Harmon County Disclaimer of Interest Form

Harmon County Disclaimer of Interest Form

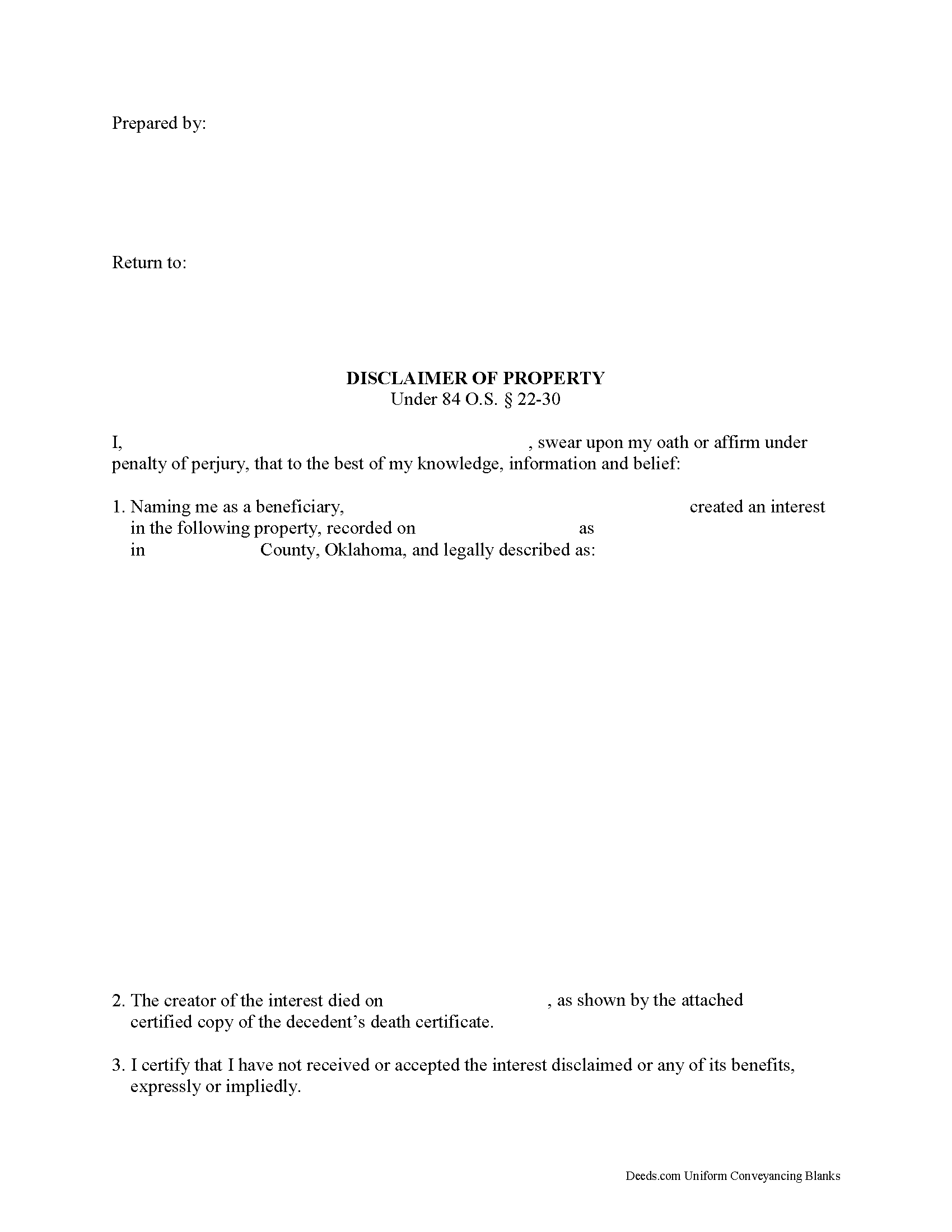

Fill in the blank form formatted to comply with all recording and content requirements.

