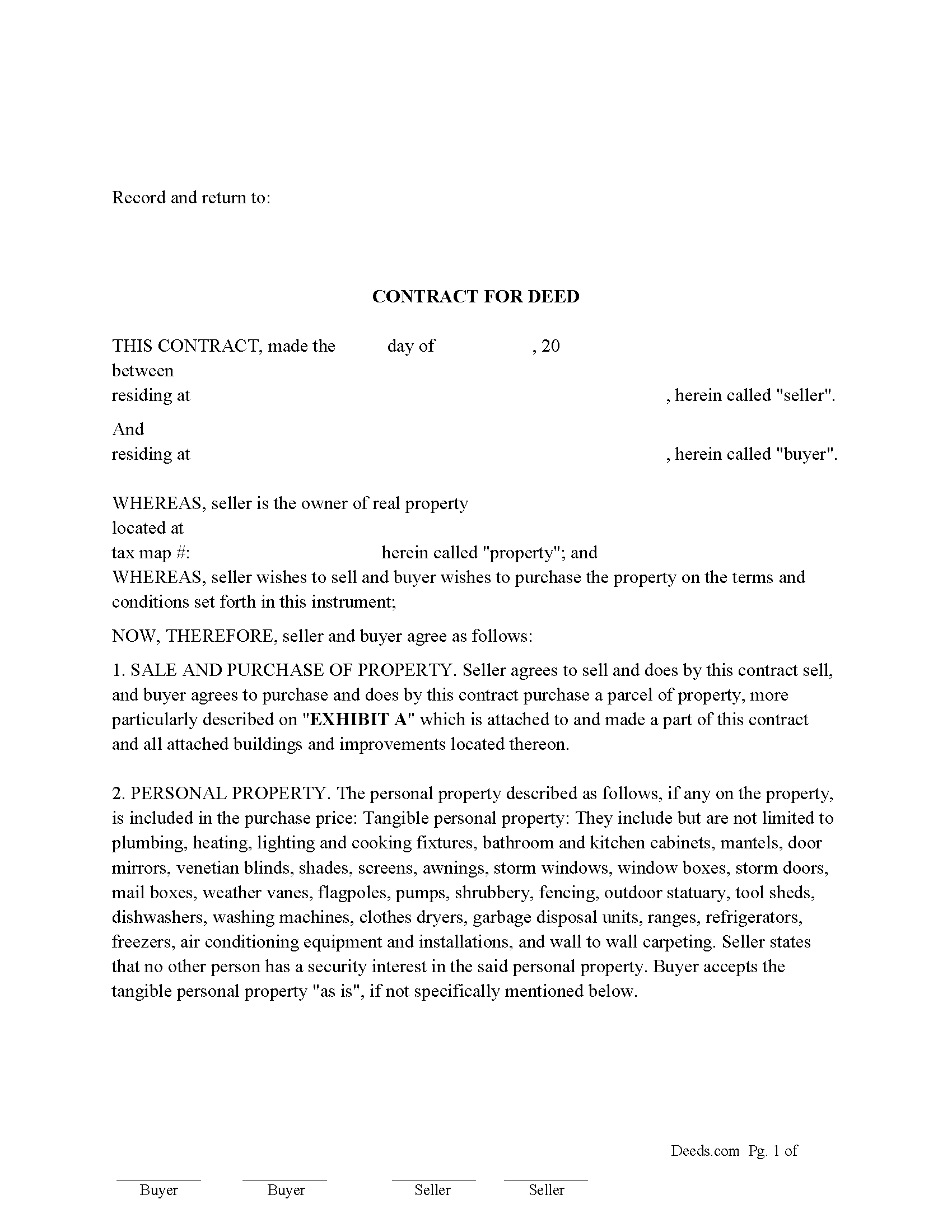

Putnam County Contract for Deed Form

Putnam County Contract for Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

