Curry County Transfer of Homestead Affidavit Form

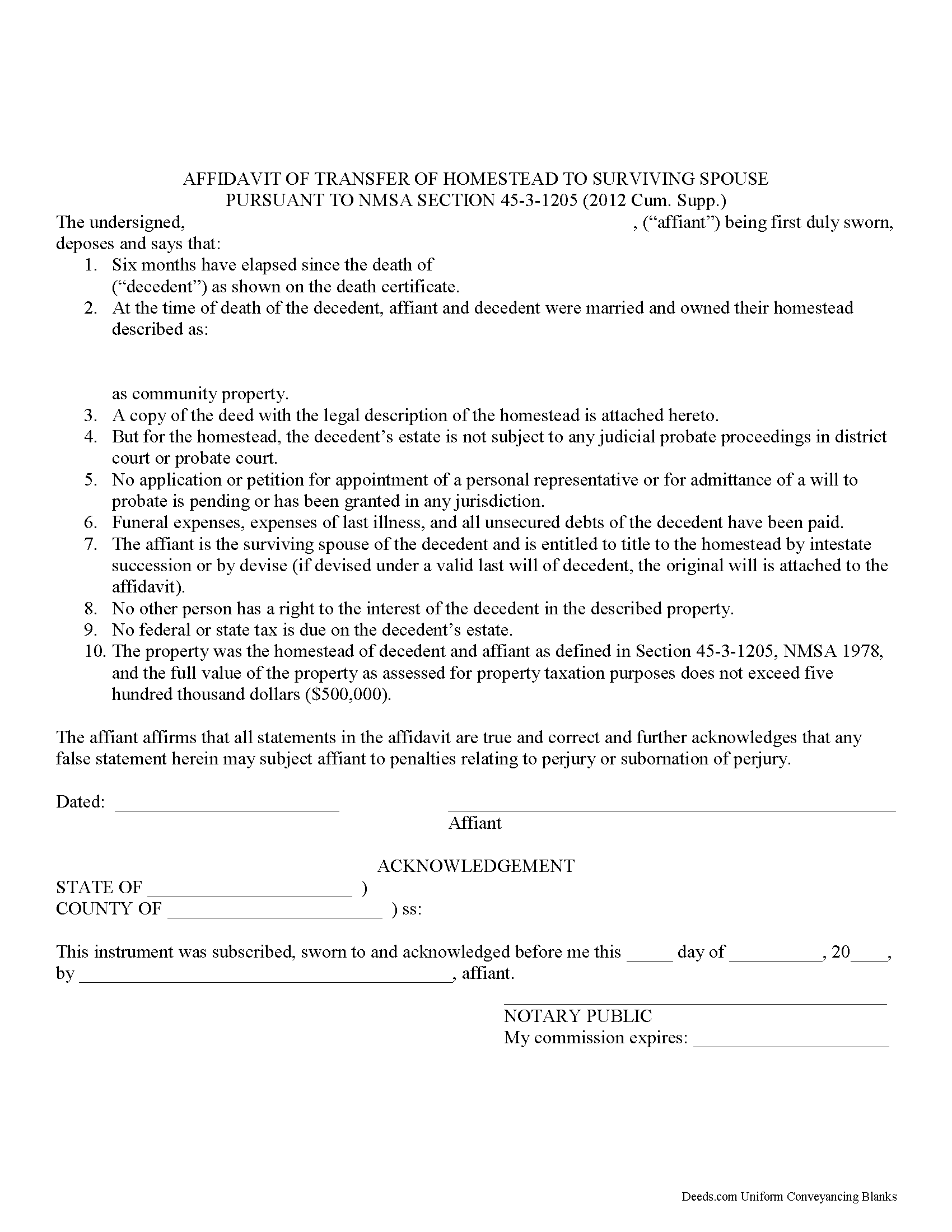

Curry County Transfer of Homestead Affidavit Form

Fill in the blank form formatted to comply with all recording and content requirements.

