Cape May County Mortgage Secured and Promissory Note Form (New Jersey)

All Cape May County specific forms and documents listed below are included in your immediate download package:

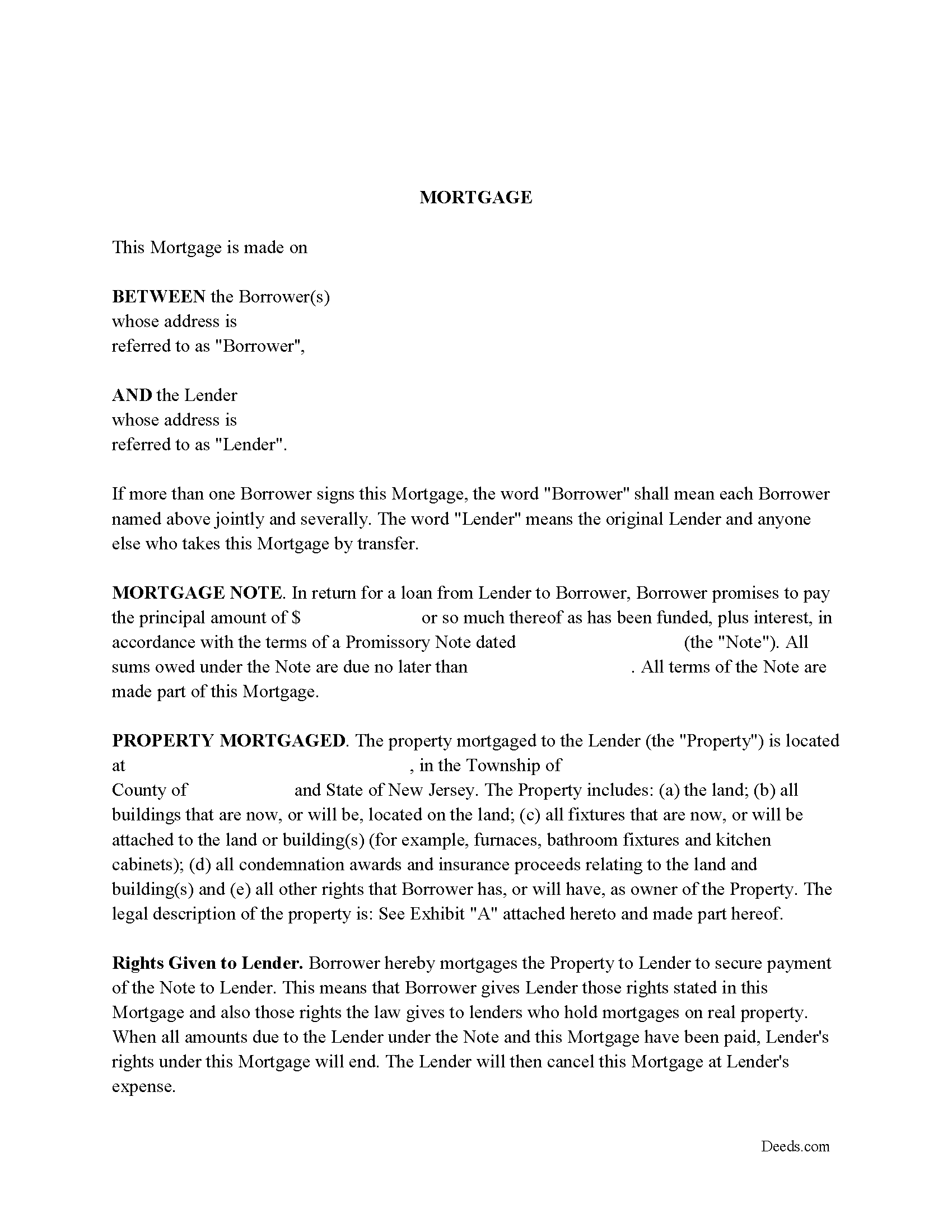

Mortgage Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Cape May County compliant document last validated/updated 5/7/2025

