Westchester County Bargain and Sale Deed Without Covenants Form (New York)

All Westchester County specific forms and documents listed below are included in your immediate download package:

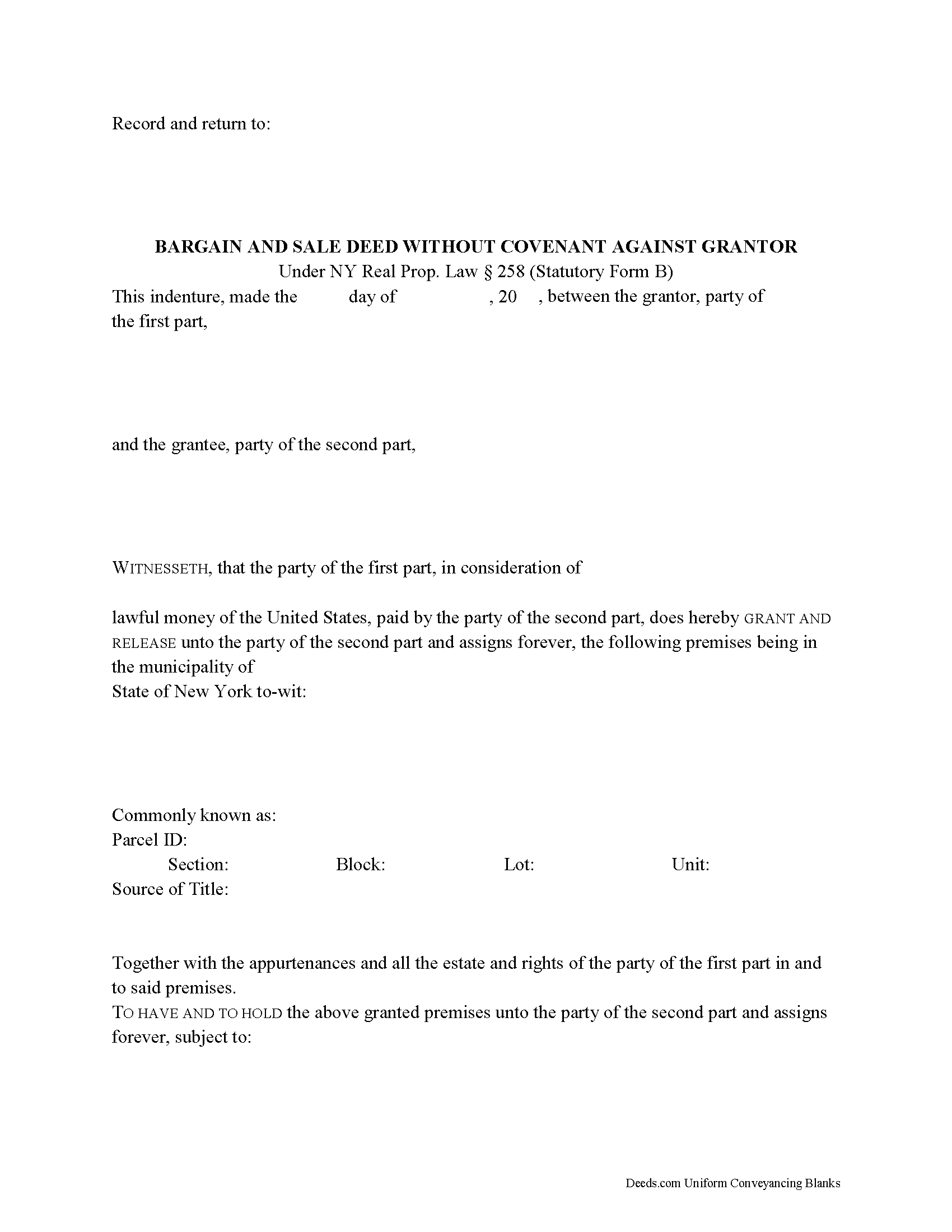

Bargain and Sale Deed without Covenants Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Westchester County compliant document last validated/updated 6/24/2025

