Sandoval County Transfer on Death Deed Form (New Mexico)

All Sandoval County specific forms and documents listed below are included in your immediate download package:

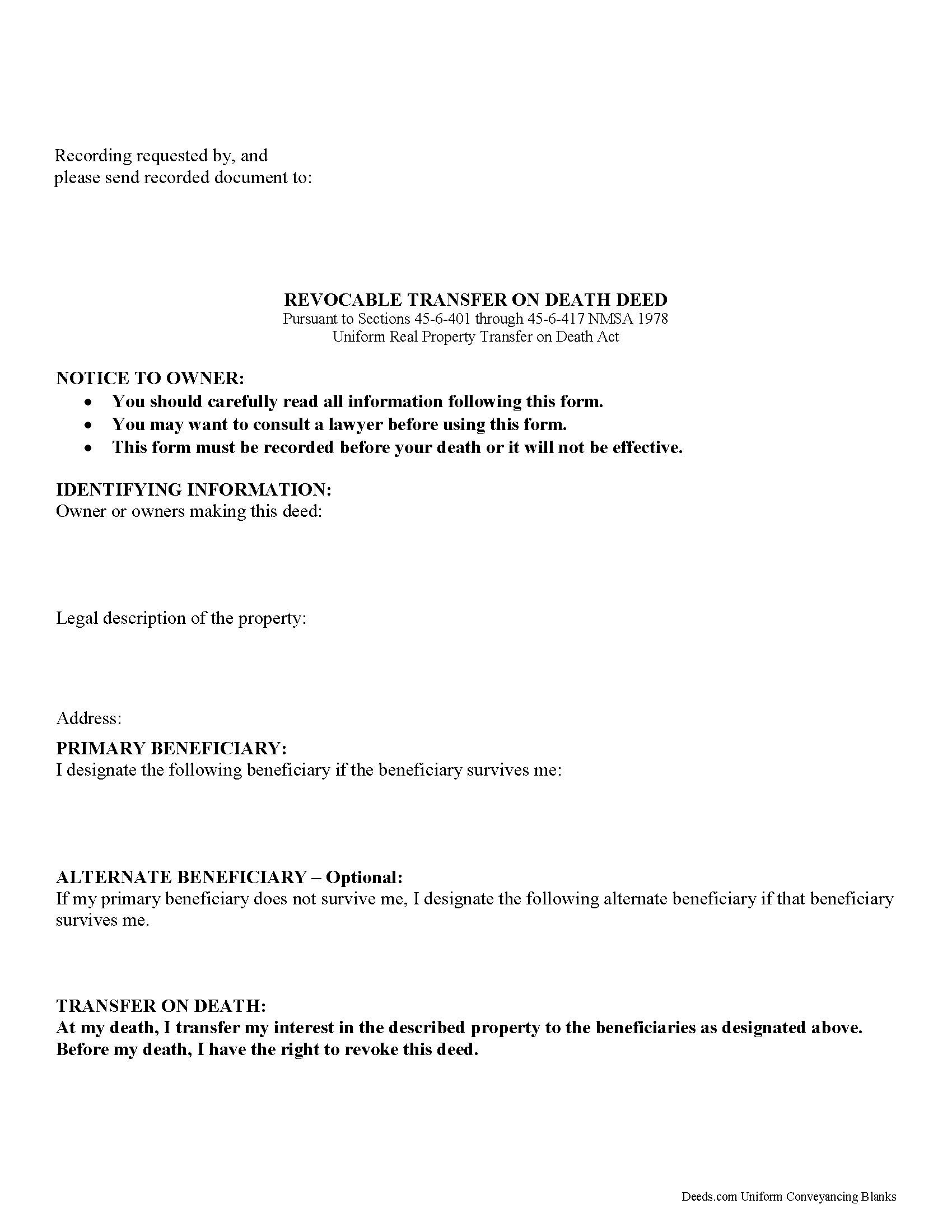

Transfer on Death Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Sandoval County compliant document last validated/updated 4/28/2025