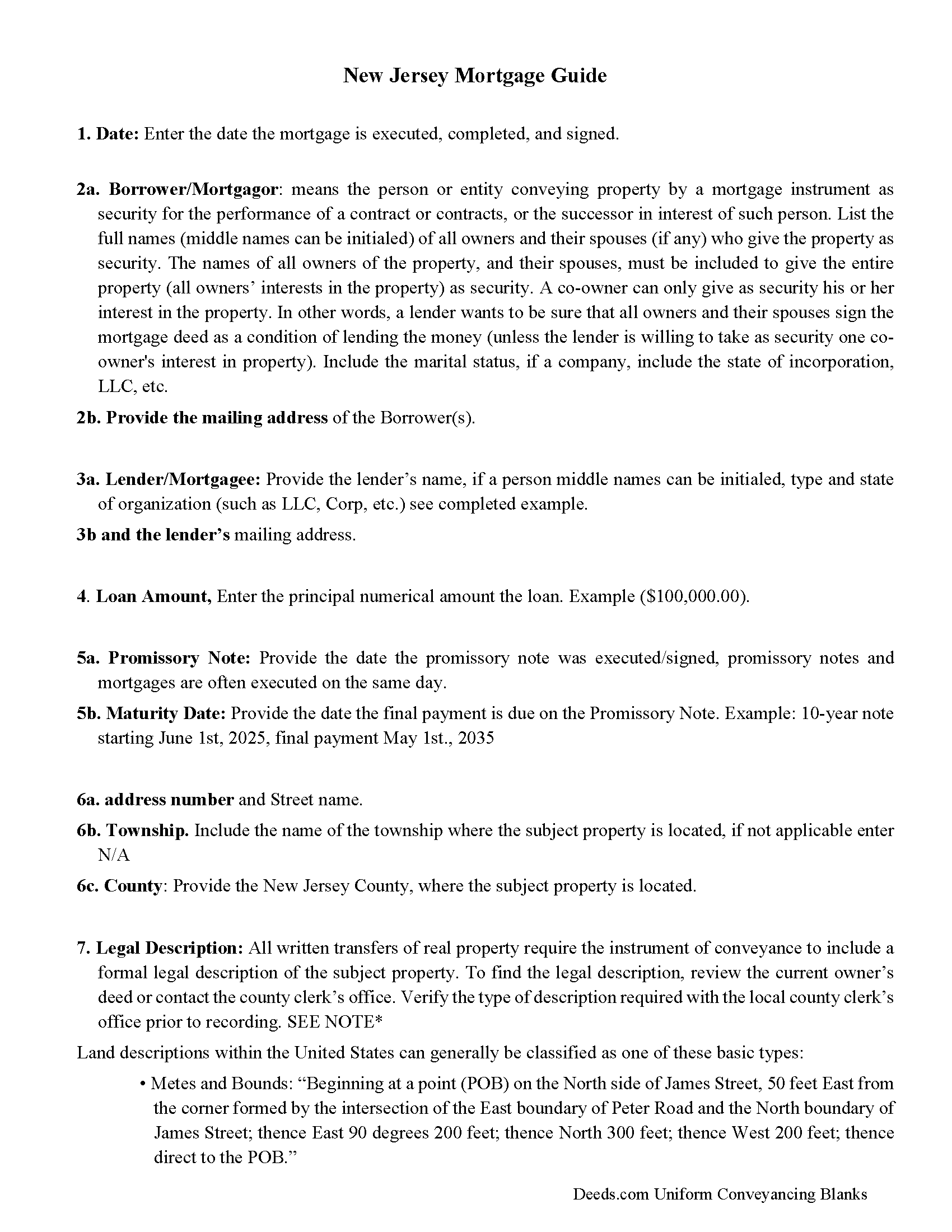

Mortgage Guidelines

Line by line guide explaining every blank on the form.