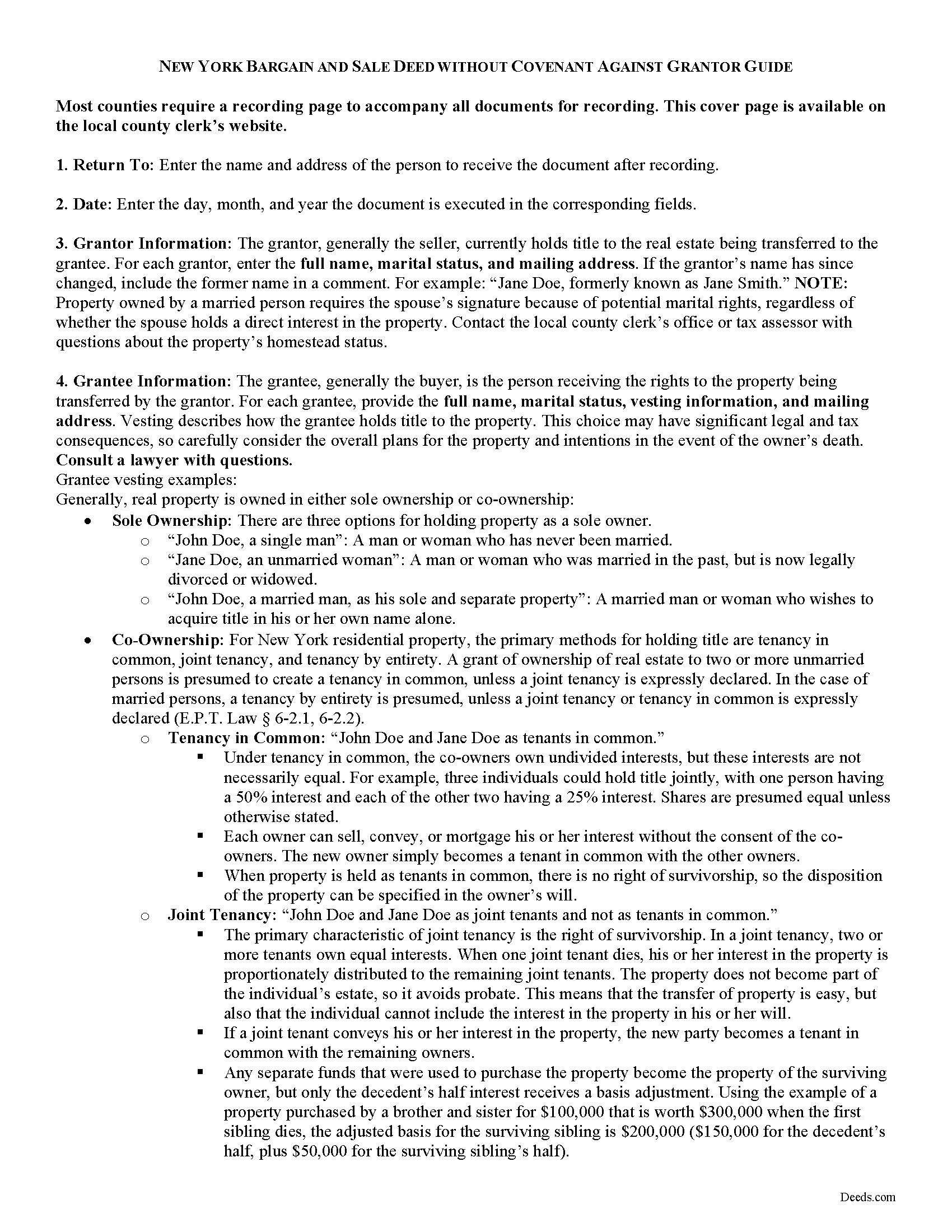

Bargain and Sale Deed Without Covenants Guide

Line by line guide explaining every blank on the form.