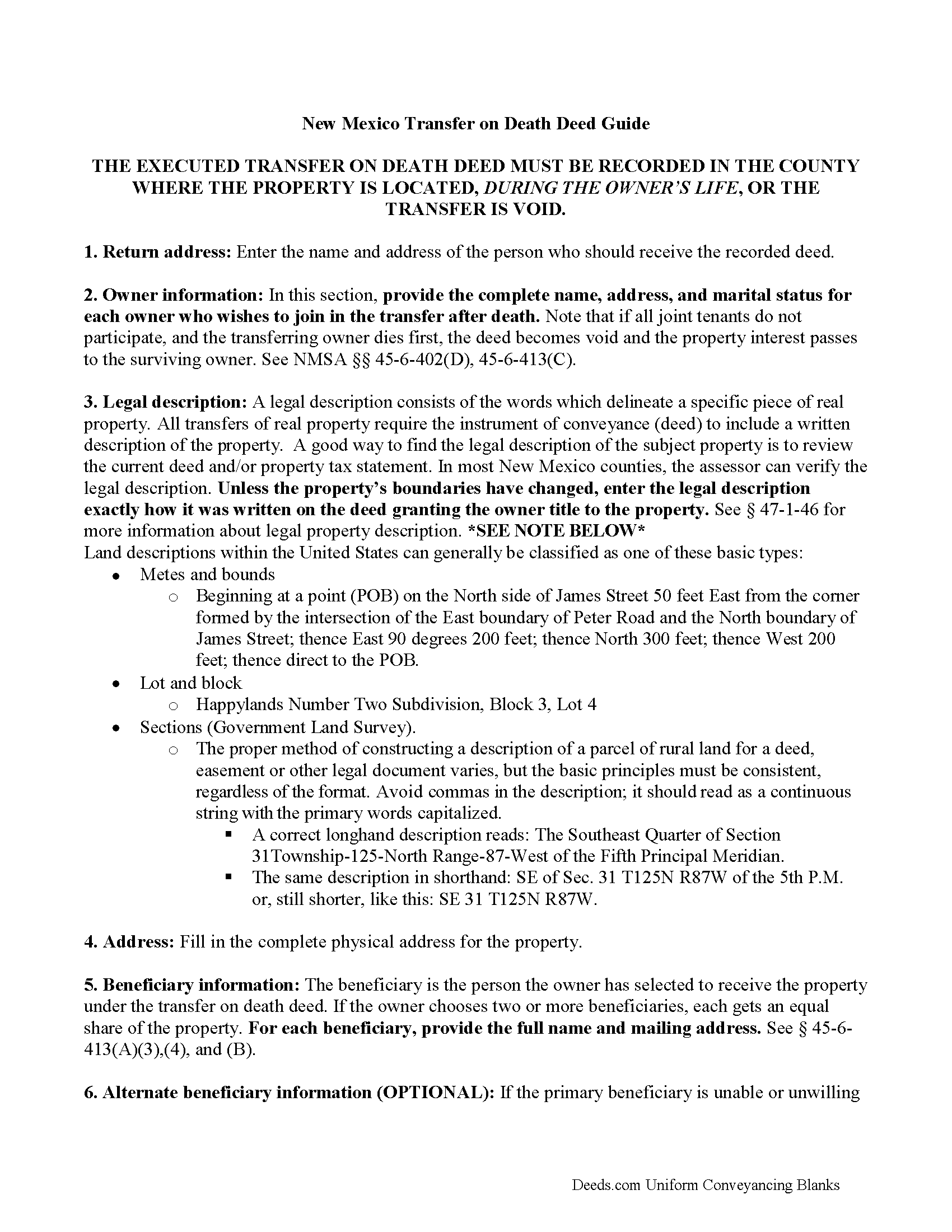

Transfer on Death Deed Guide

Line by line guide explaining every blank on the form.