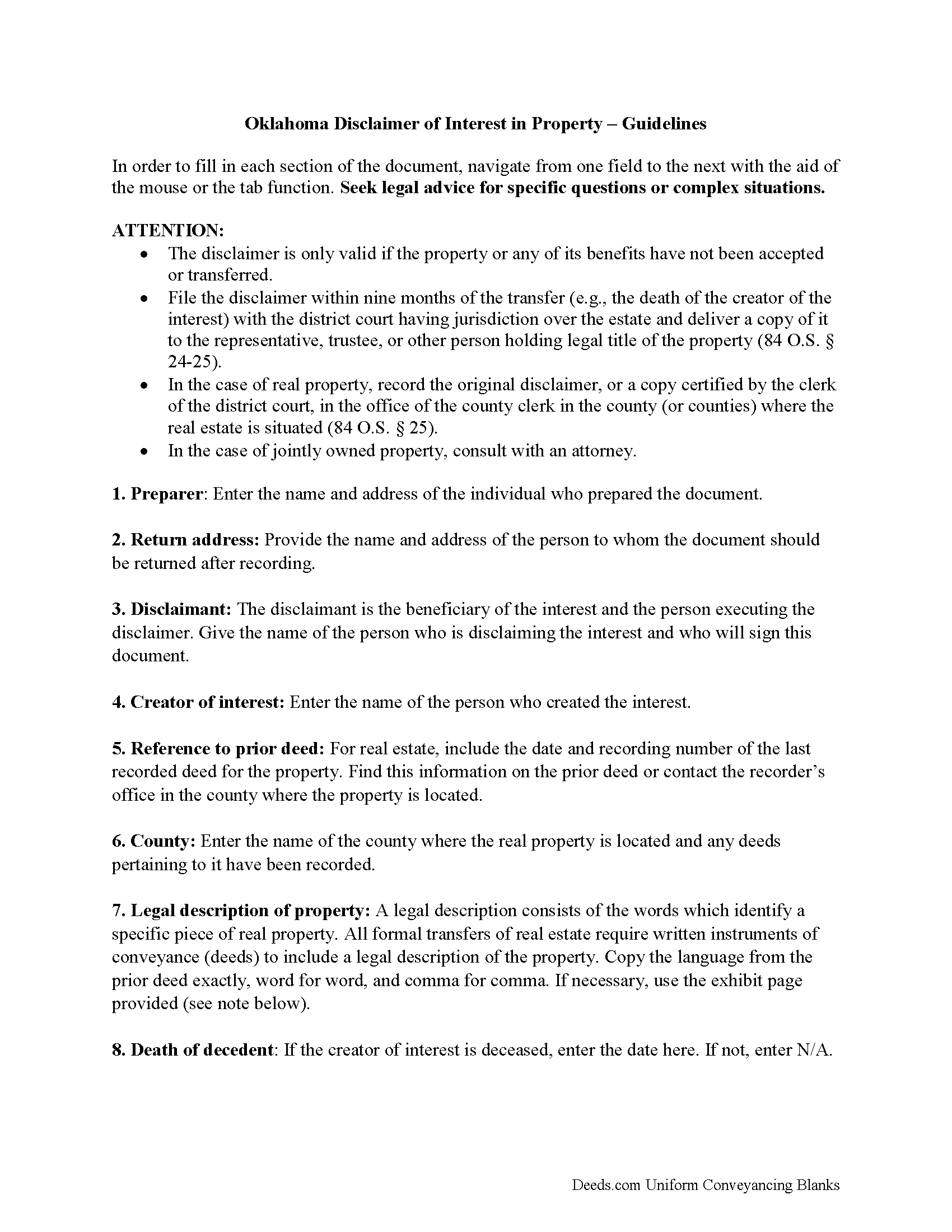

Harmon County Disclaimer of Interest Guide

Line by line guide explaining every blank on the form.

