Chenango County Revocation of Transfer on Death Deed Form

Chenango County Revocation of Transfer on Death Deed Form

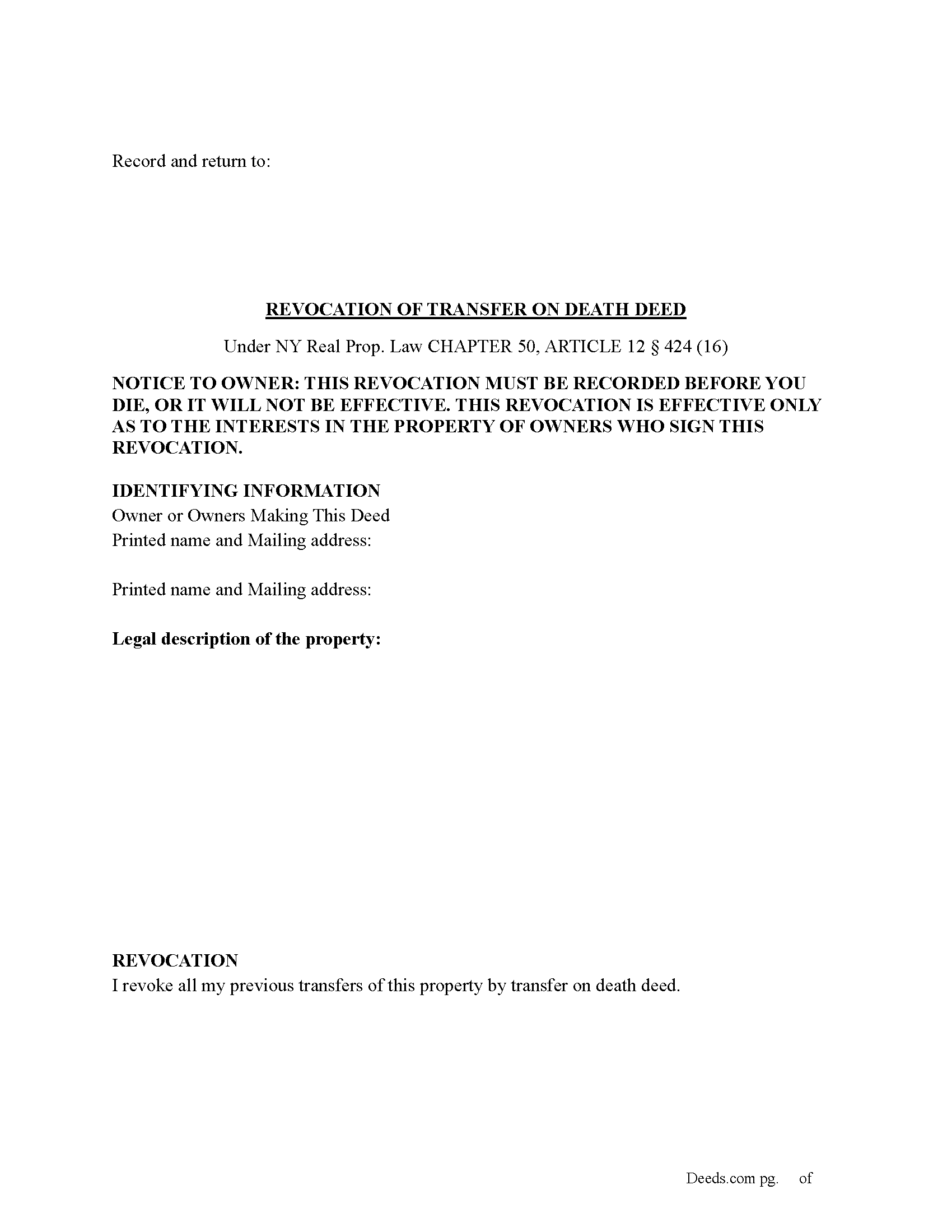

Fill in the blank Revocation of Transfer on Death Deed form formatted to comply with all New York recording and content requirements.

Chenango County Revocation of Transfer on Death Deed Guide

Line by line guide explaining every blank on the Revocation of Transfer on Death Deed form.