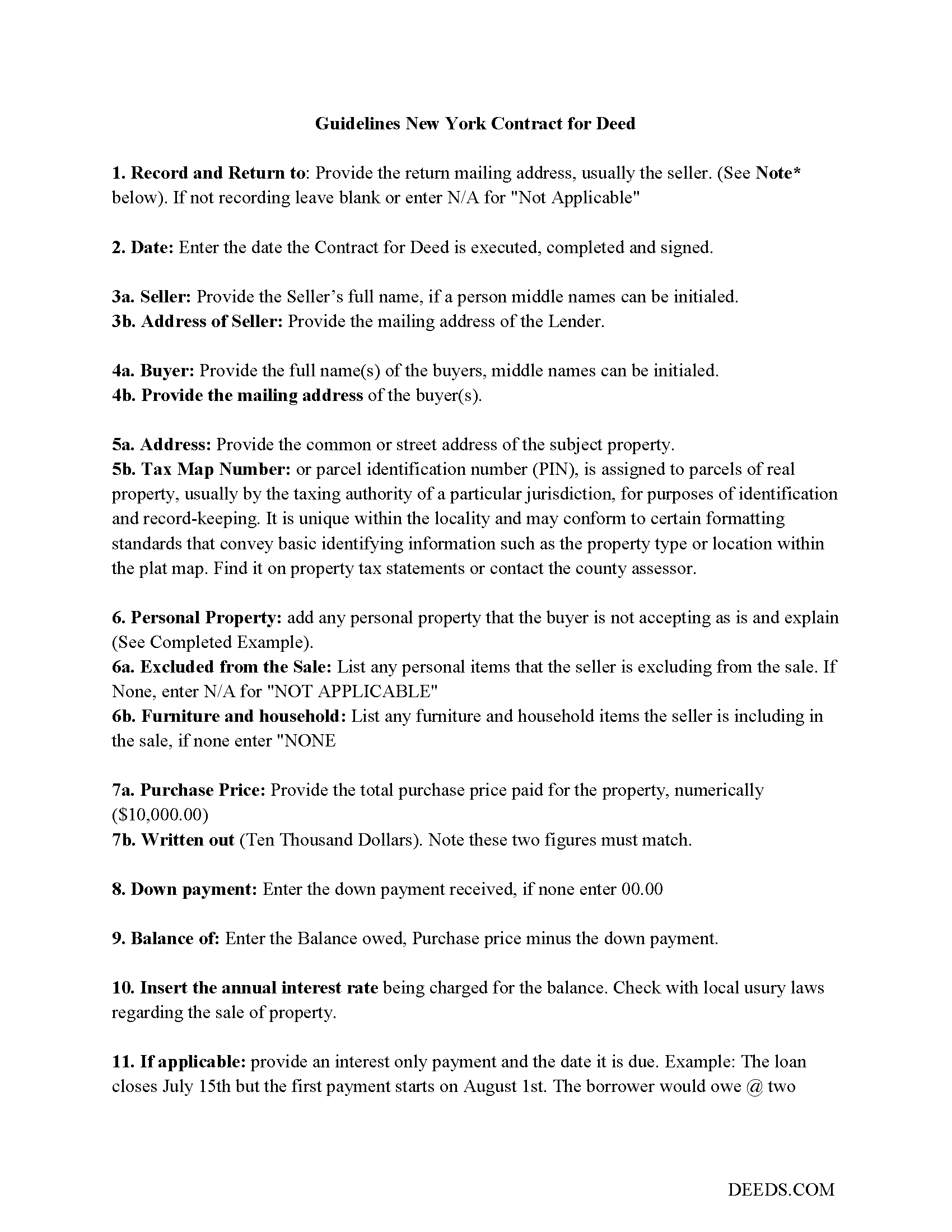

Putnam County Contract for Deed Guidelines

Line by line guide explaining every blank on the form.

