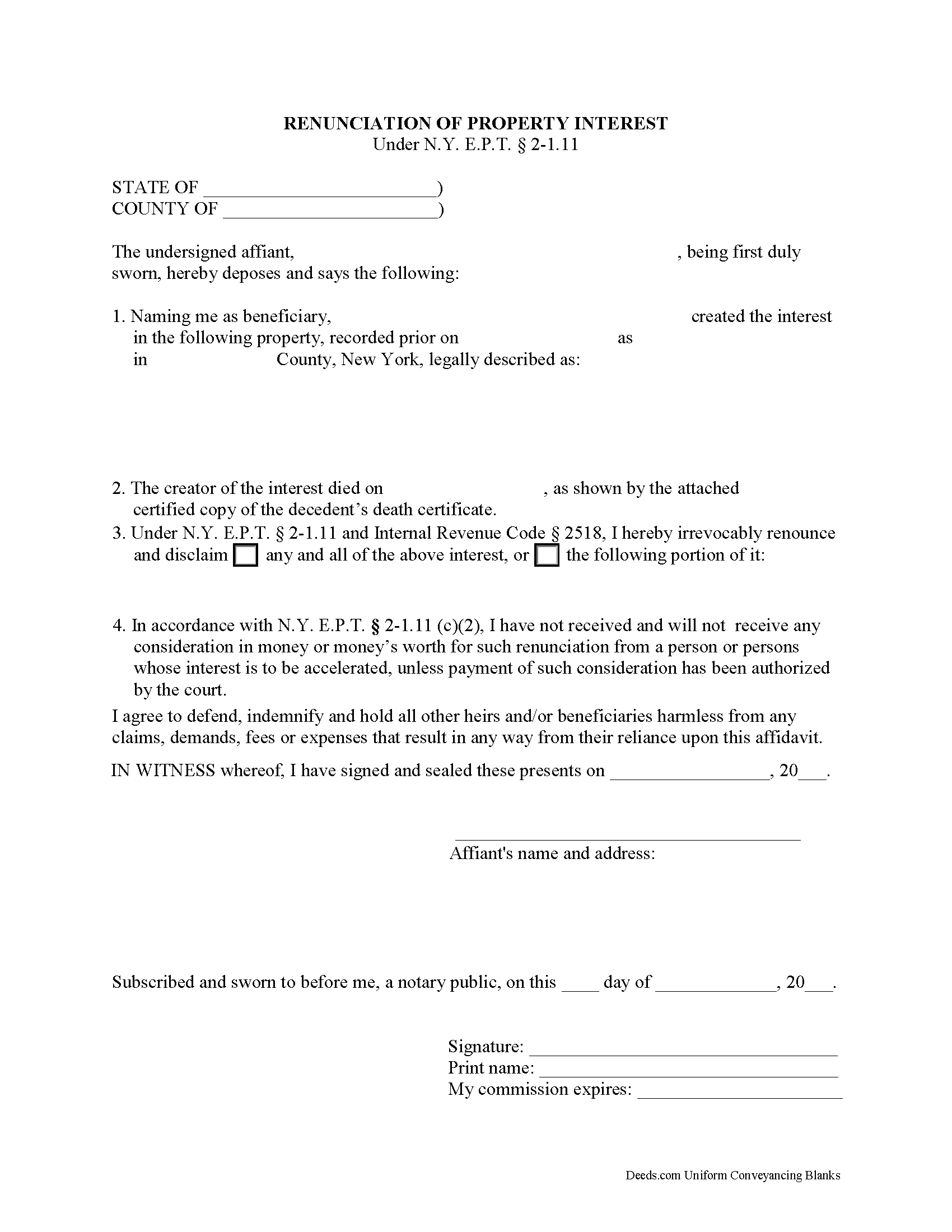

Schuyler County Disclaimer of Interest Form

Schuyler County Disclaimer of Interest Form

Fill in the blank form formatted to comply with all recording and content requirements.

