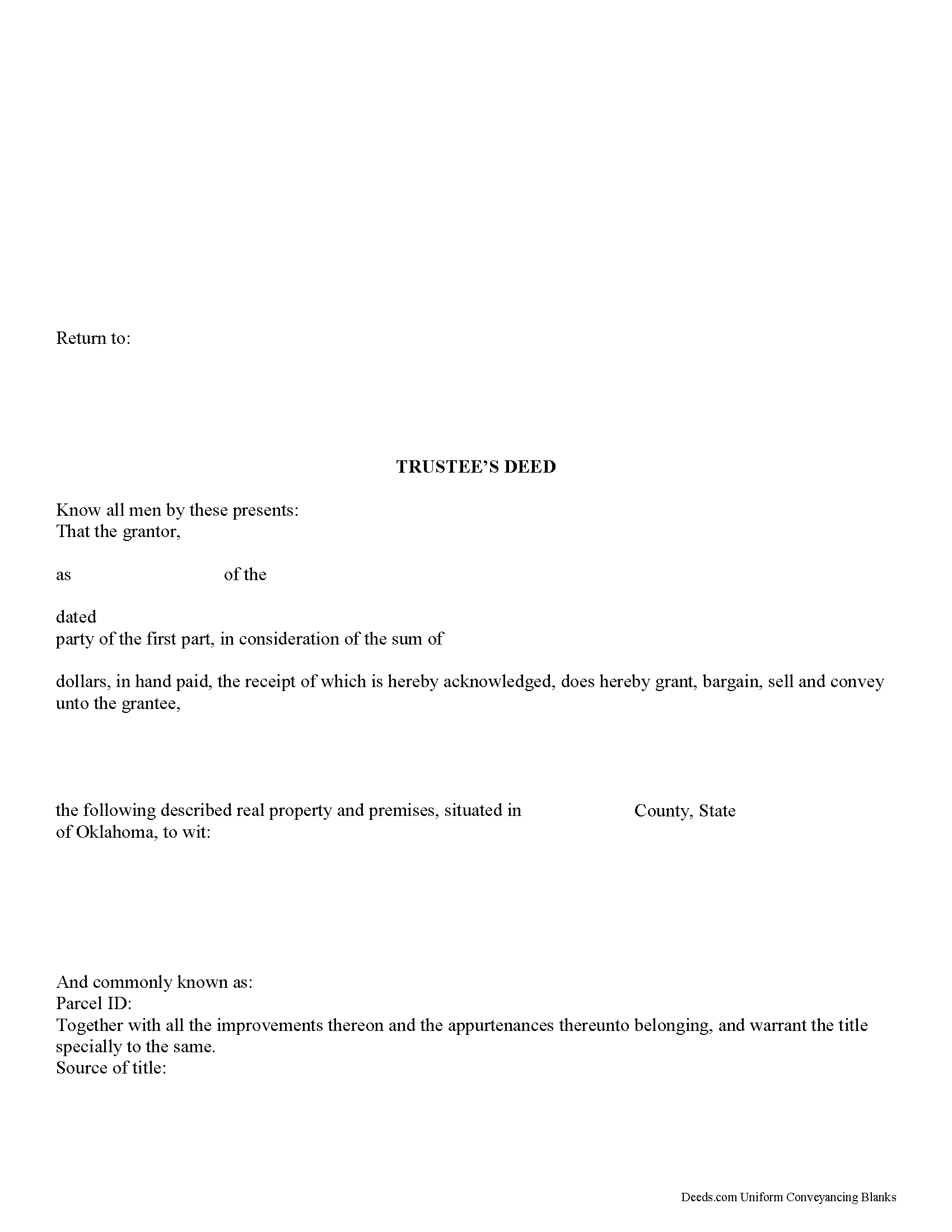

Wagoner County Trustee Deed Form

Wagoner County Trustee Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

