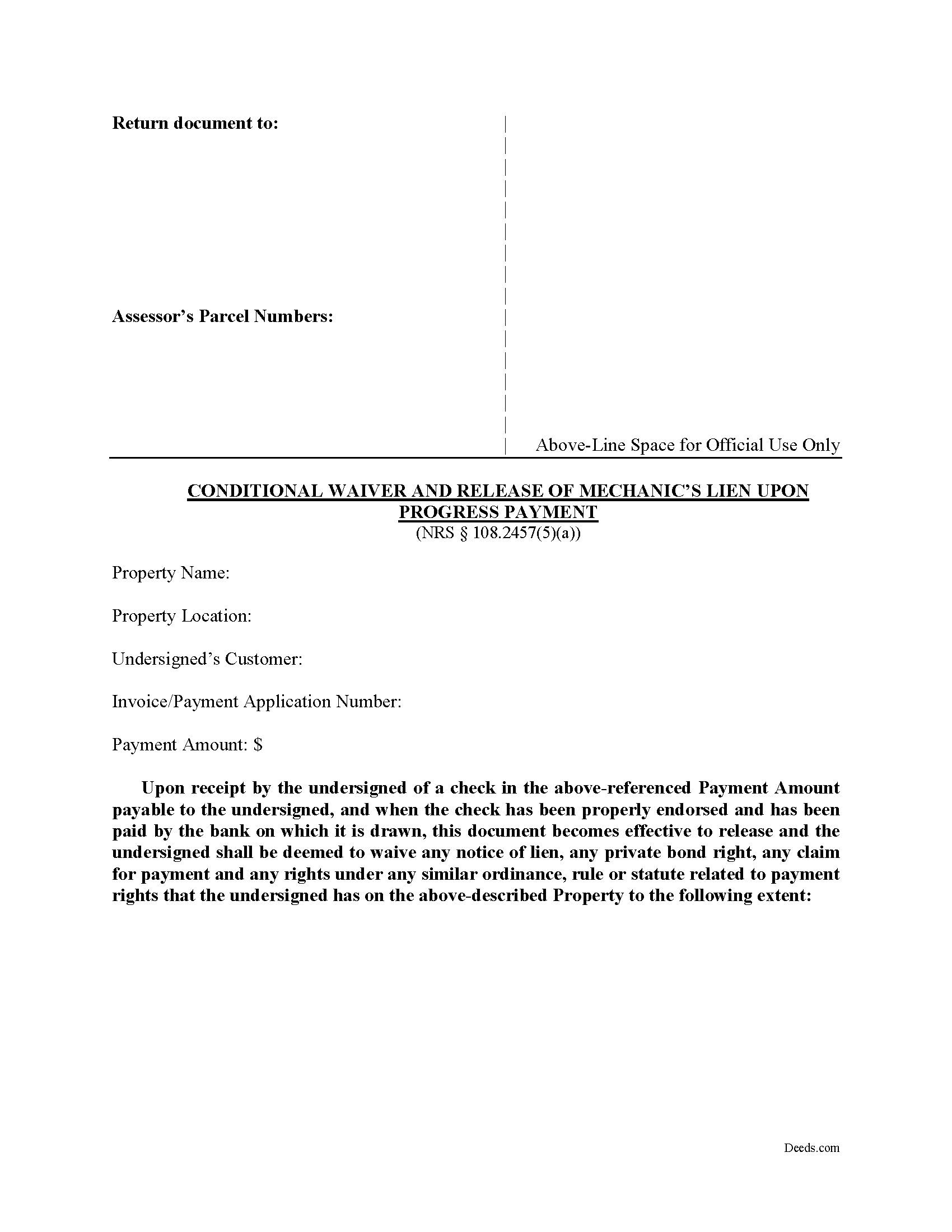

Storey County Conditional Waiver upon Progress Form

Storey County Conditional Waiver upon Progress Form

Fill in the blank Conditional Waiver upon Progress form formatted to comply with all Nevada recording and content requirements.