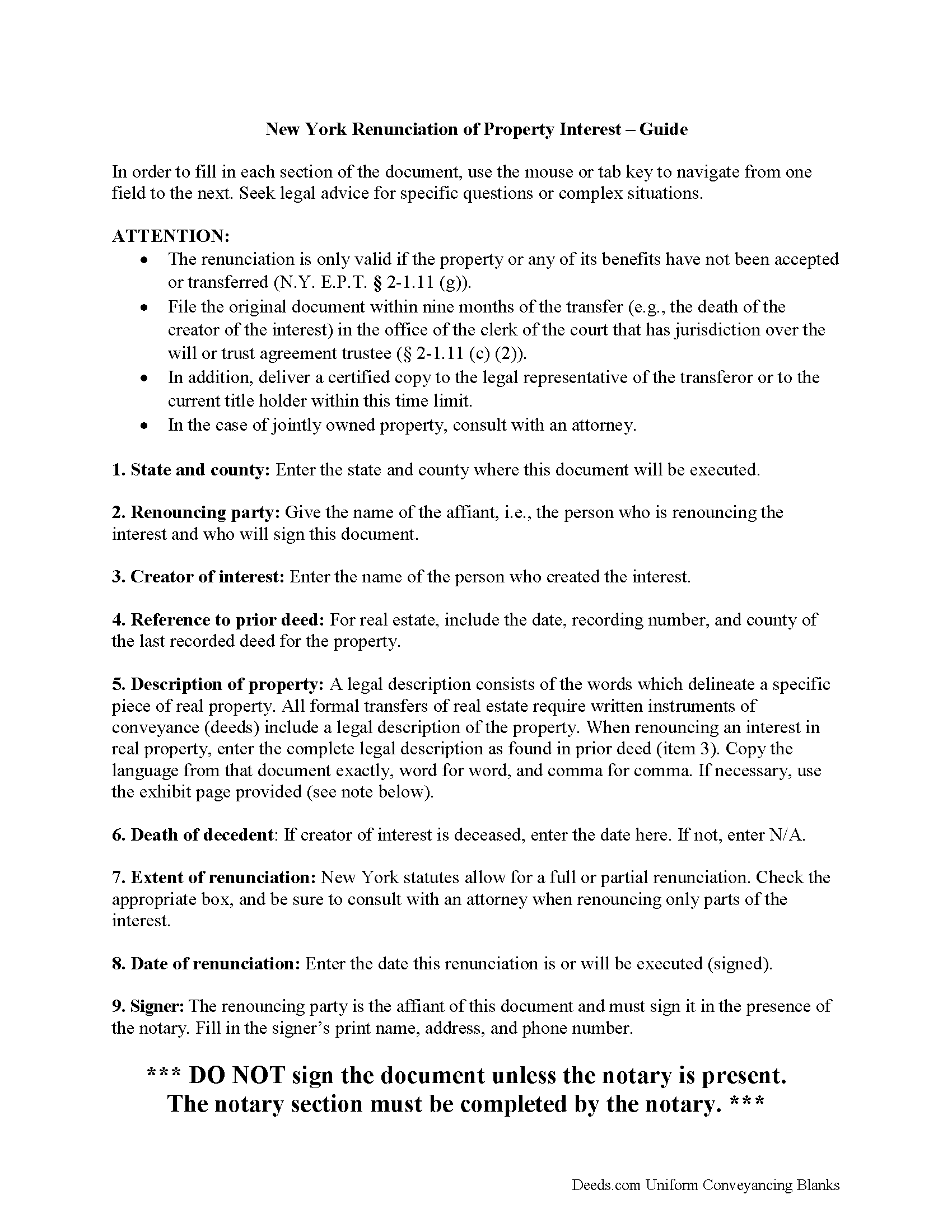

Schuyler County Disclaimer of Interest Guide

Line by line guide explaining every blank on the form.