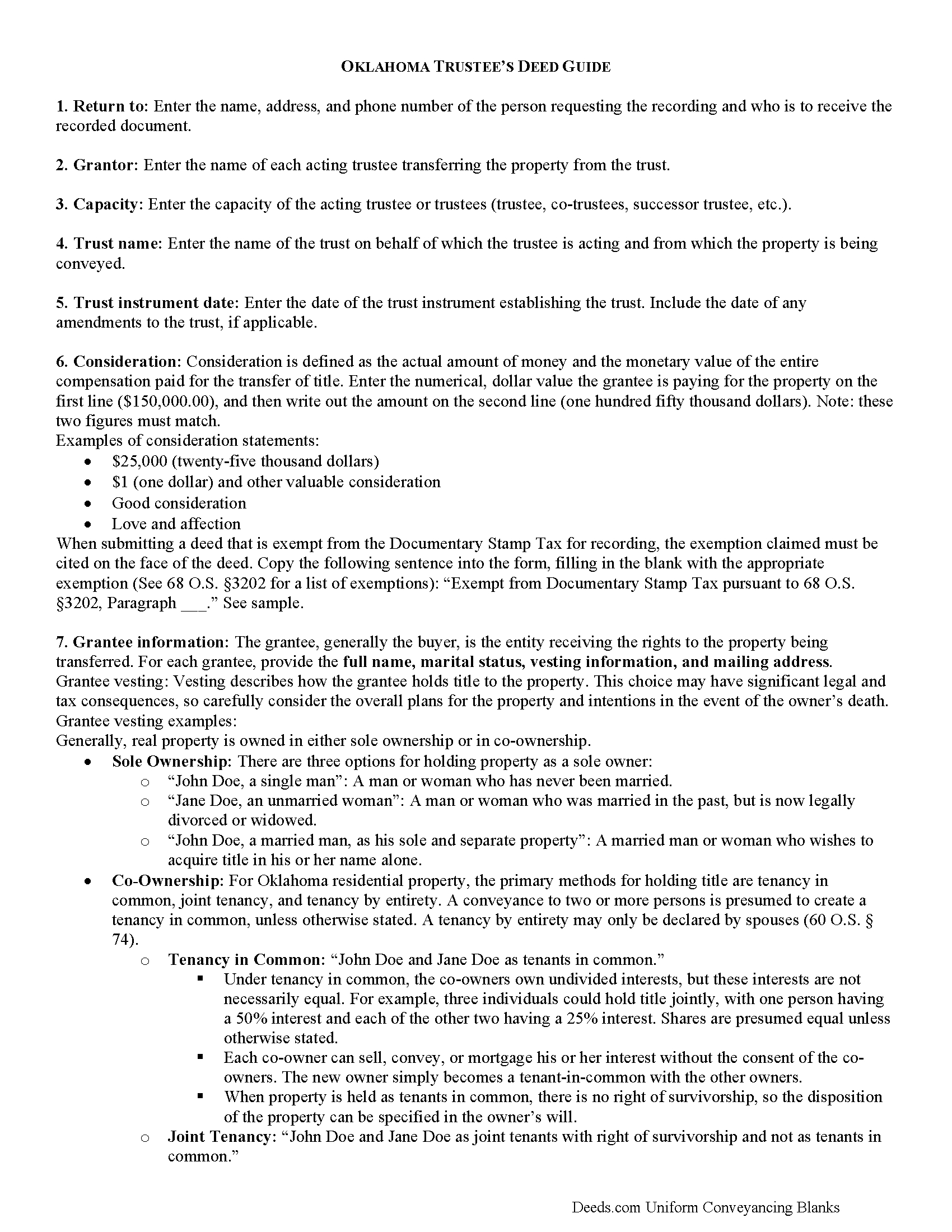

Wagoner County Trustee Deed Guide

Line by line guide explaining every blank on the form.