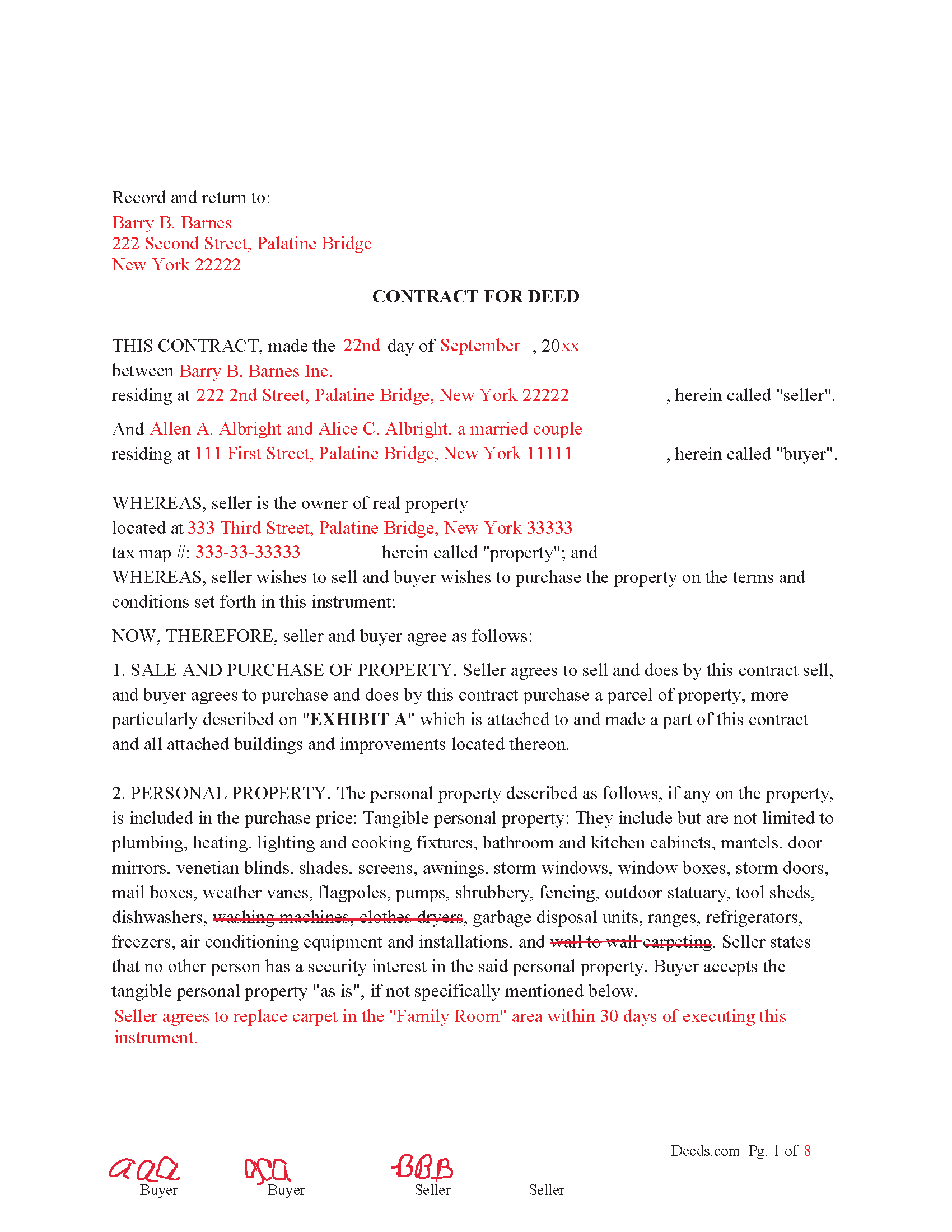

Putnam County Completed Example of the Contract for Deed

Example of a properly completed form for reference.