Included Cape May County compliant document last validated/updated 6/19/2025

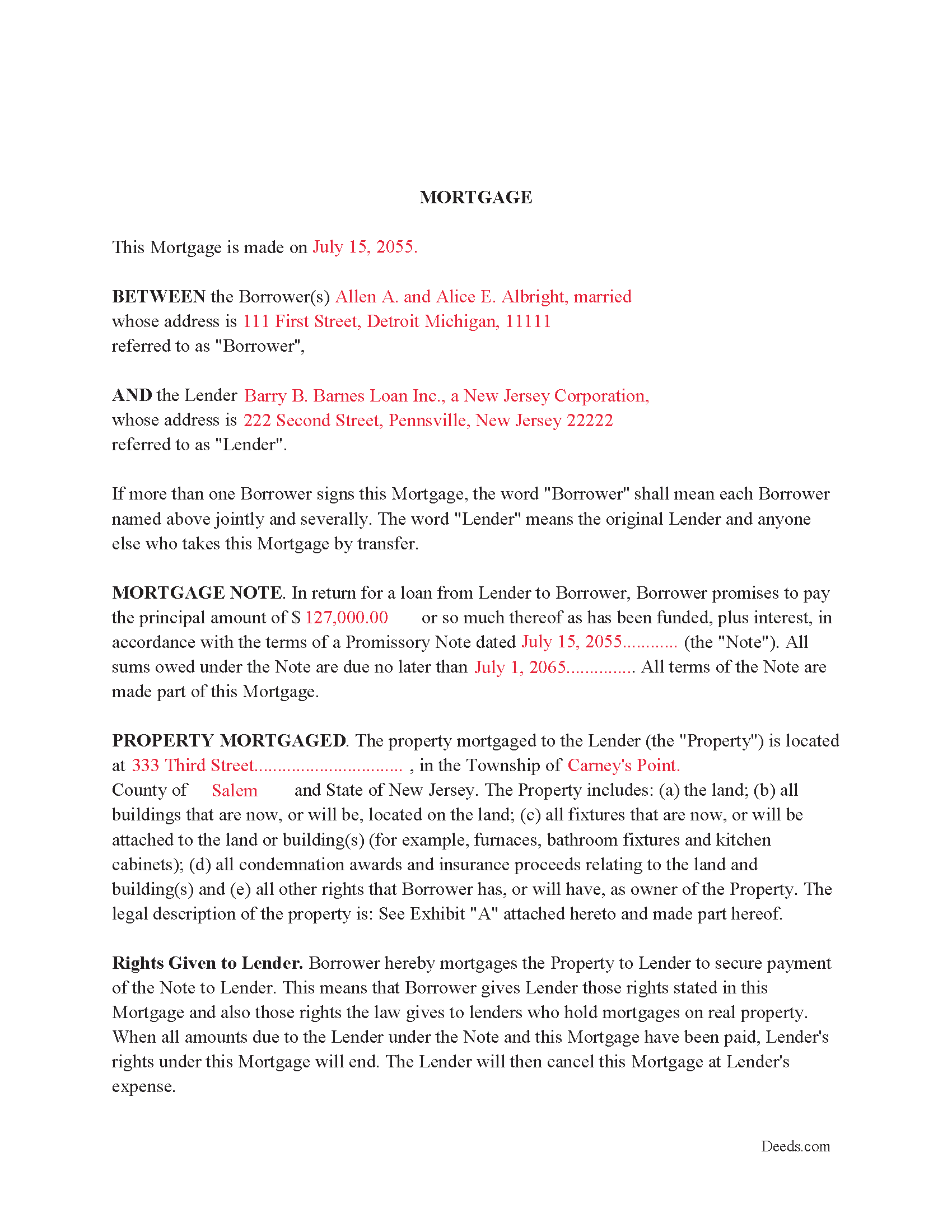

Completed Example of the Morgage Document

Example of a properly completed form for reference.

