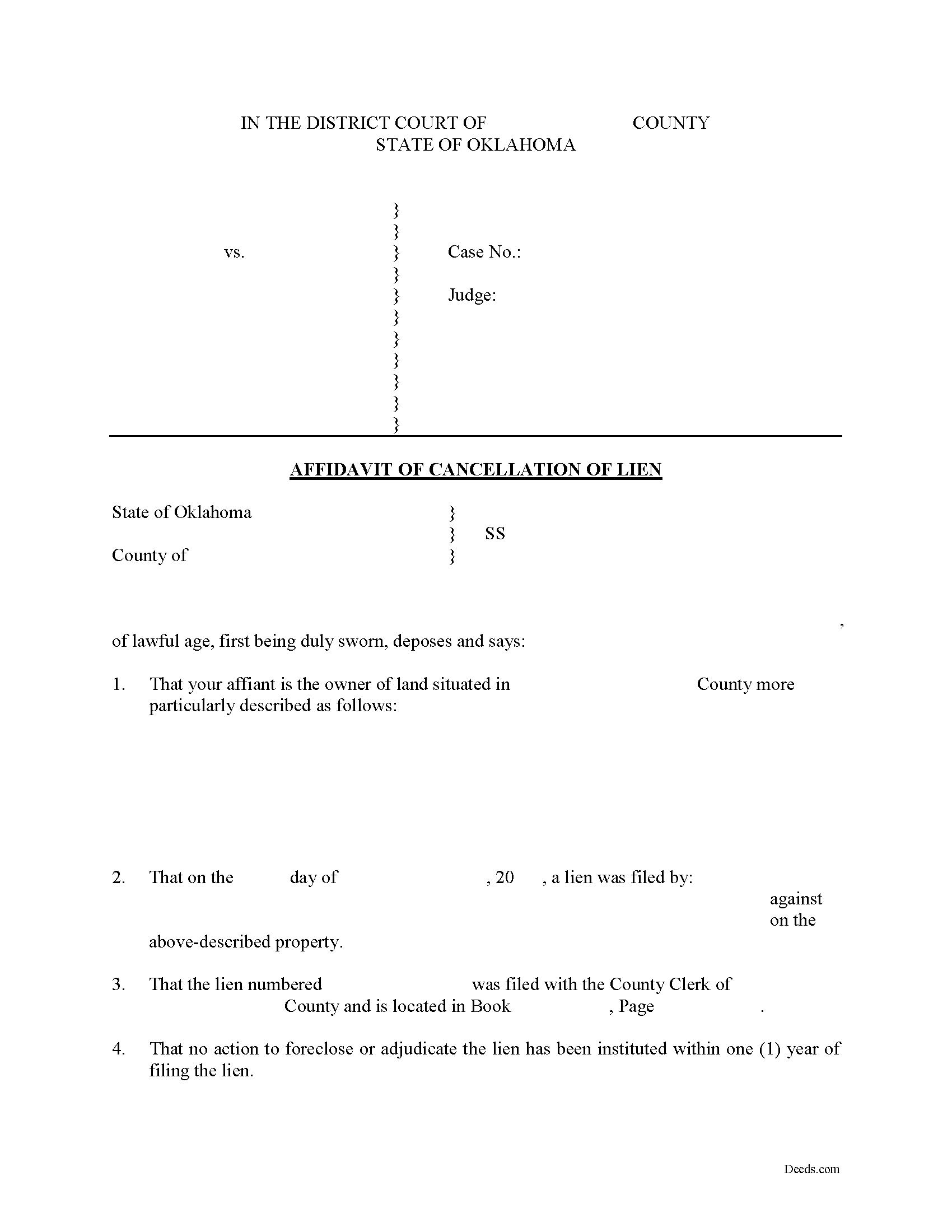

Marshall County Affidavit of Cancellation of Lien Form

Marshall County Affidavit of Cancellation of Lien Form

Fill in the blank Affidavit of Cancellation of Lien form formatted to comply with all Oklahoma recording and content requirements.