Included Westchester County compliant document last validated/updated 5/12/2025

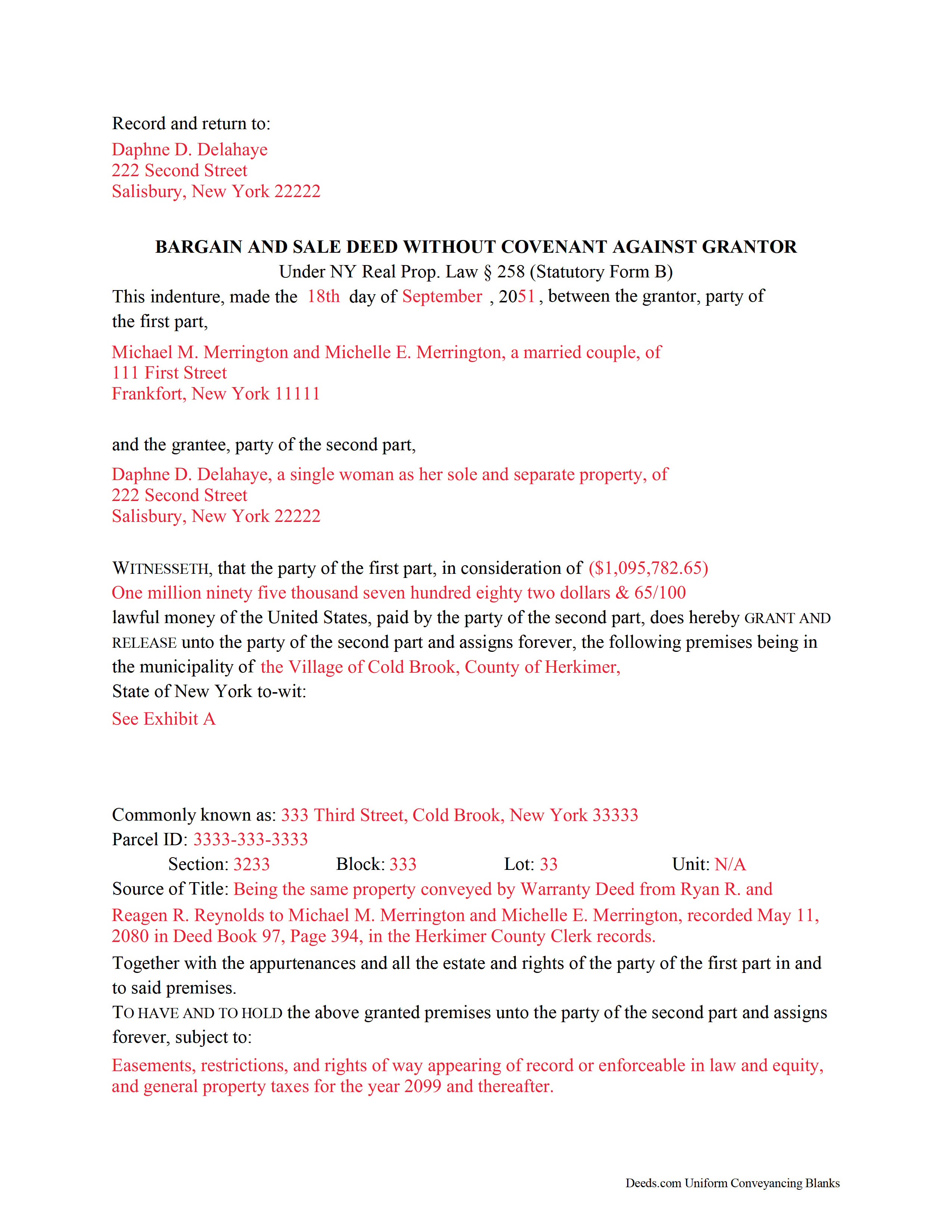

Completed Example of the Bargain and Sale Deed without Covenants Document

Example of a properly completed form for reference.