Included Cape May County compliant document last validated/updated 3/25/2025

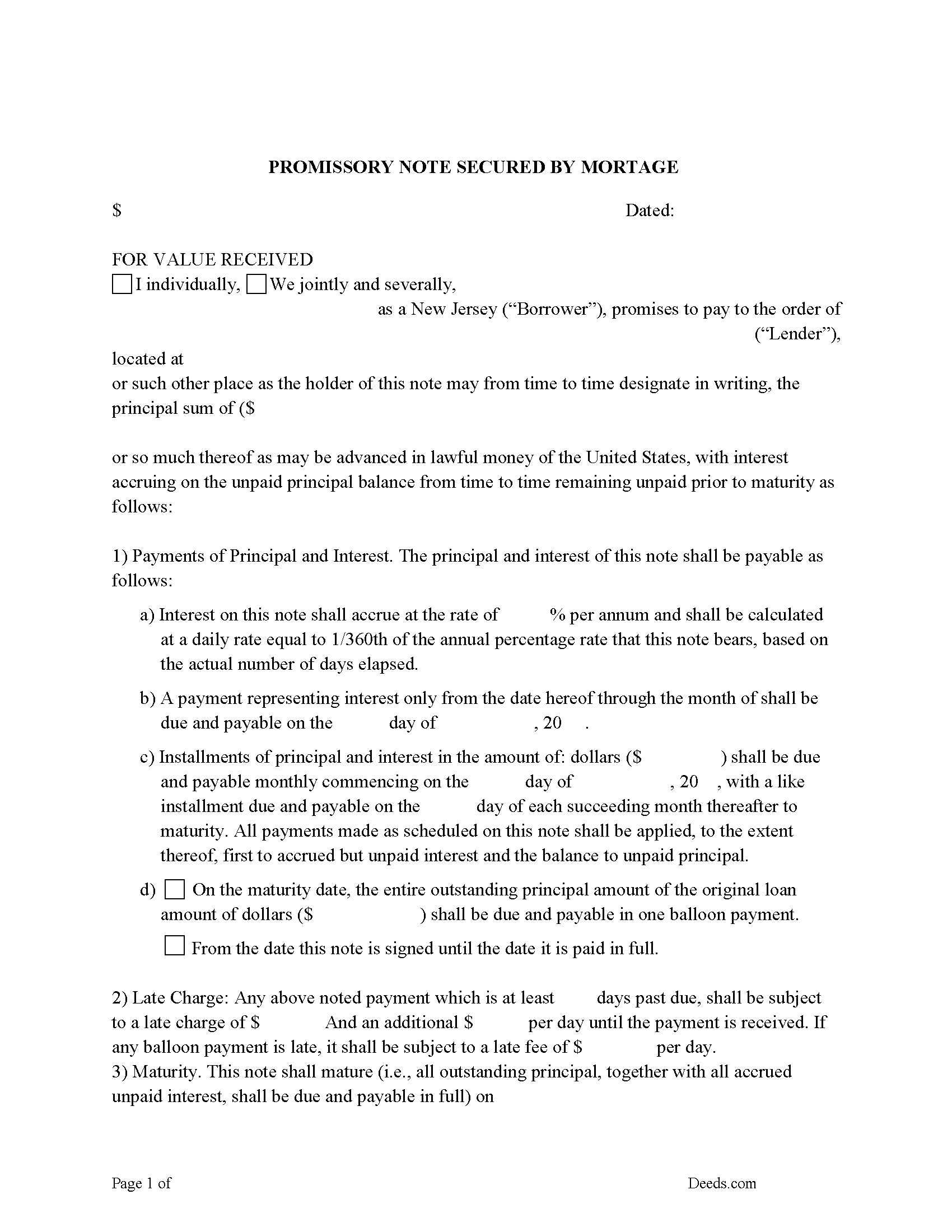

Promissory Note Form

Can be used for traditional installment or balloon payment.

