Lewis County Revocation of Transfer on Death Deed Form

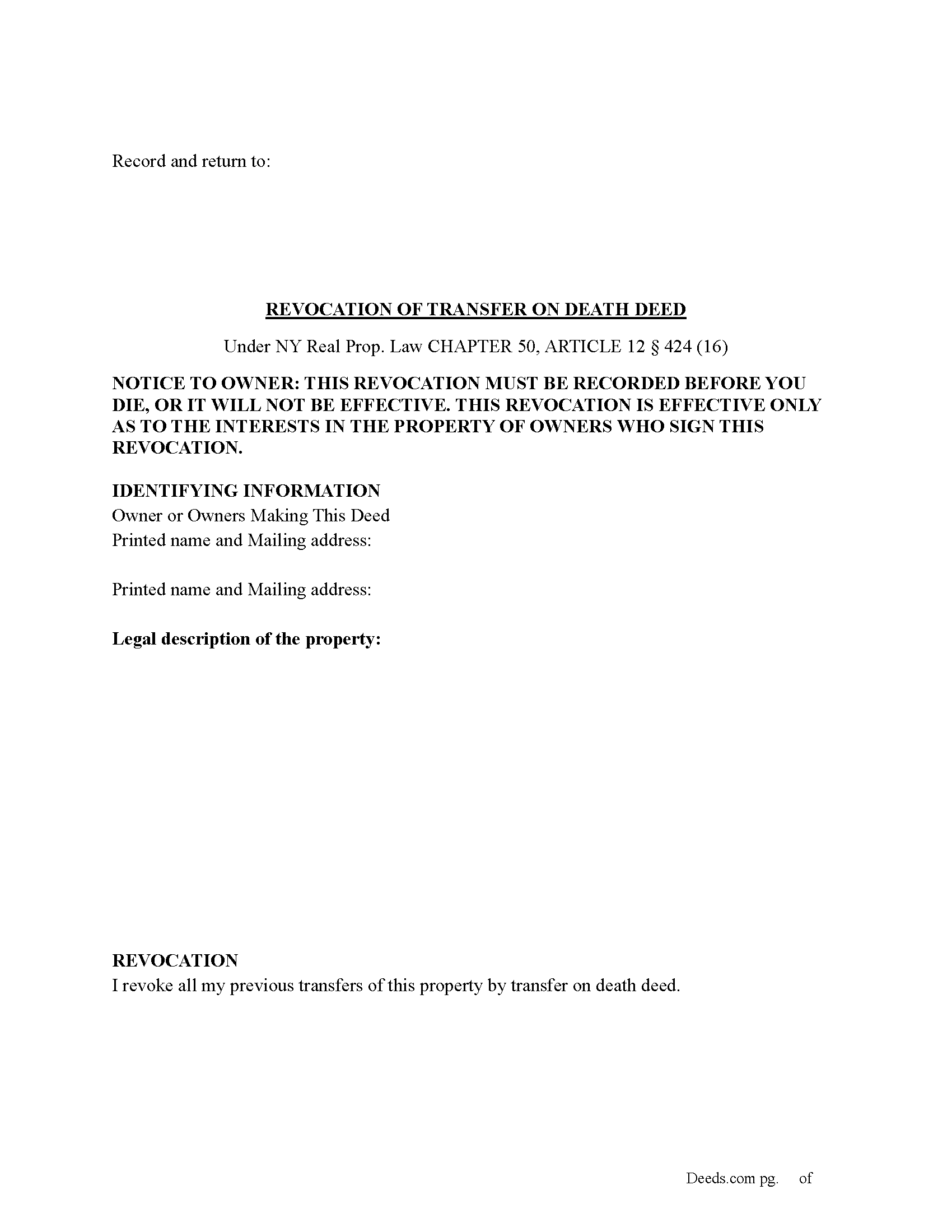

Lewis County Revocation of Transfer on Death Deed Form

Fill in the blank Revocation of Transfer on Death Deed form formatted to comply with all New York recording and content requirements.

Lewis County Revocation of Transfer on Death Deed Guide

Line by line guide explaining every blank on the Revocation of Transfer on Death Deed form.

