Sussex County Bargain and Sale Deed Condominium Form (New Jersey)

All Sussex County specific forms and documents listed below are included in your immediate download package:

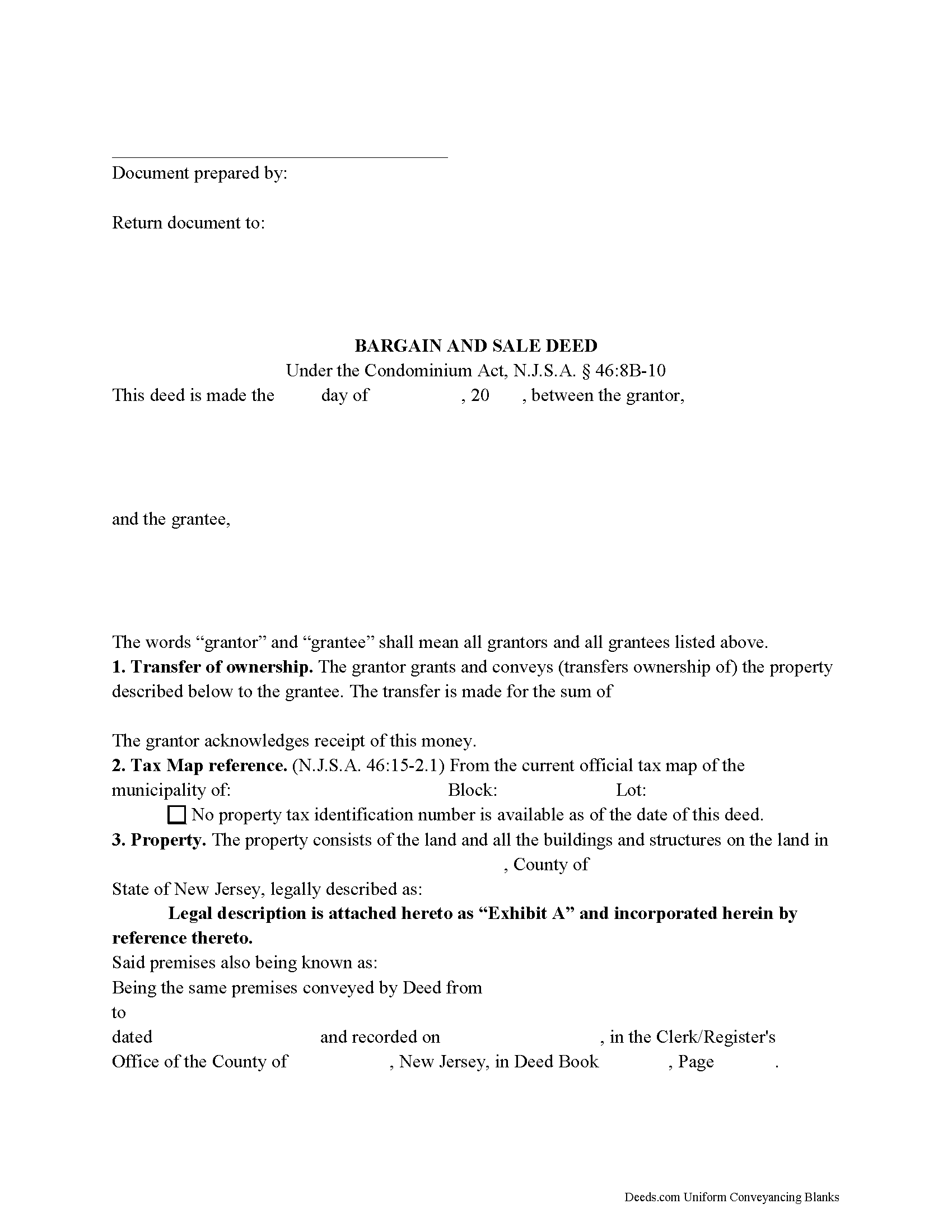

Bargain and Sale Deed Condominium Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Sussex County compliant document last validated/updated 2/28/2025