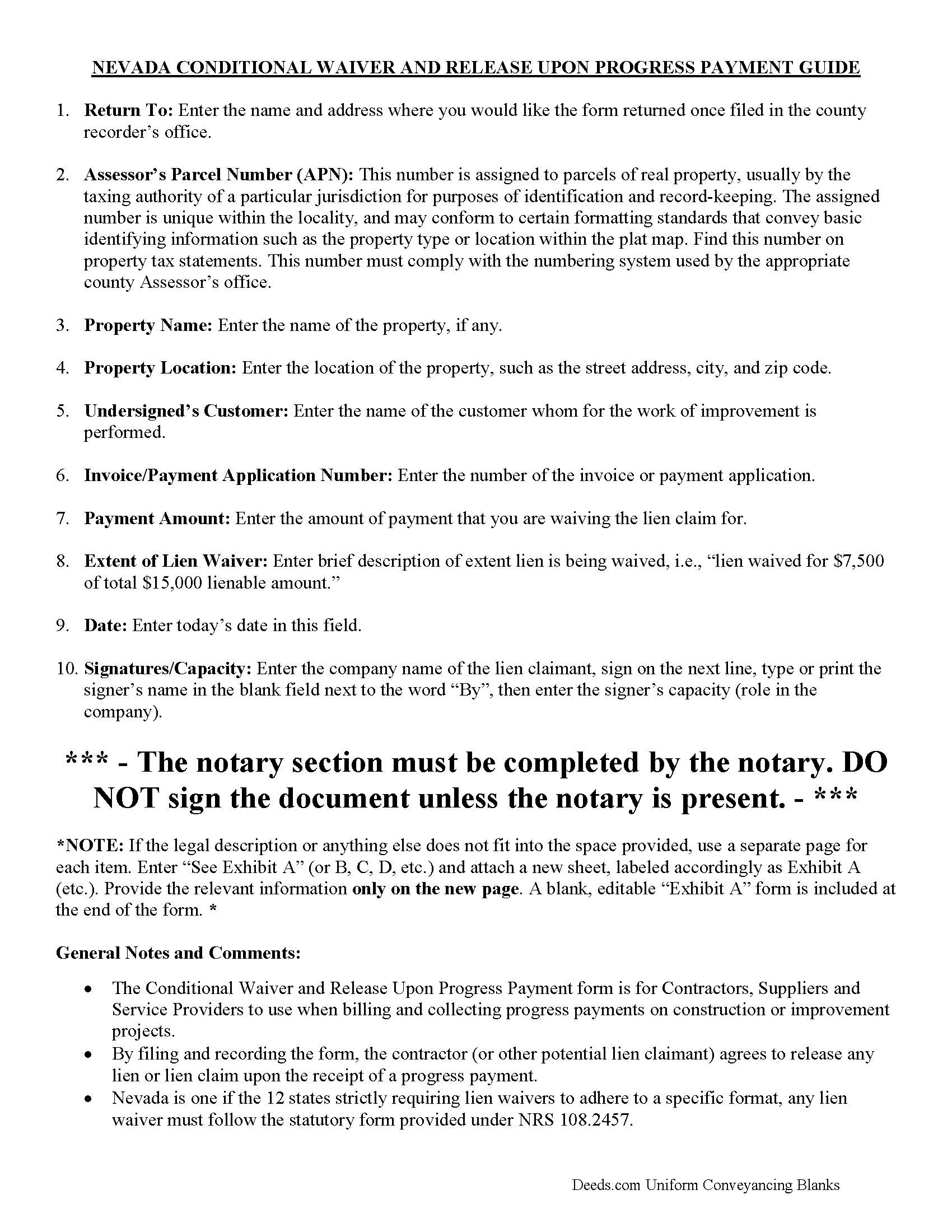

Storey County Conditional Waiver upon Progress Guide

Line by line guide explaining every blank on the form.

