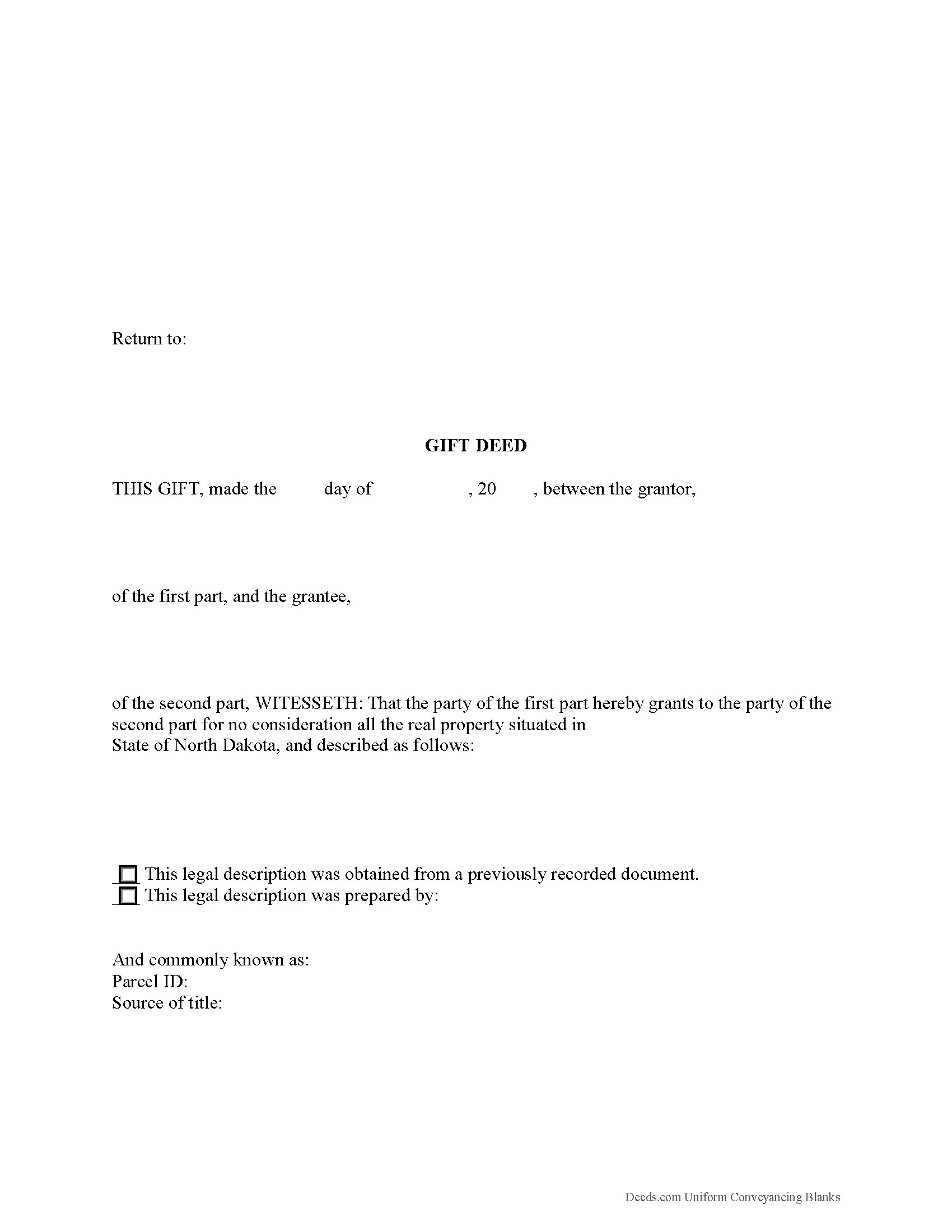

Williams County Gift Deed Form

Williams County Gift Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

