Cimarron County Transfer on Death Revocation Form

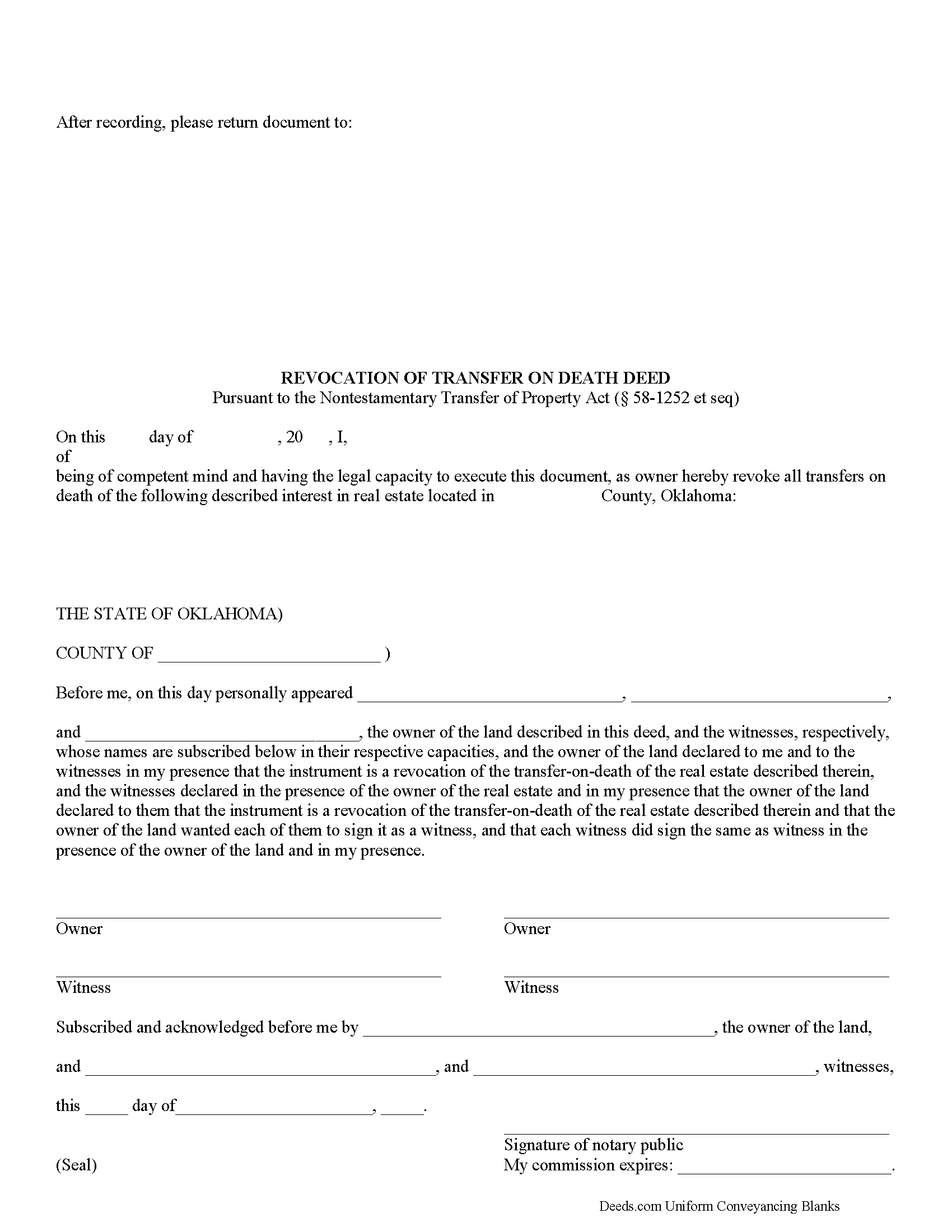

Cimarron County Transfer on Death Revocation Form

Fill in the blank form formatted to comply with all recording and content requirements.