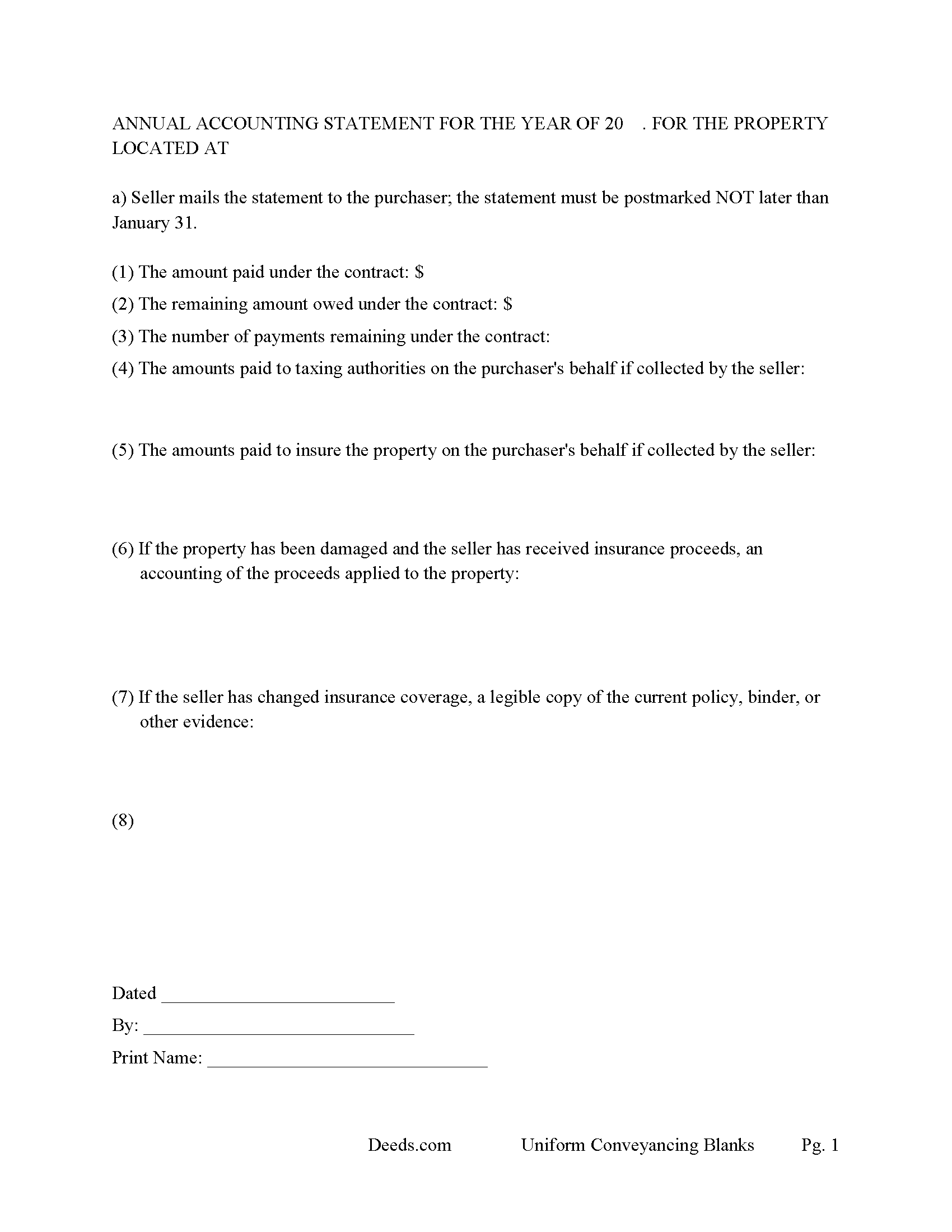

Putnam County Annual Accounting Statement Form

Required annually to notify buyer of remaining balances.

All 4 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional New York and Putnam County documents included at no extra charge:

Where to Record Your Documents

Putnam County Clerk - County Office Building

Carmel, New York 10512

Hours: Monday - Friday 9am to 5pm / Summer (mid June - mid Sept) 8am to 4pm

Phone: (845) 808-1142 Ext 2

Recording Tips for Putnam County:

- Check margin requirements - usually 1-2 inches at top

- Bring extra funds - fees can vary by document type and page count

- Recording fees may differ from what's posted online - verify current rates

- Multi-page documents may require additional fees per page

Cities and Jurisdictions in Putnam County

Properties in any of these areas use Putnam County forms:

- Brewster

- Carmel

- Cold Spring

- Garrison

- Lake Peekskill

- Mahopac

- Mahopac Falls

- Patterson

- Putnam Valley

Hours, fees, requirements, and more for Putnam County

How do I get my forms?

Forms are available for immediate download after payment. The Putnam County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Putnam County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Putnam County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Putnam County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Putnam County?

Recording fees in Putnam County vary. Contact the recorder's office at (845) 808-1142 Ext 2 for current fees.

Questions answered? Let's get started!

Contract for Deed often referred to as a Land Contract

Use this form for an Owner Financed Sale. This is an 8-page form adaptable to a multitude of situations, a general synopsis; Seller(s) and buyer(s) set their terms and conditions and once the property is paid in full, seller will provide clean title to said property. Financing with Installment payments (Example: $$$$ a month for 10 years), or balloon payment. (Example: Three years of payments with a balance of $$$) owed on this maturity date. Late fees are set by so much owed after so many days with an additional amount owed each and every day thereafter. If this Note is not paid in full at the Maturity Date, Borrowers shall pay to Lender an Overdue Loan Fee, (a) one percent (1.0%) of such principal balance if the Note is paid in full on or after thirty (30) days after the Maturity Date but less than sixty (60) days after the Maturity Date, or

(b) two percent (2.0%) of such principal balance if the Note is paid in full on or after sixty (60) days after the Maturity Date.