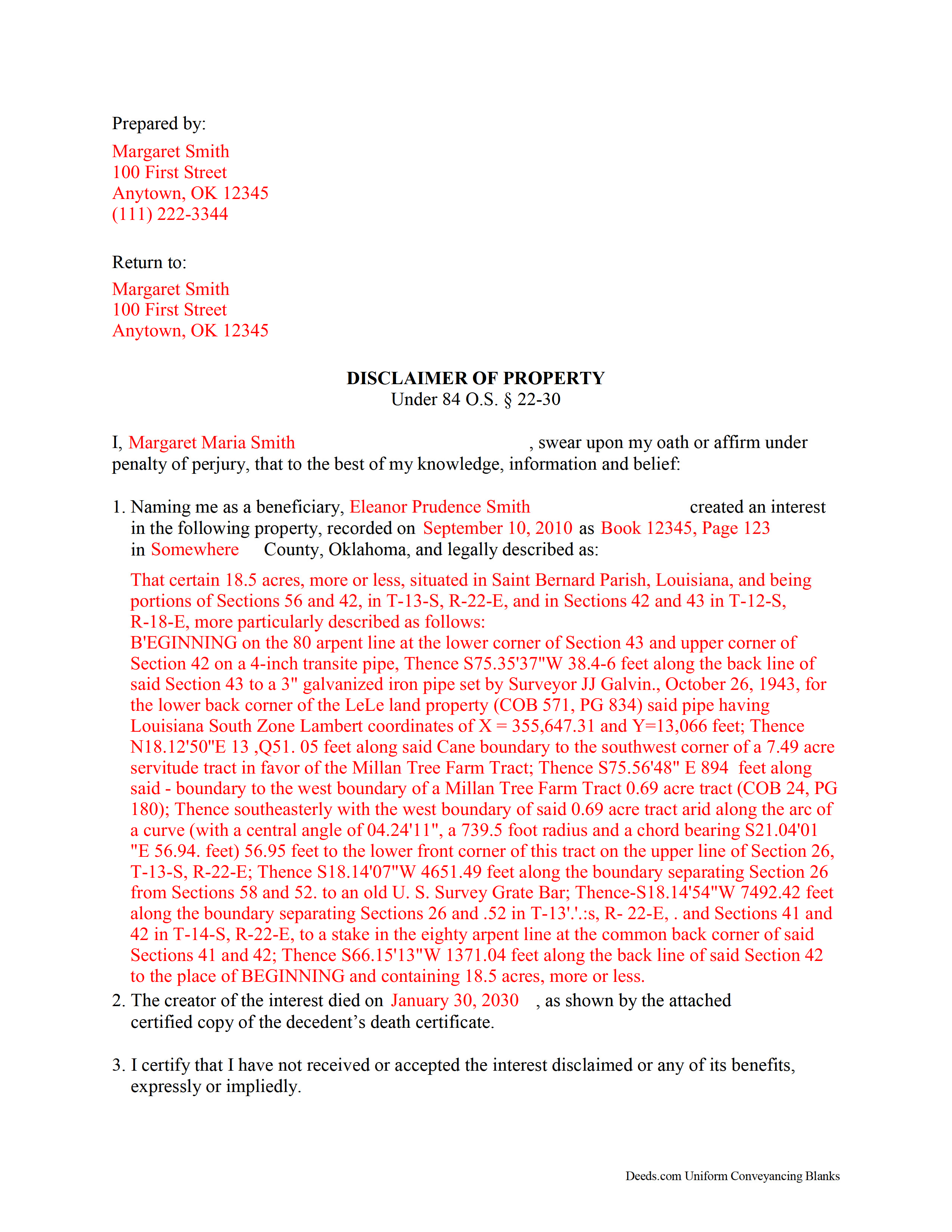

Harmon County Completed Example of the Disclaimer of Interest Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Oklahoma and Harmon County documents included at no extra charge:

Where to Record Your Documents

Harmon County Clerk

Hollis, Oklahoma 73550

Hours: 8:00 to 4:00 Monday through Friday

Phone: (580) 688-3658

Recording Tips for Harmon County:

- Bring your driver's license or state-issued photo ID

- Ensure all signatures are in blue or black ink

- Request a receipt showing your recording numbers

- Have the property address and parcel number ready

Cities and Jurisdictions in Harmon County

Properties in any of these areas use Harmon County forms:

- Gould

- Hollis

- Vinson

Hours, fees, requirements, and more for Harmon County

How do I get my forms?

Forms are available for immediate download after payment. The Harmon County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Harmon County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Harmon County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Harmon County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Harmon County?

Recording fees in Harmon County vary. Contact the recorder's office at (580) 688-3658 for current fees.

Questions answered? Let's get started!

Oklahoma Disclaimer of Property - Description

Under the Oklahoma statutes, the beneficiary of an interest in property may renounce the gift, either in part or in full (84 O.S. 22-30). Note that the option to disclaim is only available to beneficiaries who have not acted in any way to indicate acceptance or ownership of the interest.

