Esmeralda County Discharge of Lien Form (Nevada)

All Esmeralda County specific forms and documents listed below are included in your immediate download package:

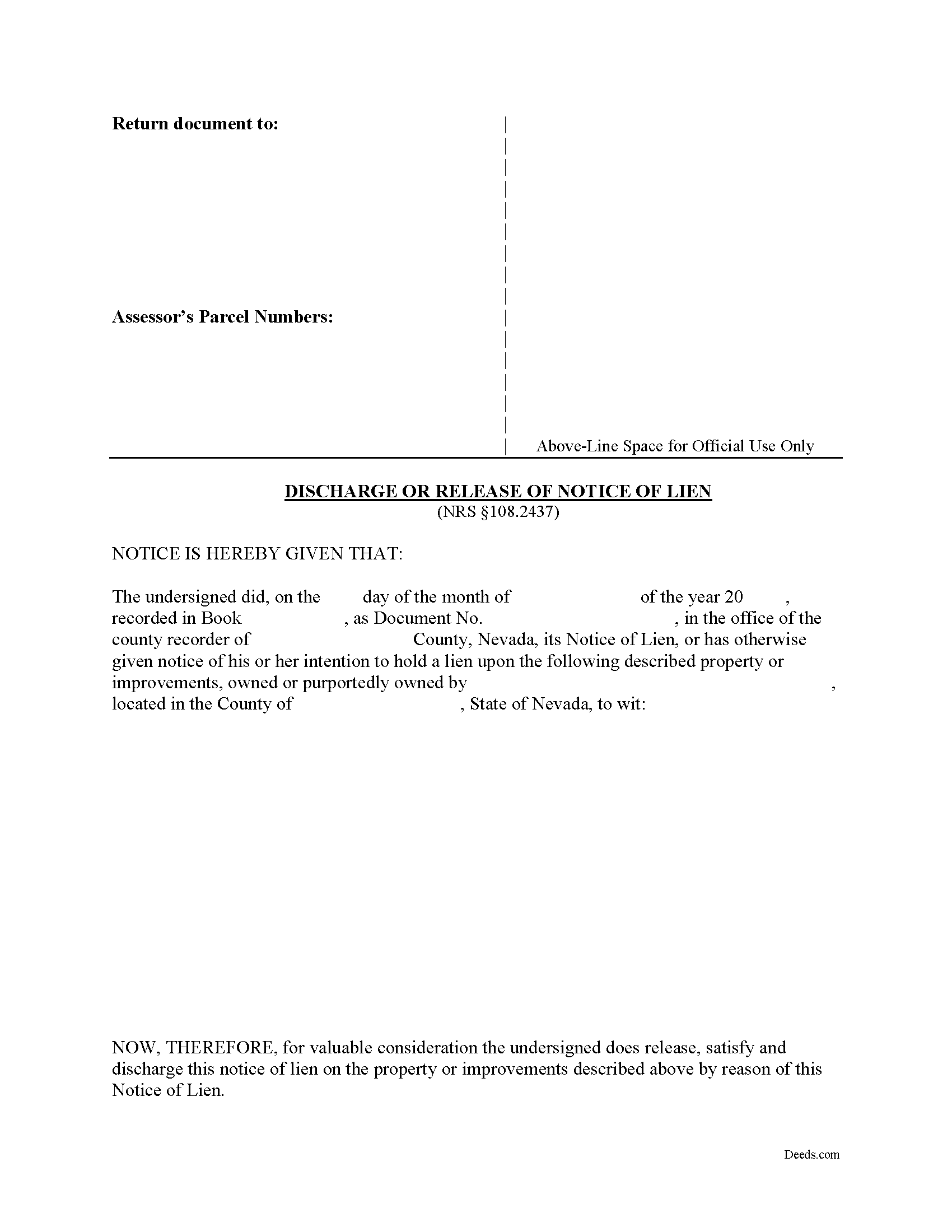

Discharge of Lien Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Esmeralda County compliant document last validated/updated 5/19/2025

