Williams County Transfer on Death Deed Revocation Form

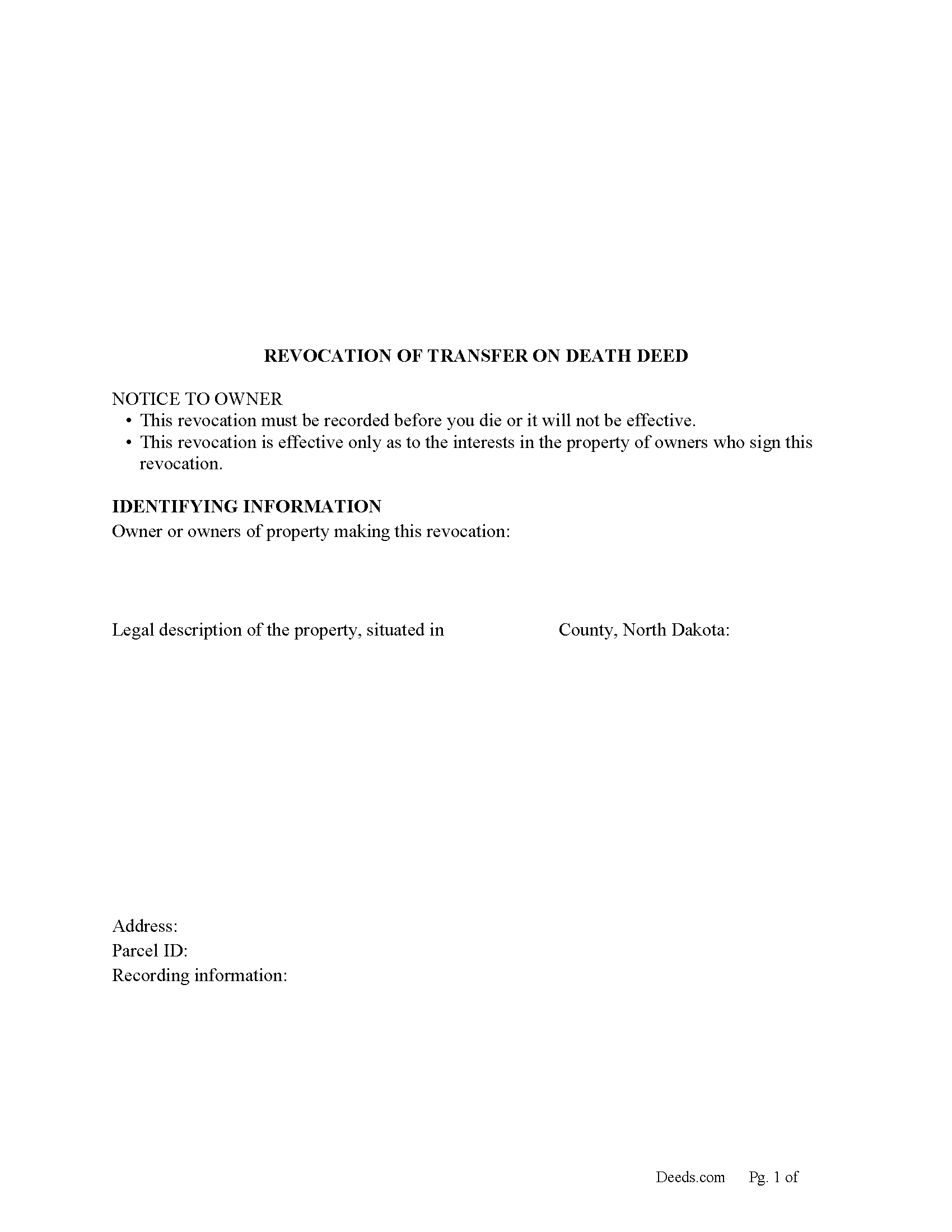

Williams County Transfer on Death Revocation Form

Fill in the blank form formatted to comply with all recording and content requirements.

