Oswego County Correction Deed Form (New York)

All Oswego County specific forms and documents listed below are included in your immediate download package:

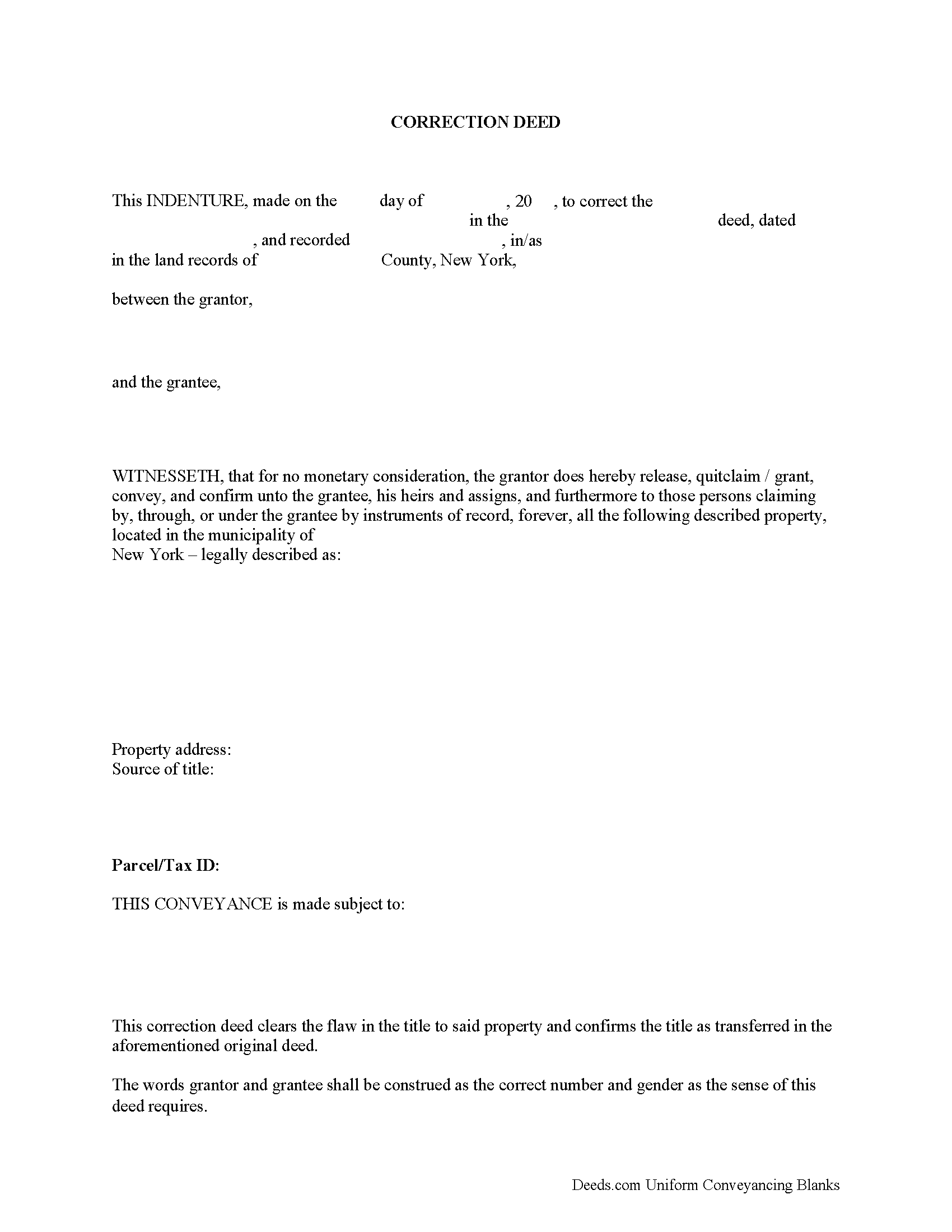

Correction Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Oswego County compliant document last validated/updated 3/28/2025