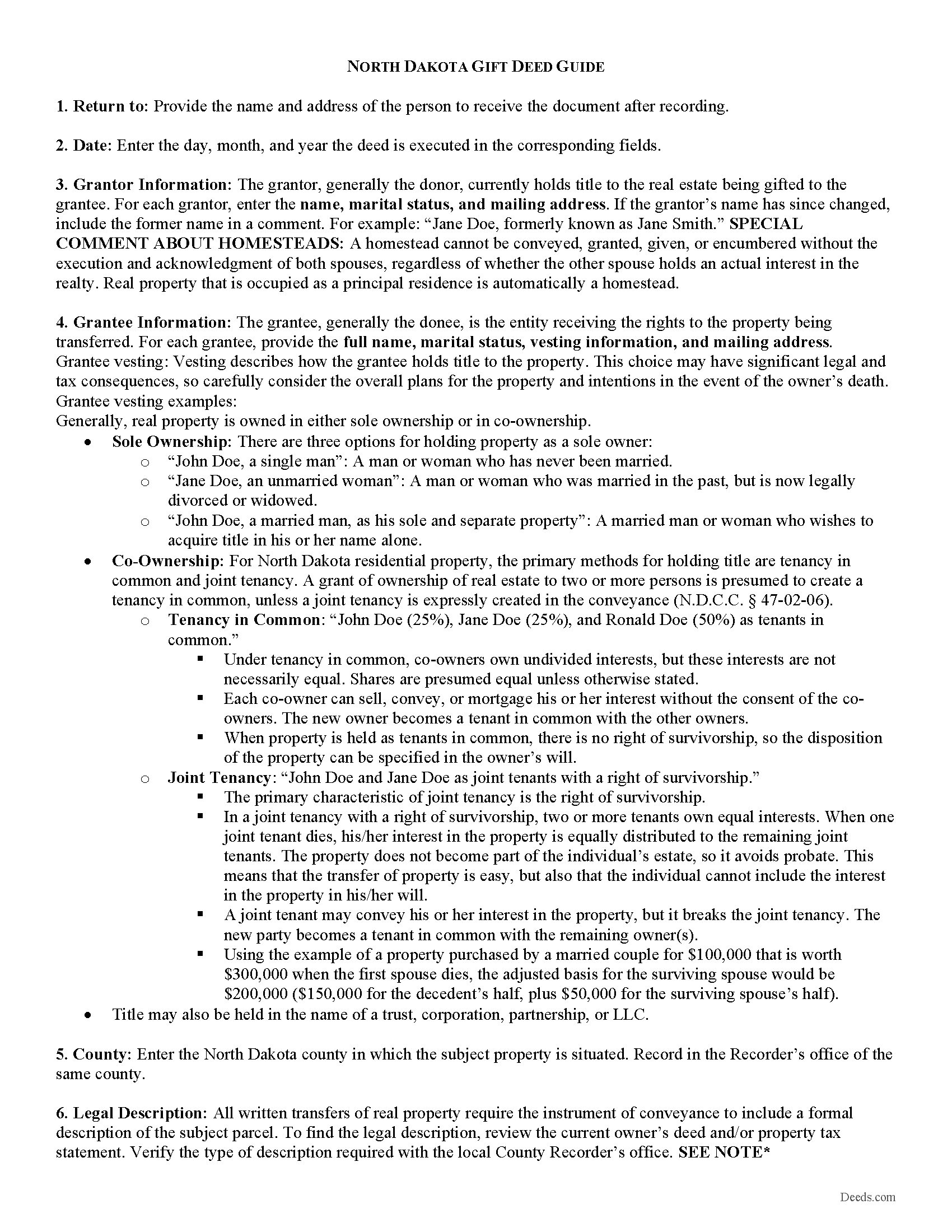

Williams County Quit Claim Deed Guide

Line by line guide explaining every blank on the form.