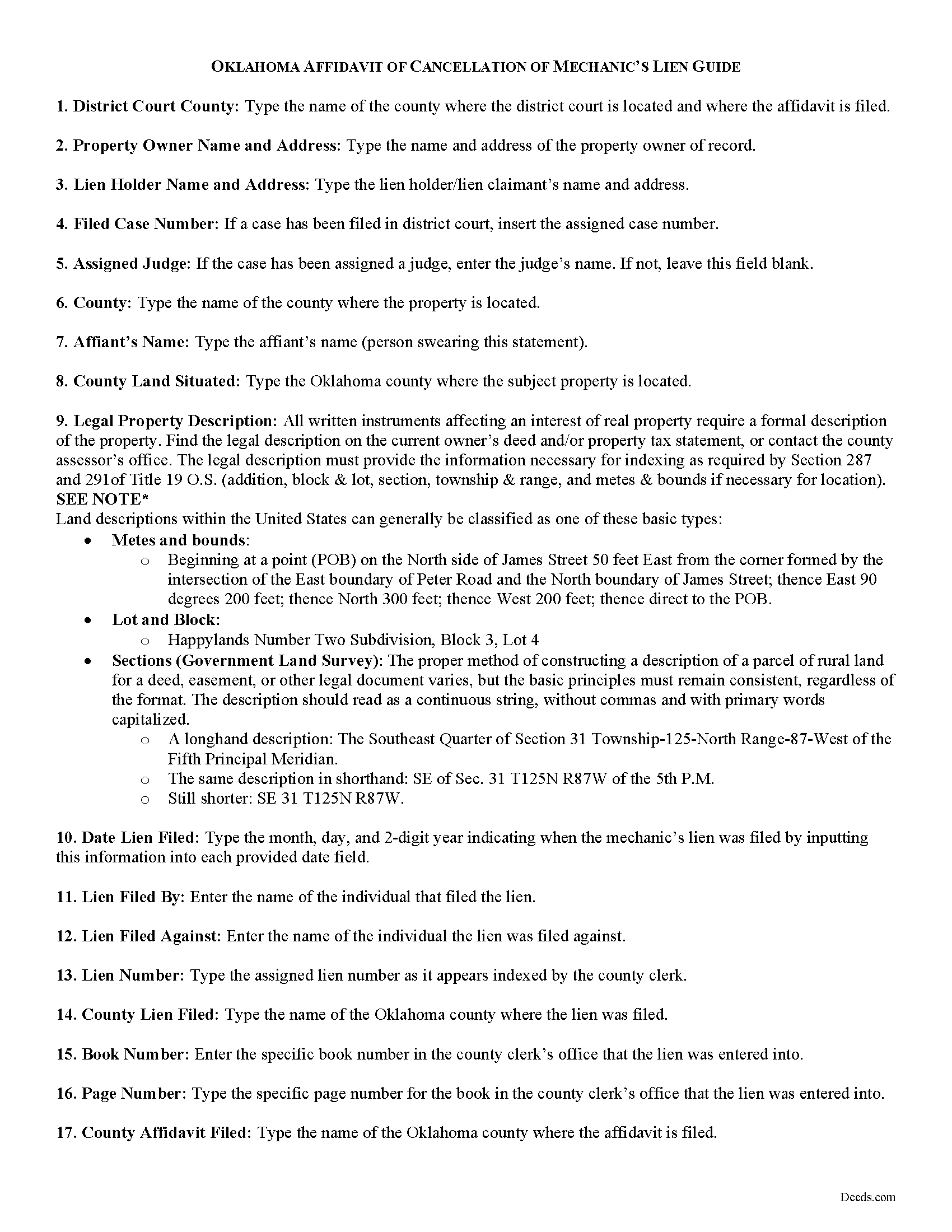

Marshall County Affidavit of Cancellation of Lien Guide

Line by line guide explaining every blank on the form.