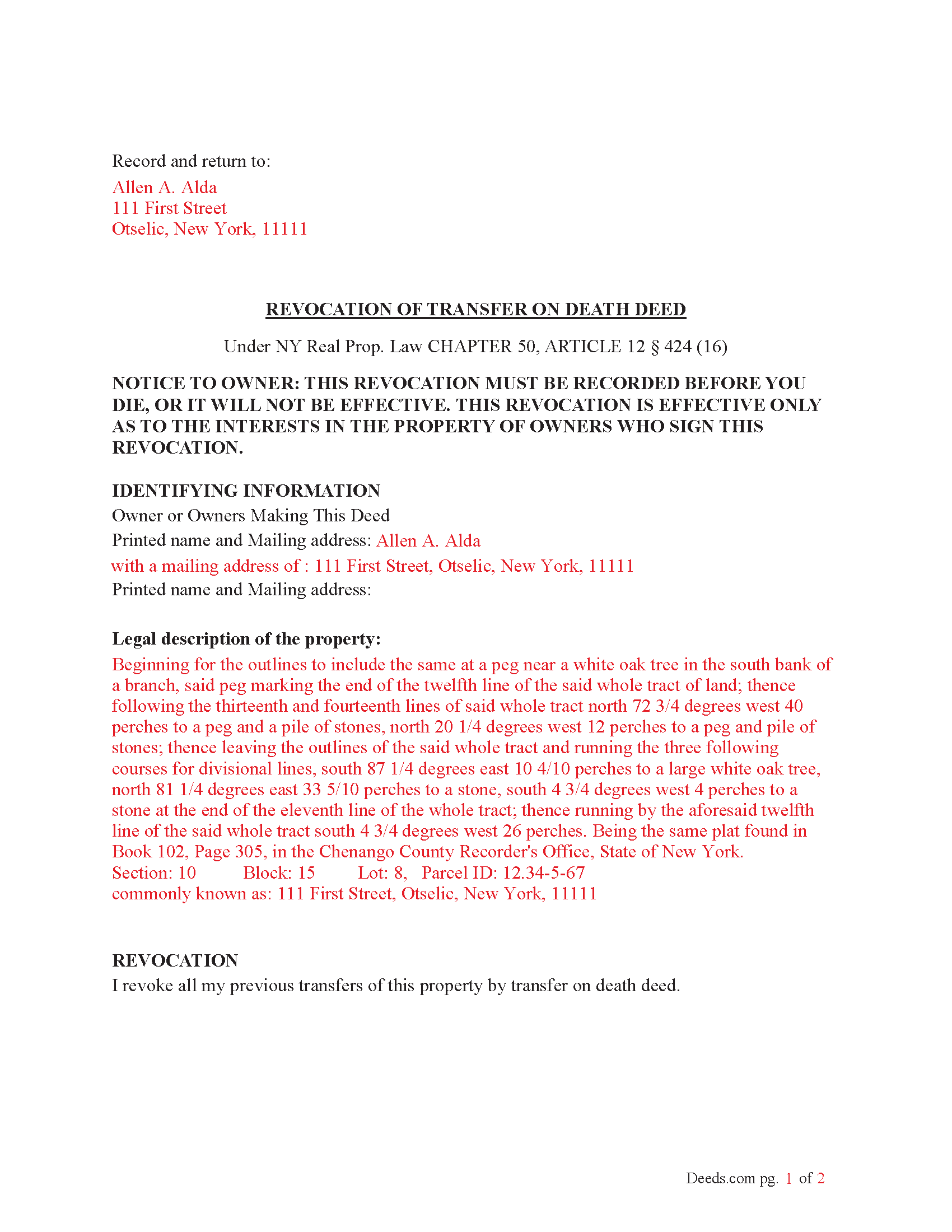

Chenango County Completed Example of the Revocation of Transfer on Death Deed Document

Example of a properly completed New York Revocation of Transfer on Death Deed document for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional New York and Chenango County documents included at no extra charge:

Where to Record Your Documents

Chenango County Clerk - County Building

Norwich, New York 13815

Hours: 8:30am to 5:00pm Monday through Friday

Phone: (607) 337-1450

Recording Tips for Chenango County:

- Bring your driver's license or state-issued photo ID

- Double-check legal descriptions match your existing deed

- Avoid the last business day of the month when possible

- Recording fees may differ from what's posted online - verify current rates

- Ask for certified copies if you need them for other transactions

Cities and Jurisdictions in Chenango County

Properties in any of these areas use Chenango County forms:

- Afton

- Bainbridge

- Earlville

- East Pharsalia

- Greene

- Guilford

- Mc Donough

- Mount Upton

- New Berlin

- North Norwich

- North Pitcher

- Norwich

- Oxford

- Pitcher

- Plymouth

- Sherburne

- Smithville Flats

- Smyrna

- South New Berlin

- South Otselic

- South Plymouth

Hours, fees, requirements, and more for Chenango County

How do I get my forms?