Included Cape May County compliant document last validated/updated 6/2/2025

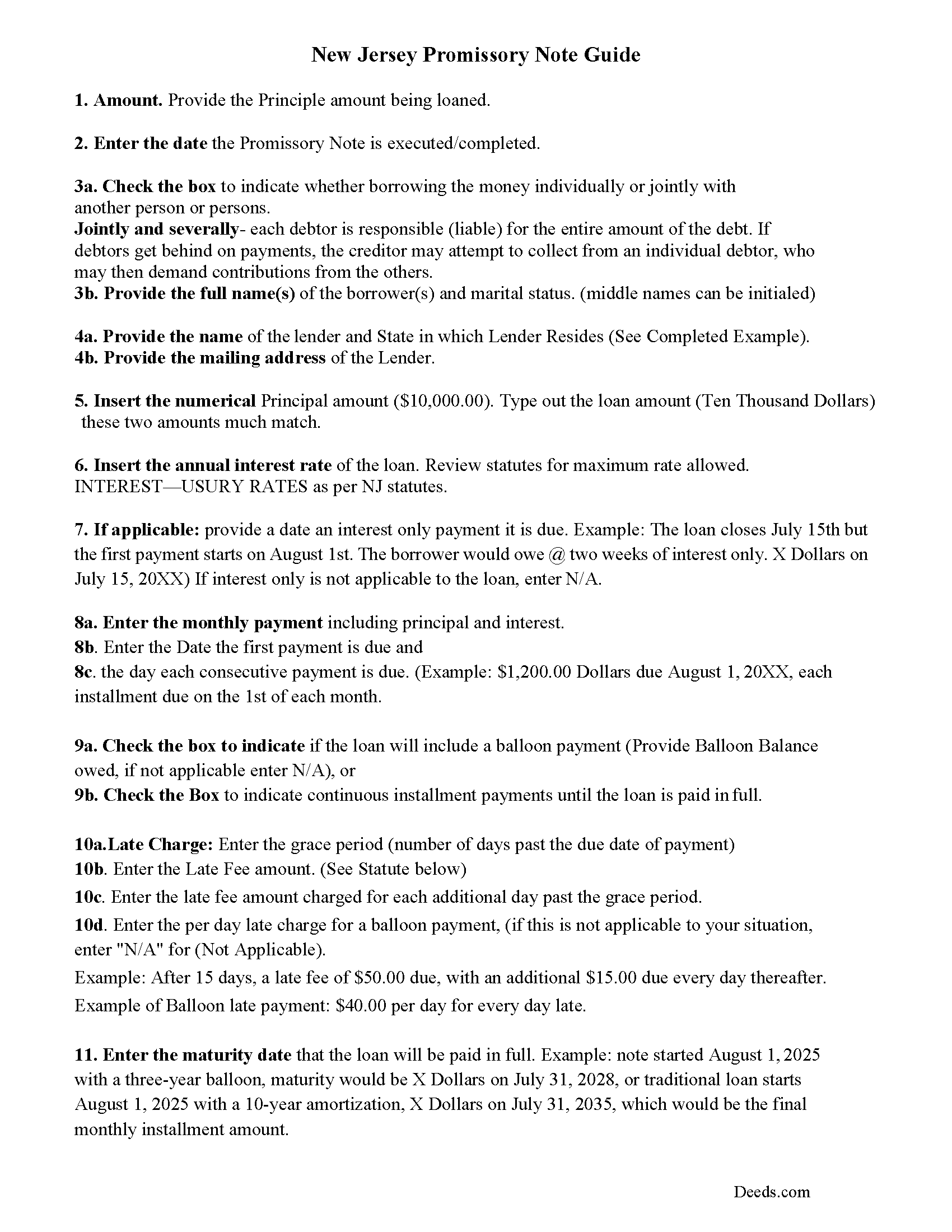

Promissory Note Guidelines

Line by line guide explaining every blank on the form.