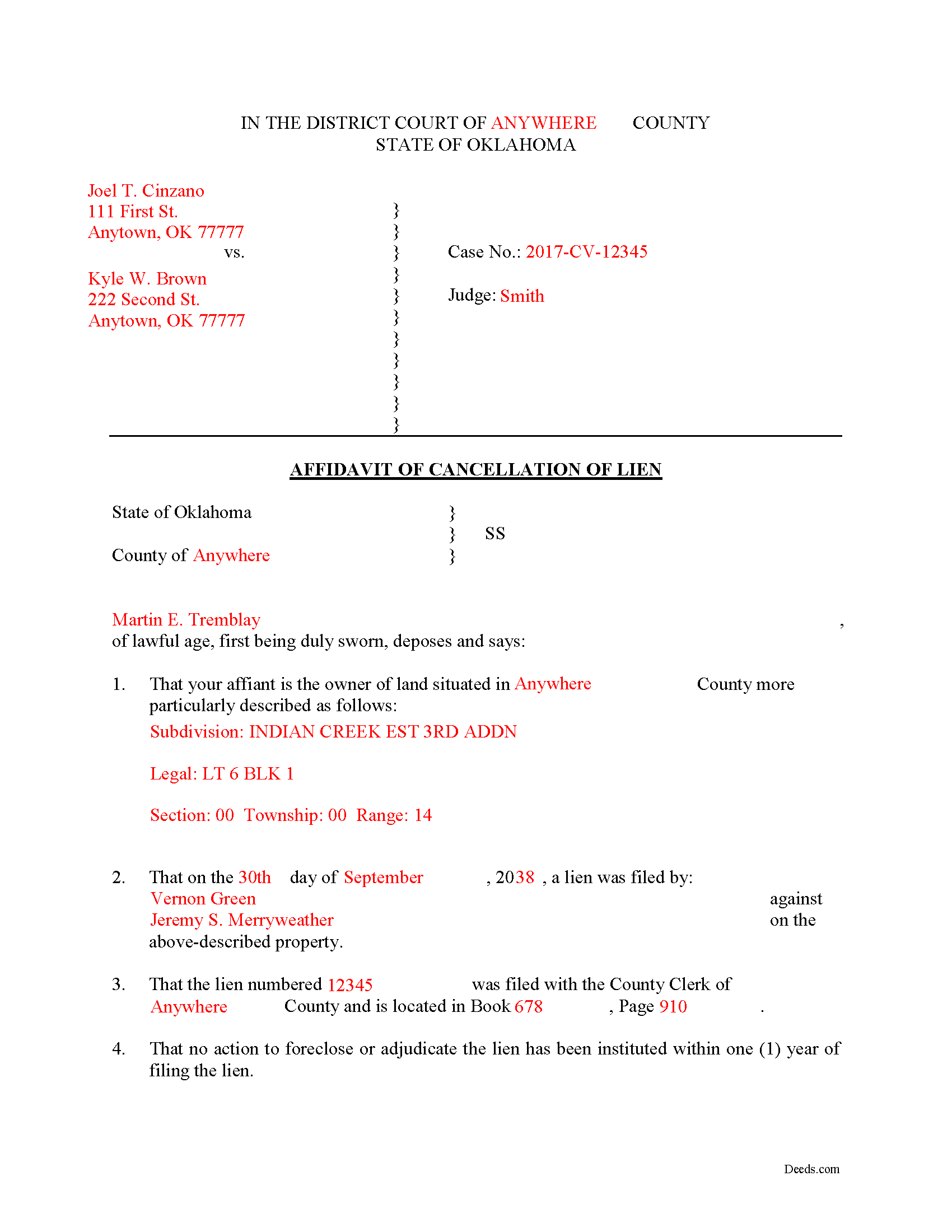

Marshall County Completed Example of the Affidavit of Cancellation of Lien Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Oklahoma and Marshall County documents included at no extra charge:

Where to Record Your Documents

Marshall County Clerk

Madill, Oklahoma 73446

Hours: 8:30am - 12:00 & 12:30 - 5:00pm

Phone: (580) 795-3220

Recording Tips for Marshall County:

- Double-check legal descriptions match your existing deed

- Avoid the last business day of the month when possible

- Recording fees may differ from what's posted online - verify current rates

- Bring extra funds - fees can vary by document type and page count

- Leave recording info boxes blank - the office fills these

Cities and Jurisdictions in Marshall County

Properties in any of these areas use Marshall County forms:

- Kingston

- Lebanon

- Madill

Hours, fees, requirements, and more for Marshall County

How do I get my forms?

Forms are available for immediate download after payment. The Marshall County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Marshall County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Marshall County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Marshall County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Marshall County?

Recording fees in Marshall County vary. Contact the recorder's office at (580) 795-3220 for current fees.

Questions answered? Let's get started!

Liens are pesky creatures and if your property is plagued by one, you probably are looking for methods to remove it. Sometimes liens can be erroneously placed on your property or the claimant neglects to ever enforce the lien. Therefore, by filing an Affidavit of Lien Cancellation, you swear to the court that the facts behind the lien justify its cancellation.