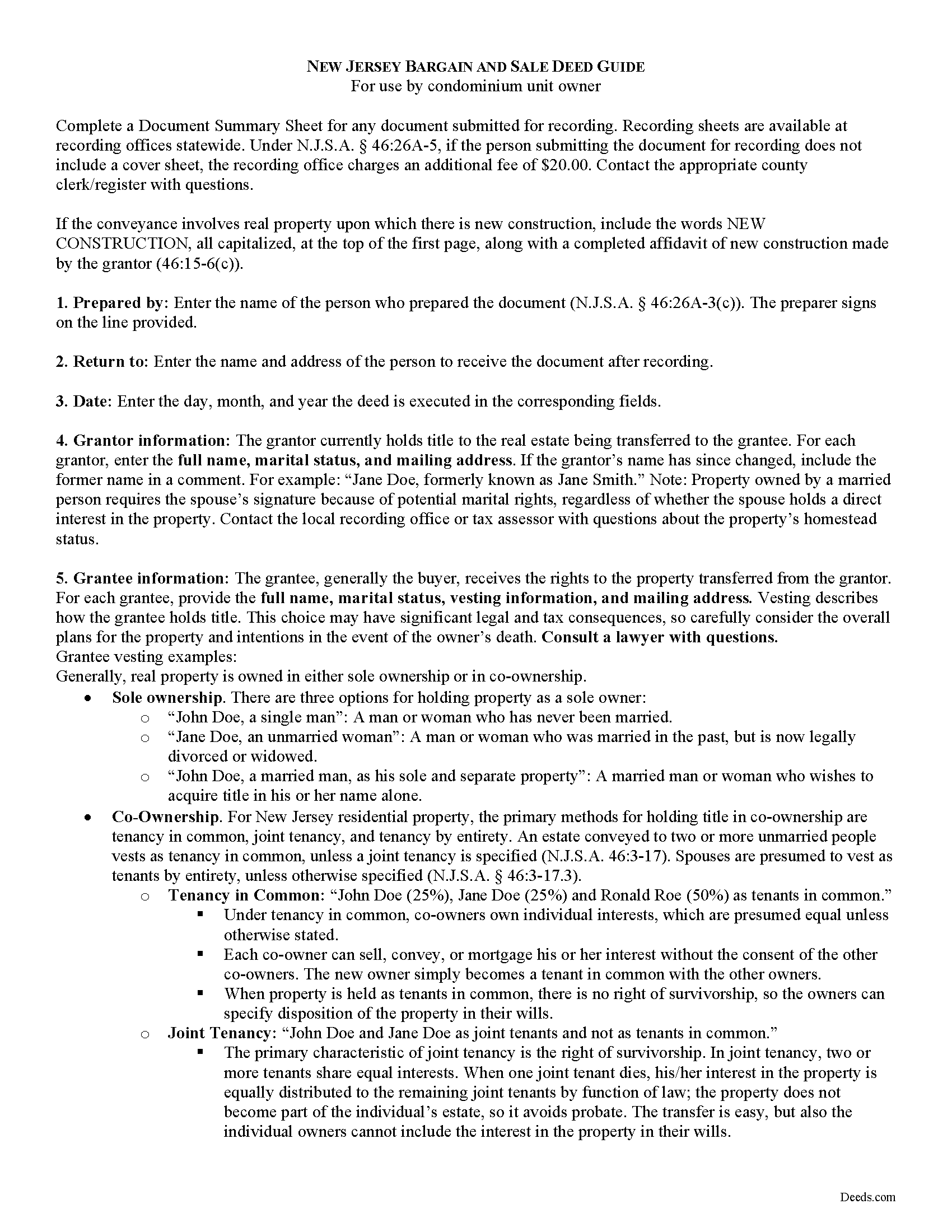

Bargain and Sale Deed Guide

Line by line guide explaining every blank on the form.

