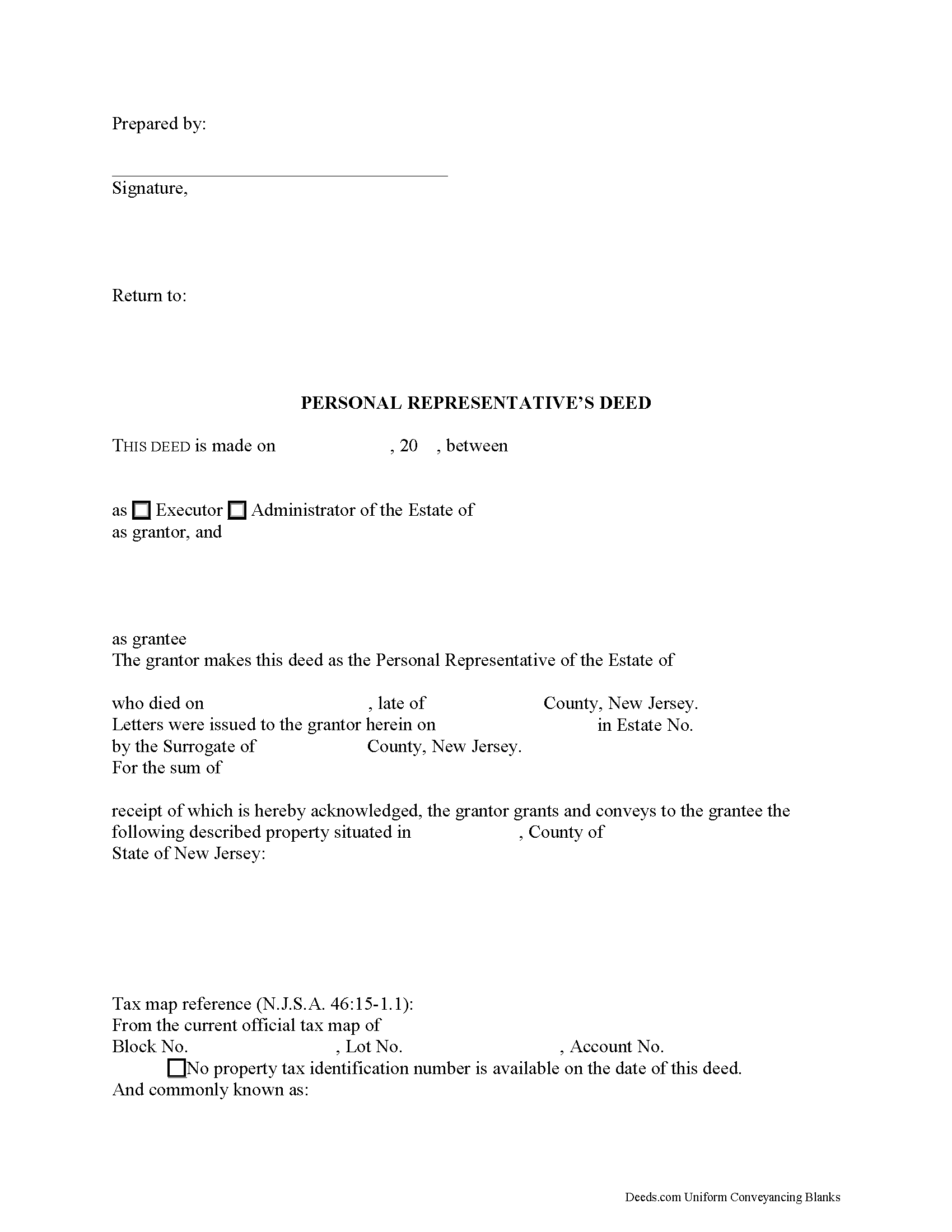

Camden County Personal Representative Deed Form

Camden County Personal Representative Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

