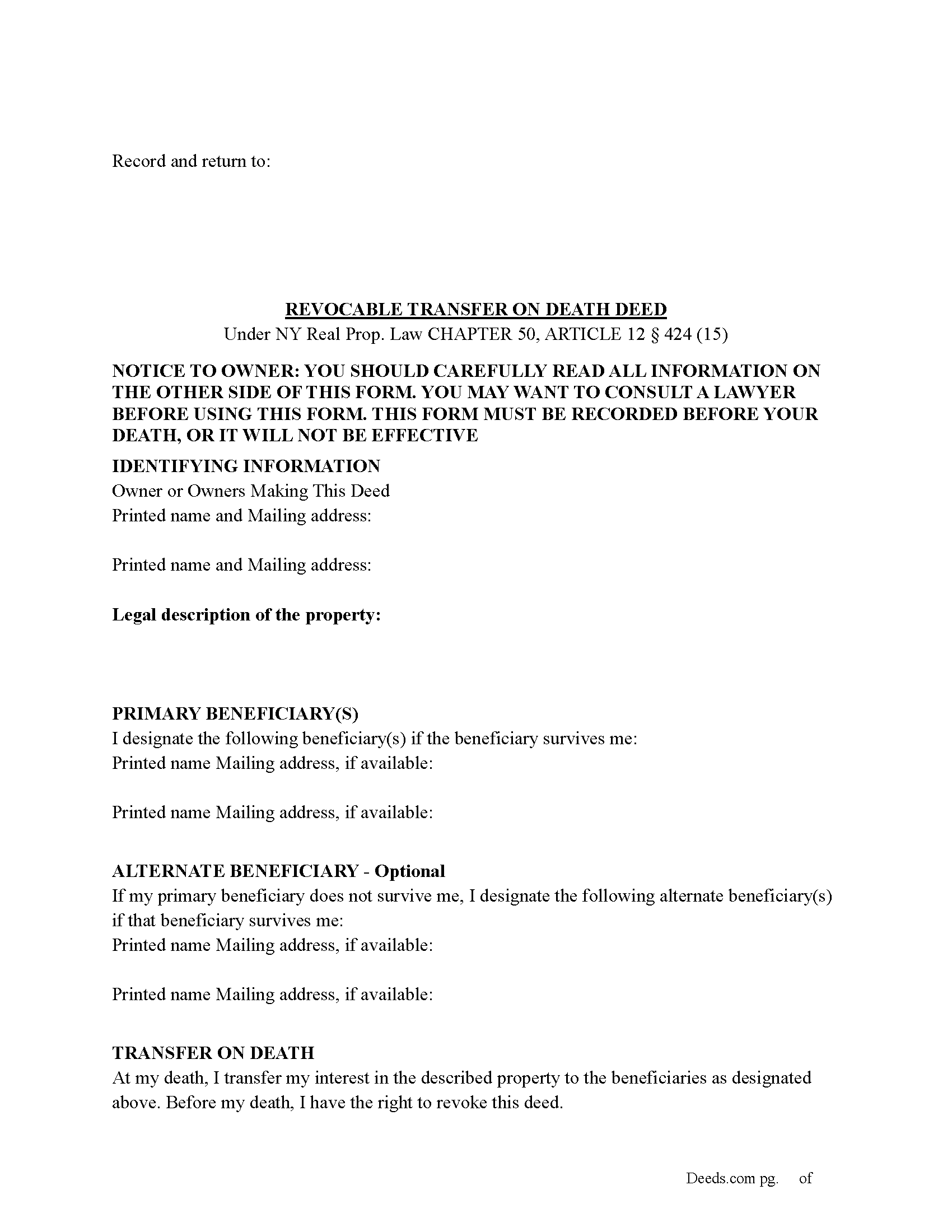

Franklin County Transfer on Death Deed Form

Franklin County Transfer on Death Deed Form

Fill in the blank Transfer on Death Deed form formatted to comply with all New York recording and content requirements.

