Wake County Certificate of Trust Form (North Carolina)

All Wake County specific forms and documents listed below are included in your immediate download package:

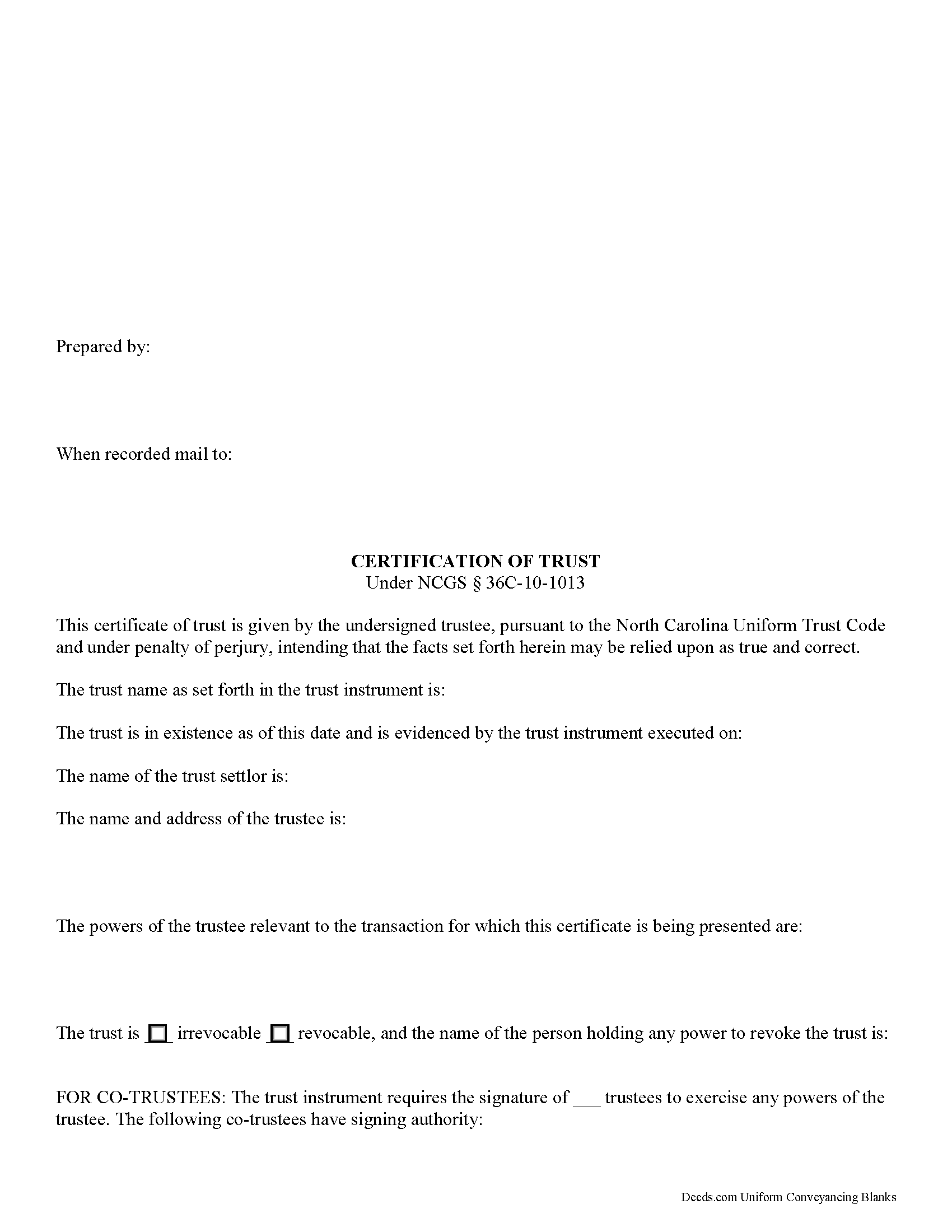

Certificate of Trust Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Wake County compliant document last validated/updated 5/8/2025