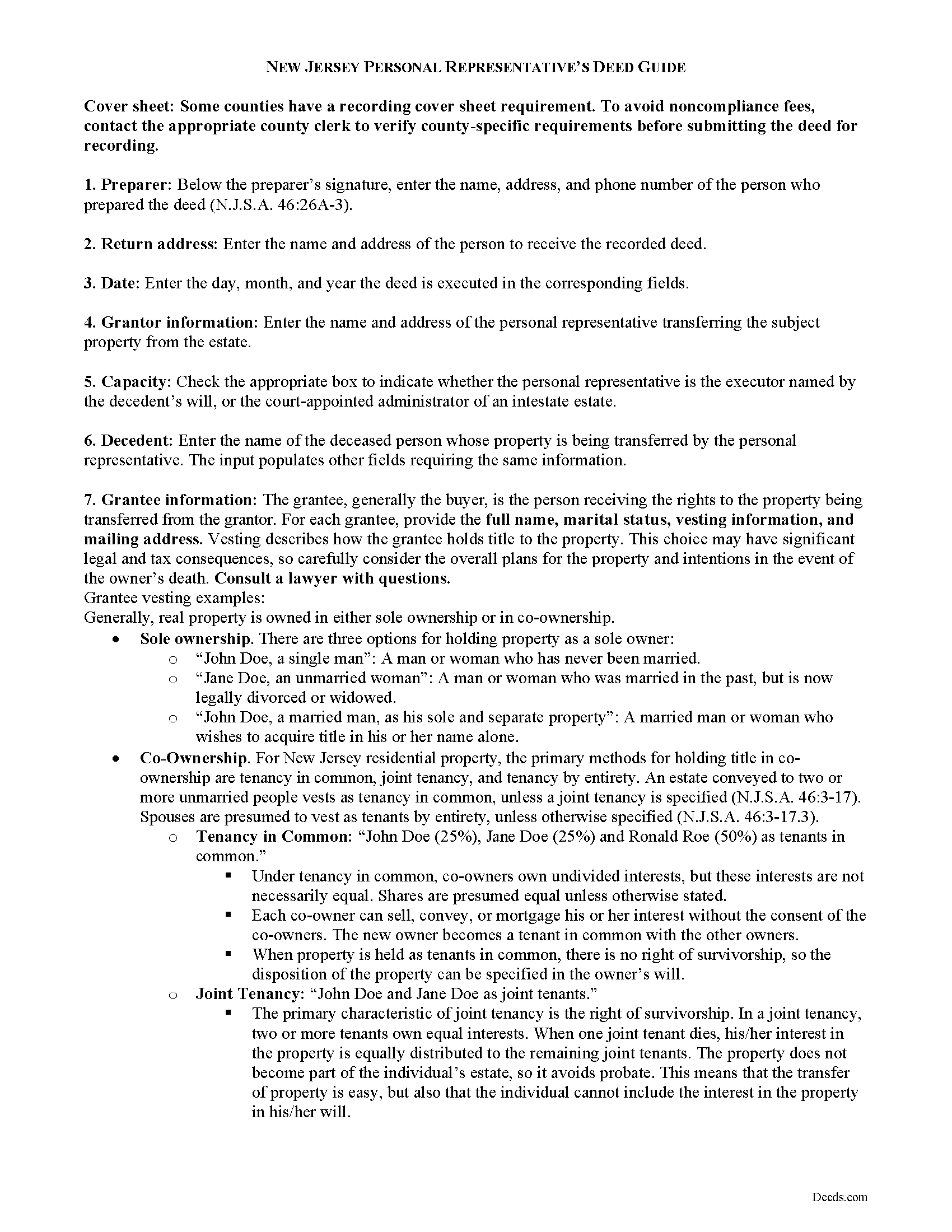

Camden County Personal Representative Deed Guide

Line by line guide explaining every blank on the form.

