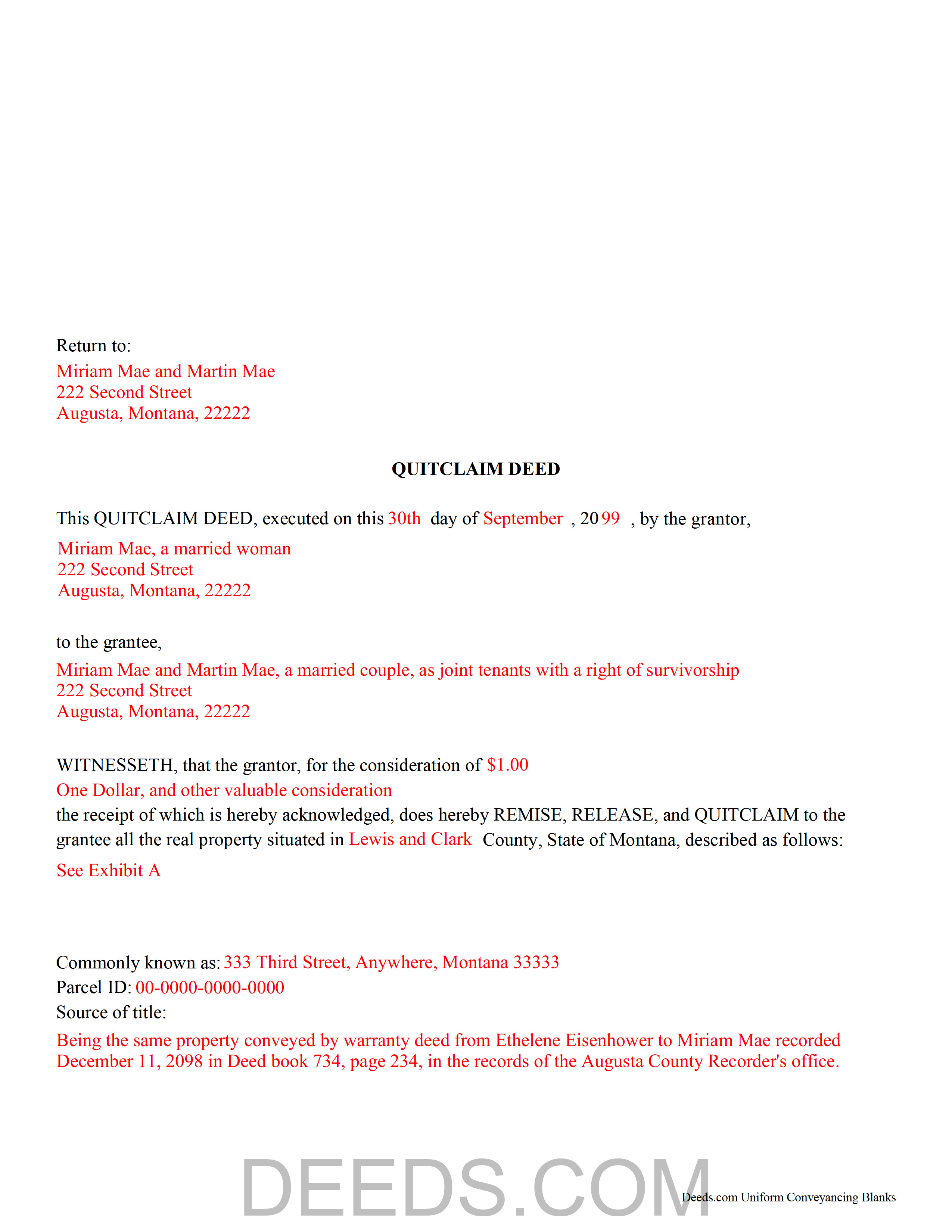

Carter County Completed Example of the Quitclaim Deed Document

Example of a properly completed Montana Quitclaim Deed document for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Montana and Carter County documents included at no extra charge:

Where to Record Your Documents

Carter County Clerk / Recorder

Ekalaka, Montana 59324

Hours: 8:00 to 12:00 & 1:00 to 5:00 Mon-Fri

Phone: (406) 775-8749

Recording Tips for Carter County:

- White-out or correction fluid may cause rejection

- Ask about their eRecording option for future transactions

- If mailing documents, use certified mail with return receipt

Cities and Jurisdictions in Carter County

Properties in any of these areas use Carter County forms:

- Alzada

- Boyes

- Capitol

- Ekalaka

- Hammond

Hours, fees, requirements, and more for Carter County

How do I get my forms?

Forms are available for immediate download after payment. The Carter County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Carter County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Carter County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Carter County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Carter County?

Recording fees in Carter County vary. Contact the recorder's office at (406) 775-8749 for current fees.

Questions answered? Let's get started!

Real property transfers are governed by Title 70 of the Montana Code of Laws. Quitclaim deeds, while valid, are not specifically defined in the statutes.

Quitclaim deeds transfer any interest in real estate the grantor may have in real estate from the grantor (seller) to the grantee (buyer) without any warranty of title. When using a quitclaim deed, there may be potential unknown claims or restrictions on the title, and the buyer accepts the risk, effectively taking the title as-is.