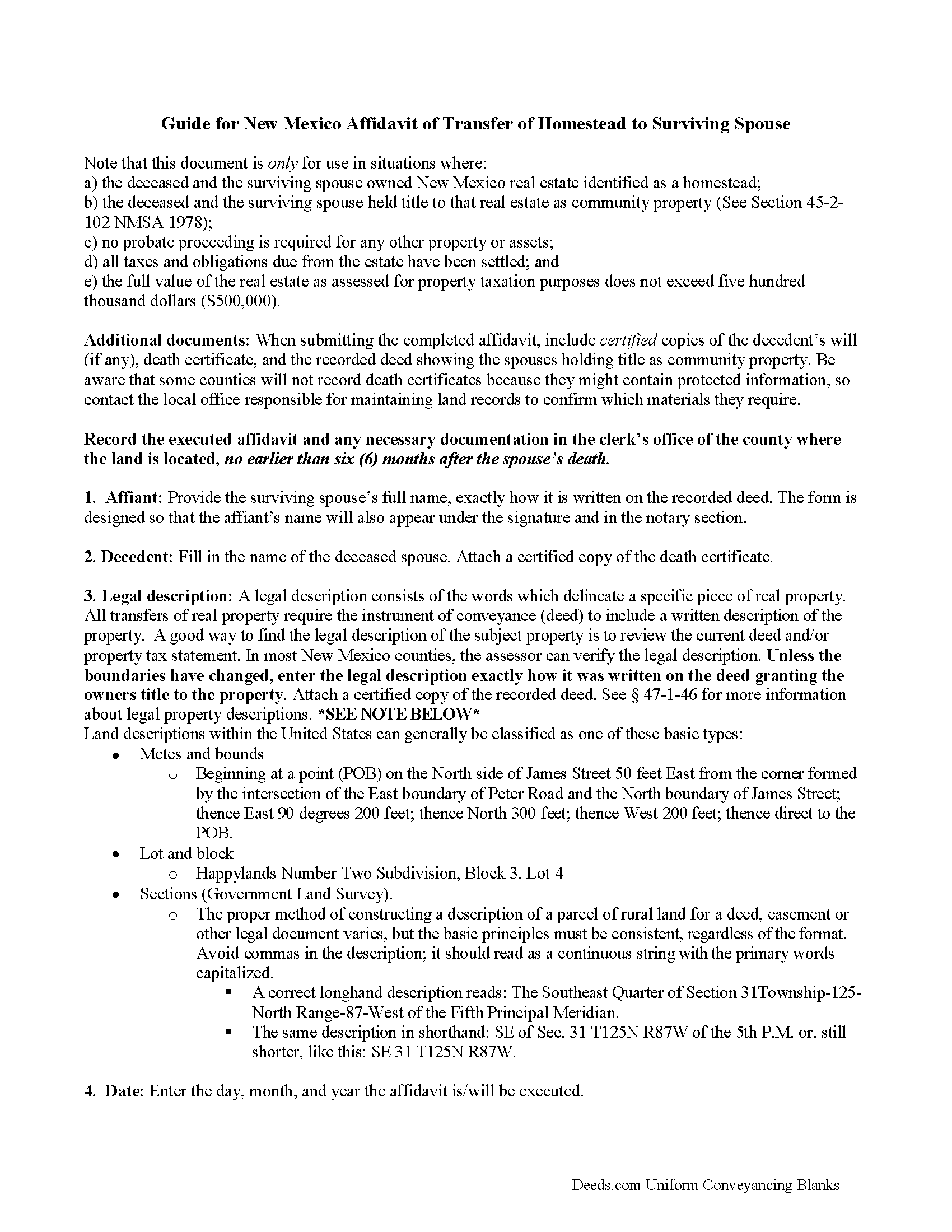

Curry County Transfer of Homestead Affidavit Guide

Line by line guide explaining every blank on the form.