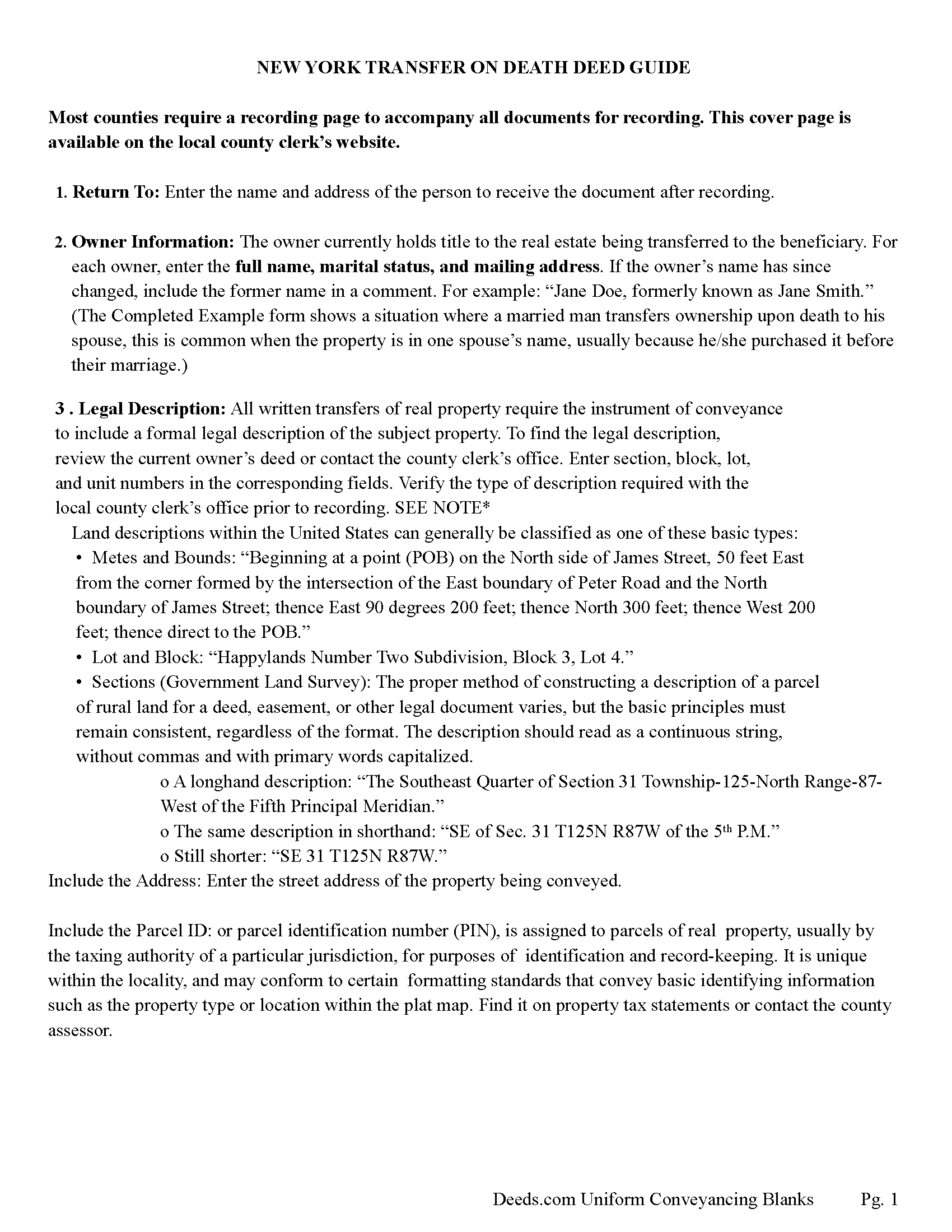

Franklin County Transfer on Death Deed Guide

Line by line guide explaining every blank on the Transfer on Death Deed form.