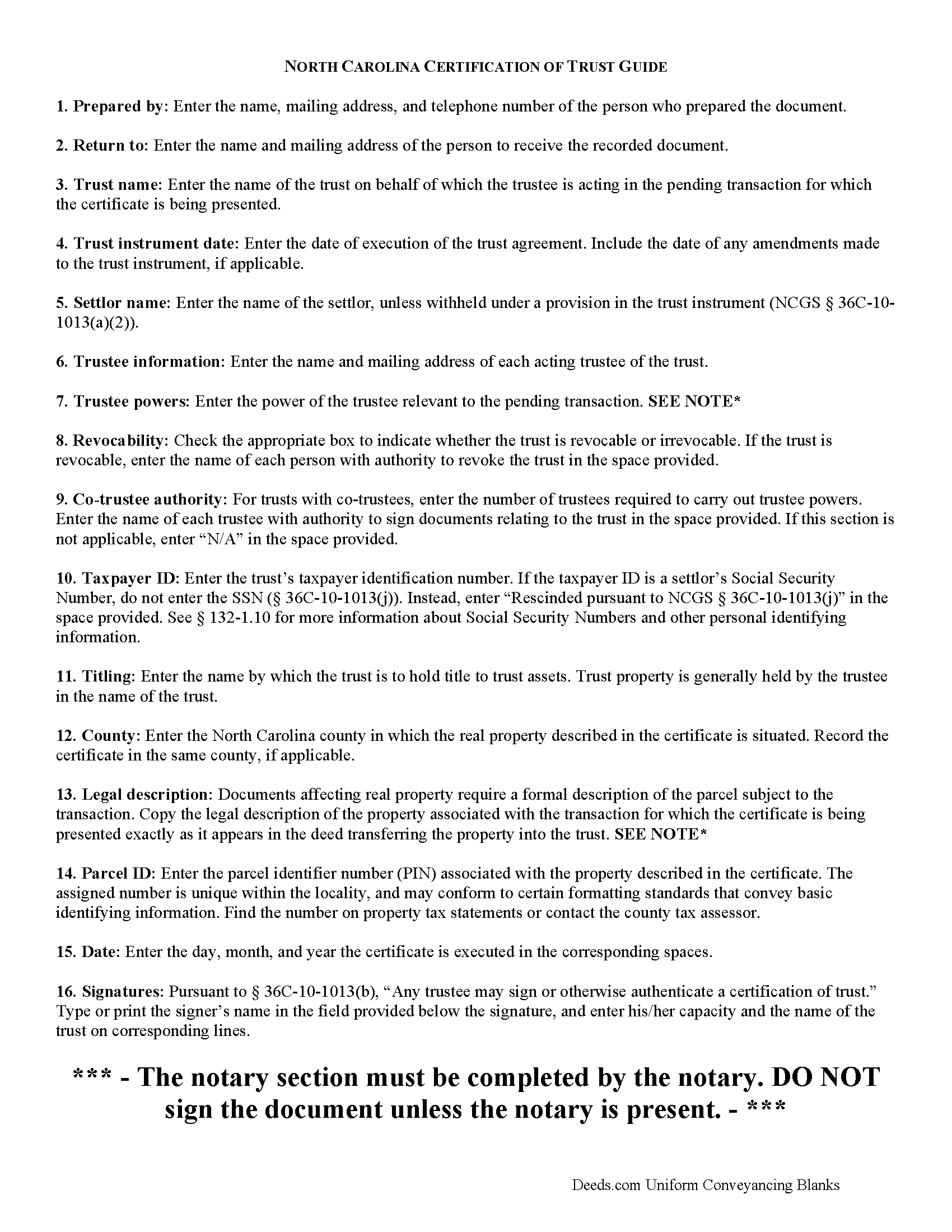

Certificate of Trust Guide

Line by line guide explaining every blank on the form.

