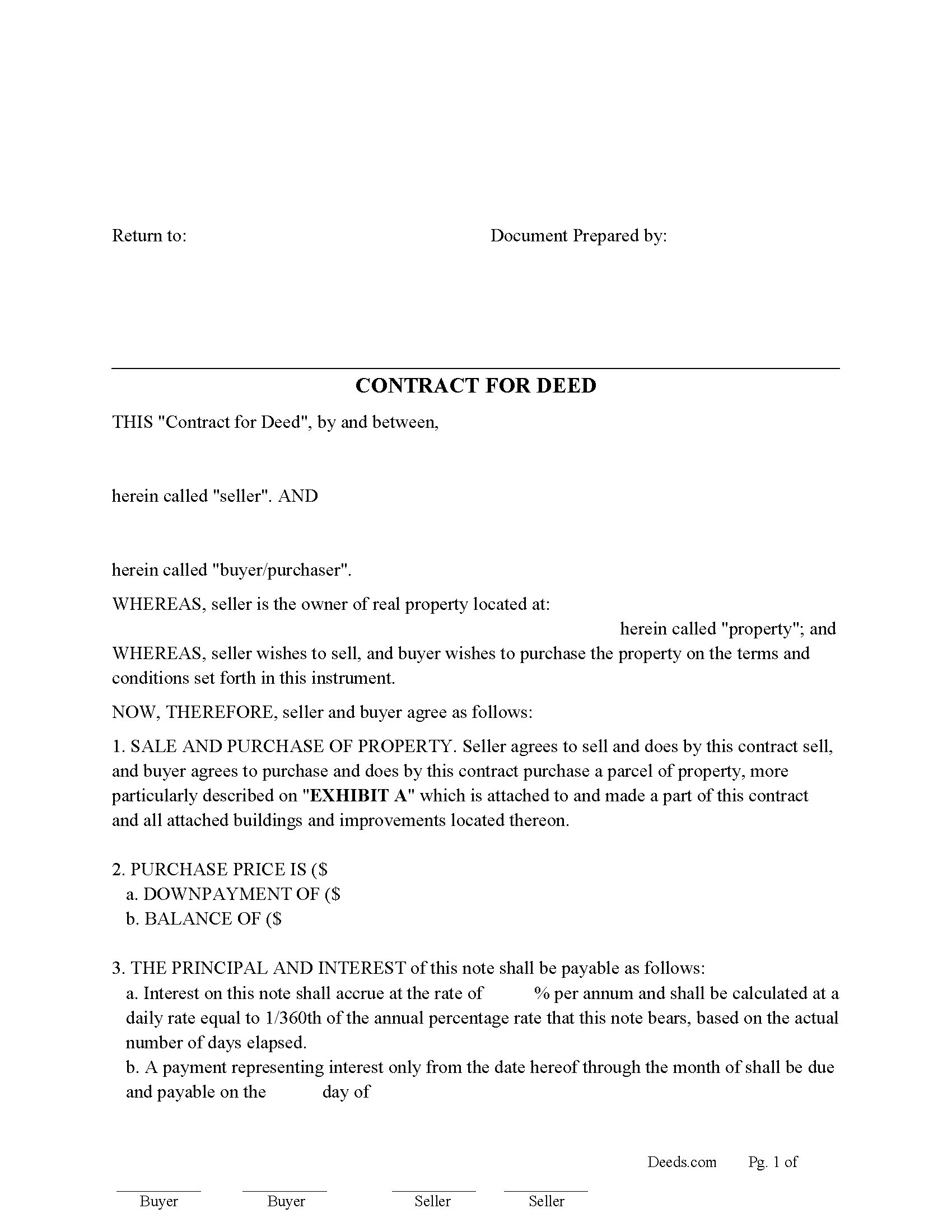

Grant County Contract for Deed Form

Grant County Contract for Deed Form

Fill in the blank Contract for Deed form formatted to comply with all Oklahoma recording and content requirements.