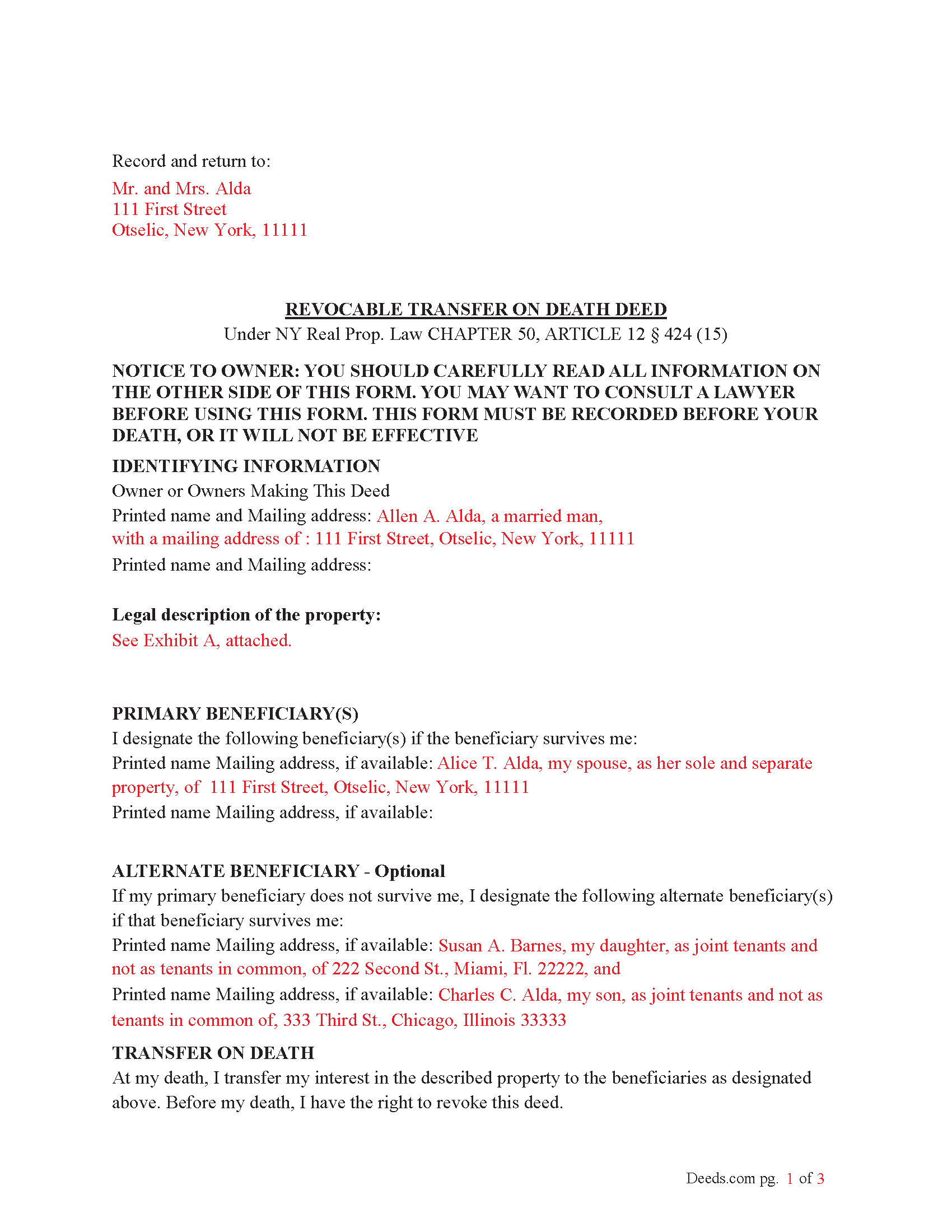

Franklin County Completed Example of the Transfer on Death Deed Document

Example of a properly completed New York Transfer on Death Deed document for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional New York and Franklin County documents included at no extra charge:

Where to Record Your Documents

Franklin County Clerk

Malone, New York 12953

Hours: 8:00 am - 4:00 pm Monday through Friday (except Holidays)

Phone: (518) 481-1681 and 1682

Recording Tips for Franklin County:

- Check that your notary's commission hasn't expired

- Verify all names are spelled correctly before recording

- Documents must be on 8.5 x 11 inch white paper

- Ask about accepted payment methods when you call ahead

Cities and Jurisdictions in Franklin County

Properties in any of these areas use Franklin County forms:

- Bombay

- Brainardsville

- Brushton

- Burke

- Chateaugay

- Constable

- Dickinson Center

- Fort Covington

- Gabriels

- Hogansburg

- Lake Clear

- Malone

- Moira

- North Bangor

- Owls Head

- Paul Smiths

- Rainbow Lake

- Saint Regis Falls

- Saranac Lake

- Tupper Lake

- Vermontville

- Whippleville

Hours, fees, requirements, and more for Franklin County

How do I get my forms?

Forms are available for immediate download after payment. The Franklin County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Franklin County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Franklin County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Franklin County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Franklin County?

Recording fees in Franklin County vary. Contact the recorder's office at (518) 481-1681 and 1682 for current fees.

Questions answered? Let's get started!

To use the Transfer on Death (TOD) Deed under New York’s Real Property Law (RPP) CHAPTER 50, ARTICLE 12 § 424 (effective July 19, 2024), follow these steps:

1. Complete the TOD Deed

Designate a beneficiary: Clearly name the individual or entity (such as a charity or trust) who will inherit your property upon your death.

Include contingent beneficiaries if desired (NOT required). These are backup beneficiaries who would inherit the property if your primary beneficiary cannot (e.g., if they predecease you). Ensure the deed is filled out correctly, including the legal description of the property.

2. Execute the TOD Deed: The TOD deed must be signed by the property owner (the transferor) in the presence of two witnesses and a Notary Public. The witnesses should not be the beneficiaries themselves, as this could raise legal issues.

3. Record the TOD Deed: The completed deed must be recorded with the County Clerk's office where the property is located during your lifetime. Recording the deed is crucial because, without it, the transfer will not be valid upon your death.