Included Sussex County compliant document last validated/updated 7/2/2025

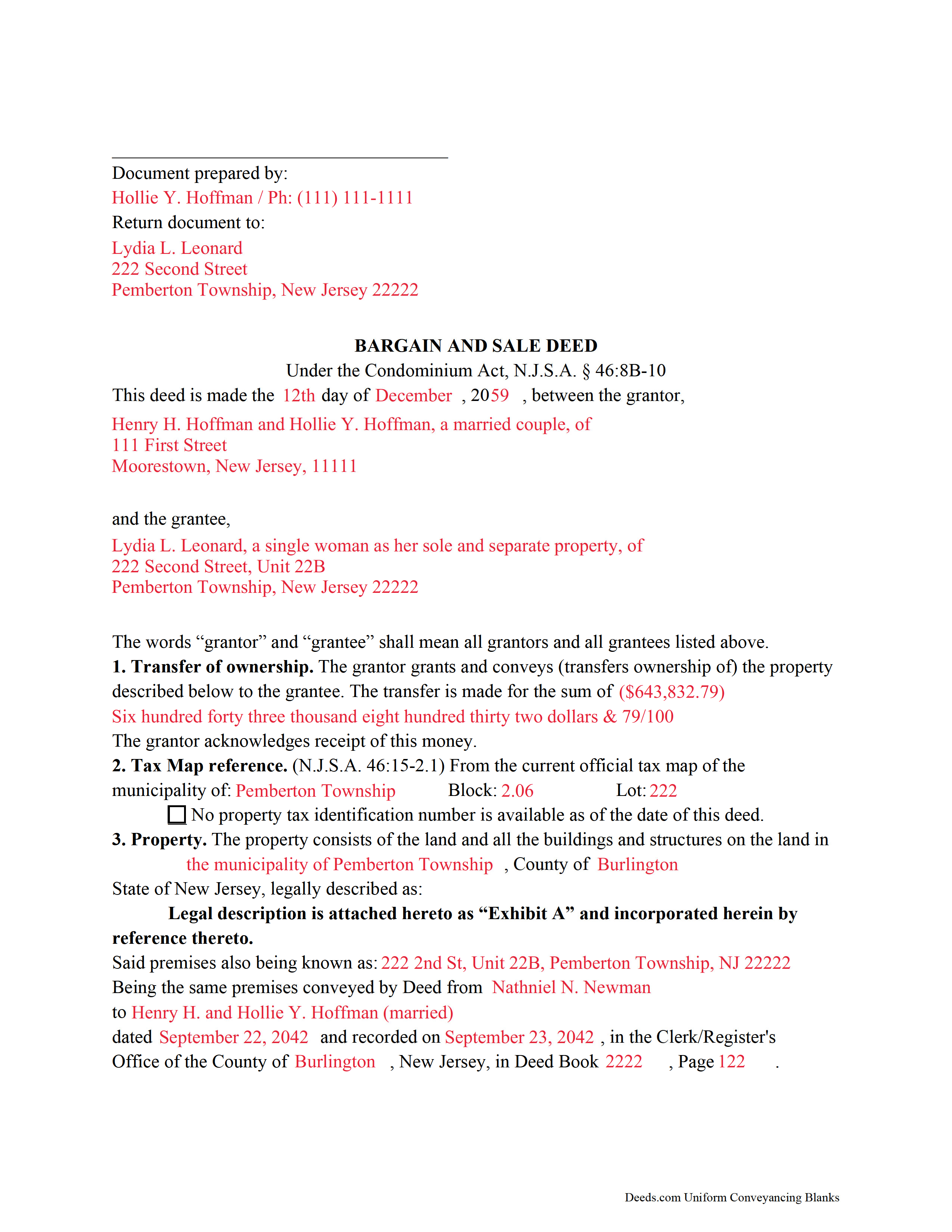

Completed Example of the Bargain and Sale Condominium Deed Document

Example of a properly completed form for reference.

Included Sussex County compliant document last validated/updated 6/18/2025

The following New Jersey and Sussex County supplemental forms are included as a courtesy with your order:

When using these Bargain and Sale Deed Condominium forms, the subject real estate must be physically located in Sussex County. The executed documents should then be recorded in the following office:

Sussex County Clerk

Hall of Records - Cochran House Bldg - 83 Spring St, Suite 304, Newton, New Jersey 07860

Hours: 8:00 to 4:00 M-F / first Monday of month until 6:00

Phone: (973) 579-0900

Local jurisdictions located in Sussex County include:

- Andover

- Augusta

- Branchville

- Franklin

- Glasser

- Glenwood

- Greendell

- Hamburg

- Highland Lakes

- Hopatcong

- Lafayette

- Layton

- Mc Afee

- Middleville

- Montague

- Newton

- Ogdensburg

- Sparta

- Stanhope

- Stillwater

- Stockholm

- Sussex

- Swartswood

- Tranquility

- Vernon

- Wallpack Center

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Sussex County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Sussex County using our eRecording service.