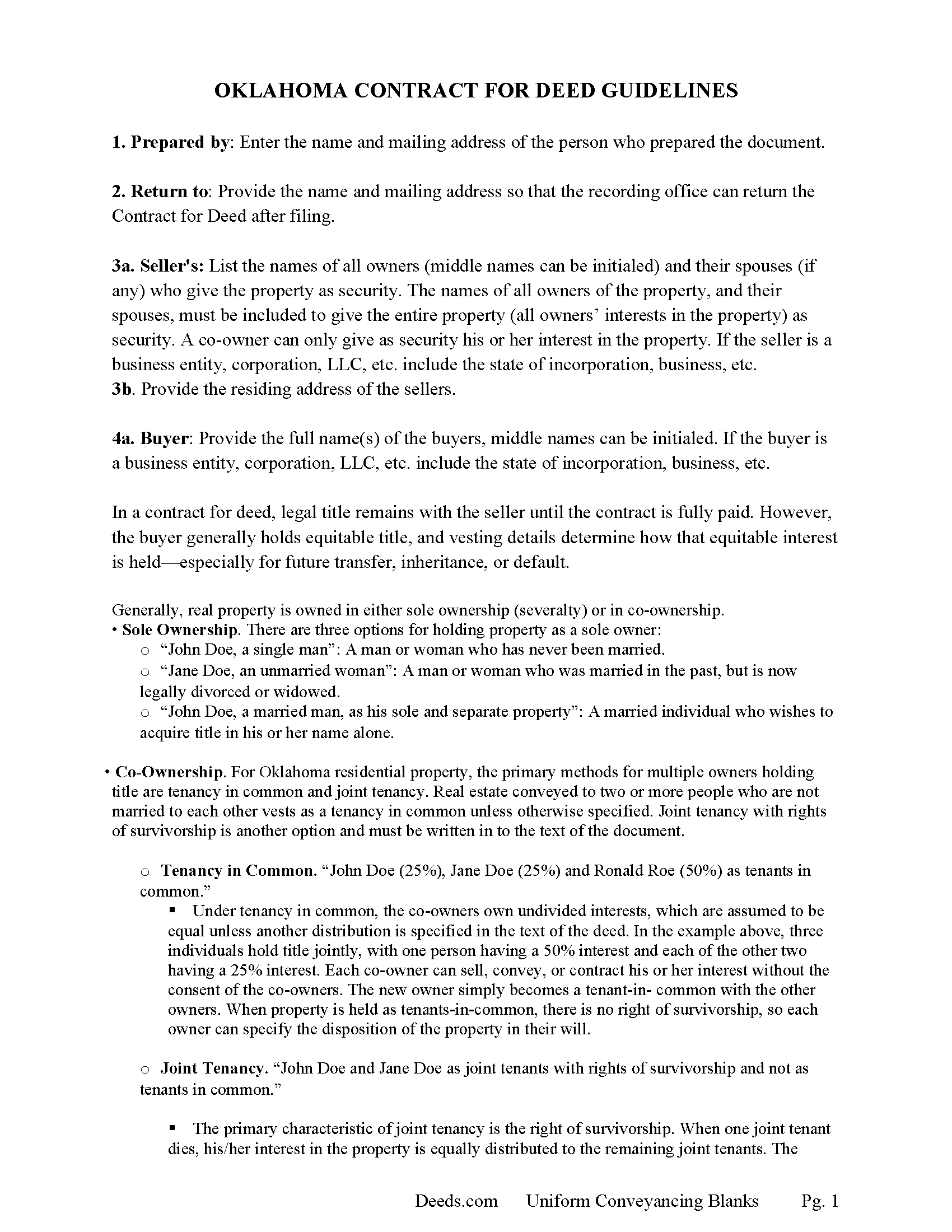

Grant County Contract for Deed Guide

Line by line guide explaining every blank on the Contract for Deed form.