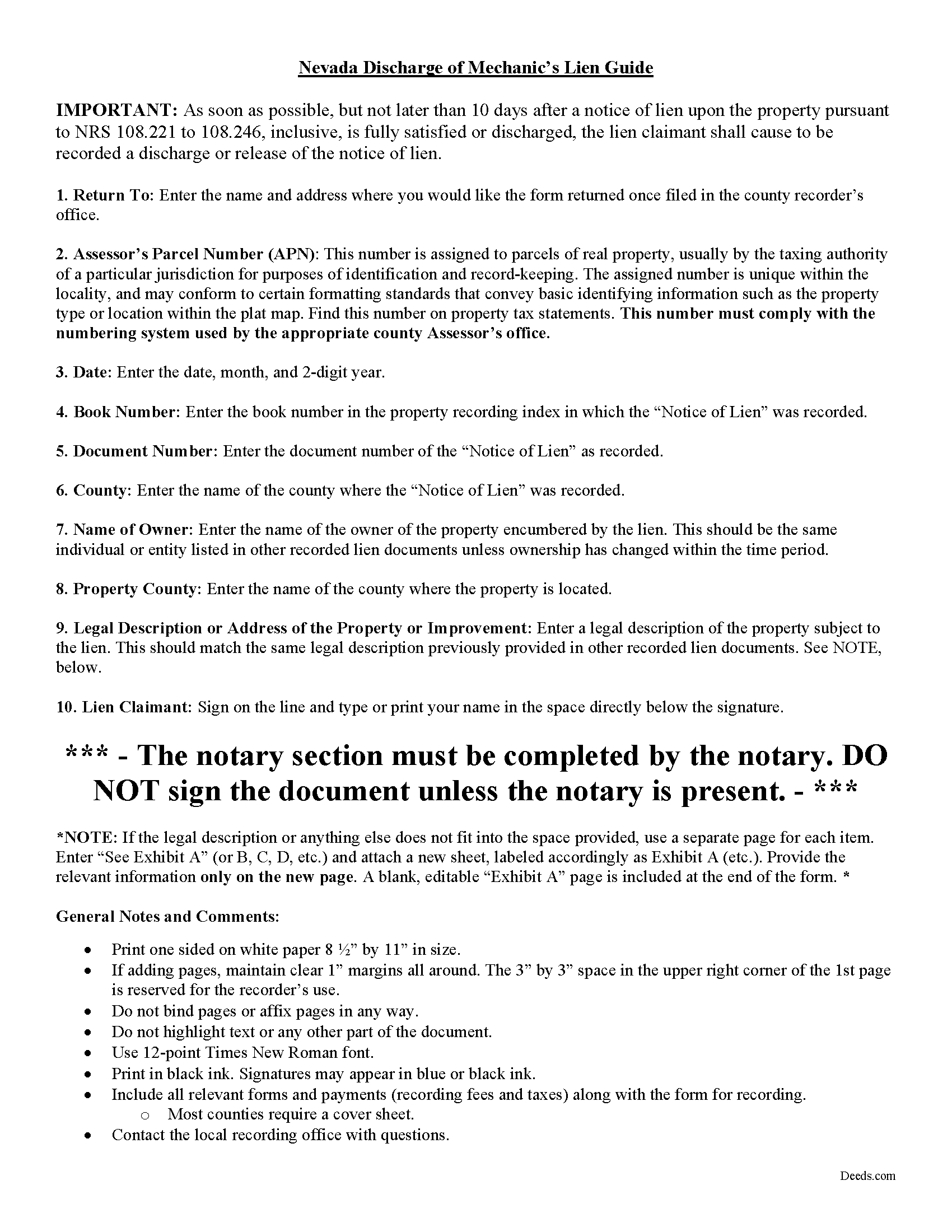

Discharge of Lien Guide

Line by line guide explaining every blank on the form.