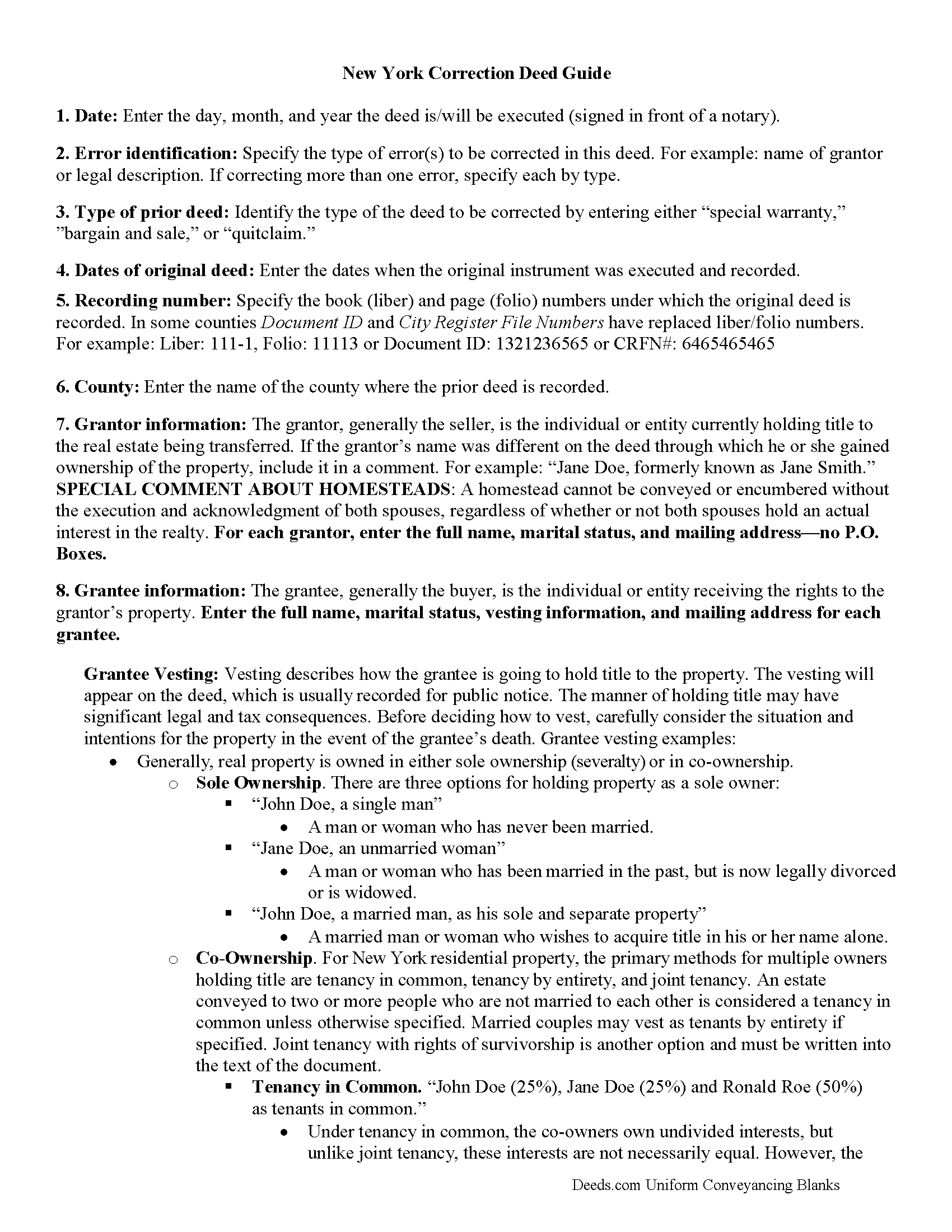

Correction Deed Guide

Line by line guide explaining every blank on the form.

