Craig County Transfer on Death Deed Form (Oklahoma)

All Craig County specific forms and documents listed below are included in your immediate download package:

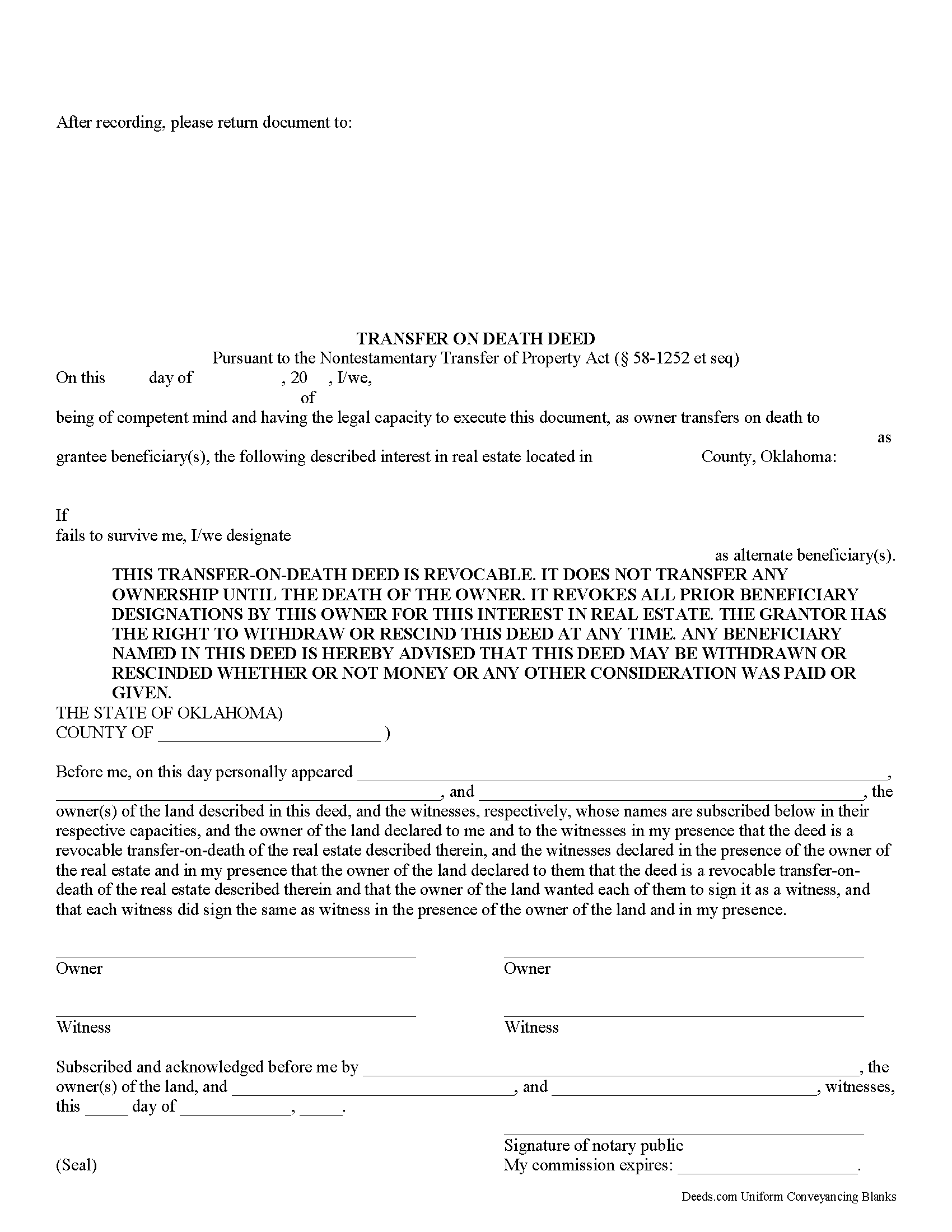

Oklahoma Transfer on Death Deed

Fill in the blank form formatted to comply with all recording and content requirements.