Included Sandoval County compliant document last validated/updated 5/8/2025

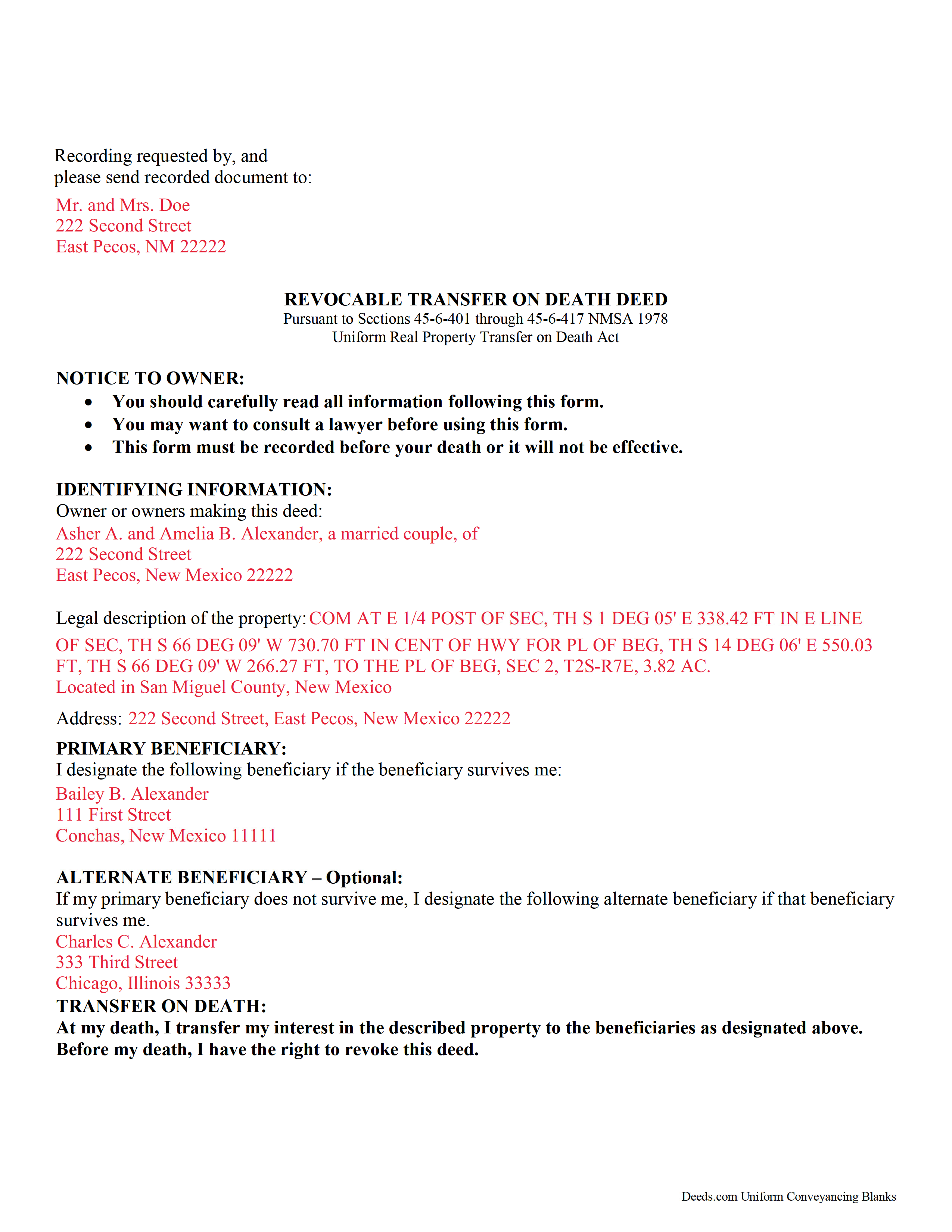

Completed Example of the Transfer on Death Deed Form

Example of a properly completed form for reference.

Included Sandoval County compliant document last validated/updated 6/17/2025

The following New Mexico and Sandoval County supplemental forms are included as a courtesy with your order:

When using these Transfer on Death Deed forms, the subject real estate must be physically located in Sandoval County. The executed documents should then be recorded in the following office:

Sandoval County Clerk

1500 Idalia Rd, Bldg D / PO Box 40, Bernalillo, New Mexico 87004

Hours: 8:00am-4:30pm M-F

Phone: (505) 867-7572

Local jurisdictions located in Sandoval County include:

- Algodones

- Bernalillo

- Cochiti Lake

- Cochiti Pueblo

- Corrales

- Counselor

- Cuba

- Jemez Pueblo

- Jemez Springs

- La Jara

- Pena Blanca

- Placitas

- Ponderosa

- Regina

- Rio Rancho

- San Ysidro

- Santo Domingo Pueblo

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Sandoval County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Sandoval County using our eRecording service.

Are these forms guaranteed to be recordable in Sandoval County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Sandoval County including margin requirements, content requirements, font and font size requirements.

Can the Transfer on Death Deed forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Sandoval County that you need to transfer you would only need to order our forms once for all of your properties in Sandoval County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by New Mexico or Sandoval County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Sandoval County Transfer on Death Deed forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

On January 1, 2014, New Mexico joined with eleven other states to enact the Uniform Real Property Transfer on Death Act (URPTODA), found at Sections 45-6-401 through 45-6-417 NMSA 1978 (2014). This enhances and adds clarity to the previous transfer on death statute already in force in the state.

A transfer on death deed (TODD) under the new law is defined by the Uniform Law Commission as an instrument that provides owners of real estate in New Mexico with a simple process for the non-probate transfer of real estate. The act allows an owner of real property to designate a beneficiary who will automatically receive the property upon the owner's death, without the need to include it in the decedent's probate estate. Instead, the property passes by means of a recorded TODD. During the owner's lifetime, the beneficiary of a TOD deed has no interest in the property and the owner retains full power to transfer or encumber the property, or even to revoke the deed outright.