4. Retain Ownership During Lifetime: After recording the TOD deed, you retain full control of the property during your lifetime. You can still sell, mortgage, or revoke the TOD deed at any time.

If you change your mind, you can revoke the TOD deed by filing a revocation form or executing a new TOD deed, which automatically invalidates the previous one.

5. Upon Your Death: Upon your death, the property automatically transfers to the designated beneficiary without going through probate.

Key points about when it takes effect:

Timing of Transfer: The deed only takes effect upon the death of the property owner. Until then, the owner retains full control over the property and can revoke or change the TOD deed at any time.

Recording Requirement: For the TOD deed to be valid, it must be recorded with the county clerk during the property owner's lifetime. If the deed is not recorded before death, it will not be effective.

Probate Avoidance: By using a TOD deed, the property passes directly to the named beneficiary without going through probate, simplifying the transfer process and reducing legal costs.

Important: Your property must be located in Franklin County to use these forms. Documents should be recorded at the office below.

This Transfer on Death Deed meets all recording requirements specific to Franklin County.

Our Promise

The documents you receive here will meet, or exceed, the Franklin County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Franklin County Transfer on Death Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4587 Reviews )

Russell L.

November 9th, 2021

Your Personal Representative's Deed and example for the state of PA were extremely helpful. Exactly what I needed! Two feedback comments: 1. Valuation Factors/Short List in my download is an outdated table dated July 2020. The PA Dept of Revenue website has a more current table dated June 2021. (Maybe same for Valuation Factors/Long List, which I didn't use.) 2. Notarization section on deed page 3 has a gender-related input needed, which confused the Notary Public representative where I live in the state of CO. Notary input the word she to apply to my wife, but wasn't clear to him if the gender input applied to the Grantor or the Notary. He assumed Grantor. Also in our non-binary world, some might find that wording offensive. Thanks again for your documents. Russ Lewis

Thank you!

Roy B.

January 31st, 2021

Great way to get forms needed and fill them out then we only need to record them!

Thank you!

Roger A.

November 2nd, 2023

Easy peasy to use! It's great to have the guide for completing the form and an example of a completed form.

It was a pleasure serving you. Thank you for the positive feedback!

Tod F.

August 9th, 2019

In 15 minutes I had my out of state documents. I am very pleased with the ease of acquiring them. I will definitely be using Deeds.com again if the need arises.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Elizabeth S.

September 8th, 2022

Easy to download. I like the fact that it gives me an example of how to fill it out and also the instructions. Thank you so much.

Thank you for your feedback. We really appreciate it. Have a great day!

Fallon G.

March 7th, 2025

Very easy to use, thank you!

Knowing our customers are happy is our top priority. Thank you for the wonderful feedback!

CAROLYN H.

July 14th, 2022

Thanks. Was simple and easy to use.

Thank you!

Ed C.

June 16th, 2025

I purchased the DIY quitclaim deed forms for Florida and couldn’t be happier. The forms were clear, professional, and easy to follow. I had everything filled out and recorded without a single issue. Worth every penny — the site is great, and the forms are exactly what I needed. Highly recommend!

Thanks so much, Ed! We’re thrilled to hear that the Florida quitclaim deed forms worked perfectly for you and that the recording process went smoothly. We appreciate your trust and recommendation!

Cindy H.

October 22nd, 2021

Very easy to use and organized. When I needed the form I needed it immediately. I didn't want to get locked into a monthly subscription. Deeds.com met that need. Thanks!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

James P.

July 28th, 2020

I wish I used this site more often. The format is pretty easy but the messages were invaluable and the staff were great. I was able to complete my transaction in a Covid environment from the security of my own home. Great service and tools!

Thank you for your feedback. We really appreciate it. Have a great day!

Regina S.

January 13th, 2022

5 STARS!!! YOU WERE AWESOME!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Greg F.

October 14th, 2022

Sorry that this a little late. I'm VERY HAPPY with everything. The deeds paperwork was just what I was looking for. It was very to fill out, it was different than n the folks used years ago. I called the county clerk, and they were very helpful. Thank you for the paperwork it was easy to use and understand.

Thank you for your feedback. We really appreciate it. Have a great day!

William D.

May 4th, 2023

I filed a Mechanic's Lien in PA. I appreciate that Deeds.com charges only a one time fee. When I took the completed paperwork to the Prothonotary Office, I paid a $70 Fee, but the staff looked over the documents and though it looked good. I recommend this service.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Leslie Y.

December 10th, 2019

I had my doubts going in but was pleasantly surprised at the thoroughness of the documents and information provided. Will use again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Bonnie C.

July 28th, 2021

Easy and convenient. Was nice to have just a one time charge without a so-called anual fee/membership. Will use again if needed. May update review after "all is said and done."

Thank you!