Included Wake County compliant document last validated/updated 6/2/2025

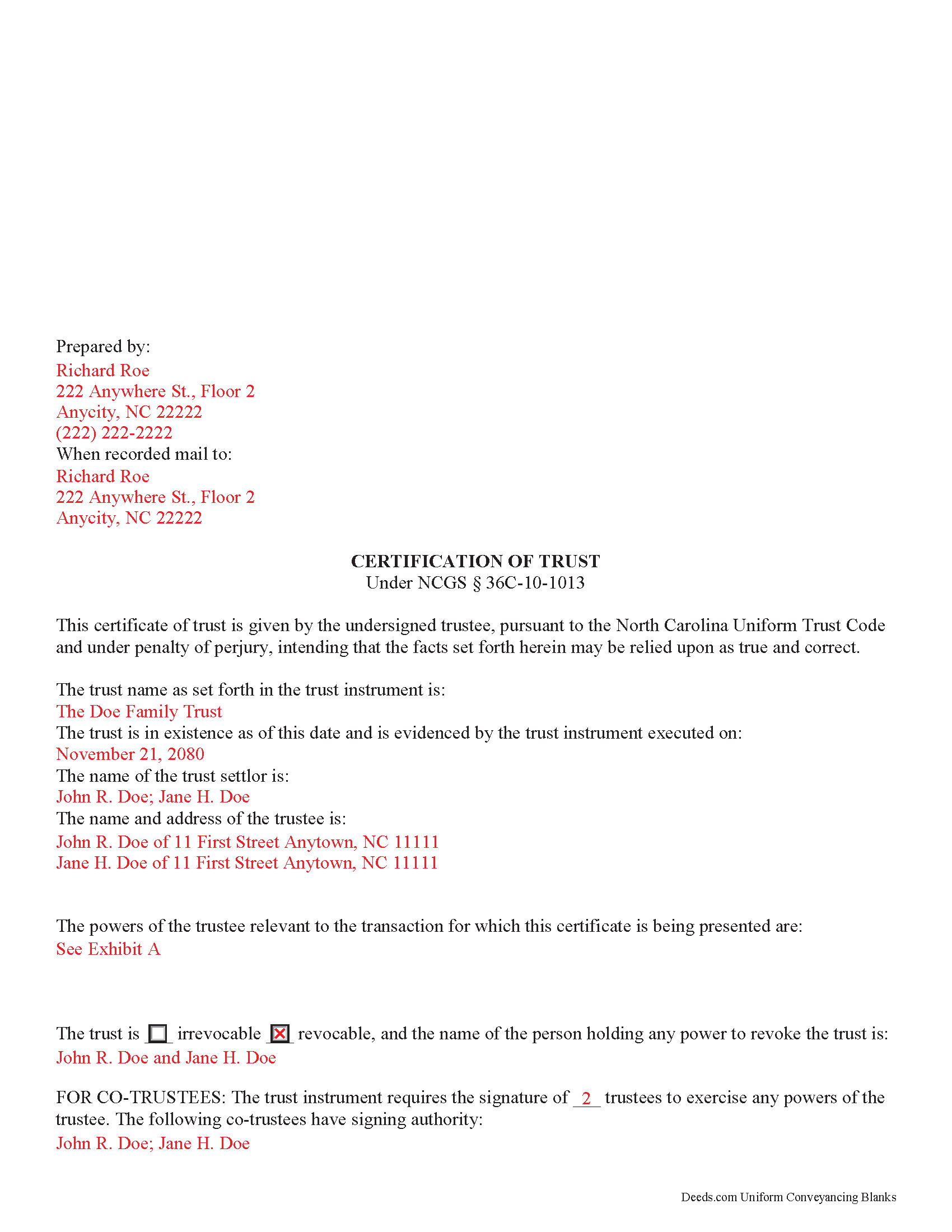

Completed Example of the Certificate of Trust Document

Example of a properly completed form for reference.

Included Wake County compliant document last validated/updated 6/17/2025

The following North Carolina and Wake County supplemental forms are included as a courtesy with your order:

When using these Certificate of Trust forms, the subject real estate must be physically located in Wake County. The executed documents should then be recorded in one of the following offices:

Wake County Register of Deeds

300 S. Salisbury St., Suite 1700, Raleigh, North Carolina 27601

Hours: 8:30 to 4:45

Phone: (919) 856-5460

Mailing Address

P.O. Box 1897, Raleigh, North Carolina 27602

Hours: N/A

Phone: N/A

Local jurisdictions located in Wake County include:

- Apex

- Cary

- Fuquay Varina

- Garner

- Holly Springs

- Knightdale

- Morrisville

- New Hill

- Raleigh

- Rolesville

- Wake Forest

- Wendell

- Willow Spring

- Zebulon

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Wake County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Wake County using our eRecording service.

Are these forms guaranteed to be recordable in Wake County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Wake County including margin requirements, content requirements, font and font size requirements.

Can the Certificate of Trust forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Wake County that you need to transfer you would only need to order our forms once for all of your properties in Wake County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by North Carolina or Wake County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Wake County Certificate of Trust forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

North Carolina Certification of Trust

Codified under the North Carolina Uniform Trust Code, which governs testamentary and non-testamentary trusts, the certification of trust at NCGS 36C-10-1013 is a document verifying a trust's existence and a trustee's authority to act in the transaction for which the certificate is being presented.

A trust is an arrangement whereby a settlor transfers property to another person (the trustee), who holds it for the benefit of a third (the beneficiary). A testamentary trust takes effect upon the settlor's death as specified by his/her will, and a non-testamentary (inter vivos) trust takes effect during the settlor's lifetime, and functions pursuant to the terms established by the settlor in an unrecorded document called the trust instrument.