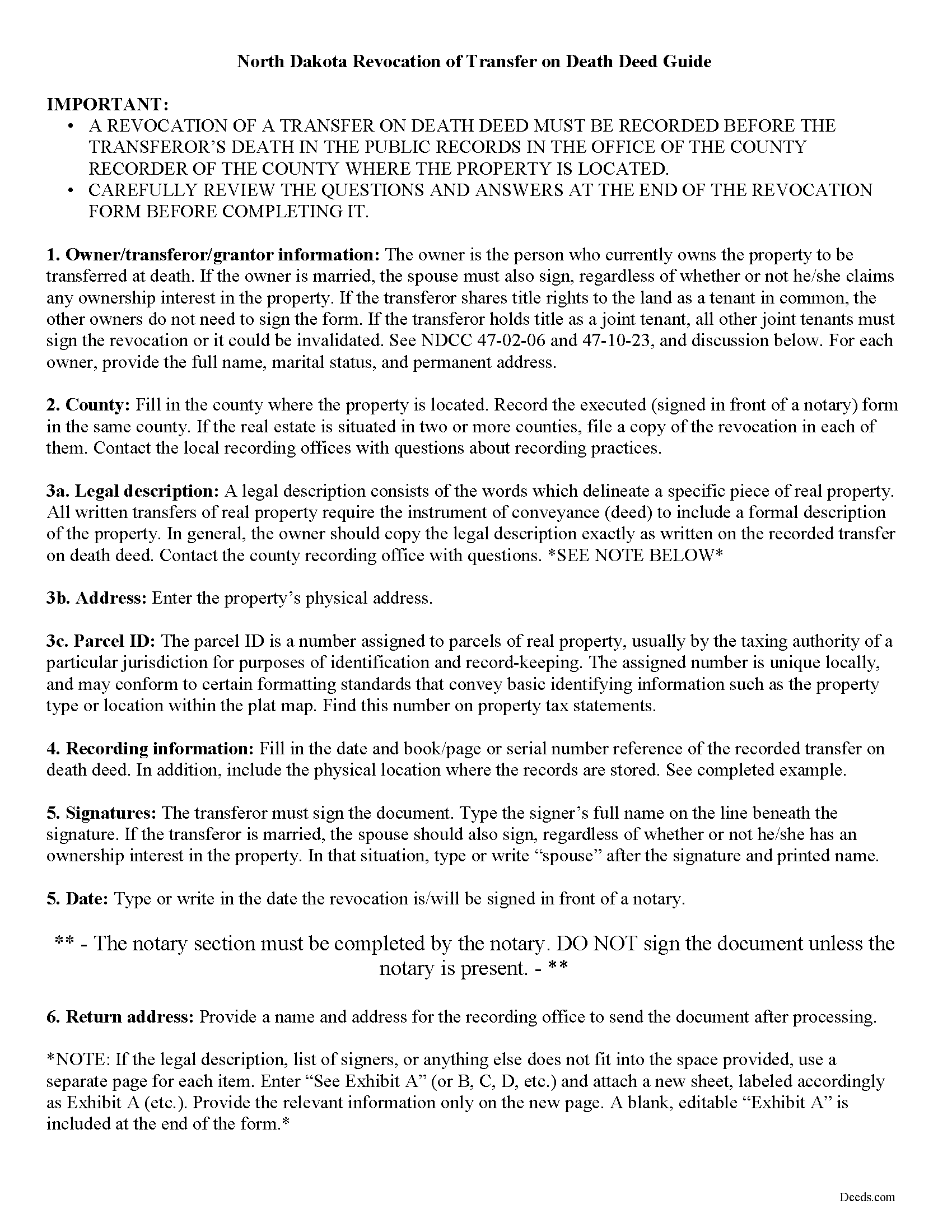

Williams County Transfer of Death Revocation Guide

Line by line guide explaining every blank on the form.