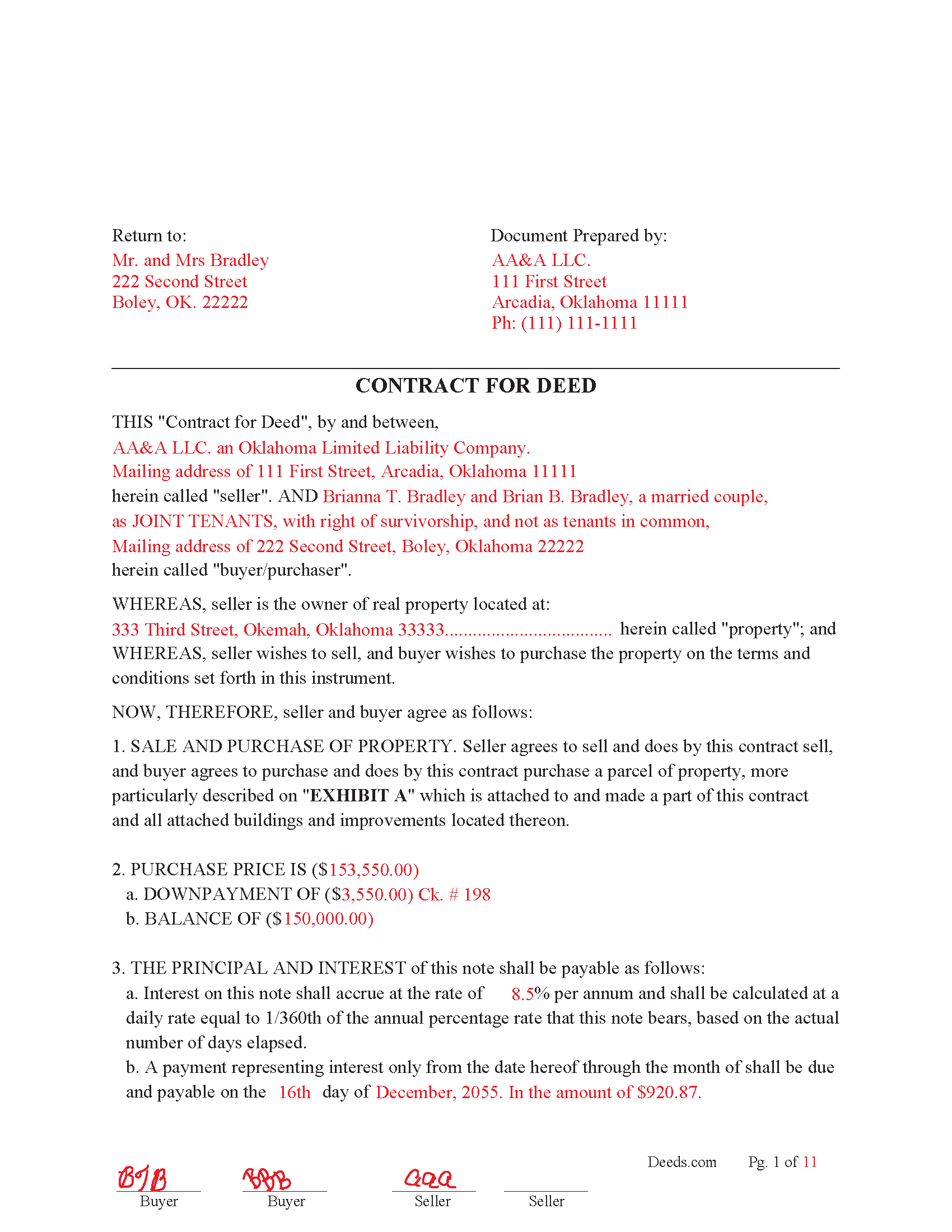

Grant County Completed Example of the Contract for Deed Document

Example of a properly completed Oklahoma Contract for Deed document for reference.