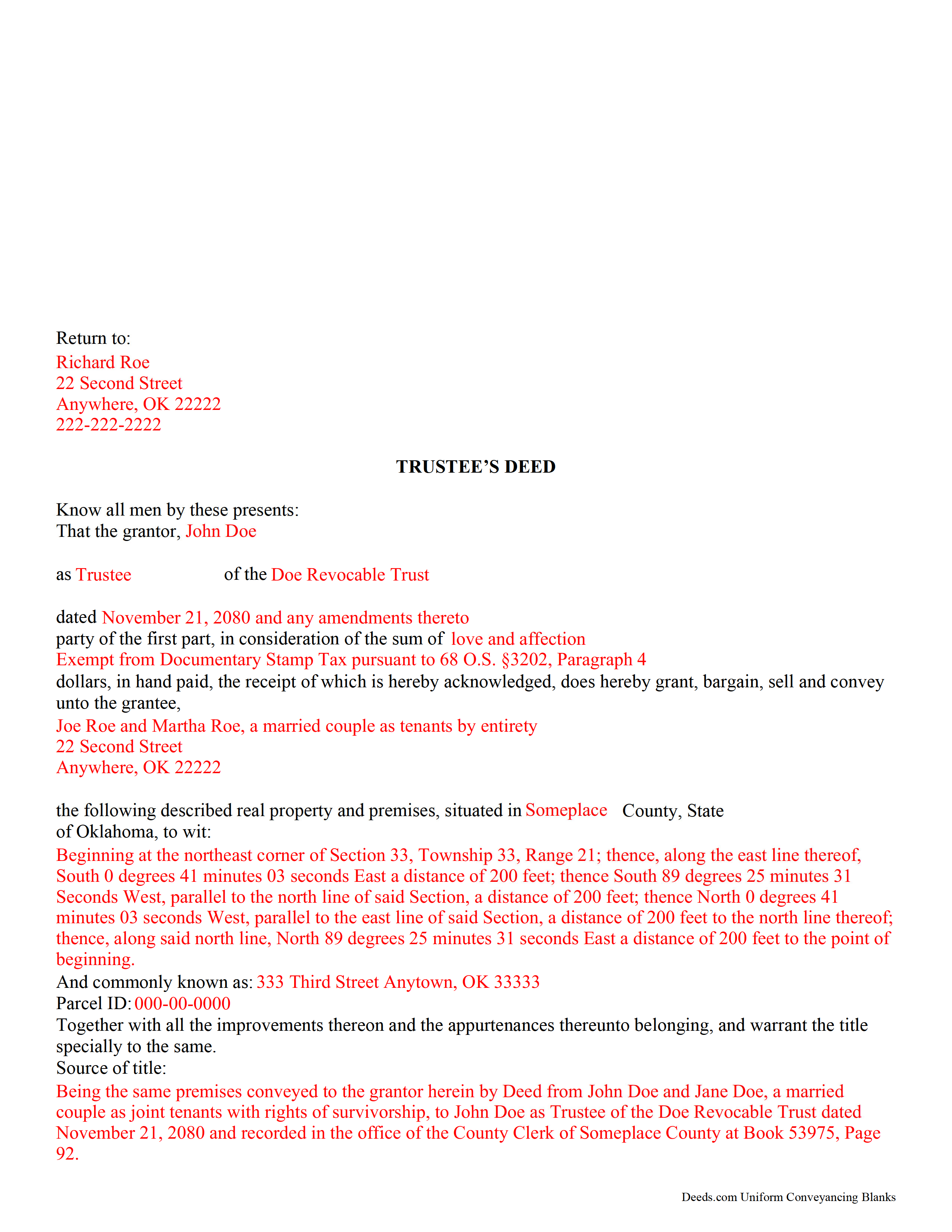

Wagoner County Completed Example of the Trustee Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Oklahoma and Wagoner County documents included at no extra charge:

Where to Record Your Documents

Wagoner County Clerk

Wagoner, Oklahoma 74477

Hours: 8:30 to 4:30 Monday through Friday

Phone: (918) 485-2216

Recording Tips for Wagoner County:

- Double-check legal descriptions match your existing deed

- Check margin requirements - usually 1-2 inches at top

- Bring extra funds - fees can vary by document type and page count

- Have the property address and parcel number ready

- Multi-page documents may require additional fees per page

Cities and Jurisdictions in Wagoner County

Properties in any of these areas use Wagoner County forms:

- Broken Arrow

- Coweta

- Okay

- Porter

- Redbird

- Wagoner

Hours, fees, requirements, and more for Wagoner County

How do I get my forms?

Forms are available for immediate download after payment. The Wagoner County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Wagoner County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Wagoner County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Wagoner County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Wagoner County?

Recording fees in Wagoner County vary. Contact the recorder's office at (918) 485-2216 for current fees.

Questions answered? Let's get started!

Oklahoma Conveyances of Real Property to and from Express Trusts

The Oklahoma Trust Act, codified at 60 O.S. 175.1 et seq., governs express trusts in the State of Oklahoma (60 O.S. 175.3(F)). An express trust is one "created with the settlor's express intent, usually declared in writing," and is sometimes referred to as a direct trust or declared trust.

Real property may be titled in the name of a trust, an arrangement whereby one person (the settlor; also called a trustor or grantor) conveys title to another person (the trustee) for the benefit of a third (the beneficiary). The various methods of creating a trust in Oklahoma are specified at 60 175.6, and include a transfer made during the settlor's lifetime to a trustee either for the settlor or for a third person (60 175.6(B)). In this type of trust, called an inter vivos (living) trust, the roles of settlor, trustee, and beneficiary are sometimes combined in one individual, on the condition that the settlor cannot also be the sole beneficiary (see 60 175.6(A)). Testamentary trusts, specified by a will to take effect upon the settlor's death, are another option (60 O.S. 175.3(C)).

In Oklahoma, a trust containing real property is invalid without "a written instrument subscribed by the trustor" and witnessing its existence (60 O.S. 175.6(F)). The trust instrument establishes the terms of the trust, enumerates the trust's assets, designates the trustee and the trustee's powers and restrictions, and identifies the trust beneficiaries. While this document is generally unrecorded to maintain privacy, a settlor may record a trust instrument pertaining to real property, particularly when he wishes to give notice to the public of restrictions on the trustee's powers (60 O.S. 175.45(c)).

To convey real property into trust, the settlor executes and records a deed, granting title to the trustee as representative of the trust. The property should be titled in the name the trustee, referencing the trust and execution date of the trust instrument. A memorandum of trust under 60 O.S. 175.6a may be required. See 60 O.S. 156 for problems arising with conveyances into trust, and consult a lawyer with questions.