Included Craig County compliant document last validated/updated 4/25/2025

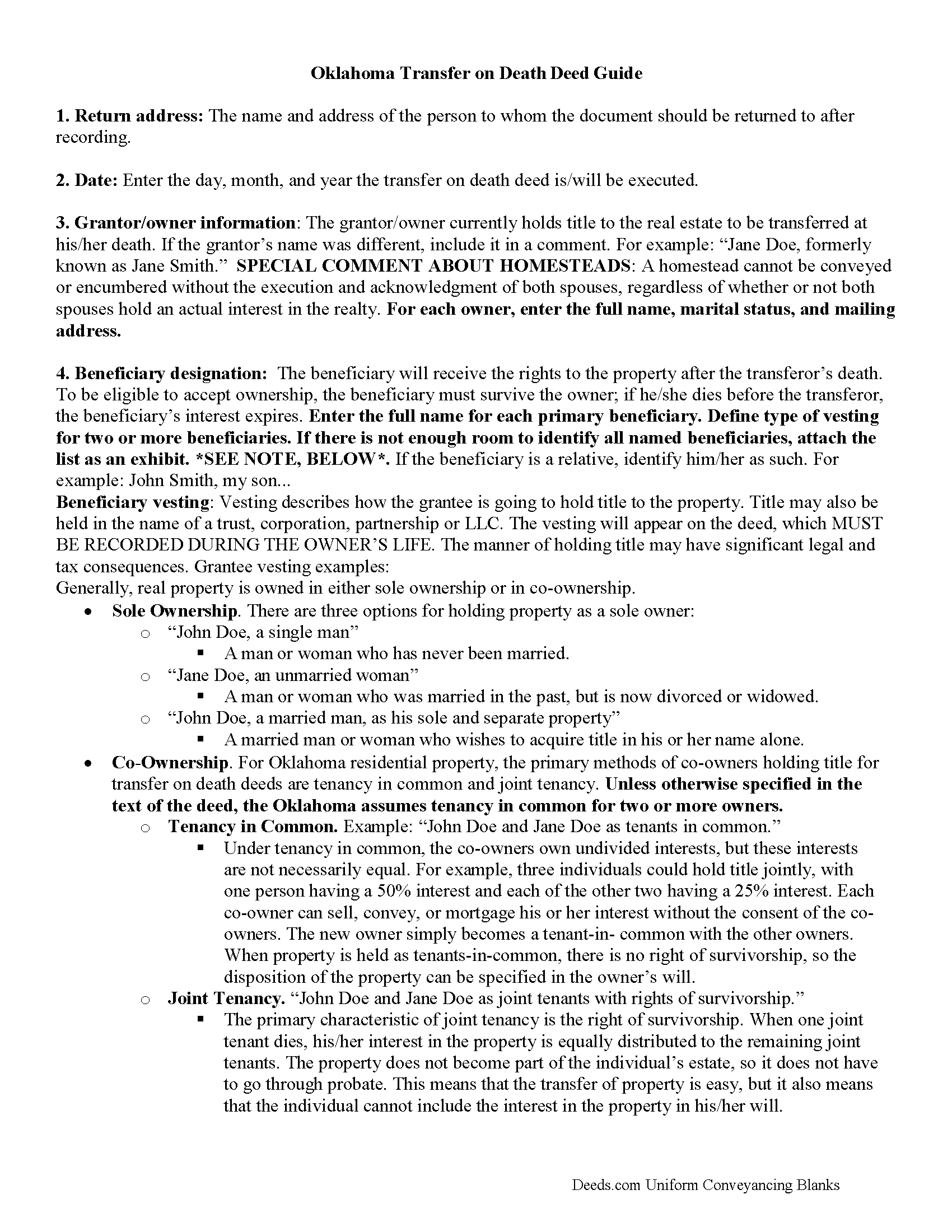

Transfer on Death Deed Guide

Line by line guide explaining every blank on the form.