New Mexico's version of the URPTODA sets out the rules and provides forms for both the deed and its revocation. To be valid, the TODD must meet three requirements ( 45-6-409):

1) it must contain the essential elements and formalities of a properly recordable inter vivos deed;

2) it must state that the transfer to the designated beneficiary is to occur at the transferor's death; and

3) it must be recorded before the transferor's death in the public records with the clerk of the county where the property is located.

TODDs represent a potential future interest, conveying whatever rights, if any, the owner retains in the property at the time of death. So, unlike inter vivos deeds ("traditional" documents such as warranty or quitclaim deeds), a TODD does not require notice, delivery, acceptance, or consideration ( 45-6-410).

The transferor (owner) under a TODD must meet the same standards for capacity as someone who executes a will, but the deed is not affected by the terms of the deceased owner's will. For example, Mary executes and records a TODD leaving her house and land to Bob, and then leaves the same property to Joe in her will. In most cases, Bob gets the land and Joe gets nothing.

If Mary actually wanted to leave the land to Joe, she could execute and record a revocation of the transfer to Bob, then record a new TODD in Joe's name. Alternately, she could sell the land to someone else entirely, and include a statement in the deed, revoking all or part of any previously recorded TODDs. See Section 45-6-411 for more information.

TODDs also offer some flexibility to beneficiaries. If the recipient is unable or unwilling to accept the transfer, Section 45-6-414 authorizes a beneficiary to disclaim all or part of his/her interest as provided by the Uniform Disclaimer of Property Interests Act [Chapter 45, Article 2, Part 11 NMSA 1978].

Overall, New Mexico's statutory transfer on death deed is a flexible estate planning tool that allows owners of real property in the state to convey a potential future interest in real property to one or more beneficiaries. The transfer may be changed or revoked at any time during the owner's life, simply by recording the appropriate documents. Each situation is unique, so carefully review all the benefits and drawbacks of this and any other real estate decisions. Seek legal counsel for help with specific questions or complex situations.

(New Mexico TODD Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Sandoval County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Sandoval County Transfer on Death Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4562 Reviews )

MARY LACEY M.

June 30th, 2025

Great service! Recording was smooth and swiftly performed. Deeds.com is an excellent service.rn

We are delighted to have been of service. Thank you for the positive review!

Robert F.

June 30th, 2025

Breeze.... It feels silly to hire an attorney to do this for just one beneficiary. Thanks.

Thank you for your feedback. We really appreciate it. Have a great day!

Pauline C.

June 29th, 2025

Everything that was stated to be included in my order was complete. Very satisfied

Thank you for your positive words! We’re thrilled to hear about your experience.

Peggy J.

July 26th, 2021

I have been researching for months to figure out how to remove deceased owner of property with right of survivorship in Florida. The County Clerk was not helpful. They refer you to get legal advice which is expensive. So hopefully by completing these forms I can actually complete the task. And would be helpful to be reassured that this is all I need to complete overdue task. I was hesitant to pay, but I believe this is legit. If so- a great Thank you.

Thank you for your feedback. We really appreciate it. Have a great day!

gary c.

January 26th, 2022

process was easy and simple to do

Thank you for your feedback. We really appreciate it. Have a great day!

Karen C.

October 23rd, 2019

Legal documents that served the purpose nothing too exciting.

Thank you Karen. Have a great day!

Viola G.

July 7th, 2022

Some of the forms I ordered didn't have enough space for all of the information, but were useful as a guide for creating what I needed. Now I'll be trying the e-recording to see how that goes.

Thank you!

Z. L.

October 20th, 2021

I appreciate a service that can reach any county in Texas to file deed distribution deeds. It is convenient, time and money saving for our clients and takes the headache out of estate administration. Thanks.

Thank you!

Carol M.

March 14th, 2019

worked very well

Thank you for your feedback. We really appreciate it. Have a great day!

Kevin V.

June 29th, 2020

This is an option for recording that worked flawlessly with my county government. Given Covid19 has closed county offices to the public as well as the personal kiosks options to record shrunk dramatically. I recommend Deeds.Com for your recording needs.

Thank you for your feedback. We really appreciate it. Have a great day!

Sherri S.

March 30th, 2021

Easy to access forms, and reasonably priced. I'll definitely use again in the future.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Tammy C.

September 24th, 2020

Was very easy to use and i would recommend it

Thank you!

Sara D.

September 25th, 2019

Would have been beneficial to have more information about the previous sale history of the property. The report was received in a very timely manner.

Thank you for your feedback. We really appreciate it. Have a great day!

Clarence F.

January 25th, 2022

very easy to use !!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Chad N.

March 16th, 2021

Thank you for taking care of a recording very quickly. I am very impressed by your service an would recommend to anyone. Easy to navigate.

Thank you for your feedback. We really appreciate it. Have a great day!