Included Oswego County compliant document last validated/updated 1/6/2025

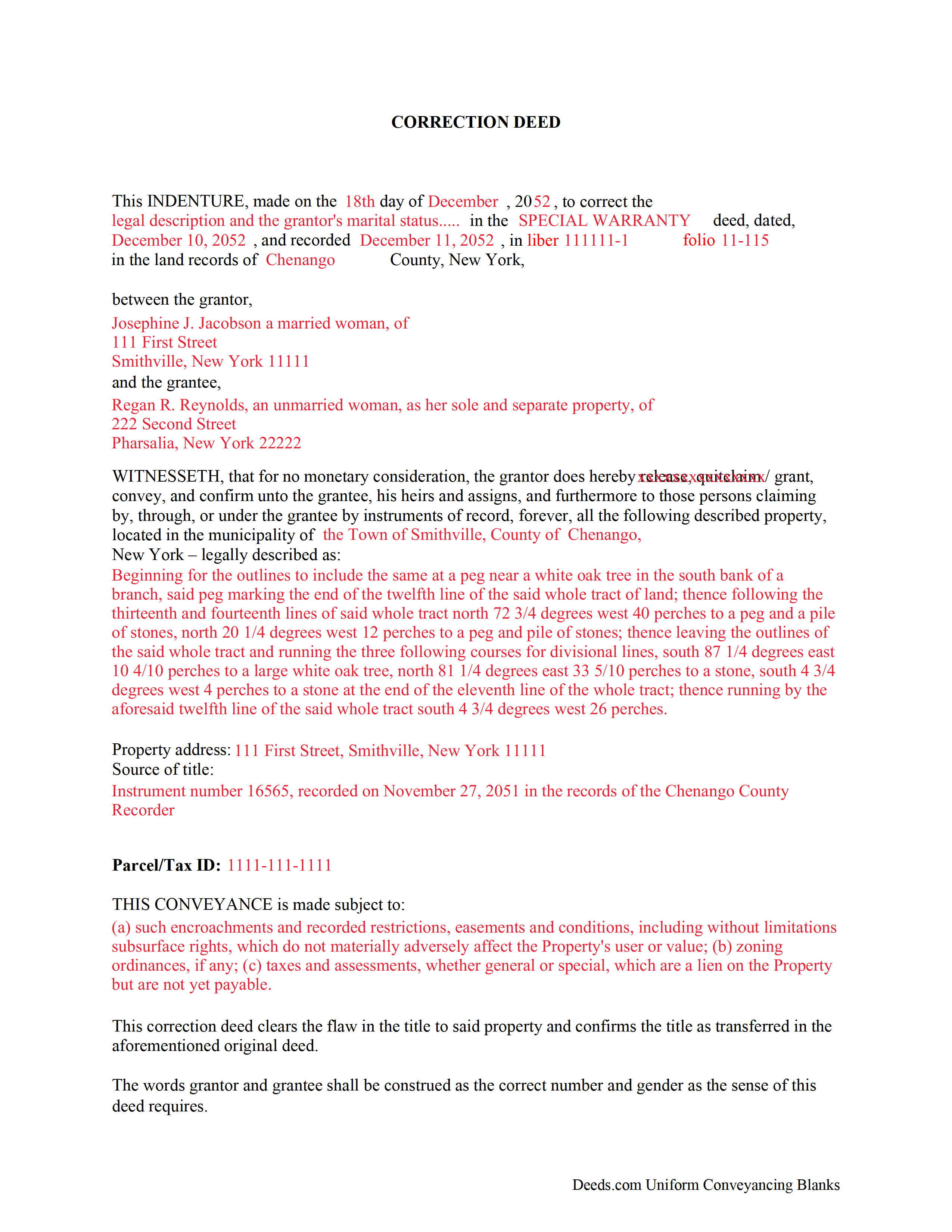

Completed Example of the Correction Deed Document

Example of a properly completed form for reference.

Included Oswego County compliant document last validated/updated 6/25/2025

The following New York and Oswego County supplemental forms are included as a courtesy with your order:

When using these Correction Deed forms, the subject real estate must be physically located in Oswego County. The executed documents should then be recorded in the following office:

Oswego County Clerk's Office

46 E Bridge St, Oswego, New York 13126

Hours: 9:00am to 5:00pm / July-August 8:30am to 4:00pm

Phone: (315) 349-8621

Local jurisdictions located in Oswego County include:

- Altmar

- Bernhards Bay

- Central Square

- Cleveland

- Constantia

- Fulton

- Hannibal

- Hastings

- Lacona

- Lycoming

- Mallory

- Maple View

- Mexico

- Minetto

- New Haven

- Orwell

- Oswego

- Parish

- Pennellville

- Phoenix

- Pulaski

- Redfield

- Richland

- Sandy Creek

- West Monroe

- Williamstown

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Oswego County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Oswego County using our eRecording service.

Are these forms guaranteed to be recordable in Oswego County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Oswego County including margin requirements, content requirements, font and font size requirements.

Can the Correction Deed forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Oswego County that you need to transfer you would only need to order our forms once for all of your properties in Oswego County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by New York or Oswego County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Oswego County Correction Deed forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Correction deeds are sometimes called confirmatory instruments. As such, they confirm and perfect an existing title created earlier and remove any defects from it, but they do not pass title on their own. They make explicit reference to the instrument that is being corrected by indicating its execution and recording date, the place of recording and the number under which the document is filed. They also need to identify the error or errors by type before supplying the correction in the subsequent body of the deed.