Included Westchester County compliant document last validated/updated 7/9/2025

The following New York and Westchester County supplemental forms are included as a courtesy with your order:

When using these Bargain and Sale Deed Without Covenants forms, the subject real estate must be physically located in Westchester County. The executed documents should then be recorded in the following office:

Westchester County Clerk

110 Dr. Martin Luther King Jr. Blvd, White Plains, New York 10601

Hours: 8:00am to 5:00pm M-F

Phone: (914) 995-3080 or 3094

Local jurisdictions located in Westchester County include:

- Amawalk

- Ardsley

- Ardsley On Hudson

- Armonk

- Baldwin Place

- Bedford

- Bedford Hills

- Briarcliff Manor

- Bronxville

- Buchanan

- Chappaqua

- Cortlandt Manor

- Crompond

- Cross River

- Croton Falls

- Croton On Hudson

- Dobbs Ferry

- Eastchester

- Elmsford

- Goldens Bridge

- Granite Springs

- Harrison

- Hartsdale

- Hastings On Hudson

- Hawthorne

- Irvington

- Jefferson Valley

- Katonah

- Larchmont

- Lincolndale

- Mamaroneck

- Maryknoll

- Millwood

- Mohegan Lake

- Montrose

- Mount Kisco

- Mount Vernon

- New Rochelle

- North Salem

- Ossining

- Peekskill

- Pelham

- Pleasantville

- Port Chester

- Pound Ridge

- Purchase

- Purdys

- Rye

- Scarsdale

- Shenorock

- Shrub Oak

- Somers

- South Salem

- Tarrytown

- Thornwood

- Tuckahoe

- Valhalla

- Verplanck

- Waccabuc

- West Harrison

- White Plains

- Yonkers

- Yorktown Heights

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Westchester County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Westchester County using our eRecording service.

Are these forms guaranteed to be recordable in Westchester County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Westchester County including margin requirements, content requirements, font and font size requirements.

Can the Bargain and Sale Deed Without Covenants forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Westchester County that you need to transfer you would only need to order our forms once for all of your properties in Westchester County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by New York or Westchester County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Westchester County Bargain and Sale Deed Without Covenants forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

In New York, title to real property can be transferred from one party to another by executing a bargain and sale deed without covenant against grantor. This type of deed is statutory under NY Real Prop. Law Section 258 Statutory Form B. A bargain and sale deed without covenant conveys whatever interest the grantor holds in the property at the time of execution (NY Real Prop. Law Section 258 (Statutory Form B)).

There are two types of bargain and sale deeds in New York. One type contains a specific covenant against grantor's acts, while the other does not. Bargain and sale deeds without covenant do not guarantee that the property conveyed is without encumbrances made by the grantor. Bargain and sale deeds provide less surety than a deed with full covenants (Statutory Form A), which offers the fullest surety of title because its warranty covers the entire chain of title, even preceding the time the grantor owned the property. Bargain and sale deeds differ from quitclaim deeds in that they imply that the grantor held or holds an interest in the property being conveyed.

A lawful bargain and sale deed without covenant meets all state and local standards for recorded documents, including the grantor's full name, mailing address, and marital status; the consideration given for the transfer; and the grantee's full name, mailing address, marital status, and vesting. Vesting describes how the grantee holds title to the property. Generally, real property is owned in either sole ownership or in co-ownership.

For New York residential property, the primary methods for holding title are tenancy in common, joint tenancy, and tenancy by entirety. A grant of ownership of real estate to two or more unmarried persons is presumed to create a tenancy in common, unless a joint tenancy is expressly declared. In the case of married persons, a tenancy by entirety is presumed, unless a joint tenancy or tenancy in common is expressly declared (E.P.T. Law Sections 6-2.1, 6-2.2).

As with any conveyance of realty, this deed requires a complete legal description of the parcel, including the section, block, lot, and unit numbers. Recite the prior deed reference to maintain a clear chain of title, and detail any restrictions associated with the property.