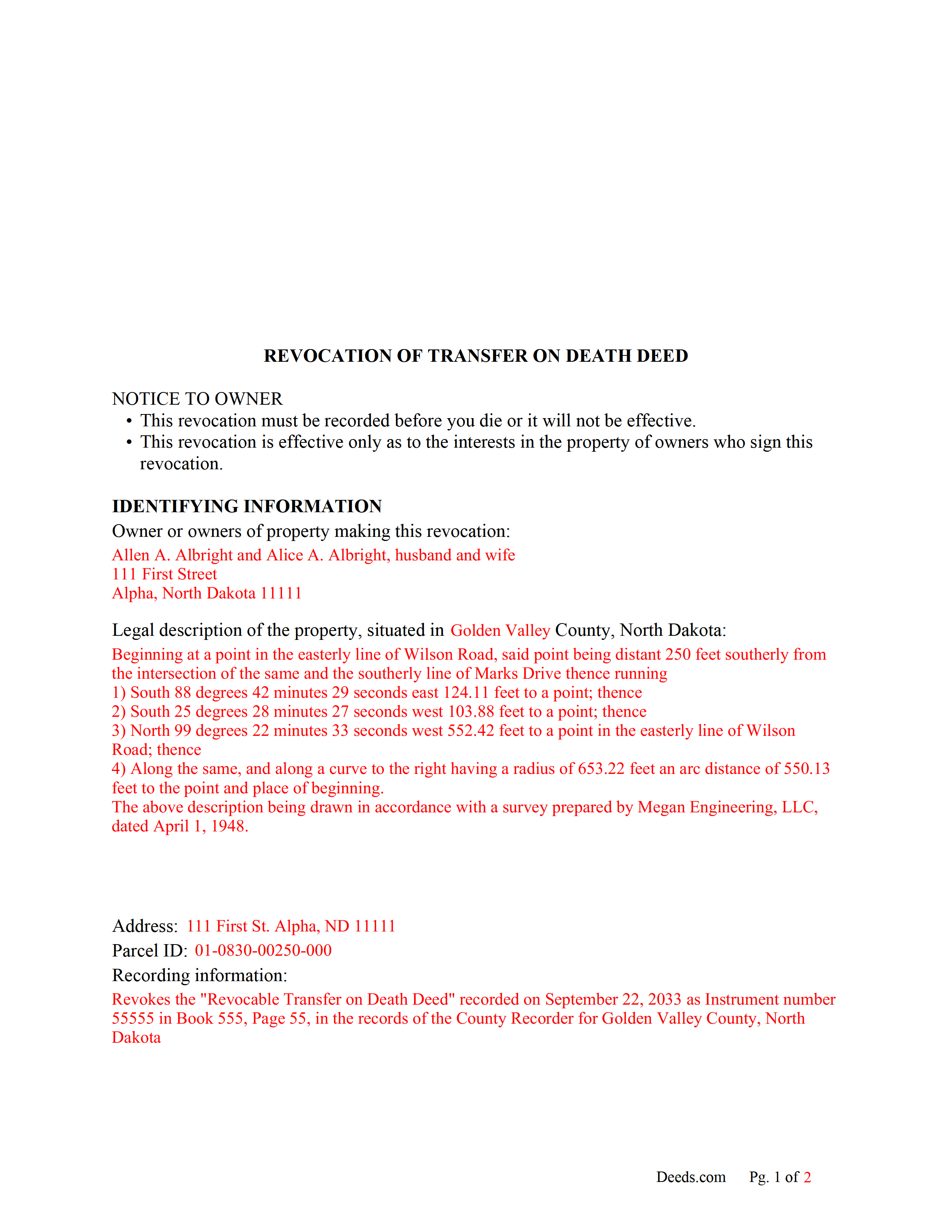

Williams County Completed Example of the Transfer on Death Revocation Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional North Dakota and Williams County documents included at no extra charge:

Where to Record Your Documents

Williams County Recorder

Williston, North Dakota 58801 / 58802-2047

Hours: 8:00am to 5:00pm M-F Central Time

Phone: (701) 577-4540

Recording Tips for Williams County:

- Verify all names are spelled correctly before recording

- Make copies of your documents before recording - keep originals safe

- Ask about their eRecording option for future transactions

Cities and Jurisdictions in Williams County

Properties in any of these areas use Williams County forms:

- Alamo

- Epping

- Grenora

- Mcgregor

- Ray

- Tioga

- Trenton

- Wildrose

- Williston

- Zahl

Hours, fees, requirements, and more for Williams County

How do I get my forms?

Forms are available for immediate download after payment. The Williams County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Williams County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Williams County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Williams County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Williams County?

Recording fees in Williams County vary. Contact the recorder's office at (701) 577-4540 for current fees.

Questions answered? Let's get started!

Revoking North Dakota's Transfer on Death Deeds

Note that revocations of transfer on death deeds must be recorded during the owner's life or they have no effect.

In 2011, North Dakota enacted the Uniform Real Property Transfer on Death Act, found in the North Dakota Century Code (NDCC) at Chapter 30.1-32.1.

According to this statute, owners of North Dakota real property may transfer property to one or more beneficiaries effective, at the transferor's death, by lawfully executing and recording a transfer on death deed (TODD) in the county or counties where the property is located (NDCC 32.1-02). The instruments must contain all the information required for traditional deeds, as well as a statement that the transfer will occur at the owner's death (30.1-32.1-06).