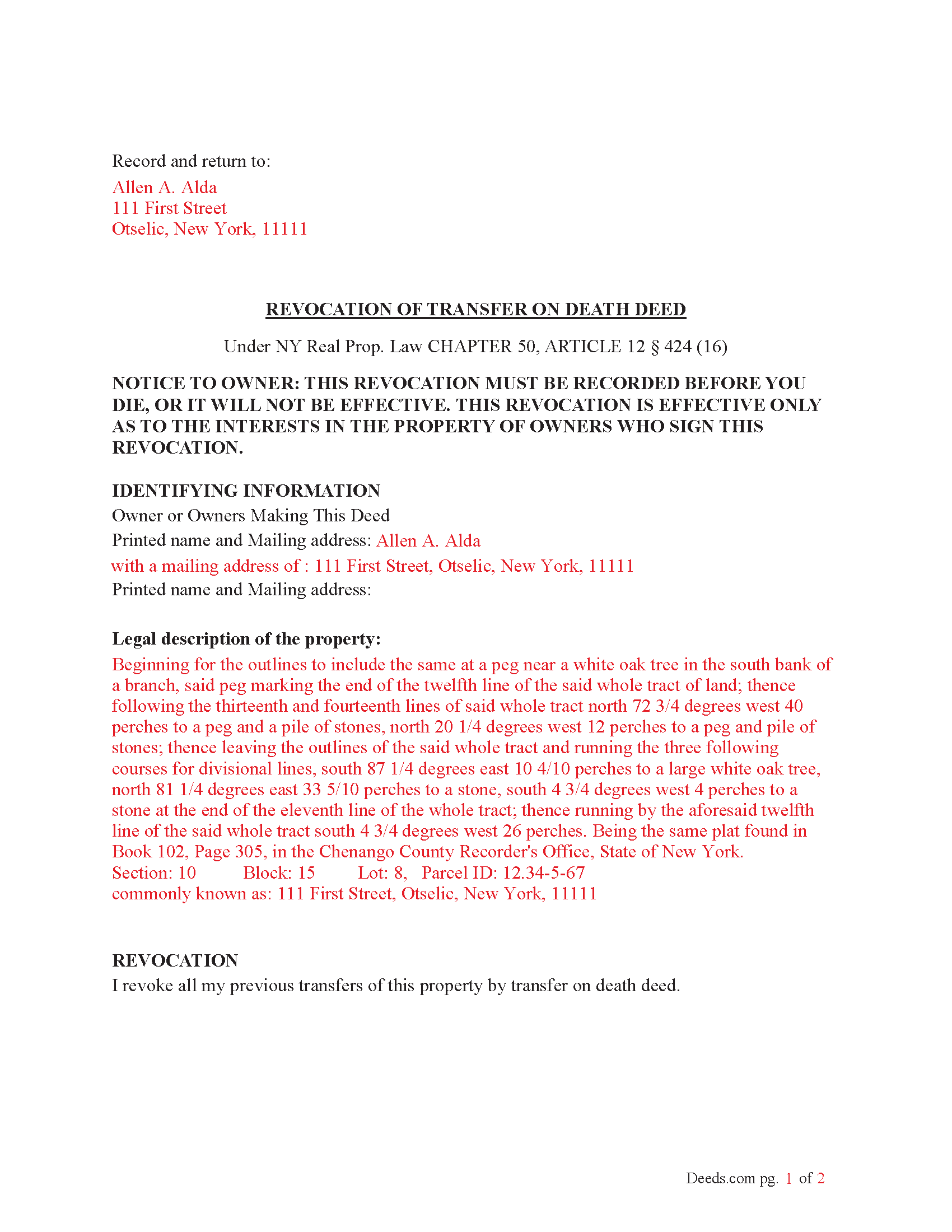

Lewis County Completed Example of the Revocation of Transfer on Death Deed Document

Example of a properly completed New York Revocation of Transfer on Death Deed document for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional New York and Lewis County documents included at no extra charge:

Where to Record Your Documents

Lewis County Clerk - County Court House

Lowville, New York 13367

Hours: Monday - Friday 8:30 am - 4:30 pm

Phone: (315) 376-5333

Recording Tips for Lewis County:

- Ensure all signatures are in blue or black ink

- White-out or correction fluid may cause rejection

- Avoid the last business day of the month when possible

- Ask about their eRecording option for future transactions

- Ask about accepted payment methods when you call ahead

Cities and Jurisdictions in Lewis County

Properties in any of these areas use Lewis County forms:

- Beaver Falls

- Brantingham

- Castorland

- Constableville

- Copenhagen

- Croghan

- Deer River

- Denmark

- Glenfield

- Greig

- Harrisville

- Lowville

- Lyons Falls

- Martinsburg

- Port Leyden

- Turin

- West Leyden

Hours, fees, requirements, and more for Lewis County

How do I get my forms?