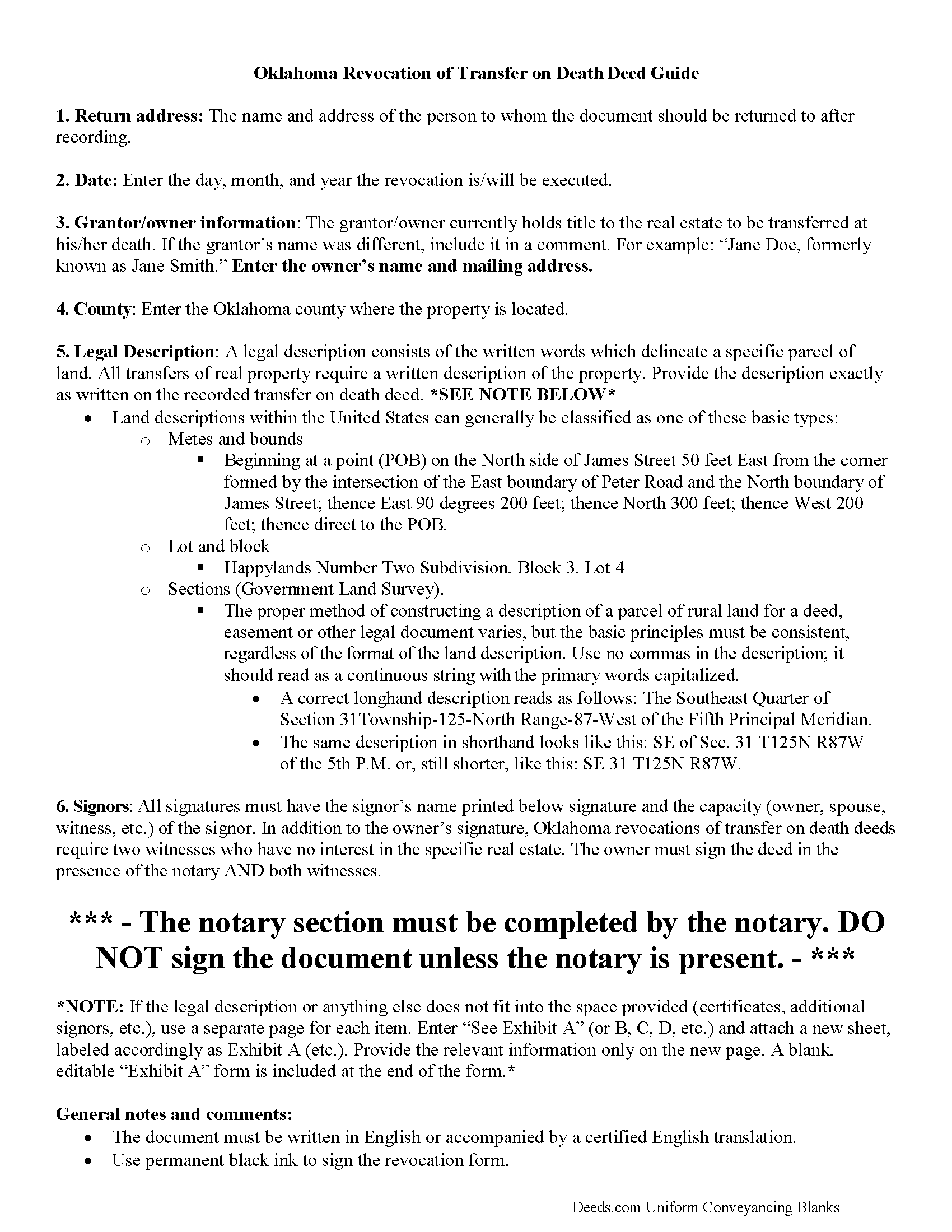

Cimarron County Transfer on Death Revocation Guide

Line by line guide explaining every blank on the form.