Sign the deed in the presence of a notary public or other authorized official. For a valid transfer, record the deed at the county clerk's office in the county where the property is located. Contact the same office to confirm accepted forms of payment. Most counties in New York require a recording page to accompany all documents for recording. This cover page is available on the local county clerk's website, and it factors into the total page count when calculating recording fees.

In New York, the real estate transfer tax is due at the time of recording. File Form TP-584 (Combined Real Estate Transfer Tax Return) with the appropriate county clerk (TAX Law 31-D-1449-EE(2)(d)). Non-residents of New York State must also file an IT-266 Tax Form (Non-Resident Real Property Estimated Income Tax Payment Form) (TAX Law 22-663).

Pursuant to R.P.P. Law 9-333.3, a Real Property Transfer Report is required to accompany all conveyances, excluding deeds of oil and gas or mineral rights. Use Form RP-5217-NYC for real property transfers within the five boroughs of New York City, and use Form RP-5217 for real property transfers in all other counties. Contact the local county clerk's office to confirm the specific local requirements.

This article is provided for informational purposes only and is not a substitute for legal advice. Speak to an attorney with questions related to bargain and sale deeds without covenant, or for any other issues related to transfers of real property in New York.

(New York BSD without Covenants Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Westchester County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Westchester County Bargain and Sale Deed Without Covenants form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4563 Reviews )

JAMES D.

July 10th, 2025

Slick as can be and so convenient.rnrnWorked like a charm

Thank you for your feedback. We really appreciate it. Have a great day!

MARY LACEY M.

June 30th, 2025

Great service! Recording was smooth and swiftly performed. Deeds.com is an excellent service.rn

We are delighted to have been of service. Thank you for the positive review!

Robert F.

June 30th, 2025

Breeze.... It feels silly to hire an attorney to do this for just one beneficiary. Thanks.

Thank you for your feedback. We really appreciate it. Have a great day!

Bradley B.

May 3rd, 2021

Just as advertised.

Thank you for your feedback. We really appreciate it. Have a great day!

Janette K.

May 17th, 2019

I ordered a Transfer of Deed on Death document. It was easy to fill in, came with a useful guide and was customized to my county/state. It got the job done and was well worth the money!

Thank you for your feedback. We really appreciate it. Have a great day!

Jimmy P.

November 7th, 2021

Works well. Very satisfied.

Thank you!

Ginger M.

April 8th, 2022

Deeds.com shares alot of useful information for home owners home buyers and investors i give it a thumbs up

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Mark E.

March 12th, 2019

Thank you for your Swift response. Have docs I was looking for!

Thank you for your feedback. We really appreciate it. Have a great day!

Deborah K.

February 2nd, 2023

great job but, I wanted to upload a document. I got it wrong, but the info was good.

Thank you!

patricia l b.

August 1st, 2021

Wonderful service, very user friendly!

Thank you for your feedback. We really appreciate it. Have a great day!

Billie M.

November 15th, 2023

My overall experience was positive. Little trouble uploading documents but resolved. I had two mineral deeds to file in Arkansas, two different counties, exactly the same form, only difference being property description; one was completed, one was canceled. I emailed to inquire why and the reply was in an automatic email indicating that email address was not monitored and if further action would be taken on Deeds.com part, I would be notified. Other than that, I would recommend their services to avoid using snail mail.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Logan S.

April 27th, 2020

Wonderful experience. Was preapred to wait days, recording was finished in less than an hour.

Thank you!

Theresa B.

September 10th, 2019

Will review after I attempt to complete. I like your site. Im very nervous to try this Hope not outdated information. Will let you know if filing goes okay.

Thank you!

Lou H.

April 27th, 2019

5 stars.

Thank you!

LEON S.

November 16th, 2019

recorded deed space to small for corrective deed requirement

Thank you for your feedback. We really appreciate it. Have a great day!