Forms are available for immediate download after payment. The Lewis County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Lewis County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Lewis County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Lewis County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Lewis County?

Recording fees in Lewis County vary. Contact the recorder's office at (315) 376-5333 for current fees.

Questions answered? Let's get started!

(How do I revoke the TOD deed after it is recorded?

There are three ways to revoke a recorded TOD deed:

(1) Complete and acknowledge a revocation form and record it in each county where the property is located.

(2) Complete and acknowledge a new TOD deed that disposes of the same property and record it in each county where the property is located.

(3) Transfer the property to someone else during your lifetime by a recorded deed that expressly revokes the TOD deed. You may not revoke the TOD deed by will.) (Real Property (RPP) CHAPTER 50, ARTICLE 12 § 424(15))

Execution of Revocation: The revocation must be executed (signed) by the property owner in the presence of two witnesses and a Notary Public, similar to how the original TOD deed was executed.

Recording the Revocation: The revocation (whether via a new TOD deed or a revocation form) must be recorded in the County Clerk's office where the property is located, just like the original TOD deed. If the revocation is not recorded, it will not be valid.

Retain Control Until Revoked: The property owner retains full control over the property and can revoke the TOD deed at any time during their lifetime. However, after the owner's death, the TOD deed takes effect and cannot be revoked.

Important Considerations: Beneficiary Consent- The property owner does not need the consent of the beneficiary to revoke the TOD deed.

Automatic Revocation by Sale: If the property owner sells or transfers the property during their lifetime, this will also effectively revoke the TOD deed.

Important: Your property must be located in Lewis County to use these forms. Documents should be recorded at the office below.

This Revocation of Transfer on Death Deed meets all recording requirements specific to Lewis County.

Our Promise

The documents you receive here will meet, or exceed, the Lewis County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Lewis County Revocation of Transfer on Death Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4581 Reviews )

Dennis H.

June 26th, 2019

Thank you for this program. It will help in the future. Dennis Holt

Thank you!

ROBERT H.

September 13th, 2020

Quick and easy. A very good value even without COVID complications. Since we DO have COVID complications this is perfect.

Thank you for your feedback. We really appreciate it. Have a great day!

Hope A.

June 4th, 2021

Great Website and layout!! so easy!

Thank you!

Jenifer L.

January 2nd, 2019

I'm an attorney. I see youve mixed up the terms "grantor" and "grantee" and their respective rights in this version. Anyone using it like this might have title troubles down the line.

Thank you for your feedback Jenifer, we have flagged the document for review.

Sandra P.

July 25th, 2020

Thank so much! It' was pretty easy with the help of my Brother in-law .

Thank you for your feedback. We really appreciate it. Have a great day!

Jing H.

March 8th, 2019

Excellent work. I have recommended some friends to your website and will continue. Thanks.

Thank you Jing. Have a fantastic day!

Suzanne D.

January 7th, 2019

Information found, thank you. I own Ground Rent on property and needed to know name of property owner and address for mailing bill.

Thank you!

rich b.

September 3rd, 2021

Had pretty much everything I needed. Had to slice and dice a bit.

Thank you!

Viviana Hansen M.

March 3rd, 2024

I was thrilled that I could execute the paperwork for a lady bird deed here in Florida ! Thank you

We are grateful for your feedback and looking forward to serving you again. Thank you!

edward m.

February 27th, 2019

I would rate it 5 stars also. Eddie M.

Thank you!

Marilyn C.

April 6th, 2020

My document got recorded right away. Thank you! Will use again in the future when needed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Junior S.

December 22nd, 2022

Good

Thank you!

Xochitl B.

November 30th, 2021

Excellent website, thanks so much.

Thank you!

Linda s.

October 10th, 2020

This was such an easy process and even tho you had to pay a $15 - to me it was well worth not having to drive downtown etc or take the risk of mailing the documents (fearing that they would get lost). I'll be using this from now on...

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

LINDA C.

June 29th, 2020

EASY, FAST, AND CONVENIENT.

Thank you!