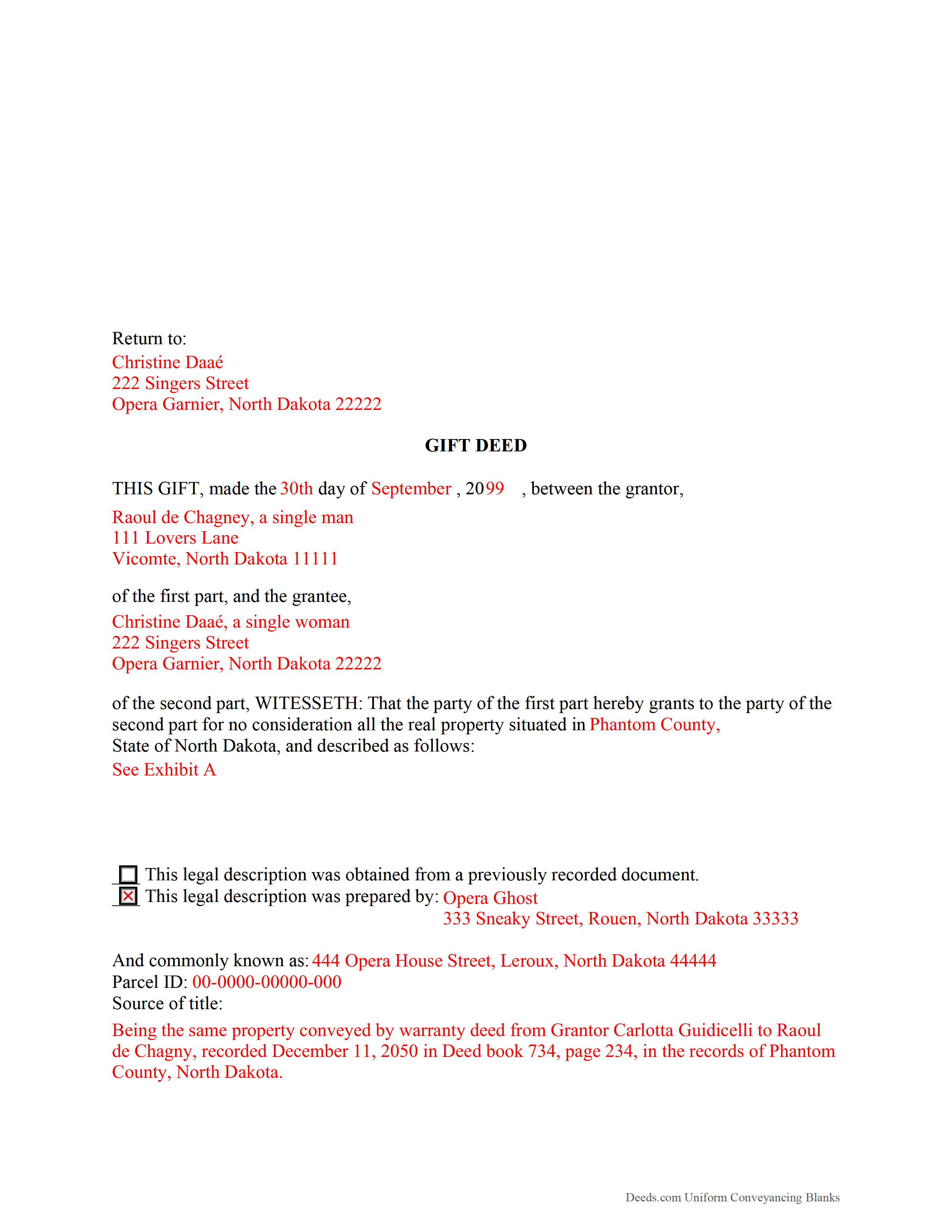

Williams County Completed Example of the Gift Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional North Dakota and Williams County documents included at no extra charge:

Where to Record Your Documents

Williams County Recorder

Williston, North Dakota 58801 / 58802-2047

Hours: 8:00am to 5:00pm M-F Central Time

Phone: (701) 577-4540

Recording Tips for Williams County:

- Bring your driver's license or state-issued photo ID

- Ensure all signatures are in blue or black ink

- Recording fees may differ from what's posted online - verify current rates

- Bring extra funds - fees can vary by document type and page count

- If mailing documents, use certified mail with return receipt

Cities and Jurisdictions in Williams County

Properties in any of these areas use Williams County forms:

- Alamo

- Epping

- Grenora

- Mcgregor

- Ray

- Tioga

- Trenton

- Wildrose

- Williston

- Zahl

Hours, fees, requirements, and more for Williams County

How do I get my forms?

Forms are available for immediate download after payment. The Williams County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Williams County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Williams County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Williams County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Williams County?

Recording fees in Williams County vary. Contact the recorder's office at (701) 577-4540 for current fees.

Questions answered? Let's get started!

Gifts of Real Property in North Dakota

A gift deed, or deed of gift, is a legal document voluntarily transferring title to real property from one party (the grantor or donor) to another (the grantee or donee). A gift deed typically transfers real property between family or close friends. Gift deeds are also used to donate to a non-profit organization or charity. The deed serves as proof that the transfer is indeed a gift and without consideration (any conditions or form of compensation).

Valid deeds must meet the following requirements: The grantor must intend to make a present gift of the property, the grantor must deliver the property to the grantee, and the grantee must accept the gift. Gift Deeds must contain language that explicitly states no consideration is expected or required, because any ambiguity or reference to consideration can make the deed contestable in court. A promise to transfer ownership in the future is not a gift, and any deed that does not immediately transfer the interest in the property, or meet any of the aforementioned requirements, can be revoked [1].

A lawful gift deed includes the grantor's full name and marital status, as well as the grantee's full name, marital status, mailing address, and vesting. Vesting describes how the grantee holds title to the property. For North Dakota residential property, the primary methods for holding title are tenancy in common, and joint tenancy. A grant of ownership of real estate to two or more persons is presumed to create a tenancy in common, unless a joint tenancy is expressly created in the conveyance (N.D.C.C. 47-02-06).