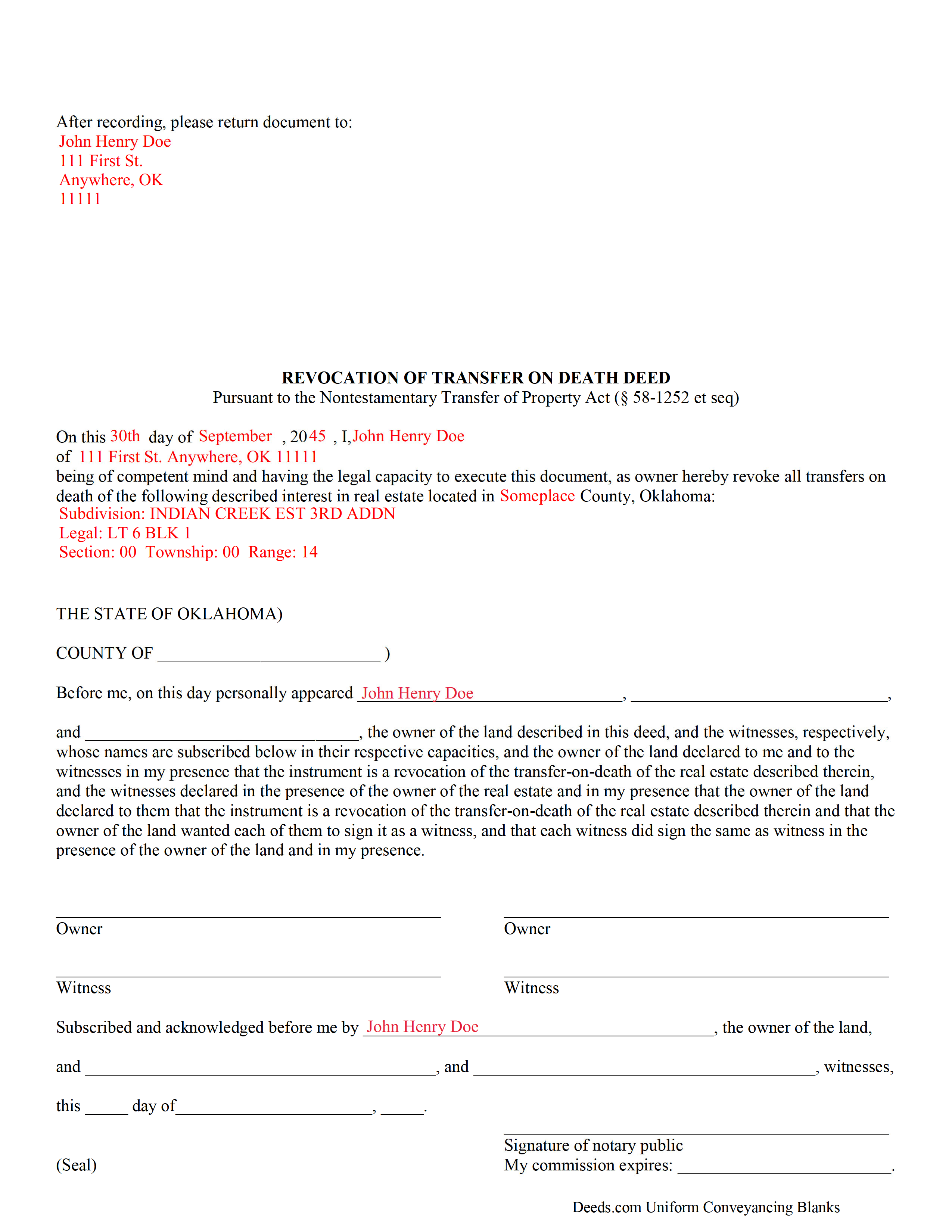

Cimarron County Completed Example of the Transfer on Death Revocation Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Oklahoma and Cimarron County documents included at no extra charge:

Where to Record Your Documents

Cimarron County Clerk

Boise City, Oklahoma 73933-0145

Hours: 8:30 to 5:00 M-F

Phone: (580) 544-2251

Recording Tips for Cimarron County:

- Documents must be on 8.5 x 11 inch white paper

- Ask about their eRecording option for future transactions

- Ask for certified copies if you need them for other transactions

Cities and Jurisdictions in Cimarron County

Properties in any of these areas use Cimarron County forms:

- Boise City

- Felt

- Kenton

- Keyes

Hours, fees, requirements, and more for Cimarron County

How do I get my forms?