Included Cape May County compliant document last validated/updated 5/14/2025

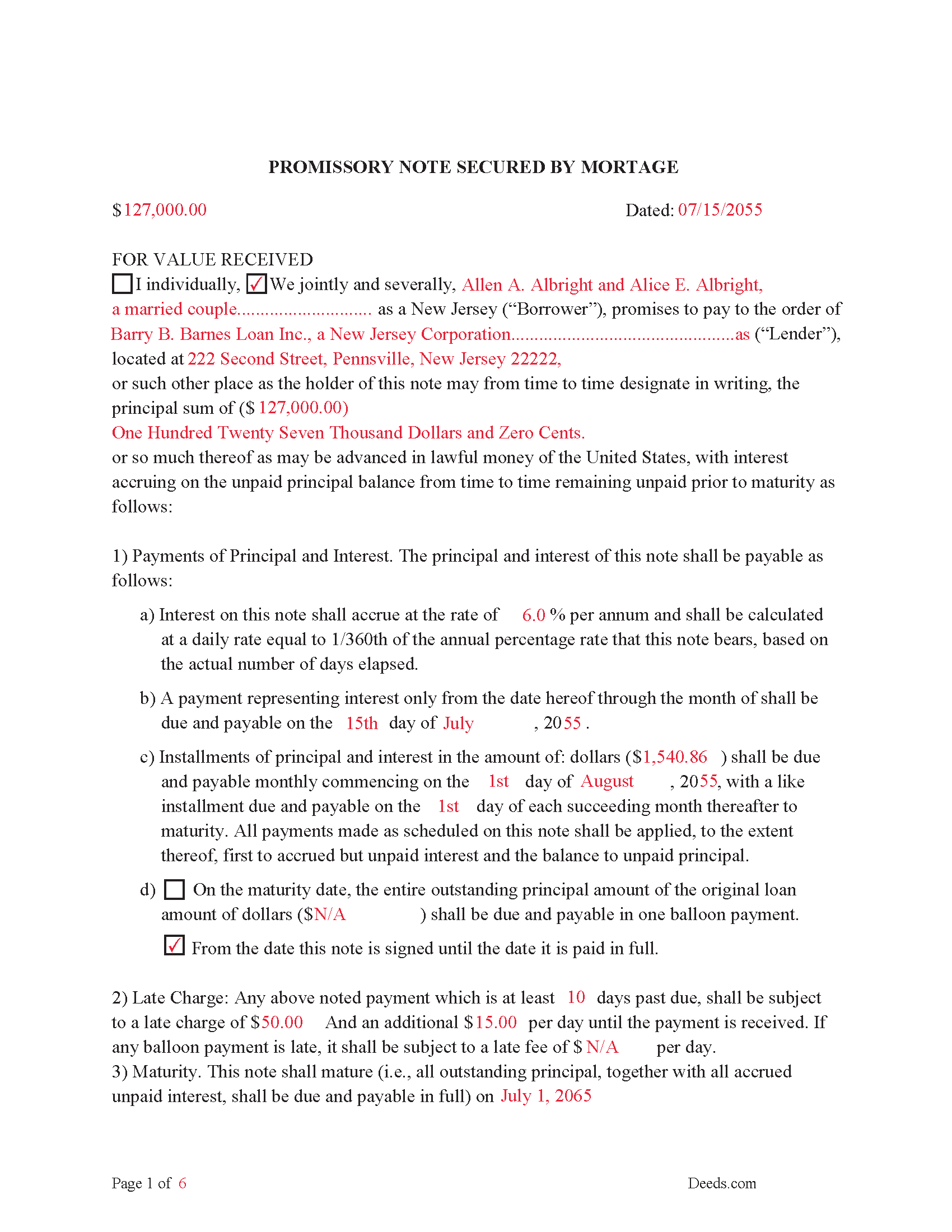

Completed Example of the Promissory Note Document

This Promissory Note is filled in and highlighted, showing how the guideline information, can be interpreted into the document.