Included Craig County compliant document last validated/updated 5/12/2025

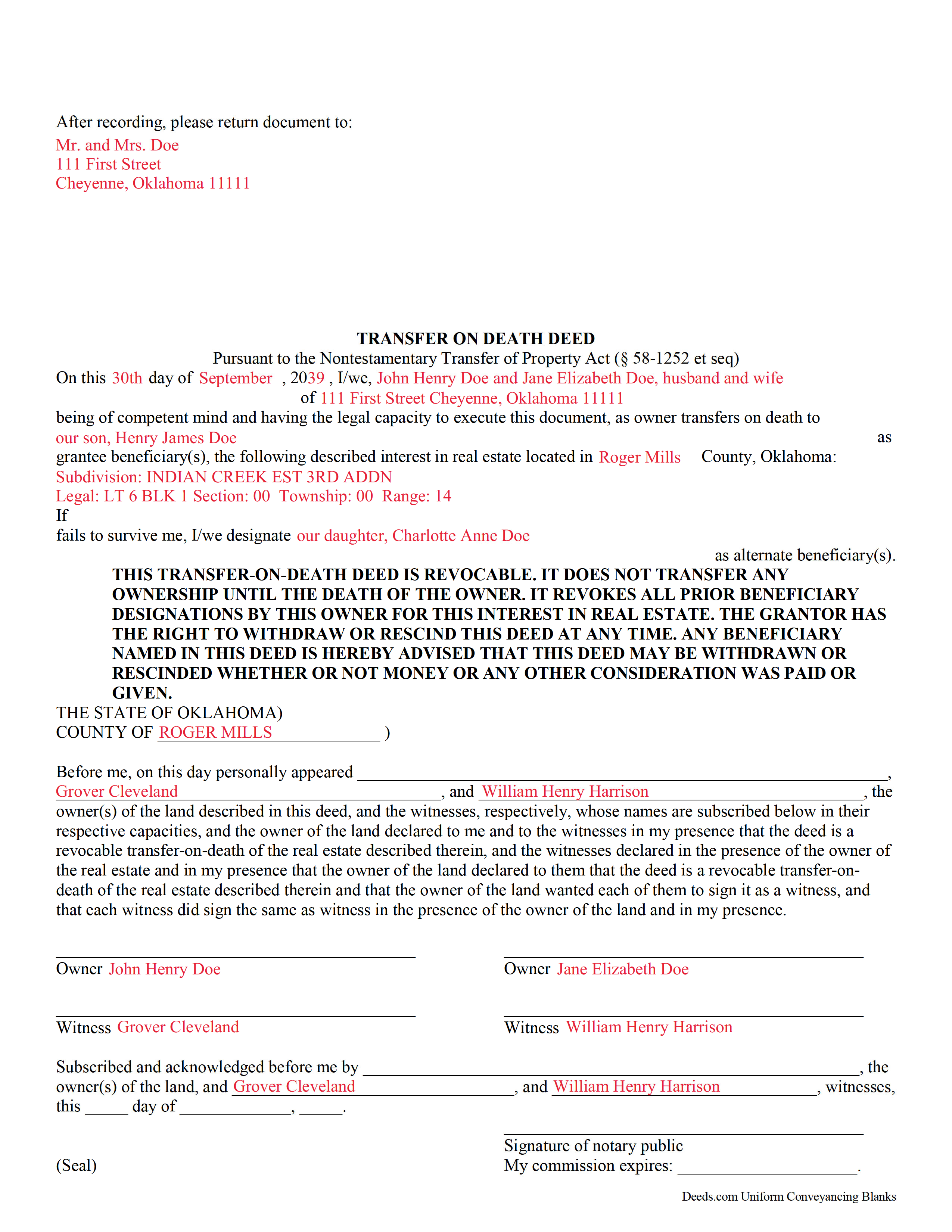

Completed Example of the Transfer on Death Deed Form

Example of a properly completed form for reference.

Included Craig County compliant document last validated/updated 5/28/2025

The following Oklahoma and Craig County supplemental forms are included as a courtesy with your order:

When using these Transfer on Death Deed forms, the subject real estate must be physically located in Craig County. The executed documents should then be recorded in the following office:

Craig County Clerk

210 W Delaware Ave #103, Vinita, Oklahoma 74301

Hours: 8:30am - 4:30pm Mon-Fri

Phone: (918) 256-2507

Local jurisdictions located in Craig County include:

- Big Cabin

- Vinita

- Welch

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Craig County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Craig County using our eRecording service.

Are these forms guaranteed to be recordable in Craig County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Craig County including margin requirements, content requirements, font and font size requirements.

Can the Transfer on Death Deed forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Craig County that you need to transfer you would only need to order our forms once for all of your properties in Craig County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Oklahoma or Craig County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Craig County Transfer on Death Deed forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Transfer on death deeds (TODDs) in Oklahoma are governed by the Nontestamentary Transfer of Property Act (Title 58 O.S. 1251-1258), enacted in 2008. This law allows owners of interests in real property located in Oklahoma to designate one or more beneficiaries to receive those interests after the owner dies, but without the need for probate.