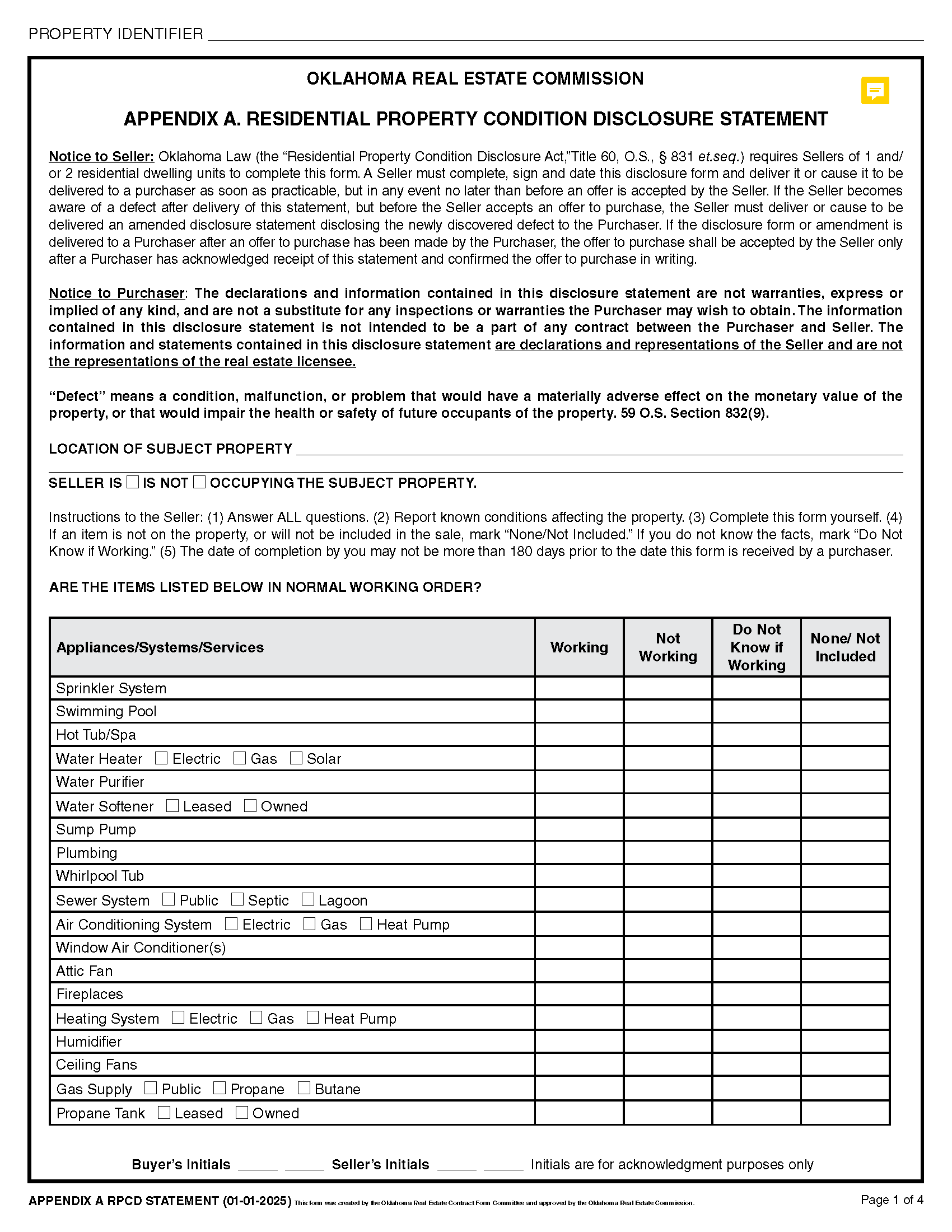

Grant County Residential Property Disclosure A

Sellers Residential Disclosure Form

Grant County Residential Property Disclosure B

Seller instructions: Oklahoma Law (the “Residential Property Condition Disclosure Act,” 60, O.S. Section 831 et. seq., effective July 1, 1995) requires a seller of 1 and 2 residential dwelling units to deliver, or cause to be delivered, a disclaimer statement to a purchaser as soon as practicable, but in any event before acceptance of an offer to purchase if you, the seller: 1) have never occupied the property and make no disclosures concerning the condition of the property; and 2) have no actual knowledge of any defect concerning the property.

Grant County Seller's Lead Based Paint Disclosure Form

Applicable to residential property built before 1978

Grant County Lead Based Paint Brochure

Issue to buyers if applicable.

All 7 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Oklahoma and Grant County documents included at no extra charge:

Where to Record Your Documents

Grant County Clerk

Medford, Oklahoma 73759

Hours: 8:00 to 4:30 Monday through Friday

Phone: (580) 395-2274

Recording Tips for Grant County:

- White-out or correction fluid may cause rejection

- Both spouses typically need to sign if property is jointly owned

- Ask about their eRecording option for future transactions

- Avoid the last business day of the month when possible

Cities and Jurisdictions in Grant County

Properties in any of these areas use Grant County forms:

- Deer Creek

- Lamont

- Manchester

- Medford

- Nash

- Pond Creek

- Wakita

Hours, fees, requirements, and more for Grant County

How do I get my forms?

Forms are available for immediate download after payment. The Grant County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Grant County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Grant County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Grant County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Grant County?

Recording fees in Grant County vary. Contact the recorder's office at (580) 395-2274 for current fees.

Questions answered? Let's get started!

In Oklahoma, a Contract for Deed (also called an installment land contract or real estate contract) is a financing tool where the seller acts like the lender. Instead of giving the buyer a deed at closing, the seller keeps legal title until the buyer makes all agreed payments, while the buyer gets equitable title and possession from day one.

COMMON USES IN OKLAHOMA

Owner Financing

Used when the buyer can’t qualify for a traditional mortgage, or wants to avoid bank lending requirements.

Low or No Down Payment Sales

Attractive to buyers with limited upfront cash.

Selling Property with Existing Liens

Sometimes used when a seller still owes money but can collect payments from the buyer to pay off the lien.

Faster, Private Transactions

Fewer formalities compared to traditional closings (though recording is still required to protect the buyer).

Rural or Unconventional Properties

Properties that might not meet bank lending standards (e.g., certain rural land, mobile homes without land, etc.).

REQUIREMENTS IN OKLAHOMA

While there isn’t one single statute titled “Contract for Deed Law,” several Oklahoma statutes govern parts of the process — mainly in Title 16 (Conveyances), Title 46 (Mortgages), and Title 68 (Revenue and Taxation).

KEY REQUIREMENTS:

Written Agreement

Must be in writing and signed by both parties to be enforceable under the Oklahoma Statute of Frauds (15 O.S. §136).