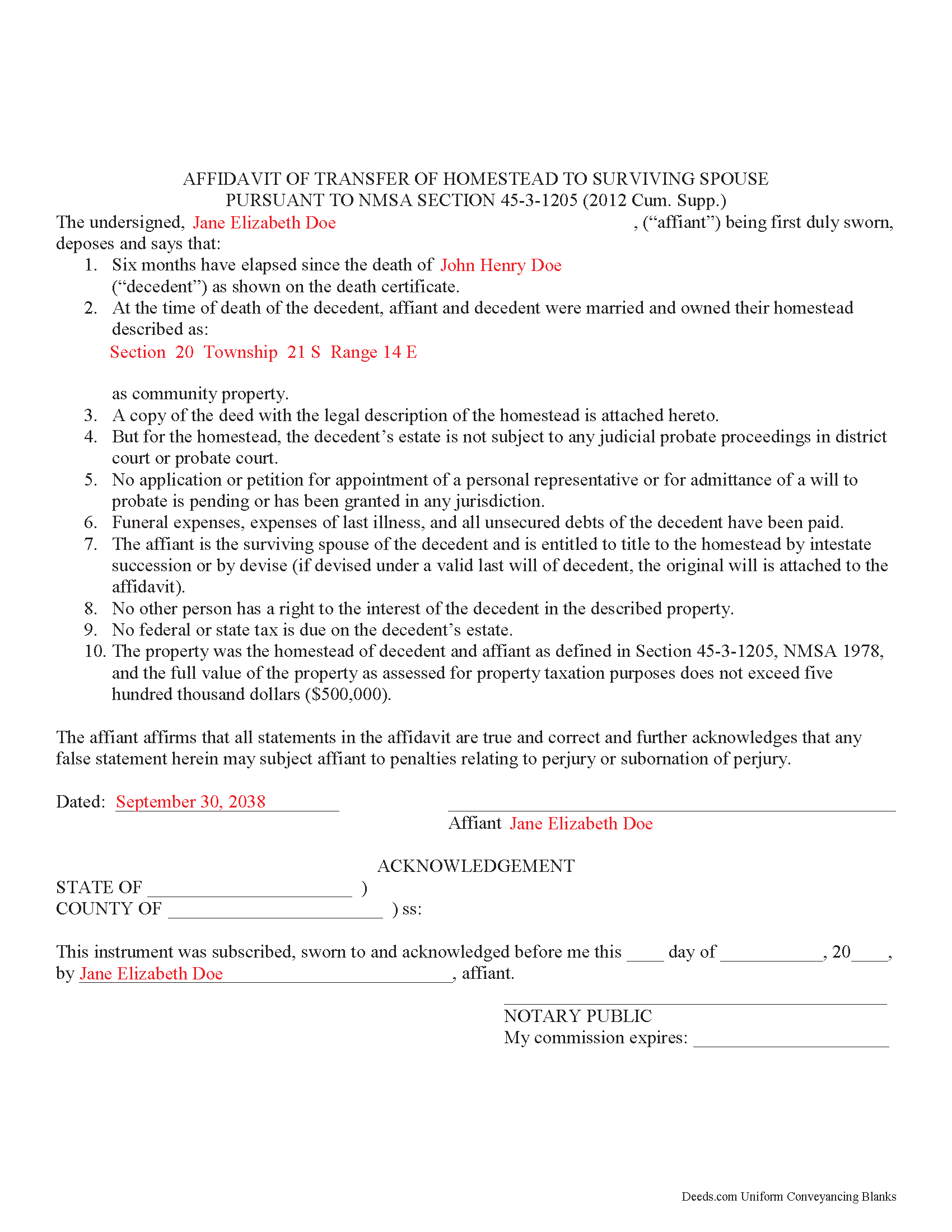

Curry County Completed Example of the Transfer of Homestead Affidavit Docuement

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional New Mexico and Curry County documents included at no extra charge:

Where to Record Your Documents

Curry County Clerk

Clovis, New Mexico 88101

Hours: 8:00am-5:00pm M-F / Recording until 4:00pm

Phone: (575) 763-5591

Recording Tips for Curry County:

- Ensure all signatures are in blue or black ink

- Request a receipt showing your recording numbers

- Recording early in the week helps ensure same-week processing

Cities and Jurisdictions in Curry County

Properties in any of these areas use Curry County forms:

- Broadview

- Cannon Afb

- Clovis

- Grady

- Melrose

- Saint Vrain

- Texico

Hours, fees, requirements, and more for Curry County

How do I get my forms?

Forms are available for immediate download after payment. The Curry County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Curry County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Curry County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Curry County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Curry County?

Recording fees in Curry County vary. Contact the recorder's office at (575) 763-5591 for current fees.

Questions answered? Let's get started!

Some married people purchase real estate in New Mexico for vacation or investment purposes and title it as the sole and separate property of one spouse. Others identify themselves as husband and wife, but do not specify how they wish to hold title. In many such situations, the death of one spouse initiates a case with the probate court to distribute the decedent's estate according to his/her will. This judicial proceeding might also include transferring ownership of real estate into the living spouse's name.