As with any conveyance of real estate, a gift deed requires a complete legal description of the parcel. All deeds in North Dakota are required to indicate whether the legal description was taken from a previous instrument, or if it is newly drafted. A metes and bounds description requires the name and address of the person drafting the description (N.D.C.C. 47-19-03.1, 57-02-39). Recite the source of title to establish a clear chain of title, and detail any restrictions associated with the property. All transactions of real property must be accompanied by a Statement of Real Estate Full Consideration form, which must be filed with either the Secretary of the State Board of Equalization or county Recorder's office, unless exempt pursuant to N.D.C.C. 11-18-02.2. Record the completed deed at the local County Recorder's office.

The IRS levies a Federal Gift Tax on any transfer of property from one individual to another with no consideration, or consideration that is less than the full market value. In accordance with federal law, individuals are permitted an annual exclusion of $15,000 on gifts. This means that gifts valued below $15,000 do not require a federal gift tax return (Form 709). Even so, donors should consider filing one for many gifts of real property [2].

In North Dakota, there is no state gift tax. For questions regarding state taxation laws, consult a tax specialist. Gifts of real property in North Dakota are subject to the federal gift tax. The grantor is responsible for paying the federal gift tax; however, if the grantor does not pay the gift tax, the grantee will be held liable [1].

With gifts of real property, the recipient of the gift (grantee) is not required to declare the amount of the gift as income, but if the property accrues income after the transaction, the recipient is responsible for paying the requisite state and federal income taxes [3].

This article is provided for informational purposes only and is not a substitute for the advice of an attorney. Contact a lawyer with any questions about gift deeds or other issues related to the transfer of real property. For questions regarding federal and state taxation laws, consult a tax specialist.

[1] https://nationalparalegal.edu/public_documents/courseware_asp_files/realProperty/PersonalProperty/InterVivosGifts.asp

[2] http://msuextension.org/publications/FamilyFinancialManagement/MT199105HR.pdf

[3] https://www.irs.gov/businesses/small-businesses-self-employed/frequently-asked-questions-on-gift-taxes

(North Dakota GD Package includes form, guidelines, and completed example)

Important: Your property must be located in Williams County to use these forms. Documents should be recorded at the office below.

This Gift Deed meets all recording requirements specific to Williams County.

Our Promise

The documents you receive here will meet, or exceed, the Williams County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Williams County Gift Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4587 Reviews )

Tiffany Dawn J.

September 28th, 2019

Would be nice to have a better description on how to complete the forms if it is separated couple and one is signing the deed over to the other. I am still unsure how it should be worded. Disappointed that the guide didn't have better explanations.

Thank you for your feedback. We really appreciate it. Have a great day!

Gene K.

April 24th, 2019

I am still in the trial stage. I am an older lawyer. Any help I can get is worth it. Once you get used to the format and data fill in the deed thing is excellent. Very professional if not a little slow. I have only done three deeds in one state so I will have to see how it goes. I like the product and their attitude towards pleasing the customer. We'll see when I try the recording part.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Karen V.

June 18th, 2021

It was a easy process to get the forms I needed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Ron B.

September 15th, 2019

Solved my requirement. Happy to have found the site

Thank you for your feedback. We really appreciate it. Have a great day!

Joseph T.

February 6th, 2019

I downloaded the wrong form, how do I change this, or can I?

Sorry to hear that. As a one time courtesy we have canceled your order and payment for the documents you ordered in error. Have a great day.

Edward S.

July 1st, 2019

Great Form and Easy to Use Guides and Samples

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

John S.

January 9th, 2023

You dont really know what your buying until after you spend the money. Cant use any of them

Thank you for your feedback. Best practice is to know what you need before purchasing. Buying legal documents should not be a exploratory endeavor. Your order has been canceled. We do hope that you find something more suitable to your needs elsewhere.

matthew h.

June 6th, 2022

Totally awesome. Useless waste of time looking anywhere else for real estate deed forms. All the stars!!

Thank you!

Ann C.

December 27th, 2019

This service is the absolute BOMB! I wish every business ran as fast and efficiently as you all do! Seriously - No joke! Thank you guys!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Gary B.

September 16th, 2022

Great service. Comprehensive. Reasonably priced.

Thank you for your feedback. We really appreciate it. Have a great day!

JESSICA B.

June 25th, 2020

easy to move through the site and create an account.

Thank you!

Tierre J.

January 3rd, 2019

I put in two orders. I did not get any results from either order and I am still waiting for my refunds.

Thank you for your feedback. Sorry we were not able to pull the information you requested. We reviewed your account and the payment voids were processed as your were notified. Sometimes, depending on your financial institution, it can take a few days for the pending charges to fall off of your statement reporting.

Carla F.

March 24th, 2021

Forms were easily accessible along with guides. Great resource. Thank you.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Sheryl G.

November 27th, 2021

Simple way to complete documents with very detailed instructions. And to be able to e-file them is great too.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Stephen P.

July 20th, 2021

Quick and Easy

Thank you!