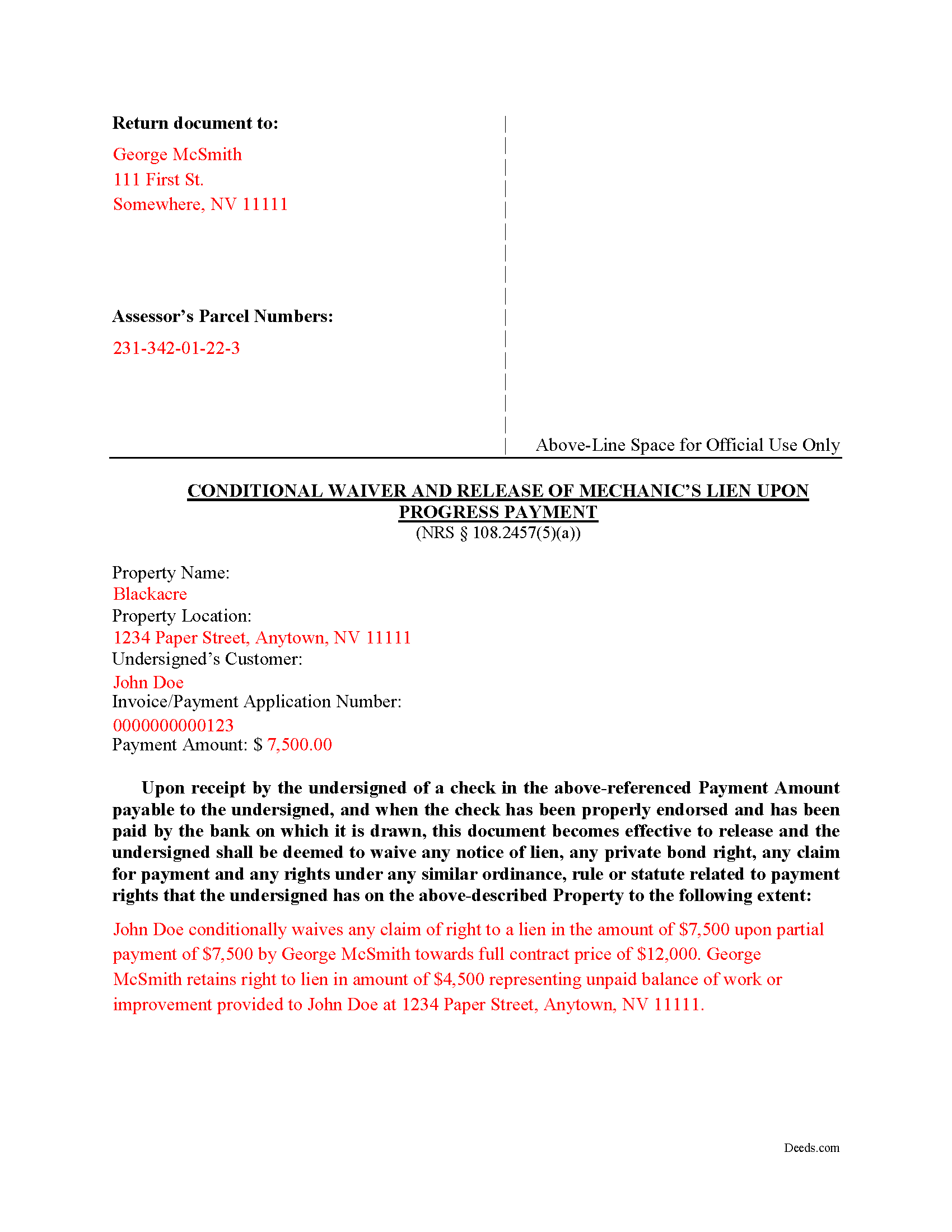

Storey County Completed Example of the Conditional Waiver upon Progress Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Nevada and Storey County documents included at no extra charge:

Where to Record Your Documents

Storey County Recorder

Virginia City, Nevada 89440

Hours: 8:00am-5:00pm M-F

Phone: (775) 847-0967

Recording Tips for Storey County:

- Ensure all signatures are in blue or black ink

- Ask if they accept credit cards - many offices are cash/check only

- Avoid the last business day of the month when possible

Cities and Jurisdictions in Storey County

Properties in any of these areas use Storey County forms:

- Virginia City

Hours, fees, requirements, and more for Storey County

How do I get my forms?