Included Cape May County compliant document last validated/updated 4/8/2025

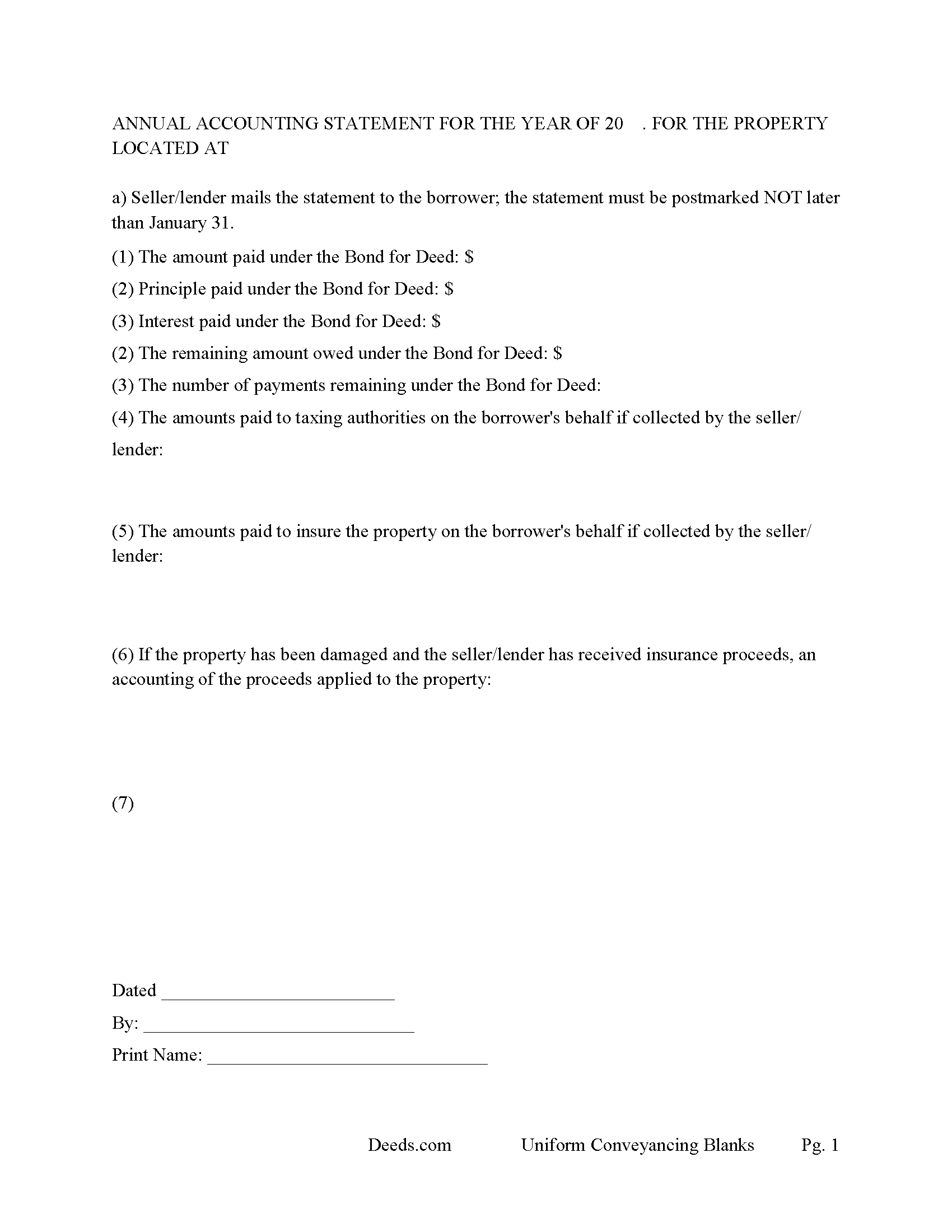

Annual Accounting Statement Form

Issued to buyer for fiscal year reporting of principal, interest, etc.

Included Cape May County compliant document last validated/updated 6/18/2025

The following New Jersey and Cape May County supplemental forms are included as a courtesy with your order:

When using these Mortgage Secured and Promissory Note forms, the subject real estate must be physically located in Cape May County. The executed documents should then be recorded in the following office:

Cape May County Clerk

7 N Main St / PO Box 5000, Cape May Court House, New Jersey 08210-5000

Hours: 8:30 to 4:30 M-F

Phone: (609) 465-1010

Local jurisdictions located in Cape May County include:

- Avalon

- Cape May

- Cape May Court House

- Cape May Point

- Dennisville

- Goshen

- Green Creek

- Marmora

- Ocean City

- Ocean View

- Rio Grande

- Sea Isle City

- South Dennis

- South Seaville

- Stone Harbor

- Strathmere

- Tuckahoe

- Villas

- Whitesboro

- Wildwood

- Woodbine

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Cape May County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Cape May County using our eRecording service.

Are these forms guaranteed to be recordable in Cape May County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Cape May County including margin requirements, content requirements, font and font size requirements.

Can the Mortgage Secured and Promissory Note forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Cape May County that you need to transfer you would only need to order our forms once for all of your properties in Cape May County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by New Jersey or Cape May County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Cape May County Mortgage Secured and Promissory Note forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

This Mortgage and Promissory Note have stringent default provisions that are typically suited for owner financing or private lender when financing residential property, small commercial property, rental property (up to 4 units), Condominiums, planned unit developments and vacant land.

DEFAULT. The Lender may declare that Borrower is in default on the Note and this Mortgage if:

(a) Borrower fails to make any payment required by the Note and this Mortgage within fifteen (15) days after its due date;

(b) Borrower fails to keep any other promise in this Mortgage;

(c) The ownership of the Property is changed for any reason;

(d) The holder of any lien on the Property starts foreclosure proceedings;

(e) Bankruptcy, insolvency or receivership proceedings are started by or against Borrower; or

(f) Borrower defaults with respect to any other loan from Lender to an affiliate of Borrower.

PAYMENTS DUE UPON DEFAULT. If the Lender declares that Borrower is in default, Borrower must immediately pay the full amount of all unpaid principal, interest, other amounts due on the Note and this Mortgage and the Lender's costs of collection and reasonable attorney fees.