Owners who execute and record a TODD retain absolute control over and use of the property interest while living. In addition, they may modify, revoke, or otherwise convey the land any way they wish, without penalty or obligation to the beneficiaries. This is possible because unlike a traditional conveyance, there is no delivery requirement to notify the beneficiaries about what they might receive -- the deed only conveys a potential future interest in whatever remains after the owner's death ( 58-1252(B), 1257).

The statutes define an interest in real property to include "any estate or interest in, over or under land, including surface, minerals, structures and fixtures" ( 58-1252)(A)), meaning that the transfer is not limited to land, but can also include mineral rights and royalties.

Even though a TODD is not impacted by the owner's will, to reduce the likelihood of fraud and coercion, it demands the same standards of competence and capacity. Additionally, the document must be signed and acknowledged, in the presence of a notary, by the owner and two disinterested witnesses (individuals with no potential claims on the property rights) prior to recording ( 58-1253, 1258).

After the owner dies, each surviving beneficiary must execute and record an affidavit affirming his/her acceptance of the transfer ( 58-1252(C), (D)). The beneficiary takes the interest subject to all recorded obligations related to it.

NOTE: The transfer on death deed and any associated changes or revocations must be recorded, DURING THE OWNER'S LIFE, in the county where the property is located.

Overall, a transfer on death deed offers a convenient, flexible estate planning tool for owners of interests in Oklahoma real property. Each circumstance is unique, so consider all options carefully. For additional information or complex situations, contact a local attorney.

(Oklahoma TODD Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Craig County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Craig County Transfer on Death Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4562 Reviews )

MARY LACEY M.

June 30th, 2025

Great service! Recording was smooth and swiftly performed. Deeds.com is an excellent service.rn

We are delighted to have been of service. Thank you for the positive review!

Robert F.

June 30th, 2025

Breeze.... It feels silly to hire an attorney to do this for just one beneficiary. Thanks.

Thank you for your feedback. We really appreciate it. Have a great day!

Pauline C.

June 29th, 2025

Everything that was stated to be included in my order was complete. Very satisfied

Thank you for your positive words! We’re thrilled to hear about your experience.

Nancy B.

July 22nd, 2021

Very user-friendly. Looks like everything I needed in one place. Great job.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Gary O.

March 11th, 2019

Easy to use,makes things easier,Thanks!

Great Idea!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jamie W.

September 27th, 2019

Very fast service. Wish I knew about this earlier.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Sharon G.

December 1st, 2021

I could not be happier with the service afforded by Deeds.com. After having been directed to two other organizations who purportedly performed this service and being told they could not accommodate me, I found Deeds.com. The website is extremely easy to use, the directions are clear and concise. The site updated me regularly as the documents were progressing through the process, and the detailing of costs was great. The turn-around -- which isn't completely in the hands of the site -- was incredibly quick. I'd use this group again without reservation. As a person who'd have to otherwise travel almost five hours to record, this has been heaven-sent!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Richard R.

June 28th, 2022

Kind of expensive for a 3 page item...but I received it pronto and it will fill the bill.

Thank you!

Ashley H.

September 21st, 2020

Thank you for the quick response time messaging back and forth to get this completed, and also the fairly speedy e-recording! Excellent customer service!!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

TIFFANY B.

April 24th, 2024

THIS SERVICE IS AMAZING! IT SAVES ME SO MUCH TIME!

We are grateful for your engagement and feedback, which help us to serve you better. Thank you for being an integral part of our community.

Katherine W.

January 24th, 2019

I was impressed by the completeness of the package of forms PLUS instructions. Particularly helpful is the filled in sample, which enables you to see what a correct, completed deed ought to look like.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Eddy O.

August 20th, 2022

Your site was very helpful.

Thank you for your feedback. We really appreciate it. Have a great day!

FRANCIS P.

July 17th, 2022

Finding what I needed was easy. The payment process was easy. Using what I found was easy. Easy-peasy and GREAT results. Professional and succinct all for the price of a steak dinner. I'll be back to DEEDS.COM when I need any paperwork/forms related to deeds.

Thank you for your feedback. We really appreciate it. Have a great day!

Ken S.

March 14th, 2019

Easy to downloand. Instructions were helpful and easy to follow. Made the process a lot easier for me.

Thanks Ken.

Yvette D.

January 15th, 2021

Excellent service and customer support. Thank you for your help and time.

Thank you!