Are these forms guaranteed to be recordable in Sussex County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Sussex County including margin requirements, content requirements, font and font size requirements.

Can the Bargain and Sale Deed Condominium forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Sussex County that you need to transfer you would only need to order our forms once for all of your properties in Sussex County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by New Jersey or Sussex County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Sussex County Bargain and Sale Deed Condominium forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

New Jersey's Condominium Act is codified under 46:8B of the New Jersey Statutes.

A condominium is a form of ownership, established by a master deed, "providing for ownership by one or more owners" in units, together with an undivided interest in the common elements appurtenant to each unit (N.J.S.A. 46:8B-3(h)). Common elements are those described in the master deed, which are "necessary or convenient to the existence, management, operation, maintenance and safety of the condominium property or normally in common use," such as hallways, lobbies, stairways, elevators, central utilities, gardens, or any such improvement intended for common use (46:8B-3(d)).

Units are part of a condominium property intended for independent use, having a direct exit to a public street or way or to a common element or common elements leading to a public street or way, together with their proportionate undivided interest in the common elements (46:8B-3(o)). Unit owners hold title to units in fee simple (46:8B-3(q)).

A unit deed is a conveyance of a unit in recordable form (46:8B-3(p)). The content requirements are established at N.J.S.A. 46:8B-10. All unit deeds require the name of the condominium as it appears in the master deed; the subdivision and county, with reference to book, page, and recording office where the master deed is on record; the unit designation as it appears in the master deed; a reference to the last prior unit deed conveying the unit, if the unit has been previously conveyed; and, finally, must reflect the proportionate undivided interest in the common elements appurtenant to the unit, as set forth in the master deed and any amendments to it. Appurtenances are rights which are attached to the unit and pass with the unit upon its sale, and to which one or more unit owners have an exclusive use, such as a balcony attached to the unit, a parking space, a storage unit, etc.

The most common form of conveyance in New Jersey is a bargain and sale deed with a covenant as to grantor's acts (46:4-6). The instrument may appear in the short form for a deed, codified at 46:4-1. By including the words, "that he has done no act to encumber the said lands," the grantor covenants that he has not done or executed any act or deed to change, charge, alter, affect, defeat, or encumber the title to the property.

The deed identifies the grantor's (selling party) information; grantee's (buying party) information, including how the grantee intends to hold title to the property; the consideration made for the transfer; and the parcel's tax map reference under 46:15-2.1.

The legal description for a unit deed contains specific information pertaining to the unit, the condominium, the appurtenances attached to the unit, and recording information for the master deed, including any amendments made to it.

Pursuant to 46:15-6(a), the deed requires a statement of the true consideration for the transfer, either in the body of the deed, the acknowledgment, the proof of the execution, or an appended affidavit by one of the parties to the deed, or the party's legal representative. Deeds exempt from the transfer fee imposed by 46:15-7 require an affidavit stating the basis for the exemption (46:15-6(b)).

Apart from meeting content requirements, the deed must conform to statutory and local formatting standards for recording.

Deeds must be signed by each grantor and acknowledged or proved as provided by Title 46 of the New Jersey Statutes. Property owned by a married person requires the spouse's signature because of potential marital rights, regardless of whether the spouse holds a direct interest in the property.

Record the deed in the clerk/recorder's office of the county where the real property is situated. Recorded deeds provide notice to subsequent purchasers (46:26A-12(a)). Include any required supplemental documentation with the deed (documentary summary sheet, relevant affidavits, certificates, etc.), along with transfer and recording fees. Deeds pertaining to an interest in real property to which an age restriction applies must be accompanied by the required certificate pursuant to 46:15-6.2.

This article is intended for general informational purposes only and does not address specific situations or replace legal advice. Consult a lawyer with questions about unit deeds, bargain and sale deeds, and transfers of real estate in New Jersey.

(New Jersey BSDC Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Sussex County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Sussex County Bargain and Sale Deed Condominium form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4562 Reviews )

MARY LACEY M.

June 30th, 2025

Great service! Recording was smooth and swiftly performed. Deeds.com is an excellent service.rn

We are delighted to have been of service. Thank you for the positive review!