The disclaimer must be in writing and include a description of the interest, a declaration of intent to disclaim all or a defined portion of the interest, and be signed by the disclaimant.

File the disclaimer within nine months of the transfer (e.g., the death of the creator of the interest) with the district court having jurisdiction over the estate and deliver a copy of it to the representative, trustee, or other person holding legal title of the property. In the case of real property, record the original disclaimer, or a copy certified by the clerk of the district court, in the office of the county clerk in the county (or counties) where the real estate is situated (84 O.S. 24-25).

A disclaimer is irrevocable and binding for the disclaiming party and his or her creditors, so be sure to consult an attorney when in doubt about the drawbacks and benefits of disclaiming inherited property. If the disclaimed interest arises out of jointly-owned property, seek legal advice as well.

(Oklahoma DOI Package includes form, guidelines, and completed example)

Important: Your property must be located in Harmon County to use these forms. Documents should be recorded at the office below.

This Disclaimer of Interest meets all recording requirements specific to Harmon County.

Our Promise

The documents you receive here will meet, or exceed, the Harmon County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Harmon County Disclaimer of Interest form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4585 Reviews )

leila m.

January 30th, 2021

Very good service, friendly customer service I absolutely will use the service again

Thank you!

Deneene C.

April 17th, 2020

Was a great help to me. I'm very pleased .

Thank you!

Phyllis R Q.

January 26th, 2022

So far so good, I did not know the convenience I would have from my seat to file a legal document! Awesome Service!

Thank you!

Jeane W.

April 13th, 2024

I needed to add my partner to my warranty deed and deeds.com made it easy to understand what form I needed, attached a great explanation of the form and a sample of the form filled out. Couldn't be happier. In fact I'm researching a Revocable Transfer on Death Deed now and they've given me the confidence to rewrite my own will on my own.

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

ralph f.

January 31st, 2019

I VERY MUCH APPRECIATE THE PROMPT RESPONSE & HELPFULNESS. I WILL DEFINITELY USE THIS SERVICE IN THE FUTURE. THANK YOU!

Thank you Ralph, we appreciate your feedback.

Curtis T.

May 12th, 2020

Deeds support was awesome and constant. Thank you.

Thank you!

Pam G.

November 21st, 2023

Loved the ease of use, the very helpful instructions, and samples to go along with the documents I needed to create.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

Angelique A.

December 27th, 2018

Very helpful and quick customer service. Highly recommended

Thank you for your feedback Angelique, we appreciate you. Have a great day!

Willard V.

May 11th, 2025

While it's nice to get all the forms and info in one package for a reasonable cost, the fixed format of the form does not allow for a lengthy meet and bounds property description for real property. Also, the Cover Sheet has big fillable sections with no instructions about what's supposed to go there. I tried the "Contact Us" link, but all it does is spin saying it's trying verify the security of my connection. Looks like I;m going to have to create my own deed in MS Word instead of just filling in the blacks of the PDF file that I downloaded. Bummer!

Your feedback is a crucial part of our dedication to ongoing improvement. Thank you for your insightful comments.

William P.

April 13th, 2021

Warranty Deed was just what I needed.Easy to complete and accepted by the county.

Thank you!

Pamela L.

November 10th, 2019

The packet was very comprehensive and easy to use (I had just one question that wasn't clearly explained). II appreciate that the forms are kept up to date.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

ALEX A.

June 30th, 2020

Yes I appreciate your services everything so far looking good this shows the facts the reasons most of all format I enjoy it I hopefully I can use it for some other legal forms also for Fry's Baker's fraud title fraud I'm interested in a lot of services that will provide me with a preferences of a fraud situations on mortgage security loans but other than that the services are awesome and I appreciate it appreciate your services and I'll keep on using it and thanks again thumbs up

Thank you!

Anna C.

March 14th, 2022

While I don't know if my filing will be accepted which is the penultimate test, I was happy with the product.

Thank you!

James I.

March 3rd, 2023

It worked out very well. Got the form(s) with clear instructions.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Michael B.

November 17th, 2020

I'm very pleased with the service provided by Deeds.com. After a format issue caused my scanner, it was a very smooth and speedy process. Highly recommended.

Thank you for your feedback. We really appreciate it. Have a great day!