BUYER DEFAULT. Buyer is in default upon the occurrence of any of the following:

a. The monthly payment, and any applicable late charge, is not made within thirty (30) days after the monthly due date; or

b. Insurance or taxes are not paid, repairs and maintenance is not performed, or the property is in violation of any applicable laws or government regulations and corrective action is not completed by buyer within thirty (30) days after notice to buyer to pay the insurance or taxes, repair the property, or correct any violation or non-compliance with any applicable laws or regulations. If buyer fails to pay any taxes, insurance, maintain the property in good repair, or correct any violations within the time specified above, seller may do so and any expense incurred by seller shall be paid by buyer to seller within thirty (30) days from receipt by buyer of a written bill therefor paid therefor by seller.

TRANSFER OF DEED. Upon payment in full of the purchase price, seller agrees to complete, sign and deliver the following to buyer: (a) a warranty deed conveying a good and marketable title to the premises described in this contract, except for encumbrances that may be caused by the acts or omissions of Buyer after the parties sign this contract; (b) Combined Real Estate Transfer Tax Return and Credit Line Mortgage (TP-584); (c) Real Property Transfer Report (RP-5217);

INTERPRETATION OF CONTRACT. New York Law.

Most "Contract for Deeds" are recorded, this is formatted for such use if needed.

(New York CFD Package includes form, guidelines, and completed example)

Important: Your property must be located in Putnam County to use these forms. Documents should be recorded at the office below.

This Contract for Deed meets all recording requirements specific to Putnam County.

Our Promise

The documents you receive here will meet, or exceed, the Putnam County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Putnam County Contract for Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4579 Reviews )

James C.

January 15th, 2021

Satisfactory. I was confused and somwhat lost on what to do and what I was getting.

Thank you!

Monte J.

June 28th, 2019

Very helpful.

Thank you!

Erika H.

December 14th, 2018

The service was fast and efficient. So glad I stumbled upon this website!

Thank you for your feedback. We really appreciate it. Have a great day!

Emily P.

November 14th, 2020

Amazing service, thanks for all your help!

Thank you for your feedback. We really appreciate it. Have a great day!

Allen P.

January 7th, 2023

Information very useful and helpful. It would be helpful to inform purchasers that legal size paper is needed to print documents. We had to run to the store and purchase some.

Thank you for your feedback. We really appreciate it. Have a great day!

Seth T.

January 8th, 2019

THE BEST WEBSITE I HAVE EVER SEEN FOR LEGAL DOCUMENTS!!! THANKS

Thanks Seth, we appreciate your feedback.

Sheron W.

May 23rd, 2022

I've used Deeds.com for a few years. The service is good, and orders are completed fast. I will continue using them and I recommend them.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Rosemary W.

February 27th, 2021

considering the current epidemic your fees save me time and parking fees. with help from DC recorder of deeds I was directed to the correct link to process my deed

Thank you for your feedback. We really appreciate it. Have a great day!

Edward M.

October 3rd, 2022

Thank you very much Very satisfied

Thank you for your feedback. We really appreciate it. Have a great day!

Kenneth M.

August 2nd, 2019

It was adequate to serve my current need, however turned out to be more expensive than I cared for.

Thank you for your feedback. We really appreciate it. Have a great day!

Patricia And James J.

January 1st, 2019

No review provided.

Thank you for your feedback. We really appreciate it. Have a great day!

Kathy C.

March 7th, 2022

It's worth the cost to download the fill in the blank forms. So quick and easy. The lady I spoke to on the phone was super nice and very helpful. She deserves a medal for being so patient with me.

Thank you!

Michael C.

April 30th, 2023

Thank you very much. I received the exact information I was seeking.

Great to hear Michael, thanks for taking the time to leave your feedback.

Patricia C.

March 31st, 2019

Only source I could find. Wasn't sure if I needed same certificate from each state and site had me checkout separately for each. Good way to keep you customer paying up. Just hope what I received is acceptable.

Thank you!

Jonnie G.

November 15th, 2019

I very much dreaded this whole endeavor but very pleasantly surprised. So far, so good. I feel much more confidant that the crucial form, when presented, will play well with the county.......

We appreciate your business and value your feedback. Thank you. Have a wonderful day!