Included Esmeralda County compliant document last validated/updated 6/18/2025

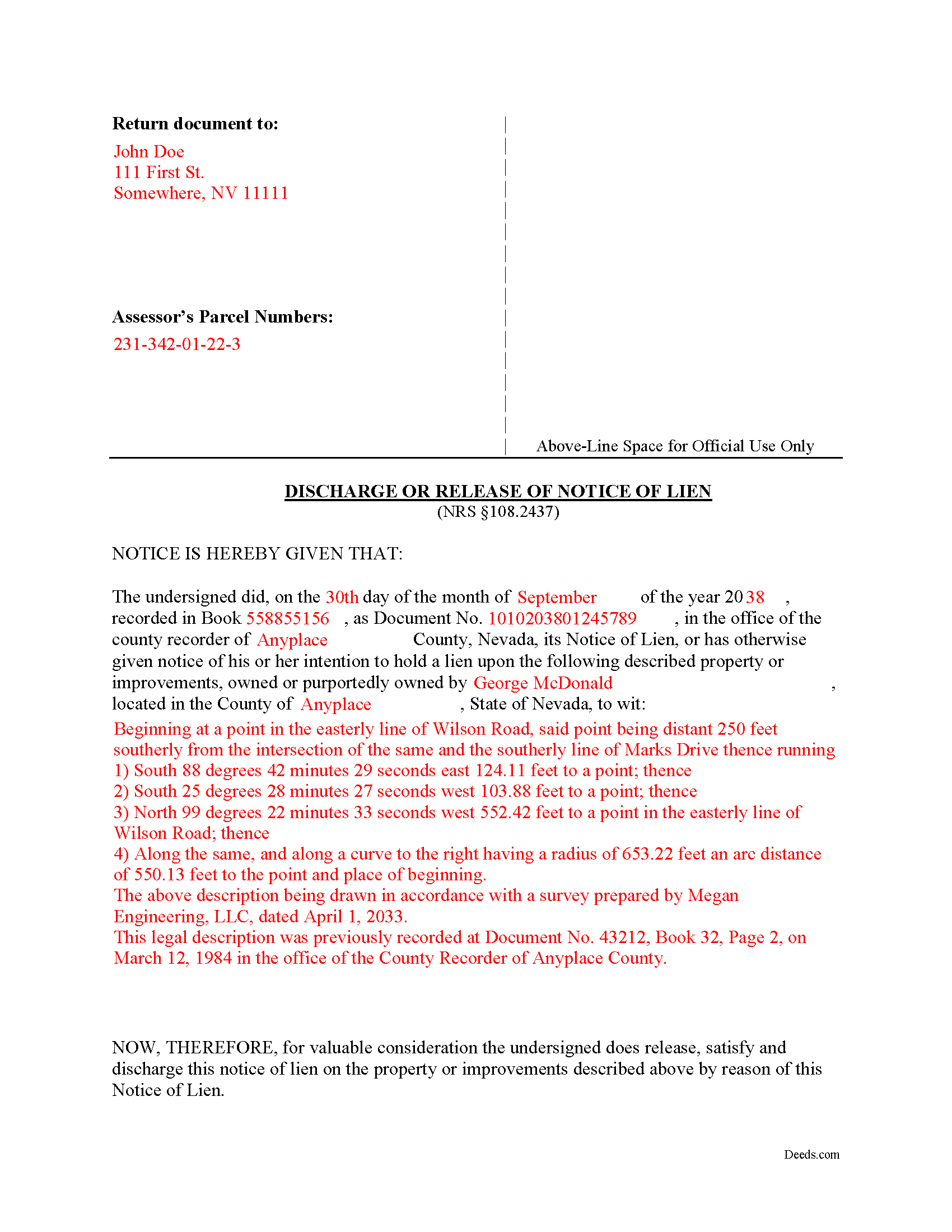

Completed Example of the Discharge of Lien Document

Example of a properly completed form for reference.

Included Esmeralda County compliant document last validated/updated 4/24/2025

The following Nevada and Esmeralda County supplemental forms are included as a courtesy with your order:

When using these Discharge of Lien forms, the subject real estate must be physically located in Esmeralda County. The executed documents should then be recorded in the following office:

Esmeralda County Auditor/Recorder

233 Crook Ave / PO Box 458, Goldfield, Nevada 89013

Hours: 8:00am to 12:00 and 1:00 to 5:00pm

Phone: (775) 485-6337

Local jurisdictions located in Esmeralda County include:

- Dyer

- Goldfield

- Silverpeak

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Esmeralda County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Esmeralda County using our eRecording service.

Are these forms guaranteed to be recordable in Esmeralda County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Esmeralda County including margin requirements, content requirements, font and font size requirements.

Can the Discharge of Lien forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Esmeralda County that you need to transfer you would only need to order our forms once for all of your properties in Esmeralda County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Nevada or Esmeralda County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Esmeralda County Discharge of Lien forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Discharging a Lien in Nevada

So at this point you've filed your mechanic's lien against a client's property after the client never paid the invoice for a completed project. Now the client has finally paid off the lien or maybe you've come to some agreement with the client to accept a lesser amount. You're free to forget about the ordeal and move on to prepare for your next job, right?