As the trust's administrator, the trustee handles the trust's assets and sees to the trust's affairs. Upon entering into a transaction involving the trust, a trustee can present a certification of trust to establish his authority to do so. The certificate contains the essential information about the trust that is necessary for the business at hand, allowing the trust instrument (containing the full scope of the trust's assets, the trustee's obligations, and identity of the beneficiary) to remain private.

Any trustee may execute a trust certificate ( 36C-10-1013(b)). In it, the trustee confirms that "the trust has not been revoked, modified, or amended in any manner that would cause the representations contained in the certification of trust to be incorrect" ( 36C-10-1013(c)). Recipients of a trustee's certificate may rely upon the statements contained within the document as correct without further inquiry ( 36C-10-1013(f)).

A certification of trust in North Carolina must state that the trust exists, and provide the date of the trust instrument. Unless withheld under a provision of the trust instrument, the document names each settlor, or person who contributes property to the trust ( 36C-1-103(17)). The certificate identifies the trust as either revocable or irrevocable, and gives the name of anyone holding a power to revoke the trust.

It also includes the name and address of the trust's currently acting trustee, along with a description of the trustee's powers relevant to the transaction for which the certificate is presented. If the trust has multiple trustees, the certificate shows how many trustees are required to exercise trustee powers, and which trustees have the authority to sign documents relating to the trust. It also specifies how trust assets will be titled (usually in the name of the trustee as representative of the trust).

Recipients of a certificate can request excerpts from the trust document designating the trustee and conferring the relevant powers necessary for the pending transaction unto the trustee ( 36C-10-1013(e)). Requesting that the trustee provide the entire trust instrument opens the recipient of a certification of trust up to certain liabilities under 36-10-1013(h). Note that this excludes the right to obtain a copy of the trust instrument in a legal proceeding involving the trust ( 36-10-1013(i)).

The certificate should also include the trust's taxpayer identification number, unless this number is the social security number of a settlor. If the taxpayer ID is rescinded from the document, however, it "shall be certified by the trustee to the person acting in reliance upon the certification of trust in a manner reasonably satisfactory to that person" ( 36C-10-1013(j)).

For transactions involving real property held in trust in North Carolina, the certification should meet all form and content requirements for real estate documents, including a legal description of the property subject to the transaction. The document may be recorded with the register of deeds in the county where the real property is located (36-10-1013(j)).

Talk to a lawyer with any questions regarding trusts and certifications of trust in North Carolina.

(North Carolina COT Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Wake County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Wake County Certificate of Trust form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4564 Reviews )

Michael G.

July 14th, 2025

Very helpful and easy to use

Your appreciative words mean the world to us. Thank you.

JAMES D.

July 10th, 2025

Slick as can be and so convenient.rnrnWorked like a charm

Thank you for your feedback. We really appreciate it. Have a great day!

MARY LACEY M.

June 30th, 2025

Great service! Recording was smooth and swiftly performed. Deeds.com is an excellent service.rn

We are delighted to have been of service. Thank you for the positive review!

KELLY S.

May 31st, 2022

Thank you for being here. very easy to understand and your site is great. I will always use you.

Thank you for your feedback. We really appreciate it. Have a great day!

William M.

May 22nd, 2021

On multiple tries, I could not get validation mail through my Yahoo email address. I tried Gmail, worked the first time. The rest of the process was super easy and fast.

Thank you!

Charles R.

December 18th, 2018

No review provided.

Thank you for your review. Have a fantastic day!

Michael L.

June 15th, 2022

Very helpful and efficient

Thank you!

Charles Z.

February 23rd, 2021

I am very happy with the service and would use again. Super fast, efficient, and very helpful friendly staff. I would recommend and would use again.

Thank you for your feedback. We really appreciate it. Have a great day!

Kathyren O.

April 25th, 2019

Very helpful and I will be using your services in the near future. Thank you

Kathyren Oleary

Thanks Kathyren, we really appreciate your feedback.

Cynthia S.

January 19th, 2019

Good find, provides guide to use.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Sallie S.

January 24th, 2019

Great speedy service with access to areas beyond my reach.

Thank you Sallie, have a great day!

Eric L.

June 28th, 2021

Great service, but still needs some knowledge to complete. Also missing Michigan right to farm paragraph.

Thank you!

JOE M.

August 31st, 2024

The form I needed were easy to find. And very affordable. Great service.

Thank you for your feedback. We really appreciate it. Have a great day!

CARRIE T.

March 10th, 2022

Thought it was pretty simple to use.

Thank you!

Lowell P.

May 26th, 2020

Exceptionally helpful instruments that are compliant with State law and anticipate various contingencies. Very pleased.

Thank you for your feedback. We really appreciate it. Have a great day!