But what if the deceased spouse died intestate (without a will) or has arranged for all of his/her assets to pass to named beneficiaries using non-probate options such as joint ownership, transfer on death designations, or trusts? If the house qualifies as a <b>homestead</b> and is vested as <b>community property</b>, the remaining spouse might be able to gain full title rights more easily by using a transfer of homestead affidavit.

This affidavit is designed to transfer the entire shared interest to the surviving spouse without the need for probate. In general, the property must meet six conditions to qualify for a transfer of homestead affidavit under Section 45-3-1205:

1. The decedent and the surviving spouse owned New Mexico real estate identified as a homestead.

2. The decedent and the surviving spouse held title to that real estate as community property (See Section 45-2-102.

3. No probate proceeding is required for any other property or assets.

4. All taxes and obligations due from the estate have been settled.

5. The full value of the property as assessed for property taxation purposes does not exceed five hundred thousand dollars ($500,000).

6. At least six months have passed since the deceased spouse's death.

To complete the transfer, the surviving spouse must record the completed, notarized document at the clerk's office for the county where the property is located. In addition to the affidavit, attach certified copies of the deed granting ownership to the married couple (including a legal description of the homestead property), the decedent's will, if any, and the death certificate. Note that some counties in New Mexico refuse to record death certificates because they might contain protected information such as social security numbers, so contact the local recording office to verify their requirements.

Important terms:

A homestead, or family home, is the principal place of residence of the deceased or surviving spouse. It includes the house, associated buildings on the property, and enough land to support reasonable access and use. See Section 45-3-1205(C) NMSA 1978.

Community property as defined in Section 40-3-8 is a vesting option that is only available to married couples. Property acquired during marriage, by either or both spouses, is assumed to be community property unless specifically identified as separate property. Deeded property acquired by the couple, whether as tenants in common or as joint tenants or otherwise, is presumed to be held as community property.

This discussion is provided as general information. Please contact an attorney for assistance with specific questions or complex situations.

(New Mexico TOHA Package includes form, guidelines, and completed example)

Important: Your property must be located in Curry County to use these forms. Documents should be recorded at the office below.

This Transfer of Homestead Affidavit meets all recording requirements specific to Curry County.

Our Promise

The documents you receive here will meet, or exceed, the Curry County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Curry County Transfer of Homestead Affidavit form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

John M.

May 14th, 2022

I found just what I needed at a very good price.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Elizabeth J.

May 17th, 2019

It is very good and I would use the site again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

M. TIMOTHY P.

February 17th, 2021

EXCELLENT service! Deed came back within minutes!

Thank you for your feedback. We really appreciate it. Have a great day!

Mayte S.

October 28th, 2020

I am pleasantly suprised at the service. Fair rates and speedy process. No complaints! Happy to use this service again and recommend to anyone. Thank you very much for all your help!

Thank you!

Rebecca W.

January 24th, 2023

Very easy to find and download.

Thank you!

Kris D.

February 7th, 2022

The Executor's Guide needs more info about what to put for grantee (estate of deceased or my name as executor?) and the price (something nominal like $10?) before there is a buyer. The guide seems to use only one example.

Thank you for your feedback. We really appreciate it. Have a great day!

Richard W.

June 23rd, 2022

My experience so far is quite good. Useful documents. It would be very helpful if the labels on the files downloaded were in text format, like "Jurat" rather than "1429107022SF21141." It would save me the extra step of providing proper file names.

Thank you for your feedback. We really appreciate it. Have a great day!

Robert h.

February 25th, 2019

excellent and simple to use. Great price for this.

Thank you Robert! We really appreciate your feedback.

Ann E Grace S.

June 22nd, 2021

Forms and instructions are very easy to access. Thank you!

Thank you for your feedback. We really appreciate it. Have a great day!

Tammy C.

September 24th, 2020

Was very easy to use and i would recommend it

Thank you!

Virginia W.

March 14th, 2021

Easy instructions and a example on how to fill out the form.

Thank you for your feedback. We really appreciate it. Have a great day!

Myron M.

June 30th, 2020

This is what we need and it was very helpful and easy to fill out. Thanks

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Pamela S.

February 7th, 2025

I love the convenience and professionalism!

Your satisfaction with our services is of utmost importance to us. Thank you for letting us know how we did!

Laurie S.

May 24th, 2023

This was amazingly easy to access.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

LISA B.

December 5th, 2019

GOT WHAT I NEEDED FORMS WORKED FINE.

Thank you!