Forms are available for immediate download after payment. The Storey County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Storey County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Storey County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Storey County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Storey County?

Recording fees in Storey County vary. Contact the recorder's office at (775) 847-0967 for current fees.

Questions answered? Let's get started!

Nevada Conditional Waiver and Release upon Progress Payment

Provided under NRS 108.2457(5)(a), this waiver offers the most protection for lien claimants, because it states that if the claimant(s) have actually been paid to date (including no returned or stopped payment checks) the waiver serves as effective proof against any lien claim on the property. The lien is "conditioned" on receiving payment and is only waived if the claimant actually receives the payment.

By filing the form, the lien claimant represents that he or she either has already paid or will use the money he or she receives from this progress payment in order to make prompt payment in full all his or her laborers, subcontractors, materialmen and suppliers for all work, materials or equipment that are the subject of this waiver and release.

Getting a lien waiver also allows property owners to shield the title to their property from the general contractor, material supplier and every subcontractor involved with a project. By releasing the lien upon a progress payment, the property owner once again has clear title and can obtain financing or sell the property.

The property owner should require lien and labor waivers to be submitted with the contractor's invoices and no payment of any invoice should be made unless properly signed lien and labor waivers are provided. Proper lien waivers can protect the property owner from liens filed by the contractor's subcontractors, suppliers and laborers who might record a lien if they are not paid by the contractor.

Each case is unique, so contact an attorney with specific questions or for complex situations.

Important: Your property must be located in Storey County to use these forms. Documents should be recorded at the office below.

This Conditional Waiver upon Progress meets all recording requirements specific to Storey County.

Our Promise

The documents you receive here will meet, or exceed, the Storey County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Storey County Conditional Waiver upon Progress form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Kenny H.

January 14th, 2020

The forms are extremely helpful. They could use some updating. Promissory note "...in the form of cash, check or money order." is a bit outdated. My note is with my son and we have an automatic bank transfer set up for payments. He could Venmo me. There are many other options and likely to be more changes in the future, so I know this is difficult to maintain.

Thank you for your feedback. We really appreciate it. Have a great day!

LIDIA M.

February 3rd, 2021

excellent

Thank you!

Anthony F.

April 7th, 2020

quick, easy and simple. Also thank you for having the e-submission area particularly with the Covid-19 /Shelter in place things happening.

Thank you for your feedback. We really appreciate it. Have a great day!

constance t.

December 30th, 2019

Excellent service!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Mitchell S.

April 25th, 2024

This service was very helpful, quick, inexpensive and easy to use. Should I ever need it again, I know right where to go.

We are sincerely grateful for your feedback and are committed to providing the highest quality service. Thank you for your trust in us.

Susan N.

August 28th, 2022

Easy to use.

Thank you!

Donna F.

March 4th, 2019

Straight forward easy to understand completing my document. The guide readily explained filing all portions of the document.

Thank you Donna, we appreciate your feedback.

Laurie R.

August 31st, 2022

FIVE STARS !!! Clear instructions Easy to navigate Thanks for making this easy for those of us who are not tech savvy

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Martha B.

January 11th, 2019

Not too hard to do, I did get it checked out by an attorney after I completed it just to be safe. He said it was fine, made no changes.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Terry M.

January 8th, 2020

Very responsive. I was notified very quickly if the deed I was looking for was available.

Thank you!

Michael S.

July 11th, 2019

So far, I'm happy with my experience. I'm still reviewing the guide for the docs I downloaded. Including the guide for the docs is indeed a plus.

Thank you Michael, we really appreciate your feedback.

Kevin P.

March 19th, 2023

Just what my parents and I have been looking for to do a Quit Deed to transfer property into my name.

Thank you!

Elizabeth B.

November 22nd, 2020

Very efficient

Thank you!

Jackie C.

April 10th, 2022

It was easy to access the documents for a minimal fee.

Thank you for your feedback. We really appreciate it. Have a great day!

Katherine N.

May 22nd, 2019

Very easy to understand and complete.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!