The Promissory Note can be used for installment or balloon payments. Includes default rates (interest rate that occurs when borrower is in default)

In addition to any other remedies available to Lender if this Note is not paid in full at the Maturity Date, Borrowers shall pay to Lender an Overdue Loan Fee, which fee shall be due at the time this Note is otherwise paid in full. The "Overdue Loan Fee" shall be determined based upon the outstanding principal balance of this Note as of the Maturity Date and shall be:

(a)one percent (1.0%) Of such principal balance if the Note is paid in full on or after thirty(30)days after the Maturity Date but less than sixty (60) days after the Maturity Date, or

(b)two percent (2.0%) of such principal balance if the Note is paid in full on or after sixty(60)days after the Maturity Date.

Late Payment Fees. Any payment which is at least ___ days past due, shall be subject to a late charge of $___ And an additional $___ per day until the payment is received. If any balloon payment is late, it shall be subject to a late fee of $___ per day.

(New Jersey Mortgage Package includes forms, guidelines, and completed examples) For use in New Jersey only.

Our Promise

The documents you receive here will meet, or exceed, the Cape May County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Cape May County Mortgage Secured and Promissory Note form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4562 Reviews )

MARY LACEY M.

June 30th, 2025

Great service! Recording was smooth and swiftly performed. Deeds.com is an excellent service.rn

We are delighted to have been of service. Thank you for the positive review!

Robert F.

June 30th, 2025

Breeze.... It feels silly to hire an attorney to do this for just one beneficiary. Thanks.

Thank you for your feedback. We really appreciate it. Have a great day!

Pauline C.

June 29th, 2025

Everything that was stated to be included in my order was complete. Very satisfied

Thank you for your positive words! We’re thrilled to hear about your experience.

Renata L.

July 30th, 2019

Was a bit difficult to navigate. I feel a fee to access the site and a fee to print is a bit much. I am in the real estate business and find the deeds very useful

Thank you for your feedback. We really appreciate it. Have a great day!

sharon s.

October 22nd, 2020

great site for downloading forms

Thank you!

Carol D.

January 17th, 2019

No review provided.

Thank you!

Kent B.

February 25th, 2019

Disappointed on most recent order. Format did not permit changing the "boilerplate" language to change "grantor" to "grantors". In so restricting, could not use pre-printed form to make a joint party conveyance.

Sorry to hear of your disappointment. We've canceled your order and payment for the warranty deed document. Have a wonderful day.

MARIA P.

April 16th, 2021

I finally was able to download the forms. Thank you and I know I will be able to use your service anytime I may need a legal document. Thanks again!

Thank you!

Shelba M.

July 26th, 2023

The web site is alright, not the easiest to navigate and the wording on the papers could be simpler to understand.

Thank you for your feedback! We appreciate your input regarding the website's navigation and the wording on our documents. We'll definitely take your suggestions into account to improve the user experience and make the content more accessible and easier to understand. Your insights are valuable to us as we strive to enhance our services. If you have any further suggestions or concerns, please feel free to share them with us. Thank you again for your feedback!

Susan E.

April 13th, 2020

Great experience from a great staff at Deeds.com. Highly recommended!

So glad we could help Susan. Thanks for the kind words.

WAYNE C.

July 11th, 2021

Wonderful forms, been coming here for years (since 2012) for my deed forms and they have never failed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Thomas G.

December 16th, 2019

fast and easy

Thank you!

Aaron H.

April 3rd, 2023

Excellent service! Easy to use interface and quick response post-recording.

Thank you for your feedback. We really appreciate it. Have a great day!

Nancy A.

April 24th, 2024

This is an excellent resource. I was surprised because the price is so low I thought the products might be inferior. Not only were were the requested documents high quality, additional unrequested documents were added to my order that I didn't realize I would need until I read them. I especially appreciate that all the documents were specific to my county. I highly recommend using deeds.com.

Your satisfaction with our services is of utmost importance to us. Thank you for letting us know how we did!

Randall S.

September 19th, 2021

I have had great success with this so far. The site had the correct forms and I was able complete the documents. It seems like a great resource!

Thank you for your feedback. We really appreciate it. Have a great day!