Once the trustee holds legal title to the property, he is presumed to have all the powers of an individual person holding absolute title unless specified otherwise by the trust instrument (60 O.S. 161, 171). This includes the specific power "to sell real or personal property at public auction or at private sale for cash" (60 O.S. 175.24(A)(2)). In order to convey real property from the trust, the trustee must execute a deed.

The trustee's deed is descriptively named for the granting party, rather than for the type of warranty conveyed (as in a "warranty deed" or "special warranty deed"). The form of a transfer from a representative is generally the same as a statutory deed, with wording varying slightly depending on the type of warranty of title the grantor wishes to convey.

In Oklahoma, a warranty deed, codified at 16 O.S. 40, conveys title with the broadest warranty, guaranteeing that the grantor has not already conveyed the property to someone else; that the property is free from encumbrances apart from those already disclosed; and that the grantor will warrant and defend the title against the claims of all persons. A grant deed transfers title with only the first two warranties listed above. A special warranty provides a lesser warranty, guaranteeing title only against defects arising during the period of the grantor's ownership. A quitclaim deed offers no warranty and merely transfers any interest a grantor may have in the property.

Trustees in Oklahoma generally convey real property from a trust using a special warranty deed, due to the fact that the trustee may not have knowledge of the condition of the title prior to the property's conveyance into trust. It is important to consult a lawyer in determining what level of warranty, if any, is appropriate to convey, as this has significant legal consequences for both the grantor and the grantee.

In any case, the transfer instrument should meet the same requirements for form and content of any instrument pertaining to real property. In the granting clause, the deed should name the trustee, trust, and the trust instrument date, and give the grantee's name, address, and vesting information. The deed should also list the consideration paid for the transfer; the consideration (or the value of the property conveyed) will determine the amount of documentary stamp tax paid. The deed must also include a legal description of the real property being conveyed. Additional documentation, such as a memorandum of trust, may be required (60 175.6a).

All instruments relating to real property must be signed by the granting party in the presence of a notary public before they are recorded in the county in which the subject property is situated.

Consult a lawyer with questions regarding real property transfers to and from trusts in Oklahoma.

(Oklahoma TD Package includes form, guidelines, and completed example)

Important: Your property must be located in Wagoner County to use these forms. Documents should be recorded at the office below.

This Trustee Deed meets all recording requirements specific to Wagoner County.

Our Promise

The documents you receive here will meet, or exceed, the Wagoner County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Wagoner County Trustee Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Patricia J.

January 10th, 2019

So simple. Thank you.

Thank you Patricia.

Michael J.

June 13th, 2022

Great site, very easy to use. Thanks

Thank you for your feedback. We really appreciate it. Have a great day!

Catherine C.

February 26th, 2021

This was great. Happy I found you!

Thank you!

Marsha D.

September 25th, 2020

Outstanding product and so easy to use! Highly recommend this product. We successfully used the Virginia deeds. Thank you.

Thank you!

Susan J.

June 6th, 2023

I was pleased that I could send the documents this way rather than having to mail it or take time out of my day to go down to the records office.

Thank you for taking the time to leave your feedback Susan, we really appreciate you. Have an amazing day.

Darrell C.

March 26th, 2022

Excellent Service

Thank you!

JAMSHEAD T.

December 13th, 2020

An excellent service. Exactly what one would hope for in the 21st century.

Thank you for your feedback. We really appreciate it. Have a great day!

Ryan J.

September 5th, 2024

This was an excellent experience. The jurisdiction I was registering the Deed with, entrusts Deeds.com with their filing needs. And the staff held my hand through the process, and worked to submit the best package, and the Deed was successfully recorded.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kimberly M.

January 8th, 2020

Love Deeds.com. Fast turnaround and easy to work with.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Zennell W.

November 24th, 2024

Quick fast and easy transaction.

We are grateful for your feedback and looking forward to serving you again. Thank you!

Ginger O.

March 27th, 2019

Thank you for making this so easy to use. I had looked all over the internet and yours was the most user friendly and for a reasonable price.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Karl L.

January 30th, 2025

Excellent Service Terrific Follow Up and Follow Throught

Your appreciative words mean the world to us. Thank you.

Thi W.

May 3rd, 2019

Absolutely the easiest and fastest service ever!!! staff very helpful.

Thank you!

Francine B.

March 25th, 2020

Looks like all forms are available. Hope they are as easy to use as it was to obtain. Thank you.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Julie Z.

December 7th, 2024

Just getting started with this process, but I was delighted to find this resource to speed up the decision making. Excellent! Very helpful!

Thank you for your positive words! We’re thrilled to hear about your experience.