Forms are available for immediate download after payment. The Cimarron County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Cimarron County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Cimarron County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Cimarron County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Cimarron County?

Recording fees in Cimarron County vary. Contact the recorder's office at (580) 544-2251 for current fees.

Questions answered? Let's get started!

Transfer on death deeds (TODDs) in Oklahoma are governed by the Nontestamentary Transfer of Property Act (Title 58 O.S. 1251-1258), enacted in 2008.

Unlike standard deeds, which convey an irrevocable interest in real property, transfer on death deeds may be changed or cancelled, provided that any modifications to the recorded TODD are filed, during the owner's life, for recording with the same office that accepted the TODD. The Oklahoma Statutes do not provide a specific form for this purpose, but they define the requirements for lawful revocation at 58-1254.

Basically, there are two ways to revoke a transfer on death deed in Oklahoma. The owner can execute and record a new TODD, conveying the potential future interest to someone else, effectively cancelling the earlier transfer (58-1254(B)). The other method involves executing and recording an instrument of revocation (58-1254(A)). Just as with TODDs, this instrument must be recorded during the owner's life. Revocation instruments are useful because they serve as a clear statement of the transferor's intent. TODDs may not be revoked by a will (58-1254(C)).

(Oklahoma TOD Revocation Package includes form, guidelines, and completed example)

Important: Your property must be located in Cimarron County to use these forms. Documents should be recorded at the office below.

This Transfer on Death Revocation meets all recording requirements specific to Cimarron County.

Our Promise

The documents you receive here will meet, or exceed, the Cimarron County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Cimarron County Transfer on Death Revocation form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4585 Reviews )

Renu A.

September 30th, 2020

The service was very reliable and they even helped with filling out the paperwork properly. Very quick turn around and efficient!

Thank you!

Janice S.

February 28th, 2019

Really easy downloading the forms the directions everything was really easy thanks!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Norma G.

July 30th, 2020

Very fast response!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Raymundo M.

November 1st, 2023

Very fast and smooth process, thank you for your quick answers and follow up.

Thank you for your feedback. We really appreciate it. Have a great day!

Priscilla M.

December 30th, 2020

Instructions are easy to follow which make filling out the forms easy and simple. I would definitely recommend Deeds.com.

Thank you!

Jan C.

May 20th, 2020

Wow - finding your service was a lifesaver! I know my forms, but I don't have the time right now to draft them from "scratch". So once I found this site it was a couple of quick clicks and VOILA!! almost a done deal. Thanks for the assistance.

Thank you for your feedback. We really appreciate it. Have a great day!

Carol T.

February 26th, 2020

Very east process. Good job!

Thank you for your feedback. We really appreciate it. Have a great day!

Helen B.

January 15th, 2021

Very Good!

Thank you!

Gerald S.

November 7th, 2020

Very pleased with the services provided by deeds.com. Quick response time after information was provided.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Peggy G.

May 19th, 2019

This is an easy document to complete and file. Thank you for having the completed sample for review.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Dina O.

December 29th, 2023

easy to use and efficient i like that they give you an example to compare your work to

We are motivated by your feedback to continue delivering excellence. Thank you!

Don M.

September 9th, 2021

I find the site very difficult to nagitagte.

Sorry to hear that Don, we’ll try harder.

Emmy M.

August 20th, 2020

I loved using this process to record my deeds. it was fast and everytime I sent a message I received a response very quickly. I am so glad they have this option. for the extra $15 to have the convenience to do it from home and not worry about finding parking, etc. so well worth it!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kelly W.

March 26th, 2020

Great resource! Wish you could expand to more than just deeds, but then you would have to rename it. :) Thanks! Kelly

Thank you!

Natasha M.

January 9th, 2024

Your forms, guides, sample deeds and submission process were accessible, easy to understand and simple. I also was pleasantly surprised by the efficiency, professionalism and ease of staff communicating with me after I uploaded the document to ensure the county accepted it. I will continue to use this website to record deeds. Thank you!

Thank you for your feedback. We really appreciate it. Have a great day!