If any lien is filed, and no action to foreclose the lien has commenced, the owner of the land may file a petition in the district court of the county in which the land is situated, naming the lien claimants as defendants, and requesting the court for an decision of the lien, and if the lien claimant fails establish a lien, the court may tax against the claimant the whole, or a portion of the costs of the action as may be just. O.S. 42-177.

Liens also can be cancelled by becoming time-barred. If no action to foreclose or settle the lien is filed within one (1) year from the filing of the lien, the lien is canceled by limitation of law. Id. If a lien is canceled by limitation of law, the owner of the land may file an affidavit proving its cancellation with the county clerk of the county in which the land is located. Id. Upon receipt of the affidavit, the county clerk will attach the affidavit to the original lien document in the lien docket file and enter a notation of the filing in the mechanics' lien journal. Id.

This article is provided for informational purposes only and should not be relied upon as a substitute for the advice from a legal professional. If you have questions about cancelling a lien, or any other issue related to liens in Oklahoma, please contact an attorney.

Important: Your property must be located in Marshall County to use these forms. Documents should be recorded at the office below.

This Affidavit of Cancellation of Lien meets all recording requirements specific to Marshall County.

Our Promise

The documents you receive here will meet, or exceed, the Marshall County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Marshall County Affidavit of Cancellation of Lien form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4585 Reviews )

Christine B. B.

May 20th, 2019

The Personal Representatives Deed is definitely a helpful document for my files. I find it need just a little tweaking by deeds.com , There should be more space for the legal description. I did see in the FAQ's you recommend putting it in the Exhibit and this is what I did. Also I couldn't get the year to be accepted and had to write it in. These are just some minor suggestions, on the whole I was grateful to find this document. Thank you.

Thank you for your feedback. Sorry to hear that you had trouble with the date field, we will have it reviewed.

Cheryl C.

September 1st, 2021

Very pleased. I spent a fair amount of time chasing a blank form only to be told it couldn't be given to me - I had to go through my attorney. Going thru the deeds.com was a breeze; the blank form looked exactly like one I had filed before :-)

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Michael R.

April 11th, 2023

This process was so easy.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Karri P.

February 28th, 2019

Great service and easy to purchase exactly what you want.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Alfred D.

February 28th, 2023

The material was very usable and site was easy to navigate. Well worth the money. If I have similar needs, I'll ber back.

Thank you for your feedback. We really appreciate it. Have a great day!

Darrell G.

October 14th, 2022

Very easy to work with.

Thank you!

Judy W.

January 9th, 2021

Very easy to fill out the form especially with the detailed guide and the sample. I will use deeds.com again if needed.

Thank you for your feedback. We really appreciate it. Have a great day!

Russell B.

March 15th, 2023

complete package as promised at a very reasonable cost. Easy forms to complete. Thank you. Definitely 5 stars!!!

Thank you for your feedback. We really appreciate it. Have a great day!

Lisa M.

August 30th, 2023

Awesome and so easy to use!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Roger M.

January 22nd, 2021

EASY. WORKED WITH PROBLEMS.

Thank you!

Irene G.

January 26th, 2021

Excellent service for anyone doing their own deed filing without the use of a title company or an attorney. I will definitely recommend deeds.com to my notary clients and will be personally using this service again! ;)

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Erik J.

January 8th, 2021

First time using Deeds.com and feel that your platform is clear and easy to use. I was also pleased with the messaging center and follow-up and also surprised at how quickly our particular deed was recorded and available to view. Having said that, when I first investigated Deeds.com the fee was $15 and as of 1/1/21 it has increased to $19 which I feel is pretty steep for the handling of 1 simple document especially when the turnaround was basically the same day. Your fee was nearly the equivalent of the cost of the Clerk's recording fee. Perhaps you should offer a fee schedule for those of us who are not volume recorders. Just a thought.

Thank you!

Ann M.

February 11th, 2022

I was extremely pleased with how easy this process was, and how quickly my document was recorded. I will definitely use this again!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Donald S.

March 16th, 2021

Guidelines somewhat helpful. Forms fillable but not editable unless you buy an Adobe conversion service subscription. End product looks crude and amateurish. Fields can't be reduced or enlarged to accommodate unique data. Very disappointing.

Thank you for your feedback. We really appreciate it. Have a great day!

Barbara E.

March 7th, 2023

The online forms were very helpful and self-explanatory. My husband and I used several as we completed our estate planning documents. Thank you for these forms.

Thank you for your feedback. We really appreciate it. Have a great day!