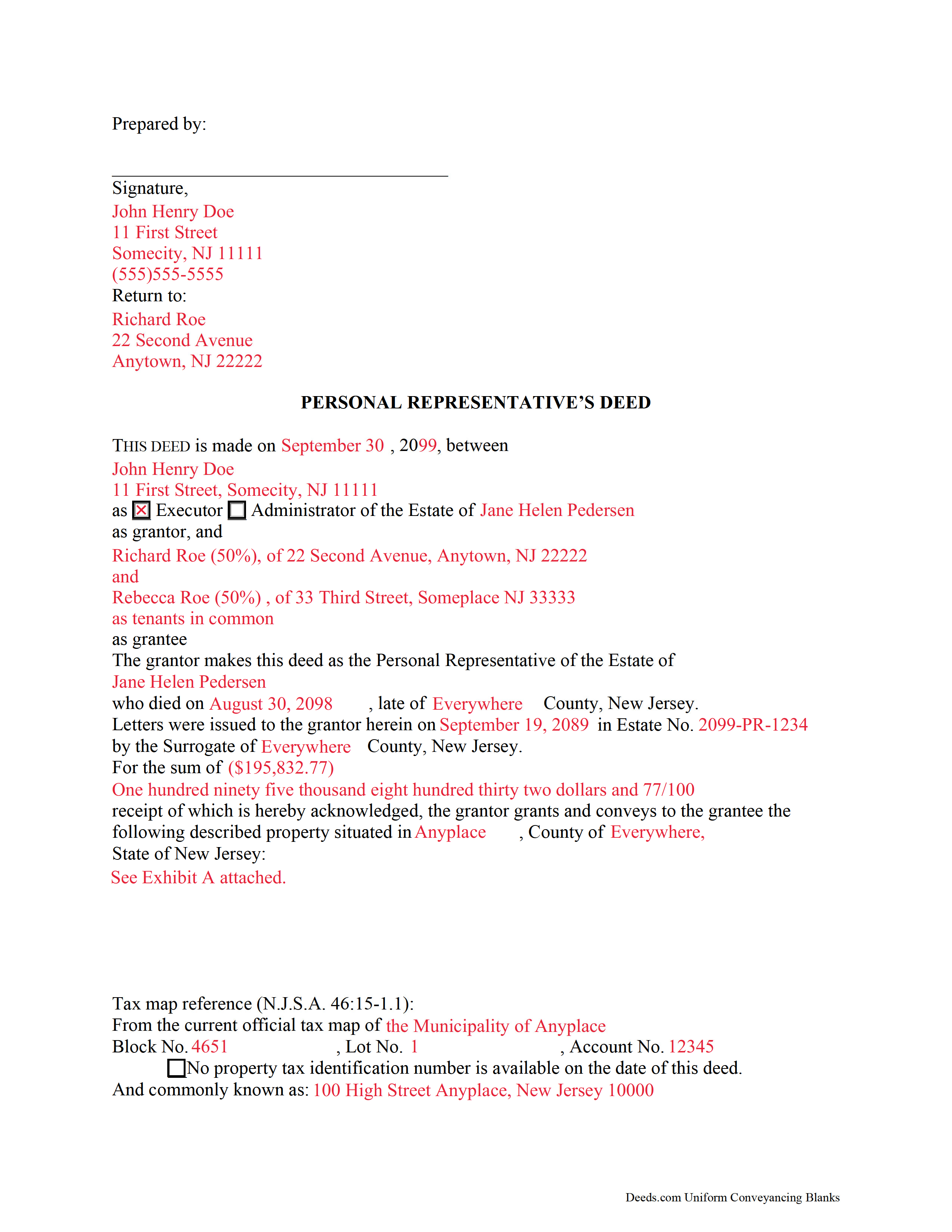

Camden County Completed Example of the Personal Representative Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional New Jersey and Camden County documents included at no extra charge:

Where to Record Your Documents

Camden County Clerk

Camden City, New Jersey 08102

Hours: 8:30 to 4:00 M-F

Phone: (856) 225-5300

Recording Tips for Camden County:

- Ensure all signatures are in blue or black ink

- Verify all names are spelled correctly before recording

- Recorded documents become public record - avoid including SSNs

- Bring extra funds - fees can vary by document type and page count

- Check margin requirements - usually 1-2 inches at top

Cities and Jurisdictions in Camden County

Properties in any of these areas use Camden County forms:

- Atco

- Audubon

- Barrington

- Bellmawr

- Berlin

- Blackwood

- Camden

- Cedar Brook

- Cherry Hill

- Clementon

- Collingswood

- Gibbsboro

- Glendora

- Gloucester City

- Haddon Heights

- Haddon Township

- Haddonfield

- Lawnside

- Magnolia

- Merchantville

- Mount Ephraim

- Oaklyn

- Pennsauken

- Runnemede

- Sicklerville

- Somerdale

- Stratford

- Voorhees

- Waterford Works

- West Berlin

- Winslow

Hours, fees, requirements, and more for Camden County

How do I get my forms?

Forms are available for immediate download after payment. The Camden County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Camden County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Camden County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Camden County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Camden County?

Recording fees in Camden County vary. Contact the recorder's office at (856) 225-5300 for current fees.

Questions answered? Let's get started!

A personal representative's deed is a fiduciary instrument executed by a personal representative that conveys interest in real property from a decedent's estate to a devisee, heir, or purchaser.

In New Jersey, personal representatives (PRs) are appointed by the Surrogate Court following the opening of probate of a decedent's estate, and are responsible for settling and distributing the estate in accordance with any probated or applicable law of intestacy, and in the best interests of the estate (N.J.S.A. 3B:10-23).

A PR may be referred to as either an executor or an administrator, depending on the testacy status of the decedent. When a decedent dies testate (with a will) naming an executor of his or her estate, the court issues letters testamentary authorizing him or her as executor. When a decedent dies intestate (without a will) or when a will does not name an executor, the court issues letters of administration authorizing the heir or other applicant desiring letters as administrator.

Typically, a PR deed in New Jersey carries a covenant as to grantor's acts under N.J.S.A. 46:4-6. This means that the grantor (the estate's executor or administrator) promises that he or she has done no act to encumber the property and that he or she has not allowed anyone else to obtain any legal rights which affect the property (such as by making a mortgage or allowing a judgment to be entered against the grantor).