Forms are available for immediate download after payment. The Chenango County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Chenango County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Chenango County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Chenango County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Chenango County?

Recording fees in Chenango County vary. Contact the recorder's office at (607) 337-1450 for current fees.

Questions answered? Let's get started!

(How do I revoke the TOD deed after it is recorded?

There are three ways to revoke a recorded TOD deed:

(1) Complete and acknowledge a revocation form and record it in each county where the property is located.

(2) Complete and acknowledge a new TOD deed that disposes of the same property and record it in each county where the property is located.

(3) Transfer the property to someone else during your lifetime by a recorded deed that expressly revokes the TOD deed. You may not revoke the TOD deed by will.) (Real Property (RPP) CHAPTER 50, ARTICLE 12 § 424(15))

Execution of Revocation: The revocation must be executed (signed) by the property owner in the presence of two witnesses and a Notary Public, similar to how the original TOD deed was executed.

Recording the Revocation: The revocation (whether via a new TOD deed or a revocation form) must be recorded in the County Clerk's office where the property is located, just like the original TOD deed. If the revocation is not recorded, it will not be valid.

Retain Control Until Revoked: The property owner retains full control over the property and can revoke the TOD deed at any time during their lifetime. However, after the owner's death, the TOD deed takes effect and cannot be revoked.

Important Considerations: Beneficiary Consent- The property owner does not need the consent of the beneficiary to revoke the TOD deed.

Automatic Revocation by Sale: If the property owner sells or transfers the property during their lifetime, this will also effectively revoke the TOD deed.

Important: Your property must be located in Chenango County to use these forms. Documents should be recorded at the office below.

This Revocation of Transfer on Death Deed meets all recording requirements specific to Chenango County.

Our Promise

The documents you receive here will meet, or exceed, the Chenango County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Chenango County Revocation of Transfer on Death Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4581 Reviews )

Margaret P.

May 15th, 2025

EXCELLENT WEBSITE AND SERVICE, HIGHLY RECOMMENDED.

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Judy A S.

October 15th, 2022

Great do it yourself forms (I used the Quitclaim deed). If you think you're going to need a lot of hand holding you might consider hiring an attorney. The guide and general information provided by deeds.com will help if you have some idea of what you are doing and you are willing to research a little. Your mileage may vary but for me, this was a very efficient and economical way to get my quitclaim deed done.

Thank you for your feedback. We really appreciate it. Have a great day!

Ronald S.

May 20th, 2019

got what i wanted

Thank you for your feedback. We really appreciate it. Have a great day!

John H.

September 13th, 2021

Quality product. Forms are as advertised. Easy to use site.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Qingqiu H.

May 14th, 2022

I ordered the wrong forms at first because I'm an idiot and didn't do my research. When I told the customer service about my error they were understanding.

Thank you for your feedback. We really appreciate it. Have a great day!

Joe D.

June 15th, 2019

Complete coverage of deeds, laws, etc.

Thank you!

Clifford J.

July 4th, 2022

a lil pricey but i was able to knock out what needed to be done within 2 hours and not all day.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Lee J.

February 20th, 2023

Very good so far -- downloading all the forms. So many forms -- I had no idea ....

Thank you for your feedback. We really appreciate it. Have a great day!

Christopher H.

July 21st, 2021

The product is as advertised. I was unable to navigate this process because It is complicated and I am concerned about doing it wrong. The law is written in stupid language to make it difficult for all and keep the layering business going. Its a solid form but did not work for me. Thanks Chris

Thank you for your feedback Christopher. Sorry to hear that we’re not comfortable completing the process. It is always best to seek the advice of a legal professional is you are not completely sure of what you are doing.

Joy V.

December 24th, 2018

Very helpful and efficient!

Thank you for your feedback. We really appreciate it. Have a great day!

Keith C.

April 12th, 2019

not worth anything to me as i could never get notary info on form to print along with other info

Sorry to hear that Keith. We have processed a refund for your order.

Mary Ann G.

April 16th, 2019

Couldn't find the deed form that I needed. Needs to have a short summary to determine the correct form.

Sorry to hear that Mary Ann, we appreciate your feedback.

John M.

May 14th, 2022

I found just what I needed at a very good price.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Oldemar T.

June 23rd, 2020

You guys simplified my life. You offer very convenient services. Thank you.

Thank you!

Carol H.

December 22nd, 2021

Great help Quite useful

Thank you!