This transfer is nontestamentary, meaning it is not included in the owner's will (30.1-32.1-04). As a result, it does not require probate distribution. Even so, best practices dictate that the will and any other transfers should not contain any conflicting instructions.

Deeds under this law allow the owners to retain absolute ownership of and control over the land until death, including the ability to cancel or change the beneficiary designation, and to sell the property outright to someone else (30.1-32.1-09). Because the transfer is revocable (30.1-32.1-03), there is no obligation to notify the beneficiary or to collect consideration (money) for the potential future interest (30.1-32.1-07).

Revocability is one of the unique features of TODDs. It gives property owners the flexibility to adapt to changing circumstances by modifying or cancelling future transfers with relative ease. In addition, if the owner decides to sell the real estate to someone else, executing and recording a revocation provides a firm end point for a recorded TODD. This action reduces the potential for confusion about the title, and contributes to the property's clear chain of title (ownership history).

Section 30.1-32.1-08 provides the rules for revoking a recorded TODD. There are three main options, all of which must be executed and recorded while the owner is still alive:

- a new transfer on death deed that revokes all or part of the earlier deed

- an instrument of revocation that specifically revokes the earlier deed

- a tradition deed, such as a warranty or quitclaim deed, that conveys all the owner's interest in the property.

(North Dakota TODD Revocation Package includes form, guidelines, and completed example)

Important: Your property must be located in Williams County to use these forms. Documents should be recorded at the office below.

This Transfer on Death Deed Revocation meets all recording requirements specific to Williams County.

Our Promise

The documents you receive here will meet, or exceed, the Williams County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Williams County Transfer on Death Deed Revocation form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4587 Reviews )

David B.

May 16th, 2024

Prompt review and submission of documents could be an appropriate tagline for this business. The attention to detail and rapid response makes the company a great go to for servicing needs related to deeds.

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Tracy M.

July 9th, 2020

The form is easy to use. However, the quit claim deed form seems to be for parcel of land, because the word "real property" is not in the form.

Thank you for your feedback. We really appreciate it. Have a great day!

Susan T.

January 21st, 2019

This was perfect for my county I will be recommending your forms to all my clients thank you.

Thank you Susan, have a great day!

Rita M.

January 12th, 2019

Forget what I just wrote! I found it. Thank You! This is a very convenient service.

That's great to hear Rita, thanks for following up.

fran g.

April 25th, 2021

To hard for me. But with that being said it's a great option for most people.

Thank you!

Jacquelyn W.

February 4th, 2022

Great site with great info. Almost made the job seamless but form would not adjust to my longer than usual legal description -- I ended up having to recreate the form in word processing software (Libre). But could not have done it without the guidelines.

Thank you!

Pamela B.

June 18th, 2023

Very easy to use. Time will tell if I have any issues getting it recorded. Beats using an attorney who won't return calls and emails like I used before. I like the form plus instructions and an example of the completed form.

Thank you for your feedback. We really appreciate it. Have a great day!

Joseph S.

March 31st, 2022

The website was very easy to use. I rate it a five star

Thank you for your feedback. We really appreciate it. Have a great day!

Mary L.

February 6th, 2021

Great site. Very easy to use.

Thank you for your feedback. We really appreciate it. Have a great day!

Sarah K.

October 22nd, 2019

I was annoyed when I realized I couldn't put the document into Word or WordPerfect. I had to retype the entire document. What a waste of time and money.

Sorry to hear of your annoyance. We have canceled your order and payment. We do hope that you find something more suitable to your needs elsewhere. Have a wonderful day.

Jo Ann P.

August 19th, 2025

Was hoping I would be sent copies on paper so I can fill them out without a desk computer

We appreciate your feedback. Our forms are delivered instantly as digital files, so customers can download and print as many copies as they need. This way, you have the flexibility to complete them by hand if you prefer.

Jeremiah W.

August 2nd, 2020

Very helpful information and great forms.

Thank you for your feedback. We really appreciate it. Have a great day!

Olga E.

March 20th, 2022

Oh my that was so easy. I love it. Awesome. If someone needs help use the deeds.com

Thank you for your feedback. We really appreciate it. Have a great day!

Michele S.

February 10th, 2019

This is a great service if you know what youre looking for. Unfortunately it just wasnt right for me and my situation.

Thank you!

Sheila P.

May 17th, 2023

What a great service to provide with excellent directions! At first I thought I would need an attorney, but I walked through the steps and now I have it finished! Saved a ton of money. Thanks Deed.com.

Thank you for your feedback. We really appreciate it. Have a great day!