To transfer a clear title, the Surrogate Court must first file a waiver of transfer inheritance tax (if applicable) in the appropriate county Register of Deeds office. The waiver constitutes written consent of the Director of the Division of Taxation to transfer or release the decedent's property.

A properly executed deed grants and conveys title to the named grantee, who may be a devisee under a will; an heir entitled to distribution of the estate based on New Jersey's laws of intestate succession; or a purchaser. Required grantee information includes the grantee's name, address, marital status, and vesting information.

The deed names the granting PR and includes the PR's address, and capacity (executor or administrator), as well as the decedent's name, date of death, and county of residence. The deed cites the grantor's authority by referencing the date of grant of letters, the case number assigned to the estate, and the Surrogate Court where the estate is probated.

The full consideration, if any, given for the transfer must appear on the deed. If the transaction is exempt from realty transfer fees, as in a conveyance to a devisee or an heir to carry out distribution of the estate, note the reason for the exemption. The state requires an affidavit of consideration to be recorded with the deed.

Additionally, the deed must meet all requirements of form and content for documents affecting title to real property in New Jersey. Such requirements include a full legal description of the subject parcel, including the property's tax map reference, a recital of the source of title, and any relevant restrictions connected to the property.

A lawful deed includes the signature of the granting PR, acknowledged in the presence of a notarial officer. Include relevant supplemental documentation, such as the New Jersey seller's residency form, and any county-specific recording sheets, if applicable, with the deed for recording in the county wherein the subject parcel is situated.

Consult an attorney licensed in the State of New Jersey with questions regarding personal representative's deeds, as each situation is unique.

(New Jersey PRD Package includes form, guidelines, and completed example)

Important: Your property must be located in Camden County to use these forms. Documents should be recorded at the office below.

This Personal Representative Deed meets all recording requirements specific to Camden County.

Our Promise

The documents you receive here will meet, or exceed, the Camden County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Camden County Personal Representative Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Valerie S.

July 16th, 2020

The service was easy, fast, and cheap and we were able to close our sale 2 days after we downloaded the deed! Thanks!

Thank you for your feedback. We really appreciate it. Have a great day!

Joan L. W.

June 9th, 2021

Excellent Service

Thank you!

Ricardo M.

December 30th, 2021

easy to use

Thank you!

Barbara E.

April 4th, 2019

Fast efficient, just what I needed.

Thank you so much Barbara. We appreciate your feedback.

Deborah C.

February 1st, 2019

I would recommend these forms to others.

Thank you!

Nick J.

March 16th, 2023

We aimed to handle a survivorship affidavit (deed change) without a lawyer following my dad's death. After some searching, deeds.com seemed to have the most comprehensive and "correct looking" form we could find for our locale, so we went with it, and it was accepted by our recorder's office. I'm not sure why our local government office doesn't offer a standard form, but they don't, and deeds.com came through for us in a pinch.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Raecita H.

March 19th, 2022

This was the first time I had ever had to fill out a Warranty Deed, so if it was not for your example form on how to fill one out, I would be still be here completely lost. I had originally gone to another site for a Warranty Deed & they wanted double the amount of your price & their website had no examples forms. I am so happy with your site & service. Thank you for giving us the opportunity to be able to download the forms as much as we need to because as many mistakes I made,I had to print quite a few to be able to get it done right.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

IVAN G.

August 21st, 2020

THIS Guys Save YOU TIME , Efforts and MONEY!!! So easy and secured to use,,NOT to mention FAST!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Rebecca M.

February 22nd, 2023

Haven't used yet but I will check it out tomorrow

Thank you!

Deanna K.

June 28th, 2021

Great service. Prompt and great communication tools. Affordably priced.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

LeVivian H.

June 2nd, 2022

I loved the forms. One suggestion a large family msy need more space to type all sisters and brothers names. Very informative. Thanks.

Thank you for your feedback. We really appreciate it. Have a great day!

Remi W.

April 13th, 2020

Submitting documents electronically through Deeds.com saved me time and provided the best possible service for me in the comfort of my own home. There's no faster, better way to record documents than e-recording with Deeds.com.

Thank you for your feedback. We really appreciate it. Have a great day!

William U.

December 1st, 2020

Prompt service, reasonable price.

Thank you!

Terriana H.

December 12th, 2020

Order processed and fulfilled in the same day!

Thank you!

Carlin L.

March 14th, 2019

I have yet to have my Certification of Trust notarized nor have I gone to my bank to see if it's acceptable I hope it will be it was rather easy to do thank you so much.

Thank you for your feedback Carlin.