A new real property transfer report, RP-5217-pdf (or RP-5217NYC), with original signatures must accompany all deeds in New York, including correction deeds; the same goes for the tax affidavit TP-584, which both seller and buyer must sign. Forms are available at the county recording office or can be ordered online (but not downloaded). As a correction, the transaction may be exempt from transfer tax. Be sure to include proof that the transfer tax was paid, either by including the original cover page of the prior deed, or by providing an affidavit stating that transfer tax was paid with the prior document.

Furthermore, counties often require a cover page, which may be specific to the county or city and provided on their websites. It serves to identify the document more easily and may be called "recording and endorsement (cover) page." New recording fees per page must be paid for a correction instrument.

(New York CD Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Oswego County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Oswego County Correction Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4562 Reviews )

MARY LACEY M.

June 30th, 2025

Great service! Recording was smooth and swiftly performed. Deeds.com is an excellent service.rn

We are delighted to have been of service. Thank you for the positive review!

Robert F.

June 30th, 2025

Breeze.... It feels silly to hire an attorney to do this for just one beneficiary. Thanks.

Thank you for your feedback. We really appreciate it. Have a great day!

Pauline C.

June 29th, 2025

Everything that was stated to be included in my order was complete. Very satisfied

Thank you for your positive words! We’re thrilled to hear about your experience.

Jerry O.

July 10th, 2020

Everything I needed including detailed instructions to transfer the deed on my house from me alone to me and my wife as joint owners with right of survivorship. Formatting was compliant and blanks for all information required were provided in all the right places.

5 stars

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Fay J.

July 30th, 2020

instead of the rep giving me instructions on how to summit the documents,with 3 pages, he or she told me i had all night to figure it out!!! wow...because of that i rate the service very poorly...fast to get it done but very poor customer service...so...i give them a 2.5 rating.

Thank you for your feedback, have a wonderful day Fay.

Cheryl D.

August 24th, 2020

How easy was this. I was pleasantly surprised by the speed and price. Saved me several days of snail mail :) thanks deeds.com!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Sandra B.

February 15th, 2022

Easy to navigate through. Documents were in orderly fashion. Highly recommend. Step by step instructions

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Christine M.

September 8th, 2021

Forms were top notch, easy to complete, printed beautifully, recorded with no revisions. Highly recommend for anyone preparing their own deeds.

Thank you for the kind words Christine. Have an amazing day!

Caroline E.

June 28th, 2024

Very easy!

Thank you for your feedback. We really appreciate it. Have a great day!

ANGELA S.

February 13th, 2020

My E-deed was not excepted by the county, so I had to snail mail the documents to the recorders office. Will probably not use this site again, as it did not fulfill my purpose, but would recommend to those who do not have complicated forms.

Thank you for your feedback. We really appreciate it. Have a great day!

Patricia C.

March 31st, 2019

Only source I could find. Wasn't sure if I needed same certificate from each state and site had me checkout separately for each. Good way to keep you customer paying up.

Just hope what I received is acceptable.

Thank you!

Bernardo M.

March 11th, 2022

You think you're purchasing 1 form for $25 but you are getting several which explains the $25.

My printer ran out of black ink and I couldn't change the color of the text so that it would print. I couldn't copy and paste it to Word and work on it there. I'm going to purchase ink today so that it will at least print right.

I will have to retype the text in Word; not good.

Thank you for your feedback. We really appreciate it. Have a great day!

Della M.

July 7th, 2019

Very easy to purchase with immediate use of all of the forms that you need for probate of property.

My parents had died and left equal shares of their home to my 2 brothers and I.

Thank you!

SUSAN B.

September 16th, 2024

THE PROCEDURE IN GETTING THIS MECHANICS LIEN PROCESSED HAS SO FAR BEEN RELATIVELY SIMPLY - BETTER THAN HAVING TO WAIT ON MAIL OR GO IN PERSON TO GET RECORDED

We are delighted to have been of service. Thank you for the positive review!

Beverly L J.

August 6th, 2020

The process for receiving the quitclaim document worked well. I couldn't use the document. If I had been able to view the document before I had to pay for it, I would have known, but that isn't how your process works. However, that's the only snag I found. Otherwise the process for paying and downloading the document worked well. Thank you.

Thank you for your feedback Beverly. We certainly do not want you to pay for something you are unable to use. To that end we have canceled your order and refunded your payment. We do hope that you find something more suitable to your needs. Have a wonderful day.