Robert F.

June 30th, 2025

Breeze.... It feels silly to hire an attorney to do this for just one beneficiary. Thanks.

Thank you for your feedback. We really appreciate it. Have a great day!

Pauline C.

June 29th, 2025

Everything that was stated to be included in my order was complete. Very satisfied

Thank you for your positive words! We’re thrilled to hear about your experience.

Barbara K.

October 13th, 2022

Very impressive...Thank you

Thank you for your feedback. We really appreciate it. Have a great day!

Debby P.

April 2nd, 2020

First time user and the service was great.. I typically go to recording kiosk at the libraries. This was fast and easy.. I appreciate the great service

Thank you for your feedback. We really appreciate it. Have a great day!

A. S.

February 27th, 2019

First, I am glad that you gave a blank copy, an example copy, and a 'guide'. It made it much easier to do. Overall I was very happy with your products and organization... however, things got pretty confusing and I have a pretty 'serious' law background in Real Estate and Civil law. With that said, I spent about 10+ hours getting my work done, using the Deed of Trust and Promissory note from you and there were a few problems: First, it would be FANTASTIC if you actually aligned your guide to actually match the Deed or Promissory Note. What I mean is that if the Deed says 'section (E)' then your guide shouldn't be 'randomly' numbered as 1,2,3, for advice/instructions, but should EXACTLY match 'section (E)'. Some places you have to 'hunt' for what you are looking for, and if you did it based on my suggestion, you wouldn't need to 'hunt' and it would avoid confusion. 2nd: This one really 'hurt'... you had something called the 'Deed of Trust Master Form' yet you had basically no information on what it was or how to use it. The only information you had was a small section at the top of the 'Short Form Deed of Trust Guide'. Holy Cow, was that 'section' super confusing. I still don't know if I did it correctly, but your guide says only put a return address on it and leave the rest of the 16 or so page Deed of Trust beneath it blank... and then include your 'Deed of Trust' (I had to assume the short form deed that I had just created) as part of it. I had to assume that I had to print off the entire 17 page or so title page and blank deed. I also had to assume that the promissory note was supposed to be EXHIBIT A or B on the Short Form Deed. It would be great if someone would take a serious look at that short section in your 'Short Form Deed of Trust Guide' and realize that those of us using your products are seriously turning this into a county clerk to file and that most of us, probably already have a property that has an existing Deed... or at least can find one in the county records if necessary... and make sure that you make a distinction between the Deed for the property that already exists, versus the Deed of Trust and Promissory note that we are trying to file. Thanks.

Thank you for your feedback. We'll have staff review the document for clarity. Have a great day!

Michael H.

January 8th, 2021

Very straightforward website. Helpful in getting county specific documents.

Thank you!

barbara m.

March 16th, 2021

deeds.com is the most efficient, easy to use site for legal forms I've found! Thank You

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

HEATHER M.

September 27th, 2024

The guide I needed was very easy to understand and the template was easy to complete. I had a property attorney review the deed before I had it registered and she was impressed. She said she couldn't have written it better herself! Definitely worth the money instead of paying high dollar attorney fees for a simple task.

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Cecilia G.

July 24th, 2023

This site is so easy to use. It is so convenient to have access to forms for all states. I’d recommend this site to anyone who needs to create any real estate documents.

Thank you for your feedback. We really appreciate it. Have a great day!

Kimberly H.

April 24th, 2020

Very convenient, easy to use, and fast! I highly recommend Deeds.com!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jill A.

March 26th, 2021

Finding current forms in one place helps simplify the process. Thank you.

Thank you!

Barbara J.

October 7th, 2023

Process was simple and fast. Awaiting response form agency. I’m happy to have found deeds.com for a speedy service.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Angela M.

November 14th, 2024

Great communication and always on timely manner unless issue appears with the document.rnI like their customer service, very helpful and assisting when necessary.

We are sincerely grateful for your feedback and are committed to providing the highest quality service. Thank you for your trust in us.

MARIO D S.

March 7th, 2020

Well worth the $20.00 for the Transfer on Death Deed, if you are willing to do the leg work to notarize and record the deed. Money well spent and money well saved. The value is in the short, bullet type instructions and State specific forms and requirements.

Thank you!