Not quite; Nevada lien law requires you to perform one additional step of filing a notice of discharge to provide public notice that you are no longer claiming a lien against the title. It is essential to properly file and record this notice because you can face potential consequences by skipping this step. By this time, you've already complied with statutory lien law to the letter in order to obtain your lien, so don't be sloppy now.

The discharge of lien form gives notice to the owner, other lien claimants, and anyone else with a potential interest in the subject property that the lien has been paid in full or has otherwise terminated. If you obtained a mechanic's lien and the debtor or other person responsible for the lien pays the debt or you discharge the lien for any other reason, you must file a discharge of lien notice. As soon as possible, but not later than 10 days after a notice of lien upon the property (pursuant to NRS 108.221 to 108.246) is fully satisfied or discharged, the lien claimant must record a discharge or release of the notice of lien drafted in substantial compliance as required by Nevada lien law. Serve the discharge notice on the owner personally or by certified mail.

Failure to file this notice in time exposes you to potential liability in a civil action (pursuant to NRS 108.2437). Because a lien is a burden on the property (and the owner) and can discourage or prevent a sale, transfer, or refinancing, neglecting to discharge the lien can cause the owner damages, thus entitling her to a legal remedy. For instance, you may be liable for the costs of a lost sale or damages caused by a lender's refusal to extend credit due to the mechanic's lien on the collateral property. Even if the failure to discharge the lien did not cause any actual damages, Nevada lien law allows for a statutory penalty award of $100 to the owner. The owner or heirs are also entitled to reasonable attorney's fee and the costs of bringing the action. Again, it is essential to properly discharge any lien recorded against a property once the underlying debt has been satisfied or discharged for any other reason.

Each case is unique, so contact an attorney with specific questions or for complex situations.

Our Promise

The documents you receive here will meet, or exceed, the Esmeralda County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Esmeralda County Discharge of Lien form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4562 Reviews )

MARY LACEY M.

June 30th, 2025

Great service! Recording was smooth and swiftly performed. Deeds.com is an excellent service.rn

We are delighted to have been of service. Thank you for the positive review!

Robert F.

June 30th, 2025

Breeze.... It feels silly to hire an attorney to do this for just one beneficiary. Thanks.

Thank you for your feedback. We really appreciate it. Have a great day!

Pauline C.

June 29th, 2025

Everything that was stated to be included in my order was complete. Very satisfied

Thank you for your positive words! We’re thrilled to hear about your experience.

Thomas G.

December 16th, 2019

fast and easy

Thank you!

Melody P.

November 10th, 2021

Great service, as always!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Benjamin B.

November 10th, 2022

Your software was beneficial; facilitating preparation of a legal document and cover page in a state where I had limited legal experience.

Thank you for your feedback. We really appreciate it. Have a great day!

Angela S.

April 29th, 2021

Very easy process and efficient. Made my job easier.

Thank you for your feedback. We really appreciate it. Have a great day!

Larry F.

April 1st, 2020

Your site is useful but limited in scope. I could not find exactly what I was looking for and felt that paying when I wasn't sure was going to be extremely frustrating.

Thank you for your feedback. We really appreciate it. Have a great day!

Rick R.

February 5th, 2021

So far excellent service - I made a boo boo on the deed - no problem they made the change before they sent it off to be recorded. I will never drive to the Recorder's office again.

Thank you!

Pamela L.

June 18th, 2023

Well this could not have been any easier for me! Deeds made this whole process very efficient, and simple. I will definitely be a return customer when needed. Thank You!

Thank you Pamela, we appreciate you!

Jesse K.

October 30th, 2020

Very simple to use website for remote recording of documents. I will definately use this platform for future recordings.

Thank you for your feedback. We really appreciate it. Have a great day!

Andrew B.

January 3rd, 2022

Very easy to use and I appreciate the fees being charged after the submission.

Thank you!

Carolyn G.

January 15th, 2023

This information was extremely helpful and needed. The price is so worth it also.

Thank you!

Raj J.

December 2nd, 2020

Perfect, thanks

Thank you!

Jacinto A.

April 22nd, 2019

The forms are exactly what was needed. But wish I was able to click on the preview form to make sure it was the correct forms

Thank you for your feedback Jacinto.