These deeds are frequently used in instances such as a divorce, with one spouse signing all of his or her rights in a piece of real property over to the other spouse; when there is uncertainty about the history of the property's title, and it is necessary to clear extant claims on the title; or when a current owner or buyer wishes another party with interest in the property to disclaim that interest.

A lawful quitclaim deed includes the names and addresses of each grantor and grantee and a complete legal description of the property. Include the preparer's name, address, and signature as well (7-4-2618, 7-4-2636, MCA). Besides these requirements, the form must meet all state and local standards for recorded documents.

All recorded documents or documents affecting a change in property ownership must contain information on how the property will be vested. For Montana residential property, the primary methods for holding title are tenancy in common and joint tenancy. A grant of ownership of real estate to two or more persons is presumed to create a tenancy in common, unless otherwise stated in the conveyance (70-1-307, 70-1-314, MCA).

Include all relevant documents, affidavits, forms, and fees along with the deed for recording. Any party transferring real property is required to file a Realty Transfer Certificate. File the form with the County Clerk and Recorder. Montana law requires this form be completed and may impose up to a $500 penalty for failure to file (15-7-304--310, MCA).

A quitclaim deed must be signed by the grantor and acknowledged before a notarial officer before it is submitted for recordation in the county where the property is located (70-21-203, MCA). Recording a quitclaim deed provides constructive notice to all subsequent mortgagees and purchasers (70-21-302, MCA). Submit all deeds to the local Clerk and Recorder's office of the county in which the property conveyed is located.

This article is provided for informational purposes only and is not a substitute for legal advice. Contact a lawyer with questions about quitclaim deeds or any other issues related to the transfer of real property in Montana.

(Montana QD Package includes form, guidelines, and completed example)

Important: Your property must be located in Carter County to use these forms. Documents should be recorded at the office below.

This Quitclaim Deed meets all recording requirements specific to Carter County.

Our Promise

The documents you receive here will meet, or exceed, the Carter County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Carter County Quitclaim Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4574 Reviews )

Charles B.

April 5th, 2020

KVH really went above and beyond to help me try to find what I needed.

Thank you for your feedback. We really appreciate it. Have a great day!

randy j.

December 15th, 2018

the deed format and fill-in language are very specific to one type of easement and are not generally applicable to any other type; in other words it is not useful in a majority of situations and i would recommend against purchase unless you are creating an easement for an appurtenant landowner ONLY

Thank you for your feedback. We really appreciate it. Have a great day!

John G.

March 25th, 2020

Very straightforward ordering process to obtain the forms I needed. Thank you.

Thank you!

David O.

March 19th, 2022

Service was top-notch....fast, accurate, cost-effective.

Thank you!

Tom L.

April 18th, 2019

An excellent service that I would be happy to use again.

Thank you for your feedback. We really appreciate it. Have a great day!

Lesley B.

May 6th, 2022

It was so quick and easy to access.. Thank you!!

Thank you for your feedback. We really appreciate it. Have a great day!

Shane T.

March 7th, 2020

The Transfer on Death Deed form package was very good. But like anything, could use some improvements. There is not enough space to fill more than one beneficiary with any level of additional detail like "as his sole and separate property" The area for the legal description could be a bit bigger and potentially fit many legal descriptions. Or it could be made to simply say "See Exhibit A" as is likely necessary for most anyway. The guide should indicate what "homestead property" means so the user doesn't have to research the legal definition. (which turns out to be obvious, at least in my state, if you live there, it's your homestead.) It would be helpful if an "Affidavit of Death" form were included in the package for instances where the current deed hasn't been updated to reflect a widowed owner as the sole owner before recording with only the one signature.

Thank you for your feedback. We really appreciate it. Have a great day!

Walter P.

March 24th, 2022

Good forms for deep prep.A lot of detail needed to complete the deed.

Thank you for your feedback. We really appreciate it. Have a great day!

oscar r.

December 17th, 2021

VERY MUCH HELPFUL SAVED ME 600 on not having to hire attorney

Thank you!

Walton A.

February 3rd, 2022

Thanks ..this was very helpful and easy!

Thank you!

Jubal T.

November 27th, 2024

This is the most comprehensive, helpful real estate tool I have seen. I was at first worried because the 330# didn’t have live operators but I received messages in my account as quickly as a conversation had by text and was able to download a deed and record it the same day in a county 1,300 miles away. Highly recommended!

We are sincerely grateful for your feedback and are committed to providing the highest quality service. Thank you for your trust in us.

Gene L.

August 5th, 2020

Worked perfect. Thanks.

Thank you!

Jerry K G.

August 23rd, 2022

I got what I asked for, almost instantly.

Thank you!

Lorrie P.

January 8th, 2021

What a wonderful and easy task using deeds.com. I searched on line for the proper procedure to file a quit claim deed. It looked to confusing to do mysellf until I found deeds.com. With their instructions, I was able to fill out all the proper forms and file with the court in two days. Saved me at least a thousand dollars if I had an attorney do the same. Thank you. I will definitely use them again.

Thank you for your feedback. We really appreciate it. Have a great day!

Donna C.

June 24th, 2021

I was very impressed with the system. Easy to navigate. Took less than 15 minutes to get what I needed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!