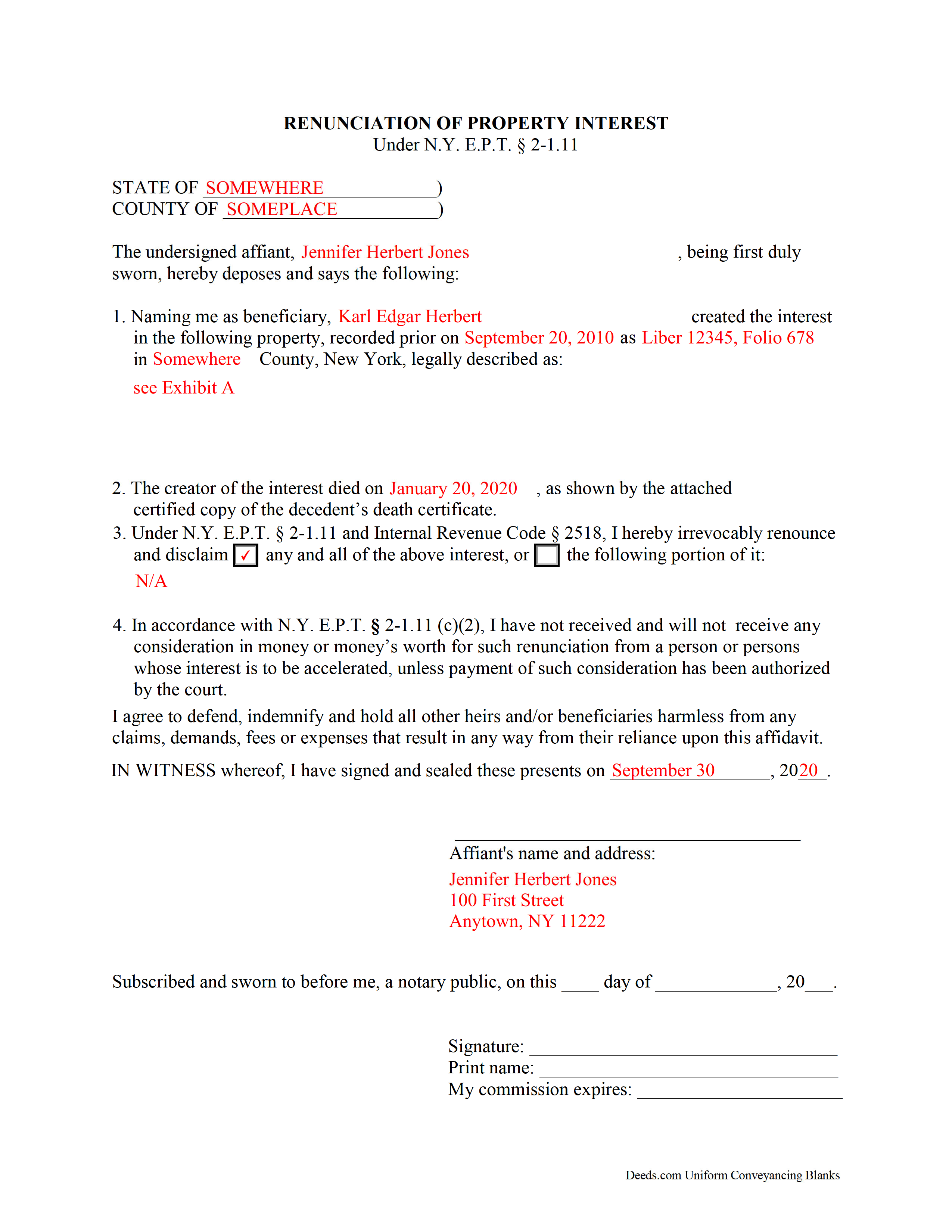

Schuyler County Completed Example of the Disclaimer of Interest Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional New York and Schuyler County documents included at no extra charge:

Where to Record Your Documents

Schuyler County Clerk

Watkins Glen, New York 14891

Hours: Monday – Friday 8:30 am - 4:30 pm

Phone: (607) 535-8133

Recording Tips for Schuyler County:

- Leave recording info boxes blank - the office fills these

- Ask about their eRecording option for future transactions

- Avoid the last business day of the month when possible

Cities and Jurisdictions in Schuyler County

Properties in any of these areas use Schuyler County forms:

- Alpine

- Beaver Dams

- Bradford

- Burdett

- Cayuta

- Hector

- Mecklenburg

- Montour Falls

- Odessa

- Reading Center

- Rock Stream

- Tyrone

- Watkins Glen

- Wayne

Hours, fees, requirements, and more for Schuyler County

How do I get my forms?

Forms are available for immediate download after payment. The Schuyler County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Schuyler County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Schuyler County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Schuyler County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Schuyler County?

Recording fees in Schuyler County vary. Contact the recorder's office at (607) 535-8133 for current fees.

Questions answered? Let's get started!