Recording: Oklahoma treats a recorded Contract for Deed as a mortgage (46 O.S. §1, §4).

Must be recorded with the county clerk within a reasonable time to protect the buyer’s equitable interest. In Oklahoma, you can record a Memorandum of Contract for Deed instead of the full contract.

Recording triggers mortgage recording tax under 68 O.S. §1904.

MORTGAGE TAX

Tax is based on the principal debt stated in the contract. Payment is due at the time of recording.

Disclosure of Terms

Contract should clearly state purchase price, interest rate, payment schedule, who pays taxes/insurance, default remedies, and conveyance terms.

Delivery of Deed

Seller delivers a warranty deed (or other agreed deed) only after all payments are made.

Default & Remedies

Oklahoma allows forfeiture clauses, but enforcement may require judicial action if the buyer has paid a significant portion of the contract.

Possession & Risk of Loss

Buyer usually takes possession immediately and bears risk of damage or loss from that point.

Best Practice in Oklahoma:

Record the Contract for Deed immediately and pay the mortgage tax so the buyer’s equitable title is protected. If it’s unrecorded, the buyer’s interest is at risk if the seller gets sued, goes bankrupt, or sells to someone else.

If you want, I can give you a sample Oklahoma Contract for Deed outline that includes the statutory mortgage tax language and meets county clerk recording standards so it doesn’t get rejected. That way it’s valid, enforceable, and protects both parties.

Important: Your property must be located in Grant County to use these forms. Documents should be recorded at the office below.

This Contract for Deed meets all recording requirements specific to Grant County.

Our Promise

The documents you receive here will meet, or exceed, the Grant County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Grant County Contract for Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4585 Reviews )

Robert J D.

December 19th, 2018

I accidentally ordered 2 forms for the affidavit of death. I only need one.

Thanks for your feedback. Looking at your account we do not see any duplicate orders. Our system does stop duplicate orders before they are processed in many cases. Have a great day.

Ardith T.

May 18th, 2020

Very clear and complete. Good value.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Michael W.

January 25th, 2022

I needed a quitclaim deed to transfer ownership of a home. An attorney wanted $400.00 to file the deed. I downloaded a blank deed for my area from deeds.com. I received it instantly. (Small fee) it came with instructions and a template. I filled it out and submitted it to the County Clerks office.it was simple and I saved a lot of money. There may be other forms you need, check with whoever you are submitting the deed. You'll have additional fees, but that is up to the municipality in which you reside. It will be helpful if you have the latest deed on file. It was much easier than I thought. This is an easy website to navigate through and it is 100% legitimate. I recommend Deeds.com.

Thank you for your feedback. We really appreciate it. Have a great day!

Sara P.

February 1st, 2019

Wonderful response time, and patient with me. Thank you.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

GLENN C.

January 22nd, 2020

Your response was very thorough

Thank you for your feedback. We really appreciate it. Have a great day!

Halilat S.

April 2nd, 2021

Excellent communications. Well done guys!

Thank you for your feedback. We really appreciate it. Have a great day!

Evelyn A.

October 30th, 2021

Was easy to use. Just didnt find what i needed

Thank you for your feedback. We really appreciate it. Have a great day!

Will O.

May 2nd, 2020

Saved me so much time and $!!

Thank you!

PATRICK C.

September 29th, 2021

Fast, honest company Worth every penny! DO IT YOURSELF SAVE THOUSANDS

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

David M.

August 9th, 2023

A real boon to those of us who are not attorneys but wish to protect our assets and avoid probate court issues. Thank you for a great service.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Douglas C.

July 24th, 2020

Even for a novice like me, this site was easy to use, with very clear & simple options and instructions. I wish every web site was as good!

Thank you for your feedback. We really appreciate it. Have a great day!

John Q.

June 26th, 2020

I downloaded the forms, which was very easy, and filled them out with the help of the very helpful instructions! I was able to go down to my court house and file the forms within 24 hours of downloading! I am at peace knowing my son's will avoid a lot of headaches when I pass because my property deed will transfer to them without probate court TOD !!!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Susanne N.

February 25th, 2021

It's hard having to change names on an account when someone dies. I called and was helped by a rep named Lilah. She was most helpful and comforting. Thank you again Lilah.

Thank you for taking the time to leave such kind words Susanne, we appreciate you.

Joyce D.

October 29th, 2021

Great service. Fast and efficient.

Thank you!

Curley B.

January 6th, 2023

So far, I'm pleased. I am a first-time user, as most of my clients are in California. I look forward to working with you more in the future.

Thank you for your feedback. We really appreciate it. Have a great day!