Renouncing Inherited Property in New York

A beneficiary of an interest in property in New York can disclaim a bequeathed asset or power (New York State Code, Estates, Powers, and Trusts, Article 2, 1.11). Such a renunciation, which must be in writing and signed by the beneficiary or a legally authorized representative, allows that beneficiary to disclaim his or her interest in the property, either in full or partially (1.11 (c) (1), 1.11 (f)).

The renunciation is only valid if the beneficiary has not indicated acceptance of the property, for example, through transfer or encumbrance, acceptance of any payment, or other actions (1.11 (g)). It must be acknowledged by a notary and accompanied by an affidavit stating that the beneficiary is not receiving monetary consideration in exchange for the renunciation (1.11 (c) (2)).

The statutes provide a nine-month window, to be extended at the discretion of the court, during which the beneficiary must file the renunciation document with the surrogate court in the county where the will or estate is being administered. The document must also be delivered to the fiduciary or administrator of the estate, or to the person holding legal title to the property (1.11 (c) (2)).

A renunciation is irrevocable (1.11 (h)) and has the same effect as though the beneficiary "had predeceased the creator or the decedent" (1.11 (e)). So, consult an attorney when in doubt about the drawbacks and benefits of renouncing inherited property.

(New York DOI Package includes form, guidelines, and completed example)

Important: Your property must be located in Schuyler County to use these forms. Documents should be recorded at the office below.

This Disclaimer of Interest meets all recording requirements specific to Schuyler County.

Our Promise

The documents you receive here will meet, or exceed, the Schuyler County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Schuyler County Disclaimer of Interest form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4581 Reviews )

Caville B.

February 10th, 2019

Received the documents, but the explanation and process is not as straightforward as I would have liked. The Instructions and Sample document were not always easy to follow. I may just have a real estate lawyer perform the task.

Thank you for your feedback. We really appreciate it. Have a great day!

Marc T.

August 31st, 2021

Walked the document through our county offices today. the directions to fill out the document were awesome and we had no issues, We now have a TOD property. Beats paying an attorney $200.00

Thank you for your feedback. We really appreciate it. Have a great day!

Lori A.

February 14th, 2023

It was quick and easy. A little expensive but convient

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

jeann p.

September 19th, 2024

The site was extremely helpful.

We are delighted to have been of service. Thank you for the positive review!

Erika H.

December 14th, 2018

The service was fast and efficient. So glad I stumbled upon this website!

Thank you for your feedback. We really appreciate it. Have a great day!

Wilma M.

August 7th, 2020

Amazingly easy. Thank you

Thank you!

Michael W.

February 8th, 2025

Wonderful service.

Thank you!

Kristy T.

March 21st, 2019

Using your site made gifting personal property (land) so quick and easy. The forms were presented ready to complete and included detailed instructions. The "completed form" example was helpful. I definitely recommend your site to anyone who does not wish to pay expensive lawyer fees.

Thank you Kristy, we appreciate your feedback

Bayyinah M.

March 30th, 2022

EasyPeasy!

Thank you!

Gina M.

August 25th, 2021

Wow, great forms. They do have some protections in place to keep you from doing something stupid but if you use the forms as intended they will work perfectly for you.

Thank you for your feedback. We really appreciate it. Have a great day!

Elizabeth F.

February 14th, 2022

This was great other than exemption codes did not populate and I couldn't refer to it.

Thank you for your feedback. We really appreciate it. Have a great day!

Christina D.

March 31st, 2025

The papers allowed me to get done what I needed. But for the price I would expect a spell check. There were spelling errors when there should not have been any. Please proof read

Your feedback is a crucial part of our dedication to ongoing improvement. Thank you for your insightful comments.

Marilyn J.

July 18th, 2020

Just what I needed!

Thank you!

Christine L.

May 13th, 2025

User friendly!

Thank you!

Spencer A.

January 25th, 2019

Deeds.com made it so easy to file my paper work with the county. It saved me half a days travel and cost me about a tank of gas. This service was well worth the saved travel time and energy. I would highly recommend this service to other individuals. The other companies I spoke with only service law firms, title companies & banks etc. Thanks deed.com, I'll be back and will refer all my friends too.

Thank you so much Spencer, we really appreciate your feedback!